Overview

The article outlines four advanced debt recovery methodologies tailored for financial institutions, highlighting the critical role of:

- Technology integration

- Strategy customization

- Compliance assurance

- Ethical standards

These methodologies are demonstrated to enhance operational efficiency and recovery rates through the application of AI for predictive analytics, automation of communication, and the customization of approaches to meet specific institutional requirements. Furthermore, adherence to legal regulations is emphasized, ultimately fostering improved financial outcomes and stronger borrower relationships.

Introduction

Financial institutions are at a pivotal point as traditional debt recovery methods increasingly prove inefficient and costly. Recovery rates are often alarmingly low, underscoring the urgent need for innovative, technology-driven solutions. This article explores advanced debt recovery methodologies that not only enhance operational efficiency but also foster improved borrower engagement and satisfaction.

How can financial organizations effectively navigate the complexities of modern debt recovery while ensuring compliance and upholding ethical standards?

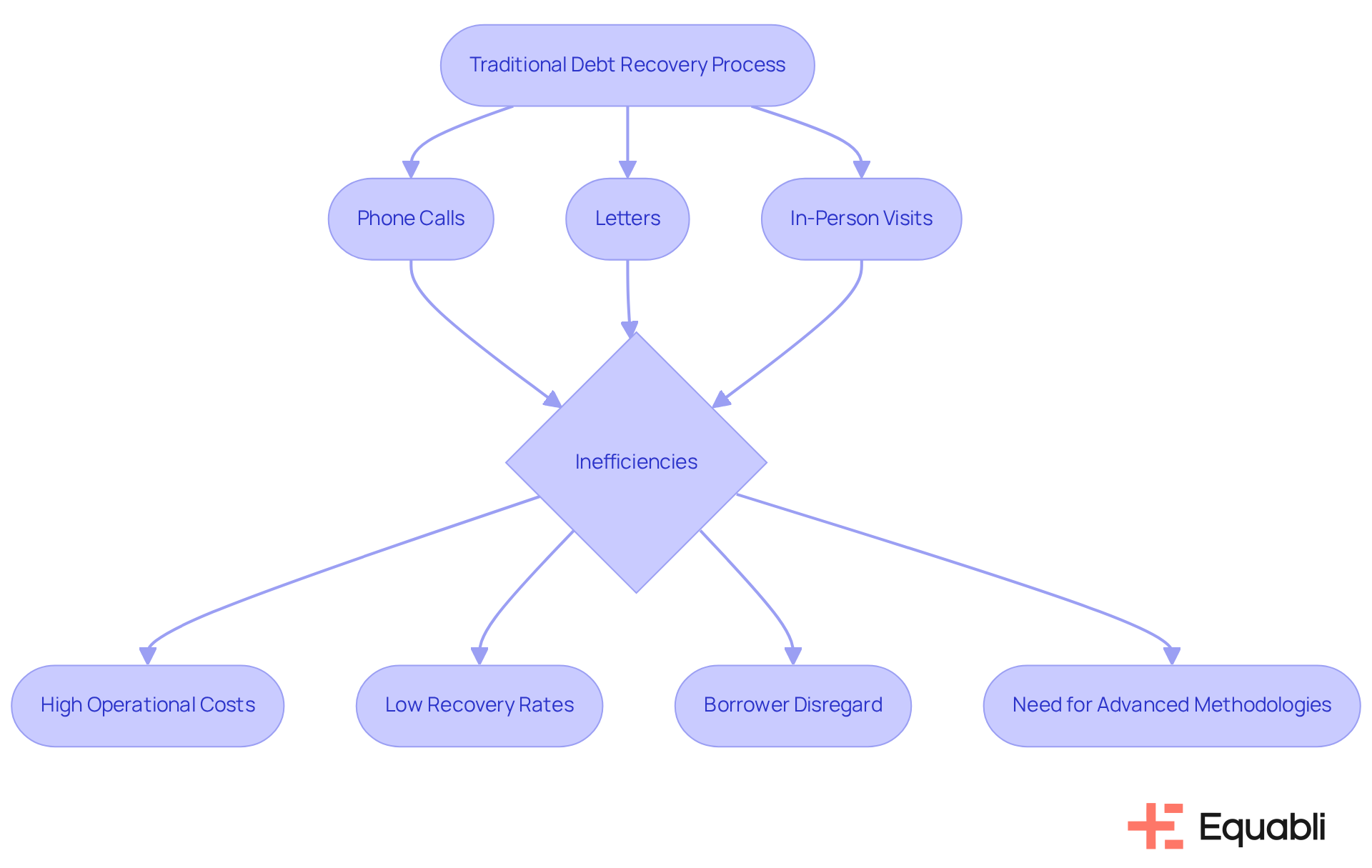

Understand Traditional Debt Recovery Processes

Conventional debt collection methods predominantly rely on manual interventions, such as phone calls, letters, and in-person visits. These outdated practices often lead to significant inefficiencies, marked by elevated operational costs and disappointing recovery rates. Evidence suggests that many borrowers frequently disregard collection calls, resulting in wasted resources and time. Furthermore, the lack of personalization in these approaches can alienate debtors, complicating repayment efforts. Recognizing these deficiencies is essential for organizations aiming to modernize their strategies and incorporate for financial institutions as more effective, technology-driven solutions.

Organizations that depend exclusively on conventional methods often experience increased Days Sales Outstanding (DSO) and rising operational expenses. For instance, debt agencies typically achieve restitution rates of only 20-30%, recovering merely $20-30 for every $100 in unpaid obligations. By scrutinizing these processes, institutions can identify specific areas where advanced debt recovery methodologies for financial institutions can enhance efficiency and borrower engagement, ultimately leading to improved return rates and heightened customer satisfaction. As Chris Warburton from ROstrategy notes, addressing the complexities of regulatory challenges is vital for enhancing customer support in receivables, underscoring the need for a transition towards more advanced, data-informed methodologies.

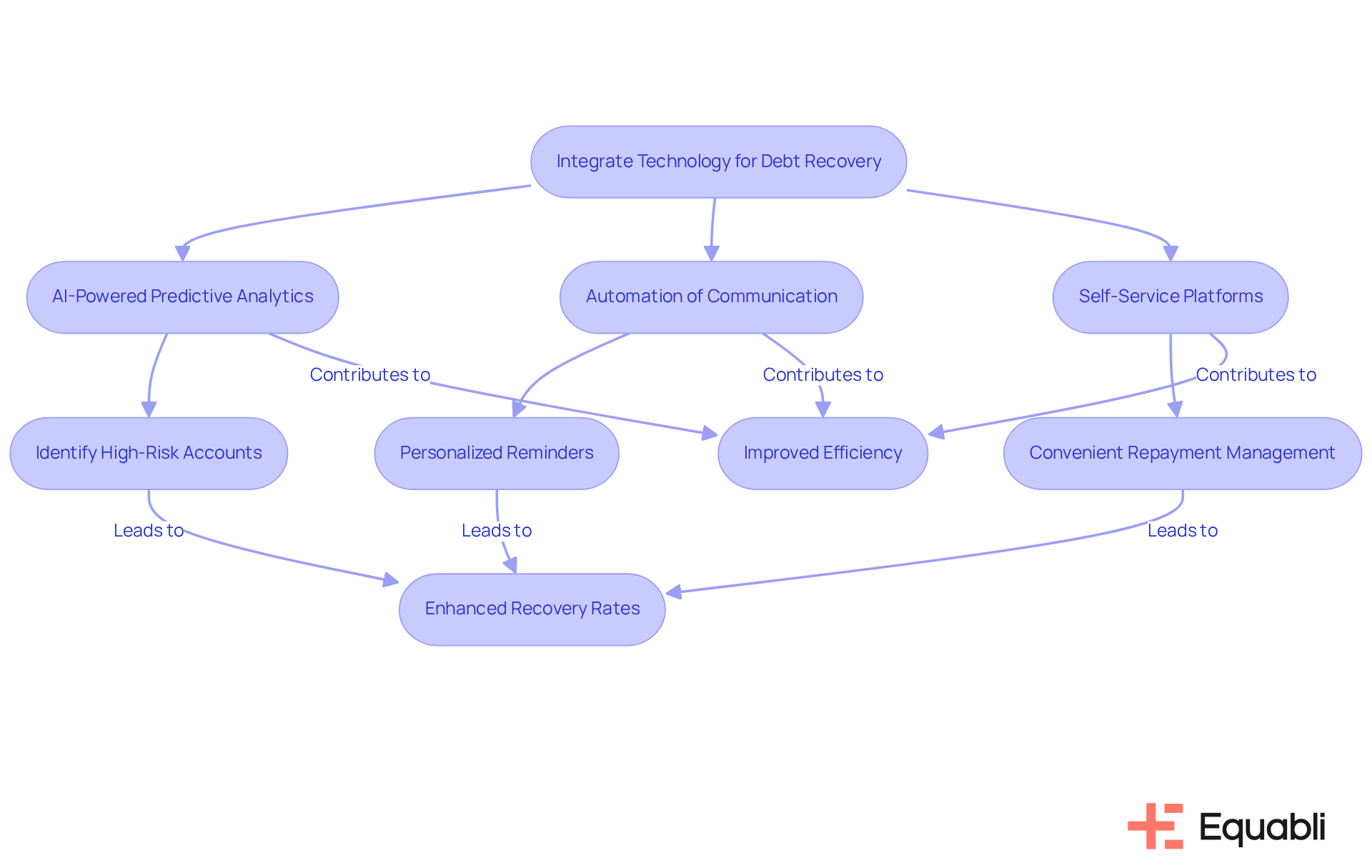

Leverage Technology for Enhanced Debt Recovery

Integrating technology into advanced debt recovery methodologies for financial institutions significantly enhances both efficiency and effectiveness. AI-powered predictive analytics empower organizations to identify high-risk accounts, enabling them to prioritize recovery efforts strategically. By analyzing historical repayment patterns, AI predicts which accounts are most susceptible to default, facilitating resource allocation towards critical cases with precision.

Moreover, automation optimizes communication with debtors through personalized reminders and tailored payment plans, thereby reducing the necessity for manual follow-ups. Platforms such as EQ Collect enhance this process by expediting vendor onboarding timelines with an intuitive, no-code file-mapping tool, ultimately boosting revenue through data-driven strategies. further allow borrowers to manage their repayments conveniently, leading to improved engagement and satisfaction.

Financial organizations that have embraced advanced debt recovery methodologies for financial institutions report recovery rate increases of up to 30% alongside substantial reductions in operational expenses, underscoring the tangible benefits of digital solutions in debt recovery. As Sara Woggerman, Owner & President, observes, "AI isn’t a future concept—it’s a journey that many collection professionals are already on," reflecting the ongoing evolution within the industry.

Furthermore, with EQ Collect's automated workflows and real-time reporting, financial organizations can ensure smarter orchestration and enhanced performance, further illustrating the effectiveness of these technologies in practical applications.

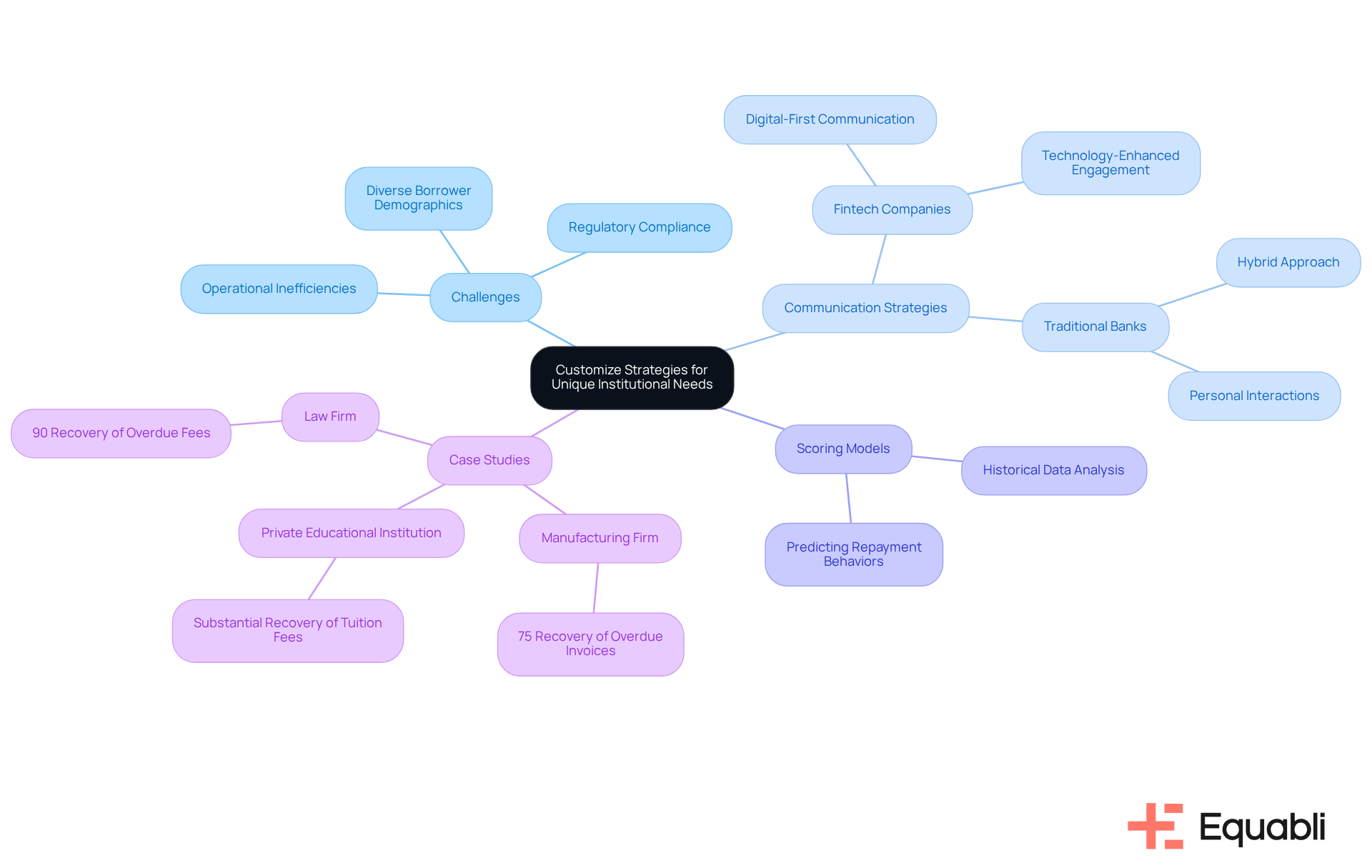

Customize Strategies for Unique Institutional Needs

Each financial organization faces distinct challenges, borrower demographics, and operational frameworks, which render a one-size-fits-all strategy for debt collection ineffective. Institutions must assess their specific needs and tailor their strategies accordingly. For instance, fintech companies typically excel with digital-first communication strategies that leverage technology for enhanced engagement, whereas traditional banks may find a hybrid approach—combining digital outreach with personal interactions—more beneficial.

Developing customized scoring models to predict repayment behaviors based on historical data is another effective strategy. By adapting their approaches to unique circumstances, institutions can significantly enhance recovery efforts and foster stronger borrower relationships through advanced debt recovery methodologies for financial institutions, ultimately leading to improved financial outcomes.

Case analyses across various sectors indicate that tailored strategies not only yield higher return rates but also reduce operational expenses. For example:

- A manufacturing firm successfully retrieved 75% of overdue invoices within three months by implementing a customized payment collection plan that addressed its specific challenges.

- A private educational institution managed to recover a substantial portion of outstanding tuition fees without resorting to legal action, illustrating the effectiveness of personalized approaches in sustaining financial stability.

These examples underscore the critical importance of , particularly advanced debt recovery methodologies for financial institutions, to meet the distinct requirements of each institution.

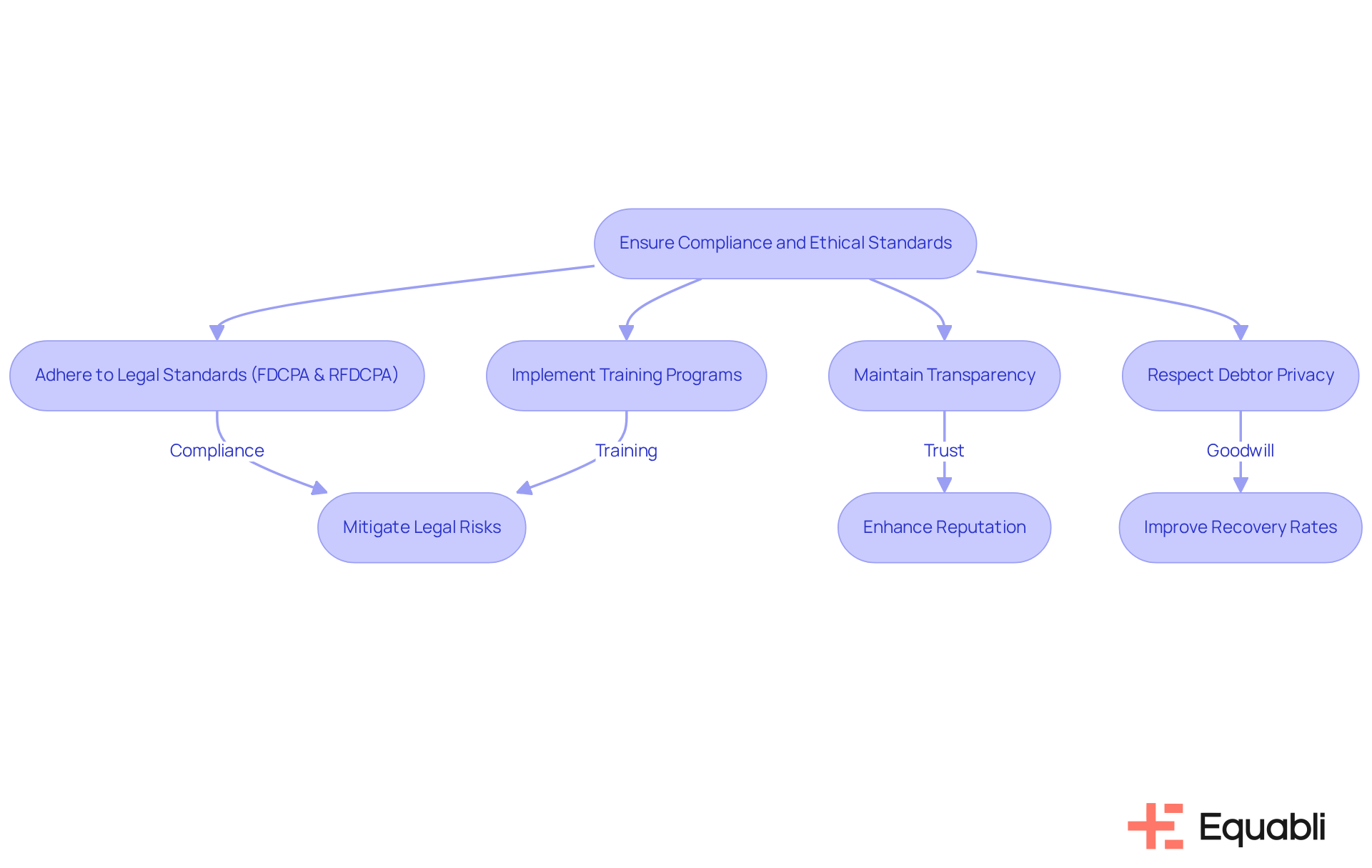

Ensure Compliance and Ethical Standards in Collections

Adhering to legal standards, including the Fair Collection Practices Act (FDCPA) and the expanded Rosenthal Fair Collection Practices Act (RFDCPA), is crucial in financial recovery. Starting July 1, 2025, covered commercial liabilities in California will be subject to the same stringent recovery practices as consumer obligations, introducing new legal risks for creditors and lenders, particularly with individual borrowers and personal guarantors. Institutions must ensure that their gathering practices do not violate consumer rights or engage in abusive behaviors. This necessitates upholding , providing clear details about financial obligations, and respecting debtor privacy.

Ethical debt collection practices not only comply with regulations but also foster trust and goodwill among borrowers. Institutions should implement comprehensive training programs for their staff that encompass the new legal requirements and prohibited conduct, such as harassment and deceptive communications. By emphasizing adherence to regulations and ethical standards, organizations can mitigate legal risks, enhance their reputation, and ultimately improve their recovery rates. Real-world examples illustrate that institutions with robust compliance frameworks experience fewer legal challenges and maintain better relationships with their customers. As noted by legal experts, adherence to these standards is essential for sustainable success in debt recovery.

Conclusion

Embracing advanced debt recovery methodologies is essential for financial institutions seeking to enhance operational efficiency and improve recovery rates. By moving away from traditional, inefficient practices and integrating innovative technology, organizations can significantly transform their debt collection processes. This shift addresses the shortcomings of conventional methods and fosters stronger relationships with borrowers, ultimately leading to better financial outcomes.

Key arguments highlight the importance of leveraging technology, such as AI and automation, to streamline recovery efforts and personalize communication with debtors. Evidence from successful case studies demonstrates that customizing strategies to cater to the unique needs of different institutions enhances effectiveness. Furthermore, maintaining compliance with legal standards and ethical practices ensures that organizations build trust and minimize risks associated with debt collection.

In a rapidly evolving financial landscape, the adoption of these advanced methodologies is not merely an option but a necessity. Institutions must proactively evaluate and refine their debt recovery strategies to remain competitive and responsive to borrower needs. By prioritizing innovation, customization, and compliance, financial organizations can secure their position in the market and achieve sustainable success in debt recovery.

Frequently Asked Questions

What are traditional debt recovery processes?

Traditional debt recovery processes mainly involve manual interventions such as phone calls, letters, and in-person visits.

What are the drawbacks of conventional debt collection methods?

Conventional methods often lead to inefficiencies, high operational costs, and low recovery rates. Many borrowers ignore collection calls, resulting in wasted resources and time, and the lack of personalization can alienate debtors.

How effective are traditional debt collection methods in recovering debts?

Debt agencies using traditional methods typically achieve restitution rates of only 20-30%, recovering about $20-30 for every $100 in unpaid obligations.

What impact do outdated debt recovery practices have on organizations?

Organizations relying solely on conventional methods often face increased Days Sales Outstanding (DSO) and rising operational expenses.

Why is it important for organizations to modernize their debt recovery strategies?

Modernizing strategies can enhance efficiency, improve borrower engagement, and lead to better recovery rates and customer satisfaction.

What role does regulatory complexity play in debt recovery?

Addressing regulatory challenges is crucial for improving customer support in receivables, highlighting the need for a transition to more advanced, data-informed methodologies.