Overview

The article provides a critical analysis of collections automation solutions for enterprise financial operations, underscoring their significance in modernizing debt recovery processes. It presents evidence through a comparison of leading providers such as Equabli, HighRadius, and Billtrust, detailing their unique features and benefits. These solutions are shown to enhance operational efficiency, borrower engagement, and compliance within an increasingly complex financial landscape, thereby offering strategic insights for executives navigating these challenges.

Introduction

The rapid evolution of financial operations necessitates innovative solutions that streamline processes and enhance efficiency. Collections automation has emerged as a pivotal strategy for enterprises seeking to modernize their debt recovery efforts, offering a blend of technology and analytics that transforms traditional practices.

With numerous providers vying for attention, organizations must discern which solution best meets their unique needs and maximizes operational potential. This article explores the landscape of collections automation solutions, comparing leading providers and their offerings, while examining the critical factors that financial institutions must consider to thrive in an increasingly competitive environment.

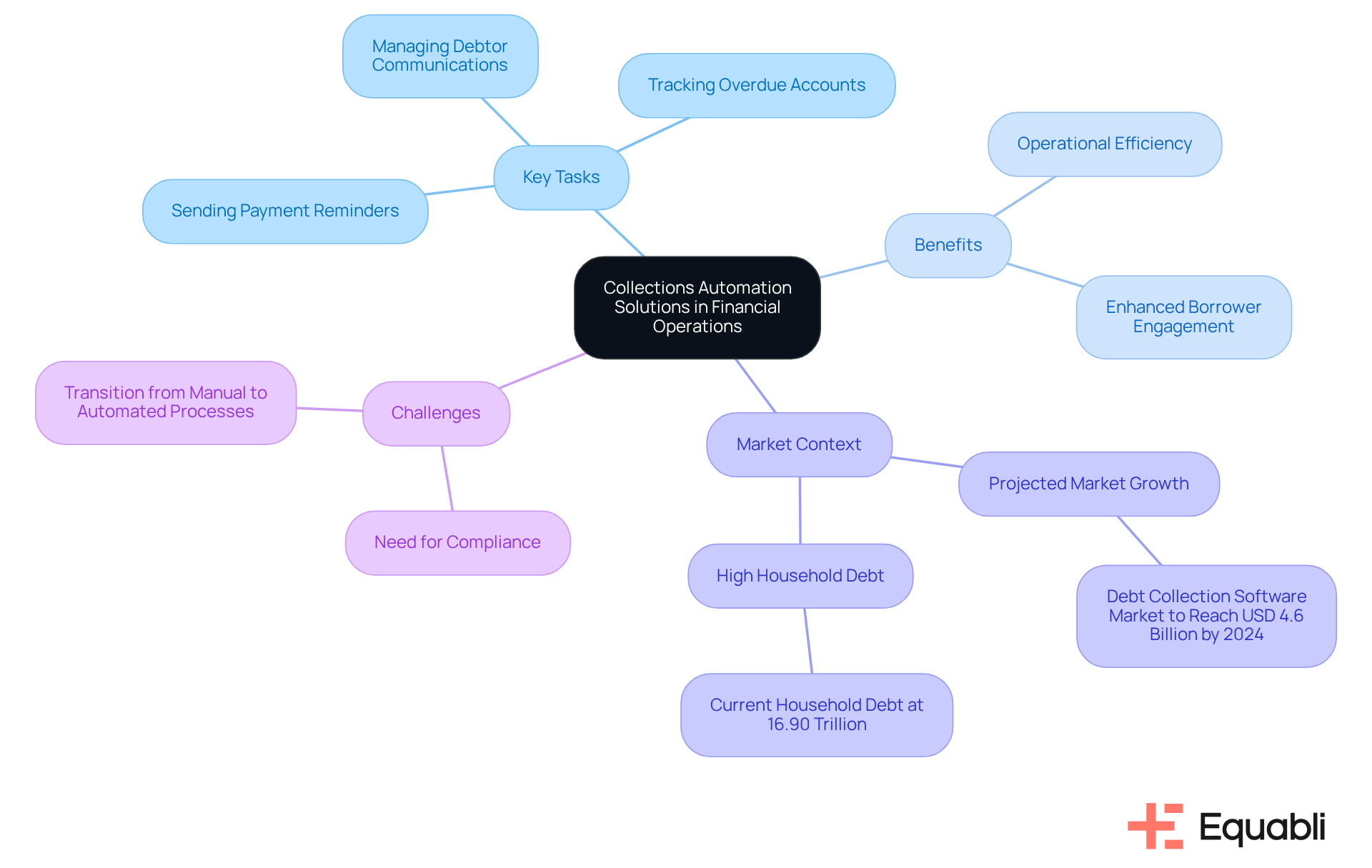

Overview of Collections Automation Solutions in Financial Operations

Collections automation solutions for enterprise financial operations are essential for modernizing the debt recovery process within financial institutions. These systems leverage technology to automate repetitive tasks, such as:

- Sending payment reminders

- Tracking overdue accounts

- Managing debtor communications

The integration of advanced analytics and artificial intelligence enables these systems to predict repayment behaviors, thereby enhancing recovery strategies. This shift from traditional manual processes to automated systems not only improves operational efficiency but also significantly boosts borrower engagement. Institutions can reallocate their resources from administrative tasks to strategic initiatives, fostering stronger relationships with customers.

As the financial landscape evolves, adopting collections automation solutions for enterprise financial operations becomes crucial for maintaining competitiveness and ensuring compliance with regulatory standards. The is projected to reach USD 4.6 billion by 2024, indicating that the transition towards digital debt recovery services is not merely a trend but a necessity for sustainable growth. Furthermore, organizations that implement automation can reduce retrieval costs to as low as 3%, highlighting the financial benefits of these innovative strategies.

In an increasingly challenging economic environment, where household debt has surged to an unprecedented high of 16.90 trillion, the demand for efficient and effective debt recovery strategies has never been more critical. Executives must consider how collections automation solutions for enterprise financial operations can not only streamline operations but also enhance compliance and risk management in their debt collection efforts.

Comparative Analysis of Leading Collections Automation Providers

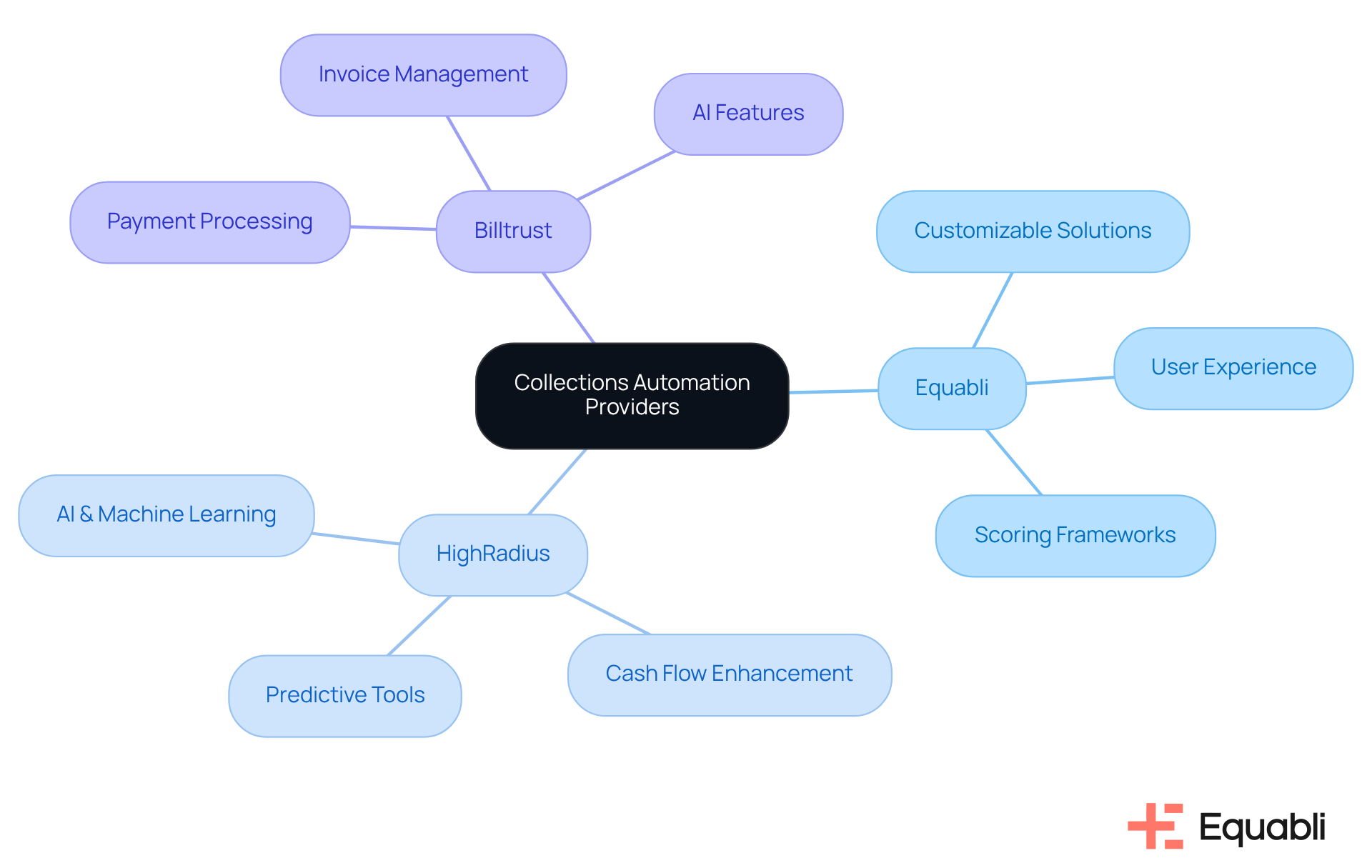

In the competitive landscape of receivables automation, HighRadius and Billtrust emerge as prominent suppliers, each offering tailored solutions that meet the specific needs of financial institutions.

The EQ Suite from Equabli, which includes EQ Engine, EQ Engage, and EQ Collect, is designed to empower organizations with adaptable scoring frameworks that predict repayment behaviors and facilitate digital recovery through self-service repayment plans. By leveraging intelligent, data-driven strategies, Equabli enhances borrower engagement and optimizes recovery methods, positioning itself as a preferred choice for institutions seeking flexibility and user-friendly solutions.

HighRadius emphasizes comprehensive accounts receivable automation, utilizing advanced AI and machine learning to enhance cash flow and reduce days sales outstanding (DSO). Its 'Autonomous Receivables' system proves particularly beneficial for larger enterprises, equipping them with predictive tools that help anticipate customer payment patterns and mitigate risks associated with receivables. The integration of big data further amplifies HighRadius's technological edge in forecasting payment behaviors.

Established in 2001, Billtrust focuses on traditional payment processing through a robust system that connects to over 200 accounts payable portals. While it excels in managing standard invoices and tracking payments, its reliance on established processes may necessitate adjustments in business workflows. Billtrust does incorporate AI functionalities to enhance customer engagements and optimize receivables; however, it lacks the sophisticated capabilities found in more recent competitors like HighRadius.

This comparative analysis highlights the distinct strengths of each provider:

- Equabli's commitment to customization and user experience

- HighRadius's focus on extensive AR management

- Billtrust's reliable payment processing

As the automation sector for debt recovery is projected to reach USD 11.96 billion by 2033, financial organizations must conduct thorough assessments of these alternatives to align with their operational needs and strategic goals. Insights from financial specialists underscore the importance of selecting the appropriate method to enhance ROI and improve overall effectiveness in receivables.

Pros and Cons of Each Collections Automation Solution

When evaluating for enterprise financial operations, it is crucial to weigh their advantages and disadvantages.

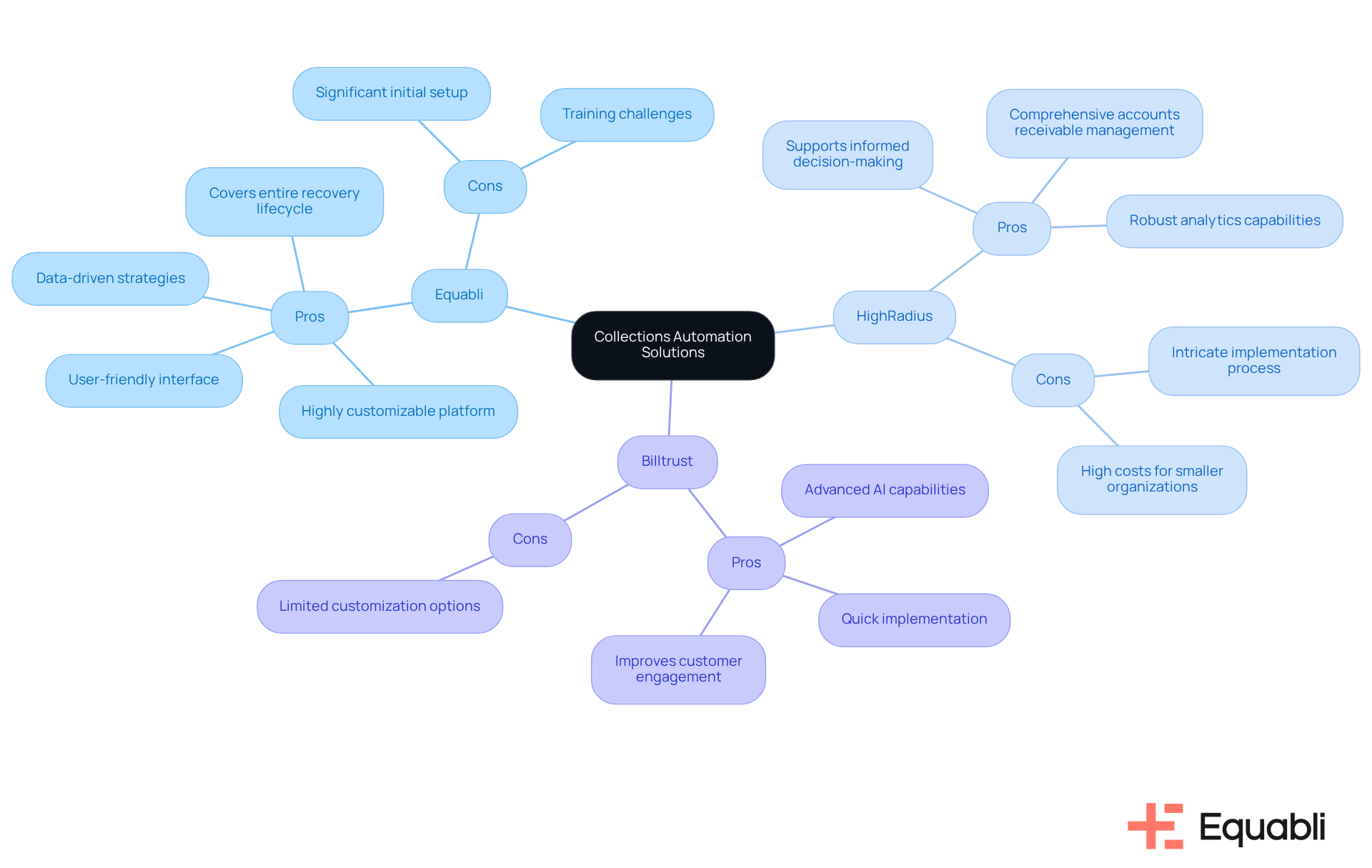

Equabli:

- Point: Equabli offers a highly customizable platform with a user-friendly interface.

- Evidence: It emphasizes data-driven strategies that enhance collection efficiency.

- Explanation: The EQ Suite empowers lenders by transforming manual processes into intelligent, cloud-based alternatives, making collections intuitive and effective. Additionally, Equabli provides a customized launch plan and covers the entire recovery lifecycle, ensuring a smooth transition to modern solutions.

- Link: However, implementation may involve significant initial setup and training, which could pose challenges for some organizations.

HighRadius:

- Point: HighRadius provides comprehensive accounts receivable management with robust analytics capabilities.

- Evidence: This makes it a strong choice for large enterprises with complex needs.

- Explanation: The depth of its analytics supports informed decision-making in managing receivables.

- Link: Nevertheless, the implementation process can be intricate, and the associated costs may be prohibitive for smaller organizations.

Billtrust:

- Point: Billtrust features advanced AI capabilities that facilitate quick implementation.

- Evidence: It improves customer engagement through personalized interactions.

- Explanation: This can lead to enhanced customer satisfaction and loyalty.

- Link: However, customization options are limited compared to competitors, which may not fulfill the varied requirements of all financial entities.

This examination emphasizes the importance of aligning the chosen approach with the particular operational needs and strategic objectives of the organization, especially regarding collections automation solutions for enterprise financial operations. The complexities of implementing automation tools must be carefully considered to optimize resource allocation and enhance overall operational efficiency.

Suitability of Solutions for Various Financial Institution Needs

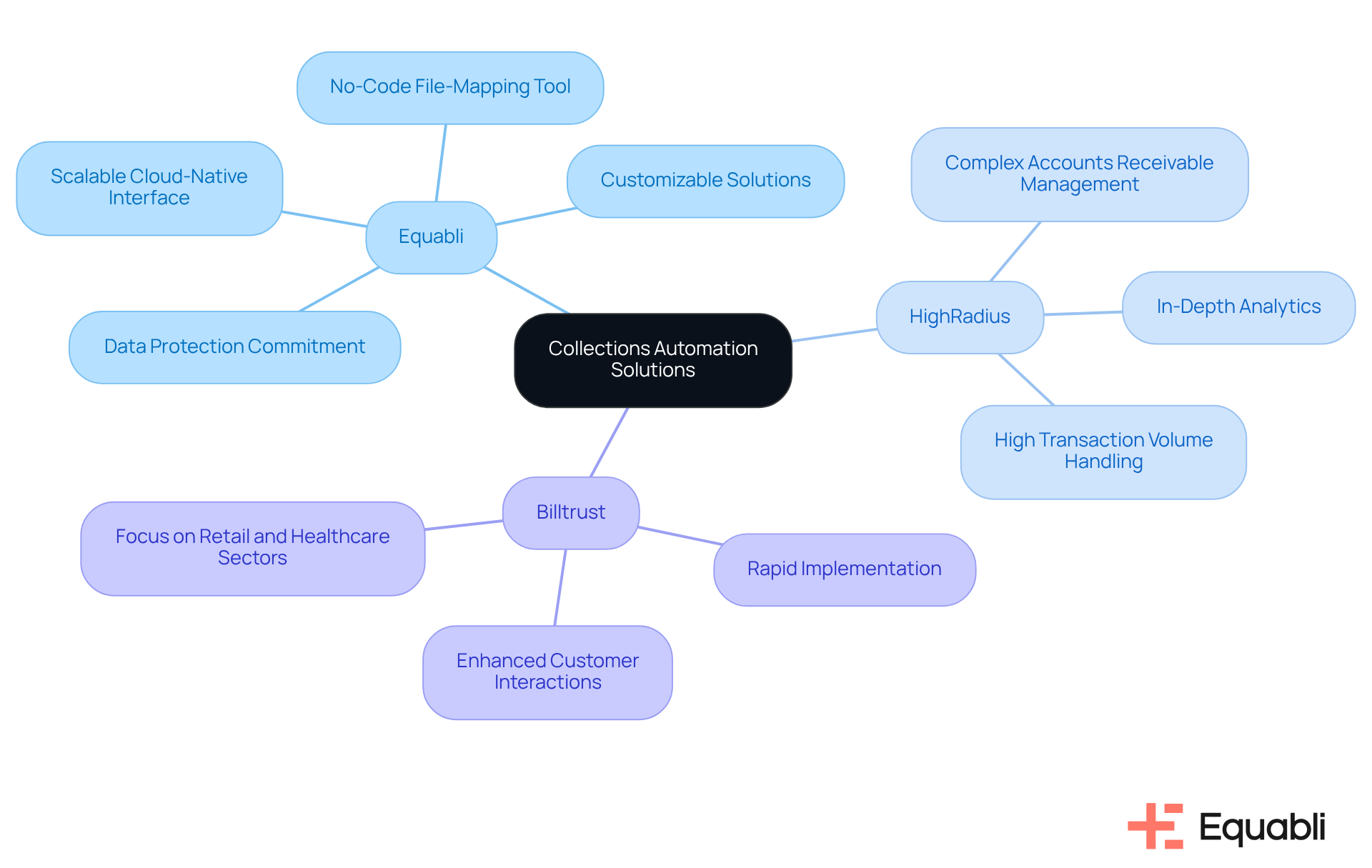

The suitability of collections automation solutions for enterprise financial operations varies significantly across different types of financial institutions.

Equabli serves as an optimal choice for lenders and collection agencies seeking customizable solutions tailored to specific collection strategies and borrower engagement needs. The company demonstrates a strong commitment to , ensuring that client data is managed with the utmost care in adherence to strict privacy policies governing data gathering and usage. Notably, EQ Collect features a no-code file-mapping tool that streamlines vendor onboarding and presents a scalable, cloud-native interface, thereby enhancing operational efficiency.

HighRadius is particularly suited for larger enterprises with intricate accounts receivable processes, as its comprehensive features adeptly manage high volumes of transactions while delivering in-depth analytics.

Billtrust aligns well with organizations that prioritize rapid implementation and enhanced customer interactions, especially in sectors such as retail and healthcare, where customer engagement is paramount.

Equabli's EQ Collect enhances debt recovery efficiency through essential features, including automated workflows, real-time reporting, and data-driven strategies that minimize execution errors. By evaluating the unique needs of each institution, decision-makers can identify the most fitting collections automation solutions for enterprise financial operations, thereby improving operational efficiency and recovery rates.

Conclusion

The exploration of collections automation solutions for enterprise financial operations highlights the critical need to integrate modern technology into the debt recovery process. By automating repetitive tasks and utilizing advanced analytics, financial institutions can markedly enhance efficiency and borrower engagement, ultimately resulting in improved recovery rates. The transition towards automation is not merely a trend; it is a strategic imperative that aligns with the evolving demands of the financial landscape.

Key insights reveal the strengths and weaknesses of leading providers such as Equabli, HighRadius, and Billtrust. Each offers distinct features tailored to varying organizational needs, from Equabli's customizable platform to HighRadius's comprehensive analytics and Billtrust's rapid implementation capabilities. Understanding these distinctions enables financial institutions to make informed decisions that align with their operational goals and enhance their overall effectiveness in managing receivables.

Given the anticipated growth of the collections automation sector, it is essential for organizations to prioritize the adoption of these solutions. By carefully evaluating their specific requirements alongside the capabilities of various providers, financial executives can strategically position their institutions for sustainable success. Embracing collections automation not only streamlines operations but also cultivates stronger relationships with customers, paving the way for a more resilient financial future.

Frequently Asked Questions

What are collections automation solutions in financial operations?

Collections automation solutions are systems designed to modernize the debt recovery process within financial institutions by automating repetitive tasks such as sending payment reminders, tracking overdue accounts, and managing debtor communications.

How do collections automation solutions improve operational efficiency?

These solutions improve operational efficiency by utilizing advanced analytics and artificial intelligence to predict repayment behaviors, allowing institutions to enhance their recovery strategies and reallocate resources from administrative tasks to strategic initiatives.

Why is it important for financial institutions to adopt collections automation solutions?

Adopting collections automation solutions is crucial for maintaining competitiveness, ensuring compliance with regulatory standards, and fostering stronger relationships with customers in the evolving financial landscape.

What is the projected growth of the debt recovery software market?

The debt recovery software market is projected to reach USD 4.6 billion by 2024, indicating a significant shift towards digital debt recovery services.

What financial benefits can organizations expect from implementing collections automation?

Organizations that implement automation can reduce retrieval costs to as low as 3%, showcasing the financial advantages of these innovative strategies.

Why is there an increased demand for efficient debt recovery strategies?

The demand for efficient debt recovery strategies has intensified due to the rising household debt, which has reached an unprecedented high of 16.90 trillion, making effective recovery methods critical in the current economic environment.

How do collections automation solutions enhance compliance and risk management?

Collections automation solutions streamline operations, which helps organizations enhance compliance with regulatory standards and improve risk management in their debt collection efforts.