Overview

The article provides a structured analysis of enterprise debt collection system software tailored for financial institutions, emphasizing key features, benefits, costs, and suitability criteria. Effective software solutions are critical, as they enhance operational efficiency through automation, compliance management, and data-driven strategies. These components ultimately lead to improved recovery rates and reduced operational costs for financial institutions, underscoring the importance of selecting the right tools in a competitive landscape.

Introduction

The financial landscape is increasingly shaped by the efficiency and effectiveness of debt collection processes. This reality makes the choice of enterprise debt collection system software a pivotal decision for institutions. With features that encompass automation, compliance management, and advanced analytics, these systems are designed to enhance operational efficiency and recovery rates. However, as financial institutions navigate the complexities of pricing models, implementation costs, and the pursuit of a solid return on investment, a critical question emerges: how can organizations ensure they select the right software that not only meets their current needs but also adapts to future challenges?

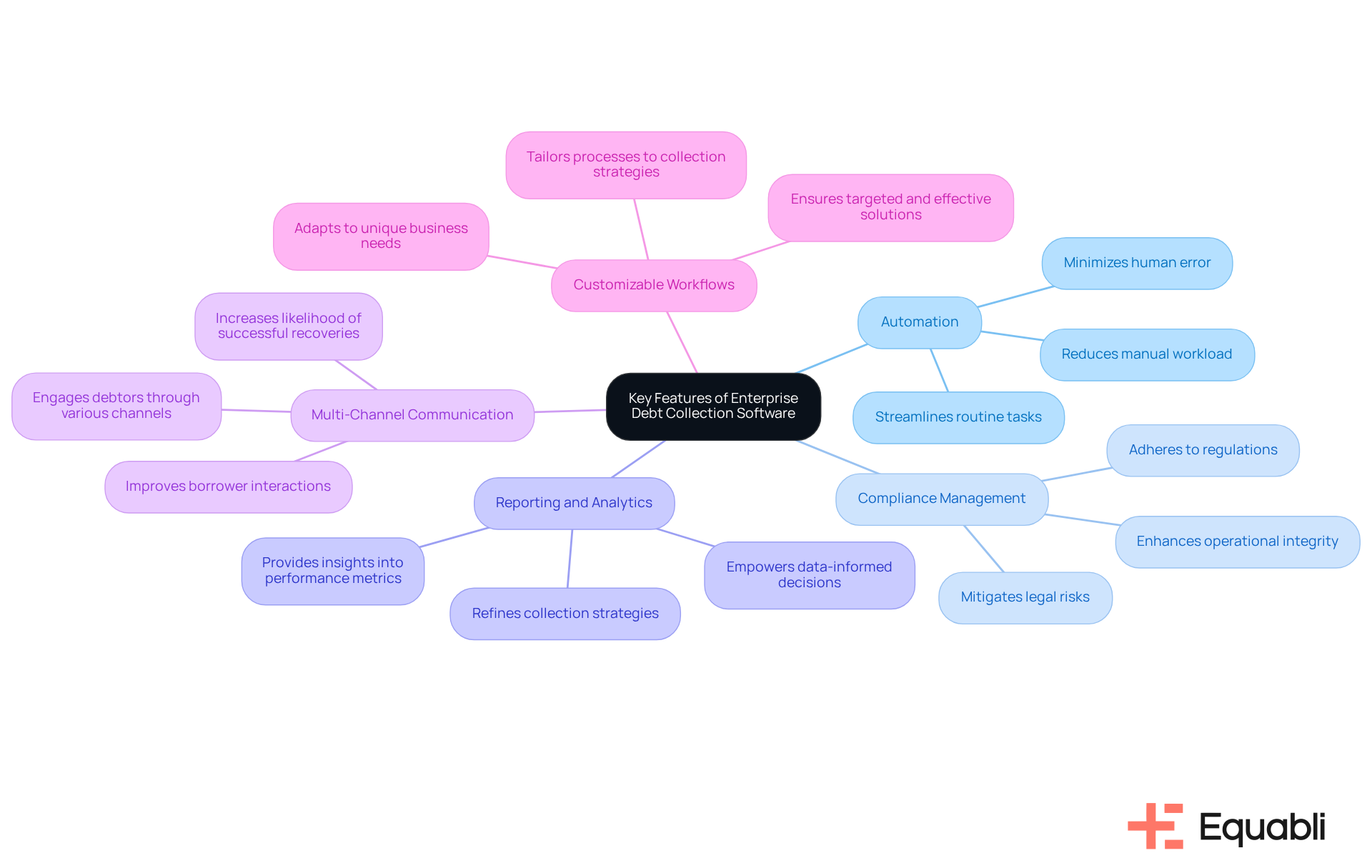

Key Features of Enterprise Debt Collection Software

Enterprise receivables management software encompasses several essential functionalities designed to enhance operational efficiency and ensure compliance. These functionalities are critical for organizations aiming to optimize their enterprise debt collection system software solutions for financial institutions.

- Automation serves as a pivotal feature, streamlining routine tasks such as payment reminders and follow-ups. This significantly reduces the manual workload for collection teams. By minimizing human error, automation not only saves time but also enables staff to concentrate on more complex cases, ultimately improving overall operational efficiency.

- Compliance Management is another vital aspect, ensuring adherence to key regulations, including the General Data Protection Regulation (GDPR) and the Fair Debt Recovery Practices Act (FDCPA). By incorporating compliance management features, institutions can mitigate legal risks and enhance their operational integrity, thereby fostering a more secure working environment.

- Reporting and Analytics functionalities provide robust tools that yield valuable insights into performance metrics, recovery rates, and debtor behavior. These analytics empower organizations to make data-informed decisions, refining their collection strategies and enhancing overall effectiveness in debt recovery.

- Multi-Channel Communication capabilities facilitate engagement with debtors through various channels—email, SMS, and phone. This flexibility not only improves borrower interactions but also increases the likelihood of , which is crucial for enterprise debt collection system software solutions for financial institutions in modern debt collection practices.

- Customizable Workflows allow institutions to tailor processes according to specific collection strategies. This adaptability is crucial as it enables organizations to modify their approaches based on unique business needs and debtor profiles, ensuring a more targeted and effective enterprise debt collection system software solutions for financial institutions.

For instance, Equabli's EQ Suite exemplifies these principles by offering a comprehensive suite of tools that empower lenders to develop custom scoring models and refine their recovery strategies. Such adaptability is indispensable in today’s dynamic financial landscape, where the ability to respond to evolving regulations and market conditions can significantly influence recovery success.

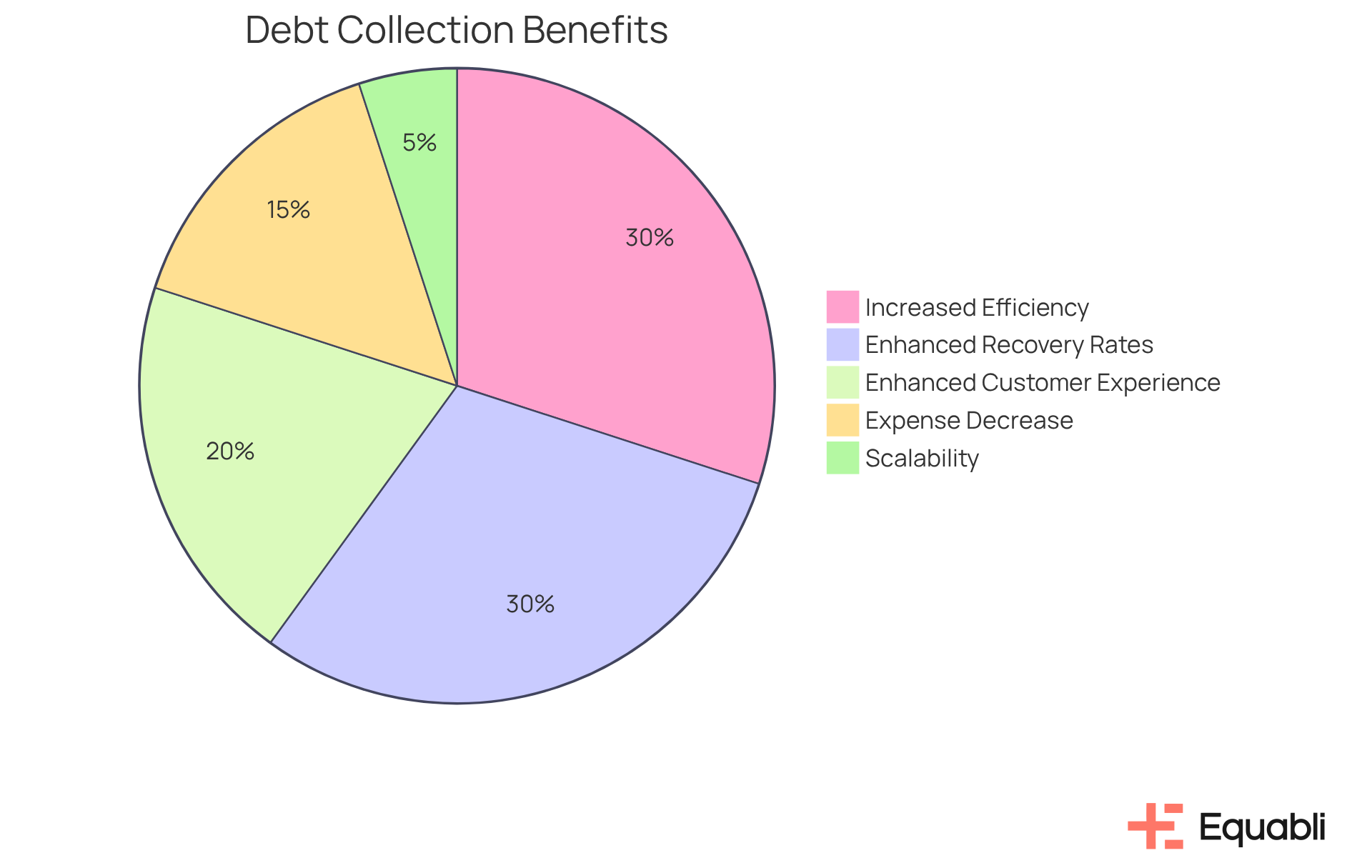

Benefits of Implementing Debt Collection Systems

Implementing debt collection systems offers significant advantages for financial institutions, including:

- Increased Efficiency: Automation of repetitive tasks enables staff to focus on more complex issues, thereby enhancing overall productivity. Organizations that have adopted automated solutions report a reduction in days sales outstanding (DSO) by up to 30%, demonstrating the efficiency gains achieved through streamlined processes. This shift not only but also enhances operational workflows.

- Enhanced Recovery Rates: Data-driven strategies empower organizations to target appropriate debtors with personalized approaches, significantly increasing the likelihood of repayment. Financial institutions utilizing automated systems have observed recovery rate increases of up to 30%, illustrating the effectiveness of these technologies in improving retrieval efforts. Such enhancements are crucial for maintaining cash flow and reducing write-offs.

- Enhanced Customer Experience: Multi-channel communication and self-service options promote better debtor engagement and satisfaction. Automated systems can tailor communication based on debtor behavior, resulting in higher engagement rates and expedited payment resolutions. This personalization fosters stronger relationships and encourages timely repayments.

- Expense Decrease: By minimizing manual involvement and optimizing procedures, organizations can achieve substantial operational savings. For instance, automation can reduce the need for large personnel groups, leading to average labor cost reductions of $38,571 per institution. Furthermore, the net profit contribution from these automated systems can reach up to $101,905, while cash flow improvements can total $833,333. These financial benefits underscore the importance of investing in technology-driven solutions.

- Scalability: Cloud-based solutions offer the flexibility to expand operations in line with institutional growth, effectively managing increasing volumes of obligations without compromising efficiency. This adaptability is essential for navigating the dynamic landscape of financial services.

These advantages illustrate how contemporary enterprise debt collection system software solutions for financial institutions can transform retrieval processes while enhancing operational efficiency.

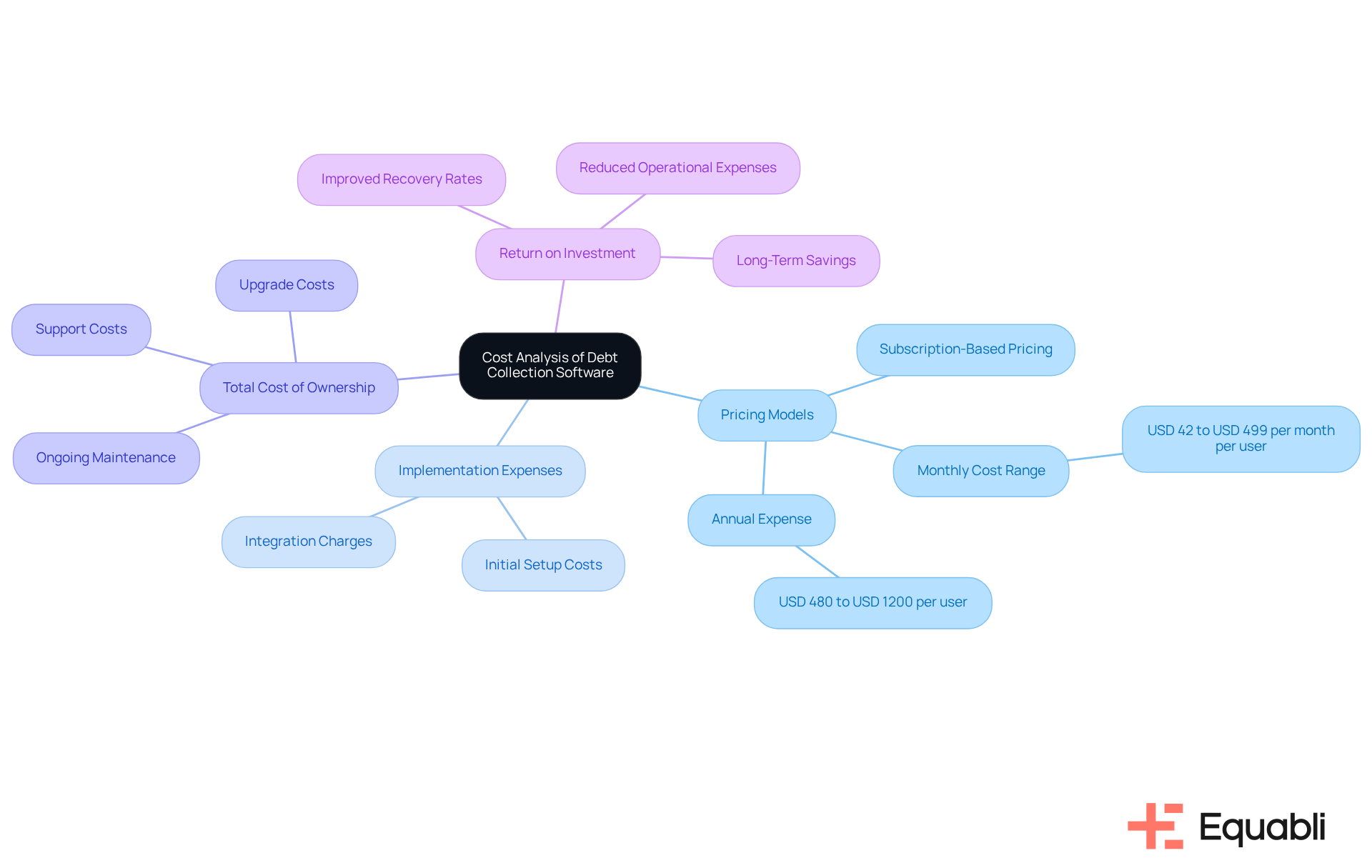

Cost Analysis of Leading Debt Collection Software Solutions

When analyzing the costs associated with enterprise debt collection system software solutions for financial institutions, several key factors must be considered.

- Pricing Models: Most software solutions adopt subscription-based pricing, typically ranging from $42 to over $499 per month per user, depending on features and scalability. The average annual expense for debt collection software varies from USD 480 to USD 1200 per user, providing a clearer perspective on the pricing landscape. This pricing framework is essential for institutions to evaluate their budgetary allocations effectively.

- Implementation Expenses: Initial setup and integration can incur additional charges, which vary by provider. Institutions should prepare for these expenses, as they can significantly impact the overall budget. Understanding these costs is vital for accurate financial forecasting and resource allocation.

- Total Expense of Ownership (TCO): Institutions must factor in ongoing maintenance, support, and potential upgrade costs over time. These elements contribute to the long-term financial commitment associated with the software, underscoring the importance of a comprehensive cost analysis in the decision-making process.

- Return on Investment (ROI): Evaluating the anticipated ROI from improved recovery rates and reduced operational expenses is crucial. While certain platforms may present higher initial costs, their can yield substantial long-term savings. This strategic assessment is imperative for financial organizations to optimize their investment in enterprise debt collection system software solutions for financial institutions.

The Debt Collection Software market is projected to grow at a 9.7% CAGR from 2024 to 2030, reaching a value exceeding USD 4.9 billion by 2030. This growth trajectory emphasizes the necessity of investing in efficient financial recovery solutions. For instance, platforms that integrate predictive analytics and automation can enhance retrieval strategies, ultimately improving recovery rates and minimizing expenses associated with manual processes. Such strategic investments are crucial for financial organizations, necessitating a thorough cost analysis prior to selecting enterprise debt collection system software solutions for financial institutions.

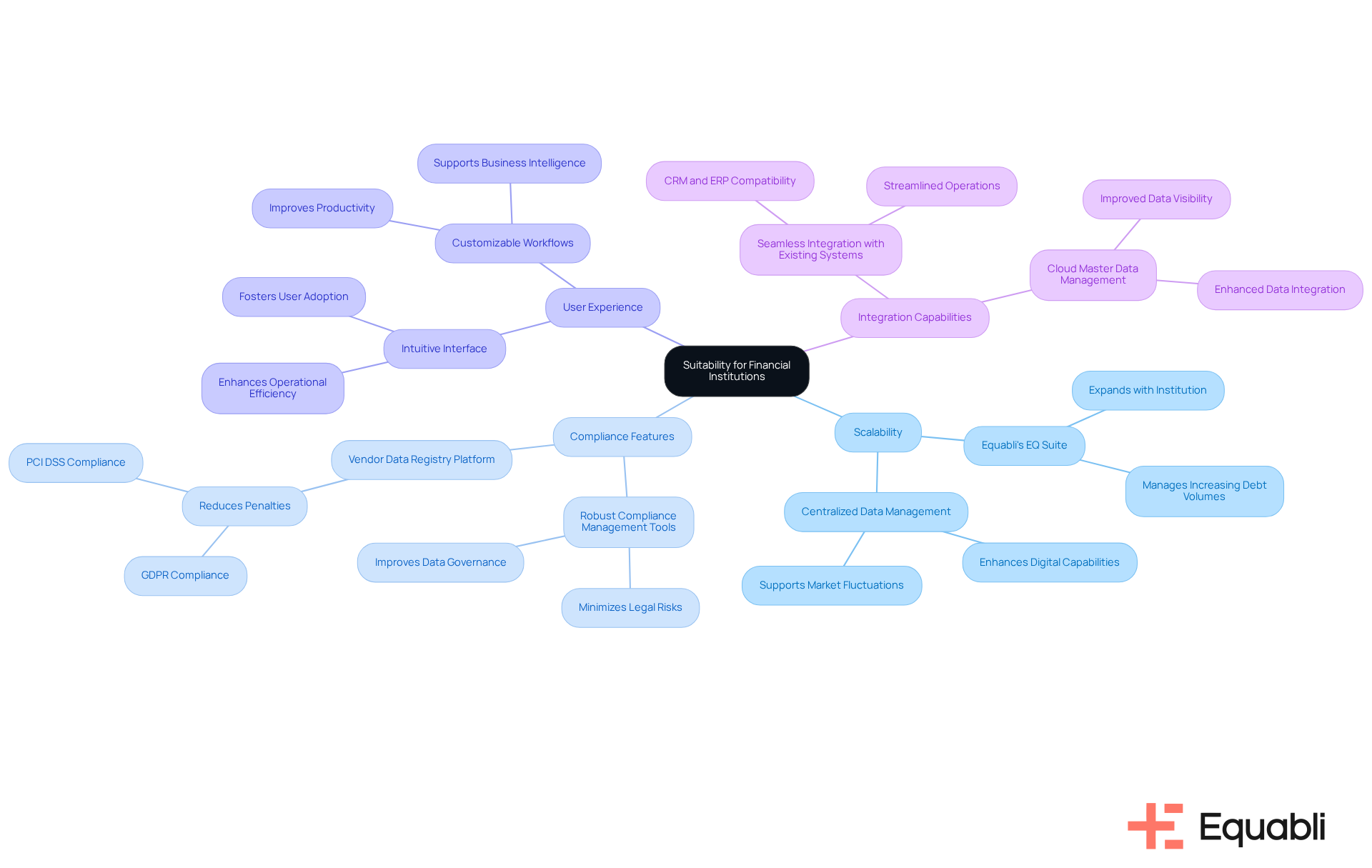

Comparative Evaluation: Suitability for Financial Institutions

In evaluating the suitability of enterprise debt collection system software solutions for financial institutions, it is essential to consider several key criteria.

- Scalability: Solutions such as Equabli's EQ Suite are engineered to expand alongside the institution, effectively managing increasing debt volumes without sacrificing performance. KPMG LLP emphasizes that centralized data management significantly enhances digital capabilities, a critical factor for institutions navigating fluctuating market conditions.

- Compliance Features: Robust compliance management tools are vital for minimizing legal risks. For example, a financial services company successfully developed a vendor data registry platform that improved data governance and compliance, leading to a notable reduction in the risk of incurring costly penalties related to regulations such as GDPR and PCI DSS.

- User Experience: An intuitive interface combined with customizable workflows fosters user adoption and operational efficiency. Pape, Director of Data Governance at MHE, states, "With better data and better BI, we can run the business more efficiently," underscoring the importance of user-friendly software in enhancing productivity.

- Integration Capabilities: The capacity to integrate seamlessly with existing systems, including CRM and ERP, is crucial for streamlined operations. Effective integration facilitates smooth data flow across systems, thereby enhancing overall efficiency.

The implementation of by Holiday Inn Club Vacations exemplifies this, resulting in improved data visibility and streamlined operations. As the debt collection landscape continues to evolve, leveraging enterprise debt collection system software solutions for financial institutions will be imperative for achieving sustainable growth and operational excellence.

Conclusion

The exploration of enterprise debt collection system software for financial institutions highlights the critical need for advanced technological solutions that enhance operational efficiency and ensure compliance with regulatory standards. By integrating features such as automation, compliance management, and multi-channel communication, financial institutions can significantly improve their debt recovery processes while mitigating risks associated with manual operations.

Key arguments illustrate the transformative benefits of implementing these systems, including:

- Increased efficiency

- Enhanced recovery rates

- Improved customer experiences

- Substantial cost savings

A thorough cost evaluation is essential, taking into account pricing models, implementation expenses, and return on investment. As the debt collection software market continues to expand, understanding these elements is vital for making informed decisions that align with institutional growth and regulatory requirements.

In a rapidly evolving financial landscape, adopting enterprise debt collection software is not merely a strategic advantage but a necessity for financial institutions aiming to thrive. Embracing these innovative solutions will streamline operations and foster stronger relationships with debtors, ultimately leading to improved recovery outcomes. Institutions are urged to assess their current systems and consider integrating advanced debt collection software to maintain competitiveness and responsiveness to market demands.

Frequently Asked Questions

What is enterprise debt collection software?

Enterprise debt collection software is a type of receivables management software designed to enhance operational efficiency and ensure compliance for organizations, particularly financial institutions, in their debt collection processes.

What are the key features of enterprise debt collection software?

Key features include automation, compliance management, reporting and analytics, multi-channel communication, and customizable workflows.

How does automation benefit debt collection teams?

Automation streamlines routine tasks such as payment reminders and follow-ups, reducing manual workload and human error, allowing staff to focus on more complex cases and improving overall operational efficiency.

Why is compliance management important in debt collection software?

Compliance management ensures adherence to regulations like the General Data Protection Regulation (GDPR) and the Fair Debt Recovery Practices Act (FDCPA), helping institutions mitigate legal risks and enhance operational integrity.

What role do reporting and analytics play in debt collection?

Reporting and analytics provide insights into performance metrics, recovery rates, and debtor behavior, enabling organizations to make data-informed decisions and refine their collection strategies for better effectiveness.

How does multi-channel communication enhance debt collection efforts?

Multi-channel communication allows engagement with debtors through various channels such as email, SMS, and phone, improving borrower interactions and increasing the likelihood of successful recoveries.

What is the significance of customizable workflows in debt collection software?

Customizable workflows allow institutions to tailor processes according to specific collection strategies, enabling them to adapt their approaches based on unique business needs and debtor profiles for more targeted effectiveness.

Can you provide an example of enterprise debt collection software?

Equabli's EQ Suite is an example that offers tools for lenders to develop custom scoring models and refine recovery strategies, demonstrating adaptability to evolving regulations and market conditions.