Overview

The article evaluates credit collection services for financial institutions, highlighting their essential role in maintaining cash flow stability and effective debt management. Key performance indicators (KPIs), such as Days Sales Outstanding and Recovery Rate, are detailed to support this evaluation. These metrics enable organizations to measure and enhance their debt recovery effectiveness. Furthermore, the adoption of innovative digital solutions is discussed as a means to improve operational efficiency, underscoring the strategic importance of these services in the current financial landscape.

Introduction

The landscape of credit collection services is evolving rapidly, particularly as financial institutions navigate the complexities of managing overdue debts in a digital age. Effective performance evaluations of these services are not merely beneficial; they are essential for maintaining cash flow stability and fostering positive customer relationships. Organizations must leverage the right strategies and metrics to optimize their recovery processes.

This article examines the critical components of evaluating credit collection services, exploring key performance indicators and actionable steps to enhance effectiveness while addressing common challenges faced in the evaluation process.

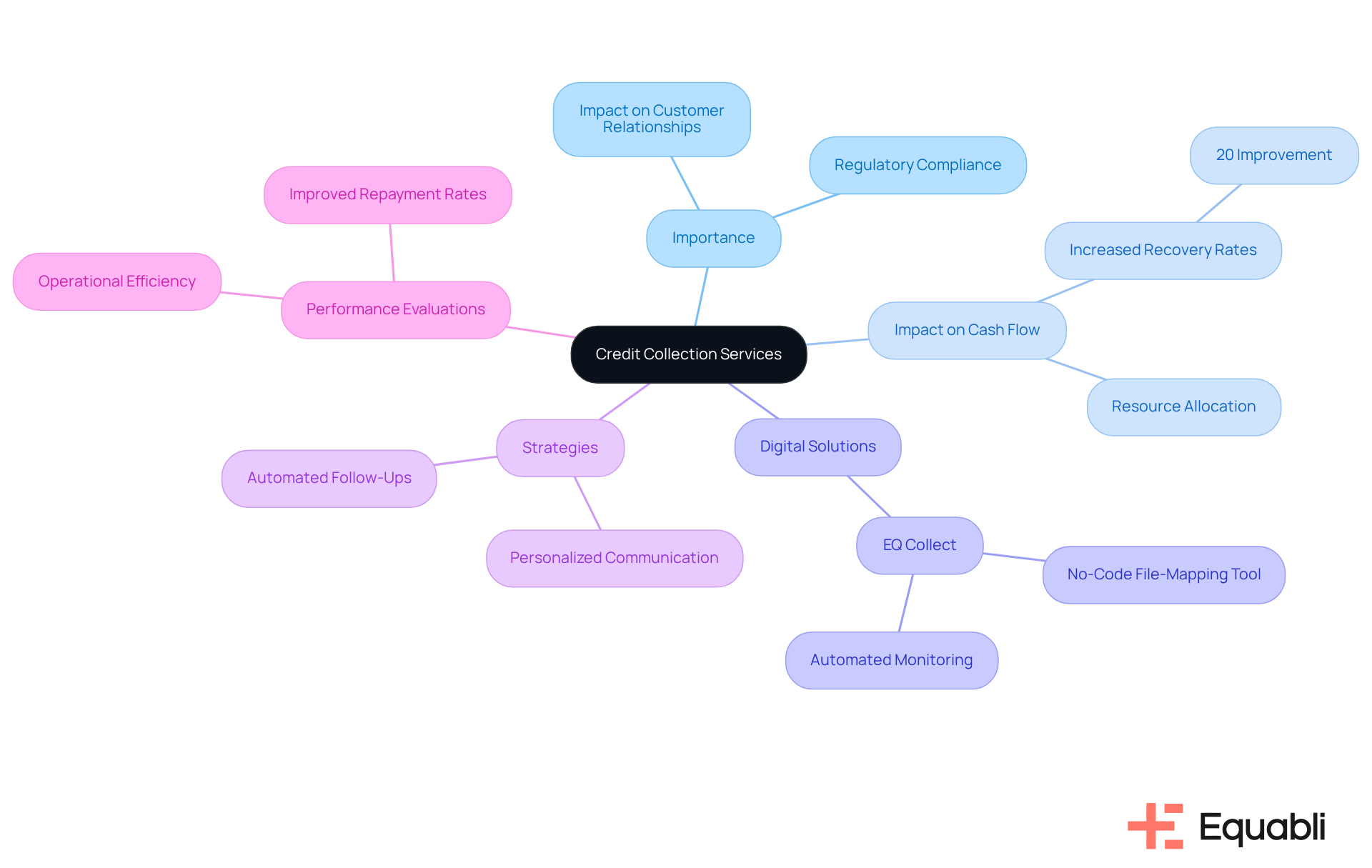

Understand Credit Collection Services and Their Importance

Credit recovery services performance evaluations for financial institutions are essential, significantly impacting cash flow stability through the effective management of overdue debts. These services not only facilitate fund recovery but also play a crucial role in fostering customer relationships and ensuring compliance with regulatory standards. As of 2025, the credit retrieval landscape has transformed, with a marked shift towards digital solutions such as EQ Collect that enhance operational efficiency and borrower engagement. Institutions adopting innovative strategies, including personalized communication and automated follow-ups, have reported improved repayment rates and reduced operational costs.

Data indicates that organizations leveraging modern credit retrieval services can achieve a 20% increase in recovery rates, thereby substantially improving their cash flow. Furthermore, effective credit retrieval strategies contribute to a more stable financial environment, allowing organizations to allocate resources more efficiently and invest in growth opportunities.

As Benjamin Franklin astutely noted, 'Creditors have better memories than debtors,' underscoring the importance of proactive recovery efforts. By prioritizing these services, including the utilization of EQ Collect's no-code file-mapping tool and automated monitoring capabilities, financial organizations can bolster their bottom line while cultivating a culture of accountability and trust with clients. Ultimately, comprehending and optimizing for financial institutions is vital for sustaining financial health and achieving long-term growth.

Identify Key Performance Indicators for Evaluation

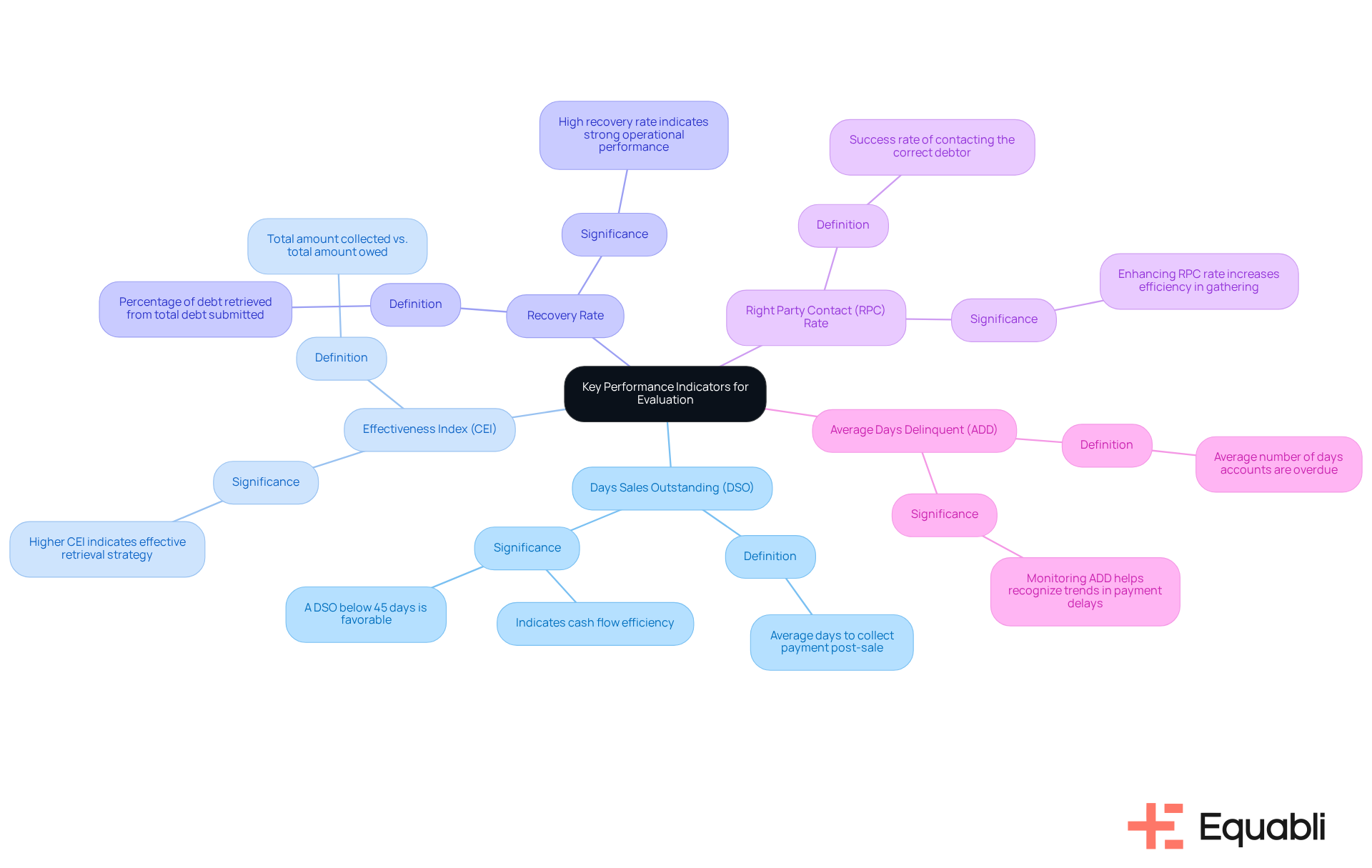

To effectively assess credit collection services performance evaluations for financial institutions, organizations should focus on several key performance indicators (KPIs) that provide essential insights into their recovery processes.

- Days Sales Outstanding (DSO) serves as a critical metric, measuring the average number of days required to collect payment post-sale. A DSO below 45 days is typically regarded as favorable, indicating efficient cash management and expedited access to funds for reinvestment. Utilizing EQ Collect's data-oriented approaches can assist institutions in by optimizing their retrieval processes, ultimately enhancing cash flow.

- The Effectiveness Index (CEI) evaluates the efficiency of the retrieval process by comparing the total amount collected against the total amount owed. A higher CEI signifies a more effective retrieval strategy, which is essential for sustaining healthy cash flow. Employing EQ Collect's automated workflows can enhance CEI by minimizing execution errors, thereby improving overall retrieval effectiveness.

- The Recovery Rate reflects the percentage of debt retrieved from the total debt submitted for recovery. A high recovery rate indicates robust gathering efforts and strong operational performance. It is noteworthy that bad debts impact an average of 9% of all credit-based B2B sales in the US, underscoring the importance of monitoring this metric. EQ Collect's real-time reporting capabilities provide insights that can help institutions boost their recovery rates while ensuring compliance oversight.

- The Right Party Contact (RPC) Rate measures the success rate of contacting the correct debtor. Enhancing the RPC rate is vital for increasing efficiency in gathering and minimizing the time spent on unproductive contacts. Effective customer communication regarding due dates and overdue balances can significantly impact this rate. EQ Collect's user-friendly interface enhances communication methods, thereby improving RPC rates.

- Lastly, Average Days Delinquent (ADD) tracks the average number of days accounts are overdue. Monitoring ADD assists organizations in recognizing trends in payment delays, enabling prompt interventions and adjustments in recovery strategies. With EQ Collect's automated monitoring, organizations can gain insights into ADD trends and respond proactively.

By consistently tracking these KPIs and leveraging the advanced features of EQ Collect, including compliance oversight, financial institutions can utilize credit collection services performance evaluations for financial institutions to gain valuable insights into their recovery results, identify areas needing enhancement, and implement strategies to improve overall effectiveness in managing delinquent accounts.

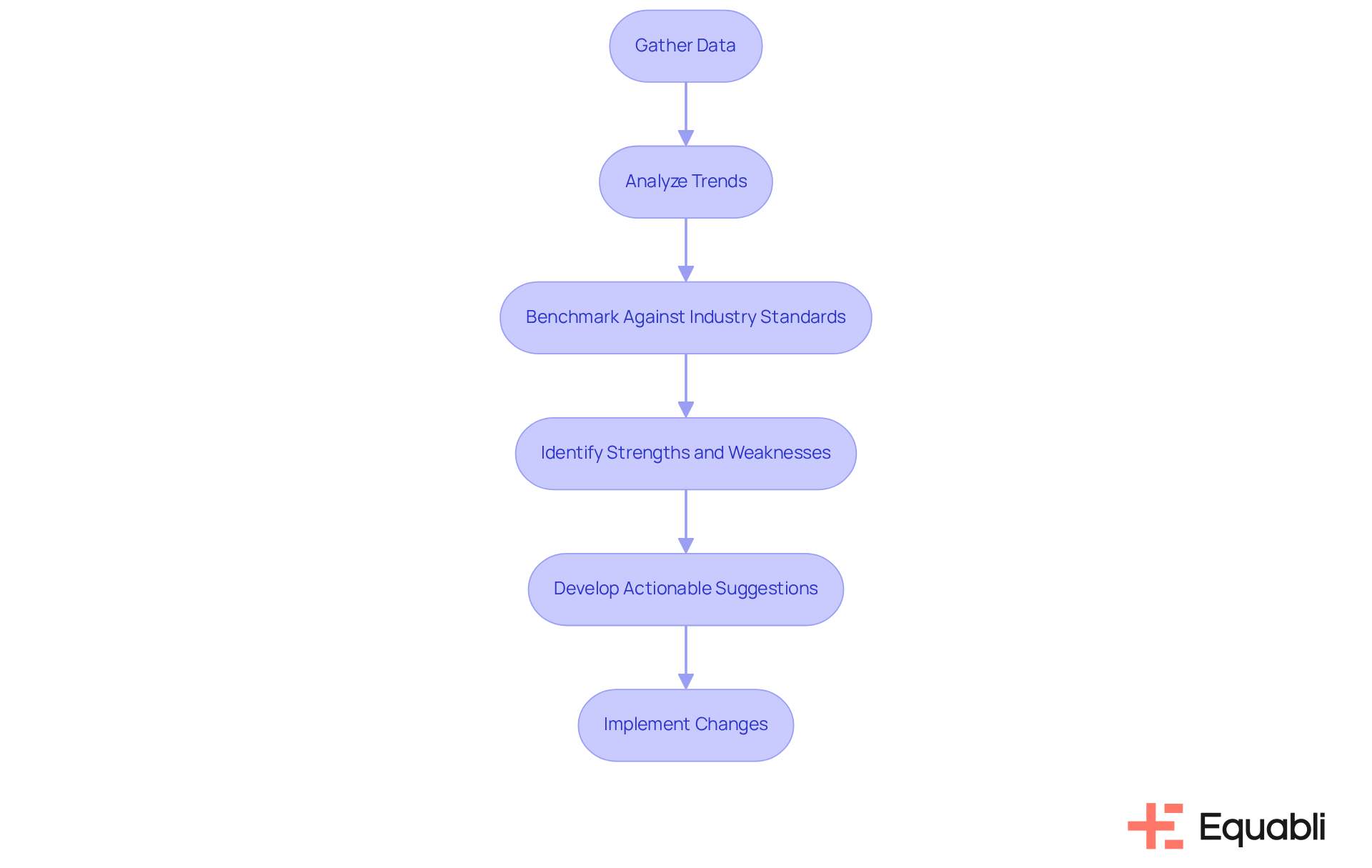

Conduct a Step-by-Step Performance Evaluation

To conduct a thorough performance evaluation of credit collection services, follow these steps:

- Gather Data: Collect pertinent information on the KPIs identified earlier, including historical metrics and current collection strategies. This foundational step ensures a of the operational landscape.

- Analyze Trends: Review the data to identify trends over time. Look for patterns in recovery rates, DSO, and other KPIs to understand variations in results. This analysis provides critical insights into credit collection services performance evaluations for financial institutions, focusing on performance fluctuations and operational effectiveness.

- Benchmark Against Industry Standards: Compare your organization's performance against industry benchmarks to gauge the effectiveness of credit collection services performance evaluations for financial institutions. This comparison can highlight areas where your institution excels or falls short, guiding strategic adjustments.

- Identify Strengths and Weaknesses: Based on the analysis, pinpoint strengths in your gathering methods and areas that require enhancement. Recognizing these elements is crucial for developing a targeted improvement strategy.

- Develop Actionable Suggestions: Create a list of suggestions for improving retrieval efficiency, such as adopting new technologies or refining communication strategies with debtors. These recommendations should be pragmatic and aligned with industry best practices.

- Implement Changes: Put the recommendations into action and monitor their impact on performance over time. Continuous evaluation of these changes ensures that the organization remains agile and responsive to evolving challenges.

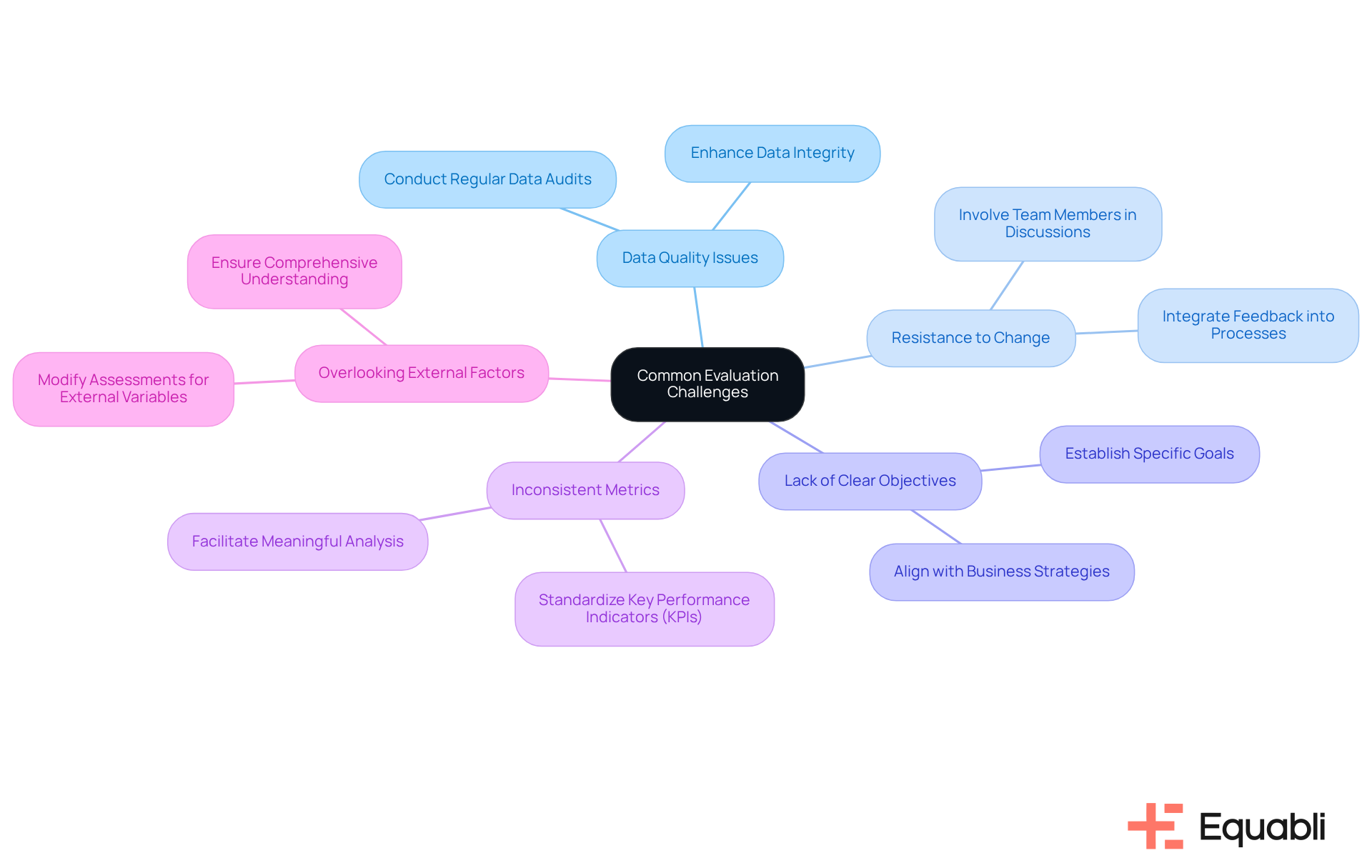

Troubleshoot Common Evaluation Challenges

When performing for financial institutions, institutions may encounter several challenges that require strategic attention. The following are common issues along with actionable recommendations to address them:

- Data Quality Issues: Accurate and up-to-date data is critical for effective evaluations. Conduct regular data audits to uphold data integrity, as poor data quality can lead to misguided approaches and operational inefficiencies. By ensuring data accuracy, institutions can enhance their decision-making processes.

- Resistance to Change: Staff may resist new evaluation processes, which can hinder implementation. To mitigate this, involve team members in discussions about the benefits of assessments and integrate their feedback into the execution process. This collaboration fosters support and minimizes resistance, ultimately enhancing the evaluation framework.

- Lack of Clear Objectives: Evaluations without specific goals can become unfocused, leading to ineffective outcomes. Establish clear objectives that align with overall business strategies to ensure evaluations are targeted and measurable. This clarity will drive more impactful assessments and facilitate better alignment with institutional goals.

- Inconsistent Metrics: Utilizing consistent Key Performance Indicators (KPIs) across evaluations is essential for accurate comparisons over time. Standardizing metrics allows for meaningful analysis and effective tracking of improvements, providing a clearer picture of performance trends.

- Overlooking External Factors: External elements, such as economic conditions, can significantly influence retrieval results. It is crucial to modify assessments to account for these variables, ensuring a comprehensive understanding of the factors impacting performance.

By proactively addressing these challenges, financial institutions can enhance the effectiveness of credit collection services performance evaluations for financial institutions and refine their credit collection strategies.

Conclusion

Effective evaluation of credit collection services is essential for financial institutions aiming to enhance cash flow and sustain robust customer relationships. Understanding the significance of these services and implementing strategic evaluations enables organizations to optimize their debt recovery processes and ensure compliance with regulatory standards.

Key performance indicators (KPIs) such as:

- Days Sales Outstanding (DSO)

- Effectiveness Index (CEI)

- Recovery Rate

- Right Party Contact (RPC) Rate

- Average Days Delinquent (ADD)

are crucial in assessing performance. By leveraging modern tools like EQ Collect, institutions can meticulously track these metrics, identify strengths and weaknesses, and implement targeted improvements to elevate recovery rates and operational efficiency.

In conclusion, the insights provided highlight the necessity for financial institutions to prioritize the evaluation of their credit collection services. By adopting a systematic approach to performance assessment, organizations can effectively navigate challenges and enhance their overall financial health. Embracing innovation and data-driven strategies will not only improve recovery outcomes but also foster a culture of accountability and trust with clients, paving the way for sustainable growth in an evolving financial landscape.

Frequently Asked Questions

What are credit collection services and why are they important?

Credit collection services are essential for managing overdue debts, facilitating fund recovery, fostering customer relationships, and ensuring compliance with regulatory standards. They significantly impact cash flow stability for financial institutions.

How has the credit retrieval landscape changed by 2025?

By 2025, the credit retrieval landscape has transformed with a shift towards digital solutions, such as EQ Collect, which enhance operational efficiency and borrower engagement.

What benefits do institutions experience by adopting innovative credit retrieval strategies?

Institutions that adopt innovative strategies, including personalized communication and automated follow-ups, report improved repayment rates and reduced operational costs.

What impact can modern credit retrieval services have on recovery rates?

Organizations leveraging modern credit retrieval services can achieve a 20% increase in recovery rates, which substantially improves their cash flow.

How do effective credit retrieval strategies contribute to financial stability?

Effective credit retrieval strategies contribute to a more stable financial environment, enabling organizations to allocate resources more efficiently and invest in growth opportunities.

What tools can financial organizations use to enhance their credit collection efforts?

Financial organizations can utilize tools such as EQ Collect's no-code file-mapping tool and automated monitoring capabilities to enhance their credit collection efforts.

What is the significance of proactive recovery efforts in credit collection?

Proactive recovery efforts are crucial as they help maintain accountability and trust with clients, ultimately bolstering the financial organization's bottom line.

Why is it vital for financial institutions to understand and optimize credit collection services?

Understanding and optimizing credit collection services is vital for sustaining financial health and achieving long-term growth for financial institutions.