Overview

The article presents effective strategies for implementing a Compliance Management System (CMS) within financial institutions, underscoring its critical role in managing compliance risks and cultivating a culture of adherence. Key components—risk assessment, training, and continuous monitoring—are highlighted as fundamental for maintaining operational integrity and adapting to regulatory changes. This proactive approach not only safeguards institutions from potential penalties but also enhances trust with stakeholders, ultimately reinforcing the institution's reputation and operational resilience.

Introduction

In an increasingly complex regulatory landscape, financial institutions are under significant pressure to ensure compliance with established standards. The implementation of an effective Compliance Management System (CMS) is crucial, as it not only protects against potential legal repercussions but also cultivates a culture of integrity and trust among clients and stakeholders.

The challenge, however, lies in navigating the numerous components and strategies essential for a successful CMS implementation. What key steps must financial institutions undertake to develop a robust CMS that adapts to evolving regulations while enhancing operational performance?

Define Compliance Management System and Its Importance

A Conformance Oversight System (COS) serves as a structured framework that organizations employ to ensure compliance with laws, regulations, and internal policies. For financial institutions, adopting compliance management system implementation strategies for financial institutions is essential, as these strategies effectively manage the risks associated with non-compliance, which can result in substantial penalties and reputational harm.

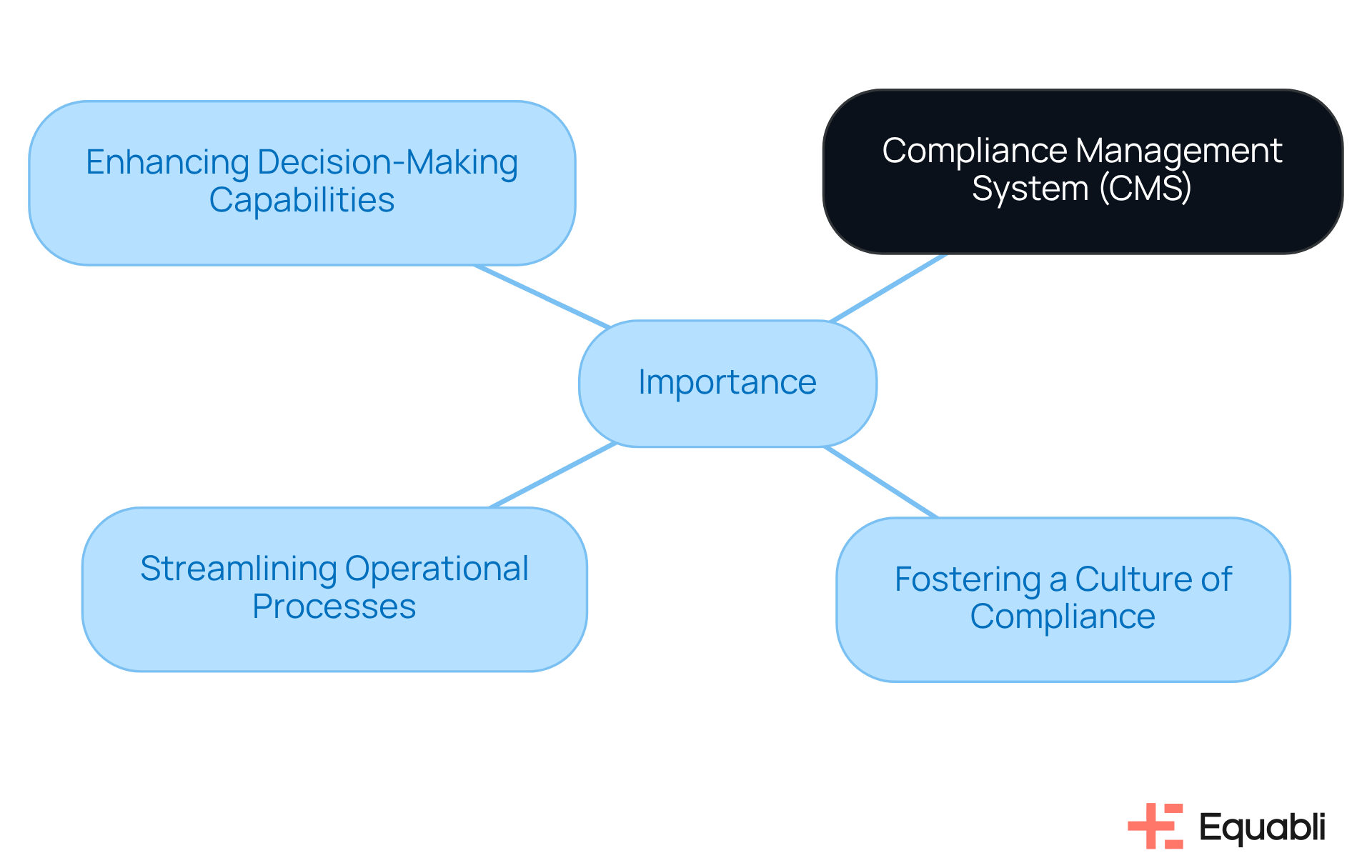

The importance of a CMS lies in its ability to:

- Foster a culture of compliance

- Streamline operational processes

- Enhance decision-making capabilities

By adopting a CMS, institutions not only shield themselves from legal repercussions but also cultivate trust with clients and stakeholders, ultimately driving improved operational performance and customer satisfaction.

Identify Key Components of an Effective Compliance Management System

An effective Compliance Management System is comprised of several key components:

- Risk Assessment: Regularly assess potential regulatory risks specific to your institution's operations. This proactive approach mitigates exposure to compliance failures and enhances operational resilience.

- Policies and Procedures: Establish clear, documented guidelines that outline adherence expectations and procedures. These frameworks are essential for establishing compliance management system implementation strategies for financial institutions and ensuring operational integrity.

- Training and Communication: Implement ongoing training programs to ensure all employees understand regulatory requirements and their roles in maintaining them. Continuous education fosters a knowledgeable workforce, essential for compliance adherence.

- Monitoring and Auditing: Establish processes for continuous monitoring and periodic audits to evaluate adherence effectiveness. This systematic oversight identifies gaps and reinforces across the organization.

- Reporting Mechanisms: Establish avenues for reporting adherence issues or breaches without fear of retaliation. Encouraging transparency enables early detection of potential compliance risks and promotes a culture of integrity.

- Leadership Supervision: Ensure that upper-level executives are actively engaged in adherence initiatives and foster a culture of conformity throughout the organization. Executive involvement is critical in driving compliance management system implementation strategies for financial institutions and aligning these strategies with strategic objectives.

Develop and Implement Your Compliance Management System

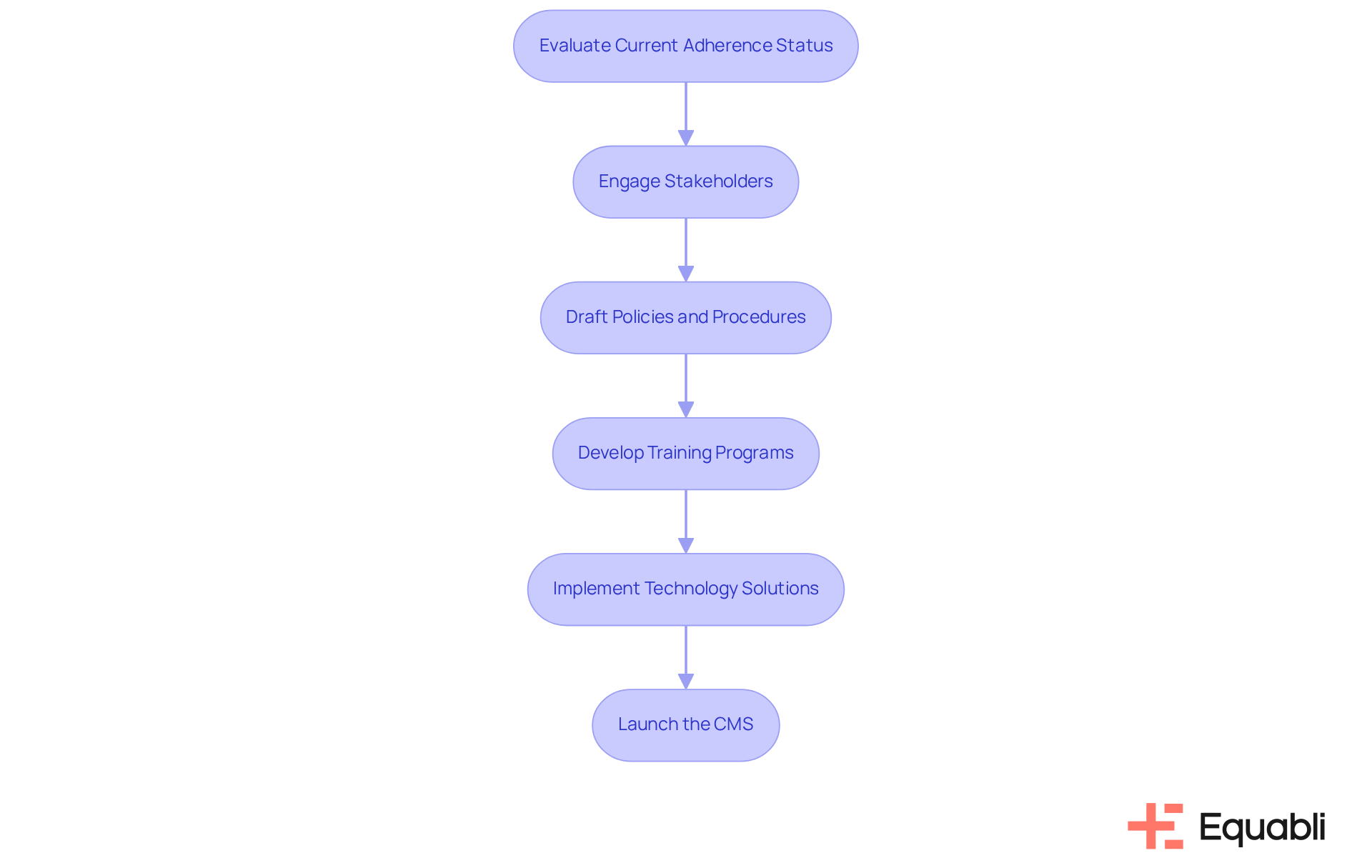

To develop and implement your Compliance Management System (CMS), adhere to the following structured approach:

- Evaluate Current Adherence Status: Conduct a thorough review of existing regulatory practices to identify compliance gaps. This assessment will inform necessary adjustments and enhance overall adherence.

- Engage Stakeholders: Involve key stakeholders from various departments to gather insights and foster a collaborative approach. Engaging diverse perspectives ensures comprehensive policy development and enhances buy-in across the organization.

- Draft Policies and Procedures: Create comprehensive policies that address identified risks and regulatory requirements. Well-defined procedures not only mitigate risks but also establish a clear framework for compliance.

- Develop Training Programs: Design tailored training sessions for different roles within the organization to ensure understanding and buy-in. Effective training is crucial for operationalizing compliance management system implementation strategies for financial institutions and equipping employees with the necessary knowledge.

- Implement Technology Solutions: Utilize technology, such as Equabli's , to automate adherence tracking and reporting processes. Leveraging technology enhances efficiency and accuracy in compliance management system implementation strategies for financial institutions.

- Launch the CMS: Officially roll out the CMS, ensuring all employees are informed and equipped to adhere to new policies. A successful launch is critical for fostering a culture of compliance within the organization.

Establish Continuous Monitoring and Improvement Processes

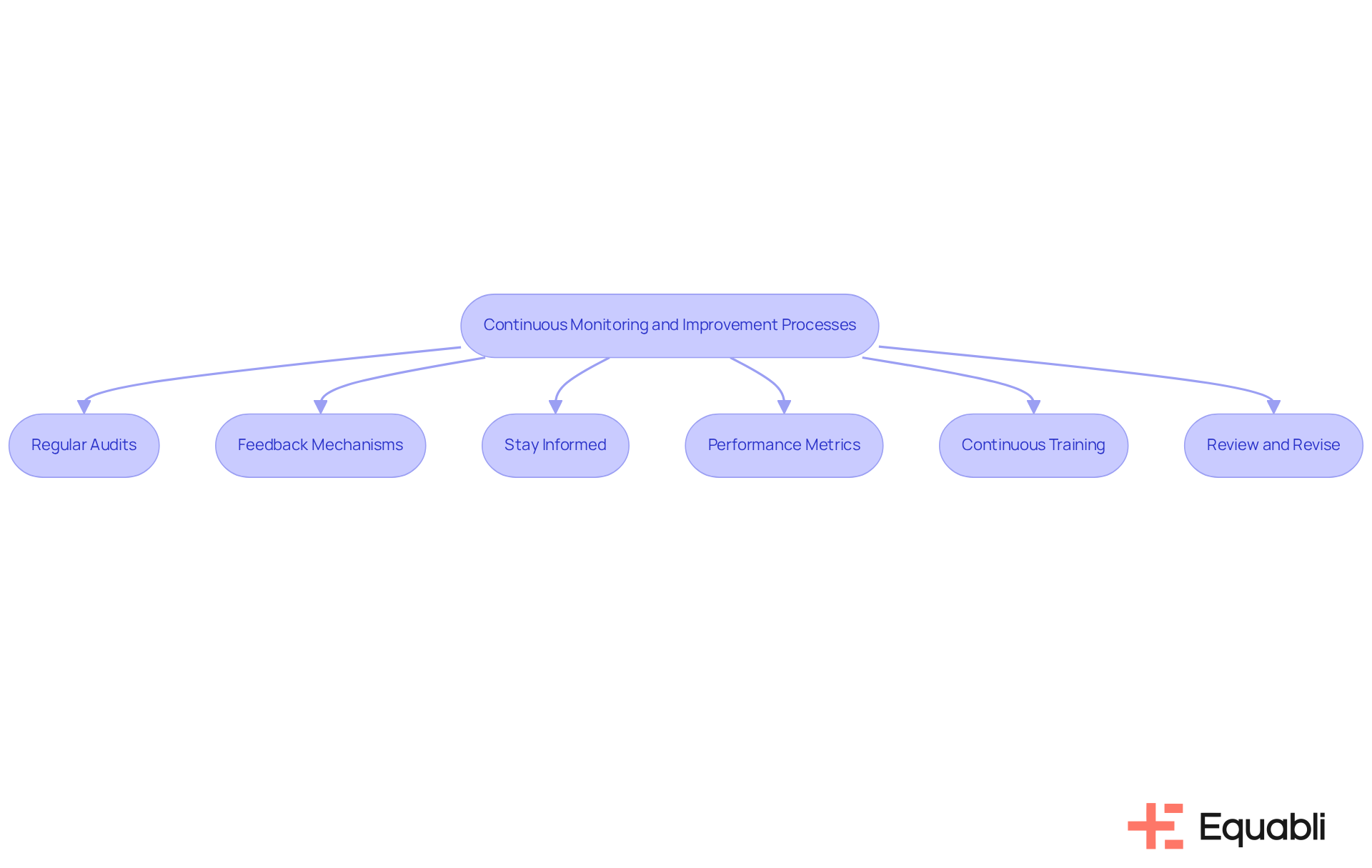

To ensure the effectiveness of your for financial institutions, it is essential to establish continuous monitoring and improvement processes.

- Regular Audits: Periodic audits must be scheduled to assess adherence to established policies and identify areas for improvement. This practice not only highlights compliance gaps but also fosters a culture of accountability within the organization by employing compliance management system implementation strategies for financial institutions.

- Feedback Mechanisms: Implementing systems for employees to provide input on adherence processes is crucial. Such mechanisms enable the identification of potential enhancements, ensuring that the compliance management system implementation strategies for financial institutions evolve in response to frontline insights.

- Stay Informed: It is imperative to remain informed about changes in regulations and industry standards. This vigilance allows for timely adaptations of the compliance management system implementation strategies for financial institutions, safeguarding the organization against compliance risks.

- Performance Metrics: Establishing key performance indicators (KPIs) is vital for assessing the effectiveness of adherence efforts. These metrics provide quantifiable data that can guide strategic decisions and inform compliance management system implementation strategies for financial institutions.

- Continuous Training: Ongoing training programs are necessary to address new compliance challenges and reinforce the importance of adherence. By investing in employee education, organizations can utilize compliance management system implementation strategies for financial institutions to mitigate risks associated with non-compliance.

- Review and Revise: Regular reviews of the CMS are essential. Necessary adjustments should be made based on audit findings, employee feedback, and regulatory changes to ensure the compliance management system implementation strategies for financial institutions remain robust and effective.

Conclusion

Implementing an effective Compliance Management System (CMS) is essential for financial institutions seeking to navigate the complexities of regulatory requirements and mitigate associated risks. A structured framework enables organizations not only to comply with laws and regulations but also to cultivate a culture of integrity and trust among clients and stakeholders. This proactive approach ultimately enhances operational performance and customer satisfaction, positioning compliance as a strategic asset.

Key components of a successful CMS encompass:

- Thorough risk assessments

- Clear policies and procedures

- Ongoing training

- Robust monitoring mechanisms

Engaging leadership and stakeholders throughout the development and implementation process ensures that compliance strategies align with organizational objectives. Continuous improvement practices, including regular audits and feedback loops, further fortify the CMS, allowing institutions to adapt to evolving regulatory landscapes and internal challenges while maintaining operational excellence.

In a rapidly changing financial environment, the significance of a well-implemented compliance management system cannot be overstated. Institutions must prioritize compliance not merely as a legal obligation but as a strategic asset that drives operational excellence and fosters stakeholder confidence. By committing to these best practices and embracing a culture of compliance, financial institutions can effectively safeguard against risks and position themselves for sustainable success.

Frequently Asked Questions

What is a Compliance Management System (CMS)?

A Compliance Management System (CMS) is a structured framework that organizations use to ensure compliance with laws, regulations, and internal policies.

Why is a Compliance Management System important for financial institutions?

A Compliance Management System is crucial for financial institutions as it helps manage the risks associated with non-compliance, which can lead to significant penalties and reputational damage.

What are the key benefits of implementing a Compliance Management System?

The key benefits of implementing a CMS include fostering a culture of compliance, streamlining operational processes, and enhancing decision-making capabilities.

How does a Compliance Management System contribute to organizational trust?

By adopting a CMS, institutions can shield themselves from legal repercussions and cultivate trust with clients and stakeholders, leading to improved operational performance and customer satisfaction.