Overview

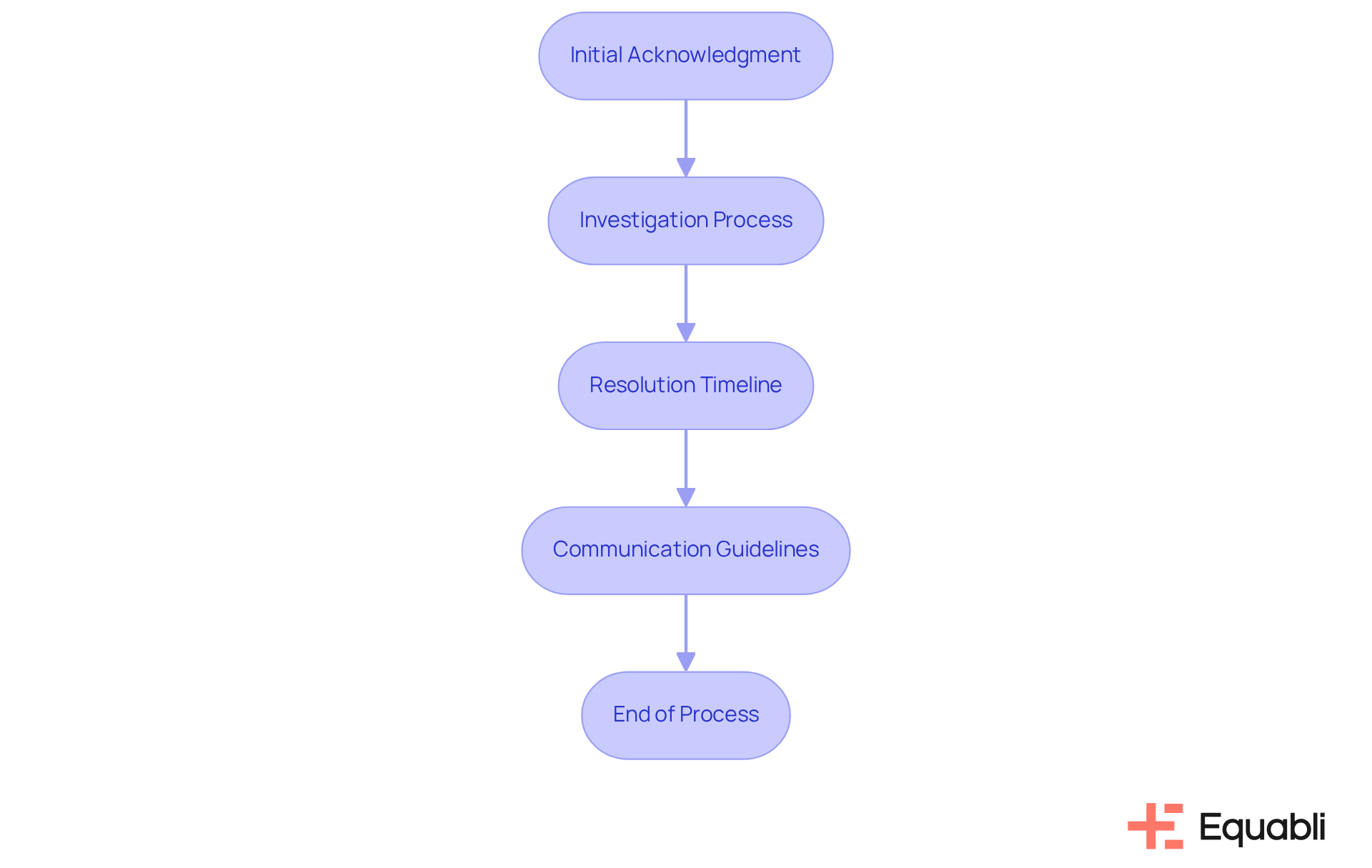

The article delineates four critical credit dispute resolution protocols for financial institutions. These protocols encompass the establishment of clear processes for acknowledgment, investigation, resolution timelines, and communication guidelines.

By enhancing operational efficiency and customer satisfaction, these measures promote trust and transparency. Furthermore, the integration of mediation and technology serves to streamline conflict management, thereby improving overall client relationships.

Introduction

Navigating the complexities of credit disputes presents a significant challenge for financial institutions, which often struggle to implement effective resolution protocols. Establishing clear and efficient credit dispute resolution processes enhances operational efficiency and significantly boosts customer satisfaction and retention.

With rising customer expectations and increasing demand for transparency, financial organizations must ensure they are equipped to handle disputes effectively while fostering trust. This article explores essential protocols, the role of mediation, the impact of technology, and the importance of staff training in creating a robust framework for credit dispute resolution.

Establish Clear Credit Dispute Resolution Protocols

To establish effective for financial institutions, it is essential to clearly define the steps involved in the conflict process. This includes:

- Initial Acknowledgment: All conflicts should be recognized within a specific timeframe, ideally within 24 hours. This prompt response is crucial for maintaining customer trust and satisfaction.

- Investigation Process: Institutions should outline the steps for examining conflicts, which includes gathering necessary documentation and coordinating with relevant departments to ensure a thorough review.

- Resolution Timeline: A clear timeline for resolving disputes should be established, typically within 30 days. This timeframe helps ensure timely responses and demonstrates the institution's commitment to resolving issues efficiently.

- Communication Guidelines: Creating thorough guidelines for interacting with clients throughout the process is essential. This encompasses offering frequent updates and clear clarifications of final outcomes, which can greatly improve user experience.

The implementation of credit dispute resolution protocols for financial institutions not only enhances operational efficiency but also boosts customer satisfaction, leading to higher retention rates and reduced legal risks. As industry specialists highlight, a clearly outlined conflict management procedure, including credit dispute resolution protocols for financial institutions, is essential for promoting trust and openness in financial organizations. Furthermore, statistics indicate that 10% of conflicts arise from differences in opinion, while 90% stem from the wrong tone of voice, underscoring the importance of effective communication. As Thomas Crum states, "The quality of our lives depends not on whether or not we have conflicts, but on how we respond to them." Moreover, empathy plays an essential role in conflict management; as Arthur P. Ciaramicoli observes, "Empathy is the key to negotiating and resolving conflict." By recognizing typical challenges in applying these protocols, organizations can prevent misapplication and improve their conflict management processes.

Utilize Mediation as a Key Dispute Resolution Tool

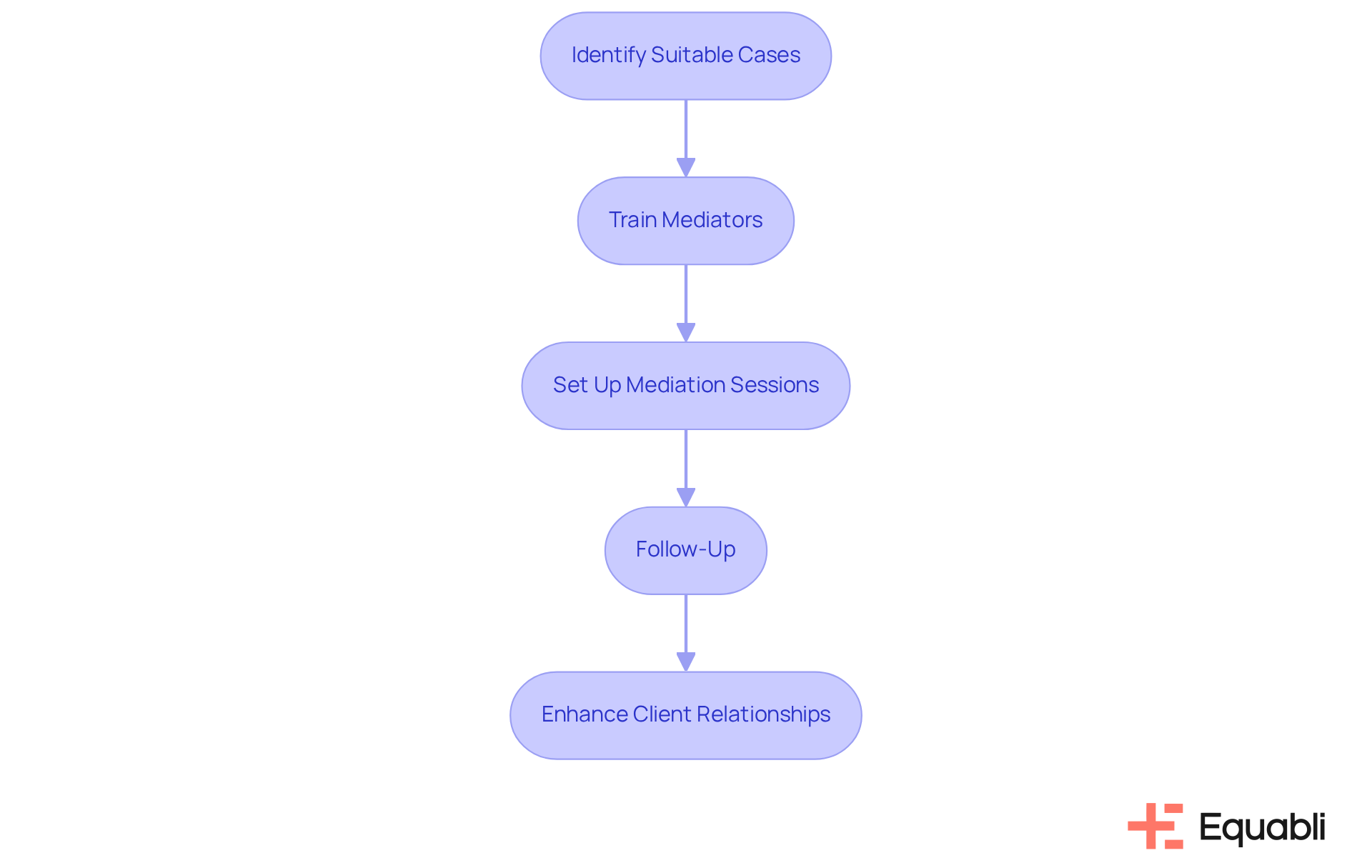

Incorporating mediation into the credit dispute resolution protocols for financial institutions is essential for proactively addressing disagreements. This approach not only simplifies the conflict management process but also fosters a cooperative environment that enhances customer relationships.

Identify Suitable Cases: Focus on disputes that are appropriate for mediation, particularly those that are less complex or arise from misunderstandings. This targeted approach ensures that , ultimately preserving business relationships.

Train Mediators: Investing in the education of internal personnel or employing external mediators with expertise in conflict management is crucial. Skilled mediators facilitate discussions and assist parties in navigating their differences constructively, thereby enhancing the mediation process.

Set Up Mediation Sessions: Establishing a structured environment for mediation sessions is vital. Ensuring that both parties feel comfortable and valued in a neutral setting fosters open communication and encourages collaborative problem-solving, which is essential for effective conflict resolution.

Follow-Up: After mediation, it is imperative to check in with both parties to ensure that the agreement is being executed effectively and to address any remaining concerns. This follow-up reinforces the commitment to maintaining positive relationships and demonstrates the organization's dedication to conflict resolution.

As highlighted by conflict resolution experts, mediation can significantly enhance interactions between financial entities and their clients, which is essential for effective credit dispute resolution protocols for financial institutions, fostering trust and loyalty. Current trends indicate a growing reliance on credit dispute resolution protocols for financial institutions, reflecting their effectiveness in preserving business relationships while resolving conflicts efficiently. Furthermore, mediation serves as an economical substitute for litigation, enabling organizations to allocate resources more effectively. The confidentiality of Alternative Dispute Resolution (ADR) processes protects the privacy of the parties involved, underscoring its advantages over traditional litigation. Acting in good faith during mediation can also prevent hasty litigation, ensuring a constructive approach to conflict resolution.

Leverage Technology for Efficient Dispute Management

To effectively leverage technology in dispute management, financial institutions should consider several essential tools:

- Conflict Management Software: Implementing robust software solutions enables institutions to track conflicts, document communications, and manage timelines efficiently. This technology streamlines the entire conflict process, enhancing accountability and transparency.

- Automated Alerts: Employing automated systems to inform clients about updates concerning their issues ensures they remain informed throughout the resolution process. This proactive communication fosters trust and enhances customer satisfaction.

- Data Analytics: Utilizing data analytics tools empowers institutions to recognize trends in conflicts, guiding future strategies and assisting in avoiding similar problems. By examining historical data, banks can enhance their processes and decrease the occurrence of conflicts.

- Protected Communication Channels: Creating secure avenues for clients to submit complaints and receive updates is essential for upholding confidentiality and adhering to regulations. These channels not only safeguard sensitive information but also improve the overall user experience.

Incorporating these technologies can significantly improve credit dispute resolution protocols for financial institutions, leading to enhanced operational efficiency and increased customer satisfaction. As highlighted by industry experts, including Jim Marous, co-publisher of The Financial Brand, "Financial organizations must be capable of providing an easy to navigate, seamless digital platform that extends well beyond a miniaturized online banking service." Furthermore, a statistic indicates that 62% of consumers regard how their financial institutions manage conflicts as significant, underscoring the importance of implementing advanced conflict management software. Successful implementations of such software in banks have demonstrated measurable improvements in and customer loyalty.

Train Staff on Best Practices for Dispute Resolution

To enhance staff capabilities in dispute resolution, training programs should concentrate on the following key areas:

- Comprehending Conflict Protocols: It is essential that all staff members are well-versed in established conflict management protocols and understand their specific roles within these frameworks. This foundational knowledge ensures consistency and effectiveness in handling disputes.

- Communication Skills: Training should focus on effective communication techniques, such as active listening and empathy, as emphasized by experts like Arthur P. Ciaramicoli and Jeremy Pollack. These skills foster better engagement with customers and facilitate smoother interactions, ultimately enhancing customer satisfaction.

- Conflict Management Techniques: Personnel must be equipped with various conflict management strategies, including negotiation and mediation skills, alongside the necessity of facilitated dialogue as a best practice for handling disagreements. This equips staff to navigate conflicts proactively and constructively.

- Regulatory Compliance: It is critical to educate personnel on pertinent regulations and compliance obligations, emphasizing how adherence to these standards affects conflict outcomes. Understanding these regulations guarantees that all settlements align with , thereby protecting the organization.

Investing in thorough training not only enables personnel at financial institutions to manage conflicts more effectively using credit dispute resolution protocols for financial institutions, but also improves customer satisfaction and loyalty. Effective dispute resolution training has been shown to lead to improved employee engagement and reduced turnover costs, ultimately contributing to a more positive organizational reputation.

Conclusion

Establishing effective credit dispute resolution protocols is essential for financial institutions seeking to uphold customer trust and satisfaction. By implementing clear steps that encompass:

- Conflict acknowledgment

- Issue investigation

- Resolution timelines

- Open communication

organizations can develop a robust framework that enhances operational efficiency and customer experience.

The article underscores the significance of mediation as a proactive conflict management tool, emphasizing the necessity for:

- Appropriate case identification

- Mediator training

- Structured sessions

- Follow-ups

Furthermore, leveraging technology through conflict management software, automated alerts, data analytics, and secure communication channels markedly improves the resolution process. Training staff on best practices in conflict resolution, including communication skills and regulatory compliance, further strengthens an institution's capability to manage disputes effectively.

In conclusion, the importance of well-defined credit dispute resolution protocols cannot be overstated. As financial institutions navigate the complexities of customer interactions, prioritizing these protocols will lead to enhanced customer satisfaction and loyalty, while fostering a culture of transparency and trust. Embracing these best practices is crucial for any organization aiming to thrive in a competitive landscape, ensuring that conflicts are resolved efficiently and amicably.

Frequently Asked Questions

What are the key steps involved in establishing credit dispute resolution protocols for financial institutions?

The key steps include initial acknowledgment of conflicts within 24 hours, outlining an investigation process, establishing a resolution timeline typically within 30 days, and creating communication guidelines for interacting with clients.

Why is initial acknowledgment of conflicts important?

Initial acknowledgment is crucial for maintaining customer trust and satisfaction, as it shows that the institution is responsive to issues raised by clients.

What should the investigation process entail?

The investigation process should involve gathering necessary documentation and coordinating with relevant departments to ensure a thorough review of the conflict.

What is the typical timeline for resolving disputes?

A clear resolution timeline should be established, typically within 30 days, to ensure timely responses and demonstrate the institution's commitment to resolving issues efficiently.

How can communication guidelines improve the dispute resolution process?

Communication guidelines enhance the user experience by ensuring clients receive frequent updates and clear clarifications of final outcomes throughout the dispute resolution process.

What are the benefits of implementing credit dispute resolution protocols?

Implementing these protocols enhances operational efficiency, boosts customer satisfaction, leads to higher retention rates, and reduces legal risks for financial institutions.

What percentage of conflicts arises from differences in opinion versus tone of voice?

Statistics indicate that 10% of conflicts arise from differences in opinion, while 90% stem from the wrong tone of voice, highlighting the importance of effective communication.

What role does empathy play in conflict management?

Empathy is essential in conflict management as it aids in negotiating and resolving conflicts effectively, fostering better understanding between parties involved.