Overview

This article examines various global debt collection models that financial institutions can implement to enhance risk management.

- Advanced technologies, including automation and data analytics, are highlighted for their role in improving debt recovery processes and operational efficiency.

- These advancements not only align with best practices but also provide a strategic framework for effective risk management strategies.

Introduction

The landscape of debt collection is evolving rapidly, driven by the imperative for financial institutions to manage risk effectively while maximizing recovery rates. As organizations contend with rising delinquency rates and changing borrower behaviors, innovative solutions are emerging that leverage advanced analytics, automation, and cloud technologies. This article explores ten global debt collection models that enhance operational efficiency and align with best practices in risk management. However, with numerous options available, how can institutions ascertain which model is best suited to their unique challenges and objectives?

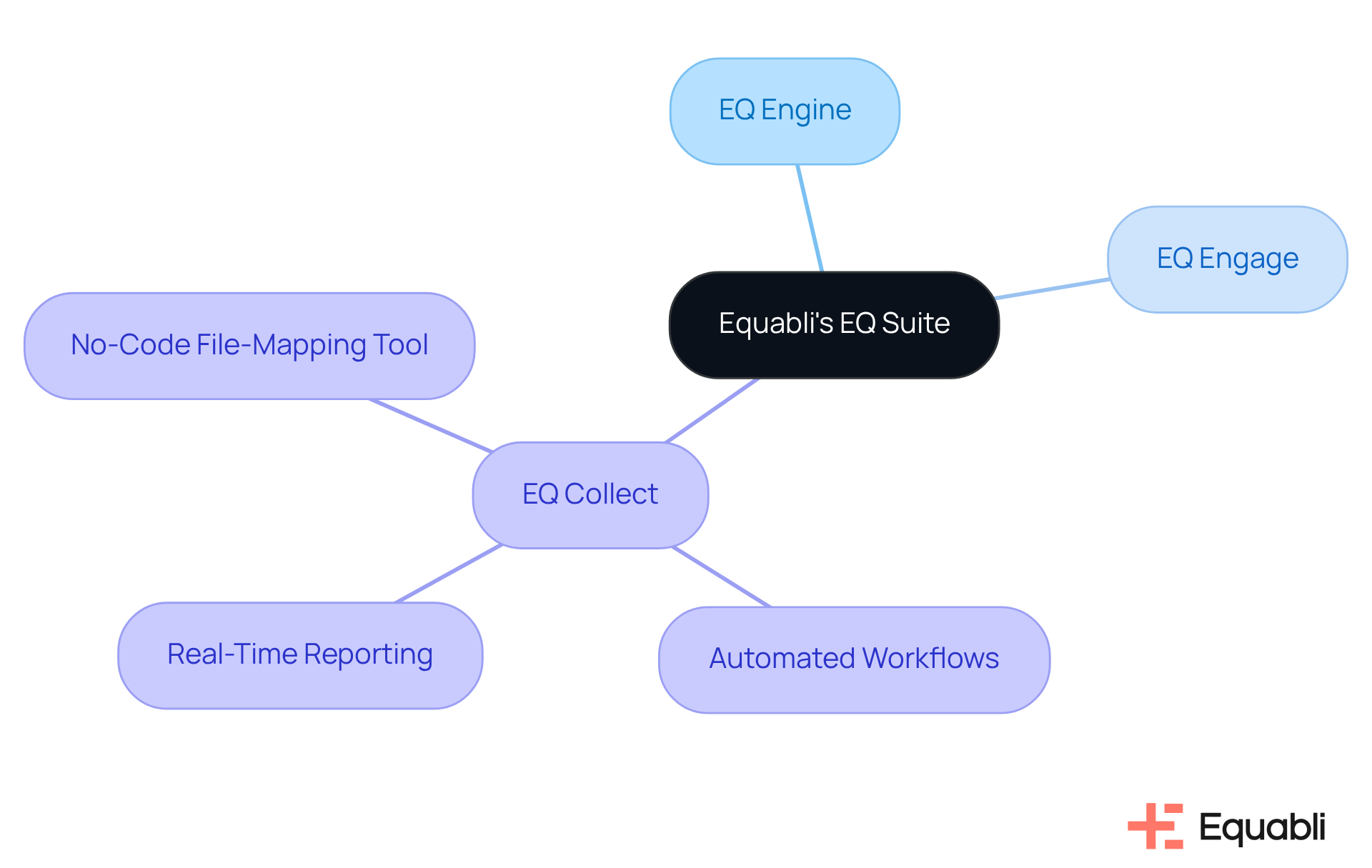

Equabli's EQ Suite: Intelligent Solutions for Data-Driven Debt Recovery

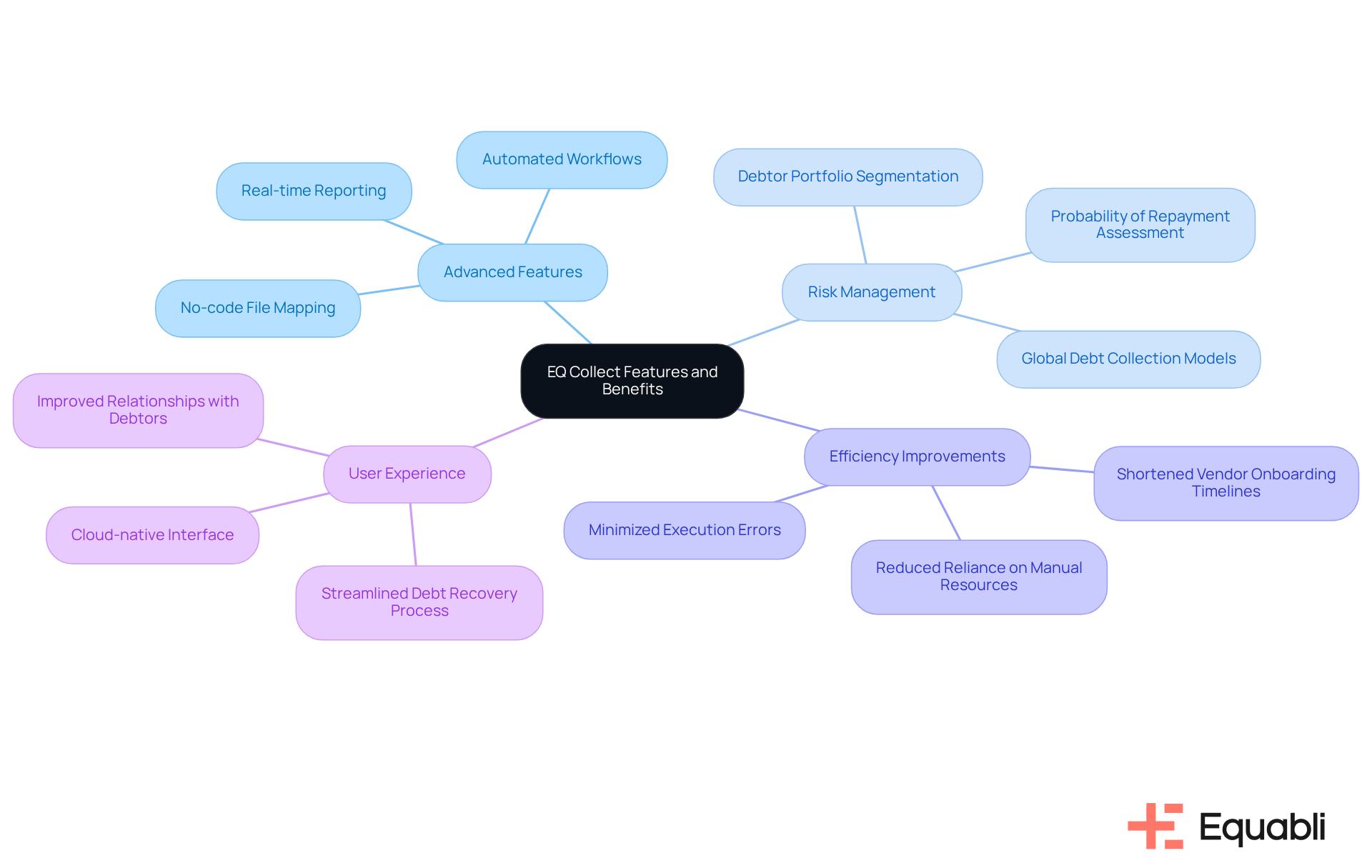

Equabli's EQ Suite stands as a comprehensive solution designed to optimize recovery processes, with a strong emphasis on data protection and compliance. Central to this suite are the EQ Engine, EQ Engage, and EQ Collect, which leverage advanced analytics and machine learning to predict repayment behaviors and refine recovery strategies. For instance, EQ Collect incorporates features such as:

- Automated workflows

- Real-time reporting

- A no-code file-mapping tool

These features collectively enhance operational efficiency and minimize execution errors. This capability allows financial institutions to significantly while improving their bottom lines.

Moreover, the cloud-native architecture of the EQ Suite facilitates seamless integration into existing workflows, positioning it as a preferred choice for lenders and creditors seeking to modernize their recovery efforts while maintaining stringent compliance oversight. By adopting these intelligent solutions, financial institutions can not only enhance borrower engagement but also fundamentally transform their debt recovery processes, thereby aligning with global debt collection models for financial institutions' risk management strategies as well as best practices in compliance and operational excellence.

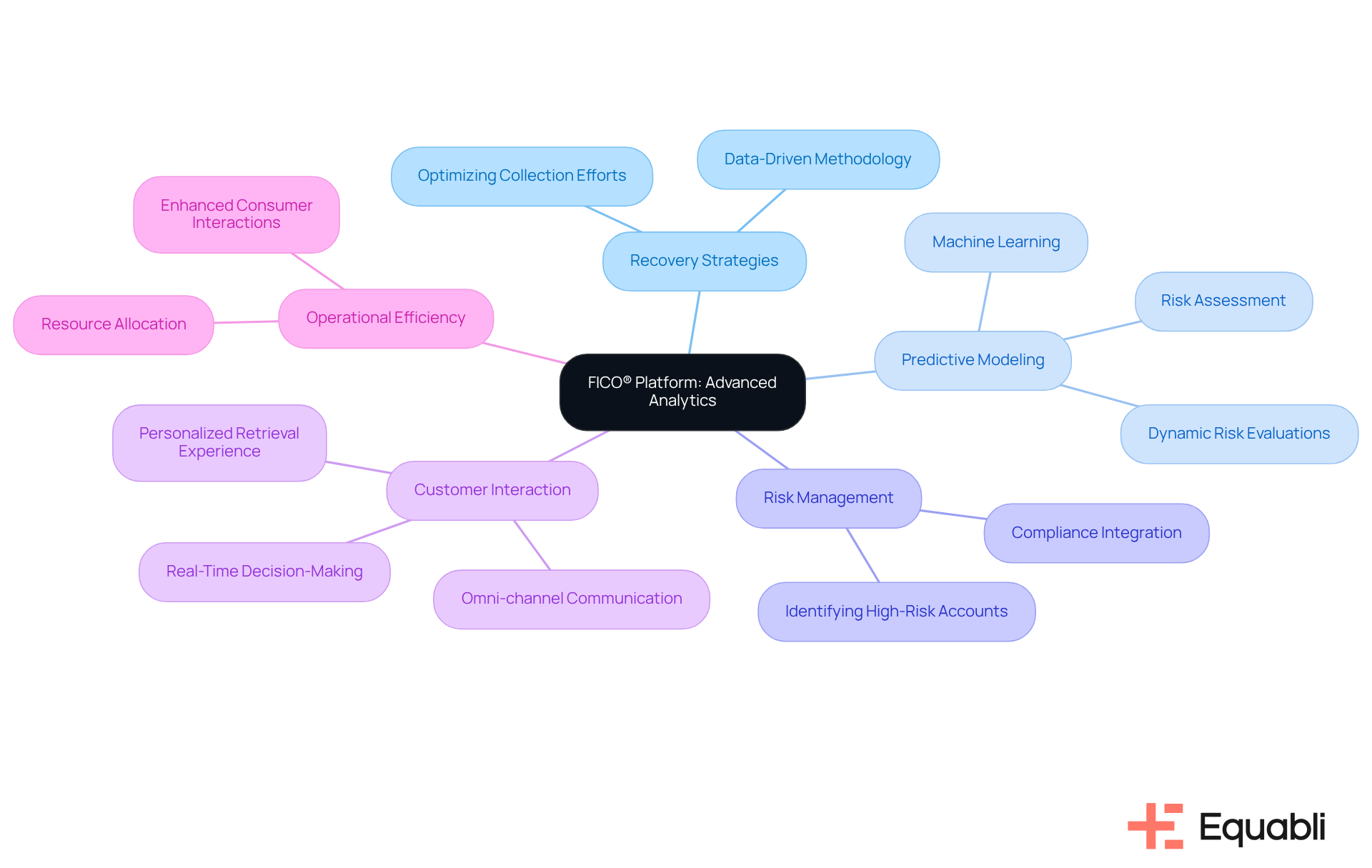

FICO® Platform: Advanced Analytics for Optimized Collection Strategies

The FICO® Platform leverages advanced analytics to empower financial institutions in optimizing their recovery strategies, aligning with global debt collection models for financial institutions' risk management strategies. By employing global debt collection models for financial institutions' risk management strategies, organizations can effectively use predictive modeling and sophisticated risk evaluation tools to pinpoint high-risk accounts and customize their recovery initiatives. This not only enhances targeting precision but also facilitates omni-channel communication, enabling collectors to interact with debtors through their preferred channels. Consequently, this approach significantly boosts recovery rates while simultaneously improving customer satisfaction through a more personalized retrieval experience.

Equabli's EQ Engine further refines this process by utilizing machine learning and automation to predict the risk of delinquency for active accounts, thereby fostering the development of intelligent servicing strategies that scale retrieval efforts without sacrificing performance. Real-world applications of predictive modeling illustrate its efficacy in prioritizing accounts based on dynamic risk assessments, which leads to more efficient resource allocation and improved consumer interactions.

Jack Mahoney, Chief Analytics Officer, emphasizes that organizations recognizing data as a strategic asset will excel in the years ahead by integrating global debt collection models for financial institutions' risk management strategies into their collection methods. Furthermore, the case study 'Real-Time Decision-Making: Elevating Consumer Interaction' demonstrates how immediate guidance during consumer interactions can further enhance customer satisfaction.

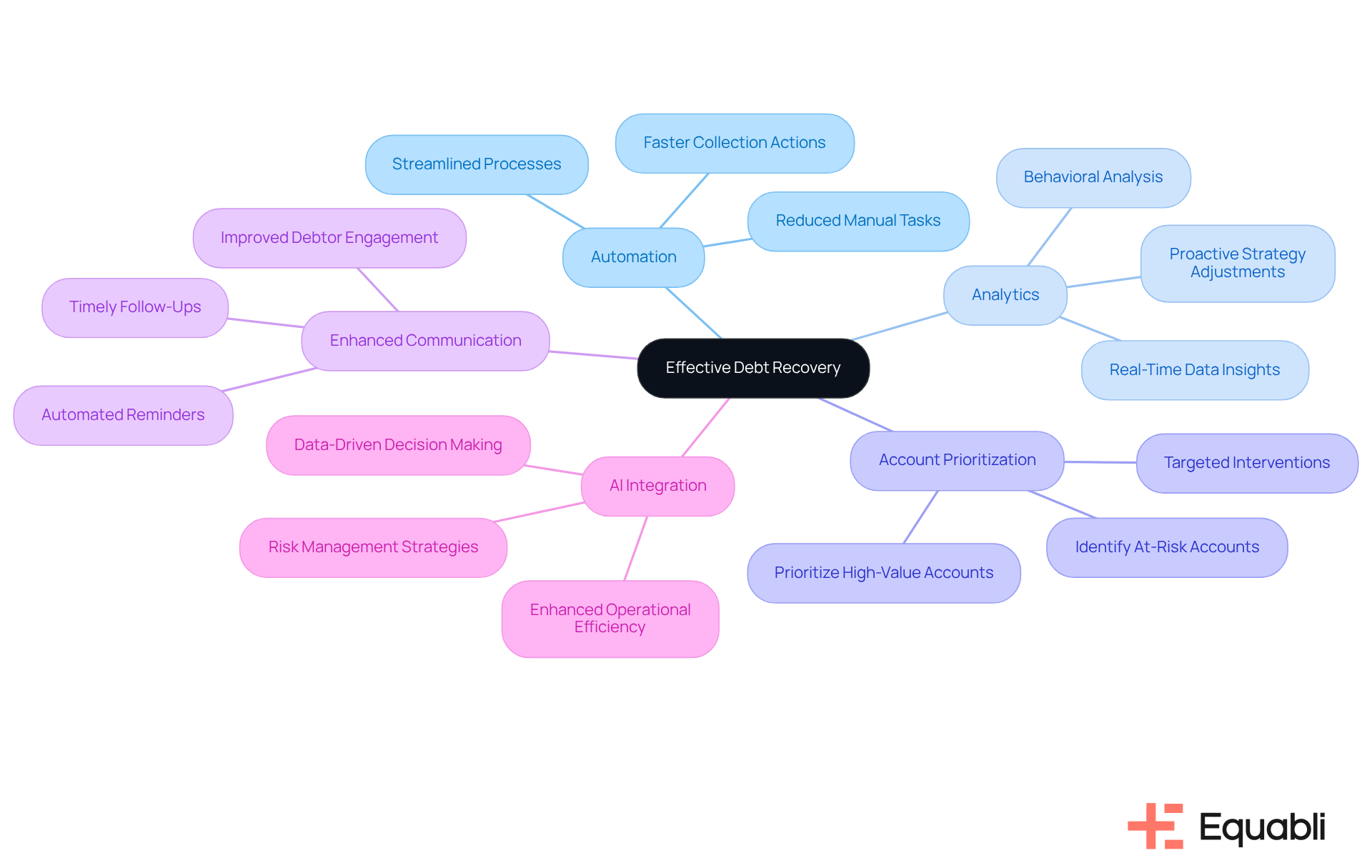

Prodigal: Automation and Analytics for Effective Debt Recovery

Prodigal leverages automation and analytics to transform debt collection processes. By employing AI-driven insights, the platform effectively prioritizes accounts, ensuring recovery efforts focus on those with the highest potential for recuperation. This strategic approach streamlines communication with debtors and , enabling them to concentrate on high-value interactions that yield results.

The platform's robust analytics capabilities provide real-time data on debtor behavior, allowing organizations to dynamically adapt their strategies. Companies utilizing Prodigal's insights have reported significant improvements in collection rates, as they can swiftly identify at-risk accounts and implement targeted interventions. This proactive strategy is crucial in today's competitive landscape, where timely action can differentiate successful restoration from increased write-offs.

Moreover, the integration of AI in financial recovery strategies aligns with global debt collection models for financial institutions' risk management strategies, as supported by industry experts who emphasize the importance of data-driven decision-making. By harnessing these advanced technologies, financial institutions can enhance operational efficiency and cultivate stronger relationships with debtors, ultimately resulting in improved financial outcomes.

CR Software: Streamlined Tools for Efficient Debt Collection

Equabli's EQ Suite revolutionizes the debt retrieval process by automating workflows and enhancing communication. This cloud-based solution integrates seamlessly with existing systems, enabling organizations to and boost efficiency. The user-friendly interfaces of EQ Suite allow for customization based on specific requirements, significantly enhancing effectiveness.

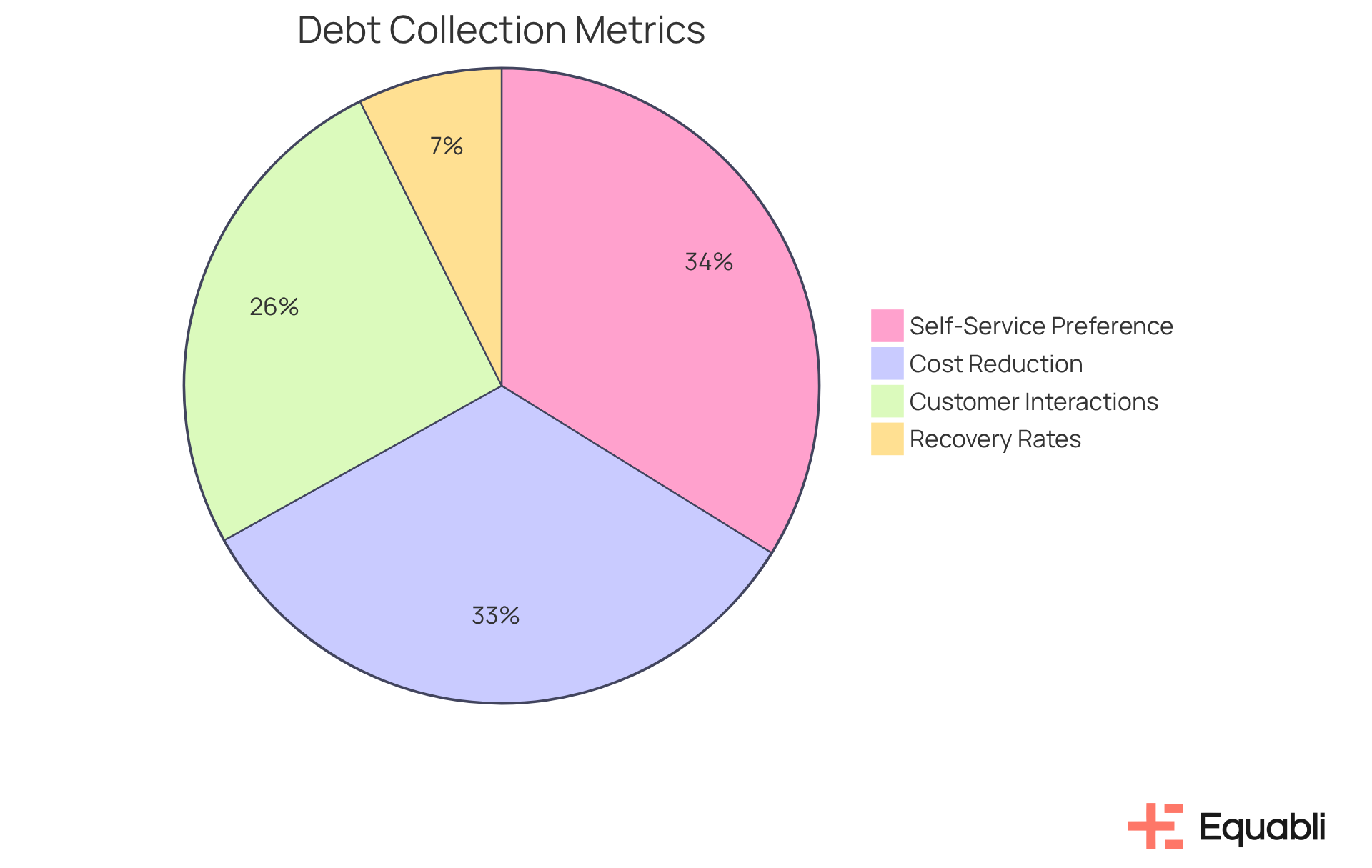

Evidence indicates that agencies employing automated systems can reduce operational costs by up to 90% while autonomously managing up to 70% of customer interactions. Moreover, debt recovery agencies that leverage automated communication experience operational advancements at a rate eight times faster.

The platform's robust reporting capabilities facilitate accurate monitoring of performance metrics, fostering continuous improvement in collection methodologies. Evidence-based strategies yield a 15-25% increase in recovery rates, underscoring the importance of utilizing user-friendly financial recovery software in today's digital landscape.

Notably, 92% of customers opt for self-service payment options when available, highlighting the crucial role of personalized communication and self-service solutions in enhancing borrower engagement and recovery efficiency.

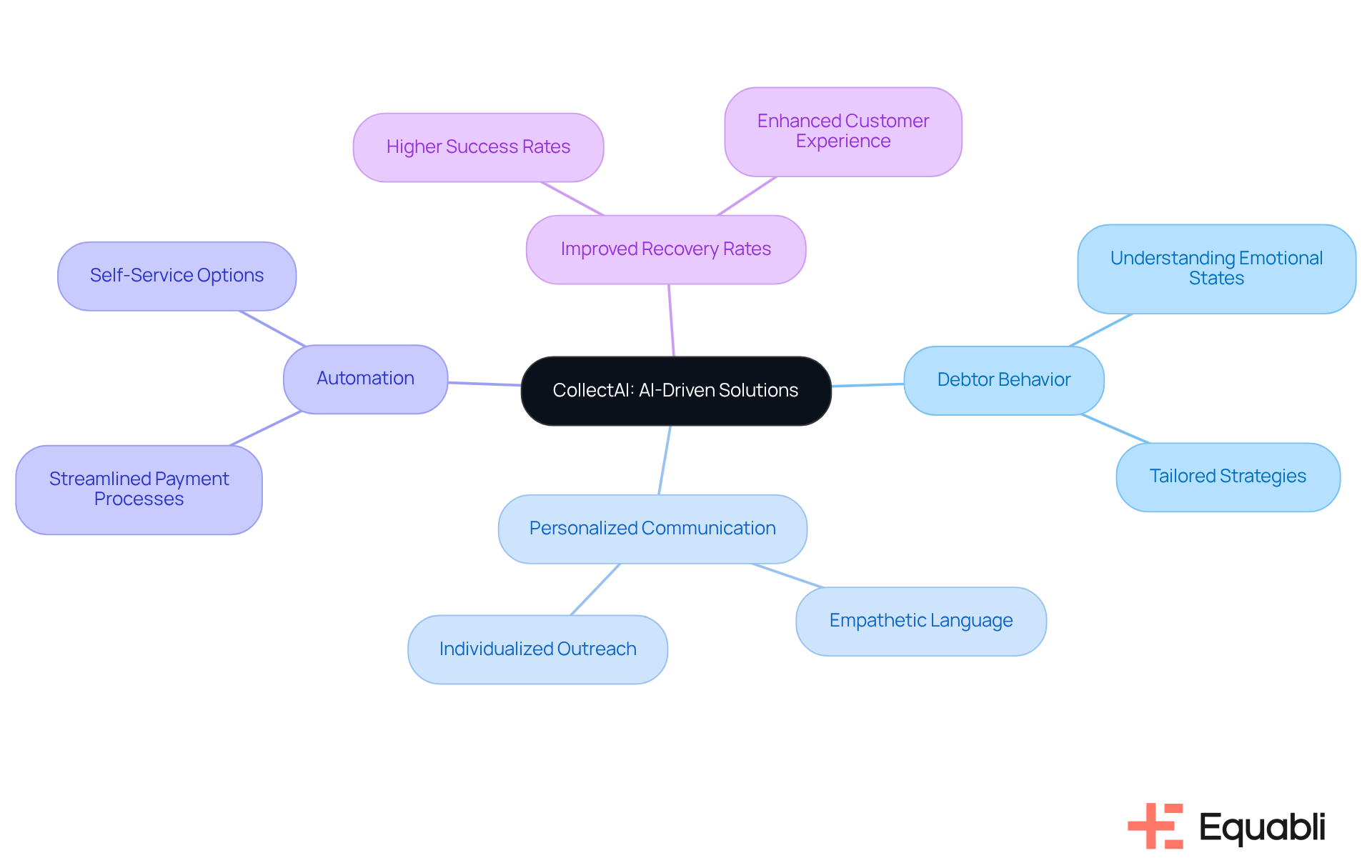

CollectAI: AI-Driven Solutions for Enhanced Customer Engagement

CollectAI enhances customer interaction in financial recovery through AI-powered solutions. By examining debtor behavior and preferences, the platform tailors communication strategies to individual situations, significantly improving the likelihood of successful recoveries. This personalized approach is further strengthened by that streamline payment processes, enabling debtors to manage their accounts via self-service options. As a result, recovery rates improve, and the overall customer experience becomes more favorable, effectively mitigating the stigma often associated with financial recovery.

Real-world applications of these strategies illustrate their effectiveness, demonstrating how organizations can foster better relationships with debtors while achieving their financial objectives.

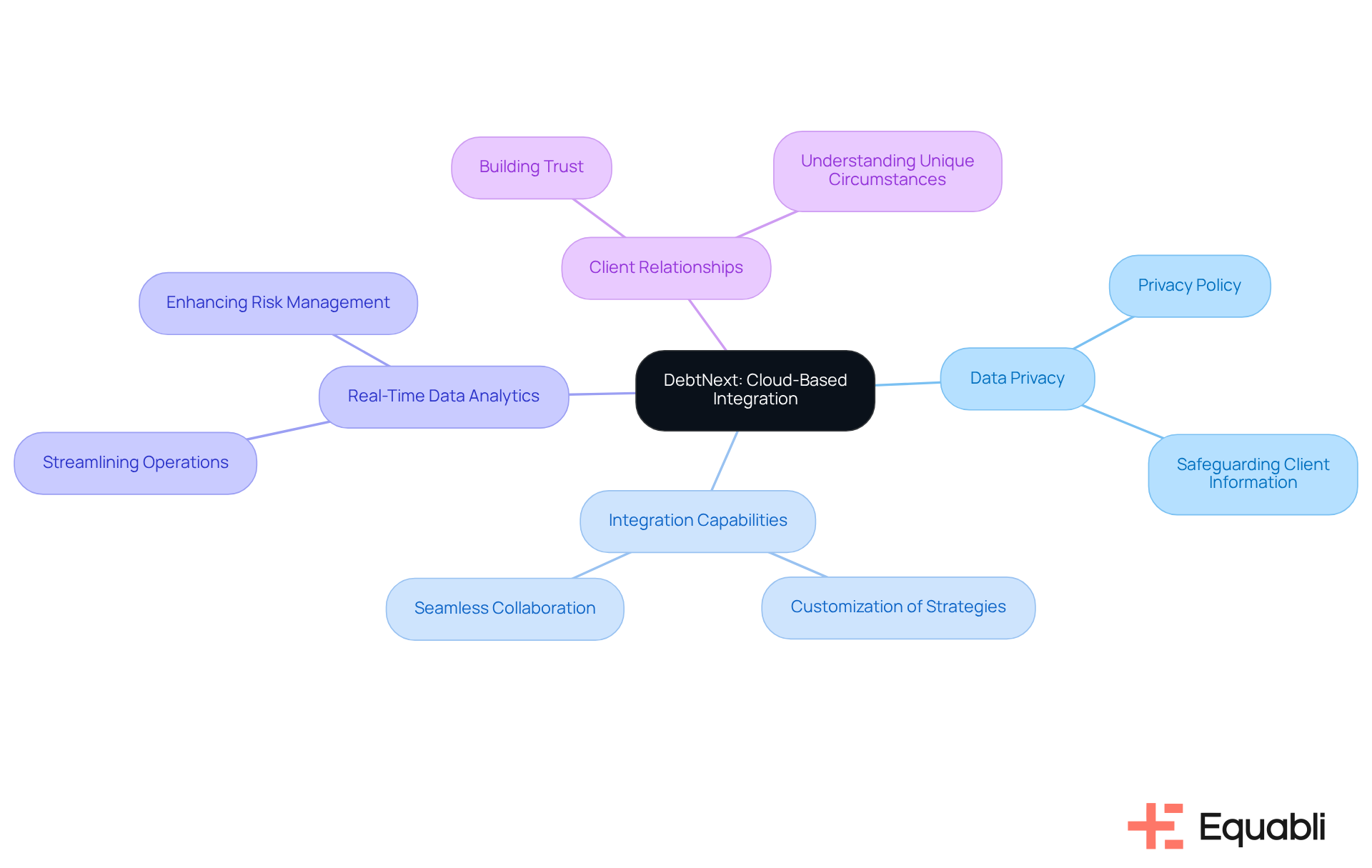

DebtNext: Cloud-Based Integration for Versatile Collection Strategies

Equabli operates as a cloud-based platform that delivers versatile solutions for debt recovery, with a strong emphasis on safeguarding private information, as detailed in our Privacy Policy. This policy outlines our , ensuring client interactions are managed with utmost care and transparency.

Our robust integration capabilities empower organizations to [customize their gathering strategies](https://radiusgs.com/give-customers-secure-digital-payment-options), leveraging real-time data and analytics. By harnessing cloud technology, Equabli facilitates seamless collaboration among collection teams and enhances data accessibility, thus ensuring responsible management of client information.

This adaptability is crucial for responding to dynamic market conditions and optimizing efforts across various channels. Industry experts highlight that integrating real-time data analytics into financial recovery processes is essential for global debt collection models for financial institutions' risk management strategies, as it not only streamlines operations but also fosters stronger relationships with clients, demonstrating a commitment to understanding their unique circumstances and protecting their information.

Chetu: Customized Software Solutions for Tailored Debt Collection

Equabli provides tailored software solutions specifically designed to meet the unique needs of debt recovery agencies and financial institutions, utilizing global debt collection models for financial institutions' risk management strategies. By developing customized platforms such as EQ Collect, organizations can streamline their gathering processes and enhance operational efficiency. Key features include:

- A user-friendly, scalable, cloud-native interface

- A no-code file-mapping tool that significantly reduces vendor onboarding timelines

- Automated workflows that minimize execution errors and reliance on manual resources

Moreover, the integration of advanced technologies, such as AI and machine learning, empowers clients to leverage data-driven insights for improved decision-making and superior outcomes. With delivering exceptional clarity and top-tier compliance oversight, Equabli ensures more intelligent coordination and enhanced performance in receivable management.

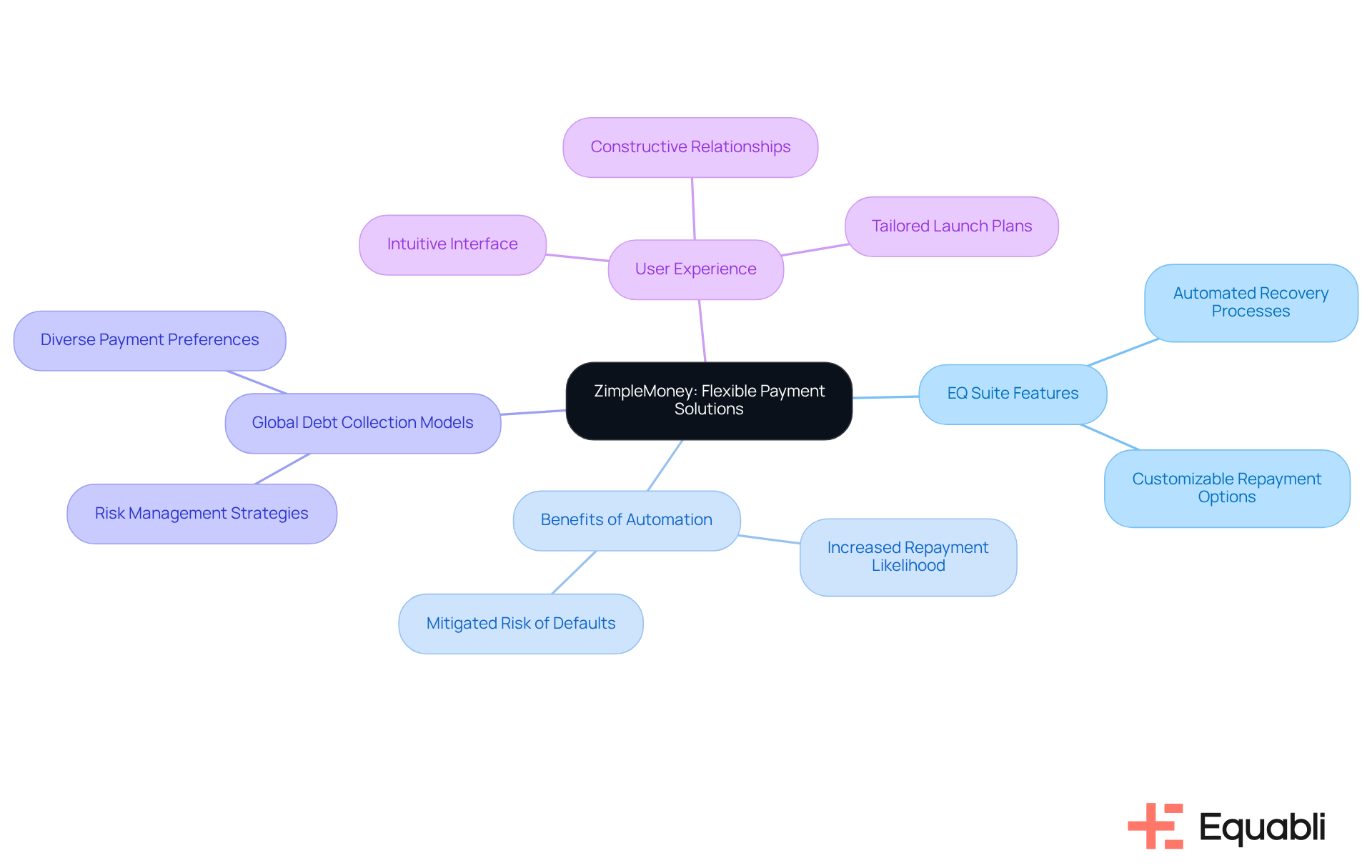

ZimpleMoney: Flexible Payment Solutions for Improved Recovery

Equabli delivers advanced recovery solutions that significantly enhance retrieval efforts. Its EQ Suite empowers financial institutions to automate recovery processes while offering customizable repayment options tailored to borrowers' needs.

The inefficiencies and missed opportunities associated with manual financial recovery highlight the necessity for adopting global debt collection models for financial institutions' risk management strategies. By accommodating diverse payment preferences, Equabli not only increases the likelihood of timely repayments but also mitigates the risk of defaults.

The platform's simplifies the accumulation process for both lenders and borrowers, fostering a constructive relationship throughout the recovery lifecycle. Supported by Equabli's expert team and tailored launch plans designed to ensure a seamless transition, financial institutions can effectively adopt modern, cloud-based solutions that enhance efficiency and compliance management, while also implementing global debt collection models for financial institutions' risk management strategies.

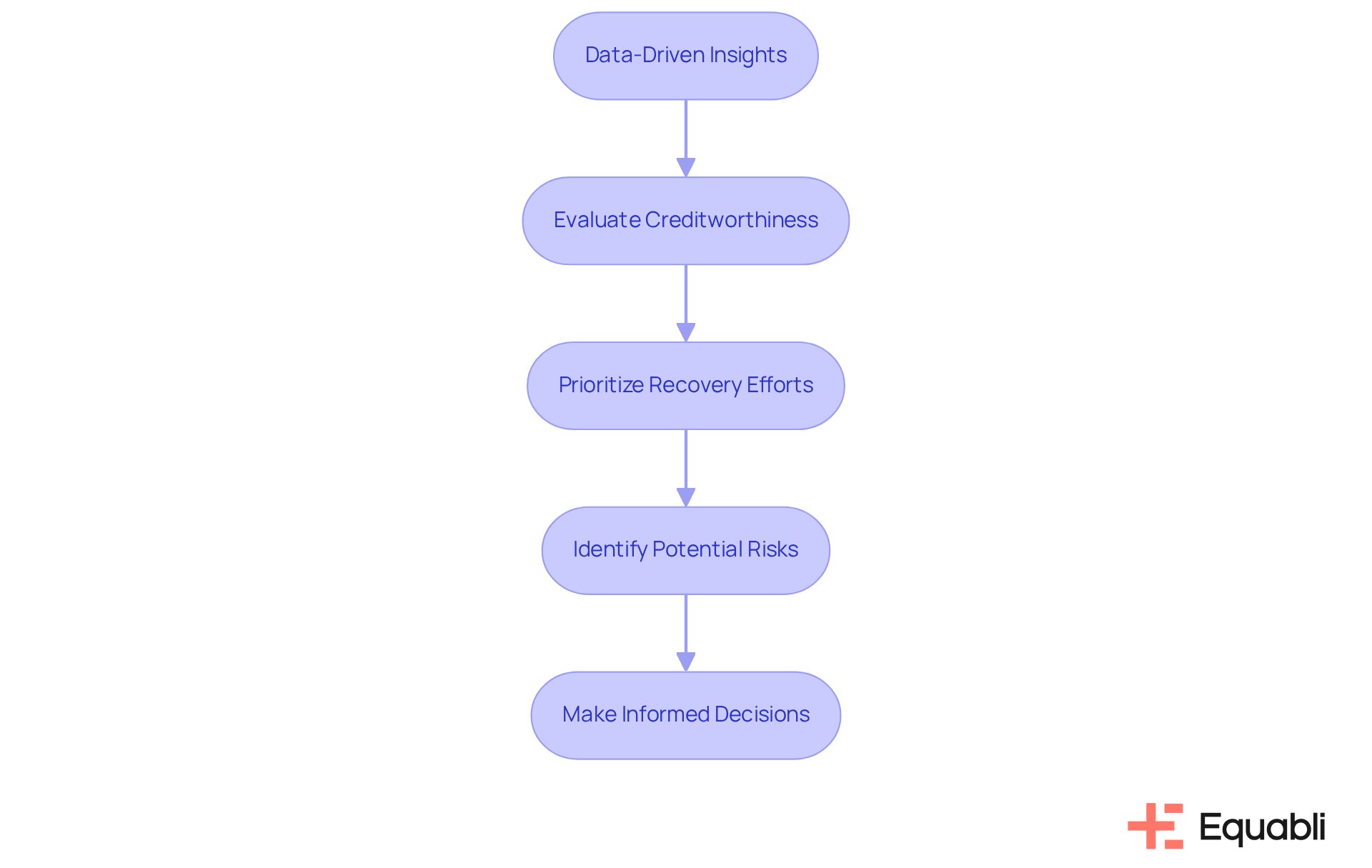

Dun & Bradstreet: Data-Driven Insights for Risk Management in Collections

Dun & Bradstreet delivers data-informed insights essential for effective risk management strategies, particularly in global debt collection models for financial institutions. By providing extensive business information and analytics, organizations can evaluate the creditworthiness of debtors, thereby prioritizing their recovery efforts effectively. This capability equips financial institutions to identify potential risks and make informed decisions, which ultimately enhances recovery rates and minimizes losses through the use of global debt collection models for financial institutions' risk management strategies.

Furthermore, Equabli's EQ Engine amplifies these efforts through machine learning and automation, predicting the risk of delinquency in active accounts. This integration facilitates the development of , which improve efficiency in fund recovery and enhance overall retrieval processes.

Experian: Credit Reporting and Analytics for Enhanced Debt Collection

Equabli's EQ Collect presents advanced features that enhance traditional credit reporting and analytics solutions. By leveraging EQ Collect's no-code file-mapping tool, financial institutions can significantly shorten vendor onboarding timelines, thereby utilizing global debt collection models for financial institutions' risk management strategies to improve debt recovery efficiency. This data-centric approach allows organizations to assess the probability of repayment with greater precision, which is essential for developing global debt collection models for financial institutions' risk management strategies.

Furthermore, automated workflows minimize execution errors and reduce reliance on manual resources, ensuring retrieval efforts are both effective and compliant with industry standards. With and unmatched transparency, EQ Collect empowers financial institutions to utilize global debt collection models for financial institutions' risk management strategies, allowing them to segment their debtor portfolios based on risk profiles.

Its user-friendly, scalable, cloud-native interface transforms debt recovery into a streamlined and strategic process, fostering improved relationships with debtors through equitable and informed collection practices.

Conclusion

The exploration of global debt collection models underscores the pivotal role that innovative technology plays in enhancing financial institutions' risk management strategies. Leveraging advanced solutions such as Equabli's EQ Suite and the FICO® Platform, organizations can streamline debt recovery processes while ensuring compliance and improving overall efficiency. The integration of automation, analytics, and personalized communication not only optimizes collection efforts but also cultivates stronger relationships with debtors, ultimately resulting in improved financial outcomes.

Key insights from the article emphasize the necessity of adopting intelligent solutions tailored to the unique needs of financial institutions. The predictive analytics capabilities of FICO® and the customized approaches offered by platforms like Prodigal and CollectAI empower organizations to identify high-risk accounts, enhance borrower engagement, and implement targeted recovery strategies. Furthermore, the focus on cloud-based integration and real-time data highlights a shift towards more adaptable and responsive debt collection practices.

As the debt recovery landscape evolves, financial institutions are urged to embrace these innovative models and technologies. By doing so, they can mitigate risks associated with delinquent accounts and position themselves for long-term success in a competitive market. The future of debt collection hinges on the ability to harness data, automate processes, and prioritize customer-centric approaches, ensuring organizations remain agile and effective in their recovery efforts.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a comprehensive solution designed to optimize debt recovery processes with a focus on data protection and compliance. It includes the EQ Engine, EQ Engage, and EQ Collect, which utilize advanced analytics and machine learning to predict repayment behaviors and refine recovery strategies.

What features does EQ Collect offer?

EQ Collect includes features such as automated workflows, real-time reporting, and a no-code file-mapping tool, all aimed at enhancing operational efficiency and minimizing execution errors.

How does the EQ Suite benefit financial institutions?

The EQ Suite allows financial institutions to reduce operational costs, improve their bottom lines, enhance borrower engagement, and modernize their recovery efforts while maintaining compliance oversight.

What is the FICO® Platform?

The FICO® Platform is a data-driven solution that employs advanced analytics to help financial institutions optimize their debt recovery strategies, utilizing predictive modeling and risk evaluation tools to identify high-risk accounts.

How does the FICO® Platform enhance customer satisfaction?

By facilitating omni-channel communication and allowing collectors to interact with debtors through their preferred channels, the FICO® Platform significantly boosts recovery rates and improves customer satisfaction through personalized experiences.

What role does Prodigal play in debt recovery?

Prodigal leverages automation and analytics to transform debt collection processes by prioritizing accounts with the highest potential for recovery and streamlining communication with debtors.

What advantages does Prodigal offer to organizations?

Prodigal provides real-time data on debtor behavior, enabling organizations to adapt their strategies dynamically, resulting in significant improvements in collection rates and stronger relationships with debtors.

How do these platforms align with global debt collection models?

All three platforms—Equabli's EQ Suite, the FICO® Platform, and Prodigal—align with global debt collection models for financial institutions' risk management strategies by employing data-driven decision-making and advanced technologies to enhance operational efficiency and recovery outcomes.