Overview

The article underscores the critical importance of analyzing comprehensive debt collection industry trends for financial institutions. It highlights the necessity for these organizations to adapt to technological advancements and consumer preferences, thereby enhancing their operational effectiveness and profitability. This assertion is supported by evidence illustrating how the integration of AI, omnichannel communication, and ethical practices can significantly improve recovery rates, reduce costs, and foster stronger relationships with borrowers. Such strategies ultimately position institutions for success in an increasingly competitive landscape.

Introduction

The debt collection landscape is experiencing a significant transformation, propelled by technological advancements and evolving consumer expectations. For financial institutions, comprehending these critical trends is not merely advantageous; it is imperative for enhancing operational efficiency and profitability.

As organizations confront the challenge of adapting to these swift changes, the pivotal question emerges: how can they effectively harness emerging strategies to not only boost recovery rates but also cultivate stronger relationships with borrowers?

This article explores the essential trends shaping the debt collection industry, providing insights that can empower financial institutions to adeptly navigate the complexities of contemporary recovery practices.

Explore the Importance of Debt Collection Trends for Financial Institutions

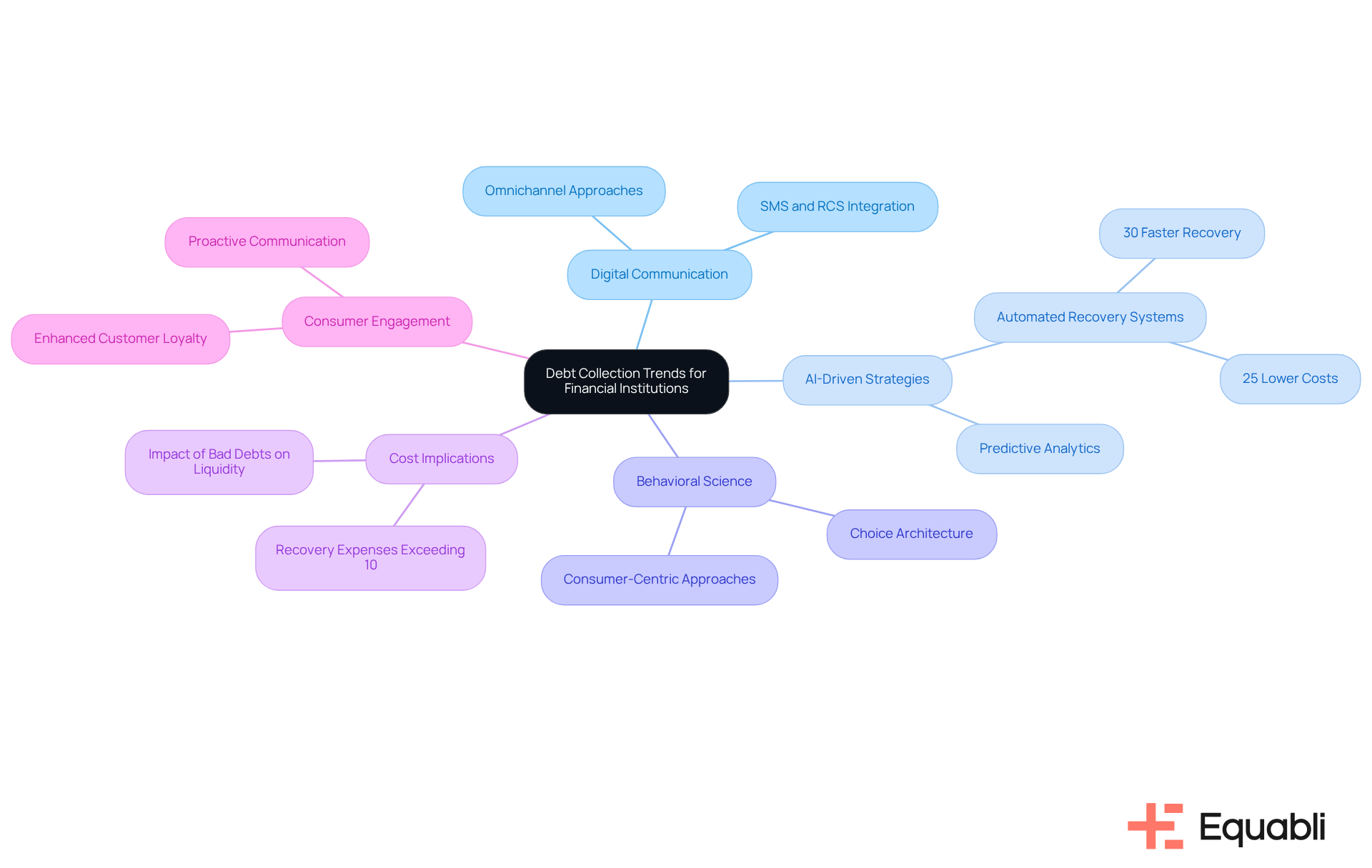

Financial organizations must recognize that the comprehensive debt collection industry trends analysis for financial institutions significantly influences their operational effectiveness and profitability. The increasing reliance on digital communication and AI-driven strategies allows organizations to enhance their gathering processes, which supports a comprehensive debt collection industry trends analysis for financial institutions that aligns with evolving consumer expectations. This proactive approach not only but also fosters stronger relationships with borrowers, thereby enhancing customer loyalty and satisfaction.

Institutions that fail to adapt risk falling behind in a competitive landscape, which requires a comprehensive debt collection industry trends analysis for financial institutions to navigate the rapidly shifting consumer preferences. Evidence indicates that banks utilizing automated recovery systems, such as those offered by Equabli, recover amounts 30% faster and at a 25% lower cost than their peers, underscoring the necessity of embracing these advancements.

Furthermore, a comprehensive debt collection industry trends analysis for financial institutions shows that recovery expenses often exceed 10% of their operational budgets, highlighting the financial ramifications of not modernizing payment collection methods. Integrating behavioral science into recovery processes can transform the experience into one that is more consumer-centric, thereby improving engagement and repayment outcomes.

In this context, effective financial recovery strategies will incorporate a comprehensive debt collection industry trends analysis for financial institutions, utilizing omnichannel approaches that provide seamless experiences, enabling customers to manage their interactions while ensuring compliance and efficiency. By leveraging features from EQ Collect, including automated workflows and real-time reporting, financial organizations can enhance their recovery efficiency and facilitate strategic growth.

As Jo Mikleus states, 'As the receivables recovery industry approaches 2025, the most valuable AI investments will be those that emphasize transparency, personalization, and proactive engagement,' aligning with Equabli's commitment to delivering innovative solutions that meet these evolving needs.

Identify Current Trends Impacting Debt Collection Practices

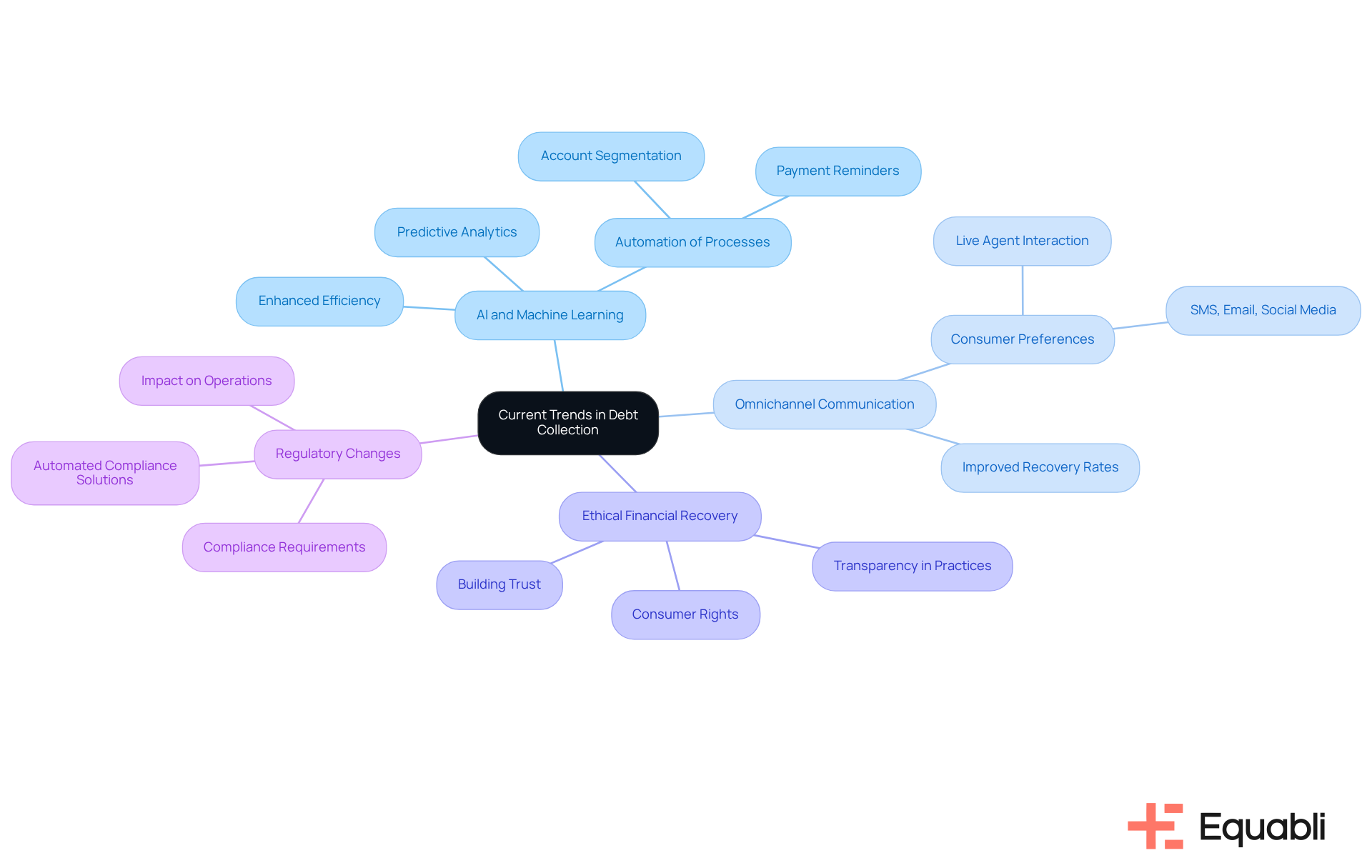

A comprehensive debt collection industry trends analysis for financial institutions reveals that several key trends are currently reshaping debt collection practices, significantly impacting how they engage with borrowers.

- AI and Machine Learning: Financial institutions are increasingly harnessing AI and machine learning technologies to analyze debtor behavior, predict repayment likelihood, and refine collection strategies. These advanced tools enable organizations to automate routine processes, such as account segmentation and payment reminders, leading to enhanced efficiency and improved debtor cooperation. This shift towards automation not only streamlines operations but also positions institutions to respond dynamically to debtor needs, ultimately fostering better repayment outcomes.

- Omnichannel Communication: With consumers expressing a preference for multiple communication channels—including SMS, email, and social media—financial institutions must adopt an omnichannel approach to effectively engage borrowers. This strategy improves interaction quality and by allowing consumers to choose their preferred method of communication. By prioritizing consumer preferences, institutions can cultivate stronger relationships and increase overall recovery effectiveness.

- Ethical Financial Recovery: There is a rising focus on ethical practices within the financial recovery sector, emphasizing the treatment of consumers with respect and transparency. Institutions are increasingly adopting ethical financial recovery strategies that prioritize consumer rights and foster trust, essential for maintaining long-term relationships. This commitment to ethical standards not only mitigates reputational risk but also aligns with regulatory expectations, reinforcing institutional integrity.

- Regulatory Changes: The landscape of debt recovery is continuously evolving due to new regulations. Financial organizations must remain aware of these changes to ensure compliance and evade possible penalties. Automated compliance solutions are becoming vital for managing these regulatory requirements efficiently. By integrating robust compliance frameworks, institutions can safeguard their operations and enhance their strategic positioning in the marketplace.

By acknowledging and adjusting to the comprehensive debt collection industry trends analysis for financial institutions, financial organizations can improve their retrieval methods, boost overall performance, and meet the expectations of contemporary consumers.

Implement Technology-Driven Strategies for Effective Debt Recovery

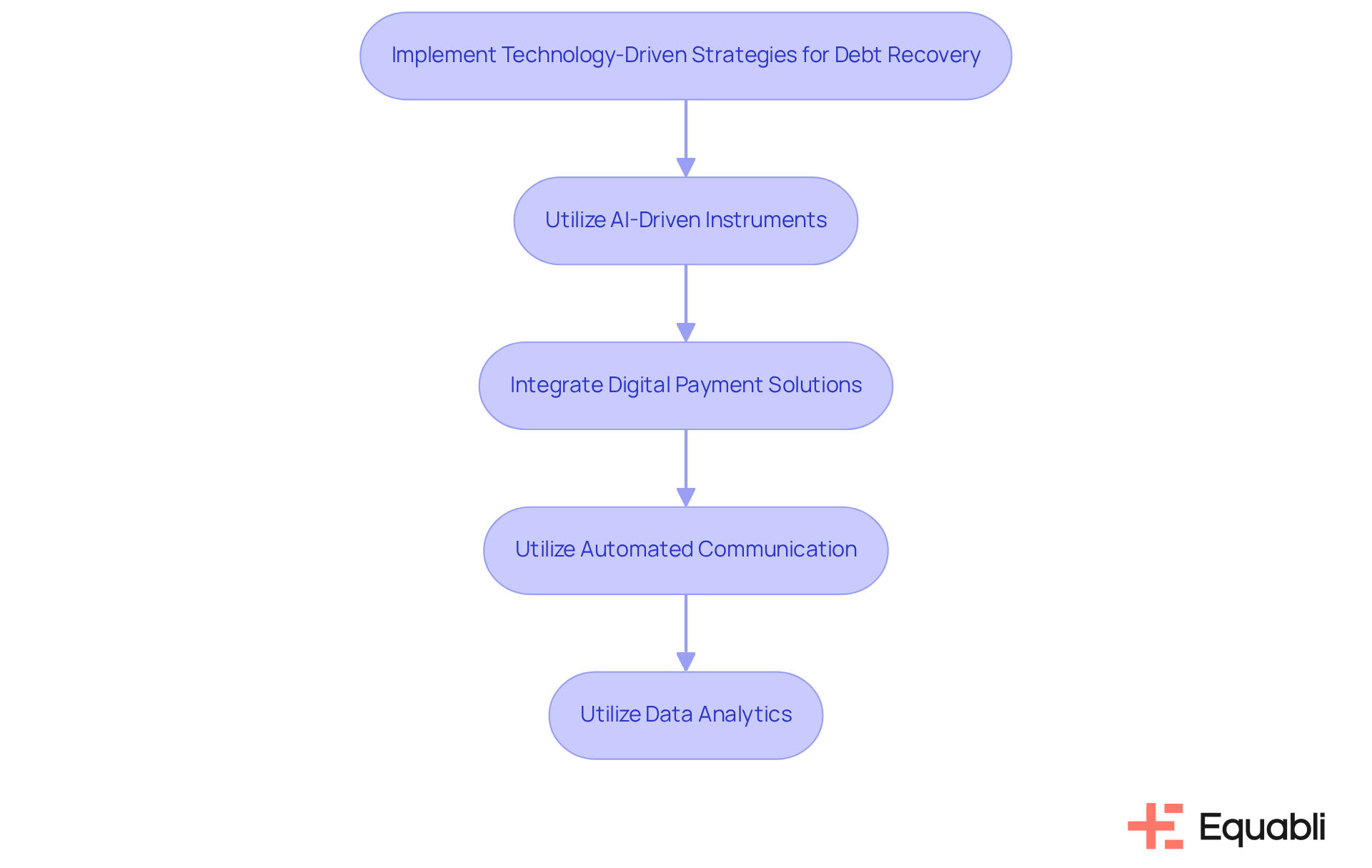

To implement technology-driven strategies for effective debt recovery, financial institutions should consider the following steps:

- Utilize AI-Driven Instruments: Employ AI algorithms to assess data and forecast repayment patterns, facilitating the creation of customized recovery approaches. Equabli's EQ Suite offers custom scoring models that predict repayment and align efforts, showcasing how integrating AI generative tools can lead to a 40% reduction in operational expenses and a 10% increase in recoveries. This strategic implementation underscores the importance of leveraging advanced technology to enhance operational efficiency.

- Integrate Digital Payment Solutions: Providing a variety of digital payment options facilitates easier repayment for consumers. Equabli's EQ Engage empowers borrowers with self-service repayment plans, enhancing the customer experience and improving recovery rates by 15-25% through automation. Contemporary payment recovery techniques can assist in achieving an 80% success rate within 120 days, making this integration essential for operational success.

- Utilize Automated Communication: Implementing automated messaging systems to follow up with debtors ensures timely reminders and reduces the manual workload. With Equabli's EQ Collect, organizations can streamline operations and enhance performance through , enabling them to save time and energy. Notably, 50% of survey participants indicate that automated financial recovery technology allows them to shift focus from administrative tasks to profit-generating work, thereby improving overall productivity.

- Utilize Data Analytics: Employing data analytics to recognize trends in debtor behavior assists organizations in enhancing their retrieval approaches based on real-time insights. Equabli's intelligent EQ Suite utilizes predictive analytics to flag high-risk accounts early, allowing for proactive outreach before accounts become seriously delinquent. Additionally, utilizing behavioral insights and customer segmentation techniques can significantly enhance engagement and improve repayment outcomes, reinforcing the necessity of data-driven decision-making.

By adopting these technology-focused approaches, financial entities can engage in a comprehensive debt collection industry trends analysis for financial institutions, which will greatly improve their recovery processes, lower operational expenses, and boost borrower interaction, ultimately resulting in a more effective and efficient recovery framework.

Ensure Compliance and Ethical Standards in Debt Collection

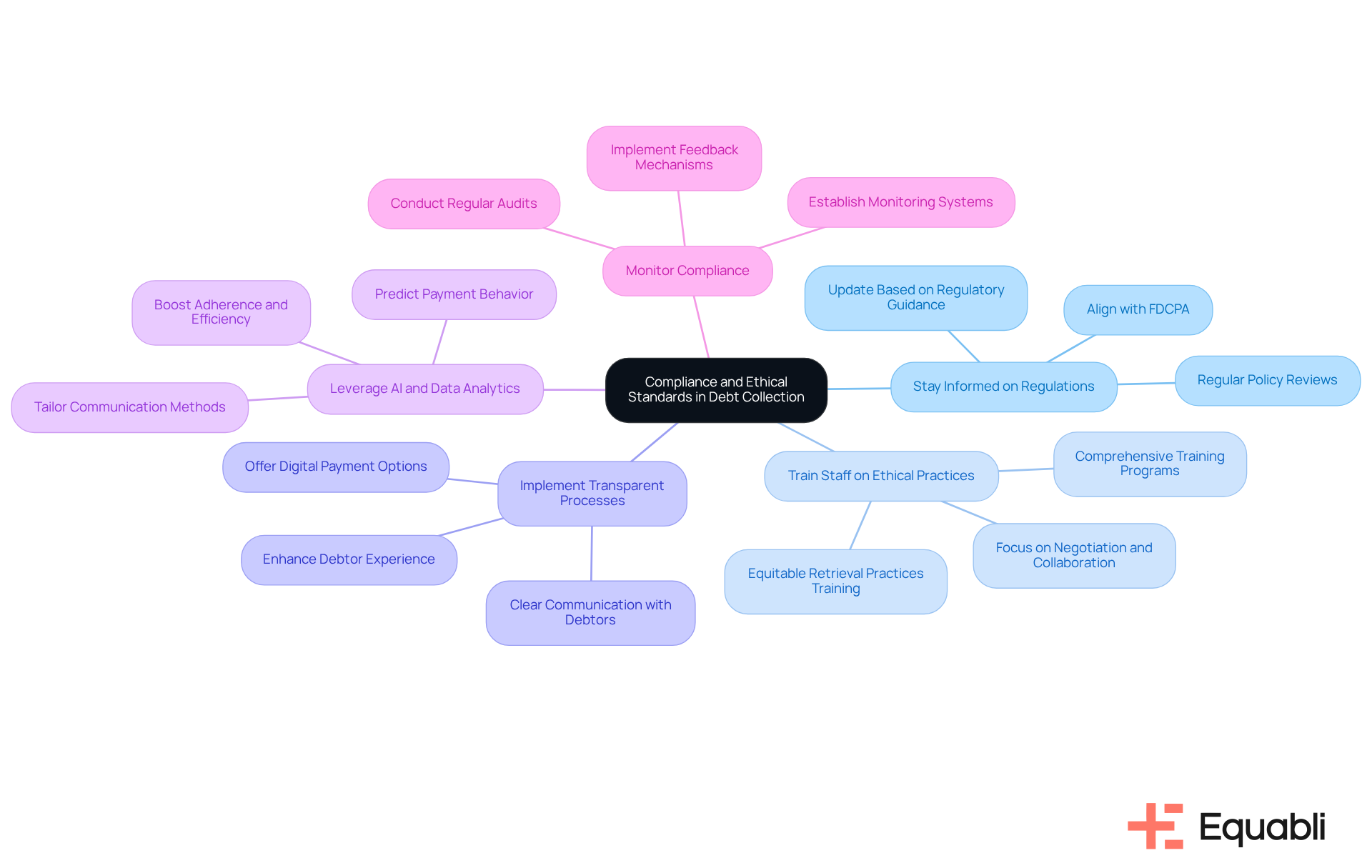

Ensuring compliance and ethical standards in debt recovery is imperative for financial institutions, especially in the context of a comprehensive debt collection industry trends analysis for financial institutions and the evolving regulatory landscape.

- Stay Informed on Regulations: Regularly reviewing and updating policies to align with federal and state regulations, including the Fair Debt Collection Practices Act (FDCPA) and recent guidance from regulatory bodies, is essential. This proactive approach not only mitigates compliance risks but also positions organizations as leaders in ethical debt collection practices.

- Train Staff on Ethical Practices: Implementing comprehensive training programs focused on ethical communication and respectful treatment of debtors is critical. Such training should underscore the importance of negotiation and collaboration over aggressive tactics, fostering a positive recovery environment. Organizations are increasingly investing in equitable retrieval practices training to ensure staff are well-equipped to handle debtor interactions ethically, ultimately enhancing recovery outcomes.

- Implement Transparent Processes: Maintaining clear communication with debtors regarding their obligations and the recovery process is vital. Transparency builds trust and can lead to . Furthermore, offering digital payment options facilitates faster and more secure transactions, enhancing the overall debtor experience and operational efficiency.

- Leverage AI and Data Analytics: Utilizing AI and data analytics to predict payment behavior and tailor communication methods based on debtor behavior patterns is a strategic advantage. This approach not only boosts adherence but also increases the efficiency of retrieval techniques, aligning with contemporary industry practices.

- Monitor Compliance: Establishing robust systems for monitoring adherence to regulations and ethical standards is crucial. Regular audits and feedback mechanisms can ensure that all collection activities are conducted lawfully and ethically, reinforcing the organization’s commitment to compliance.

By prioritizing these practices, financial institutions can effectively mitigate risks, enhance their reputation, and improve overall collection outcomes, which is part of a comprehensive debt collection industry trends analysis for financial institutions that aligns with the industry's shift towards ethical and compliant debt collection strategies.

Conclusion

The analysis of comprehensive debt collection industry trends is essential for financial institutions seeking to enhance operational efficiency and profitability. By adopting modern strategies such as AI-driven solutions and omnichannel communication, organizations can improve recovery rates and foster stronger relationships with borrowers. This proactive adaptation to the evolving landscape of consumer preferences is critical for maintaining a competitive edge in the industry.

Key insights indicate that the integration of technology, including automated recovery systems and data analytics, significantly influences debt collection practices. Institutions prioritizing ethical standards and compliance can cultivate trust and enhance their reputation, ultimately resulting in improved recovery outcomes. The focus on transparency and consumer-centric approaches further emphasizes the necessity of aligning debt collection strategies with contemporary expectations.

In light of these trends, financial institutions are urged to embrace innovative technologies and ethical practices within their debt recovery strategies. By doing so, they not only mitigate risks but also position themselves for sustainable growth in a dynamic market. The commitment to modernizing debt collection processes transcends mere compliance; it represents a strategic imperative that can lead to enhanced performance and increased customer loyalty.

Frequently Asked Questions

Why is understanding debt collection trends important for financial institutions?

Understanding debt collection trends is crucial for financial institutions as it significantly influences their operational effectiveness and profitability, allowing them to align with evolving consumer expectations.

How does digital communication and AI impact debt collection?

Digital communication and AI-driven strategies enhance debt collection processes, improve recovery rates, and foster stronger relationships with borrowers, thereby increasing customer loyalty and satisfaction.

What are the risks of not adapting to debt collection trends?

Institutions that fail to adapt risk falling behind in a competitive landscape and may struggle to navigate rapidly shifting consumer preferences, which can negatively affect their recovery rates and overall performance.

What evidence supports the use of automated recovery systems?

Evidence indicates that banks using automated recovery systems, such as those from Equabli, recover amounts 30% faster and at a 25% lower cost compared to their peers, highlighting the benefits of embracing modern technology.

What financial impact do recovery expenses have on financial institutions?

Recovery expenses often exceed 10% of operational budgets, demonstrating the financial ramifications of not modernizing payment collection methods.

How can behavioral science improve debt recovery processes?

Integrating behavioral science into recovery processes can create a more consumer-centric experience, improving engagement and repayment outcomes.

What strategies should financial institutions use for effective recovery?

Effective recovery strategies should include a comprehensive analysis of debt collection trends and utilize omnichannel approaches for seamless customer interactions while ensuring compliance and efficiency.

What features can enhance recovery efficiency for financial organizations?

Features like automated workflows and real-time reporting, as provided by tools such as EQ Collect, can enhance recovery efficiency and facilitate strategic growth for financial organizations.

What does Jo Mikleus suggest about the future of the receivables recovery industry?

Jo Mikleus suggests that as the receivables recovery industry approaches 2025, the most valuable AI investments will focus on transparency, personalization, and proactive engagement to meet evolving needs.