Overview

This article provides an authoritative overview of effective compliance strategies for financial institutions to adhere to Regulation F. It highlights key approaches, including:

- The utilization of automated tools

- The importance of conducting regular staff training

- The engagement of legal counsel

These strategies are designed to enhance operational efficiency while mitigating the risks associated with non-compliance. By implementing these measures, organizations can not only ensure regulatory adherence but also strengthen their overall risk management framework.

Introduction

Navigating the intricate landscape of Regulation F compliance presents significant challenges for financial institutions, particularly as the regulatory environment continues to evolve. This article outlines ten strategic approaches organizations can adopt to ensure adherence while optimizing operational efficiency.

As compliance demands escalate, a critical question arises: how can financial institutions balance the costs of implementation with the risks of non-compliance? This exploration not only highlights essential tools and practices for effective compliance but also offers critical insights that can transform regulatory adherence from a burden into a strategic advantage.

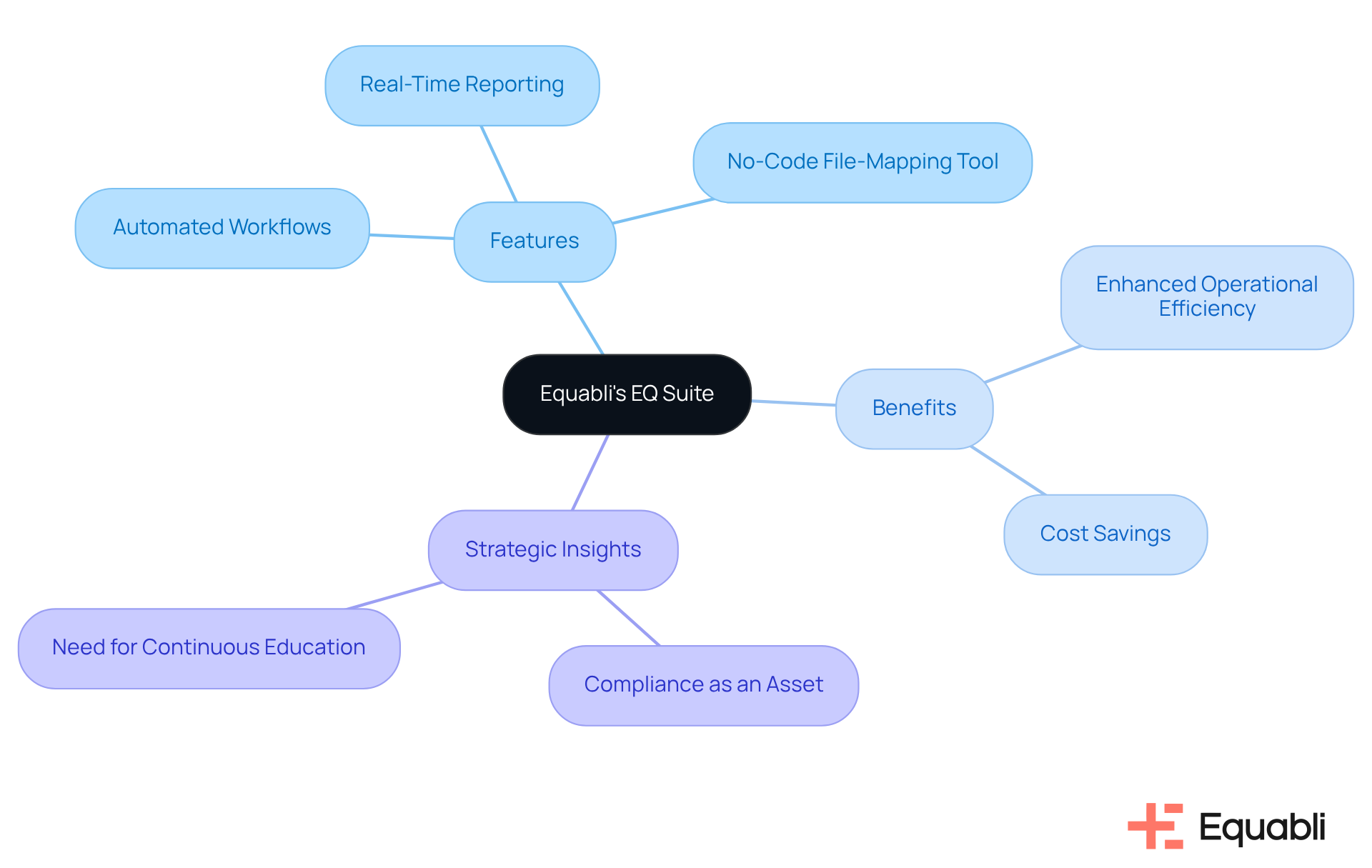

Equabli's EQ Suite: Comprehensive Tools for Regulation F Compliance

Equabli's EQ Suite presents a comprehensive array of tools specifically designed to assist financial organizations in navigating the complexities of regulation F compliance strategies for financial institutions. By automating adherence processes, the EQ Suite empowers lenders to manage collections in strict alignment with regulation F compliance strategies for financial institutions. This approach not only simplifies regulation F compliance strategies for financial institutions but also significantly enhances , allowing institutions to concentrate on their core business activities while ensuring legal adherence.

The EQ Suite incorporates vital features such as:

- Automated workflows

- Real-time reporting

- A no-code file-mapping tool

Collectively, these features foster regulation F compliance strategies for financial institutions. As Paul Koziarz asserts, businesses must maintain a continuous state of remediation and education to counter sophisticated cyber threats; the integration of ongoing education within the EQ Suite addresses this critical need. Additionally, Bill Harrison highlights the importance of viewing adherence not merely as a cost but as a financial asset, reinforcing the strategic investment perspective.

Organizations are increasingly recognizing that the costs associated with non-compliance can far exceed the initial investment in regulation F compliance strategies for financial institutions. A case study on cost savings through adherence to regulation F compliance strategies for financial institutions exemplifies this notion, juxtaposing the daunting upfront costs of implementing these regulatory protocols with the significantly larger expenses incurred from violations.

The EQ Suite emerges as an essential resource for financial organizations aiming to safeguard sensitive data, optimize their operations, and exceed compliance standards, particularly through regulation F compliance strategies for financial institutions, all while adhering to our Privacy Policy regarding data usage.

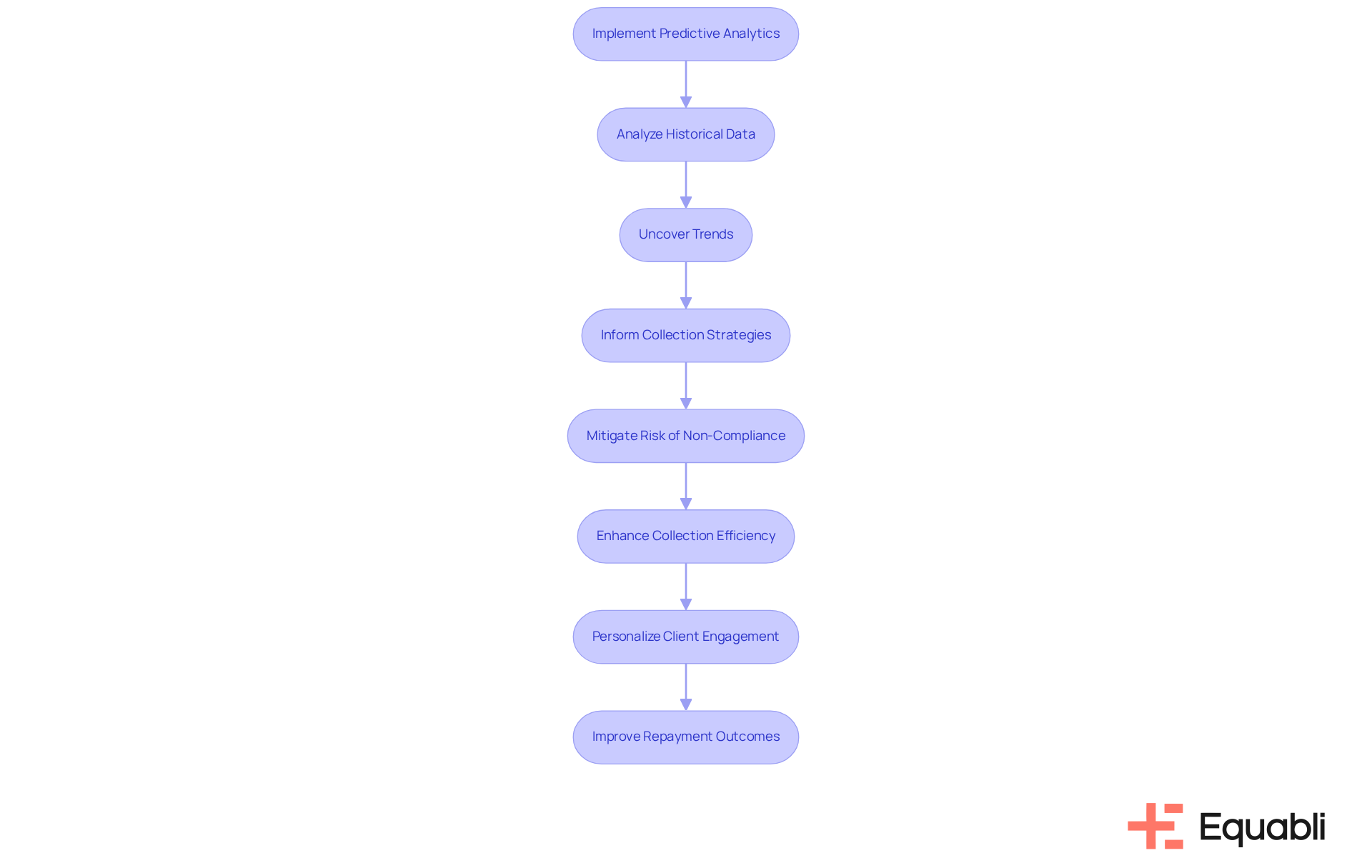

EQ Engine: Predictive Analytics for Enhanced Compliance

The EQ Engine represents a pivotal advancement in predictive analytics, fundamentally transforming how financial organizations assess borrower behaviors and repayment probabilities. By meticulously analyzing historical data, organizations can uncover trends that directly inform their collection strategies, ensuring adherence to regulation F compliance strategies for financial institutions. This proactive methodology not only mitigates the risk of non-compliance but also significantly enhances the efficiency of collection efforts. Forecasting the risk of delinquency for active accounts enables organizations to devise tailored servicing strategies for each communication channel, thereby improving operational efficiency and reducing roll-rates.

Financial organizations leveraging these predictive capabilities have reported potential reductions in operational expenses by distinguishing between effective and ineffective collection strategies. This differentiation allows for more personalized client engagement, enhancing communication and ultimately improving repayment outcomes. Looking ahead to 2025, the integration of predictive analytics is expected to refine predictions regarding loan-seeking behavior, enabling organizations to implement regulation F compliance strategies for financial institutions to navigate compliance challenges with heightened accuracy and confidence.

To successfully implement these strategies, it is imperative for organizations to invest in and provide training for personnel on data interpretation. This investment will maximize the benefits derived from predictive insights, positioning organizations to thrive in an increasingly complex regulatory landscape.

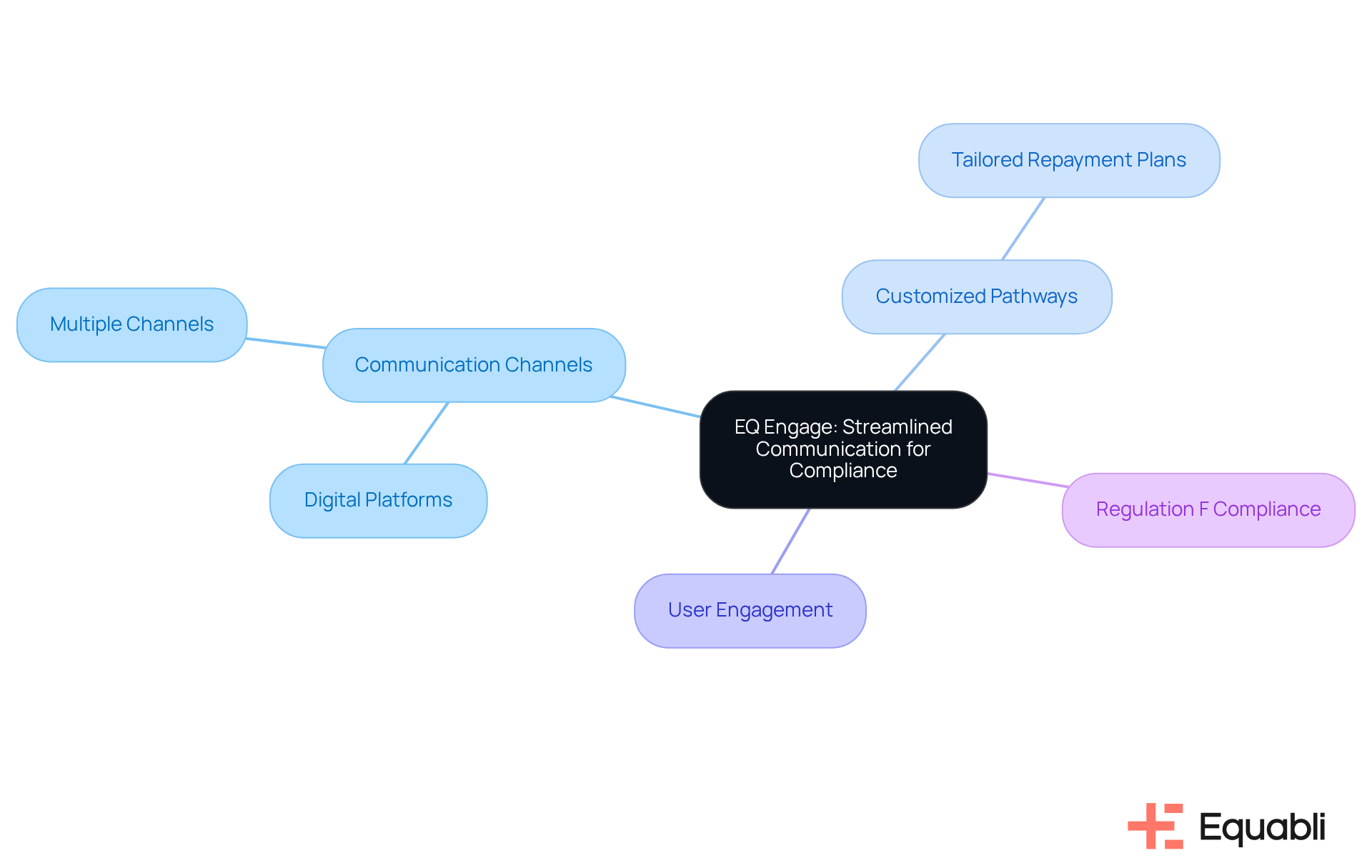

EQ Engage: Streamlined Communication for Compliance

EQ Engage serves as a pivotal solution designed to enhance communication between financial entities and loan seekers, ensuring adherence to regulation F compliance strategies for financial institutions. By providing multiple communication channels, including digital platforms, EQ Engage empowers organizations to effectively connect with loan seekers while following these regulatory guidelines.

This innovative platform facilitates the development of , enabling loan recipients to manage tailored repayment plans. These features not only bolster user engagement but also guarantee the timely delivery of essential disclosures and notifications, all while maintaining a steadfast commitment to regulation F compliance strategies for financial institutions and data protection.

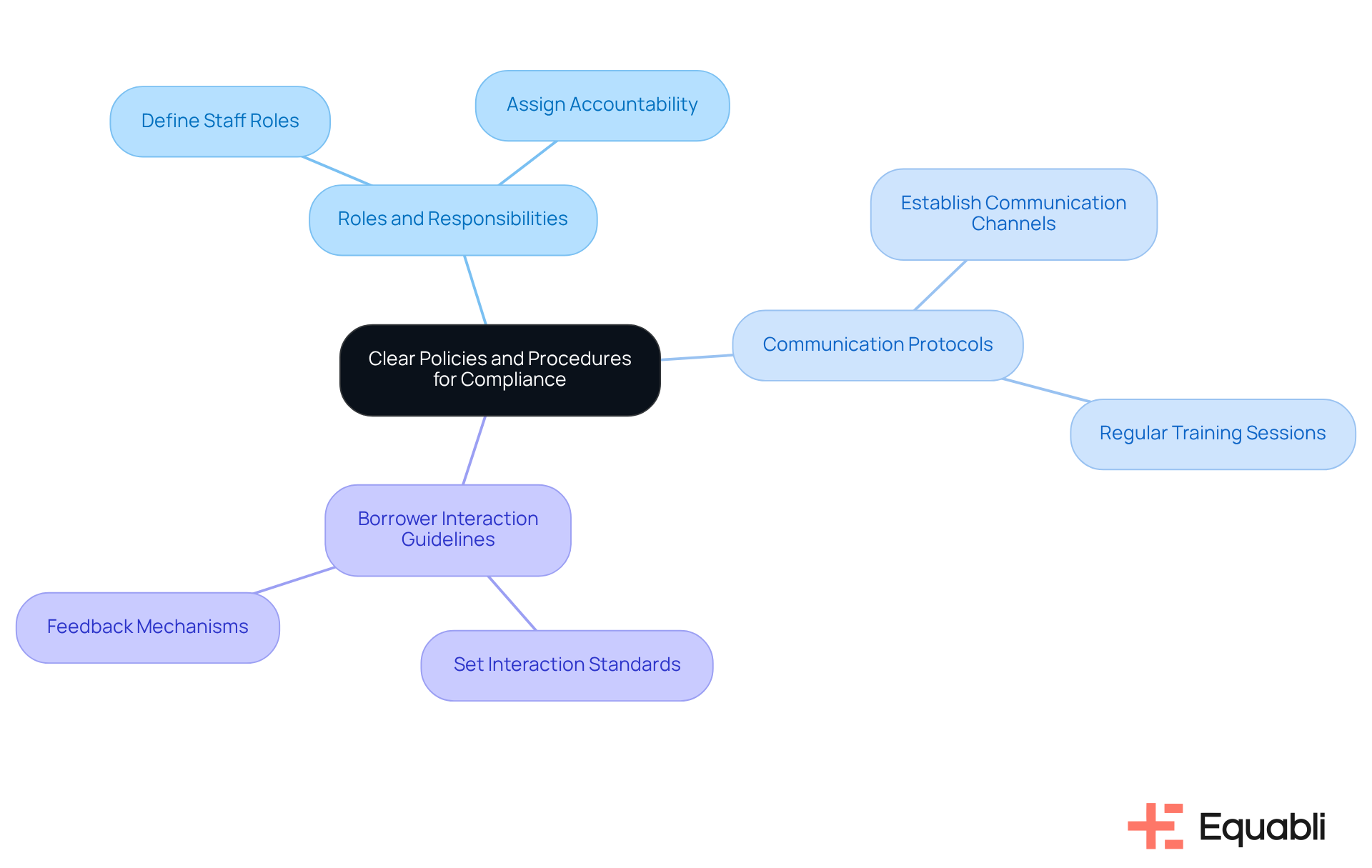

Establish Clear Policies and Procedures for Compliance

Financial organizations must establish clear policies and procedures that comply with regulation f compliance strategies for financial institutions. This necessity is underscored by the importance of defining roles and responsibilities, outlining communication protocols, and setting guidelines for borrower interactions. By implementing well-documented policies, institutions can ensure that all staff members understand their obligations. This not only reduces the risk of non-compliance but also fosters a culture of accountability, which is critical for in the financial sector.

Conduct Regular Staff Training on Regulation F

Regular staff training on regulation F compliance strategies for financial institutions is essential for ensuring that all employees understand compliance requirements and best practices. Training sessions must encompass the specifics of regulation F compliance strategies for financial institutions, including:

- Permissible communication methods

- Borrower rights

By investing in ongoing education, monetary organizations can empower their personnel to make informed decisions that support regulation F compliance strategies for financial institutions. This proactive approach ultimately mitigates the risk of violations, reinforcing the organization’s commitment to compliance and operational integrity.

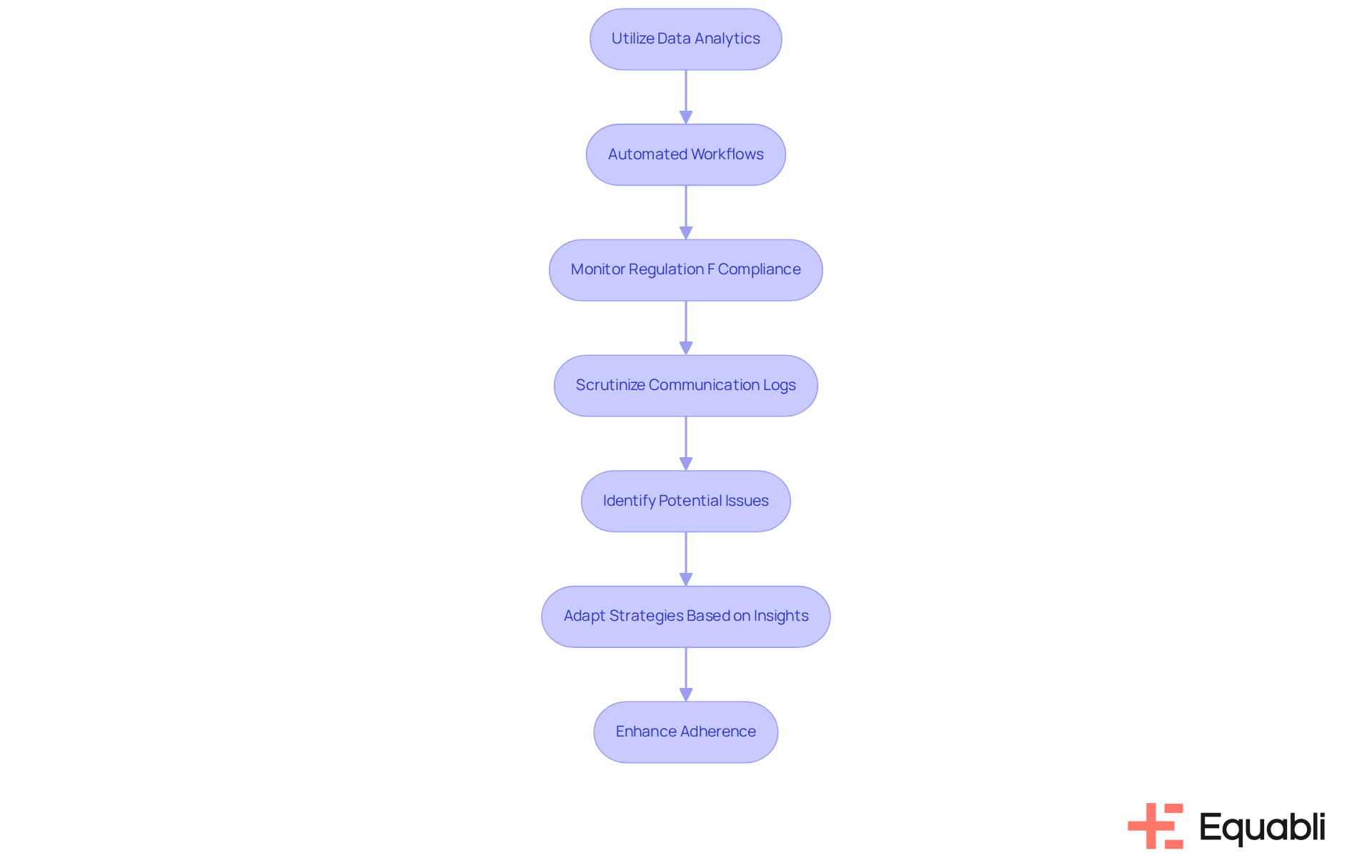

Leverage Data Analytics for Compliance Monitoring

Utilizing data analysis for regulatory oversight empowers financial organizations to monitor their regulation F compliance strategies for financial institutions in real-time. Evidence of this capability is seen in EQ Collect's automated workflows and data-driven strategies, which allow organizations to scrutinize communication logs, borrower interactions, and repayment behaviors. This proactive approach enables the identification of potential regulatory issues related to regulation F compliance strategies for financial institutions before they escalate, thereby enhancing adherence and fostering a culture of continuous improvement. Organizations can adapt their strategies based on real-time insights, which is critical in today's dynamic regulatory environment. With features such as , EQ Collect facilitates smarter orchestration and improved performance in debt collection processes.

Develop a Compliance Calendar for Regulatory Deadlines

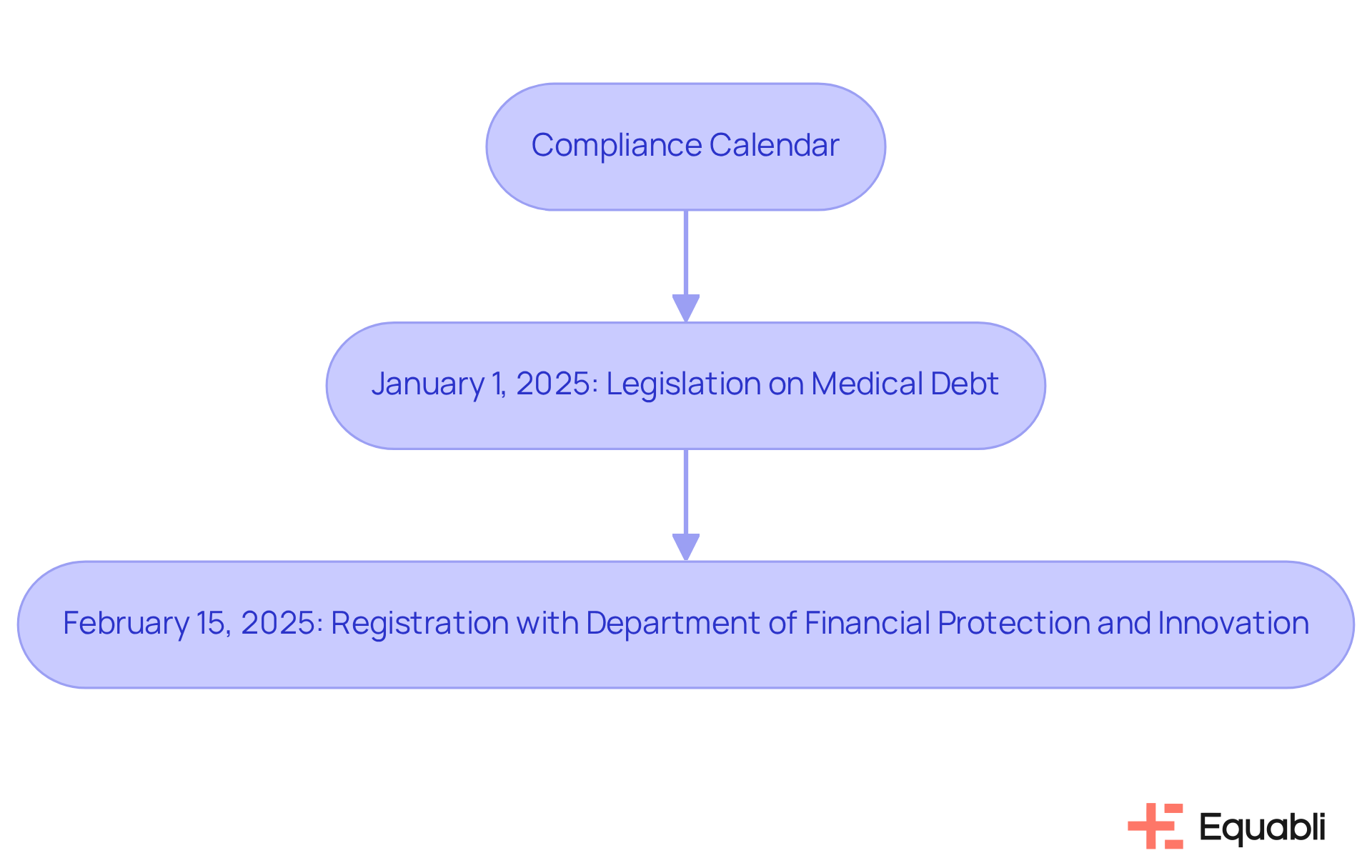

Establishing a regulatory calendar that highlights critical deadlines is vital for monetary organizations. This calendar must encompass key dates related to reporting, training, and policy evaluations specifically associated with for financial institutions. By outlining a clear timeline, institutions can proactively manage their compliance efforts, thereby significantly reducing the risk of missed deadlines and the penalties that accompany them.

Notably, by February 15, 2025, certain monetary services providers in California are mandated to register with the Department of Financial Protection and Innovation to maintain legal operations. Furthermore, beginning January 1, 2025, legislation in California, Illinois, and Rhode Island will prohibit credit bureaus from including specific medical debt information in consumer reports.

These impending compliance deadlines underscore the necessity of a well-structured schedule, which not only aids in meeting obligations but also fosters a culture of accountability and diligence within the organization. Neglecting these deadlines can lead to substantial financial repercussions and reputational damage, emphasizing the need for monetary organizations to prioritize their compliance strategies.

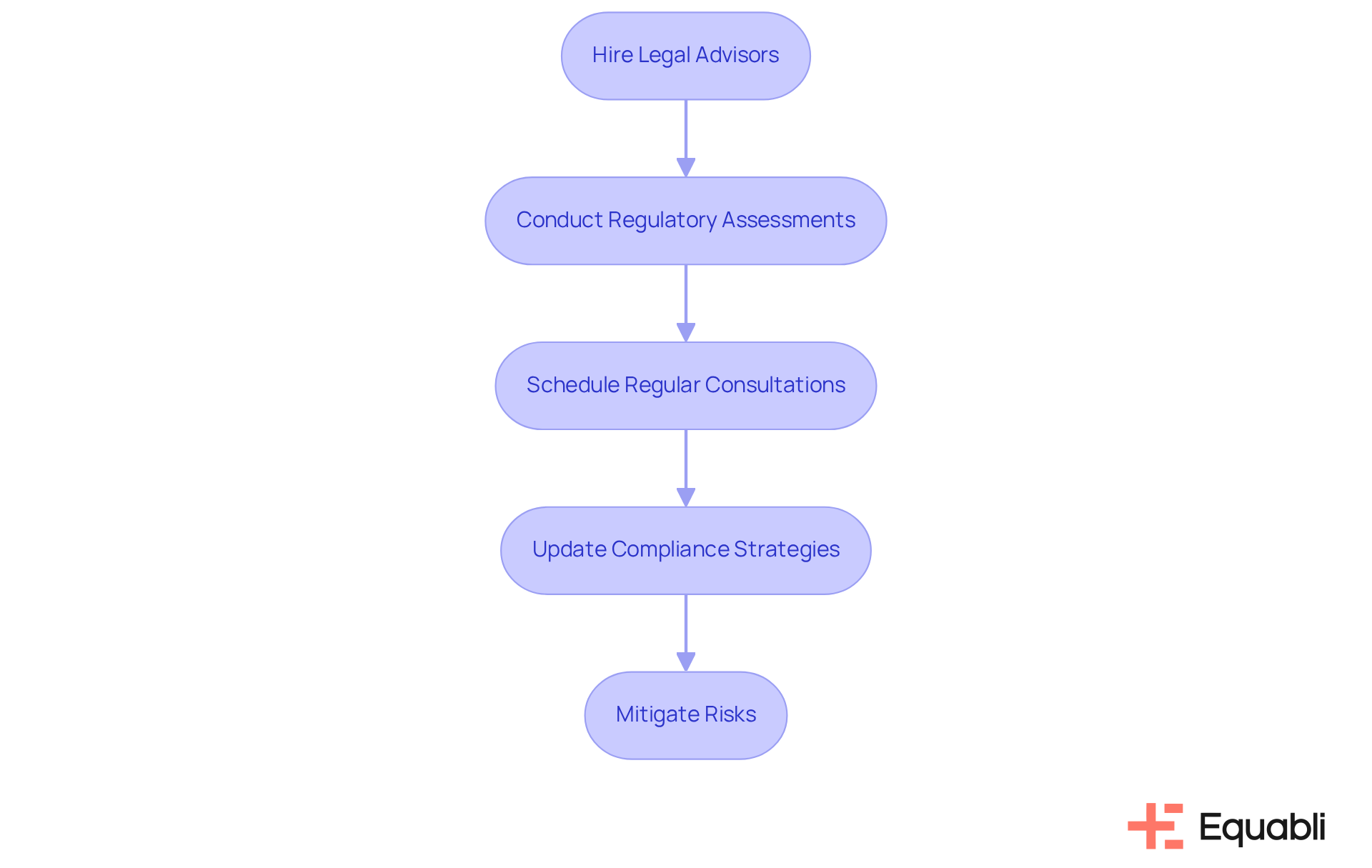

Engage Legal Counsel for Compliance Reviews

Hiring legal advisors for regulatory assessments is essential for financial organizations aiming to effectively navigate the complexities of regulation f compliance strategies for financial institutions. Legal professionals provide extensive expertise on regulation f compliance strategies for financial institutions, enabling organizations to identify potential risks and develop robust mitigation strategies.

Regular consultations with legal advisors not only keep institutions updated on regulation f compliance strategies for financial institutions but also encourage a proactive approach to compliance management. This ongoing dialogue ensures that regulation f compliance strategies for financial institutions are continuously refined, aligning with evolving legal standards and enhancing the overall compliance posture.

Notably, over 60 percent of sensitive information stored across various environments lacks consistent security measures, highlighting the critical need for comprehensive regulatory strategies. By prioritizing legal assessments, financial organizations can significantly reduce their exposure to regulatory risks, which is essential for effective regulation f compliance strategies for financial institutions, thereby safeguarding their operations and reputation.

To remain ahead of , organizations should schedule regular reviews with legal advisors, ensuring they are well-informed and prepared.

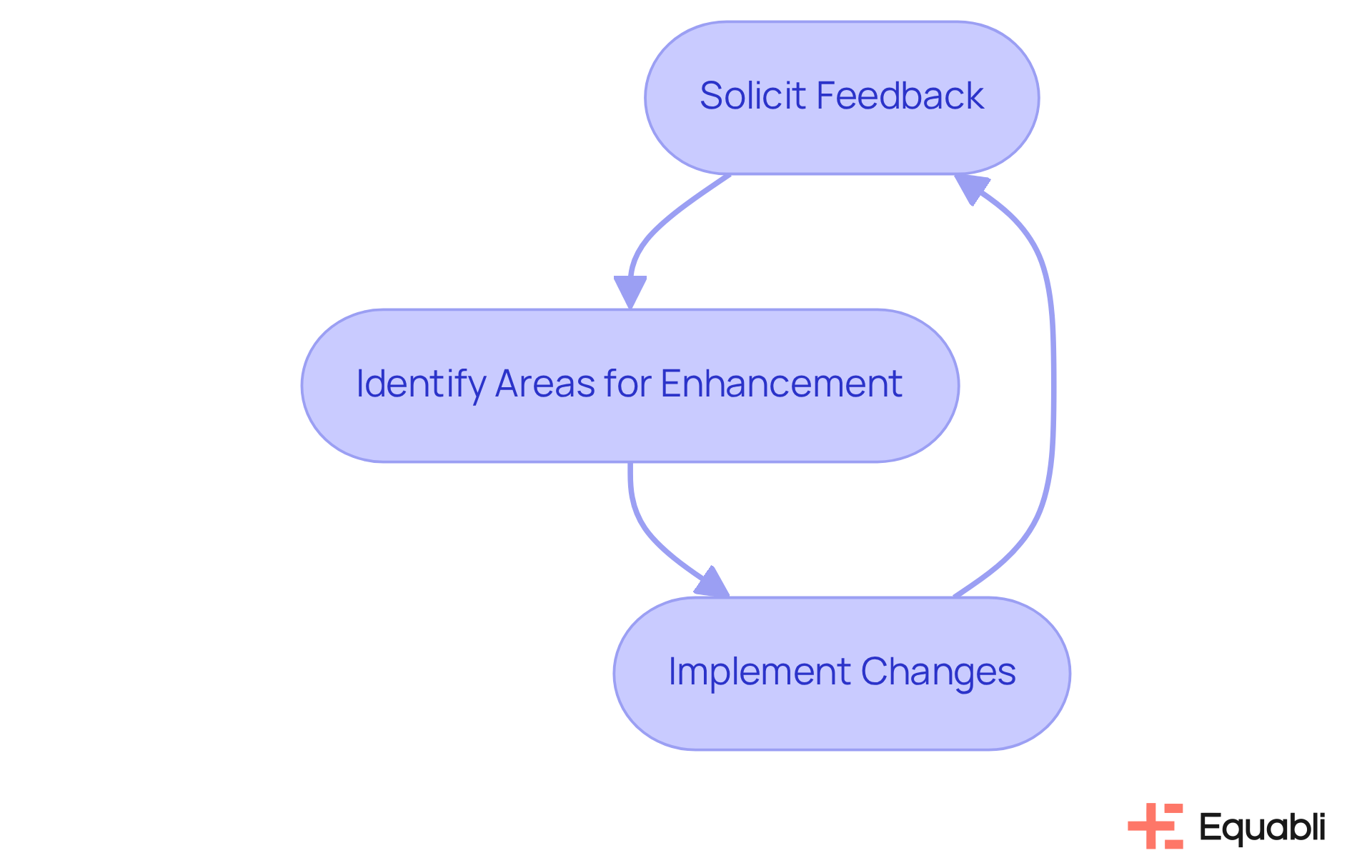

Establish a Feedback Loop for Continuous Compliance Improvement

Establishing a feedback loop for continuous improvement allows financial organizations to refine their strategies based on real-world experiences. By soliciting input from employees and borrowers, these organizations can identify specific areas for enhancement and implement changes that strengthen their regulation of compliance strategies for financial institutions. This iterative process fosters a culture of accountability and responsiveness, ensuring that organizations remain aligned with and operational demands.

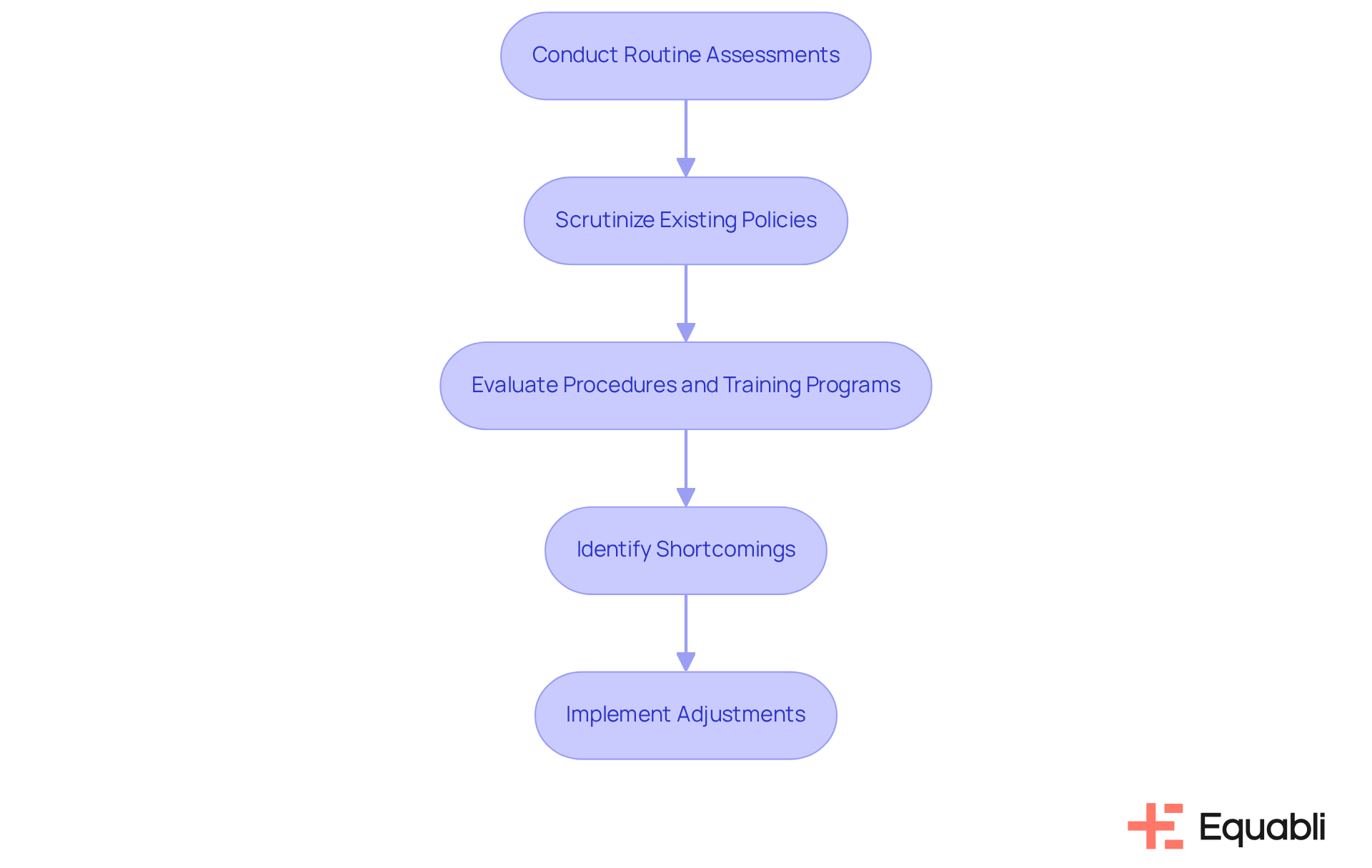

Conduct Regular Audits of Compliance Practices

Routine assessments of adherence practices are critical for financial organizations to ensure regulation compliance strategies for financial institutions. These evaluations must scrutinize the , procedures, and training programs, identifying any potential shortcomings. By systematically evaluating compliance practices, institutions can implement informed adjustments that not only enhance their overall compliance posture but also mitigate the risk of regulatory violations.

Conclusion

The strategies outlined for Regulation F compliance underscore the imperative for financial institutions to adopt a proactive and systematic approach to meet regulatory requirements. By leveraging advanced tools and methodologies, organizations can ensure adherence while enhancing operational efficiency and mitigating risks associated with non-compliance.

Key insights from the article emphasize the significance of integrated solutions like Equabli's EQ Suite, which provides:

- Automated workflows

- Predictive analytics

- Streamlined communication channels

These features collectively empower organizations to maintain compliance while optimizing their operations. Furthermore, establishing clear policies, conducting regular staff training, and engaging legal counsel are essential practices that reinforce a culture of accountability and continuous improvement.

In a rapidly evolving regulatory landscape, the importance of these compliance strategies is paramount. Financial institutions are urged to prioritize these practices not merely as a means to avoid penalties but as a strategic investment that can enhance their reputation and operational integrity. By adopting a comprehensive compliance framework, organizations can navigate the complexities of Regulation F with confidence and resilience, ultimately fostering trust and reliability in their operations.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a comprehensive set of tools designed to help financial organizations navigate the complexities of regulation F compliance. It automates adherence processes, allowing lenders to manage collections while ensuring compliance with regulatory standards.

What features does the EQ Suite include?

The EQ Suite includes automated workflows, real-time reporting, and a no-code file-mapping tool, all aimed at enhancing regulation F compliance for financial institutions.

How does the EQ Suite contribute to operational efficiency?

By automating compliance processes, the EQ Suite simplifies regulation F adherence, allowing financial institutions to focus on their core business activities while ensuring legal compliance.

Why is ongoing education important in the context of the EQ Suite?

Ongoing education is crucial to counter sophisticated cyber threats. The EQ Suite integrates continuous education to help organizations stay informed and compliant.

How do organizations view the costs of compliance according to the article?

Organizations increasingly recognize that the costs of non-compliance can far exceed the initial investment in compliance strategies, viewing adherence as a financial asset rather than merely a cost.

What is the EQ Engine and its purpose?

The EQ Engine is a predictive analytics tool that helps financial organizations assess borrower behaviors and repayment probabilities by analyzing historical data, thereby enhancing compliance with regulation F.

How does the EQ Engine improve collection strategies?

By forecasting the risk of delinquency, the EQ Engine allows organizations to develop tailored servicing strategies for communication channels, improving operational efficiency and reducing roll-rates.

What benefits do financial organizations gain from using predictive analytics?

Financial organizations can reduce operational expenses by distinguishing between effective and ineffective collection strategies, leading to more personalized client engagement and improved repayment outcomes.

What is EQ Engage and how does it support compliance?

EQ Engage is a solution that enhances communication between financial entities and loan seekers, providing multiple channels for effective connection while ensuring adherence to regulation F compliance.

How does EQ Engage enhance user engagement?

EQ Engage allows for the development of customized communication pathways and tailored repayment plans, ensuring timely delivery of disclosures and notifications while maintaining compliance with regulatory guidelines.