Overview

This article examines the implementation of effective debt sales strategies for financial institutions, highlighting their critical role in managing non-performing loans and improving recovery rates. It presents key steps such as:

- Assessing current processes

- Integrating technology solutions

- Training staff

- Conducting regular evaluations of strategies

These measures not only enhance financial health but also contribute to operational efficiency within these organizations.

Introduction

The management of non-performing loans presents a significant challenge for financial institutions, particularly as they strive to maintain liquidity and recover value from overdue accounts. Effective debt sales strategies are essential, as they not only optimize portfolio performance but also enhance compliance and operational efficiency. This necessity raises a critical question: how can organizations ensure they are adopting the right approaches and technologies to maximize recovery rates while minimizing risks?

This article explores the essential steps that financial institutions must undertake to implement successful debt sales strategies, focusing on the intersection of technology, staff training, and regular evaluations to drive improved financial outcomes.

Define Debt Sales Strategies and Their Importance

The systematic approach to the disposition of non-performing loans or obligations to third parties through loan selling methods highlights the importance of debt sales strategies and implications for financial institutions. These methods, which include debt sales strategies and implications for financial institutions, are essential for financial organizations aiming to manage their portfolios effectively, reduce operational costs, and recover some value from overdue accounts. By delineating these methods, organizations can identify the optimal timing and techniques for selling receivables, ensuring compliance with regulatory standards while maximizing recovery rates.

Understanding the importance of and implications for financial institutions enables organizations to maintain liquidity and improve overall financial health, marking it as a critical initial step in the sales process. The Debt Collection Improvement Act of 1996 (DCIA) underscores the necessity for prompt recovery actions and mandates credit bureau reporting and the collection of taxpayer identifying numbers, which are vital for compliance and operational efficiency.

Current trends indicate an increasing dependence on technology-driven solutions, particularly in the context of debt sales strategies and implications for financial institutions, allowing them to utilize data analytics for improved decision-making. Expert opinions highlight that effective debt sales strategies and implications for financial institutions not only elevate recovery rates but also enhance overall economic stability.

Case studies, such as Wachovia's implementation of content integration solutions, demonstrate how strategic asset sales can lead to substantial cost savings, with Wachovia achieving $2.3 million in savings and a 64% return on investment through its CAS solution. This exemplifies the tangible advantages of efficient debt sales strategies and implications for financial institutions regarding liabilities. Nevertheless, financial organizations must remain vigilant regarding the operational risks associated with selling obligations to purchasers, as inadequate systems and controls can exacerbate these risks.

Furthermore, the OCC's guidance on loan-sale arrangements emphasizes the importance of internal policies and due diligence, providing a framework for best practices that financial entities should follow when engaging in loan sales.

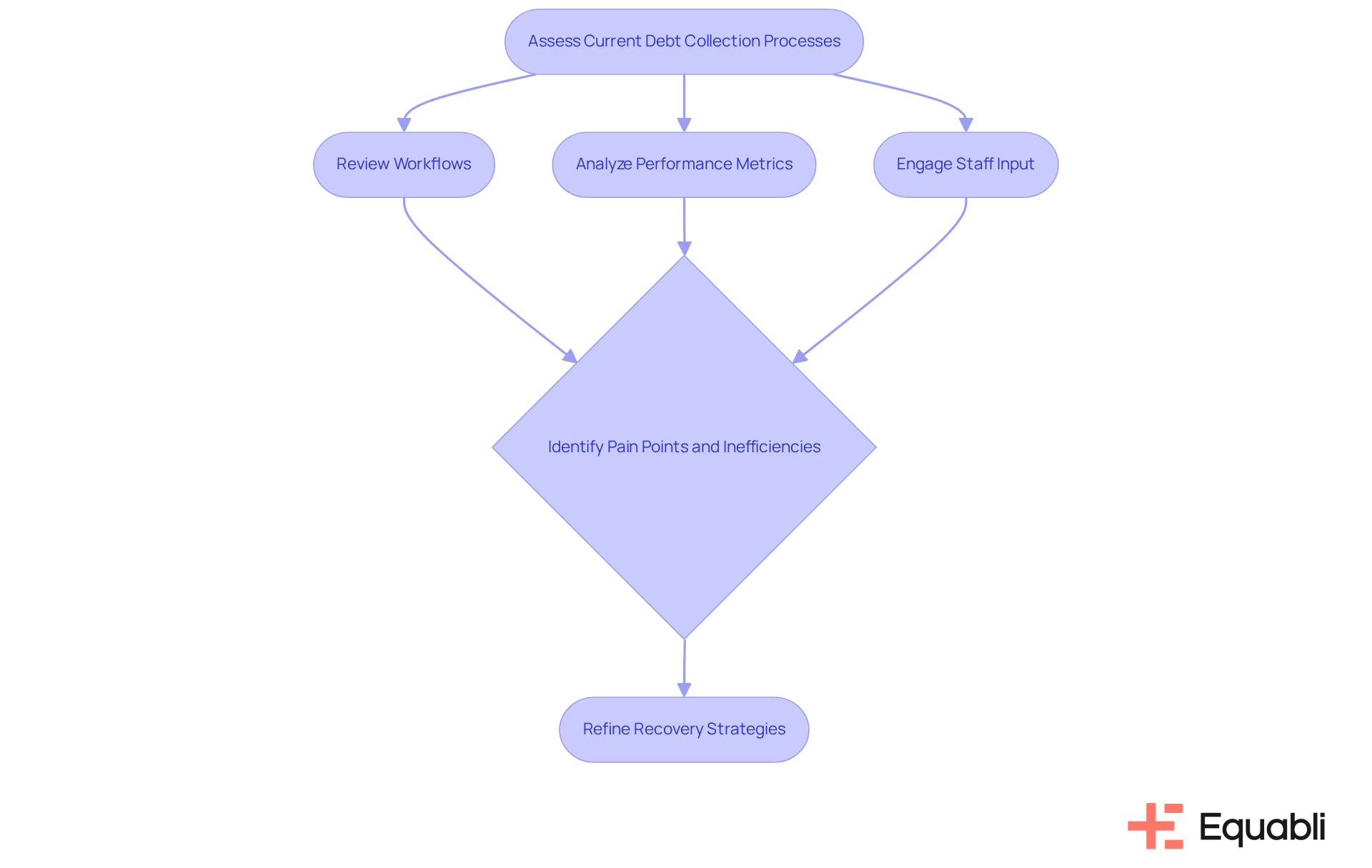

Assess Current Debt Collection Processes

To effectively assess current receivable recovery processes, financial organizations must conduct a comprehensive review of their existing workflows, performance metrics, and recovery rates. This assessment should encompass a detailed analysis of key performance indicators (KPIs) such as:

Engaging input from staff involved in the collection process is crucial to pinpointing pain points and inefficiencies. Understanding the advantages and disadvantages of current methods enables organizations to identify which liabilities are suitable for sale and refine their overall in the context of debt sales strategies and implications for financial institutions.

For instance, organizations with a high average days delinquent, typically exceeding 60 days in sectors like construction and professional services, may need to recalibrate their approaches to improve recovery outcomes. By leveraging these insights, financial organizations can establish more efficient recovery processes that align with their operational objectives.

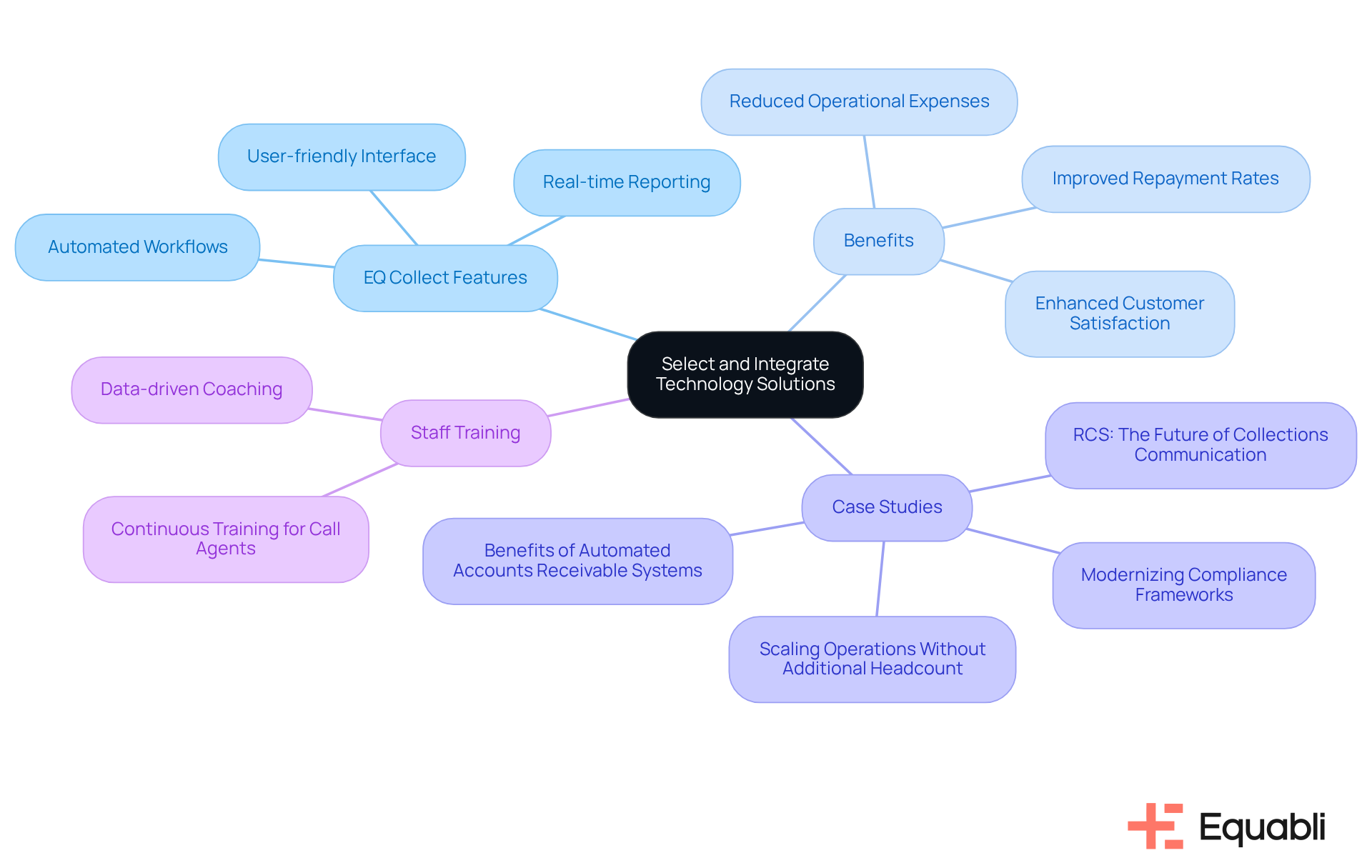

Select and Integrate Technology Solutions

Choosing and incorporating technological solutions is essential for optimizing receivable recovery procedures within financial organizations. Embracing Equabli's EQ Collect significantly enhances operational efficiency by providing features such as:

- Automated workflows

- Real-time reporting

- A user-friendly interface

Additionally, the no-code file-mapping tool streamlines vendor onboarding, enabling institutions to manage delinquent accounts more effectively through intelligent, data-driven approaches tailored to specific needs.

The impact of EQ Collect on financial recovery efficiency is substantial. The platform grants real-time access to debtor information, allowing agents to engage clients more effectively and tailor communication strategies. Moreover, automated reminders and self-service options empower debtors to manage their accounts at their convenience, resulting in improved repayment rates and heightened customer satisfaction.

Successful integration of EQ Collect has been evidenced in various case studies. For example, agencies that adopted EQ Collect reported:

- Reduced operational expenses

- Enhanced recovery rates

This demonstrates the transformative efficiency of technology in modernizing traditional financial recovery methods. Furthermore, organizations prioritizing compliance with regulatory standards while implementing EQ Collect can mitigate risks and foster trust with clients and debtors alike.

Training staff on these advanced tools is vital for and improving overall collection outcomes. By equipping teams with the necessary skills to navigate EQ Collect, financial organizations can ensure a seamless transition and cultivate a culture of continuous improvement in financial management.

Train Staff on New Strategies and Tools

Training staff on new strategies and tools necessitates a well-structured approach that integrates workshops, online courses, and . Financial institutions must prioritize critical areas, including:

- Adherence to loan retrieval regulations

- Effective communication strategies

- The integration of technology in financial management

Continuous education is essential for keeping staff informed about industry trends and best practices, which ultimately supports compliance and operational efficiency.

By addressing the challenges associated with manual financial management, organizations can leverage Equabli's EQ Suite to modernize their receivable processes, enhancing efficiency and intuitiveness. The EQ Engage feature provides customizable repayment options and bolsters borrower engagement through personalized communication and self-service repayment solutions. Furthermore, organizations that implement focused compliance training initiatives alongside Equabli's innovative tools have reported significant improvements in their recovery rates.

The role of the Client Success Representative is pivotal in this process, facilitating training and ensuring that teams are adept at utilizing Equabli's solutions effectively. By investing in comprehensive training and harnessing Equabli's capabilities, financial organizations can enhance borrower engagement and empower their teams to navigate various financial scenarios proficiently, ultimately leading to improved collection outcomes.

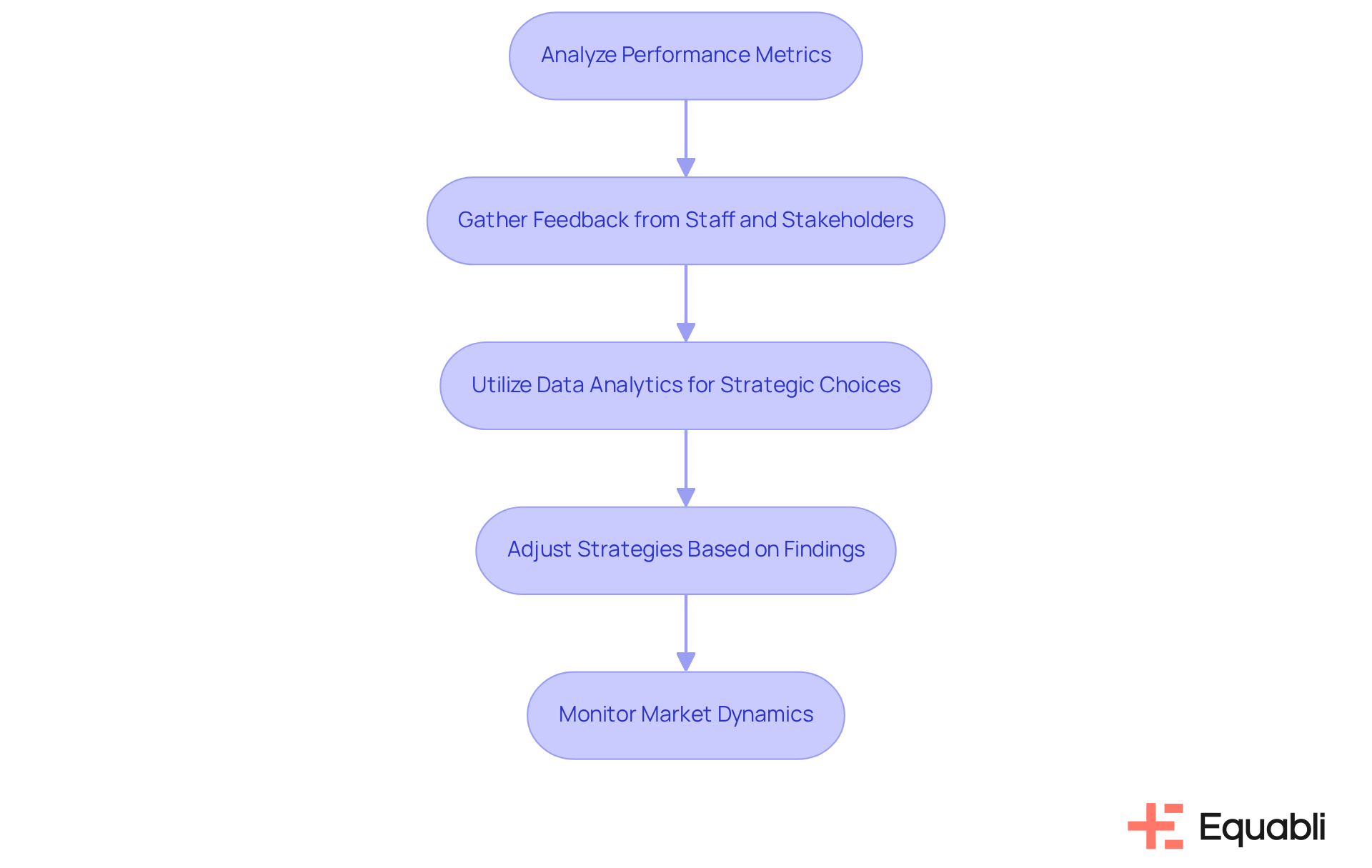

Evaluate and Adjust Strategies Regularly

To enhance the efficiency of credit sales tactics, financial organizations must adopt a structured assessment procedure that considers and implications for financial institutions. This structured approach includes a thorough analysis of performance metrics, such as recovery rates and the effectiveness of various sales channels. Evidence suggests that gathering feedback from staff and stakeholders is essential to pinpoint areas needing enhancement. By utilizing data analytics, organizations can make strategic choices related to debt sales strategies and implications for financial institutions, including the types of debts sold, the optimal timing for sales, and effective approaches to engage with debt purchasers.

Regular assessments not only promote agility but also enable organizations to respond proactively to market dynamics, ultimately leading to enhanced financial results. For instance, case studies have shown that institutions routinely adjusting their strategies based on performance metrics experience significantly higher recovery rates. This reinforces the notion that a data-driven approach is vital for adapting to evolving market conditions and enhancing overall debt sales strategies and implications for financial institutions. Expert insights further substantiate this claim, indicating that a structured assessment procedure is not merely beneficial but essential for long-term success in debt collection.

Conclusion

Implementing effective debt sales strategies is essential for financial institutions seeking to enhance operational efficiency and financial health. By systematically addressing non-performing loans through well-defined methods, organizations can optimize their recovery processes while ensuring compliance with regulatory standards. The integration of technology and staff training further emphasizes the necessity of adopting innovative solutions to navigate the complexities of debt management.

Key insights throughout the article highlight the importance of:

- Assessing current debt collection processes

- Selecting appropriate technology solutions

- Regularly evaluating strategies

For instance, case studies demonstrate how organizations like Wachovia have achieved significant cost savings and improved recovery rates through strategic asset sales and the integration of tools like EQ Collect. Furthermore, the continuous training of staff in adapting to new technologies and methodologies is a critical factor in driving successful outcomes.

In summary, the importance of implementing robust debt sales strategies cannot be overstated. Financial institutions must adopt a proactive approach, which includes:

- Regular assessments and adjustments to their processes

- Leveraging data analytics and technology to respond effectively to market dynamics

By prioritizing these strategies, organizations can enhance their financial performance and contribute to the overall stability of the economic landscape. It is imperative for financial entities to take action now, refining their debt management practices to secure a more resilient future.

Frequently Asked Questions

What are debt sales strategies?

Debt sales strategies refer to systematic approaches used by financial institutions to sell non-performing loans or obligations to third parties. These strategies are essential for managing portfolios effectively, reducing operational costs, and recovering value from overdue accounts.

Why are debt sales strategies important for financial institutions?

Debt sales strategies are important as they help organizations maintain liquidity, improve financial health, and ensure compliance with regulatory standards while maximizing recovery rates from overdue accounts.

What legislation emphasizes the need for prompt recovery actions in debt collection?

The Debt Collection Improvement Act of 1996 (DCIA) emphasizes the necessity for prompt recovery actions and mandates credit bureau reporting and the collection of taxpayer identifying numbers for compliance and operational efficiency.

How is technology impacting debt sales strategies?

Current trends show an increasing dependence on technology-driven solutions, particularly data analytics, which enhances decision-making and improves recovery rates for financial institutions.

Can you provide an example of a successful debt sales strategy?

An example is Wachovia's implementation of content integration solutions, which resulted in $2.3 million in savings and a 64% return on investment through its CAS solution, demonstrating the tangible benefits of effective debt sales strategies.

What risks should financial organizations be aware of when selling obligations?

Financial organizations must be vigilant regarding operational risks associated with selling obligations, as inadequate systems and controls can exacerbate these risks.

What guidance does the OCC provide regarding loan-sale arrangements?

The OCC's guidance emphasizes the importance of internal policies and due diligence, providing a framework for best practices that financial entities should follow when engaging in loan sales.

How should financial organizations assess their current debt collection processes?

Organizations should conduct a comprehensive review of their existing workflows, performance metrics, and recovery rates, including key performance indicators (KPIs) such as Collection Effectiveness Index (CEI), average days delinquent, and overall recovery rates.

Why is staff input important in assessing debt collection processes?

Engaging input from staff involved in the collection process is crucial for identifying pain points and inefficiencies, which helps organizations refine their recovery strategies and determine suitable liabilities for sale.