Overview

The article presents a comprehensive analysis of strategies aimed at optimizing debt recovery within enterprise portfolios. It highlights the critical role of:

- Data analytics

- Personalized communication

- Ethical practices

in enhancing recovery efforts. Evidence is provided through the demonstration of advanced technologies, including:

- Predictive analytics

- Automated reminders

which significantly improve collection efficiency and foster better debtor relationships. Ultimately, these strategies lead to improved recovery outcomes and a reduction in operational costs, underscoring their importance in enterprise-level debt collection.

Introduction

In an era marked by increasingly complex financial landscapes, the imperative to optimize debt recovery within enterprise portfolios has reached a critical juncture. Organizations are actively pursuing innovative strategies that not only enhance collection rates but also nurture positive client relationships. This article explores ten transformative strategies that harness advanced technologies, data analytics, and ethical practices to streamline debt recovery processes.

How can enterprises effectively balance efficiency with empathy in their collection efforts, ensuring compliance and customer satisfaction?

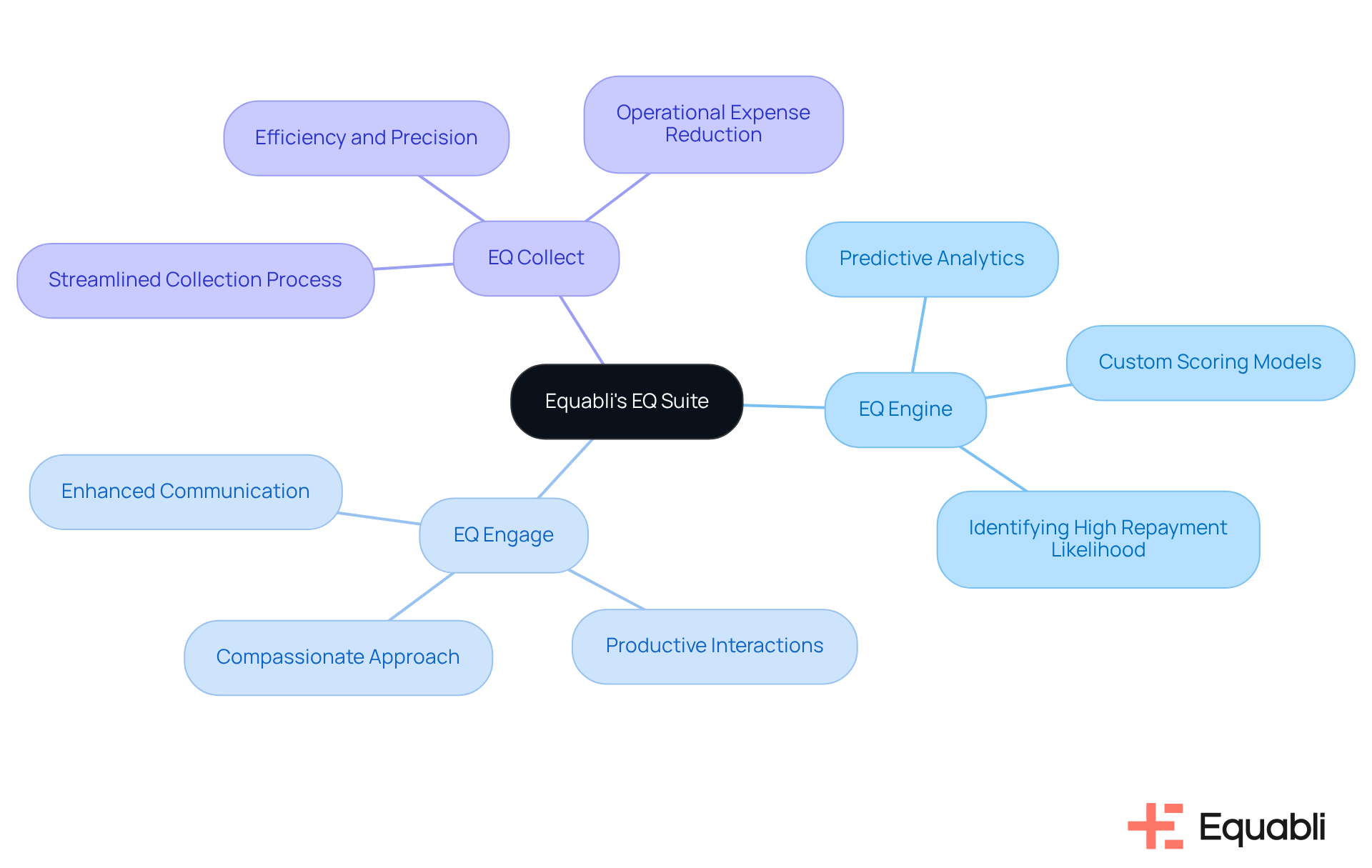

Equabli's EQ Suite: Intelligent Solutions for Debt Recovery Optimization

Equabli's EQ Suite showcases significant advancements in strategies for optimizing debt recovery processes in enterprise customer portfolios. Central to this suite is the EQ Engine, which enables organizations to create custom scoring models that accurately predict repayment behaviors. This allows businesses to identify clients with the highest likelihood of repayment, thereby concentrating collection efforts where they can yield the most substantial results.

Moreover, EQ Engage enhances communication with debtors, facilitating more productive interactions that can lead to successful resolutions. The EQ Collect component further streamlines the collection process, ensuring that organizations manage their portfolios with both efficiency and precision. By leveraging these intelligent solutions, businesses can adopt strategies for optimizing debt recovery processes in enterprise customer portfolios while significantly reducing operational expenses.

For instance, organizations utilizing the EQ Engine have reported notable improvements in their collection outcomes, underscoring the transformative impact of integrating advanced technology into traditional financial collection methods. This contemporary approach addresses not only the financial aspects of collection but also acknowledges the emotional challenges faced by borrowers, promoting a more compassionate and effective resolution process.

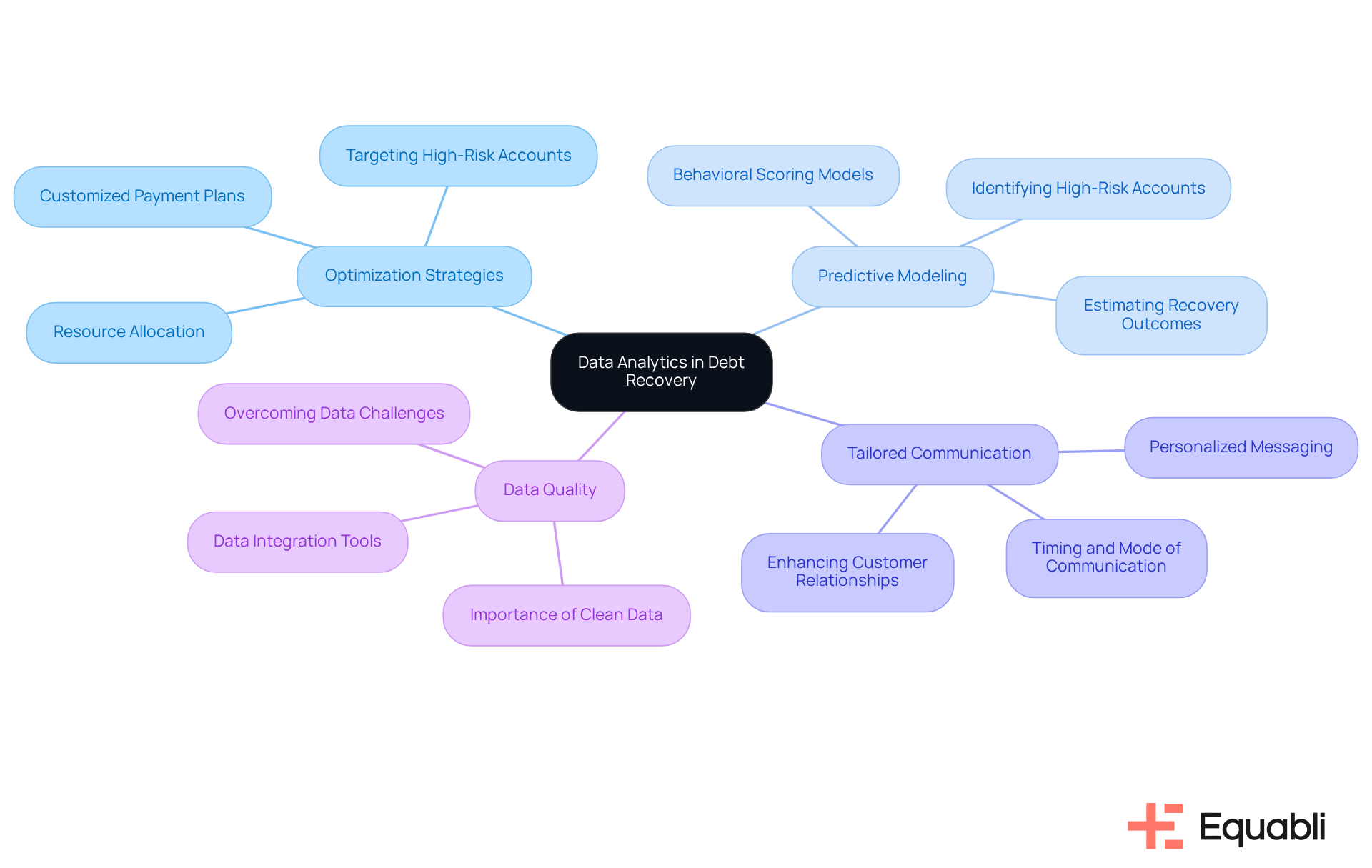

Data Analytics: Leverage Insights for Targeted Debt Recovery Strategies

Data analytics serves as a pivotal tool for organizations aiming to refine their strategies for optimizing debt recovery processes in enterprise customer portfolios through informed decision-making. By analyzing historical payment behaviors, businesses can implement strategies for optimizing debt recovery processes in enterprise customer portfolios and prioritize accounts according to their likelihood of repayment. For instance, predictive modeling can identify high-risk accounts, which supports the implementation of strategies for optimizing debt recovery processes in enterprise customer portfolios, enabling teams to allocate resources more strategically and concentrate efforts on those most likely to yield returns.

The insights derived from data analytics are instrumental in shaping communication strategies. Tailoring messages to resonate with specific debtor groups not only enhances collection rates but also fortifies customer relationships. This targeted approach is substantiated by evidence indicating that agencies leveraging have experienced recovery rate improvements of 25%. Moreover, utility providers have adeptly utilized predictive models to pinpoint customers at risk of default, facilitating proactive outreach through personalized payment plans.

Nonetheless, the success of these methodologies is contingent upon the quality of the data analyzed. Experts emphasize that without clean data, predictive modeling initiatives can become ineffective. Furthermore, while integrating predictive modeling into collection practices represents a significant shift towards more ethical and customer-centric approaches, agencies often face challenges in adopting these analytical tools. By harnessing data-informed insights, organizations can navigate the complexities of financial collection more adeptly, ensuring that their strategies for optimizing debt recovery processes in enterprise customer portfolios are both efficient and responsive to the evolving landscape of customer behavior.

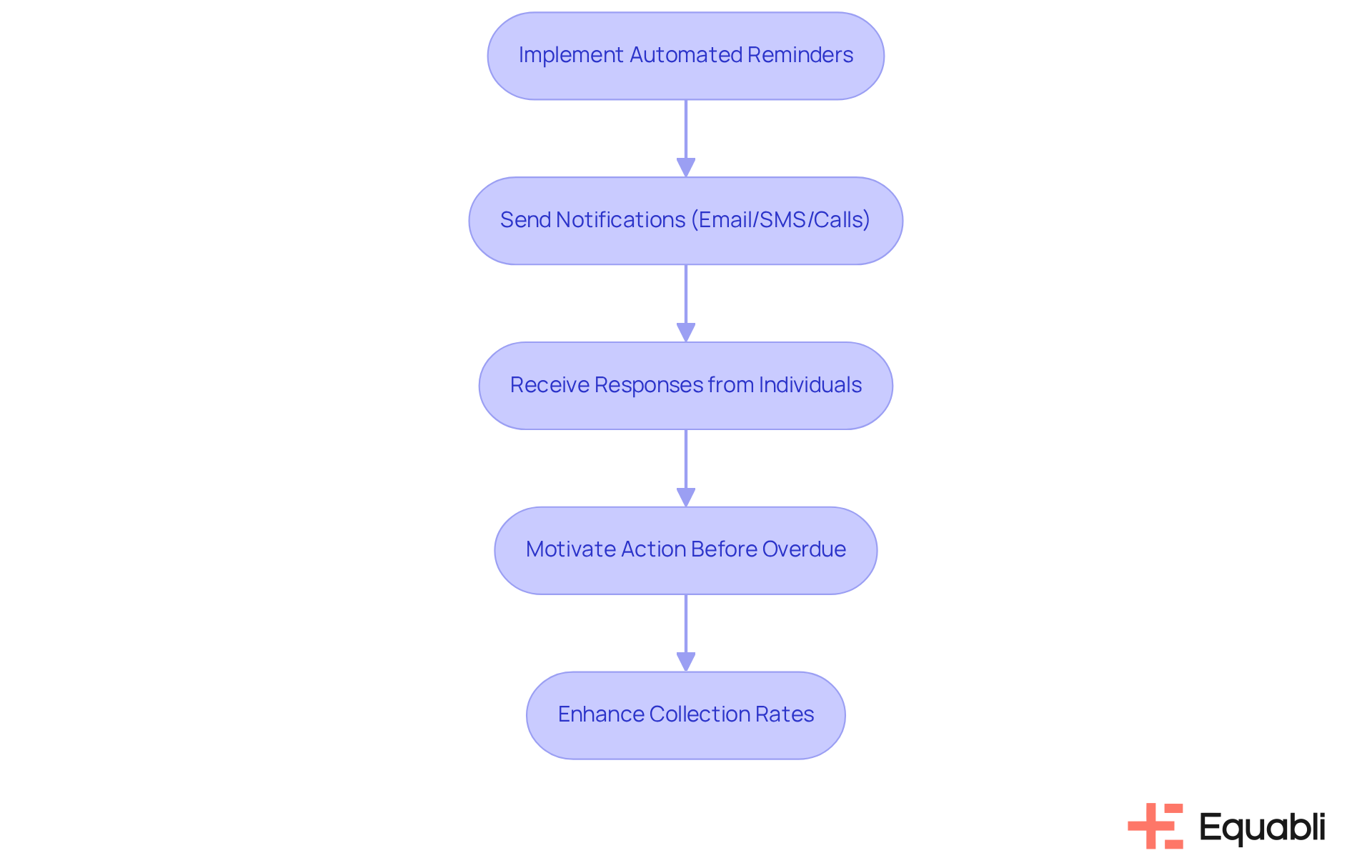

Automated Reminders: Enhance Follow-Up Efficiency in Debt Recovery

Implementing automated reminders significantly enhances the efficiency of follow-up processes in debt collection. These systems facilitate timely notifications via email, SMS, or phone calls, reminding individuals of upcoming payments or overdue balances. Organizations utilizing automated reminders report faster resolution times and improved collection rates.

By ensuring that reminders are dispatched at optimal intervals, companies can motivate individuals to act before accounts become significantly overdue. This proactive approach not only enhances overall collection rates but also reinforces compliance with regulatory standards, ultimately contributing to strategies for in enterprise customer portfolios.

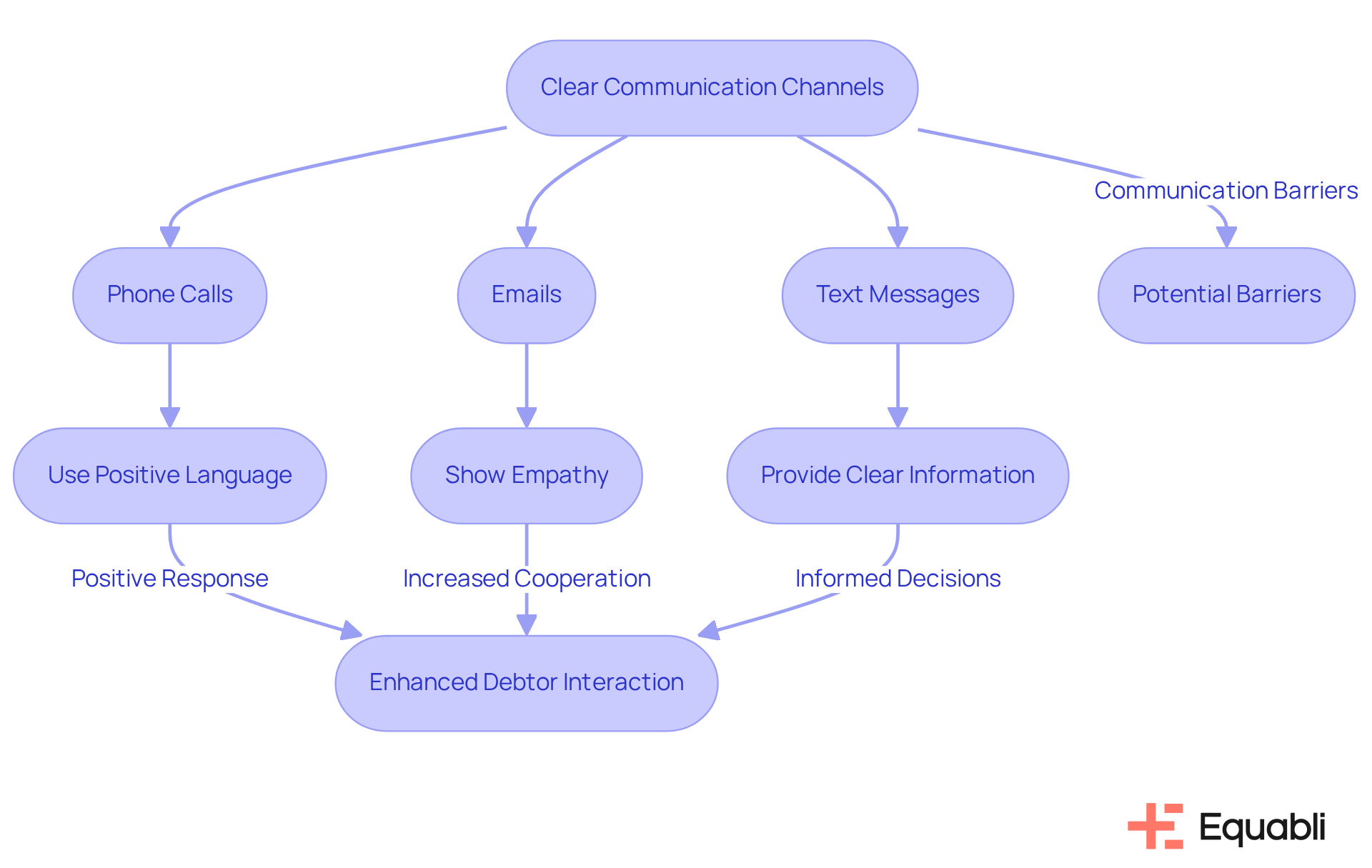

Clear Communication Channels: Build Trust and Transparency in Debt Recovery

Clear communication pathways are essential for nurturing trust and openness in financial collection. Organizations should utilize a range of platforms—such as phone calls, emails, and text messages—to effectively interact with individuals in debt. Offering clear, precise information regarding debts, repayment choices, and possible outcomes aids in clarifying the process and enables clients to make knowledgeable decisions.

Positive language and empathetic communication significantly enhance debtor interactions. According to recent statistics, 82% of customers are more likely to respond when payment reminders are framed in a supportive and positive manner. When clients feel acknowledged and valued, they are more inclined to cooperate, resulting in . A multi-channel strategy not only enhances the likelihood of prompt replies but also establishes a foundation of trust, which is crucial for implementing strategies for optimizing debt recovery processes in enterprise customer portfolios. By addressing communication barriers and ensuring that messages are customized to each individual's circumstances, organizations can create a more supportive environment that encourages compliance and collaboration. Furthermore, as highlighted in the case study 'Empathy in Debt Recovery Conversations,' training agents to handle stressful conversations with empathy can lead to more productive discussions and successful resolutions.

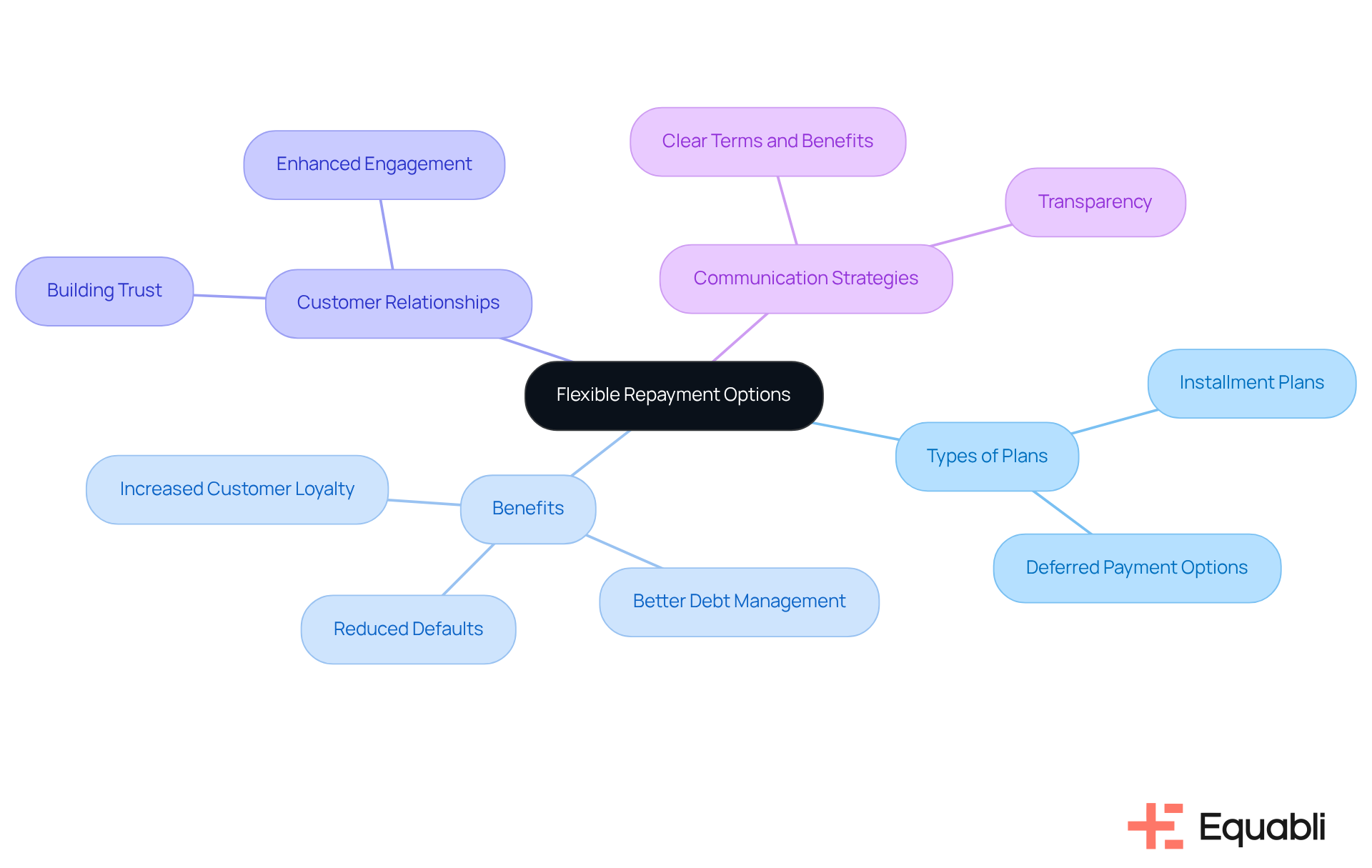

Flexible Repayment Options: Increase Engagement and Recovery Rates

Flexible repayment options are crucial for enhancing engagement and are essential components of strategies for optimizing debt recovery processes in enterprise customer portfolios. By providing individuals in debt with the ability to select payment plans tailored to their financial circumstances, organizations can significantly mitigate the risk of defaults.

For instance, installment plans and deferred payment options, as implemented by Barclays Bank in Ghana and BAAC in Thailand, empower individuals to manage their obligations more effectively, thereby alleviating the stress associated with debt.

This strategy not only leads to improved recovery rates but also incorporates strategies for optimizing debt recovery processes in enterprise customer portfolios, cultivating goodwill and loyalty among customers. When creditors exhibit understanding and support through , debtors feel valued and are more likely to sustain a positive relationship with their creditors.

It is imperative to clearly communicate the terms and benefits of these flexible options, as this fosters transparency and builds trust. Organizations that implement strategies for optimizing debt recovery processes in enterprise customer portfolios frequently observe a significant increase in customer satisfaction and retention, ultimately enhancing their financial outcomes.

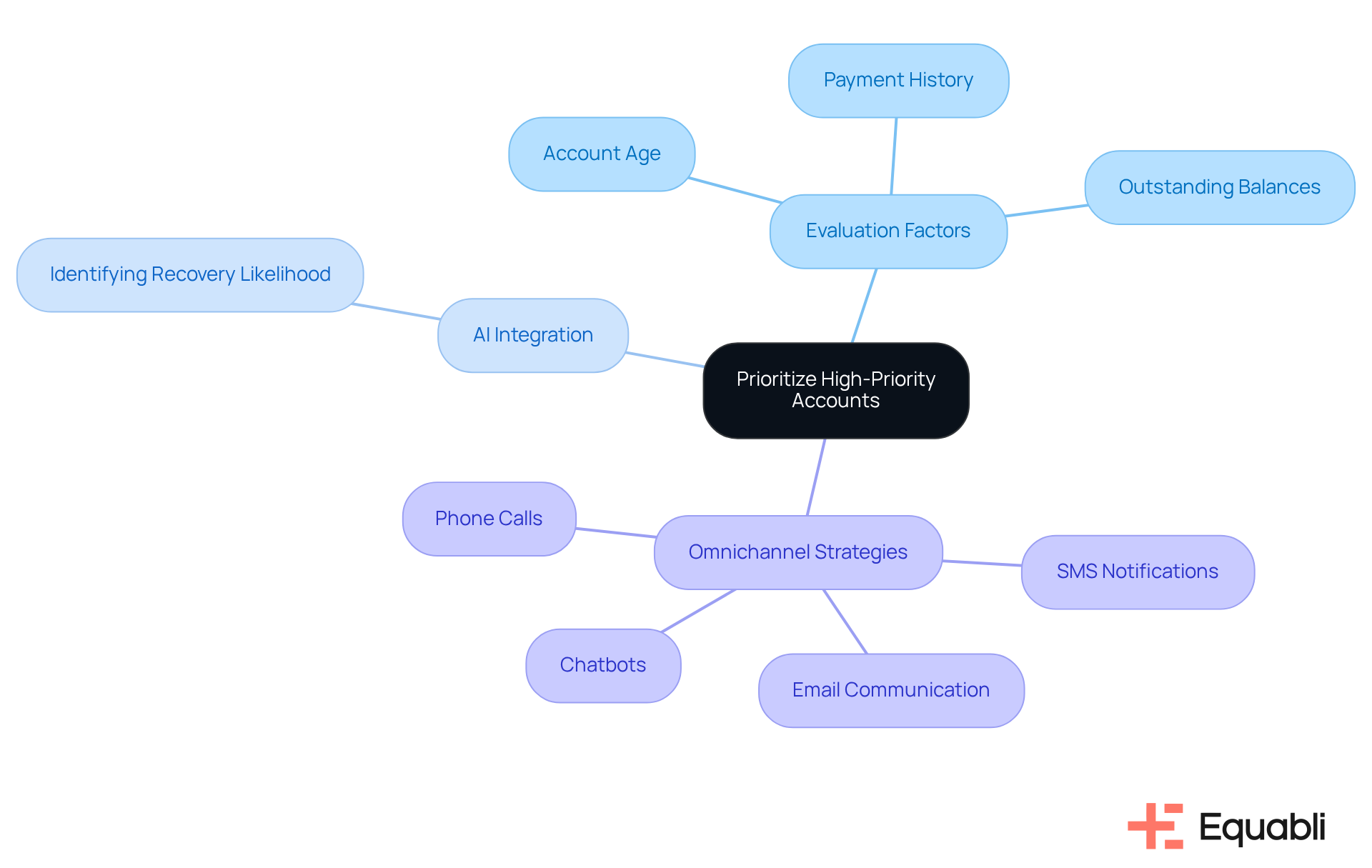

Prioritize High-Priority Accounts: Optimize Resource Allocation in Debt Recovery

Enhancing resource distribution in debt collection begins with prioritizing high-value accounts. Organizations must conduct comprehensive evaluations of their portfolios to identify accounts with the highest potential for successful restoration. Key factors such as payment history, account age, and outstanding balances are critical in informing this prioritization process. Furthermore, the integration of AI-powered predictive analytics can significantly enhance this effort by identifying accounts based on their likelihood of recovery, enabling organizations to focus their resources more strategically.

Focusing on these high-priority accounts not only improves return rates but also ensures effective resource utilization. By strategically directing efforts toward accounts that promise the greatest returns, businesses can markedly enhance their financial outcomes. Additionally, employing omnichannel communication strategies to engage debtors through various channels can improve collection rates, aligning with modern consumer preferences. This targeted approach is essential for implementing strategies for in enterprise customer portfolios, especially as the landscape evolves toward more data-driven practices in 2025.

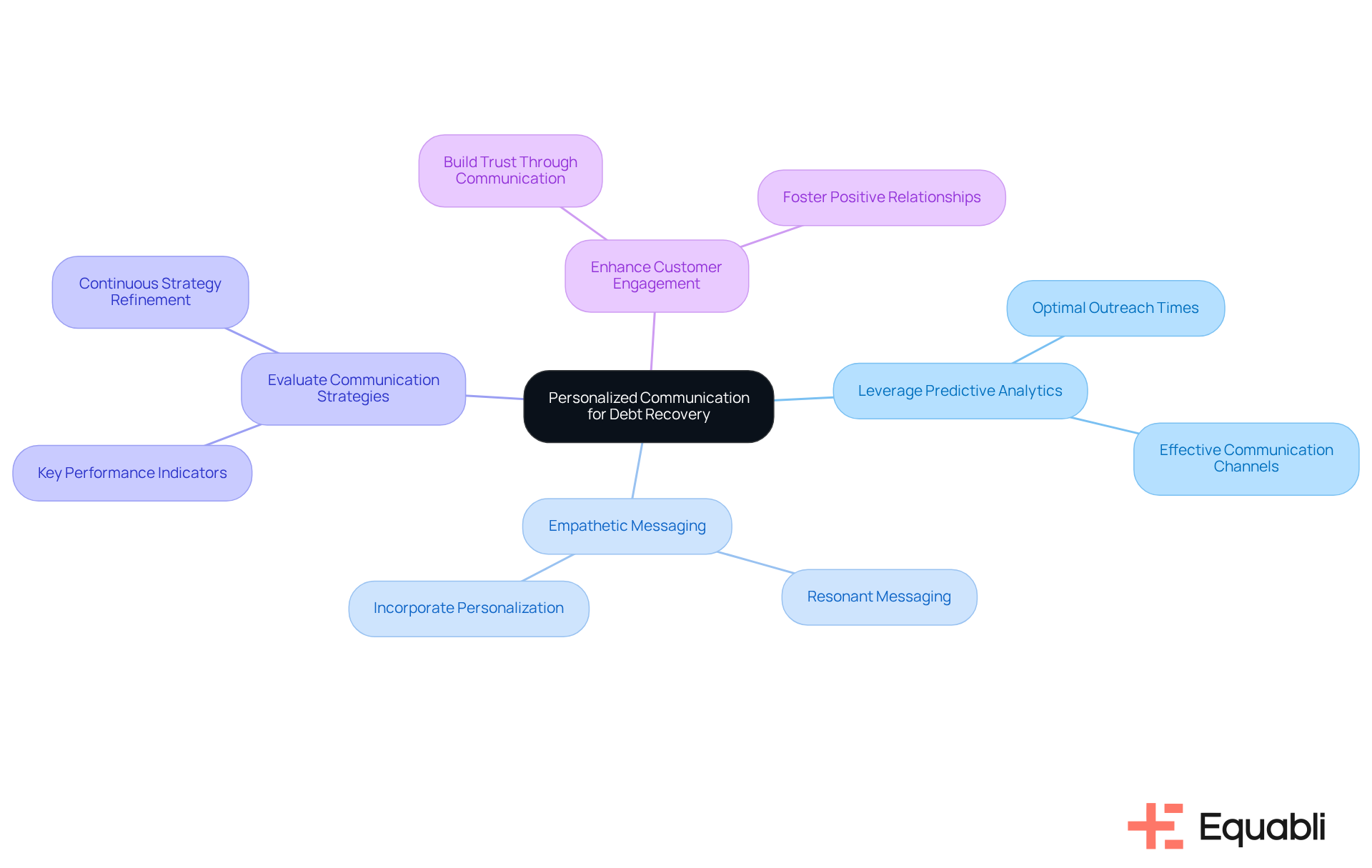

Personalized Communication: Strengthen Customer Relationships for Better Recovery

Personalized communication represents one of the key strategies for optimizing debt recovery processes in enterprise customer portfolios, significantly bolstering engagement and response rates. By tailoring messages to individual circumstances—such as payment history and preferences—organizations can foster a more supportive experience. Data analytics, for instance, can pinpoint optimal outreach times and channels, enabling a more strategic approach.

Evidence indicates that customized messaging can yield a 25% increase in healing rates, underscoring the effectiveness of this method. Moreover, incorporating the individual's name in communications has been shown to reduce social distance, thereby encouraging participation in resolving obligations. This strategy not only enhances the likelihood of successful recovery but also nurtures a positive relationship with customers, increasing their willingness to engage favorably in future interactions.

To effectively customize messages, organizations should implement the following strategies:

- Leverage predictive analytics to determine the most effective communication channels for each debtor, whether through SMS, email, or voice calls.

- Frame messages in a manner that resonates with the debtor's circumstances, employing empathetic language for those who may feel overwhelmed.

- Continuously evaluate communication strategies using key performance indicators (KPIs) to refine methods and boost engagement.

By adopting strategies for optimizing debt recovery processes in enterprise customer portfolios, organizations can improve their financial collection outcomes while maintaining a respectful and understanding dialogue with their clients.

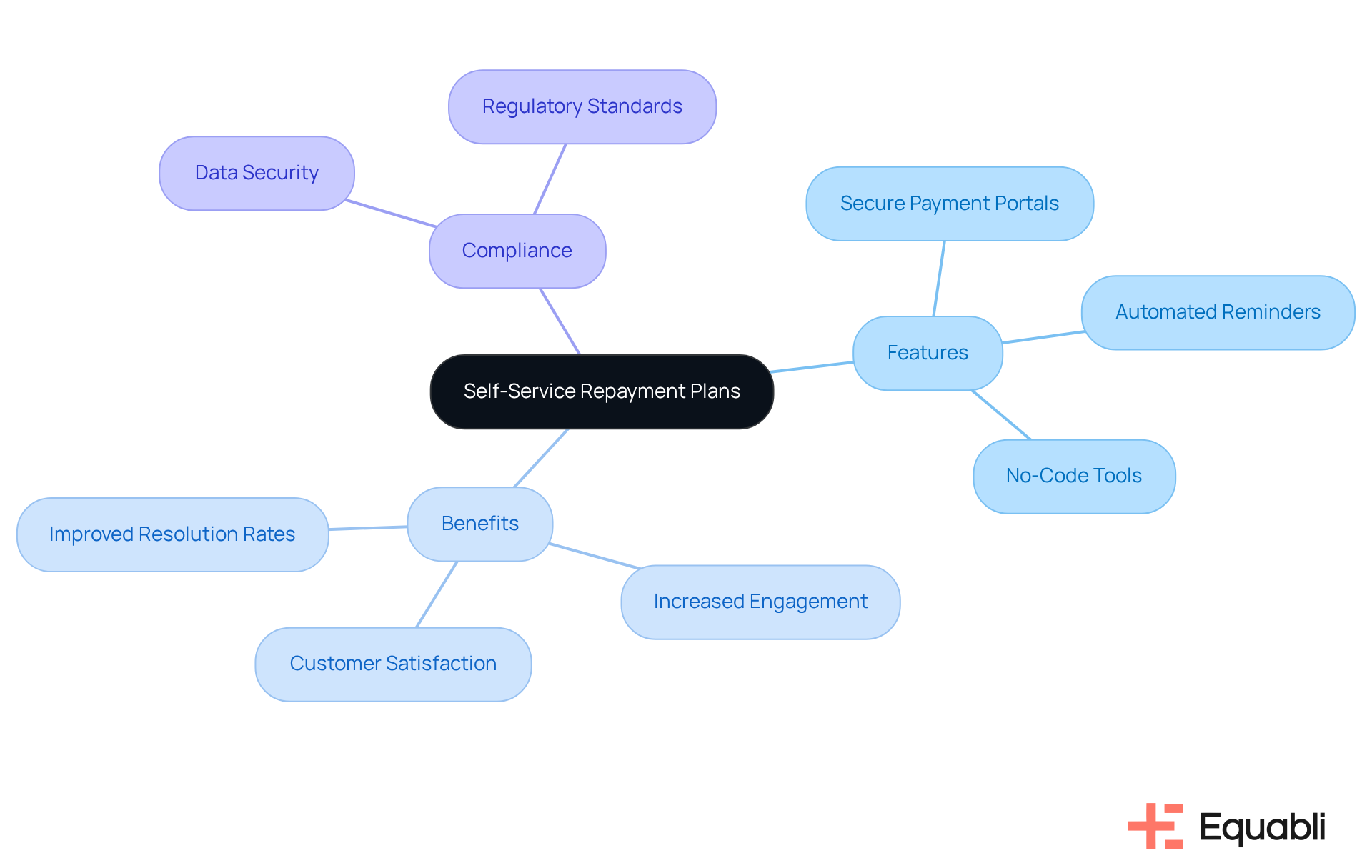

Self-Service Repayment Plans: Empower Customers for Improved Recovery

Self-service repayment plans serve as a pivotal mechanism in empowering customers and are part of the strategies for optimizing debt recovery processes in enterprise customer portfolios. By providing online platforms that enable debtors to manage their payments, establish flexible payment plans, and track their progress, organizations can markedly elevate customer satisfaction and engagement.

The integration of features from EQ Collect, including secure online payment portals, automated payment reminders, and a no-code file-mapping tool, significantly enhances the user experience, aligning with consumer preferences for convenience and self-service options. Such tools not only streamline vendor onboarding timelines but also bolster efficiency and augment collections through data-driven strategies, notably automated workflows that reduce execution errors and reliance on manual resources.

This empowerment translates into improved resolution rates; research indicates that consumers utilizing are more inclined to fulfill their obligations in full. Additionally, by instilling a sense of responsibility and ownership among debtors, organizations can foster more constructive interactions, ultimately enhancing the overall customer experience.

Data suggests that self-service platforms can yield a 15-25% improvement in collection rates, highlighting their role in strategies for optimizing debt recovery processes in enterprise customer portfolios. It is imperative to ensure that these self-service platforms comply with stringent data security protocols and regulatory standards, thereby safeguarding sensitive information and preserving consumer trust, in alignment with Equabli's commitment to data protection.

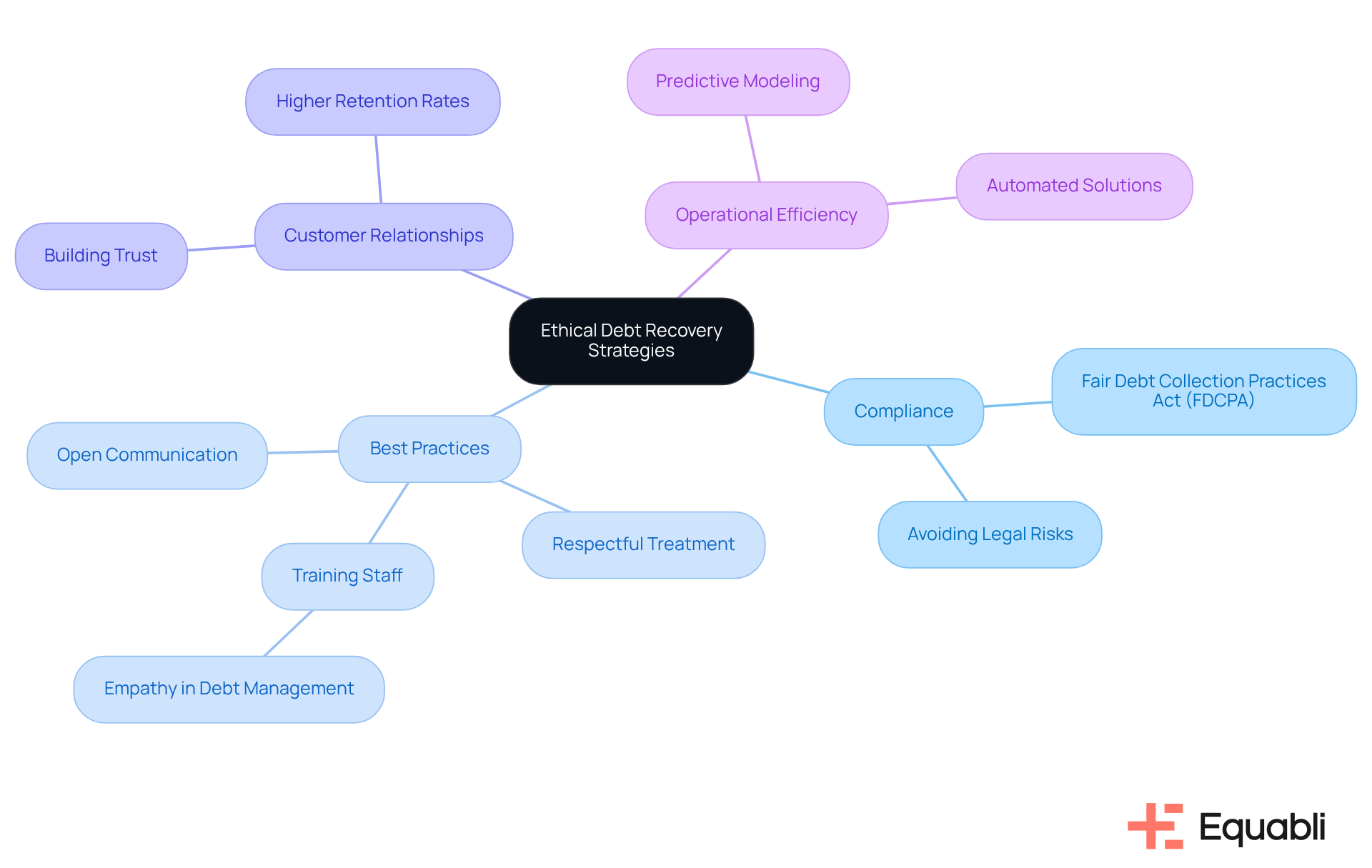

Ethical Debt Recovery Strategies: Ensure Compliance and Protect Reputation

Ethical financial collection methods are critical for compliance with regulations and safeguarding an organization's reputation. By implementing best practices such as open communication and respectful treatment of clients, organizations can mitigate legal risks while fostering goodwill among customers. Training staff to not only enhances the debtor experience but also aligns with the principles set forth in the Fair Debt Collection Practices Act (FDCPA), which underscores ethical conduct in collections.

Organizations prioritizing ethical practices typically cultivate long-term relationships with customers, resulting in higher retention rates and a strengthened brand image. For instance, companies employing advanced analytics and predictive modeling can effectively identify high-risk borrowers while ensuring compliance, thus applying strategies for optimizing debt recovery processes in enterprise customer portfolios. Industry specialists indicate that the adoption of strategies for optimizing debt recovery processes in enterprise customer portfolios can lead to a substantial increase in restoration rates, highlighting the importance of ethical engagement and strategic compliance. This dual focus not only enhances operational efficiency but also demonstrates the organization's commitment to responsible financial collection.

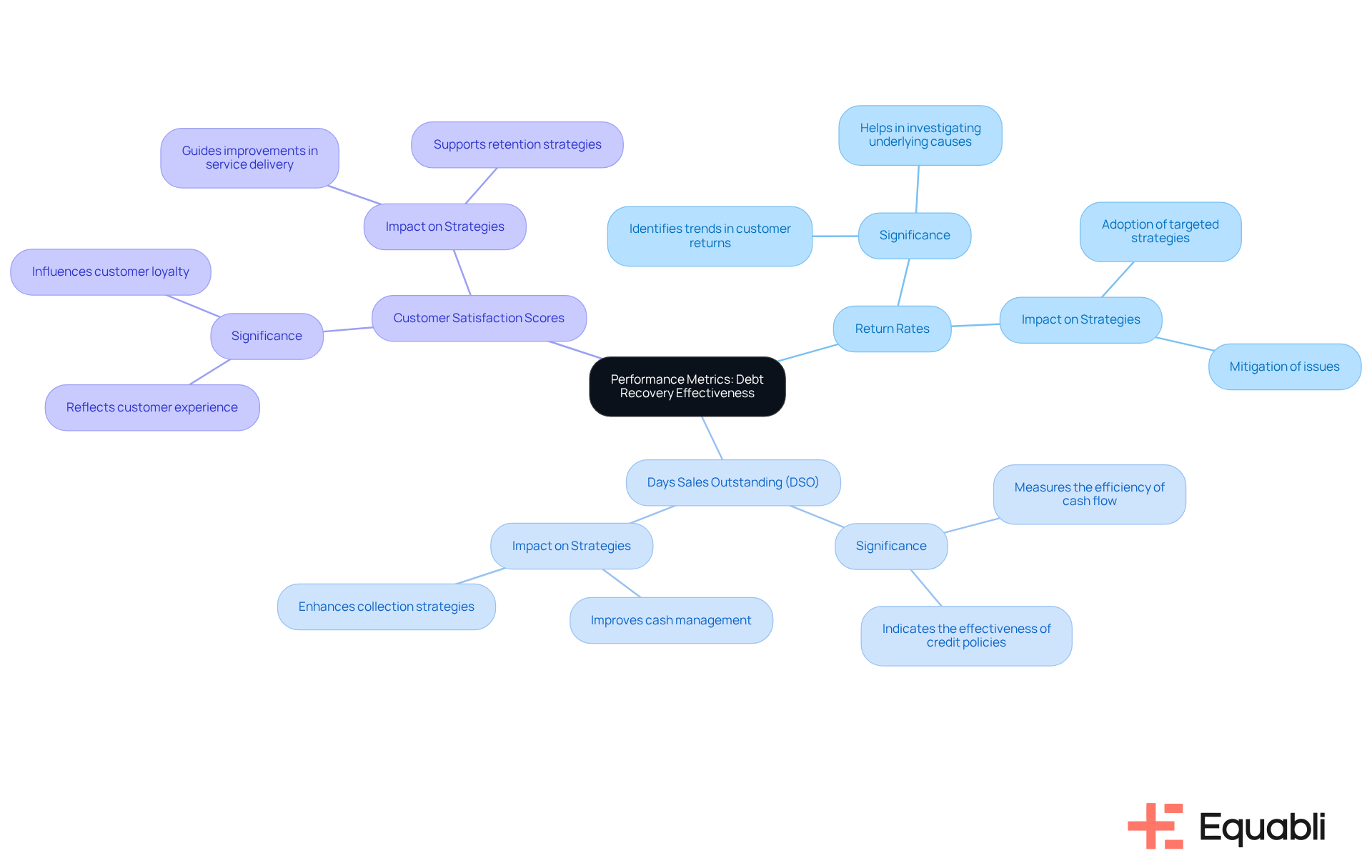

Performance Metrics: Measure and Improve Debt Recovery Effectiveness

Performance metrics are crucial for evaluating and enhancing the strategies for optimizing debt recovery processes in enterprise customer portfolios. Organizations must monitor key performance indicators (KPIs) such as:

- Return rates

- Days sales outstanding (DSO)

- Customer satisfaction scores

By analyzing these metrics, companies can identify trends, assess the efficacy of their strategies for optimizing debt recovery processes in enterprise customer portfolios, and make data-driven modifications as needed.

For example, a decline in return rates may prompt organizations to investigate the underlying causes and adopt targeted strategies to mitigate these issues. This continuous improvement approach not only enhances outcomes but also contributes to overall operational efficiency.

As we look to 2025, the focus on evaluating financial collection efficiency is evolving, with organizations increasingly adopting advanced analytics and technology to refine their strategies for optimizing debt recovery processes in enterprise customer portfolios. NYCEEC serves as a prime example of this trend, leveraging innovative financing models to optimize their restoration processes. This case underscores the impact of strategic performance measurement on achieving sustainable growth, as evidenced by NYCEEC's financing of nearly USD 100 million in clean energy projects, illustrating how effective KPI tracking can yield substantial results.

To maintain competitiveness, businesses should consider the latest trends in evaluating financial success, including the integration of and customer feedback systems. By effectively monitoring KPIs and implementing strategies for optimizing debt recovery processes in enterprise customer portfolios, organizations can stay responsive to the ever-changing landscape of debt recovery.

Conclusion

Optimizing debt recovery in enterprise portfolios is essential for enhancing financial outcomes and nurturing positive client relationships. The strategies discussed herein emphasize the significance of leveraging advanced technology, data analytics, and empathetic communication to develop effective debt recovery processes. By integrating these intelligent solutions, organizations can improve collection rates and adopt a more compassionate approach to financial obligations.

Key insights include the utility of tools such as Equabli's EQ Suite, which empowers businesses to employ predictive analytics for targeted recovery efforts. The implementation of automated reminders, clear communication channels, and flexible repayment options further assists organizations in effectively engaging with clients. Moreover, prioritizing high-risk accounts and personalizing communication fosters stronger relationships and enhances the likelihood of successful debt resolution.

Ultimately, the journey toward optimizing debt recovery processes transcends mere financial metrics; it encompasses the creation of a sustainable and ethical framework that respects the debtor's experience. As organizations adopt these strategies, they can cultivate trust, improve customer satisfaction, and achieve superior financial outcomes. The call to action is unequivocal: invest in intelligent solutions and embrace best practices to navigate the complexities of debt recovery, ensuring long-term success and compliance in an evolving landscape.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a collection of intelligent solutions designed to optimize debt recovery processes in enterprise customer portfolios. It includes components like the EQ Engine, EQ Engage, and EQ Collect, which enhance predictive analytics, communication with debtors, and the overall collection process.

How does the EQ Engine work?

The EQ Engine allows organizations to create custom scoring models that predict repayment behaviors, helping businesses identify clients most likely to repay their debts. This enables them to focus collection efforts effectively.

What role does EQ Engage play in debt recovery?

EQ Engage enhances communication with debtors, facilitating more productive interactions that can lead to successful resolutions during the debt recovery process.

How does EQ Collect contribute to debt recovery?

EQ Collect streamlines the collection process, ensuring that organizations manage their portfolios with efficiency and precision, which ultimately improves collection outcomes.

What benefits have organizations seen from using the EQ Engine?

Organizations utilizing the EQ Engine have reported notable improvements in their collection outcomes, highlighting the positive impact of integrating advanced technology into traditional financial collection methods.

How does data analytics improve debt recovery strategies?

Data analytics helps organizations refine their debt recovery strategies by analyzing historical payment behaviors, allowing them to prioritize accounts based on their likelihood of repayment and allocate resources more strategically.

What is the significance of predictive modeling in debt recovery?

Predictive modeling identifies high-risk accounts, enabling teams to concentrate their efforts on those most likely to yield returns, which can improve recovery rates significantly.

How can tailored communication strategies benefit debt recovery?

Tailoring communication messages to specific debtor groups enhances collection rates and strengthens customer relationships, leading to more effective debt recovery efforts.

What challenges do organizations face when adopting predictive analytics?

Organizations often encounter challenges related to the quality of data analyzed. Without clean data, predictive modeling initiatives can be ineffective, hindering the success of debt recovery strategies.

How do automated reminders enhance debt recovery efficiency?

Automated reminders send timely notifications via email, SMS, or phone calls regarding upcoming payments or overdue balances, resulting in faster resolution times and improved collection rates.

What impact do optimal reminder intervals have on debt recovery?

Dispatching reminders at optimal intervals motivates individuals to act before accounts become significantly overdue, enhancing overall collection rates and ensuring compliance with regulatory standards.