Overview

The statute of limitations for debt collectors establishes the maximum period during which creditors can legally initiate lawsuits to recover debts, typically spanning three to six years, and extending up to ten years for specific obligations. Understanding these timelines is crucial; actions such as making a payment or acknowledging a debt can reset the statute, thereby reviving creditors' capacity to pursue legal action. This complexity can significantly impact debtors' financial responsibilities. Therefore, it is imperative for individuals to remain informed about these regulations to navigate their obligations effectively.

Introduction

Understanding the intricate landscape of debt collection is essential for both creditors and borrowers, particularly regarding the statute of limitations. This legal timeframe dictates how long creditors can pursue repayment through litigation, varying significantly based on the type of debt and state regulations. The stakes are high; a simple acknowledgment of a debt can reset this clock, reopening the door for creditors to take action. How can individuals navigate this complex legal terrain without inadvertently compromising their financial standing? This question underscores the necessity for informed decision-making in a challenging financial environment.

Define the Statute of Limitations in Debt Collection

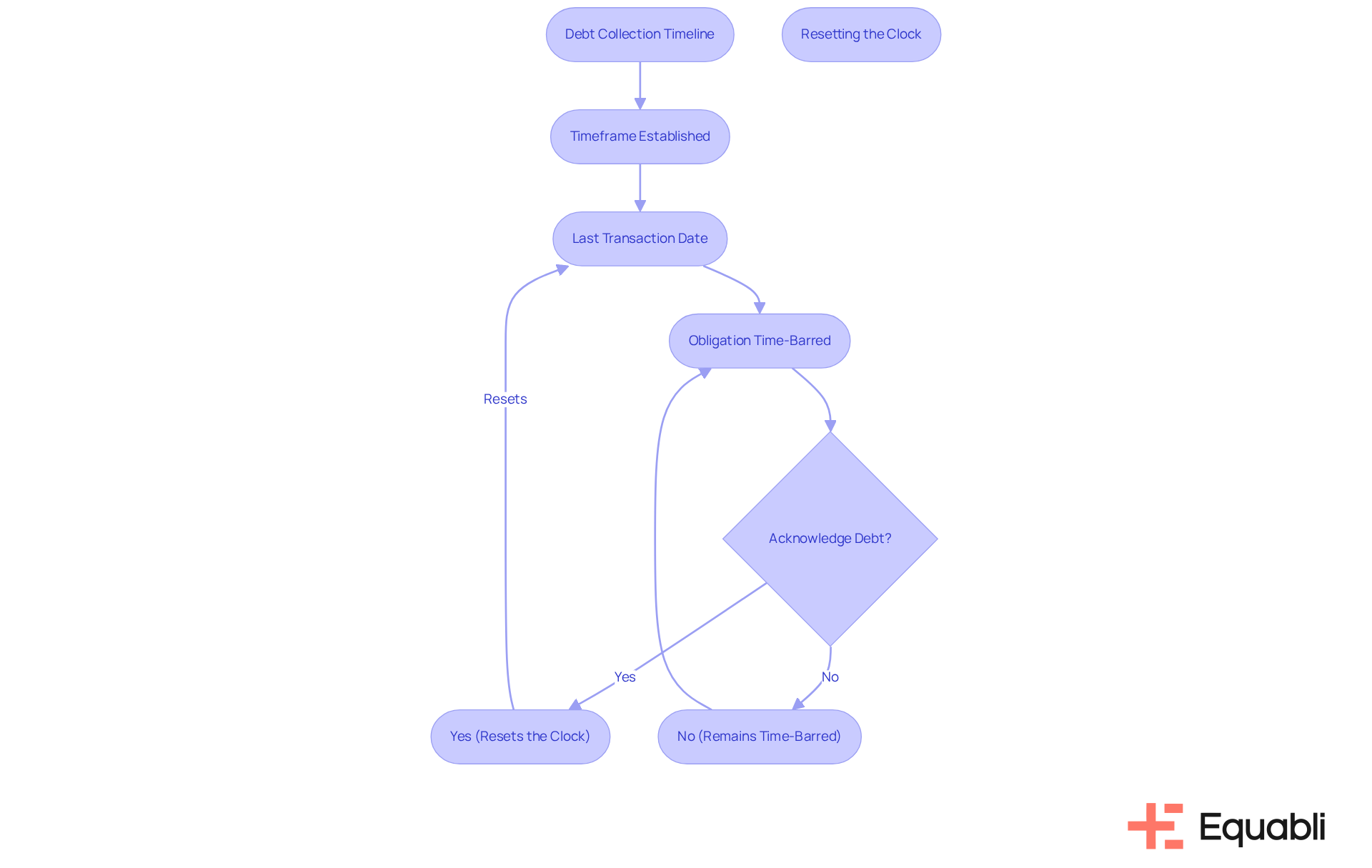

The statute of limitations debt collectors establishes the maximum timeframe creditors have to initiate a lawsuit for recovery. This period varies significantly based on the type of obligation and state laws, typically spanning three to six years in most jurisdictions. Notably, certain financial obligations, such as tax responsibilities, can extend this period up to ten years. The countdown commences from the date of the last transaction or recognition of the obligation.

Once the time limit for legal action expires, the obligation is classified as 'time-barred,' effectively preventing creditors from pursuing repayment. However, creditors retain the ability to pursue collection through alternative channels, including phone calls and written correspondence.

Understanding these timelines is crucial; actions such as making a payment or acknowledging the obligation can debt collectors rely on, renewing the creditor's capacity to pursue legal action. For example, if a consumer acknowledges an obligation verbally, it can restart the six-year clock, enabling collectors to take legal action once more.

Therefore, individuals must exercise caution when interacting with collection agencies regarding old liabilities to avoid unintentionally reinstating time-barred responsibilities.

Explore Implications for Debt Collectors and Debtors

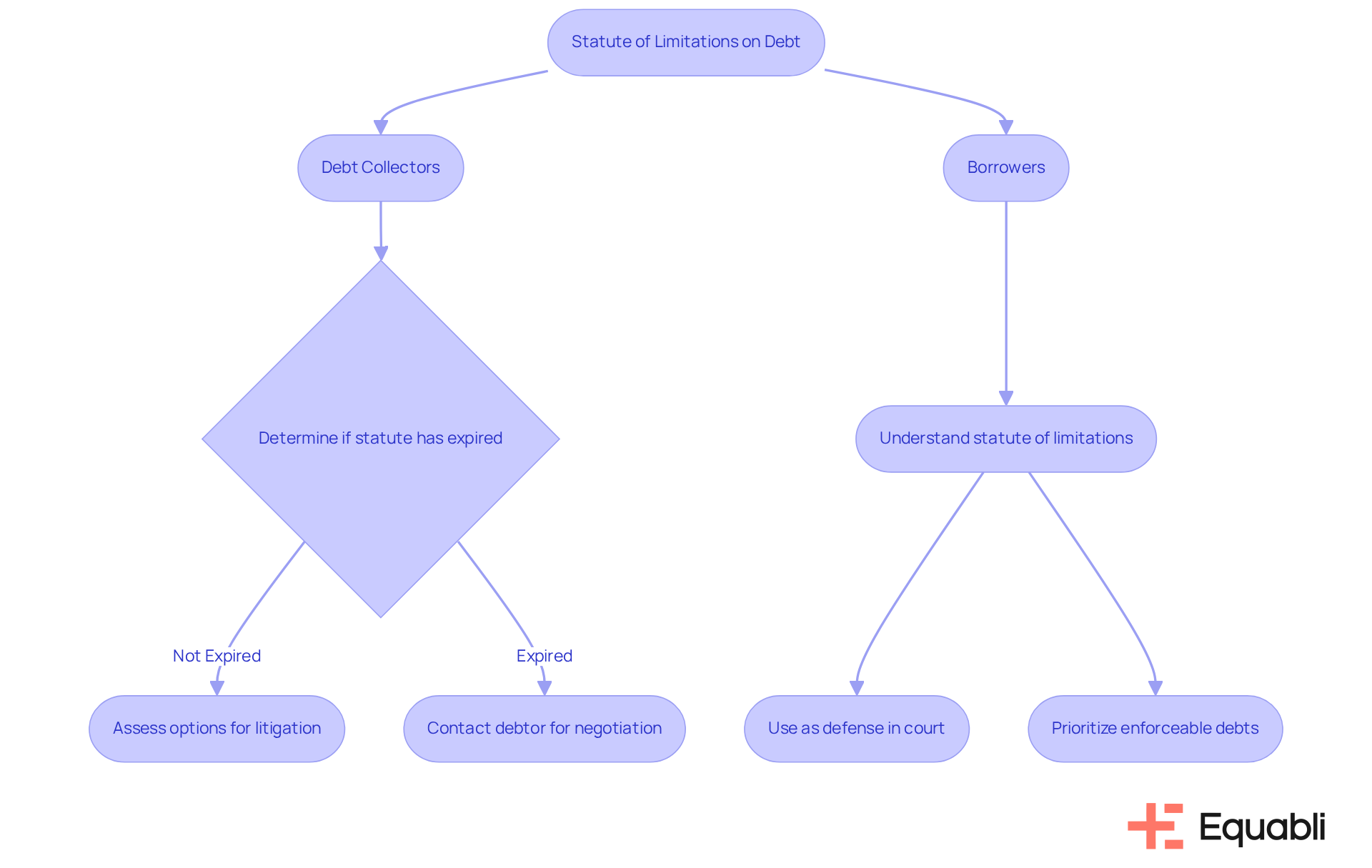

The consequences of the time limit are crucial for both creditors and borrowers. For debt collectors, understanding the statute of limitations debt collectors face is essential in determining whether they can pursue a debt through litigation. If the statute of limitations debt collectors has expired—typically around 10 years for consumer debt—they cannot initiate a lawsuit, significantly limiting their recovery options. However, they retain the ability to contact debtors for negotiation purposes, provided they do not imply that legal action is still a possibility. As Congressman Steve Cohen stated, "Consumers must be safeguarded from overzealous collectors who are bending the rules to collect."

Conversely, borrowers can leverage their understanding of the statute of limitations debt collectors to defend against unjust collection attempts. If a collector attempts to litigate for an expired obligation, the individual can use the statute of limitations debt collectors as a defense in court, effectively negating the collector's claim. Additionally, comprehending the statute of limitations debt collectors enables borrowers to strategically prioritize their obligations, focusing on enforceable liabilities while avoiding unnecessary expenditures on those that are not. For instance, making a partial payment on a time-barred obligation can unintentionally reactivate the entire responsibility, extending the collector's ability to pursue it. This risk is underscored in the case study 'Risks of Reviving Old Obligations,' which examines how such transactions can reactivate liability.

Both parties must navigate these legal timelines with care to protect their interests. Numerous creditors sell for a fraction of their worth, complicating the collection landscape and necessitating vigilance and informed decisions from both collectors and borrowers.

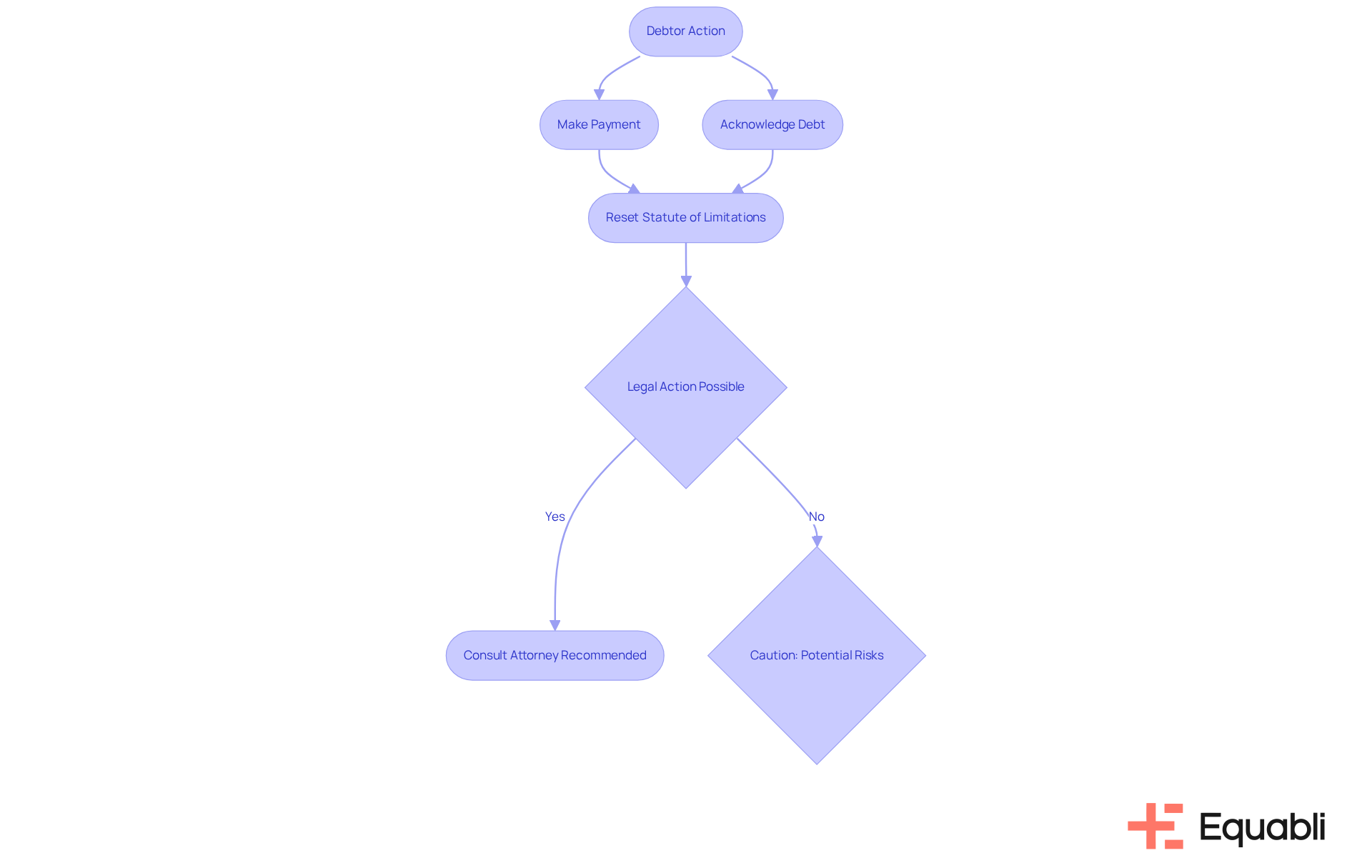

Understand the Impact of Acknowledgment and Payments

Recognizing an obligation or making a payment can reset the time limit, meaning that any partial payment or written acknowledgment effectively restarts the clock on the period within which creditors can legally pursue collection. This reset can have significant consequences for individuals who may mistakenly believe they are nearing the end of their obligation. The statute of limitations debt collectors must adhere to can differ by type of obligation, typically ranging from three to six years, but in certain situations, it can extend up to ten years. Understanding this variation is , as it directly impacts their legal standing.

For creditors, grasping this dynamic is essential. They may tactically encourage borrowers to make minor contributions or recognize the obligation, thereby prolonging their capacity to initiate legal proceedings. Legal specialists emphasize that such actions can unintentionally cause individuals to re-enter a cycle of responsibility, making it imperative for them to thoroughly understand the consequences of any correspondence or financial transaction related to previous obligations. Additionally, adverse information, including outstanding obligations, can remain on a credit report for as long as seven years, further complicating an individual's financial situation.

Case studies illustrate the potential pitfalls of this practice. For instance, an individual who makes a partial contribution on a time-barred obligation may find themselves facing renewed collection attempts, as the limitations period resets, enabling creditors to seek the entire amount due. This underscores the importance of consulting with consumer protection attorneys to navigate these complexities and understand jurisdiction-specific statutes of limitations debt collectors, as well as the protections offered under the Fair Debt Collection Practices Act (FDCPA).

Ultimately, debtors should approach any acknowledgment or payment with caution, as these actions can significantly alter their legal standing and financial obligations.

Conclusion

Understanding the statute of limitations for debt collection is essential for both creditors and debtors alike. This legal timeframe dictates how long creditors can pursue debts through litigation, typically ranging from three to ten years depending on the type of obligation and state laws. Once this period expires, debts become time-barred, limiting collectors' options to recover funds. However, the implications of this statute extend beyond mere timelines; they significantly influence how both parties navigate their financial responsibilities.

Key insights highlight the importance of recognizing how actions such as acknowledging a debt or making a payment can reset the statute of limitations, inadvertently renewing a creditor's ability to pursue repayment. Moreover, borrowers can gain a strategic advantage by understanding these laws, enabling them to defend against unjust collection attempts and prioritize their financial obligations effectively. The potential pitfalls of inadvertently reviving old debts underscore the necessity for informed decision-making in financial interactions.

Ultimately, a comprehensive understanding of the statute of limitations for debt collection empowers individuals to protect their interests and promotes a fairer debt recovery process. It is crucial for debtors to remain vigilant and consult with legal experts when engaging with collection agencies, ensuring they are fully aware of their rights and the implications of their actions. By doing so, individuals can navigate the complexities of debt collection with greater confidence and security.

Frequently Asked Questions

What is the statute of limitations in debt collection?

The statute of limitations in debt collection is the maximum timeframe that creditors have to initiate a lawsuit for recovery of a debt. This period typically ranges from three to six years, depending on the type of obligation and state laws.

How long can the statute of limitations extend for certain financial obligations?

For certain financial obligations, such as tax responsibilities, the statute of limitations can extend up to ten years.

When does the statute of limitations period begin?

The statute of limitations period begins from the date of the last transaction or recognition of the obligation.

What happens when the statute of limitations expires?

When the statute of limitations expires, the obligation is considered 'time-barred,' which prevents creditors from pursuing legal action for repayment.

Can creditors still pursue collection after the statute of limitations has expired?

Yes, creditors can still pursue collection through alternative means such as phone calls and written correspondence, even after the statute of limitations has expired.

How can actions like making a payment or acknowledging a debt affect the statute of limitations?

Actions such as making a payment or acknowledging the obligation can reset the statute of limitations, allowing creditors to renew their capacity to pursue legal action.

What should individuals be cautious about when dealing with collection agencies regarding old debts?

Individuals should be cautious when interacting with collection agencies regarding old debts to avoid unintentionally reinstating time-barred responsibilities, which can occur if they acknowledge the debt or make a payment.