Overview

This article delves into the critical role of financial institutions in mastering the Fair Debt Collection Practices Act (FDCPA) to ensure compliance and uphold ethical debt collection practices. Understanding and adhering to the FDCPA is not merely a legal obligation; it serves as a robust shield against potential legal repercussions while simultaneously enhancing institutional reputation and fostering consumer trust. Compliance with these regulations cultivates respectful interactions and operational efficiencies within debt collection processes, ultimately prompting institutions to prioritize ethical standards in their practices.

Introduction

The landscape of debt collection is governed by stringent regulations designed to protect consumers from abusive practices, with the Fair Debt Collection Practices Act (FDCPA) at the forefront. This pivotal legislation outlines the ethical parameters that collectors must adhere to and serves as a crucial framework for financial institutions striving for compliance and operational integrity.

As the regulatory environment evolves, organizations face the pressing question: how can they ensure compliance while fostering positive relationships with their clients?

This article delves into the intricacies of the FDCPA, exploring its key provisions, the implications of compliance, and modern strategies that financial institutions can implement to navigate the complexities of debt collection effectively.

Explore the Fair Debt Collection Practices Act (FDCPA)

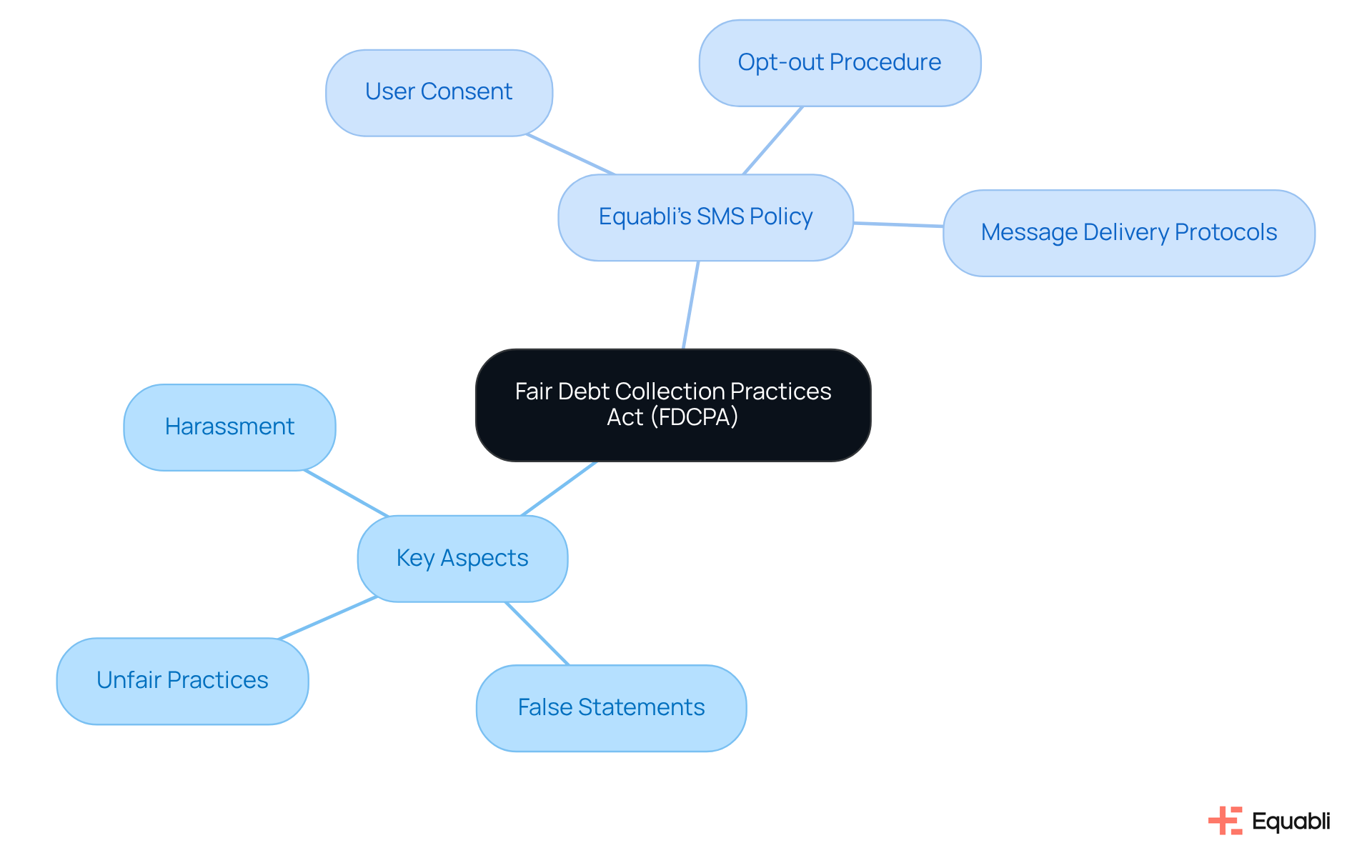

Established in 1977, the Fair Debt Collection Practices Act aims to eradicate abusive collection methods employed by collectors. This legislation delineates rules that creditors must follow when attempting to recover amounts from clients. Specifically, the Fair Debt Collection Practices Act ensures that personal, family, and household financial obligations are handled with fairness and dignity for consumers. Key aspects of the Fair Debt Collection Practices Act include:

- Strict prohibitions against harassment

- False statements

- Unfair practices

For financial institutions, understanding these regulations is imperative to navigate the complexities of debt collection in a legal and ethical manner.

In this context, Equabli’s SMS Policy places a strong emphasis on user consent, mandating that individuals provide their mobile numbers and opt-in for communications. This requirement guarantees that individuals retain over their information. Furthermore, the policy outlines a straightforward opt-out procedure, allowing users to effortlessly cease receiving messages by texting STOP. This approach not only strengthens adherence to the principles of fair treatment but also enhances user autonomy.

Additionally, the policy specifies message delivery protocols, indicating that if a device does not support MMS, messages may be sent as SMS. This clarity is essential for user understanding. The frequency of messages may vary by account, and message and data charges could apply, in accordance with the Fair Debt Collection Practices Act's purpose to safeguard individuals and uphold ethical standards in credit collection.

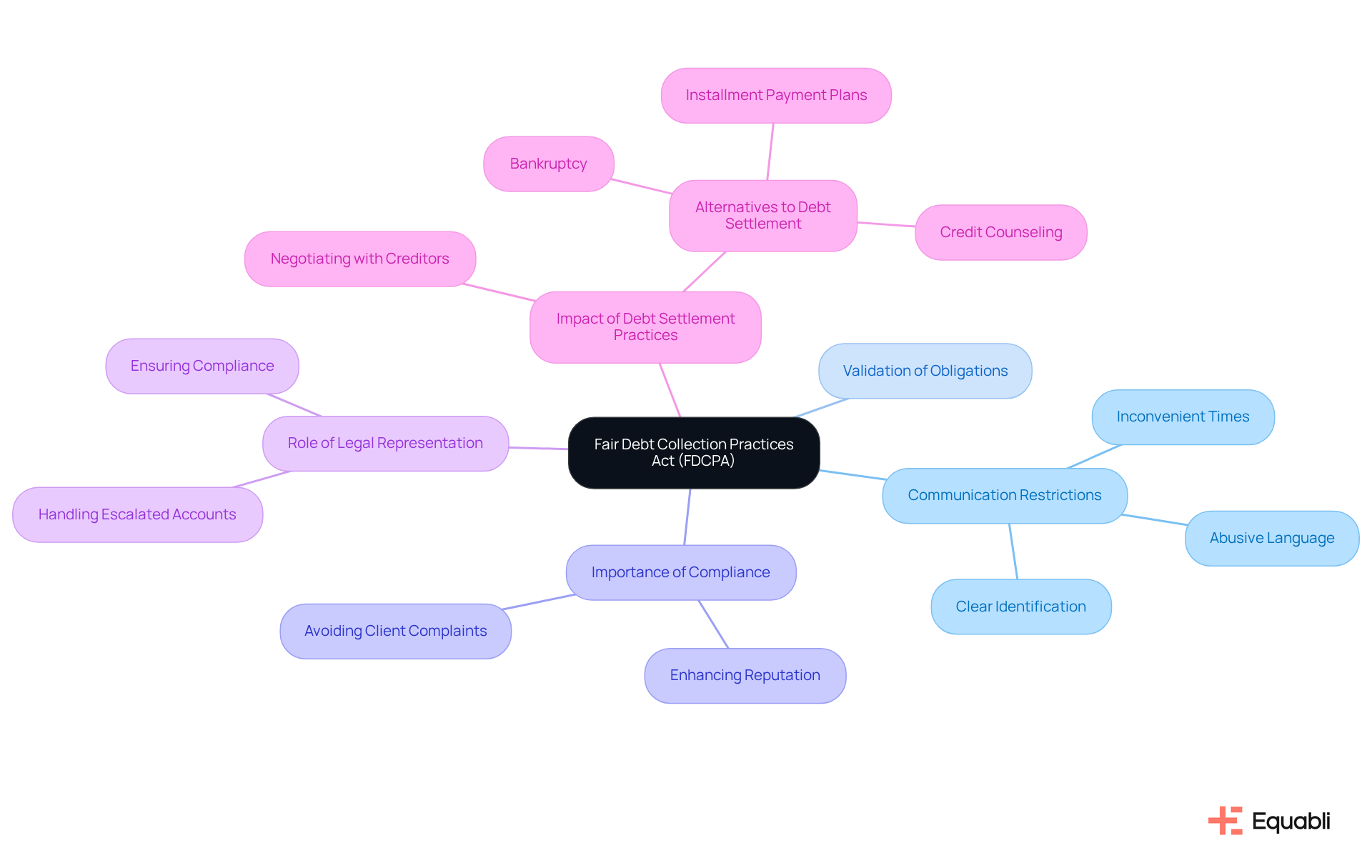

Understand Key Provisions and Limitations of the FDCPA

The Fair Debt Collection Practices Act establishes critical regulations that debt collectors must follow to ensure fair treatment of consumers. Among the key provisions are:

- Communication Restrictions: Debt collectors are prohibited from contacting consumers at inconvenient times or locations, such as late at night or at their workplace if the employer disapproves. This regulation is designed to protect consumers from undue stress and harassment, in accordance with the fair debt collection practices act. The fair debt collection practices act explicitly prohibits the use of abusive language, threats, or any form of intimidation during the collection process. This provision is essential for maintaining . Collectors must clearly identify themselves and inform individuals of their rights under the fair debt collection practices act. Clarity in communication fosters trust and aids individuals in understanding their responsibilities and options.

- Validation of Obligations: Consumers have the right to request validation of their obligations, and collectors are required to provide this information. This process ensures that individuals are not held accountable for debts they might not owe.

Understanding these provisions is vital for financial institutions to avoid practices that could lead to violations of the fair debt collection practices act and result in client complaints. Recent data indicates a significant number of client grievances concerning violations of debt collection practices, underscoring the necessity of compliance. Financial institutions that adhere to these guidelines not only reduce the risk of harassment claims but also enhance their reputation by cultivating positive relationships with consumers. Legal experts emphasize that staying informed about changes to communication limitations and the constraints imposed by the fair debt collection practices act is essential for effective collection strategies.

Equabli's EQ Collect enhances compliance with the fair debt collection practices act by providing automated workflows that minimize execution errors and ensure timely reporting. Additionally, the no-code file-mapping tool streamlines vendor onboarding, enabling institutions to manage their collection processes effectively. By leveraging data-driven strategies, financial institutions can refine their debt collection processes while adhering to legal requirements. Organizations that implement EQ Collect not only mitigate the risk of harassment claims but also bolster their reputation by nurturing positive connections with clients. Legal experts reiterate that being aware of changes to communication limitations and the constraints set by the fair debt collection practices act is crucial for successful collection strategies.

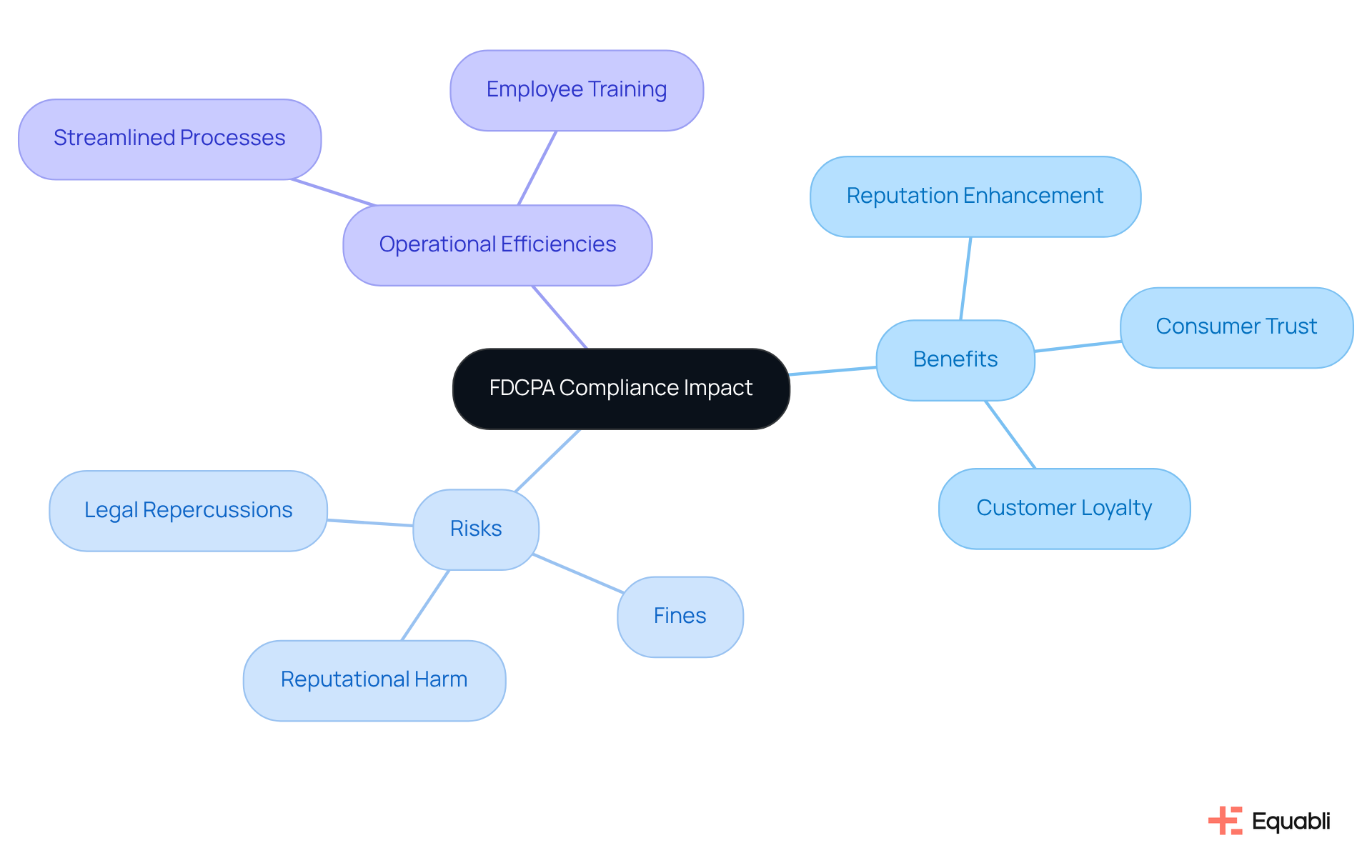

Assess the Impact of FDCPA Compliance on Financial Institutions

Adherence to the fair debt collection practices act is not merely a legal obligation for financial institutions; it represents a strategic advantage that extends beyond compliance. By prioritizing adherence to regulations, organizations significantly mitigate the risk of legal repercussions while simultaneously enhancing their reputation among clients. Research indicates that firms demonstrating strong compliance with debt collection regulations cultivate greater consumer trust, as clients feel respected and valued throughout the collection process. This trust fosters improved customer relationships, ultimately leading to enhanced loyalty and long-term engagement.

Furthermore, compliance with financial debt collection regulations can drive substantial operational efficiencies. Well-defined adherence guidelines , empowering institutions to manage delinquency more effectively. For instance, organizations that implement comprehensive training initiatives on debt collection practices often report improved staff performance and a more cohesive operational framework. As Lisa Alvarez, SVP of Regulatory Compliance at SWBC, asserts, "Providing an effective training program helps employee performance and contributes to the organization’s success." In contrast, non-compliance with the fair debt collection practices act can lead to costly lawsuits, fines, and reputational harm, highlighting the critical need to embed training on the fair debt collection practices act within the core operations of financial institutions. Since 2008, American financial institutions have incurred penalties exceeding $243 billion for regulatory violations, underscoring the high stakes involved. As industry leaders emphasize, a commitment to regulatory compliance not only safeguards against legal challenges but also nurtures a culture of respect and transparency that benefits both the institution and its clients.

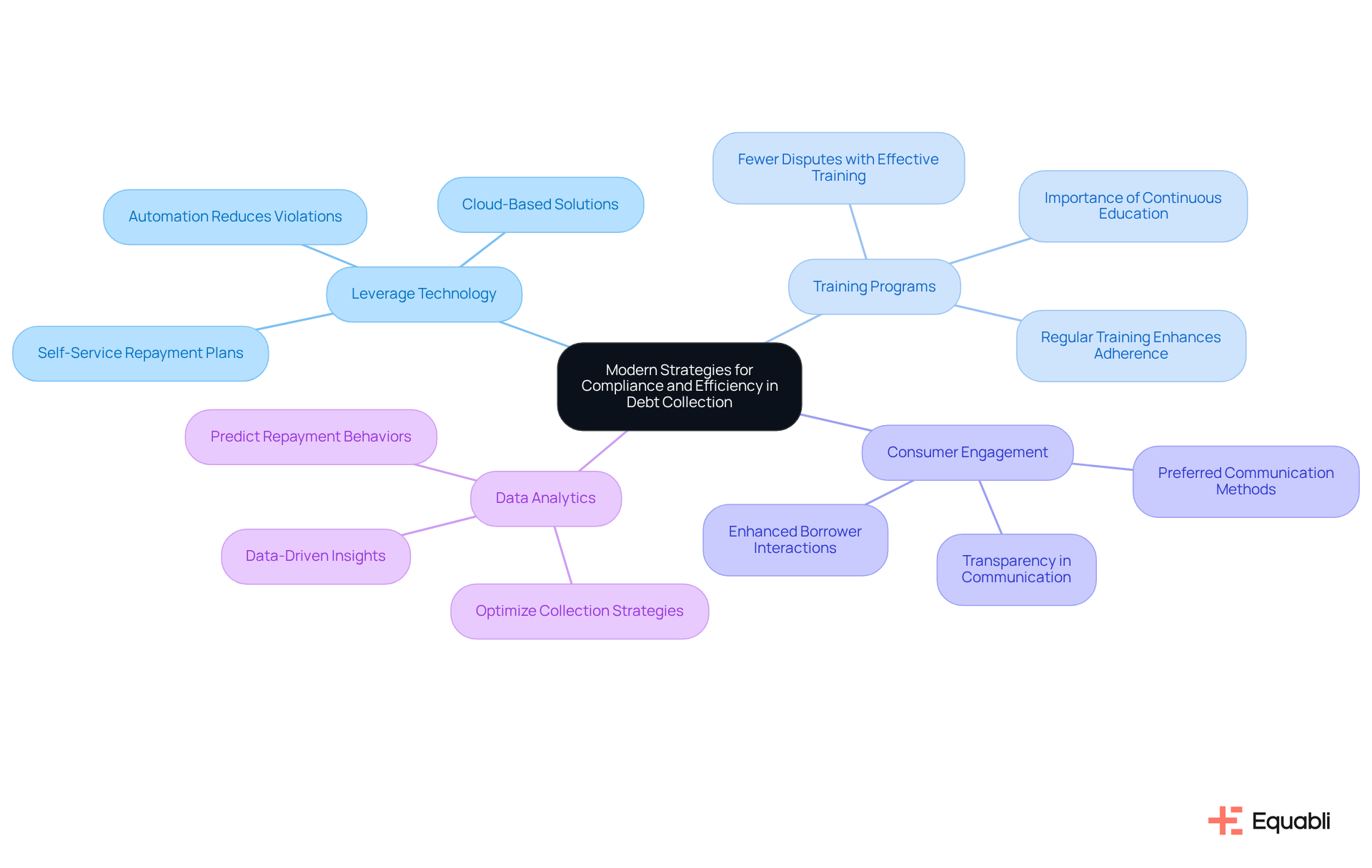

Implement Modern Strategies for Compliance and Efficiency in Debt Collection

To enhance compliance and efficiency in debt collection, financial institutions must adopt strategic measures that yield tangible results:

- Leverage Technology: Implementing cloud-based debt collection solutions, such as Equabli's EQ Suite, is essential. These user-friendly, customizable solutions are built on high-security standards and automate regulatory checks, significantly lowering the risk of violations while enhancing operational efficiency. Research indicates that automation can reduce rule violations by up to 37% compared to manual procedures. The EQ Engine, for example, empowers borrowers with self-service repayment plans, allowing institutions to engage borrowers through their preferred channels, ultimately leading to improved collection rates.

- Training Programs: Establishing regular training sessions focused on debt collection regulations and best practices is critical. Effective training programs have been shown to significantly enhance adherence outcomes; agencies prioritizing the fair debt collection practices act experience 28% fewer disputes and 34% higher resolution rates. Continuous education ensures that staff remain well-versed in their responsibilities and the latest regulatory changes. Alarmingly, only 12% of organizations have an advanced training program for ethics, underscoring the necessity for enhanced training initiatives.

- Consumer Engagement: Utilizing consumer-friendly communication methods, such as text messaging and online portals, fosters engagement and transparency. By aligning communication strategies with consumer preferences, institutions can enhance borrower interactions and improve overall satisfaction. Agencies with robust FDCPA adherence programs have encountered 28% fewer disputed accounts and 34% higher resolution rates, reinforcing the connection between effective communication methods and enhanced adherence results. Equabli's EQ Engage platform facilitates strong agency and inventory management, ensuring regulatory oversight in these interactions.

- Data Analytics: Employing data-driven insights to customize collection strategies that resonate with consumer behaviors is paramount. Advanced analytics, such as those offered by Equabli's SCORE + SEGMENT feature, enable institutions to predict repayment behaviors and optimize their approaches, ultimately leading to more effective collections. This comprehensive approach to data standardization and strategy execution enhances portfolio management and regulatory solutions.

By implementing these strategies, financial institutions can not only ensure compliance with the fair debt collection practices act but also enhance their overall collection effectiveness, positioning themselves for sustainable growth in a competitive landscape.

Conclusion

The Fair Debt Collection Practices Act (FDCPA) is not merely a regulatory framework; it is a cornerstone for ethical and respectful debt collection practices. By establishing definitive guidelines, the FDCPA safeguards consumers against abusive tactics and champions transparency and fairness in financial transactions. For financial institutions, understanding and adhering to these regulations is essential—not only as a legal obligation but as a strategic avenue to build trust and foster positive client relationships.

This article has illuminated key provisions of the FDCPA, such as:

- Communication restrictions

- Validation of obligations

- The imperative of ethical practices in debt collection

Furthermore, it underscores how contemporary strategies—leveraging technology and implementing robust training programs—can bolster compliance and enhance operational efficiency. By prioritizing adherence to the FDCPA, financial institutions can effectively mitigate risks while cultivating a culture of respect that benefits both the organization and its clients.

Ultimately, the importance of the FDCPA transcends mere compliance; it embodies an opportunity for financial institutions to affirm their commitment to ethical practices. By adopting modern strategies and nurturing a consumer-centric approach, organizations can not only fulfill regulatory requirements but also elevate their reputation and secure long-term success in the competitive debt collection landscape. Proactively pursuing compliance and ethical engagement is critical for establishing a sustainable future in financial services.

Frequently Asked Questions

What is the Fair Debt Collection Practices Act (FDCPA)?

The Fair Debt Collection Practices Act (FDCPA) is a legislation established in 1977 aimed at eradicating abusive collection methods used by debt collectors. It sets rules that creditors must follow when recovering amounts from clients, ensuring that personal, family, and household financial obligations are handled fairly and with dignity.

What are the key prohibitions outlined in the FDCPA?

The FDCPA includes strict prohibitions against harassment, false statements, and unfair practices in debt collection.

Why is it important for financial institutions to understand the FDCPA?

It is imperative for financial institutions to understand the FDCPA to navigate the complexities of debt collection in a legal and ethical manner.

What does Equabli’s SMS Policy emphasize regarding user consent?

Equabli’s SMS Policy emphasizes that individuals must provide their mobile numbers and opt-in for communications, ensuring they retain ownership rights over their information.

How can users opt-out of receiving messages according to Equabli’s SMS Policy?

Users can easily opt-out of receiving messages by texting STOP, which allows them to cease communications effortlessly.

What message delivery protocols are specified in Equabli’s SMS Policy?

The policy indicates that if a device does not support MMS, messages may be sent as SMS, providing clarity for user understanding.

Are there any charges associated with receiving messages under Equabli’s SMS Policy?

Yes, the frequency of messages may vary by account, and message and data charges could apply, in line with the FDCPA's purpose to safeguard individuals and uphold ethical standards in credit collection.