Overview

This article delves into effective debt recovery strategies utilized by credit collection agencies, highlighting the critical role of technology integration, fostering positive communication, and comprehending legal rights and responsibilities. By examining the impact of advanced analytics, empathetic communication, and adherence to the Fair Debt Practices Act, it becomes evident that these elements can significantly enhance recovery rates and improve relationships between creditors and debtors.

The integration of technology not only streamlines processes but also provides valuable insights that can inform decision-making. Moreover, fostering positive communication establishes trust and encourages cooperation between parties, which is essential in debt recovery scenarios. Understanding legal rights and responsibilities ensures that agencies operate within the framework of the law, thereby avoiding potential pitfalls.

In conclusion, embracing these strategies is not merely beneficial; it is imperative for agencies seeking to optimize their recovery efforts and maintain healthy relationships with clients. The evidence is clear: when technology, communication, and compliance are prioritized, both recovery rates and stakeholder satisfaction can see marked improvement.

Introduction

Credit collection agencies serve as a pivotal link in the financial ecosystem, facilitating the often fraught process of debt recovery between creditors and debtors. By employing innovative strategies and technologies, these agencies significantly enhance recovery rates while fostering respectful communication that benefits all parties involved.

Yet, a pressing challenge persists: how can these agencies effectively balance debt retrieval with ethical practices and compliance?

This article explores best practices and emerging techniques that collection agencies can leverage to navigate the complexities of debt recovery, all while upholding integrity and transparency.

Understand the Role of Collection Agencies in Debt Recovery

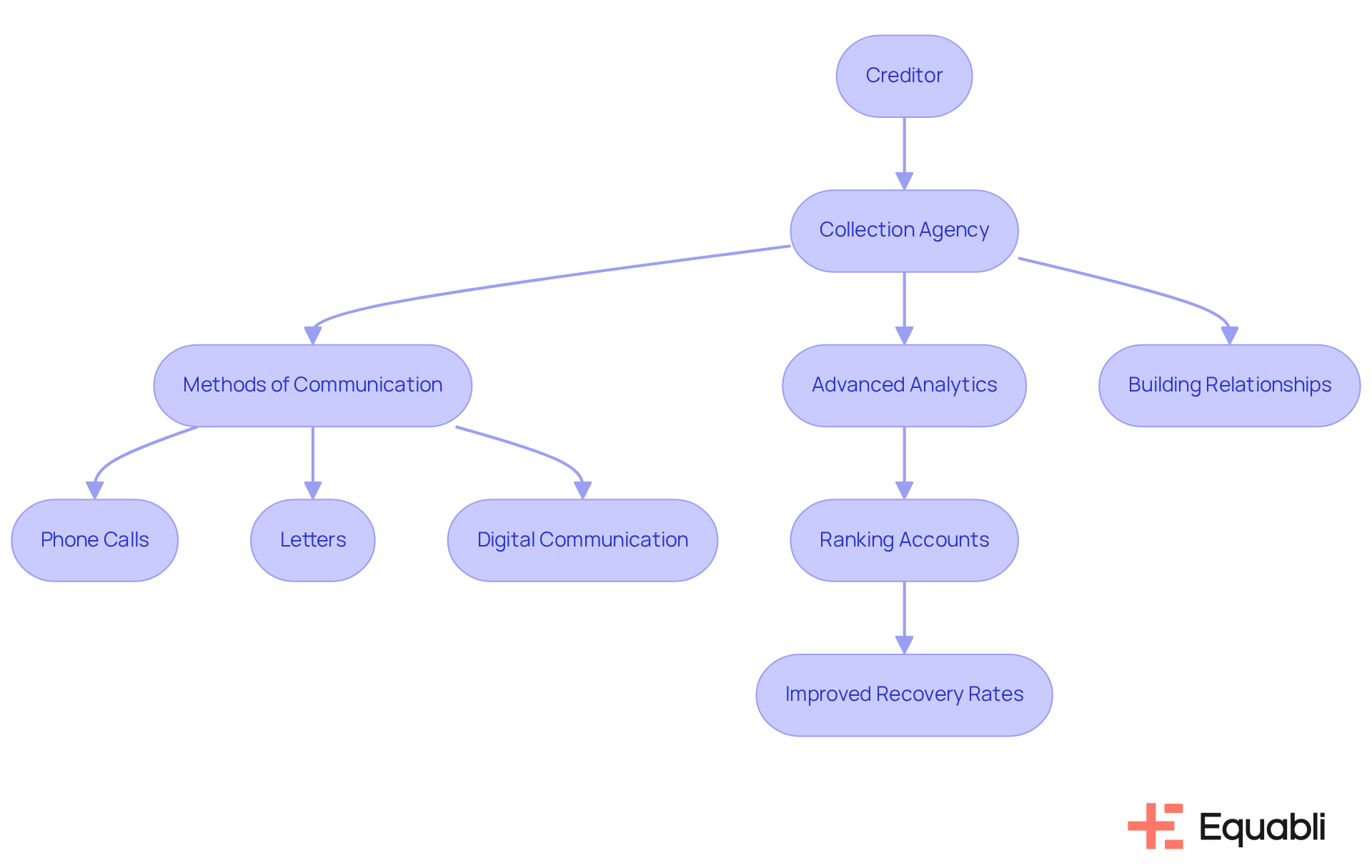

Credit coll collection agencies serve as essential intermediaries between creditors and debtors, focusing on the retrieval of unpaid debts through various methods, including phone calls, letters, and digital communication. They also offer services such as credit reporting and legal action when necessary. By utilizing these abilities, creditors can significantly improve their collection efforts.

For instance, organizations frequently employ advanced analytics to rank accounts according to collectability, ensuring effective resource distribution. This strategic method has demonstrated the ability to produce significant outcomes; case studies suggest that efficient use of can result in an impressive 30% rise in recovery rates.

Moreover, industry leaders stress the significance of building strong working relationships with reputable credit coll collection agencies, promoting their complete incorporation into the recovery process. Robert I. Wall from Commercial Receivers Incorporated states,

'You should have a solid working relationship with a quality debt recovery agency. They should be fully integrated into your collection process.'

This integration not only simplifies operations but also promotes a more compassionate method for dealing with debts through a credit coll collection agency, ultimately benefiting both creditors and those in debt.

As highlighted in the case study 'The Role of Debt Collection in the American Economy,' the impact of credit coll collection agencies on recovery rates is crucial for maintaining financial stability, especially in the current economic landscape.

Know Your Rights and Responsibilities in Debt Collection

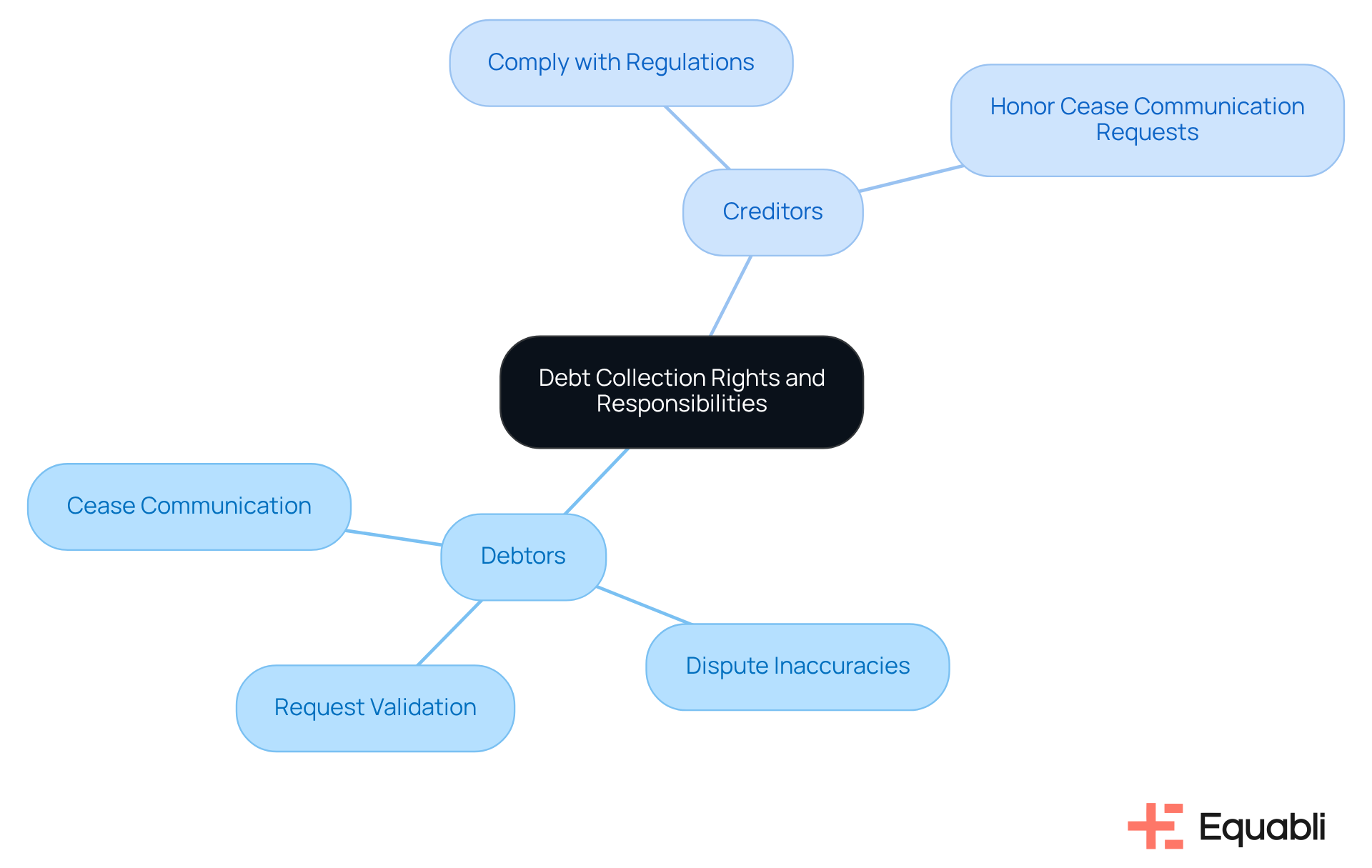

Both borrowers and lenders must be acutely aware of their rights and obligations under the Fair Debt Practices Act (FDCPA), a crucial legislation designed to protect consumers from abusive recovery methods. Debtors have the unequivocal right to:

- Request validation of their debts

- Dispute inaccuracies

- Cease communication with collectors at their discretion

Conversely, creditors are mandated to comply with these regulations, ensuring their collection methods are both ethical and lawful. For instance, a creditor who honors a debtor's request to not only adheres to legal standards but also cultivates a positive reputation—an essential factor for sustaining future business relationships. A comprehensive understanding of these rights and responsibilities can facilitate more effective and respectful interactions throughout the debt recovery process, ultimately benefiting both parties involved.

Leverage Technology for Effective Debt Collection Strategies

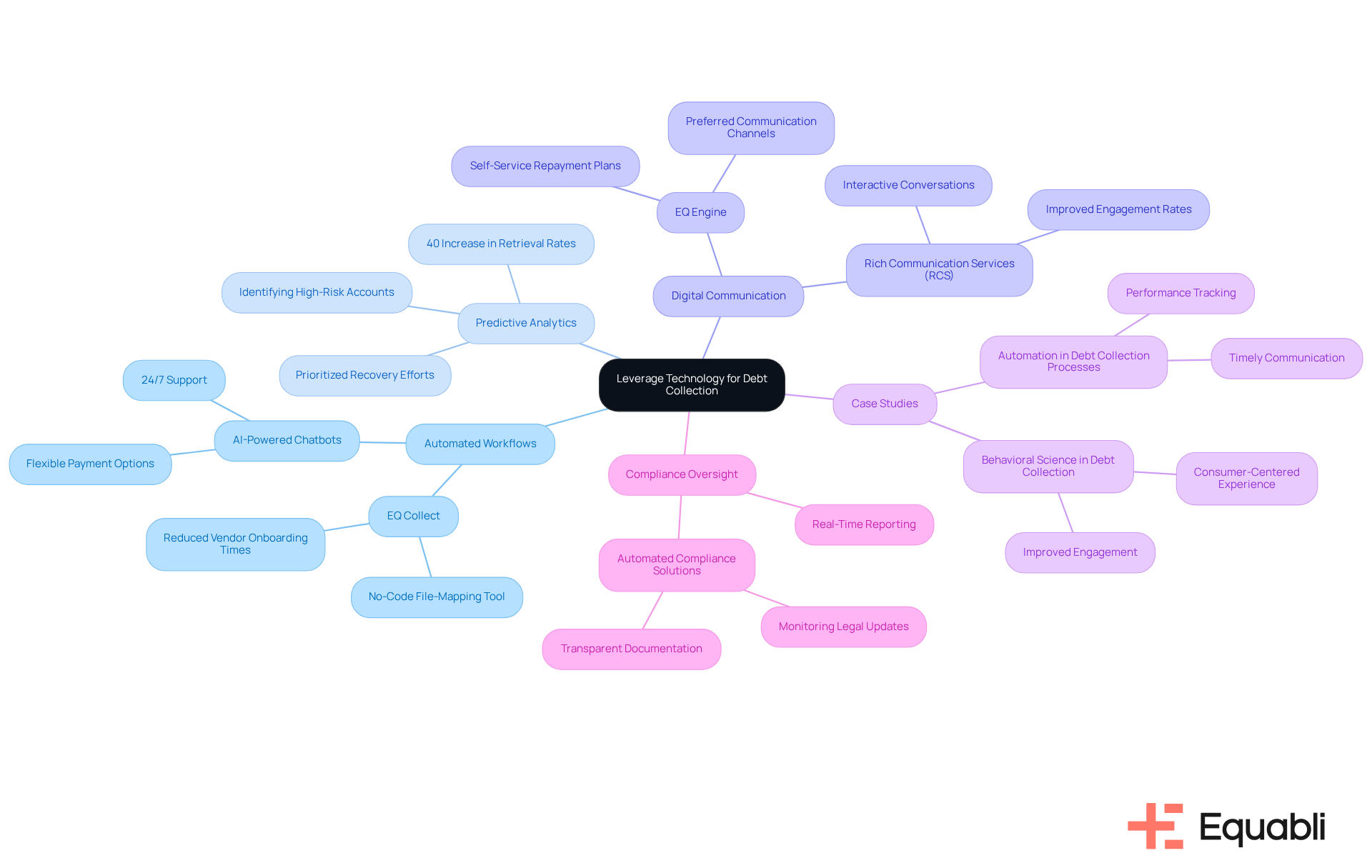

Technology is revolutionizing contemporary debt recovery strategies, with automated workflows, predictive analytics, and cloud-based platforms at the forefront. For instance, Equabli's EQ Collect significantly reduces vendor onboarding times through an intuitive, no-code file-mapping tool, thereby enhancing efficiency and boosting retrievals via data-driven tactics.

Predictive analytics empowers agencies to identify high-risk accounts early, enabling prioritized recovery efforts that enhance overall effectiveness. This proactive stance not only elevates recovery rates but also aligns with ethical standards in AI-driven debt collection, ensuring transparency and fairness in decision-making.

Furthermore, digital communication channels, such as SMS and email, are intricately linked to the features of the EQ Engine, enhancing engagement by offering convenient payment options and fostering positive interactions. With the EQ Engine, organizations can provide borrowers with and connect through their preferred channels, ultimately reducing collection costs through technology.

A notable case study revealed that a leading debt management firm experienced a remarkable 40% increase in retrieval rates after adopting an AI-driven platform that tailored communication based on debtor behavior. By harnessing these technological advancements, including the comprehensive features of EQ Collect and EQ Engine, organizations not only bolster their operational effectiveness but also cultivate a more debtor-friendly experience, leading to improved outcomes.

Additionally, the real-time reporting and compliance oversight offered by EQ Collect guarantee that agencies uphold industry standards while refining their collection processes.

Foster Positive Communication with Debtors to Enhance Recovery

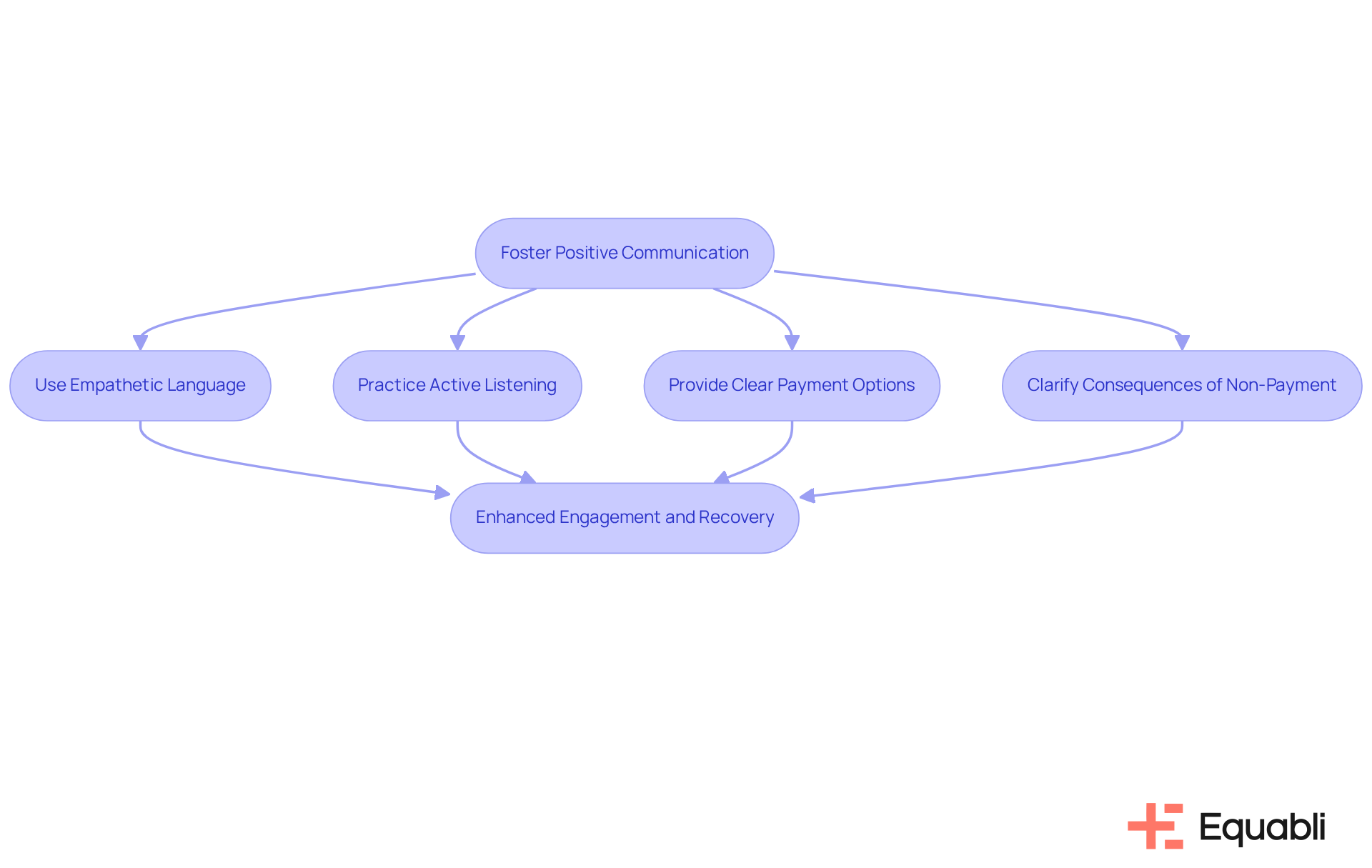

Promoting positive communication with those in debt is essential for improving recovery efforts. Approaching conversations with empathy and respect significantly enhances engagement with borrowers. By utilizing positive language and active listening techniques, agencies can build rapport and trust—key elements for effective interactions.

It is crucial for agencies to provide clear information about payment options and the consequences of non-payment, ensuring debtors feel informed and respected. Research indicates that organizations employing have experienced a 25% increase in payment compliance.

By prioritizing positive interactions, collection agencies not only enhance repayment rates but also contribute to a more respectful and ethical debt collection environment. Case studies demonstrate that organizations focusing on empathy and understanding have achieved enhanced debtor cooperation, resulting in quicker resolutions and improved long-term outcomes in debt recovery.

Conclusion

Understanding the nuances of credit collection agencies is essential for both creditors and debtors navigating the complex landscape of debt recovery. These agencies play a pivotal role in facilitating the recovery process, employing a blend of technology, analytics, and effective communication to optimize outcomes for all parties involved. By fostering collaborative relationships and integrating robust strategies, creditors can significantly enhance their collection efforts while upholding ethical standards.

The article highlights several key strategies for effective debt recovery, emphasizing the importance of:

- Leveraging technology

- Comprehending legal rights and responsibilities

- Promoting positive communication with debtors

Advanced tools, such as predictive analytics and automated workflows, empower agencies to prioritize recovery efforts and enhance engagement. Furthermore, adhering to regulations like the Fair Debt Practices Act ensures that both creditors and debtors are treated fairly, fostering a more respectful debt collection environment.

Ultimately, the significance of adopting a compassionate approach in debt recovery cannot be overstated. By prioritizing empathy and clear communication, collection agencies can not only improve recovery rates but also contribute to a healthier financial ecosystem. As the landscape of debt collection evolves, embracing best practices and innovative technologies will be crucial for success in 2025 and beyond.

Frequently Asked Questions

What is the primary role of collection agencies in debt recovery?

Collection agencies serve as intermediaries between creditors and debtors, focusing on retrieving unpaid debts through methods like phone calls, letters, and digital communication.

What additional services do collection agencies provide?

In addition to debt recovery, collection agencies offer services such as credit reporting and legal action when necessary.

How do collection agencies improve creditors' collection efforts?

By utilizing advanced analytics to rank accounts based on collectability, collection agencies help creditors effectively allocate resources, resulting in improved collection outcomes.

What impact can efficient use of debt recovery firms have on recovery rates?

Efficient use of debt recovery firms can lead to an impressive 30% increase in recovery rates, according to case studies.

Why is it important to build strong relationships with collection agencies?

Strong working relationships with reputable collection agencies promote their complete integration into the recovery process, simplifying operations and fostering a more compassionate approach to debt management.

What does Robert I. Wall from Commercial Receivers Incorporated emphasize about working with debt recovery agencies?

He emphasizes the importance of having a solid working relationship with a quality debt recovery agency, stating they should be fully integrated into the collection process.

How do collection agencies contribute to financial stability in the economy?

Collection agencies play a crucial role in maintaining financial stability by improving recovery rates, which is particularly important in the current economic landscape.