Overview

This article presents ten strategies designed to optimize credit collection services, thereby enhancing enterprise debt recovery. It underscores the critical role of data-driven tools, the establishment of effective communication channels, and the implementation of personalized approaches. Such strategies are essential for improving repayment rates and operational efficiency, ultimately aiding organizations in managing overdue accounts with greater effectiveness.

Introduction

In an environment where overdue accounts can profoundly affect an enterprise's financial stability, optimizing credit collection services is critical. Companies are actively pursuing innovative strategies that enhance recovery rates while also nurturing positive relationships with debtors. This article explores ten effective strategies that enterprises can employ to streamline their debt recovery processes, utilizing advanced tools and data-driven insights.

As organizations navigate this intricate landscape, they face the challenge of balancing efficiency with empathy—how can they recover debts while sustaining trust and engagement with their clients?

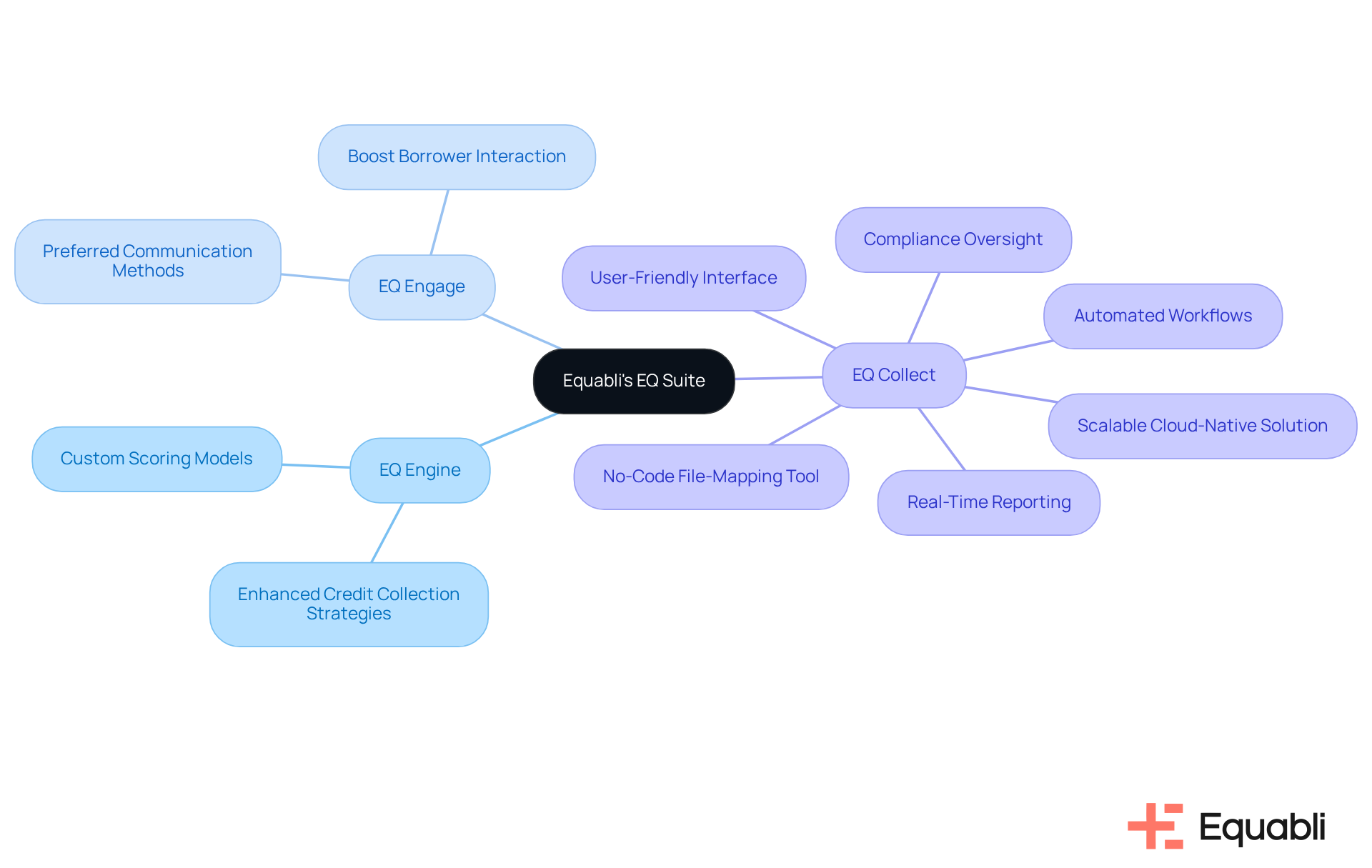

Equabli's EQ Suite: Comprehensive Tools for Data-Driven Debt Recovery

Equabli's EQ Suite presents a comprehensive solution aimed at enhancing debt recovery through credit collection services optimization strategies for enterprise debt recovery and data-driven insights. The suite features the EQ Engine, EQ Engage, and EQ Collect, which empower organizations to:

- Implement custom scoring models

- Enhance credit collection services optimization strategies for enterprise debt recovery

- Facilitate digital collections

Notably, EQ Collect boasts a user-friendly, scalable, cloud-native interface that enables enterprises to reduce vendor onboarding timelines with a straightforward, no-code file-mapping tool. This functionality not only improves operational efficiency through strategic data utilization but also minimizes execution errors via automated workflows.

Furthermore, the suite ensures unparalleled transparency and insights through real-time reporting, thereby supporting industry-leading compliance oversight with automated monitoring. By leveraging these advanced tools, businesses can significantly enhance their efficiency in managing overdue accounts while boosting borrower interaction through preferred communication methods.

This strategic approach allows clients to leverage credit collection services optimization strategies for enterprise debt recovery, enabling them to to address unique operational requirements, ultimately driving improved recovery rates and reduced operational costs.

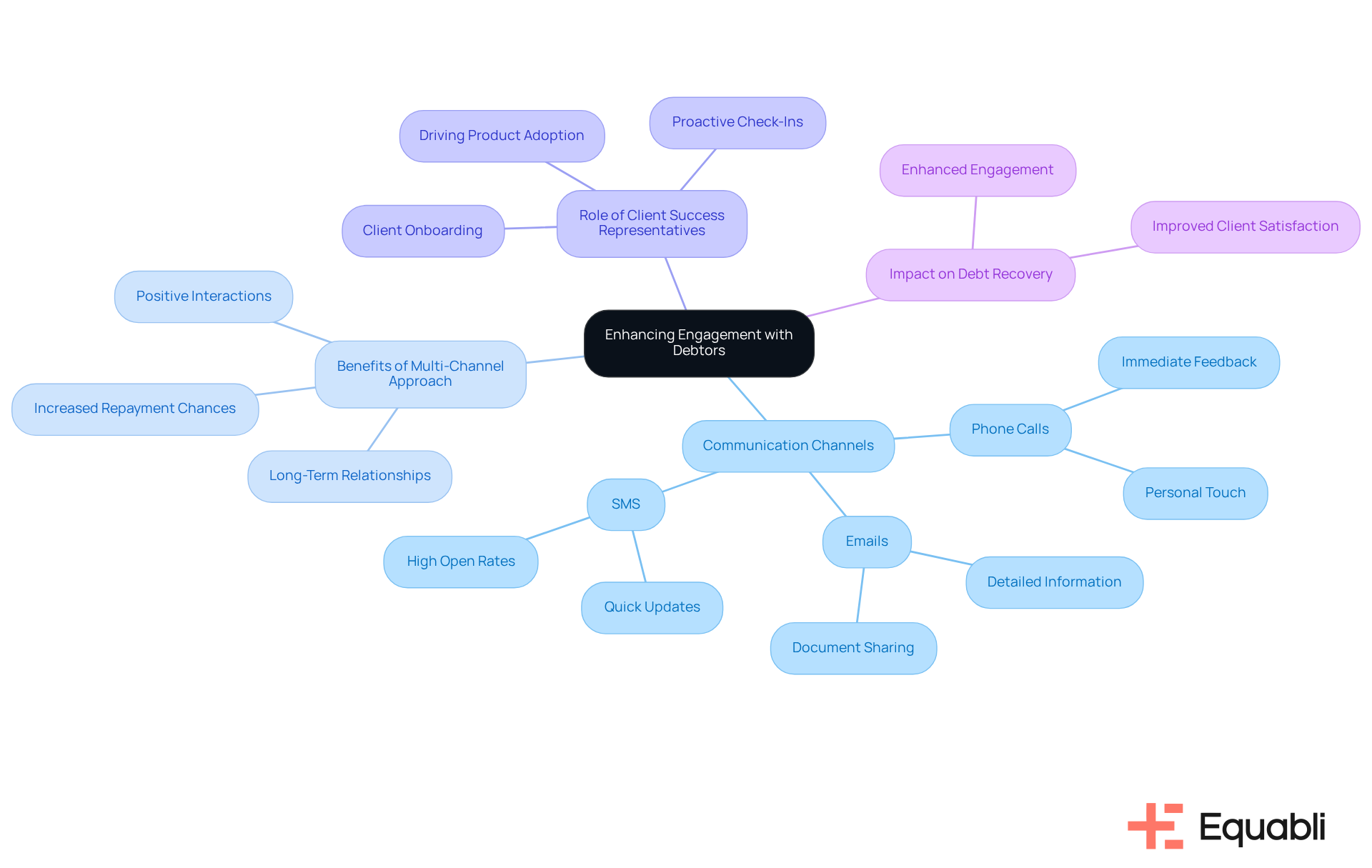

Establish Clear Communication Channels: Enhance Engagement with Debtors

Establishing clear communication channels is fundamental to enhancing engagement with individuals in debt, especially when implementing credit collection services optimization strategies for enterprise debt recovery. Enterprises should utilize multiple platforms—such as phone calls, emails, and SMS—to connect with individuals in their preferred manner. This multi-channel approach fosters positive interactions, which is vital for credit collection services optimization strategies for enterprise debt recovery, making borrowers feel valued and understood. Consequently, organizations not only improve the chances of repayment but also build long-term relationships with clients, which is beneficial for future business dealings and can be enhanced through credit collection services optimization strategies for enterprise debt recovery.

At Equabli, our Client Success Representatives play a crucial role in this process by leading the setup and implementation during client onboarding. This ensures a smooth transition and a strong start to the client relationship. By driving product adoption and client engagement, they align with business goals, ensuring our platform delivers on those outcomes. Through proactive check-ins and strategic business evaluations, they share insights and product usage trends, further enhancing the and supporting effective credit collection services optimization strategies for enterprise debt recovery.

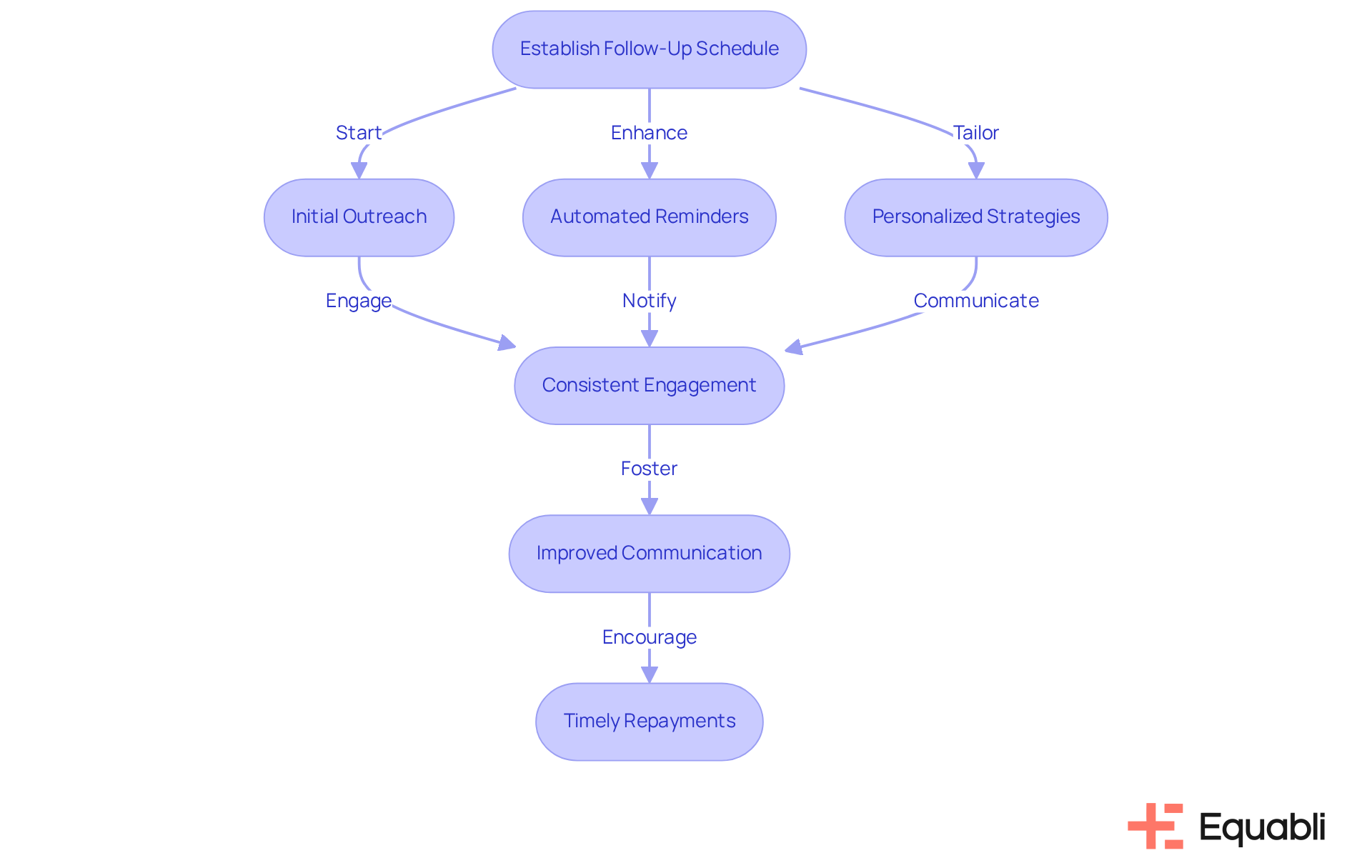

Set Up a Systematic Follow-Up Schedule: Ensure Consistent Engagement

Establishing a systematic follow-up schedule is critical for ensuring consistent engagement with individuals in debt. The challenges associated with manual debt management often lead to inefficiencies and missed opportunities. Therefore, businesses should develop a comprehensive schedule that outlines reminders for initial outreach and subsequent interactions. This structured approach not only sustains momentum in the collection process but also ensures that individuals are consistently reminded of their obligations. By facilitating open channels of communication, organizations can effectively address any concerns that borrowers may have, thereby encouraging timely repayments.

Furthermore, implementing automated reminders through Equabli's EQ Suite significantly enhances this process. Automated payment reminders and notifications streamline financial recovery follow-ups, enabling recovery teams to concentrate on more complex cases while ensuring that no account is neglected. Personalizing follow-up strategies based on debtor behavior can also markedly improve communication effectiveness, fostering trust and understanding within the borrower relationship.

Ultimately, a , supported by the innovative features of EQ Engage, is essential for credit collection services optimization strategies for enterprise debt recovery. This results in improved cash flow and reduced bad receivables. As finance professional Rick Johnson emphasizes, early and consistent follow-ups are frequently more cost-effective than engaging third-party recovery agencies or pursuing legal action.

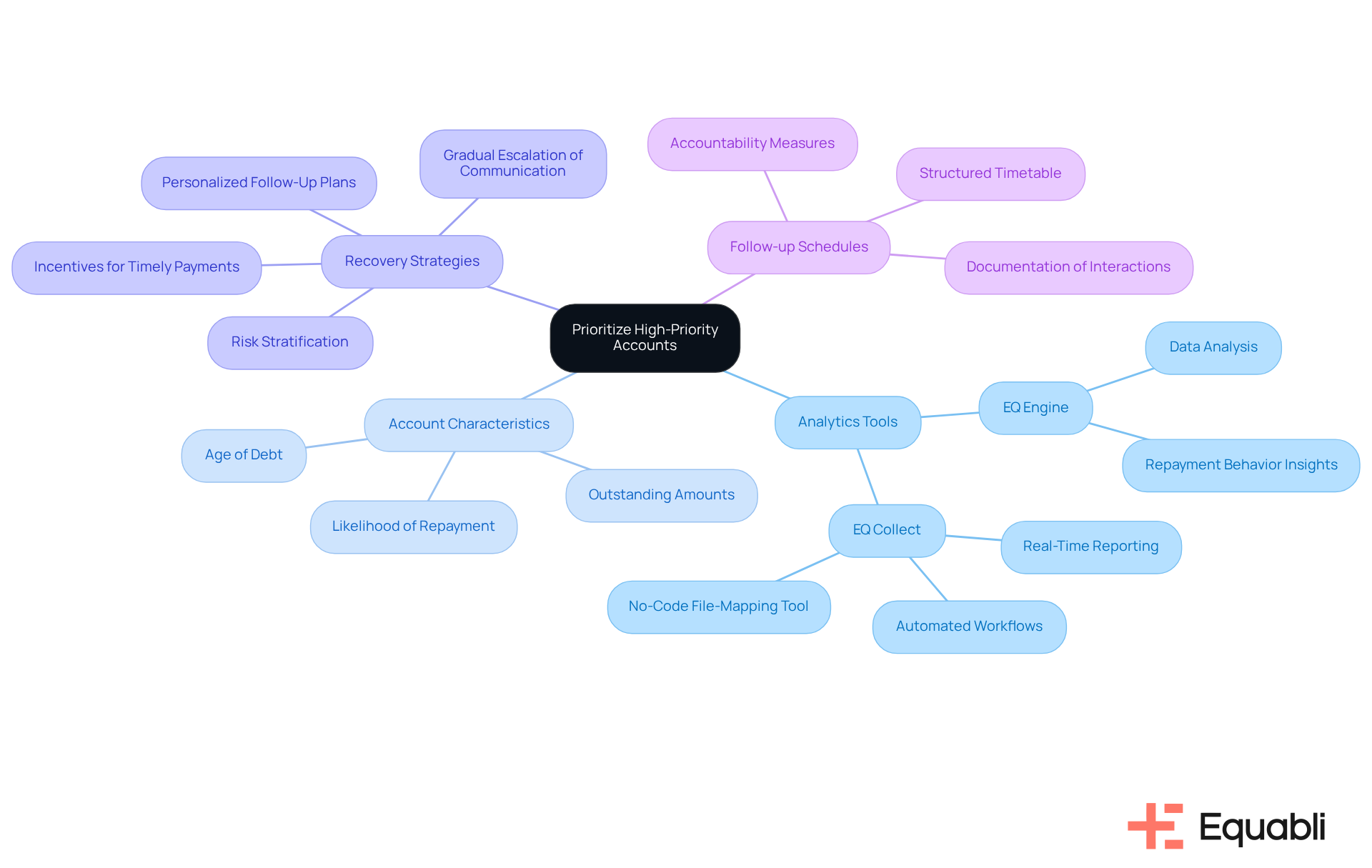

Prioritize High-Priority Accounts: Focus Resources Where They Matter Most

Prioritizing high-priority accounts is a strategic imperative for enterprises implementing credit collection services optimization strategies for enterprise debt recovery to optimize resource allocation. Evidence indicates that identifying accounts with the highest likelihood of repayment or those significantly overdue enables organizations to focus their efforts effectively. This targeted strategy utilizes credit collection services optimization strategies for enterprise debt recovery, enhancing recovery rates while also preventing the misallocation of resources on accounts less likely to yield results. Utilizing from the EQ Suite, such as the EQ Engine and EQ Collect, supports the identification of these priority accounts through analysis of repayment behaviors and outstanding amounts.

Furthermore, EQ Collect's features—including automated workflows, real-time reporting, and a no-code file-mapping tool—streamline the process by reducing vendor onboarding timelines and minimizing execution errors. Given that 17% of US small- and medium-sized businesses carry obligations between $100,000 and $250,000, the necessity to prioritize accounts becomes evident. Effective revenue recovery follow-ups not only bolster cash flow but also mitigate uncollectible accounts while preserving customer relationships. This underscores the importance of a structured follow-up schedule to prevent the oversight of accounts.

By leveraging data-informed strategies and the industry-leading compliance supervision provided by EQ Collect, financial institutions can adopt credit collection services optimization strategies for enterprise debt recovery, leading to smarter orchestration and improved performance in their recovery efforts.

Utilize Automated Reminders and Notifications: Streamline Communication

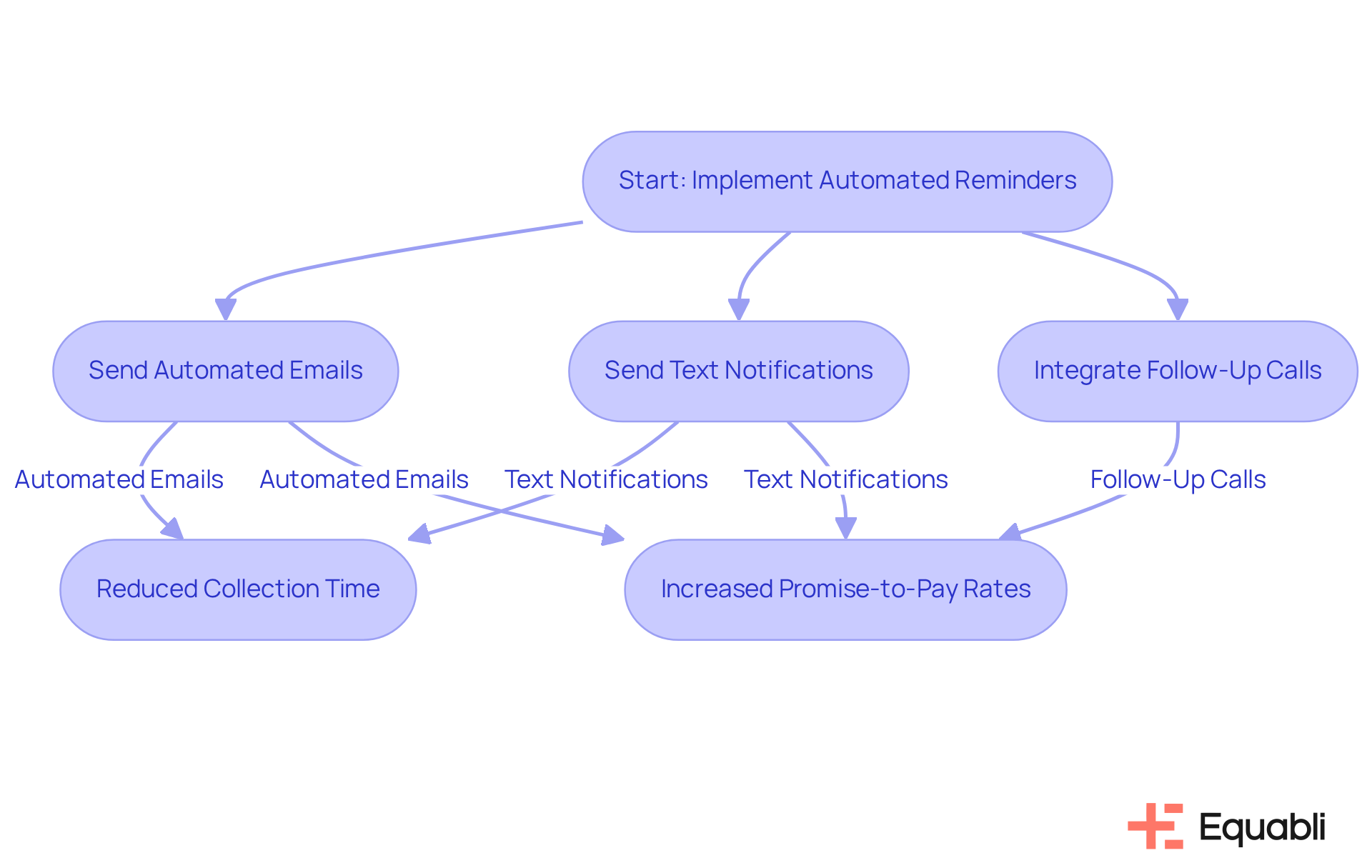

Implementing automated reminders and notifications represents a strategic advancement in communication with individuals who owe money. The burdens of manual debt collection—time-consuming tasks and inconsistent follow-ups—underscore the necessity for implementing credit collection services optimization strategies for enterprise debt recovery. Automated systems that send reminders for upcoming dues or overdue accounts facilitate consistent engagement with debtors, alleviating the operational strain on staff while enhancing the likelihood of timely payments. For instance, organizations that utilize automated email sequences can reduce collection time by up to 10 days. Furthermore, text messages achieve an impressive 98% open rate within just 5 minutes of delivery.

Moreover, businesses that integrate phone calls with follow-up texts witness an 18% increase in promise-to-pay rates, highlighting the effectiveness of prompt, automated interaction. By leveraging these technologies, enterprises can adopt credit collection services optimization strategies for enterprise debt recovery, ensuring that individuals with outstanding payments receive regular reminders of their obligations, which fosters a more efficient collection process and improves overall recovery rates. To effectively implement this strategy, organizations should consider initiating a pilot program that tests to identify the methods that yield optimal results.

Offer Flexible Repayment Options: Increase Likelihood of Payment

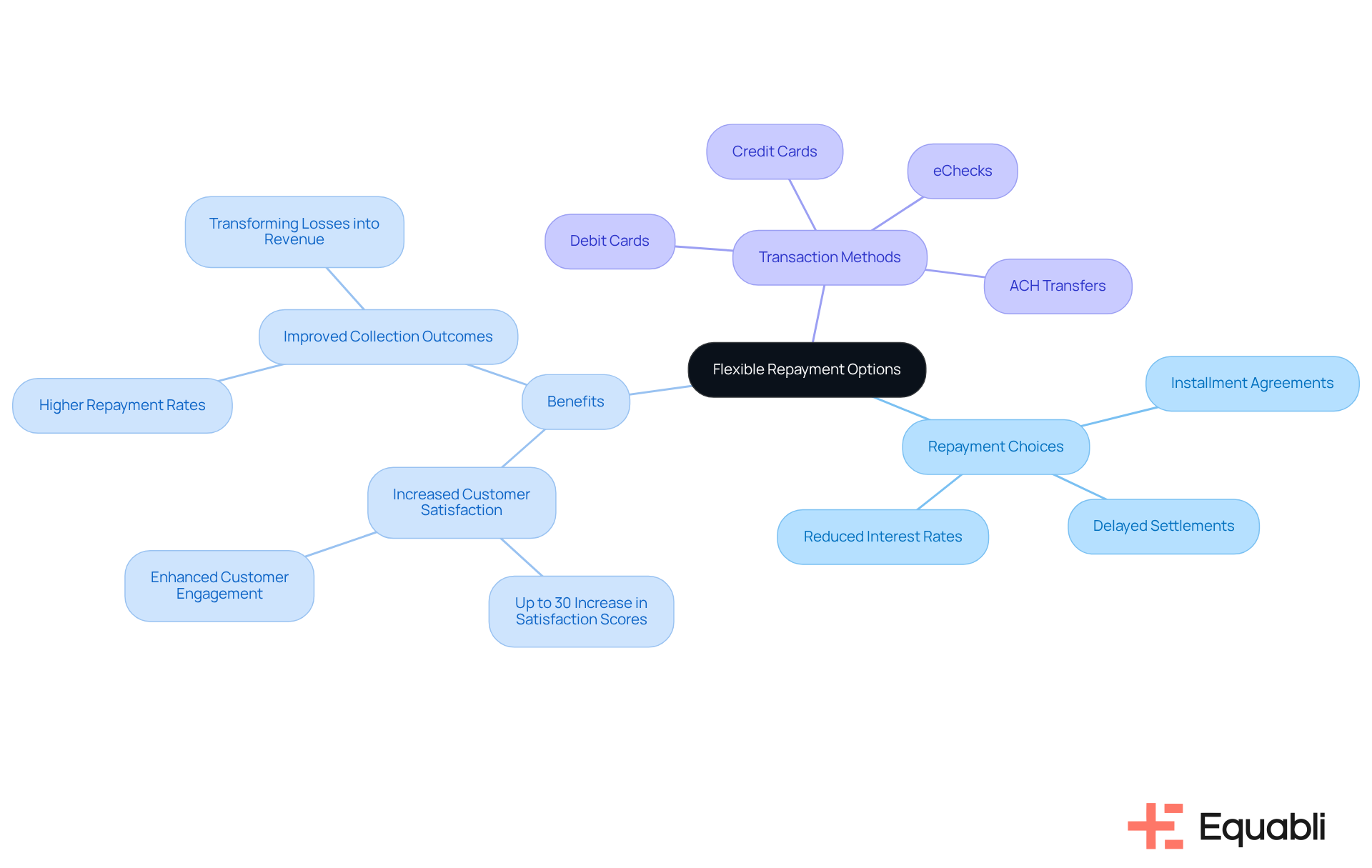

Implementing flexible repayment choices is essential for enhancing the likelihood of remittance from debtors. Businesses must explore various repayment options, including:

- Installment agreements

- Delayed settlements

- Reduced interest rates

These options should be tailored to accommodate diverse financial situations. Research from McKinsey indicates that organizations adopting adaptable billing structures can realize up to a 30% increase in customer satisfaction scores within their collections. By providing these alternatives, companies not only cultivate goodwill but also improve customer engagement, resulting in higher repayment rates.

The case study titled "Long-Term Financial Benefits of Flexible Payment Alternatives" illustrates how firms that have embraced flexible financial solutions report significant improvements in their collection outcomes, transforming potential losses into recovered income. Furthermore, offering multiple transaction methods, such as:

- Debit cards

- Credit cards

- eChecks

- ACH transfers

can streamline the repayment process. This strategic approach not only supports debt recovery but also fortifies customer relationships, positioning businesses for for enterprise debt recovery in an increasingly competitive environment. Additionally, flexible payment platforms ensure compliance by integrating robust security measures, thereby enhancing the reliability of these options.

Implement Personalized Communication: Build Trust with Debtors

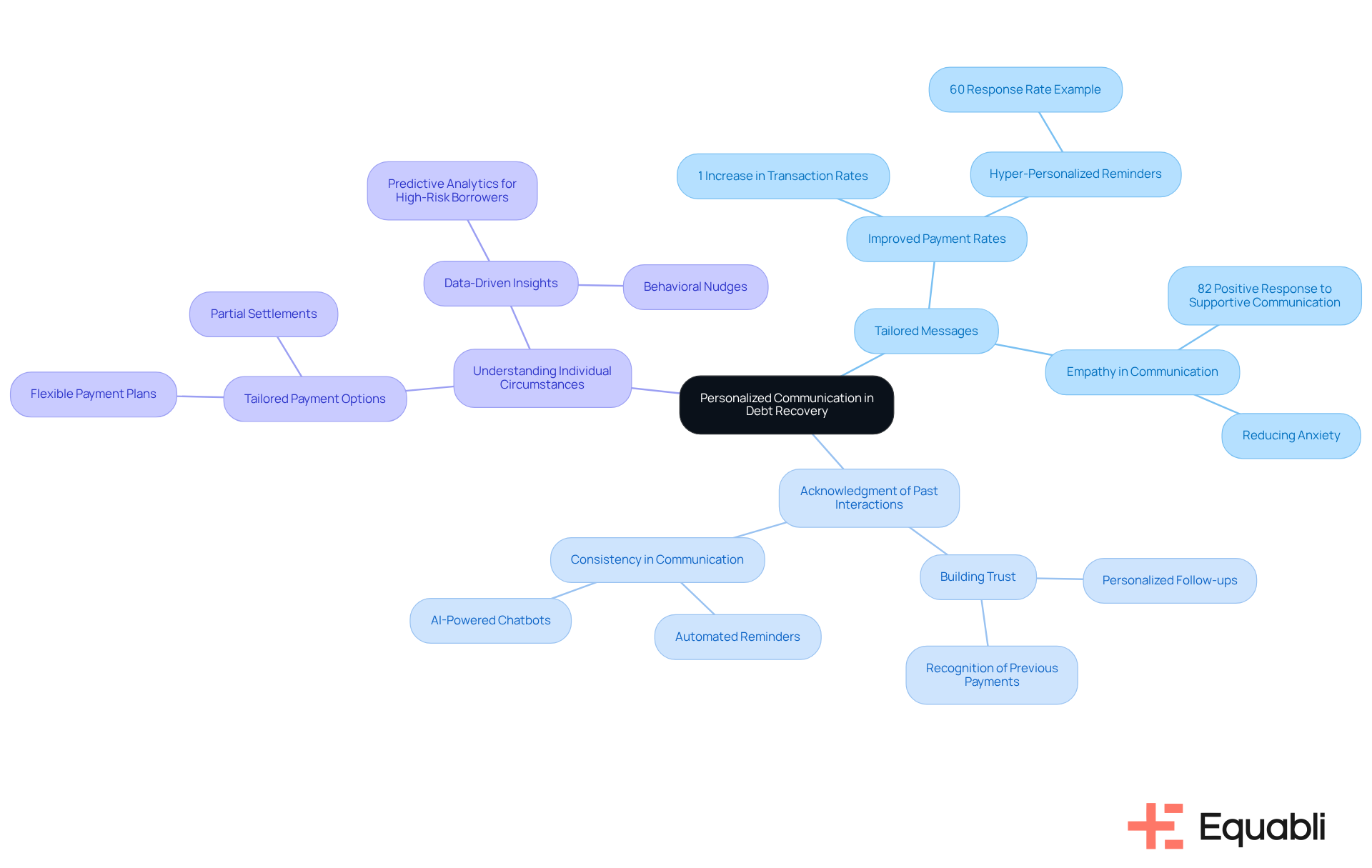

Implementing personalized communication serves as a robust strategy within credit collection services optimization strategies for enterprise debt recovery to foster trust with individuals who owe money. By addressing individuals by name and referencing their specific situations, enterprises can cultivate a more engaging and empathetic interaction. This approach not only makes individuals in debt but also encourages them to take accountability for their obligations.

Credit collection services optimization strategies for enterprise debt recovery can be achieved through personalization, which includes:

- Tailored messages

- Acknowledgment of past interactions

- A demonstration of understanding regarding the individual's circumstances

This significantly enhances the overall collection experience. Research indicates that personalization in messaging can improve transaction rates by approximately one percentage point. Furthermore, behavioral economists reveal that 82% of customers respond more positively to supportive communication, implying that when individuals in debt perceive their lenders as compassionate and understanding, they are more likely to engage constructively with the collection process.

For example, an auto loan financing company experienced over 60% response rates after transitioning to hyper-personalized payment reminders. Additionally, Equabli's EQ Engage platform empowers organizations to develop, automate, and implement credit collection services optimization strategies for enterprise debt recovery, tailored to personal needs, thereby enhancing engagement through customizable repayment options.

Compliance with the Fair Debt Collection Practices Act (FDCPA) is essential for maintaining trust with borrowers. Consider the integration of AI-powered chatbots to automate personalized reminders and enhance client engagement, ensuring that communication is consistent with brand voice and visual identity while capturing consumer preferences.

Provide Incentives for Prompt Payment: Encourage Timely Settlements

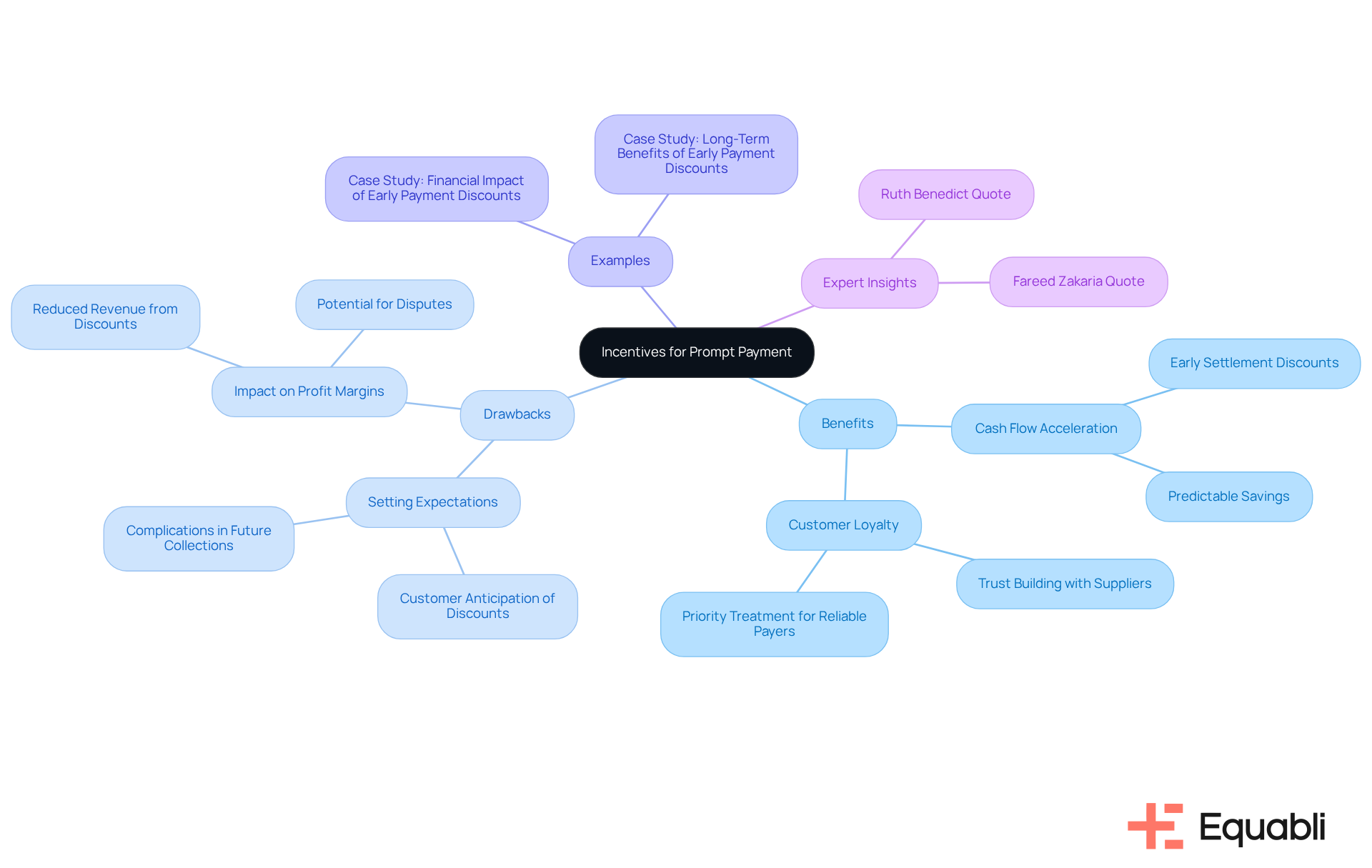

Encouraging timely remittances serves as a strategic approach for businesses aiming to enhance their debt recovery rates. By implementing discounts, reduced fees, or additional incentives, organizations can effectively motivate debtors to prioritize their financial obligations. This strategy not only accelerates cash flow but also streamlines the overall collection process. For instance, companies that utilize early settlement discounts can achieve significant savings; a 2% reduction on a $5,000 invoice retains $100 within the firm, which can accumulate to substantial annual savings.

However, it is essential to consider the potential drawbacks of frequently offering discounts, as this may set customer expectations for lower prices and complicate future collections of full amounts. Financial experts emphasize that a proactive approach to debt recovery, characterized by transparent communication of incentives, cultivates a sense of urgency among debtors, prompting quicker action. Recent trends indicate that businesses are increasingly recognizing the dual benefits of early discounts: enhanced cash flow and improved customer loyalty.

Moreover, the annualized return from leveraging early discounts is approximately 36%, making it an attractive short-term financial strategy. The cumulative effect of these discounts contributes to a more stable and profitable operation over time. By incorporating credit collection services optimization strategies for enterprise debt recovery into their collection processes, businesses can not only enhance their recovery rates but also position themselves for long-term financial stability. As Ruth Benedict aptly stated, 'A man’s indebtedness is not virtue; his repayment is.' This underscores the importance of fostering a through effective incentives.

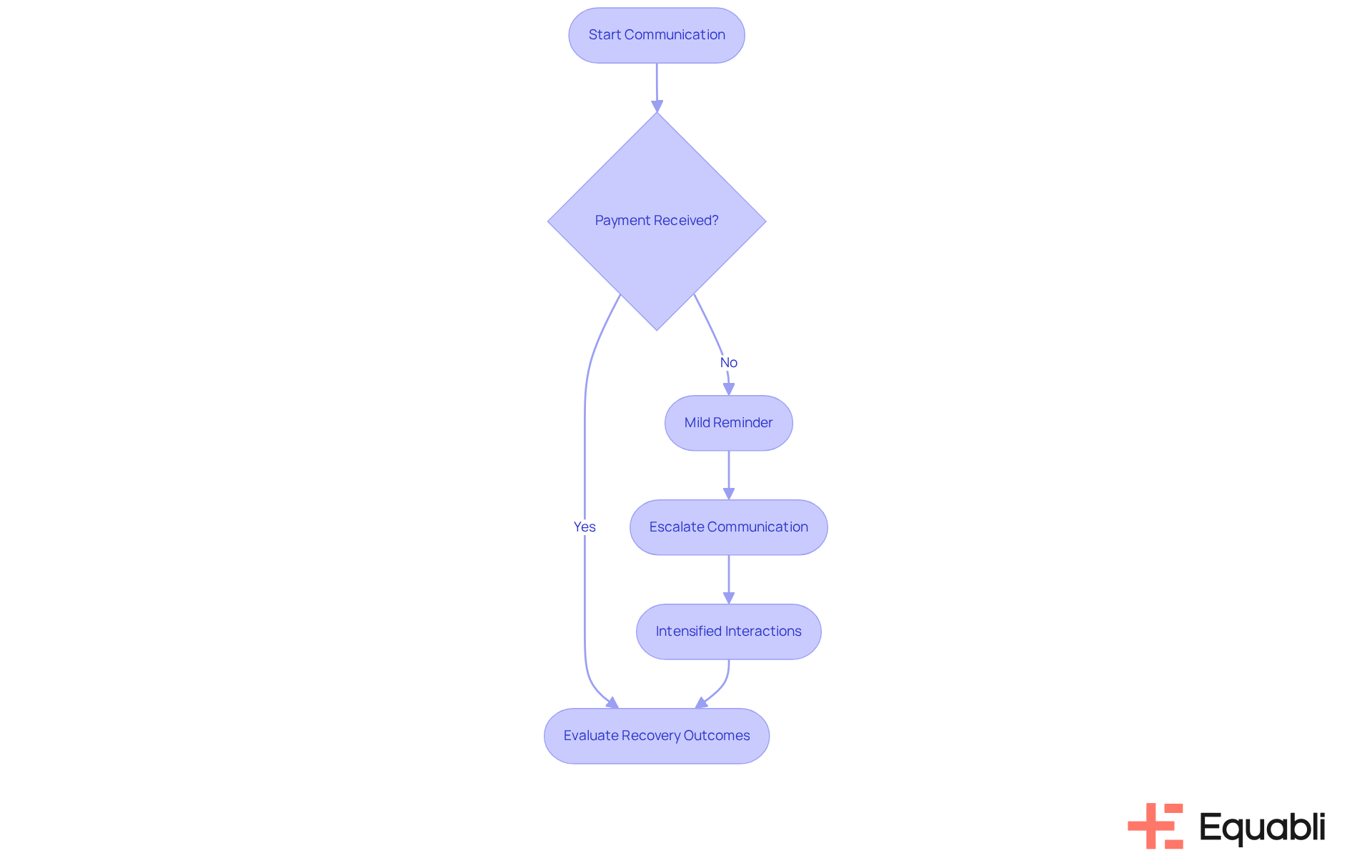

Escalate Communication Gradually for Overdue Accounts: Manage Sensitivity

Increasing dialogue gradually for overdue accounts represents a strategic approach essential for managing debtor relationships effectively. Businesses should initiate with mild reminders, progressively intensifying interactions if payments remain outstanding. This method not only facilitates respectful communication but also underscores the necessity for repayment.

By leveraging Equabli's EQ Suite, which modernizes manual processes, enterprises can enhance their credit collection services optimization strategies for enterprise debt recovery through data-driven insights. Such an approach ensures that the tone and frequency of communications are meticulously regulated, mitigating negative interactions and cultivating a more constructive relationship with debtors.

Ultimately, this strategy can lead to improved recovery outcomes and heightened borrower engagement through tailored interactions and .

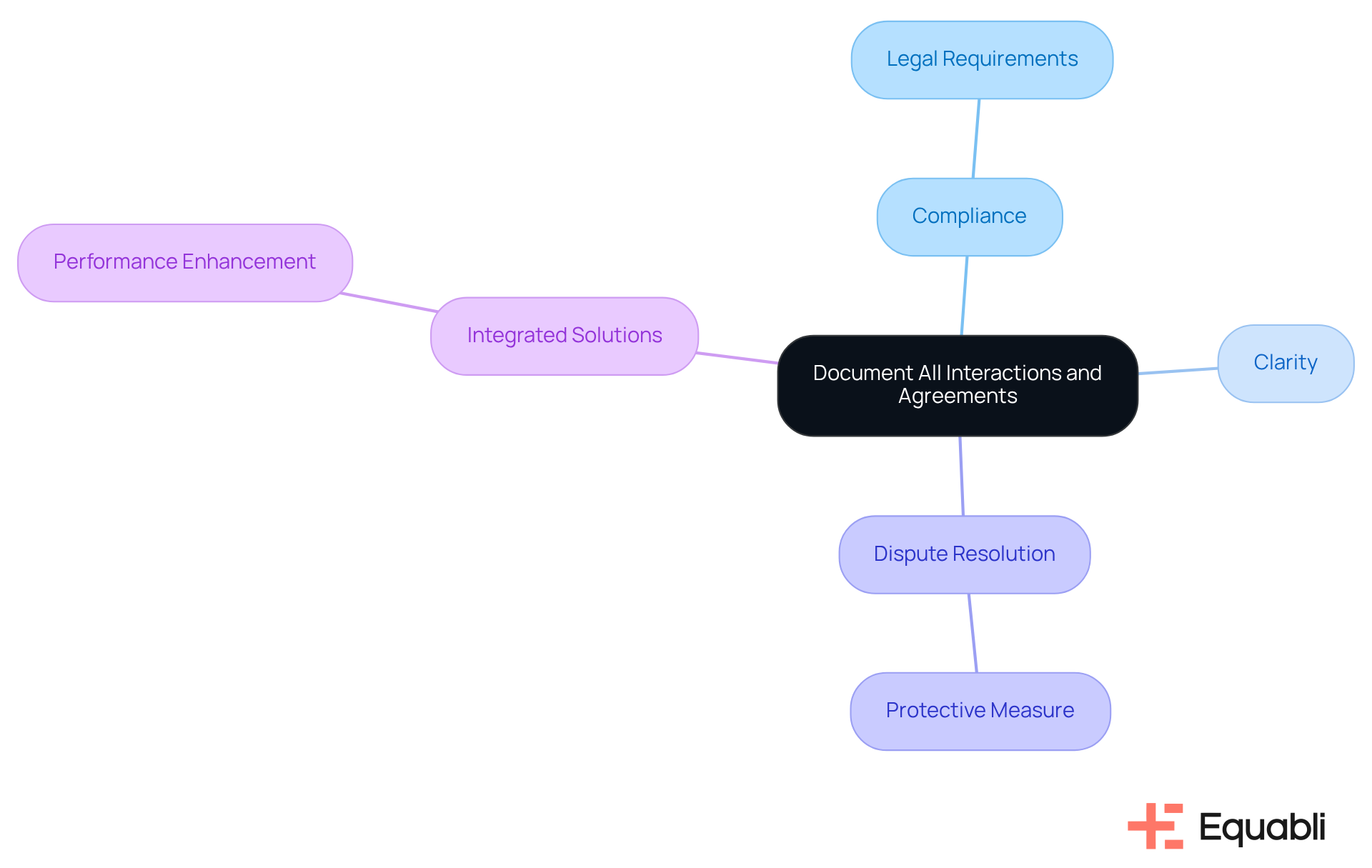

Document All Interactions and Agreements: Ensure Compliance and Clarity

Documenting all interactions and agreements is essential in the debt collection process. Comprehensive records of communications, payment agreements, and other pertinent interactions with borrowers are vital for enterprises. This documentation not only but also fosters clarity for both parties involved.

By utilizing Equabli's EQ Collect, organizations can streamline their documentation processes, leading to smarter orchestration and enhanced performance. In instances of disputes or misunderstandings, a comprehensive record serves as a protective measure for the organization and facilitates more effective issue resolution.

By prioritizing documentation and leveraging integrated solutions, enterprises can significantly enhance their operational integrity and build trust with debtors by implementing credit collection services optimization strategies for enterprise debt recovery.

Conclusion

Implementing effective credit collection services optimization strategies is essential for enterprises aiming to enhance their debt recovery processes. By leveraging advanced tools such as Equabli's EQ Suite and adopting a multi-faceted approach to communication, organizations can significantly improve engagement with debtors. This ultimately drives higher recovery rates and fosters long-term relationships.

Key strategies include:

- Establishing clear communication channels

- Setting up systematic follow-up schedules

- Prioritizing high-value accounts

The importance of personalized communication, offering flexible repayment options, and documenting all interactions is critical. These practices streamline operations, build trust, and encourage timely payments from debtors.

As businesses navigate the complexities of debt recovery, embracing these optimization strategies enhances operational efficiency and contributes to a culture of accountability and repayment. By prioritizing innovative solutions and effective communication, enterprises position themselves for success in the competitive landscape of debt collection, ensuring a more sustainable financial future.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a comprehensive solution designed to enhance debt recovery through optimized credit collection services and data-driven insights. It includes tools like the EQ Engine, EQ Engage, and EQ Collect.

What features does EQ Collect offer?

EQ Collect features a user-friendly, scalable, cloud-native interface that allows for reduced vendor onboarding timelines through a no-code file-mapping tool. It improves operational efficiency and minimizes execution errors with automated workflows.

How does the EQ Suite support compliance and reporting?

The EQ Suite provides real-time reporting and automated monitoring, ensuring transparency and supporting industry-leading compliance oversight.

What strategies does Equabli suggest for enhancing engagement with debtors?

Equabli recommends establishing clear communication channels using multiple platforms such as phone calls, emails, and SMS to connect with debtors in their preferred manner, fostering positive interactions and long-term relationships.

What role do Client Success Representatives play at Equabli?

Client Success Representatives lead the setup and implementation during client onboarding, ensuring a smooth transition and alignment with business goals through proactive check-ins and strategic business evaluations.

Why is a systematic follow-up schedule important in debt recovery?

A systematic follow-up schedule is critical for maintaining consistent engagement with debtors, preventing missed opportunities, and ensuring that individuals are reminded of their obligations.

How can automated reminders improve the debt recovery process?

Automated reminders streamline follow-ups, allowing recovery teams to focus on more complex cases while ensuring that no account is neglected, thus enhancing overall efficiency in debt recovery.

What benefits can personalized follow-up strategies provide?

Personalizing follow-up strategies based on debtor behavior can improve communication effectiveness, fostering trust and understanding in borrower relationships, which encourages timely repayments.

What is the overall impact of effective credit collection services optimization strategies?

Effective credit collection services optimization strategies can lead to improved recovery rates, reduced operational costs, better cash flow, and decreased bad receivables.