Overview

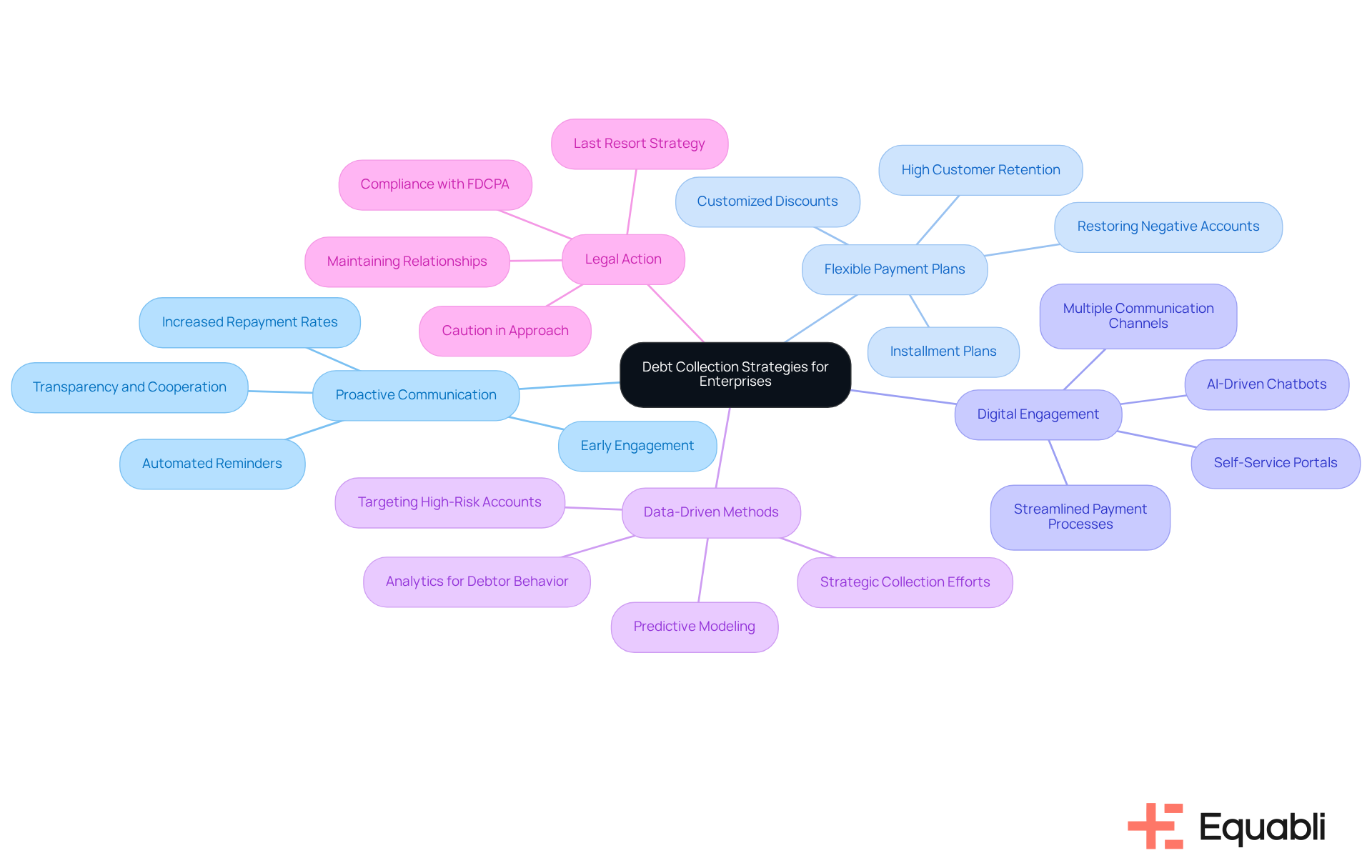

Best practices in collections strategies for financial risk management include:

- Proactive communication

- Flexible payment plans

- Data-driven methods that enhance recovery rates while preserving customer relationships

Evidence suggests that these strategies, particularly when supported by tools like EQ Engage, foster transparency and improve the likelihood of repayment. Furthermore, they ensure compliance with ethical standards, which is crucial in today's regulatory environment. Ultimately, the implementation of these practices leads to more effective financial risk management, aligning operational goals with compliance imperatives.

Introduction

In an increasingly complex financial landscape, enterprises encounter significant challenges in effectively managing debt collections. Implementing robust collections strategies is not merely a necessity; it represents a vital opportunity for organizations to enhance their financial risk management.

As businesses navigate the delicate balance between recovering debts and maintaining positive relationships with their clients, it becomes imperative to adopt best practices. This article explores strategies that empower enterprises to optimize their collections processes, ensuring compliance with regulatory standards, upholding ethical practices, and achieving improved recovery outcomes.

Explore Types of Debt Collection Strategies for Enterprises

Enterprises can adopt several effective best practices in collections strategies for enterprise financial risk management.

- Proactive Communication: Engaging with individuals in debt early through reminders and follow-ups can significantly prevent obligations from escalating. Utilizing EQ Engage, organizations can automate borrower contact strategies, ensuring consistent communication that fosters transparency and cooperation. Studies indicate that proactive communication can increase loan repayment rates and customer retention, thereby enhancing overall operational efficiency.

- Flexible Payment Plans: Offering tailored repayment options is crucial for enhancing recovery rates, particularly for high-risk accounts. EQ Engage allows enterprises to extend customized discounts and installment plans, maintaining customer retention rates above 70%. Programs that restore negative accounts instead of closing them can enhance engagement and compliance by categorizing individuals based on risk profiles and customizing communication accordingly, ultimately leading to improved recovery outcomes.

- Digital Engagement: Utilizing digital channels such as emails, SMS, and online portals enhances communication and streamlines the payment process. With EQ Engage's user-friendly, white-labeled , customers can access customized repayment options. Furthermore, AI-driven chatbots incorporated within EQ Engage can send tailored reminders and assist customers in exploring their repayment choices, thereby facilitating engagement and fulfillment of their commitments.

- Data-Driven Methods: Utilizing analytics to evaluate debtor behavior and forecast repayment probability enhances recovery efforts. EQ Engage's analytics engine allows entities to segment and target borrowers based on performance history and behavior, enabling businesses to concentrate on high-risk accounts and improve recovery rates. Predictive modeling within EQ Engage enables entities to prioritize retrieval efforts efficiently, ensuring a strategic approach to debt recovery.

- Legal Action: In cases where other methods fail, pursuing legal avenues may be necessary. However, this should be approached with caution to maintain relationships, as aggressive tactics can strain customer connections. It is essential to follow the Fair Debt Collection Practices Act (FDCPA) to avoid legal complications, ensuring compliance while pursuing recovery.

By investigating these strategies, businesses can adopt best practices in collections strategies for enterprise financial risk management that align with their operational objectives and enhance customer relationships, particularly through the smart automation and machine learning solutions provided by EQ Engage.

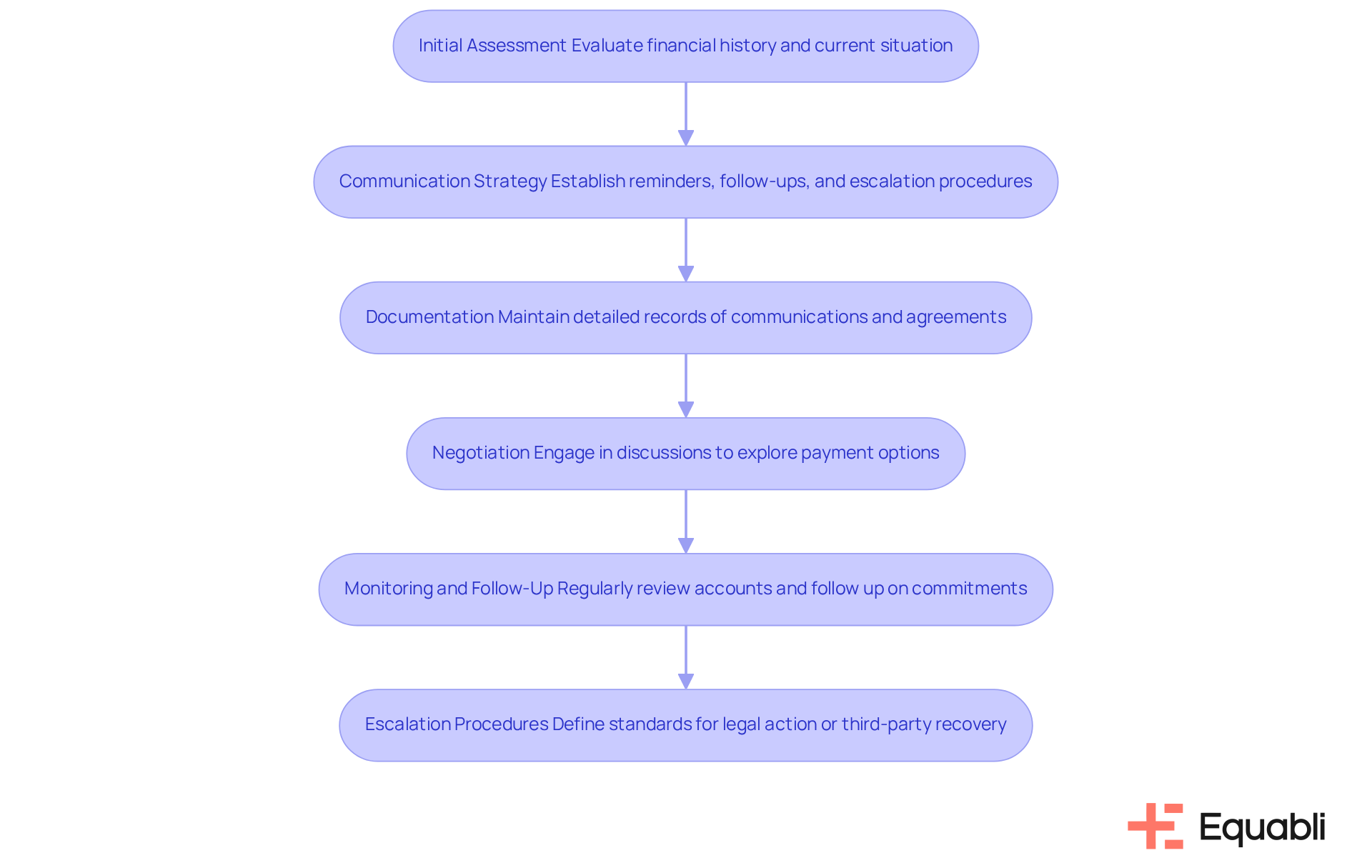

Implement Effective Steps in the Debt Collection Process

To implement an effective debt collection process, organizations should follow for enterprise financial risk management, emphasizing compliance and strategic engagement.

Initial Assessment: Begin with a thorough evaluation of the individual's financial history and current situation. This foundational step enables organizations to tailor their approach effectively, ensuring that strategies align with the debtor's circumstances.

Communication Strategy: Establish a comprehensive communication plan that encompasses reminders, follow-ups, and escalation procedures. Clear communication is essential for maintaining transparency and fostering a constructive dialogue with debtors.

Documentation: Accurate record-keeping is critical. Maintain detailed documentation of all communications and agreements to ensure compliance and facilitate future actions. This practice not only protects the organization but also reinforces accountability in the debt collection process.

Negotiation: Engage in meaningful discussions with individuals owing money to explore viable payment options. Effective negotiation can lead to mutually beneficial terms that enhance repayment likelihood while preserving the relationship with the debtor.

Monitoring and Follow-Up: Regularly review accounts and follow up on payment commitments. Consistent monitoring ensures adherence to agreements and allows organizations to address potential issues proactively.

Escalation Procedures: Define clear standards for advancing cases to legal action or third-party recovery when necessary. Establishing these protocols ensures that organizations are prepared to take decisive action when compliance is not met.

By systematically adhering to these procedures, entities can cultivate an efficient recovery process that follows best practices in collections strategies for enterprise financial risk management, improving repayment rates while also maintaining constructive relationships with borrowers.

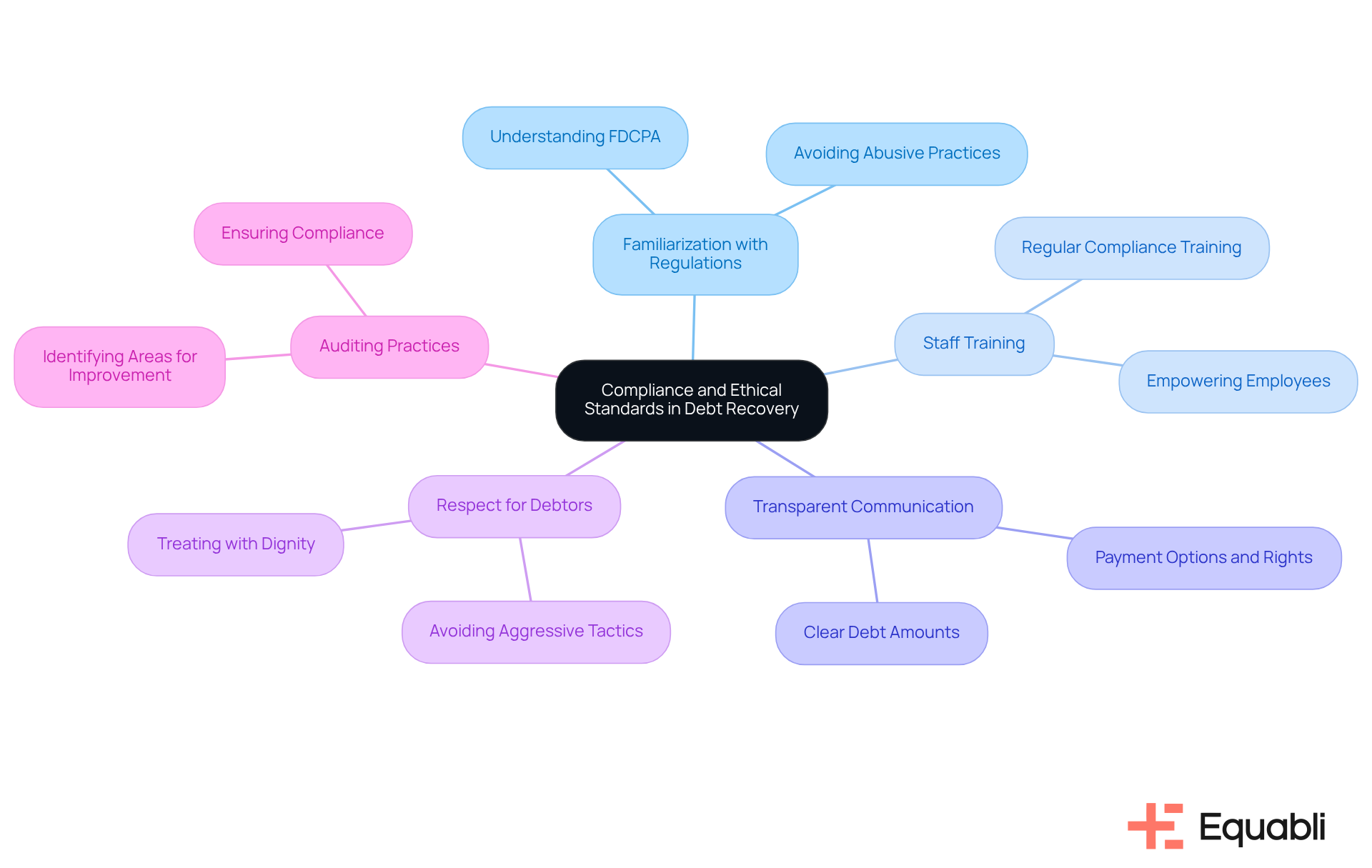

Ensure Compliance and Ethical Standards in Debt Recovery

To ensure compliance and uphold ethical standards in debt recovery, organizations must implement for enterprise financial risk management.

- Familiarization with Regulations: Organizations should thoroughly understand and comply with laws such as the Fair Debt Collection Practices Act (FDCPA). This understanding is crucial to avoid abusive practices that could lead to legal repercussions.

- Regular training for staff on compliance and ethical collection practices is essential to ensure the adoption of best practices in collections strategies for enterprise financial risk management. Such training not only reinforces adherence to standards but also empowers employees to navigate complex regulatory environments effectively.

- Transparent Communication: Maintaining transparency in all communications with individuals in debt is imperative. Clearly stating the debt amount, payment options, and rights fosters trust and ensures that debtors are fully informed of their obligations.

- Respect for Debtors: Treating all debtors with respect and dignity is non-negotiable. Recognizing their circumstances and avoiding aggressive tactics not only aligns with ethical standards but also enhances the organization's reputation.

- Conducting audits of collection practices is vital for identifying areas for improvement in the best practices in collections strategies for enterprise financial risk management. These audits ensure compliance with legal standards and help organizations refine their strategies continuously.

Furthermore, leveraging the features of EQ Collect can significantly enhance these practices. By utilizing automated workflows, businesses can minimize execution errors and reduce manual tasks, ensuring compliance oversight both internally and externally. The real-time reporting features offer unmatched clarity and understanding, enabling entities to uphold ethical standards while enhancing their recovery processes. By implementing these practices and utilizing EQ Collect, organizations can foster a culture of compliance and ethics in their debt recovery efforts, ultimately leading to better outcomes for both the organization and its clients.

Conclusion

Implementing effective collections strategies is essential for enterprises seeking to manage financial risk and enhance recovery rates. By focusing on:

- Proactive communication

- Flexible payment plans

- Digital engagement

- Data-driven methods

- Compliance with legal standards

organizations can create a robust framework for debt recovery that addresses financial obligations while nurturing customer relationships.

Key insights highlight the importance of:

- Understanding debtor behavior

- Utilizing technology for streamlined communication

- Maintaining ethical standards throughout the collection process

Employing best practices such as:

- Thorough initial assessments

- Clear communication strategies

- Regular monitoring

enables businesses to significantly improve recovery outcomes while fostering a respectful and transparent environment for debtors.

The significance of adopting these strategies extends beyond mere financial recovery. It emphasizes the need for organizations to cultivate a culture of compliance and ethical responsibility, ensuring that debt recovery processes are effective and fair. As enterprises navigate the evolving landscape of financial risk management, embracing these best practices will empower them to achieve sustainable success while maintaining positive relationships with their clients.

Frequently Asked Questions

What are some effective debt collection strategies for enterprises?

Effective debt collection strategies for enterprises include proactive communication, flexible payment plans, digital engagement, data-driven methods, and legal action when necessary.

How does proactive communication benefit debt collection?

Proactive communication helps prevent obligations from escalating by engaging with individuals in debt early through reminders and follow-ups. It can increase loan repayment rates and customer retention, enhancing overall operational efficiency.

What role do flexible payment plans play in debt recovery?

Flexible payment plans are crucial for enhancing recovery rates, particularly for high-risk accounts. They allow enterprises to offer tailored repayment options, which can maintain customer retention rates above 70% and improve engagement and compliance.

How can digital engagement improve the debt collection process?

Digital engagement through channels like emails, SMS, and online portals streamlines communication and payment processes. EQ Engage provides a user-friendly self-service portal for customers to access customized repayment options and AI-driven chatbots that assist with reminders and repayment choices.

What is the significance of data-driven methods in debt collection?

Data-driven methods utilize analytics to evaluate debtor behavior and forecast repayment probability, allowing businesses to target high-risk accounts effectively. EQ Engage's analytics engine helps segment borrowers based on performance history, improving recovery rates through strategic prioritization.

When should enterprises consider legal action in debt collection?

Legal action should be considered when other methods fail, but it must be approached cautiously to maintain customer relationships. It is essential to comply with the Fair Debt Collection Practices Act (FDCPA) to avoid legal complications during recovery efforts.