Overview

The article outlines effective strategies for integrating credit collection services within financial institutions, aimed at optimizing operations and enhancing recovery rates. It underscores the necessity of leveraging technology—specifically cloud-based solutions and APIs—while also prioritizing staff training and addressing prevalent challenges, such as data silos and resistance to change. This comprehensive approach is essential for ensuring successful implementation and achieving improved financial outcomes.

Introduction

In today's competitive financial landscape, the integration of credit collection services stands out as a crucial strategy for institutions aiming to enhance operational efficiency and customer engagement. Advanced technologies, such as EQ Collect, enable organizations to streamline processes, reduce costs, and significantly improve recovery rates. However, the path to effective integration presents several challenges, including:

- Data silos

- Employee resistance

Financial institutions must consider how to navigate these hurdles to maximize the benefits of credit collection services integration.

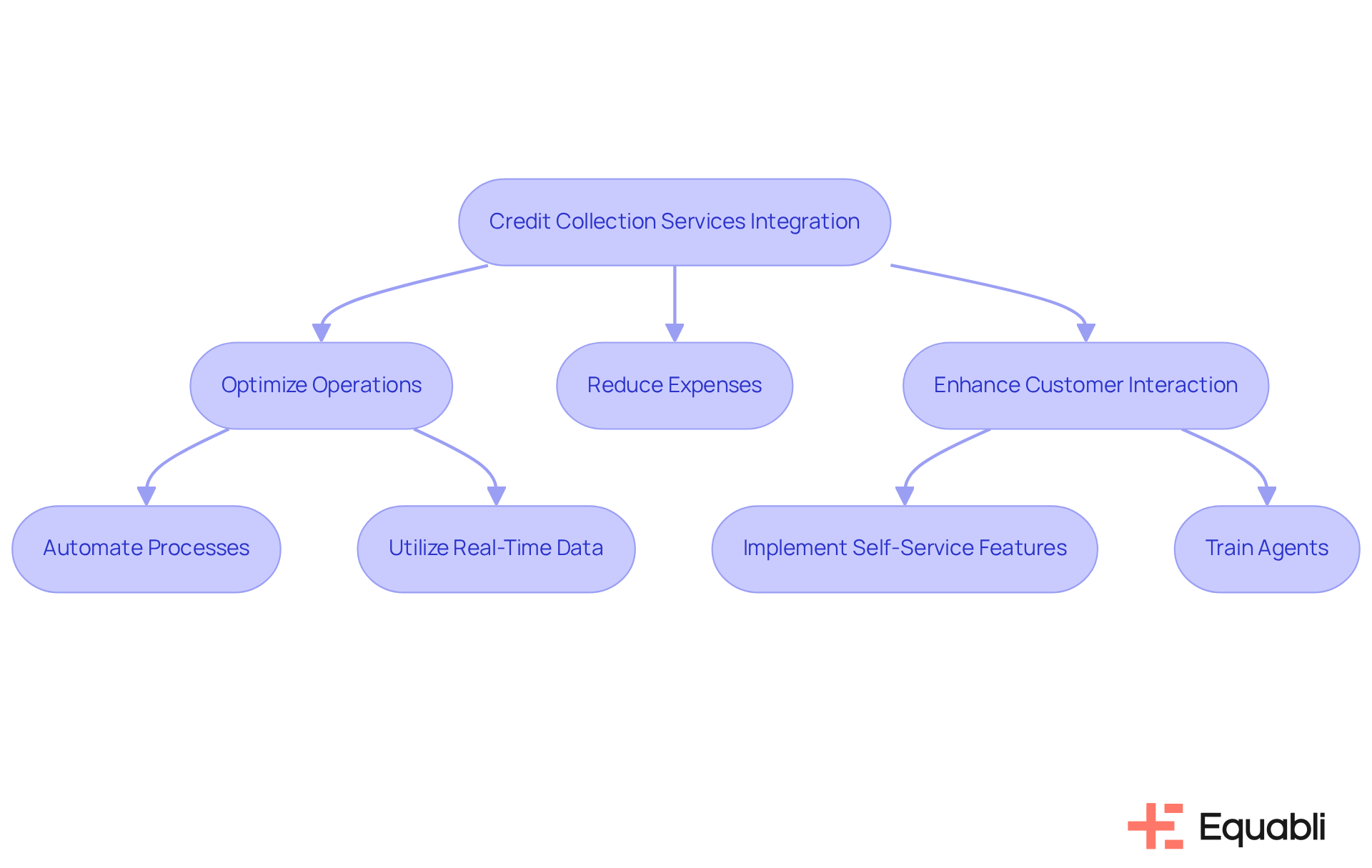

Understand the Importance of Credit Collection Services Integration

Incorporating credit collection services integration strategies for financial institutions is essential for optimizing operations, reducing expenses, and enhancing customer interaction. By leveraging advanced technology such as EQ Collect, institutions can automate critical processes, ensuring timely follow-ups and personalized communication with debtors.

Evidence shows that EQ Collect's no-code file-mapping tool significantly shortens vendor onboarding timelines. Furthermore, automated workflows and data-driven strategies not only enhance operational efficiency but also boost retrieval rates. This integration fosters seamless data sharing among departments, which is essential for implementing credit collection services integration strategies for financial institutions, leading to informed decision-making and improved regulatory compliance.

Organizations that have adopted integrated systems report a notable decrease in delinquency rates, as they can proactively manage accounts and utilize credit collection services integration strategies for financial institutions based on real-time data insights. Evidence-based gathering strategies can yield a 15-25% increase in recovery rates, underscoring the operational efficiencies achieved through such integration.

Additionally, self-service features in the initial stages free live agents to focus on more complex cases, optimizing resource allocation and enhancing customer interaction. Training agents to utilize and interpret AI scores is vital for maximizing the benefits of technology in recovery efforts.

As the regulatory landscape evolves, financial organizations must consider its impact on customer experience innovation when implementing debt recovery services. Selecting an appropriate technology stack that integrates seamlessly with existing systems is a crucial step in this process, especially when implementing credit collection services integration strategies for financial institutions, like EQ Collect's automated workflows and real-time reporting. Recognizing these advantages is vital for achieving effective integration of financial recovery services.

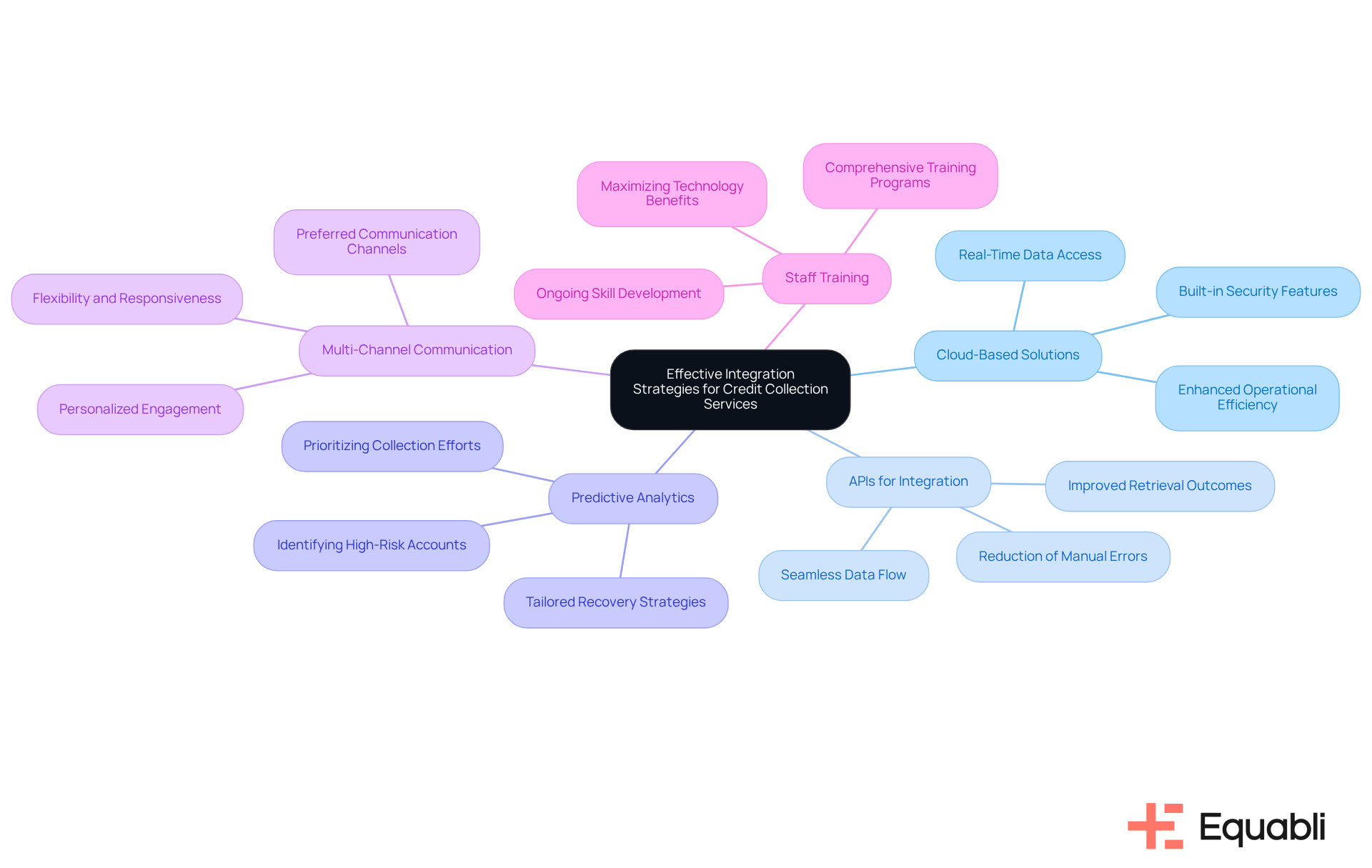

Identify Effective Integration Strategies for Credit Collection Services

To effectively integrate credit collection services, financial institutions should consider several strategic approaches:

- Leverage Cloud-Based Solutions: Implementing cloud-based platforms facilitates real-time data access and collaboration across teams. This ensures that all stakeholders possess the most current information at their fingertips. Such an approach not only enhances operational efficiency but also supports compliance with evolving regulations, as cloud solutions often come with built-in security features.

- Utilize APIs for Seamless Integration: (APIs) enable the connection of various software systems, allowing for smooth data flow between credit management and retrieval platforms. This integration reduces manual input errors and significantly boosts efficiency, resulting in improved retrieval outcomes.

- Adopt predictive analytics, which is essential in credit collection services integration strategies for financial institutions, as it aids in identifying high-risk accounts and allows institutions to tailor their recovery strategies accordingly. This data-driven approach enables organizations to prioritize efforts where they are most likely to succeed, ultimately enhancing recovery rates and financial stability.

- Implement Multi-Channel Communication: Engaging debtors through their preferred communication channels—be it SMS, email, or phone calls—creates a more personalized experience. This tailored approach increases the likelihood of successful interactions, as modern debtors expect flexibility and responsiveness in their communications.

- Train Staff on New Technologies: Investing in comprehensive training for staff on new systems and technologies is essential for maximizing the benefits of implementation. Ongoing training ensures that teams are equipped with the most current knowledge and skills, thereby improving their efficiency and effectiveness in managing assets.

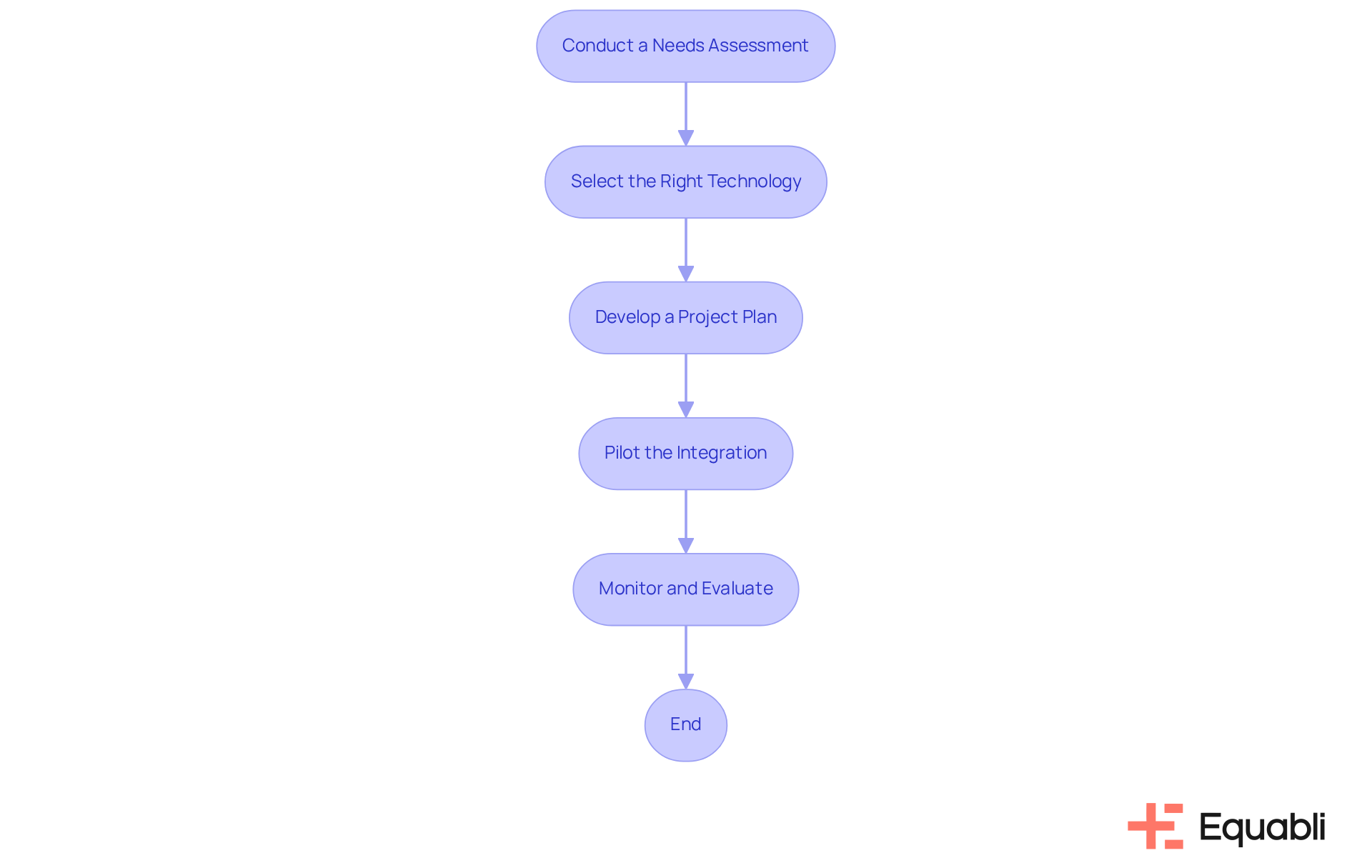

Execute the Implementation of Credit Collection Services Integration

To effectively implement credit collection services integration, it is essential to follow these critical steps:

- Conduct a Needs Assessment: Begin by assessing your existing frameworks to identify gaps necessitating integration. Engaging key stakeholders across various departments is vital to ensure a comprehensive understanding of needs and expectations.

- Select the Right Technology: Choose technology solutions that align with your institution's strategic goals and operational requirements. Prioritize scalability, user-friendliness, and compatibility with existing systems to facilitate a smooth transition. For instance, Equabli's EQ Suite offers cloud-based solutions that modernize manual processes, transforming collections into an intelligent and intuitive experience.

- Develop a Project Plan: Create a detailed project plan that outlines timelines, responsibilities, and milestones. Incorporate risk management strategies to proactively address potential challenges that may arise during the integration process.

- Pilot the Integration: Conduct a pilot test with a small group of users prior to a full rollout. This method allows for the identification and resolution of any issues, ensuring a more seamless experience during broader implementation.

- Monitor and Evaluate: Post-implementation, continuously track system performance. Utilize (KPIs) to assess success and make data-driven adjustments as necessary. Regular assessments will contribute to enhancing the integration and improving overall effectiveness.

By adhering to these measures, financial organizations can ensure a successful incorporation of credit collection services integration strategies for financial institutions, which ultimately enhances operational efficiency and recovery rates.

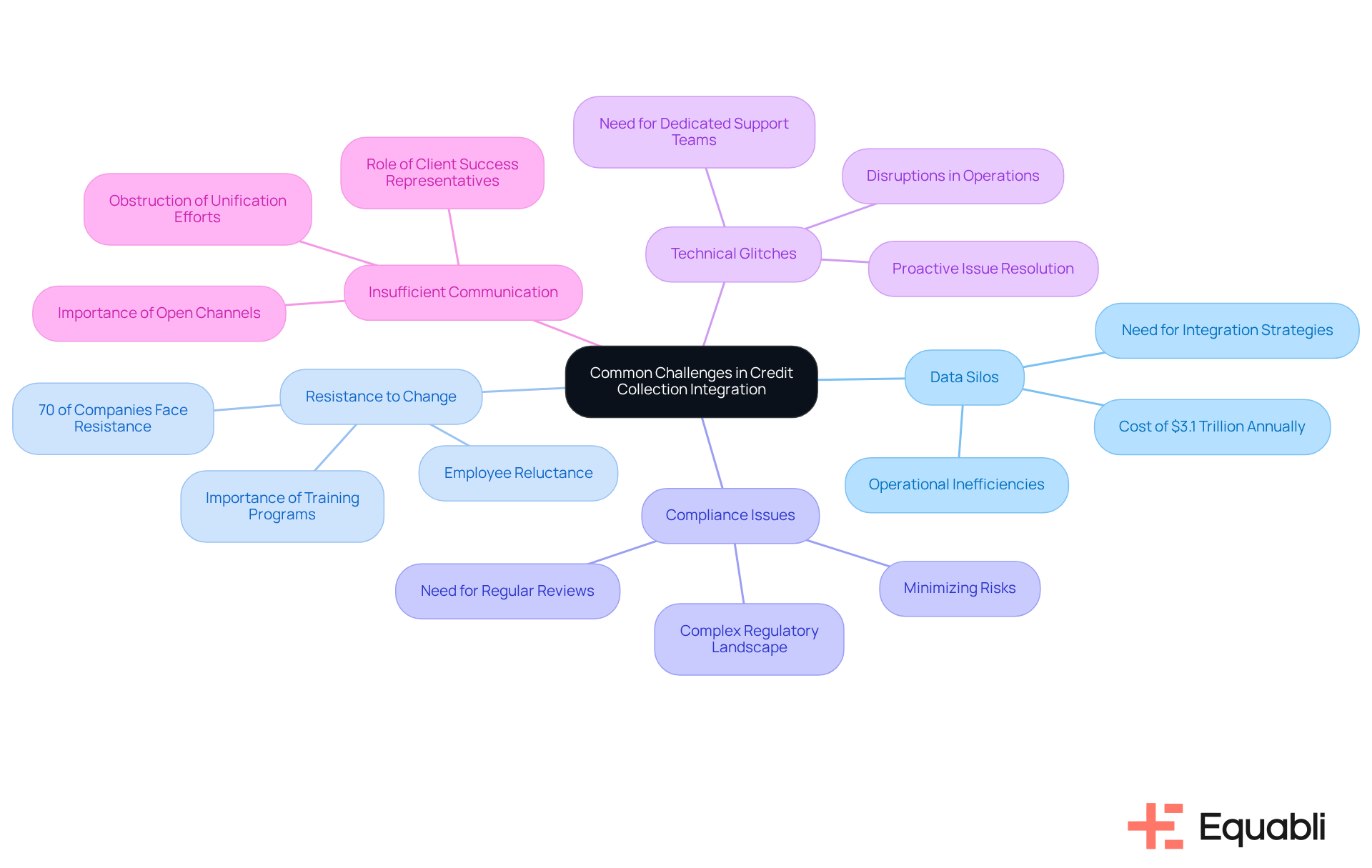

Troubleshoot Common Challenges in Credit Collection Integration

Common challenges in credit collection integration include:

- Data Silos: Various departments often operate on distinct platforms that lack efficient connectivity, leading to operational inefficiencies. Integrating these networks is crucial to effectively implement credit collection services integration strategies for financial institutions, ensuring information accessibility across departments. Addressing data silos by implementing credit collection services integration strategies for financial institutions can significantly enhance operational efficiency; studies indicate that these silos cost businesses an average of $3.1 trillion annually in lost revenue and productivity.

- Resistance to Change: Employee reluctance to embrace new technologies can hinder progress. Organizations must implement comprehensive training programs and clearly communicate the benefits of the new systems. Statistics reveal that nearly as a major barrier to successful digital transformation, underscoring the necessity for effective change management strategies. A Client Success Representative can facilitate the onboarding process, ensuring employees comprehend how the new tools align with their business objectives.

- Compliance Issues: Navigating the complexities of regulatory compliance can be both challenging and time-consuming. It is essential to regularly review compliance requirements and design integrated systems that utilize credit collection services integration strategies for financial institutions, thereby minimizing risks and maintaining operational integrity.

- Technical Glitches: Integration processes may occasionally result in technical issues that disrupt operations. Establishing a dedicated support team to promptly address these challenges can mitigate disruptions and uphold workflow continuity. Proactive check-ins and strategic business reviews by Client Success Representatives can identify and resolve issues before they escalate.

- Insufficient Communication: Ineffective communication among stakeholders can obstruct unification efforts. Promoting open communication channels ensures that all parties remain aligned and informed throughout the integration process, facilitating smoother transitions and enhanced collaboration. Client Success Representatives play a vital role in driving this communication, serving as the primary point of contact and advocate for clients, ensuring that their needs are met and that they are fully engaged with the platform.

Conclusion

Incorporating effective credit collection services integration strategies is essential for financial institutions aiming to optimize operations and enhance customer interactions. Leveraging advanced technologies, such as EQ Collect, enables organizations to automate processes, improve efficiency, and achieve superior recovery rates. The integration of these services not only streamlines communication and data sharing but also facilitates informed decision-making and compliance with evolving regulations.

The article underscores several key strategies for successful integration. These include:

- The adoption of cloud-based solutions

- The utilization of APIs for seamless data flow

- The implementation of predictive analytics

Additionally, training staff on new technologies and employing multi-channel communication are vital for maximizing integration benefits. A structured implementation plan that encompasses a needs assessment, pilot testing, and ongoing evaluation is crucial for financial institutions to effectively navigate the complexities of integrating credit collection services.

Ultimately, the importance of integrating credit collection services is paramount. As financial institutions strive to enhance operational efficiency and recovery outcomes, embracing these strategies will not only lead to improved performance but also foster a positive customer experience. By prioritizing integration and addressing common challenges, organizations can position themselves for success in a competitive landscape, ensuring responsiveness to both regulatory demands and customer expectations.

Frequently Asked Questions

Why is credit collection services integration important for financial institutions?

Credit collection services integration is essential for optimizing operations, reducing expenses, and enhancing customer interaction within financial institutions.

How does EQ Collect contribute to credit collection services integration?

EQ Collect leverages advanced technology to automate critical processes, ensuring timely follow-ups and personalized communication with debtors, which enhances operational efficiency and boosts retrieval rates.

What benefits do organizations experience after adopting integrated systems for credit collection?

Organizations that adopt integrated systems report a notable decrease in delinquency rates, proactive account management, and a 15-25% increase in recovery rates due to evidence-based gathering strategies.

How does the use of automated workflows and data-driven strategies improve credit collection?

Automated workflows and data-driven strategies enhance operational efficiency, enable seamless data sharing among departments, and lead to informed decision-making and improved regulatory compliance.

What role do self-service features play in credit collection services?

Self-service features allow live agents to focus on more complex cases, optimizing resource allocation and enhancing customer interaction during the initial stages of debt recovery.

Why is training agents to use real-time prompts and AI scores important?

Training agents to utilize real-time prompts and interpret AI scores is vital for maximizing the benefits of technology in recovery efforts, leading to improved outcomes in debt collection.

What should financial organizations consider regarding the regulatory landscape when implementing debt recovery services?

Financial organizations must consider the impact of the evolving regulatory landscape on customer experience innovation when implementing debt recovery services.

What is a crucial step in selecting technology for credit collection services integration?

Selecting an appropriate technology stack that integrates seamlessly with existing systems is crucial for implementing effective credit collection services integration strategies.