Overview

The article delineates four best practices for credit recovery agency solutions in risk management. It emphasizes the critical role of:

- Communication

- Data-driven insights

- Clear expectations

- Staff training

in enhancing debt recovery outcomes. Evidence supports the assertion that effective communication, coupled with the application of analytics, can significantly elevate collection rates and foster positive relationships with debtors. This ultimately leads to more successful recovery efforts, underscoring the importance of these practices in the context of enterprise-level operations.

Introduction

In the evolving landscape of debt collection, credit recovery agency solutions have become essential for organizations aiming to manage risk effectively. These solutions integrate advanced analytics, strategic communication, and cutting-edge technology, providing a pathway to enhance recovery rates while fostering positive relationships with debtors.

As the industry responds to new regulations and consumer expectations, the challenge lies in implementing best practices that comply with ethical standards and leverage innovation for superior outcomes. Agencies must navigate this complex terrain to ensure they are not only recovering debts but also building trust and transparency with their clients.

Understand Credit Recovery Agency Solutions

Credit recovery agency solutions for enterprise risk management provide a comprehensive suite of services designed to assist lenders and companies in recovering overdue debts. These services integrate advanced account management tools, strategic communication methods, and robust analytics for assessing debtor behavior.

Utilizing is paramount; it enables agencies to identify high-risk accounts and prioritize collection efforts effectively. Evidence indicates that targeted collection strategies can elicit responses from up to 80% of overdue accounts, significantly enhancing collection rates.

Incorporating customer relationship management (CRM) systems is essential for improving communication with debtors, fostering a more constructive collection experience. By leveraging AI-powered tools, organizations can automate payment reminders and refine contact strategies, leading to an eightfold increase in operational efficiency.

This combination of technology and personalized interaction not only aligns with client objectives but also enhances overall outcomes. As the collections landscape evolves, understanding and implementing credit recovery agency solutions for enterprise risk management will be critical for organizations aiming to enhance their effectiveness in 2025.

Implement Best Practices for Effective Credit Recovery

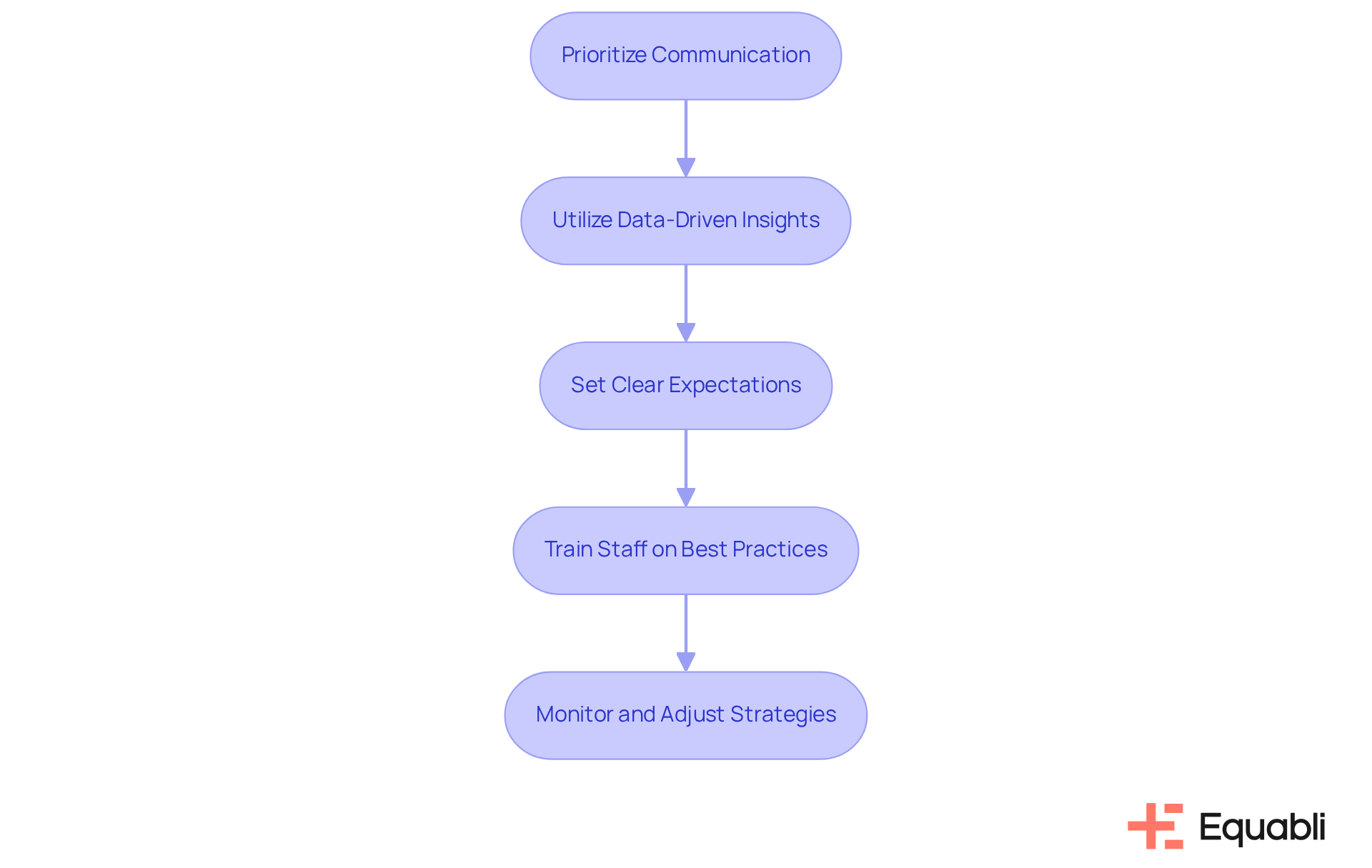

To implement effective credit recovery practices, agencies should focus on several key strategies:

- Prioritize Communication: Establish clear and consistent communication channels with individuals who owe money. Utilizing multiple platforms such as phone calls, emails, and SMS enhances outreach, which is essential for implementing for enterprise risk management, ensuring messages are tailored to the individual's preferences. Research indicates that 82% of customers respond positively when payment reminders are framed supportively, underscoring the importance of compassionate communication in fostering positive debtor relationships.

- Utilize Data-Driven Insights: Leverage analytics to assess debtor behavior and repayment likelihood. By utilizing predictive analytics, agencies can create customized repayment plans that address individual situations, significantly enhancing the likelihood of successful outcomes. Entities that consider information a strategic benefit are better equipped to thrive in the evolving collections environment, particularly through credit recovery agency solutions for enterprise risk management that emphasize data-driven decision-making.

- Set Clear Expectations: Clearly outline payment terms and conditions from the outset. This openness promotes trust and minimizes misconceptions that can obstruct credit recovery agency solutions for enterprise risk management. Consistent messaging emphasizes the severity of the debt and the creditor's dedication, ultimately contributing to more effective collection efforts with credit recovery agency solutions for enterprise risk management and fostering a transparent relationship with debtors.

- Training staff on best practices, particularly in credit recovery agency solutions for enterprise risk management, through regular sessions for agents on effective communication techniques and negotiation skills can significantly improve outcomes. Agents should be equipped to handle objections and provide solutions that work for both parties, ensuring a balanced approach that combines professionalism with empathy, thereby enhancing the overall effectiveness of the collection process.

- Monitor and Adjust Strategies: Continuously assess the effectiveness of restoration strategies and be willing to adapt based on performance metrics. This iterative method guarantees that agencies stay adaptable to evolving debtor behaviors and market conditions, facilitating optimal cash flow management and enhancing collection rates. By remaining proactive in strategy adjustment, agencies can enhance their operations through credit recovery agency solutions for enterprise risk management to better align with industry best practices.

Ensure Compliance and Ethical Standards in Debt Recovery

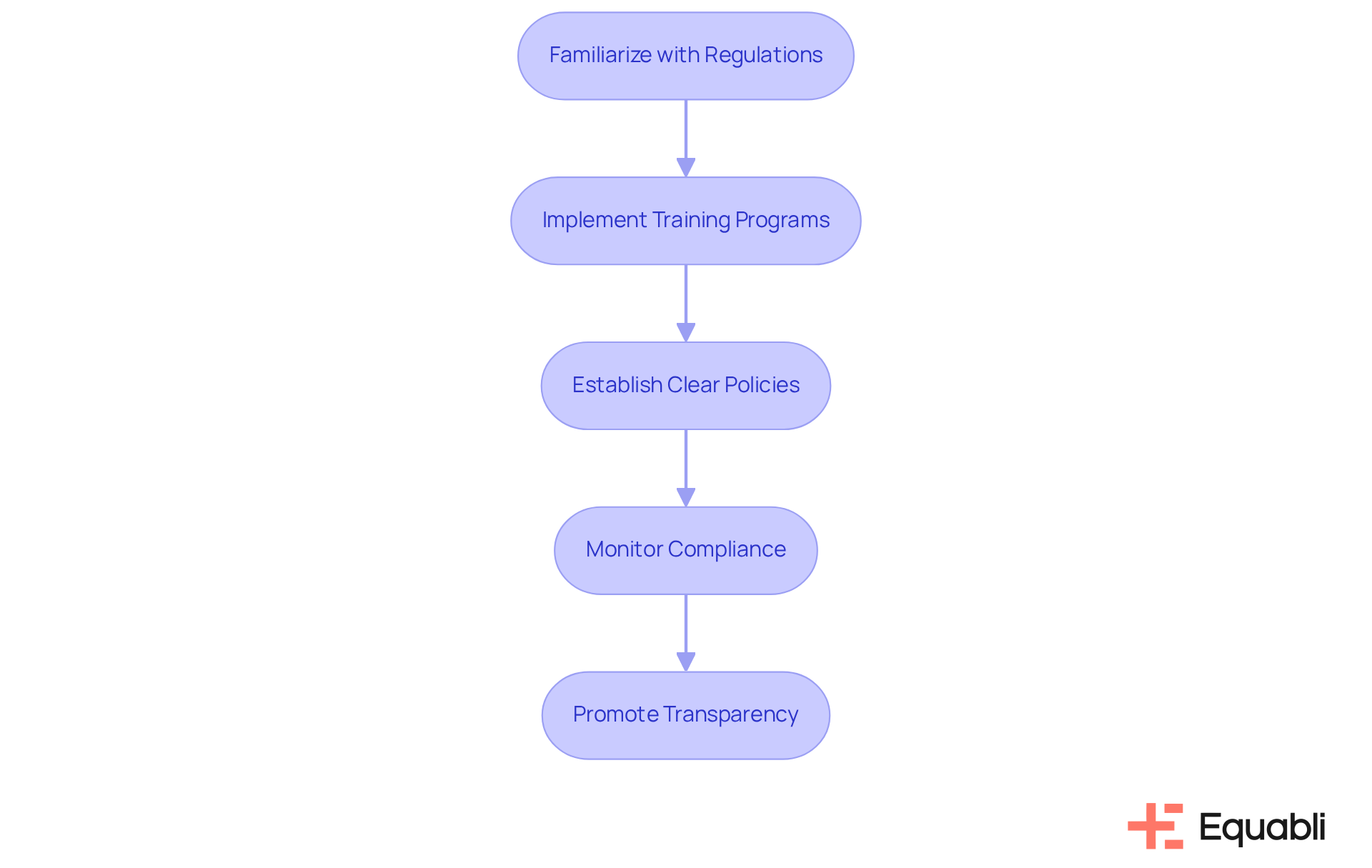

Ensuring compliance and ethical standards in debt recovery necessitates several key practices:

- Familiarize with Regulations: Agencies must remain informed about federal and state regulations governing debt collection, including the Fair Debt Collection Practices Act (FDCPA) and recent legislative changes such as Bill S4271 in New York, which mandates licensing for debt collectors. Understanding these laws is critical to prevent violations that could result in .

- Implement Training Programs: Regular training on compliance and ethical standards for all staff members is essential. Effective training programs should encompass respectful communication, proper documentation, and the importance of maintaining debtor privacy. Data indicates that organizations with comprehensive training experience improved compliance and reduced complaints. By utilizing the EQ Suite, agencies can access training modules that reinforce these principles, ensuring staff are adequately prepared.

- Establish Clear Policies: Agencies should create and implement internal guidelines that delineate acceptable practices for debt collection. These policies must prioritize the ethical treatment of borrowers and provide instructions for managing sensitive situations, equipping staff to navigate complex interactions with professionalism. The EQ Suite can assist in formulating and disseminating these policies, facilitating adherence efficiently.

- Monitor Compliance: Conducting regular audits and compliance checks can help identify potential issues before they escalate. Agencies should establish mechanisms to promptly address any compliance breaches, fostering a culture of accountability and continuous improvement. The EQ Suite's data-driven approach supports effective compliance monitoring, ensuring that all practices align with current regulations while providing real-time insights into operational performance.

- Promote Transparency: Transparency with debtors regarding their rights and the recovery process fosters trust and can lead to more successful outcomes. Providing clear details about the financial obligation, payment alternatives, and possible repercussions of non-payment is essential for cultivating a positive connection with consumers, particularly in light of the Debt Collection Fairness Act's emphasis on consumer protection. Equabli's commitment to consumer rights is reflected in its solutions, which prioritize data protection and ethical practices in debt collection.

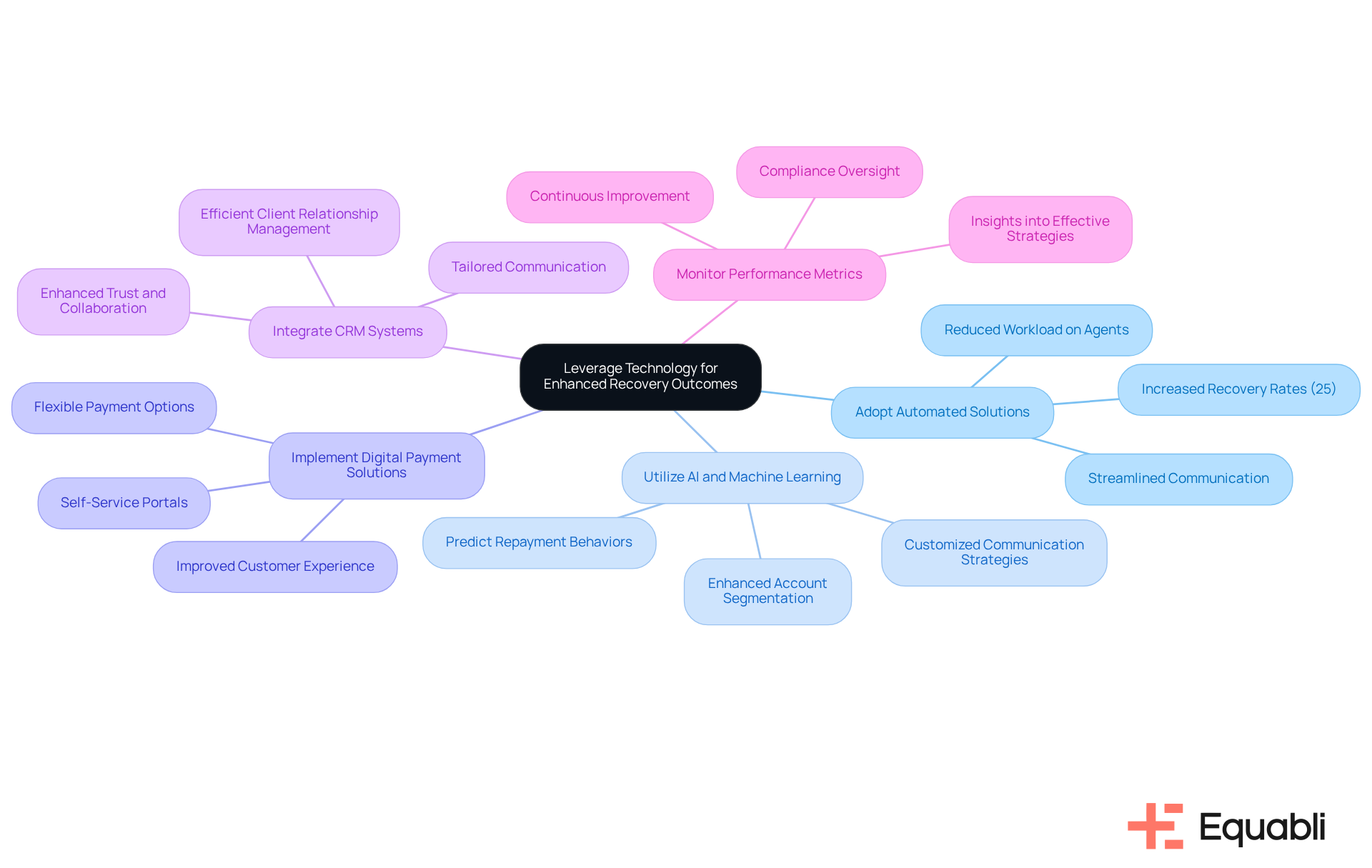

Leverage Technology for Enhanced Recovery Outcomes

Utilizing technology in credit restoration significantly enhances outcomes. Effective strategies for integrating technology are essential for organizations aiming to improve their debt collection processes.

- Adopt Automated Solutions: Implementing automated systems for reminders and follow-ups streamlines communication and reduces the workload on agents. Automation ensures timely outreach, which is crucial for maintaining debtor engagement. Agencies utilizing automation report a 25% increase in recovery rates, underscoring its effectiveness. With EQ Collect's automated workflows, organizations minimize execution errors and reduce manual resources, thereby enhancing efficiency. Furthermore, the no-code file-mapping tool expedites vendor onboarding timelines, facilitating a smoother and faster process.

- Utilize AI and Machine Learning: Advanced analytics powered by AI can predict repayment behaviors and identify the most effective communication strategies for various debtor segments. This data-oriented approach enables organizations to customize their efforts accurately, thereby improving engagement and recovery success. Approximately 57% of organizations are already leveraging AI for account segmentation and predictive analytics, moving away from conventional methods. With EQ Collect's , agencies can enhance collections and gain unparalleled insights through real-time reporting, aligning with intelligent servicing strategies.

- Implement Digital Payment Solutions: Providing flexible digital payment options enhances the customer experience and increases the likelihood of repayment. Self-service portals empower individuals to manage their payments conveniently, resulting in improved engagement and satisfaction. Tailored communication based on borrower preferences further supports this argument, as it has been shown to enhance engagement and repayment rates. EQ Collect's user-friendly, cloud-based interface simplifies these digital interactions, making it easier for individuals to engage with their accounts.

- Integrate CRM Systems: A robust CRM system aids organizations in managing client relationships efficiently. By monitoring interactions and preferences, agencies can tailor communication, which is essential for enhancing outcomes. This customized strategy fosters trust and collaboration from borrowers, aligning with the sector's growing emphasis on ethical debt collection practices. EQ Collect's features facilitate seamless integration with existing systems, ensuring a cohesive approach to debtor management.

- Monitor Performance Metrics: Employ technology to track key performance indicators (KPIs) related to restoration efforts. Analyzing these metrics provides insights into effective strategies and areas needing modification, ensuring continuous improvement in processes. Emphasizing transparency and proactive engagement in AI investments can further elevate the effectiveness of performance monitoring. With EQ Collect's automated monitoring capabilities, agencies can secure industry-leading compliance oversight, both internally and externally, ensuring that recovery efforts are not only effective but also compliant.

Conclusion

Implementing effective credit recovery agency solutions is critical for organizations focused on managing risk and optimizing their debt collection processes. By integrating advanced technology, data-driven insights, and ethical practices, agencies can enhance their recovery outcomes while preserving positive relationships with debtors.

Key strategies include:

- Prioritizing communication through diverse channels

- Utilizing predictive analytics to customize repayment plans

- Ensuring compliance with regulations to build trust

Training staff on best practices in debt recovery and continuously monitoring performance metrics are essential components of successful credit recovery initiatives. Emphasizing compassionate communication and transparency not only aids in compliance but also significantly increases the likelihood of successful debt recovery.

As the credit recovery landscape continues to evolve, organizations must adopt these best practices and leverage technology to maintain a competitive edge. By prioritizing ethical standards and implementing innovative solutions, agencies can navigate the complexities of debt recovery while achieving their financial objectives. Taking proactive steps to implement these strategies will ultimately lead to improved recovery rates and stronger relationships with clients and debtors alike.

Frequently Asked Questions

What are credit recovery agency solutions?

Credit recovery agency solutions are services designed to assist lenders and companies in recovering overdue debts, integrating advanced account management tools, strategic communication methods, and robust analytics.

How do data analytics play a role in credit recovery?

Data analytics helps agencies identify high-risk accounts and prioritize collection efforts effectively, leading to targeted strategies that can elicit responses from up to 80% of overdue accounts.

Why is customer relationship management (CRM) important in debt collection?

CRM systems improve communication with debtors, fostering a more constructive collection experience and enhancing overall collection outcomes.

How can AI-powered tools benefit credit recovery efforts?

AI-powered tools can automate payment reminders and refine contact strategies, resulting in an eightfold increase in operational efficiency.

What is the significance of understanding credit recovery agency solutions for enterprise risk management?

Understanding and implementing these solutions is critical for organizations aiming to enhance their effectiveness in debt collection as the collections landscape evolves, especially looking towards 2025.