Overview

The article delineates four strategies for enhancing credit collection processes within financial institutions, emphasizing the importance of:

- Understanding client needs

- Leveraging technology

- Enhancing communication

- Committing to continuous improvement

Evidence indicates that customizing approaches to align with client demographics, utilizing data-driven insights, and promoting proactive engagement can significantly elevate recovery rates and fortify relationships with borrowers. This strategic focus not only addresses operational efficiency but also aligns with compliance requirements, ultimately positioning institutions for sustainable growth in a competitive landscape.

Introduction

In the intricate world of finance, credit collection emerges as a critical aspect that significantly influences an institution's bottom line. Financial organizations must navigate diverse client profiles and regulatory landscapes, making tailored and efficient credit retrieval strategies essential. This article explores four key strategies that enhance collection processes and cultivate stronger relationships with borrowers. Given the evolving challenges in customer engagement and technology integration, financial institutions face the imperative question: how can they effectively adapt their practices to thrive in an increasingly competitive environment?

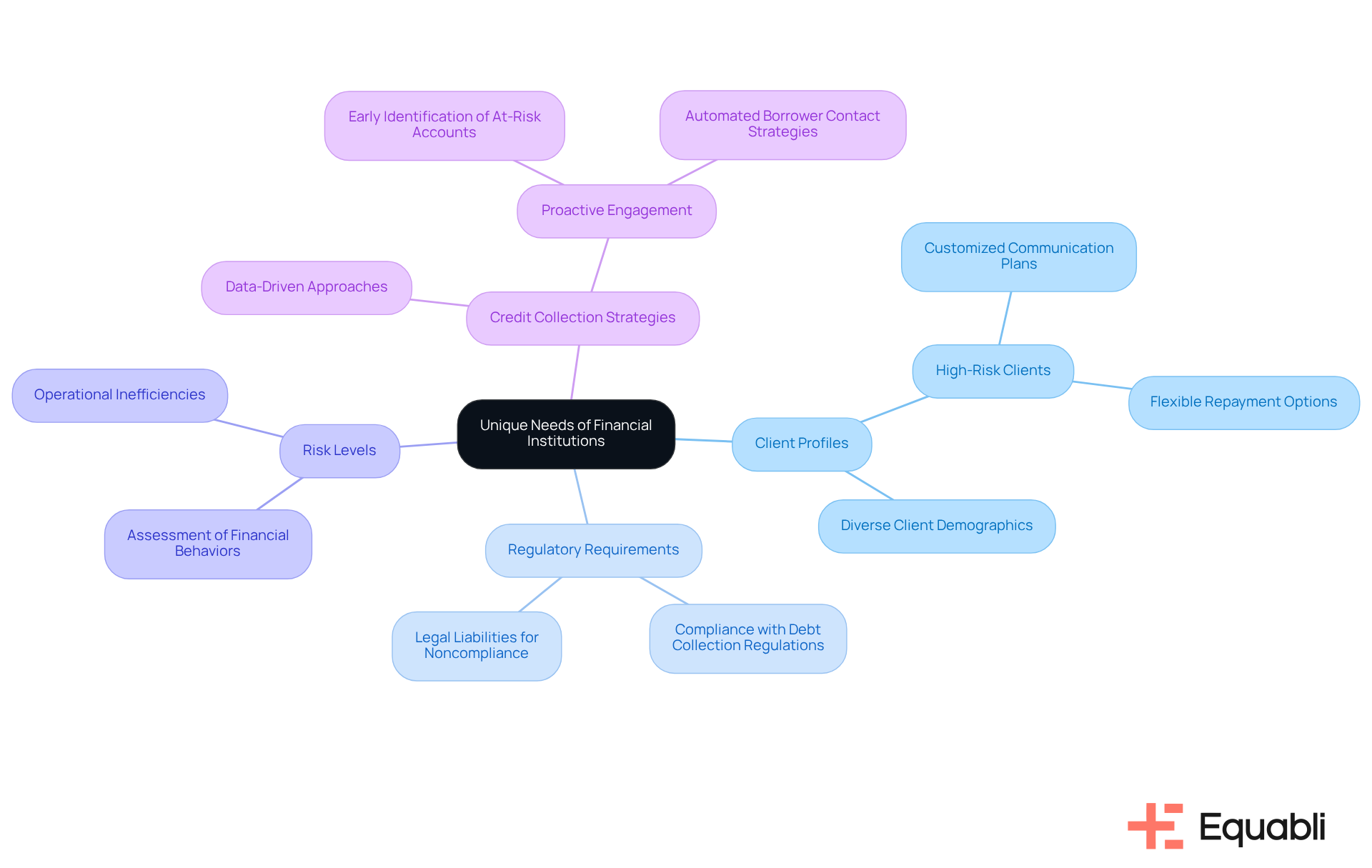

Understand the Unique Needs of Financial Institutions

Financial institutions operate within a complex landscape characterized by diverse client profiles, regulatory requirements, and varying risk levels. To enhance credit retrieval procedures, it is imperative to comprehend these distinct requirements through comprehensive evaluations of client demographics and payment patterns, utilizing in financial institutions.

For example, banks and credit unions often adopt different collection strategies due to their unique client engagement practices and risk appetites. By segmenting clients based on their financial behaviors, institutions can effectively tailor their approaches. This may involve:

- Developing customized communication plans for high-risk clients

- Providing flexible repayment options that accommodate varying financial situations

Implementing strategies for improving credit collection processes in financial institutions not only enhances collection outcomes but also builds stronger relationships with borrowers, ultimately leading to increased customer retention and satisfaction.

Equabli's EQ Collect offers a no-code file-mapping tool that streamlines vendor onboarding processes and boosts efficiency through data-centric methodologies, minimizing execution errors via automated workflows. Additionally, it provides real-time reporting and compliance oversight, ensuring organizations meet industry standards.

Furthermore, financial organizations often postpone engagement with borrowers until an account becomes overdue, underscoring the need for proactive strategies. By leveraging EQ Engage, organizations can devise and automate borrower contact strategies, equipping clients with tailored repayment plans and self-service options.

Addressing the challenges faced by banks and credit unions in debt recovery, such as operational inefficiencies and customer avoidance, is crucial for developing strategies for improving credit collection processes in financial institutions. By embracing a data-driven, customer-focused approach, organizations can significantly enhance their recovery rates and cultivate stronger ties with borrowers.

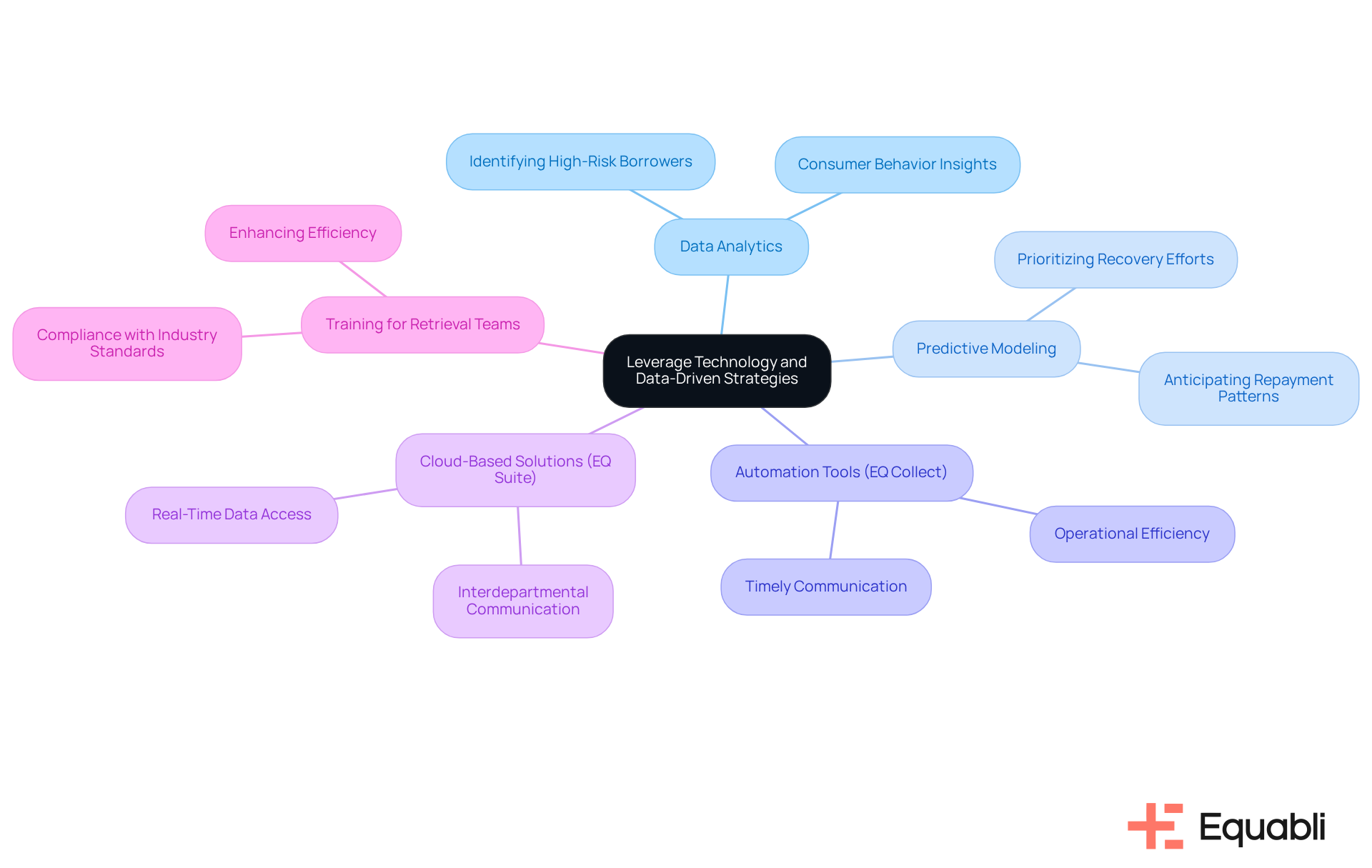

Leverage Technology and Data-Driven Strategies

In the digital age, financial organizations must adopt strategies for improving credit collection processes in financial institutions by leveraging technology to enhance their credit retrieval methods. Data analytics plays a pivotal role by providing insights into consumer behaviors, which enables organizations to anticipate repayment patterns and tailor their retrieval strategies accordingly. For instance, predictive modeling can identify customers at a significant risk of default, allowing organizations to prioritize their recovery efforts efficiently. Automation tools, such as those offered by Equabli's EQ Collect, further streamline this process by facilitating timely communication, ensuring reminders and follow-ups are dispatched without manual intervention.

The user-friendly, scalable, cloud-native interface of EQ Collect minimizes execution errors while reducing vendor onboarding timelines, significantly boosting operational efficiency. Implementing a cloud-based debt collection system, such as Equabli's EQ Suite, offers real-time data access and promotes seamless interdepartmental communication. By employing these advanced technologies, organizations can adopt strategies for improving credit collection processes in financial institutions, which can lower operational expenses and achieve enhanced recovery rates, with some reporting a remarkable 105% accomplishment of recovery objectives within six months. This is essential for sustaining a healthy cash flow and ensuring the financial stability of the organization.

Continuous training for retrieval teams is crucial to ensure compliance with evolving industry standards and to enhance the efficiency of strategies for improving credit collection processes in financial institutions, which are supported by the functionalities of EQ Collect and EQ Suite. However, organizations must remain cognizant of potential challenges in implementing these technologies, such as resistance to change and the need for adequate training resources.

Enhance Communication and Customer Engagement

To enhance credit retrieval procedures, financial institutions must implement strategies for improving credit collection processes in financial institutions by prioritizing effective communication and client engagement. A customer-centric approach is essential, recognizing the unique circumstances of each debtor. Training teams to interact with empathy and clarity fosters an environment where clients feel acknowledged and valued. Utilizing —such as phone calls, emails, and SMS—can significantly enhance engagement, allowing clients to select their preferred method of contact.

Furthermore, providing adaptable payment alternatives and tailored repayment strategies can substantially improve client satisfaction and increase the likelihood of successful collections. For instance, organizations can offer incentives for early payments or develop customized payment plans that align with the client's financial situation. Research indicates that 62% of banking clients prefer digital banking for common transactions, underscoring the necessity for institutions to adapt to evolving client preferences.

Effective client engagement strategies for improving credit collection processes in financial institutions also utilize advanced data analytics to anticipate client behavior and propose suitable repayment solutions. This proactive approach not only enhances recovery rates but also strengthens client relationships. As industry leaders stress, comprehending the entire customer journey is vital for cultivating trust and loyalty, which ultimately informs strategies for improving credit collection processes in financial institutions and leads to more effective debt recovery outcomes. By integrating features from EQ Collect, such as automated workflows and real-time reporting, financial organizations can further optimize their processes, ensuring compliance and enhancing overall efficiency in receivables. The role of Client Success Representatives at Equabli is crucial in driving product adoption and ensuring that clients utilize these tools effectively, fostering a collaborative environment that prioritizes client engagement.

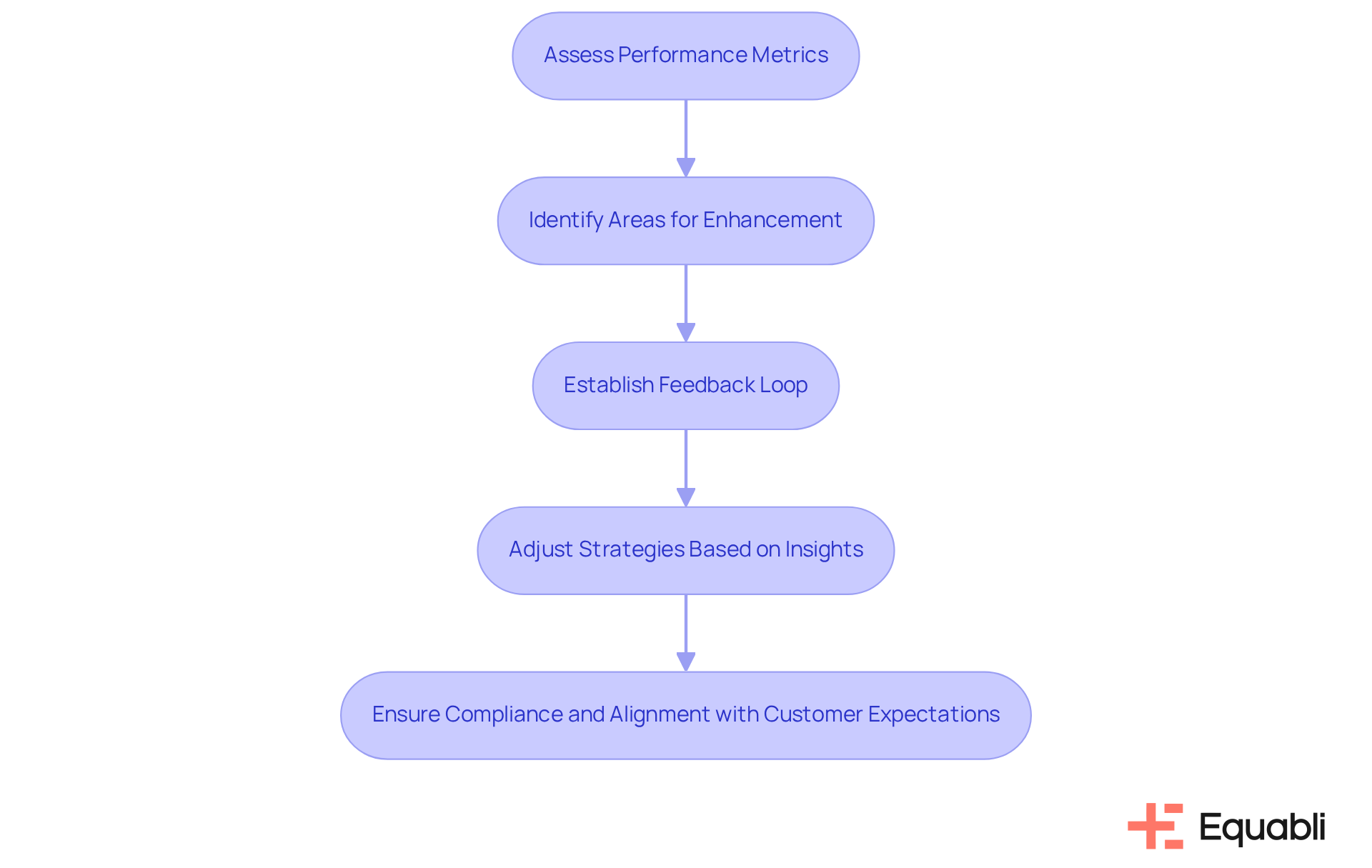

Implement Continuous Improvement and Adaptation Strategies

Financial institutions must embrace a mindset of continuous improvement to implement strategies for improving credit collection processes in financial institutions. This approach necessitates the consistent examination and assessment of , such as recovery rates and customer feedback, to identify areas for enhancement. Additionally, organizations must stay attuned to industry trends and regulatory shifts that could impact their collection strategies.

Establishing a feedback loop where collection teams can share insights and experiences fosters a culture of learning and adaptation. For instance, if a particular communication strategy fails to yield the desired outcomes, organizations should be prepared to adjust and explore alternative methods.

By adopting a proactive stance toward improvement, financial institutions can utilize strategies for improving credit collection processes in financial institutions to ensure their collection processes remain effective, compliant, and aligned with customer expectations.

Conclusion

Understanding the unique dynamics of financial institutions is crucial for enhancing credit collection processes. Tailoring strategies to meet the specific needs of diverse client profiles and regulatory environments enables organizations to significantly improve recovery rates and foster stronger relationships with borrowers.

Key strategies include:

- Leveraging technology and data-driven insights

- Enhancing communication

- Implementing continuous improvement practices

These approaches streamline collection efforts and ensure that financial institutions remain responsive to client needs and industry changes. By adopting predictive modeling and automated tools, institutions can anticipate payment behaviors and engage clients more effectively, ultimately leading to higher satisfaction and loyalty.

In a landscape where effective credit collection is vital for financial stability, embracing these strategies is essential. Financial institutions are encouraged to prioritize a customer-centric approach, utilize advanced technologies, and foster a culture of continuous improvement. By doing so, they can navigate the complexities of credit collection more adeptly, ensuring sustainable growth and enhanced cash flow.

Frequently Asked Questions

What are the unique needs of financial institutions regarding credit retrieval?

Financial institutions operate in a complex environment with diverse client profiles, regulatory requirements, and varying risk levels. Understanding these needs involves comprehensive evaluations of client demographics and payment patterns to enhance credit retrieval procedures.

How do banks and credit unions differ in their collection strategies?

Banks and credit unions often adopt different collection strategies due to their unique client engagement practices and risk appetites. This includes segmenting clients based on their financial behaviors to tailor their approaches effectively.

What are some strategies for improving credit collection processes in financial institutions?

Strategies include developing customized communication plans for high-risk clients and providing flexible repayment options that accommodate varying financial situations.

What benefits do improved credit collection processes offer?

Enhanced credit collection processes not only improve collection outcomes but also build stronger relationships with borrowers, leading to increased customer retention and satisfaction.

What is Equabli's EQ Collect, and how does it help financial institutions?

EQ Collect is a no-code file-mapping tool that streamlines vendor onboarding processes and boosts efficiency through data-centric methodologies. It minimizes execution errors via automated workflows and provides real-time reporting and compliance oversight.

Why is proactive engagement with borrowers important for financial organizations?

Financial organizations often delay engagement until an account is overdue, highlighting the need for proactive strategies. Engaging borrowers earlier can help address issues before they escalate.

How can EQ Engage assist financial institutions in managing borrower relationships?

EQ Engage allows organizations to devise and automate borrower contact strategies, equipping clients with tailored repayment plans and self-service options.

What challenges do banks and credit unions face in debt recovery?

Challenges include operational inefficiencies and customer avoidance, which necessitate the development of effective credit collection strategies.

What approach can significantly enhance recovery rates for financial institutions?

Embracing a data-driven, customer-focused approach can significantly enhance recovery rates and cultivate stronger ties with borrowers.