Overview

The article presents an authoritative analysis of advanced credit risk analytics solutions tailored for financial institutions. It highlights various tools designed to enhance risk management and lending decisions, such as Equabli's EQ Suite and FICO's analytics. These tools leverage data-driven insights and automation, which collectively improve operational efficiency, reduce default rates, and adapt to evolving market demands. By utilizing these advanced solutions, financial institutions can strategically position themselves to navigate the complexities of credit risk management effectively.

Introduction

The landscape of credit risk management is experiencing a significant transformation as financial institutions increasingly adopt advanced analytics solutions to navigate complexities and uncertainties. These innovative tools enhance decision-making processes and empower organizations to assess borrower reliability more effectively, ultimately improving lending strategies and reducing default rates. However, with the rapid evolution of technology, institutions must consider how to leverage these advanced credit risk analytics solutions effectively to remain competitive and ensure sustainable growth in an ever-changing economic environment.

Equabli EQ Suite: Intelligent Solutions for Credit Risk Management

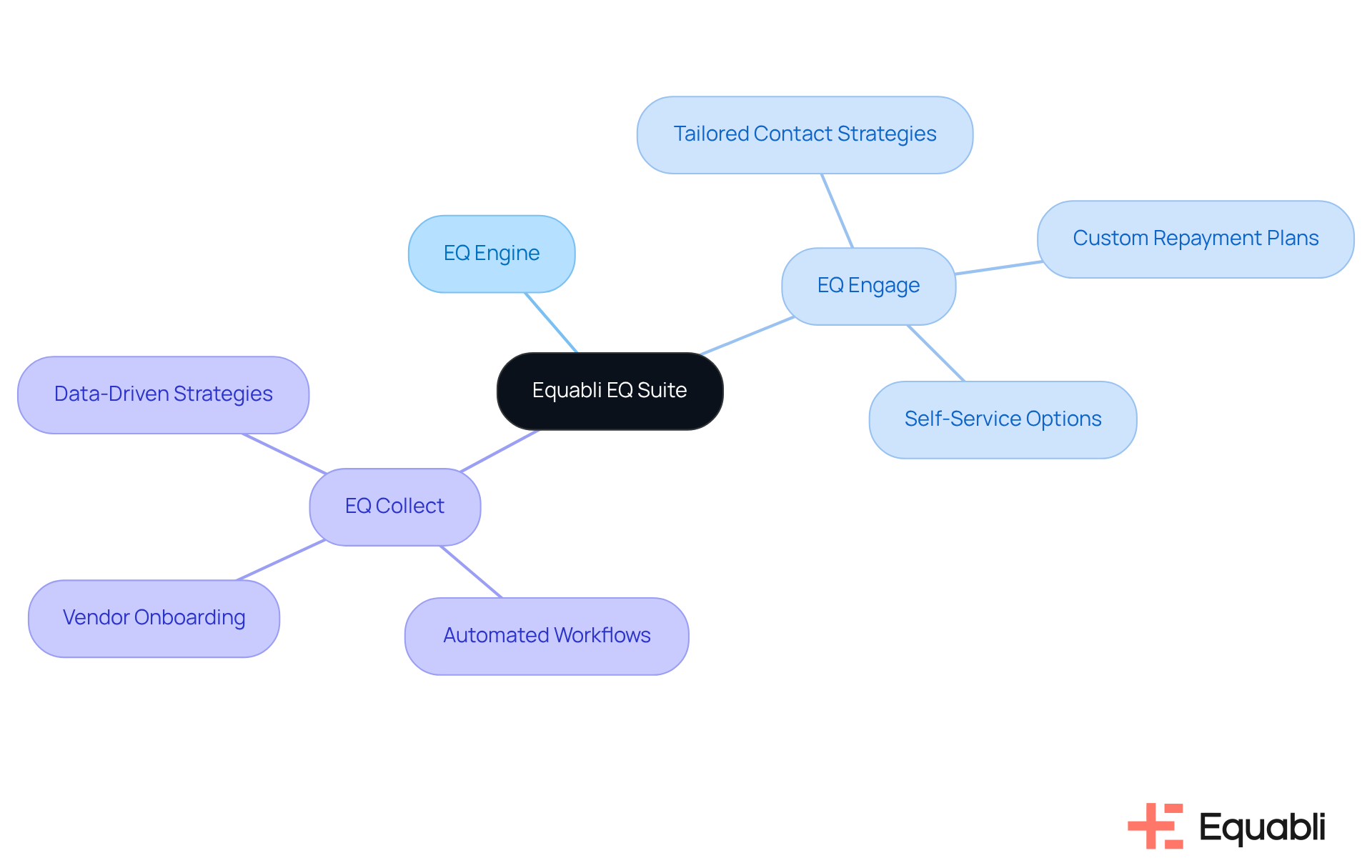

The Equabli EQ Suite provides a robust array of tools aimed at enhancing advanced credit risk analytics solutions for institutional financial risk management within monetary organizations. Central to this suite are the EQ Engine, EQ Engage, and EQ Collect, which empower users to develop custom scoring models that accurately predict repayment behaviors. EQ Collect improves debt collection efficiency by streamlining vendor onboarding with a user-friendly, no-code file-mapping tool, while also enhancing collections through data-driven strategies. Moreover, it minimizes execution errors and reduces the need for manual resources through automated workflows, ensuring compliance and operational efficiency in collections. The scalable, cloud-native interface of EQ Collect further reinforces these enhancements.

Conversely, EQ Engage facilitates borrower interaction by enabling organizations to create, automate, and implement tailored contact strategies that align with customer preferences. This tool allows financial organizations to communicate in their brand voice, develop , and empower borrowers to self-service, ultimately enhancing debt management outcomes. By leveraging these intelligent solutions, organizations can achieve significant reductions in operational expenses, directly linked to features such as automated monitoring and reporting, while simultaneously boosting collection efficiency. As the debt collection landscape evolves, the integration of advanced credit risk analytics solutions for institutional financial risk management, including AI and predictive analytics, becomes essential for maintaining a competitive edge, enabling organizations to adapt to changing consumer expectations and improve overall recovery rates. The increasing demand for digital debt collection solutions underscores the relevance of the EQ Suite in today's market.

FICO: Advanced Analytics for Credit Risk Assessment

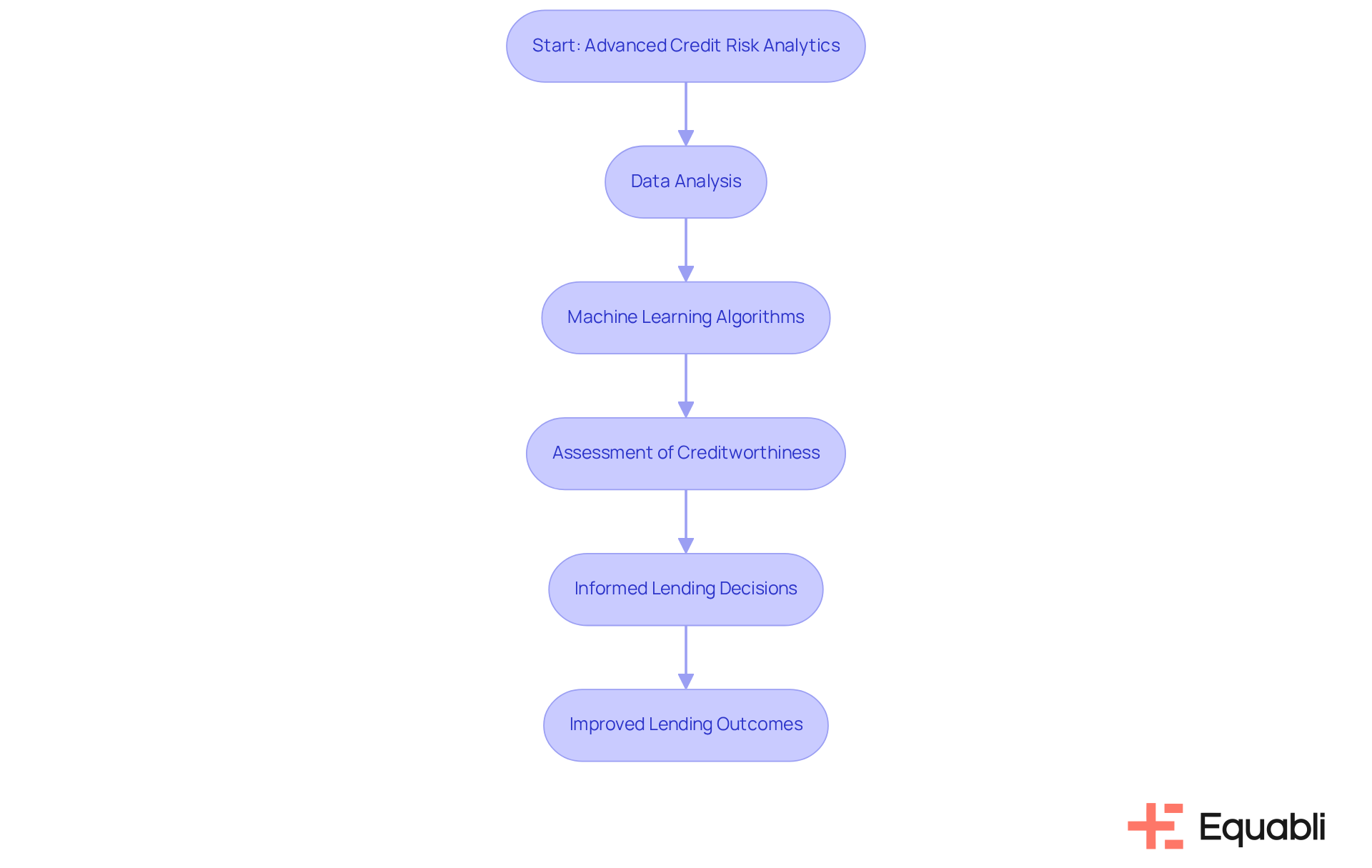

FICO provides advanced credit risk analytics solutions for institutional financial risk management that significantly enhance the ability of financial organizations to accurately assess lending potential. By leveraging sophisticated machine learning algorithms, these tools serve as advanced credit risk analytics solutions for institutional financial risk management by analyzing extensive datasets, enabling lenders to make informed decisions regarding creditworthiness. The integration of FICO's analytics provides advanced credit risk analytics solutions for institutional financial risk management, which not only streamlines assessment processes but also leads to improved lending outcomes and a notable reduction in default rates.

For instance, Santander, managing a $60 billion asset portfolio and serving over three million clients, has transformed its evaluation of financial exposure through the implementation of advanced credit risk analytics solutions for institutional financial risk management via the FICO Platform. This modernization allows the institution to efficiently process a larger volume of applications while leveraging advanced credit risk analytics solutions for institutional financial risk management to gain real-time insights into borrower behavior. The effectiveness of FICO's advanced credit risk analytics solutions for institutional financial risk management is further highlighted by the accolades received from the FICO Decisions Awards, which showcase measurable enhancements in organizational operations.

As Nikhil Behl, President of Software at FICO, articulates, 'Santander's use of machine learning illustrates how lenders can update financial analysis.' This statement exemplifies how advanced credit risk analytics solutions for institutional financial risk management can and ultimately promote economic stability.

SAS: Comprehensive Analytics for Risk Management

SAS offers for institutional financial risk management, providing a comprehensive suite of analytics tools that facilitate the efficient management of uncertainties and enable institutions to conduct thorough evaluations of credit exposure through predictive modeling and scenario analysis. By leveraging advanced credit risk analytics solutions for institutional financial risk management, organizations can uncover critical insights into potential challenges, which supports the development of proactive strategies aimed at minimizing losses.

High-quality, well-structured data is vital for achieving accurate outcomes in predictive analytics, enabling institutions to utilize advanced credit risk analytics solutions for institutional financial risk management to effectively gauge the likelihood of borrower defaults. For instance, financial institutions that have implemented predictive models report a 25% improvement in the accuracy of credit evaluations, significantly reducing default rates.

Furthermore, a prominent bank's fraud detection model, powered by SAS analytics, successfully averted losses exceeding $10 million within a single quarter. Continuous monitoring of predictive models is crucial to adapt them based on new data and shifts in the economic landscape, ensuring their ongoing accuracy and relevance.

Additionally, SAS's recent acquisition of Kamakura Corporation enhances its analytics capabilities, demonstrating a commitment to advancing management solutions. As financial organizations increasingly adopt these sophisticated tools, they are better equipped to navigate the complexities of management, thereby ensuring resilience in a perpetually evolving economic environment.

Moody's Analytics: Tools for Enhanced Credit Risk Modeling

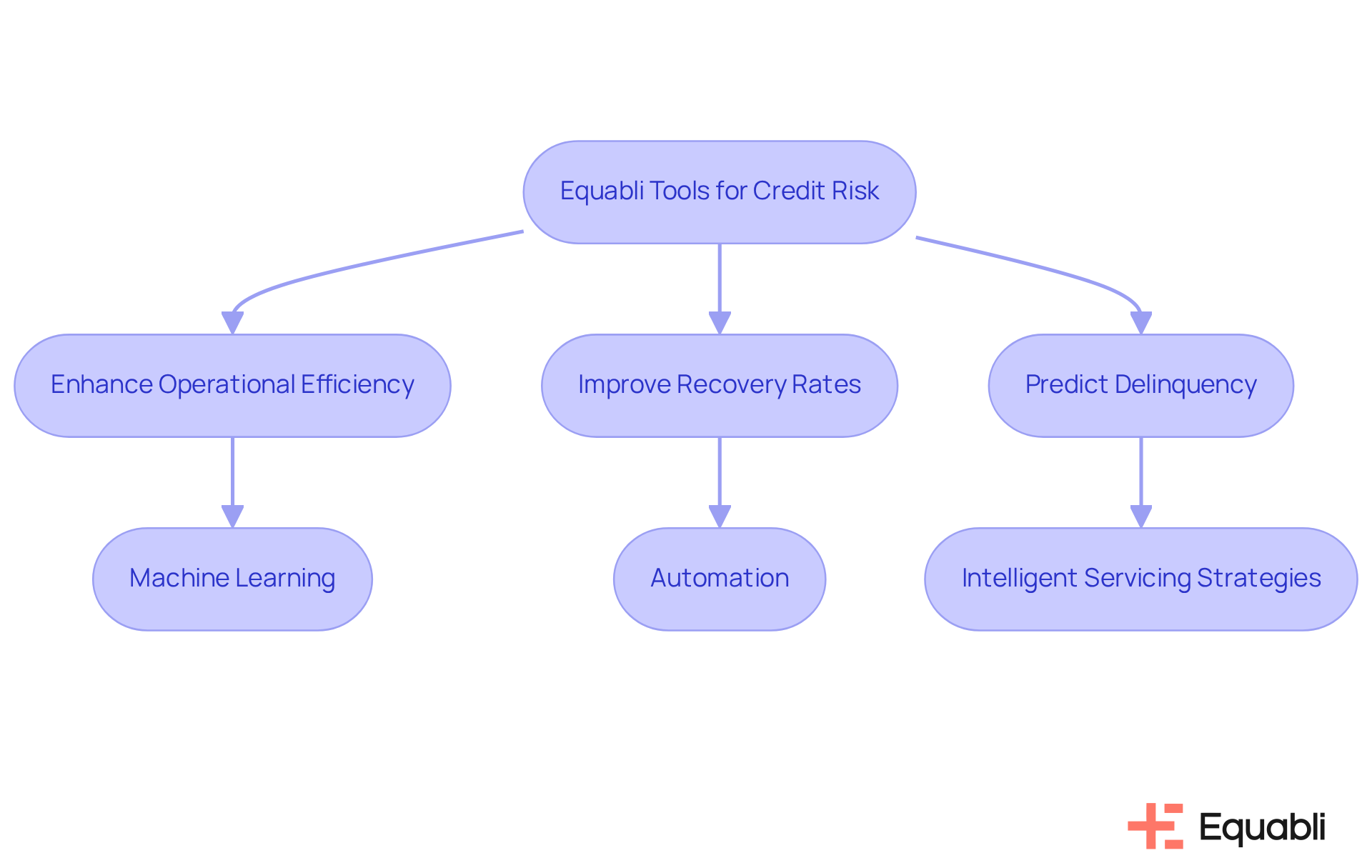

Equabli provides advanced features that empower financial organizations to enhance operational efficiency at every phase of debt recovery, minimizing effort without compromising results. By leveraging machine learning and automation, organizations can significantly improve recovery rates and scale their collections operations while maintaining high performance. This allows organizations to predict the likelihood of delinquency in active accounts, leading to the development of intelligent servicing strategies. Furthermore, Equabli's solutions bolster Moody's Analytics by enhancing collection performance through predictive assessment and intelligent automation.

Experian: Credit Risk Solutions for Informed Lending Decisions

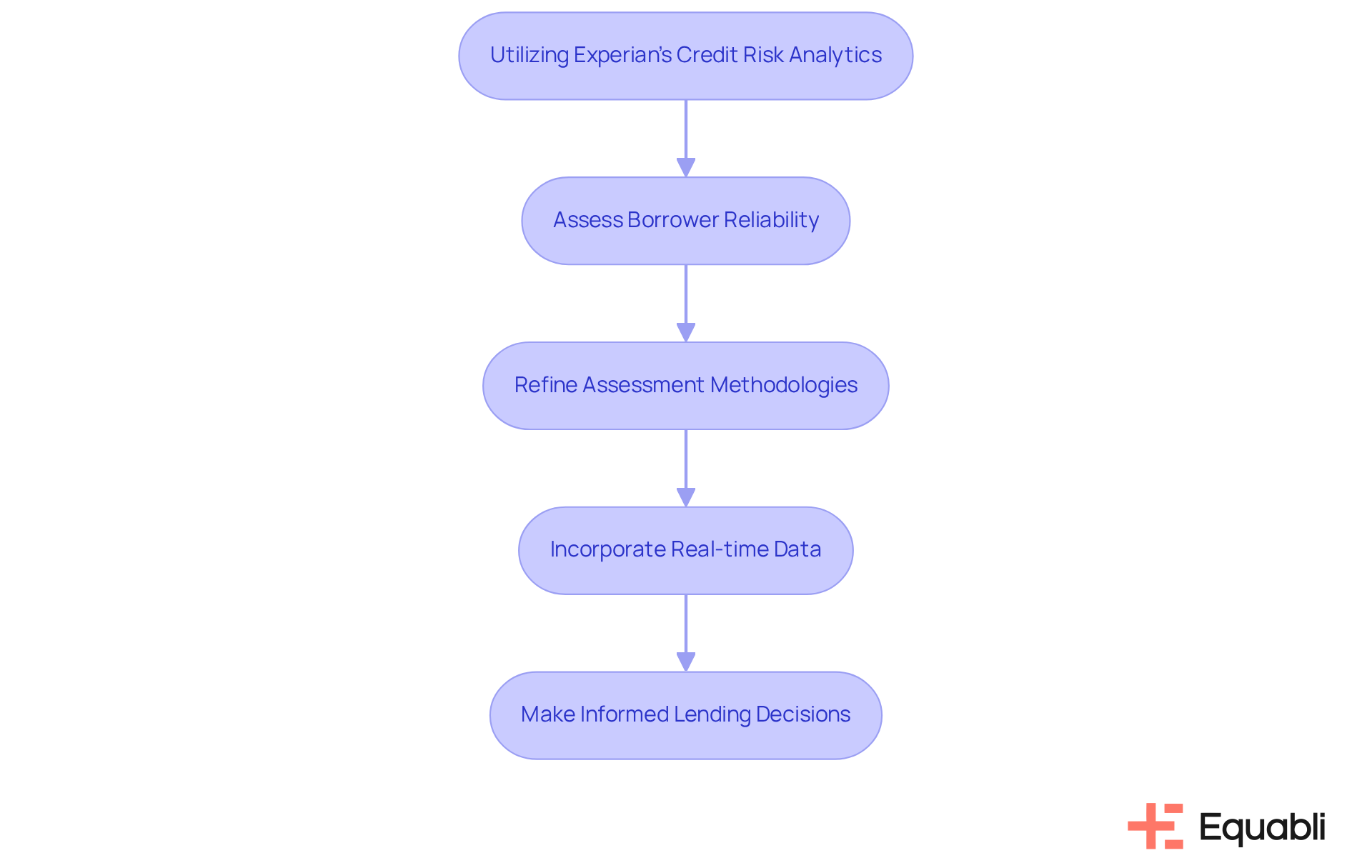

Experian offers advanced credit risk analytics solutions for institutional financial risk management, providing a robust suite of financial assessment solutions designed to empower organizations in making informed lending decisions. By leveraging extensive financial data and sophisticated analytics, lenders can effectively assess borrower reliability, thereby enhancing their lending strategies through advanced credit risk analytics solutions for institutional financial risk management.

In 2025, the impact of advanced credit risk analytics solutions for institutional financial risk management on lending practices is increasingly pronounced, with organizations utilizing Experian's tools to refine their assessment methodologies and mitigate the risk of defaults. The incorporation of facilitates a more nuanced understanding of borrower profiles, guaranteeing that lending decisions are grounded in accurate and current information.

As financial institutions progressively recognize the critical role of loan data in their lending processes, Experian stands out as a crucial partner in delivering advanced credit risk analytics solutions for institutional financial risk management, fostering responsible lending practices, and improving overall portfolio performance.

Recent studies indicate that the big data scoring system forecasts an individual's likelihood of defaulting on a loan with 18.4% greater accuracy than traditional scoring methods. Furthermore, a standardized scoring model ensures that all borrowers are evaluated using consistent criteria, establishing a fair and transparent lending framework. Financial organizations are encouraged to consider the adoption of big data scoring models to enhance their evaluation capabilities and improve lending outcomes.

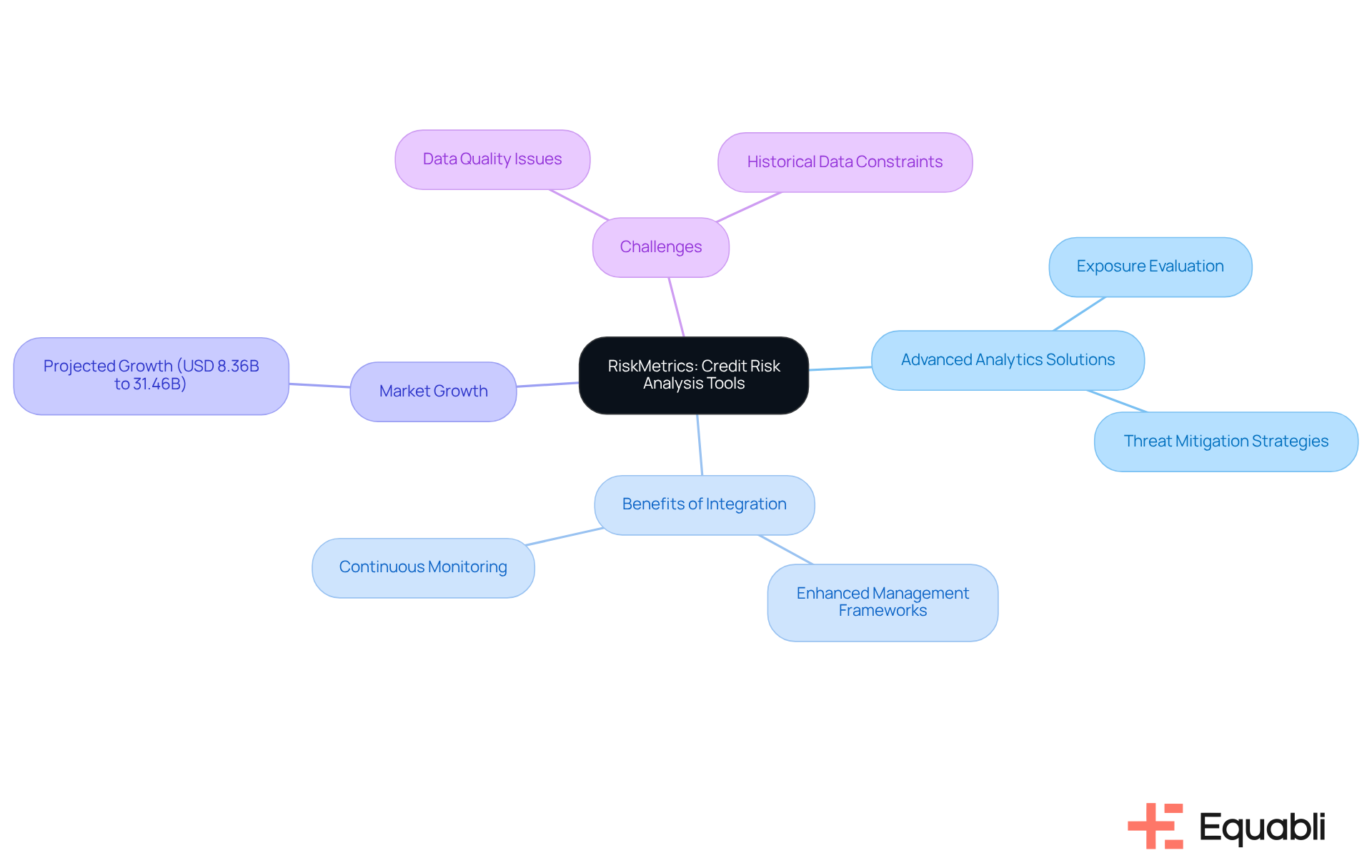

RiskMetrics: Essential Tools for Credit Risk Analysis

RiskMetrics provides advanced credit risk analytics solutions for institutional financial risk management, equipping organizations with critical tools to effectively evaluate and manage their exposure. Their advanced credit risk analytics solutions for institutional financial risk management enable firms to pinpoint potential threats and devise strategies for mitigation.

By integrating RiskMetrics into their operations, institutions can significantly enhance their management frameworks, ensuring a proactive stance in fluctuating economic conditions. This integration streamlines the assessment process while fostering a culture of and informed decision-making, essential for navigating today’s complex economic landscape.

Continuous oversight of financial exposure is vital, as lenders must track changes in borrowers' economic conditions and market dynamics post-financing. Furthermore, the credit assessment market is projected to grow from USD 8.36 billion in 2024 to USD 31.46 billion by 2034, highlighting the importance of implementing advanced credit risk analytics solutions for institutional financial risk management to effectively manage uncertainties.

As Gary Cohn emphasized, without investment in risk management, any business remains fundamentally uncertain. Nevertheless, challenges such as data quality issues and the constraints of historical data must be addressed to ensure effective risk modeling.

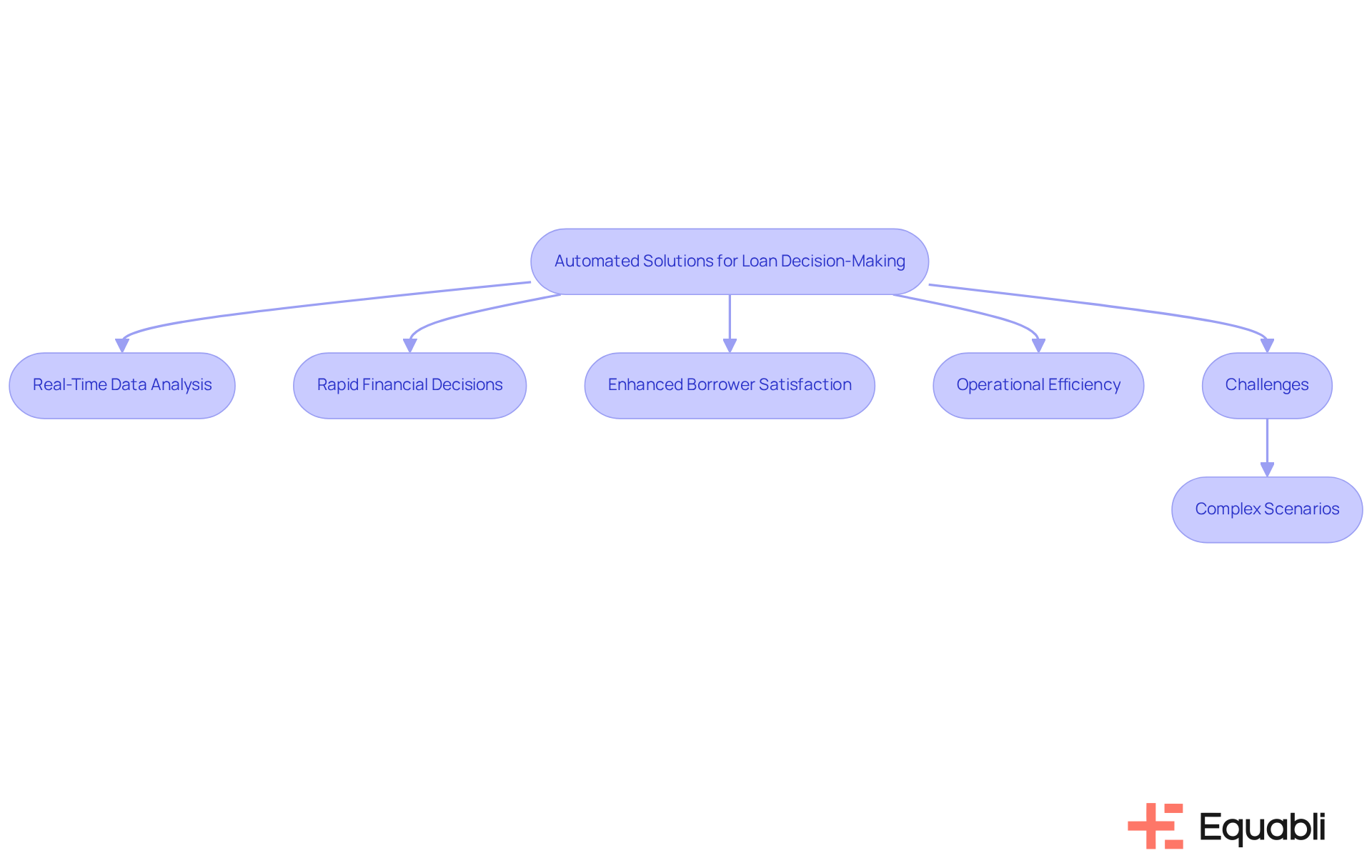

Zoot Enterprises: Automated Solutions for Credit Decisioning

Zoot Enterprises offers advanced , significantly enhancing the lending process for financial institutions. By utilizing real-time data analysis, these tools enable organizations to make rapid and accurate financial decisions, thereby improving operational efficiency. Organizations employing Zoot's solutions can anticipate enhanced borrower satisfaction, as the speed and precision of evaluations lead to faster loan approvals. Furthermore, automated systems can scale effortlessly to manage a large number of applications without proportional increases in staffing, further optimizing resources.

As Raj Dash, a senior expert at McKinsey, emphasizes, banks must implement more automated credit-decisioning models that can tap into new data sources to remain competitive. The integration of real-time data not only reduces the time taken for decision-making but also minimizes errors, ultimately fostering a more responsive lending environment. Additionally, robust security measures are essential to safeguard customer data and ensure compliance with regulatory requirements.

As monetary organizations progressively embrace advanced credit risk analytics solutions for institutional financial risk management, they prepare themselves to meet the rising demand for swift and dependable assessments, ensuring they remain competitive in a rapidly changing market. Notably, banks with €50 billion in assets could see an additional profit of €100 million to €200 million from improved credit-decisioning models, underscoring the financial benefits of adopting Zoot's solutions.

However, it is crucial to recognize that automated lending decision-making may struggle to manage complex or non-standard financial scenarios that require human judgment, necessitating a balanced approach to implementation.

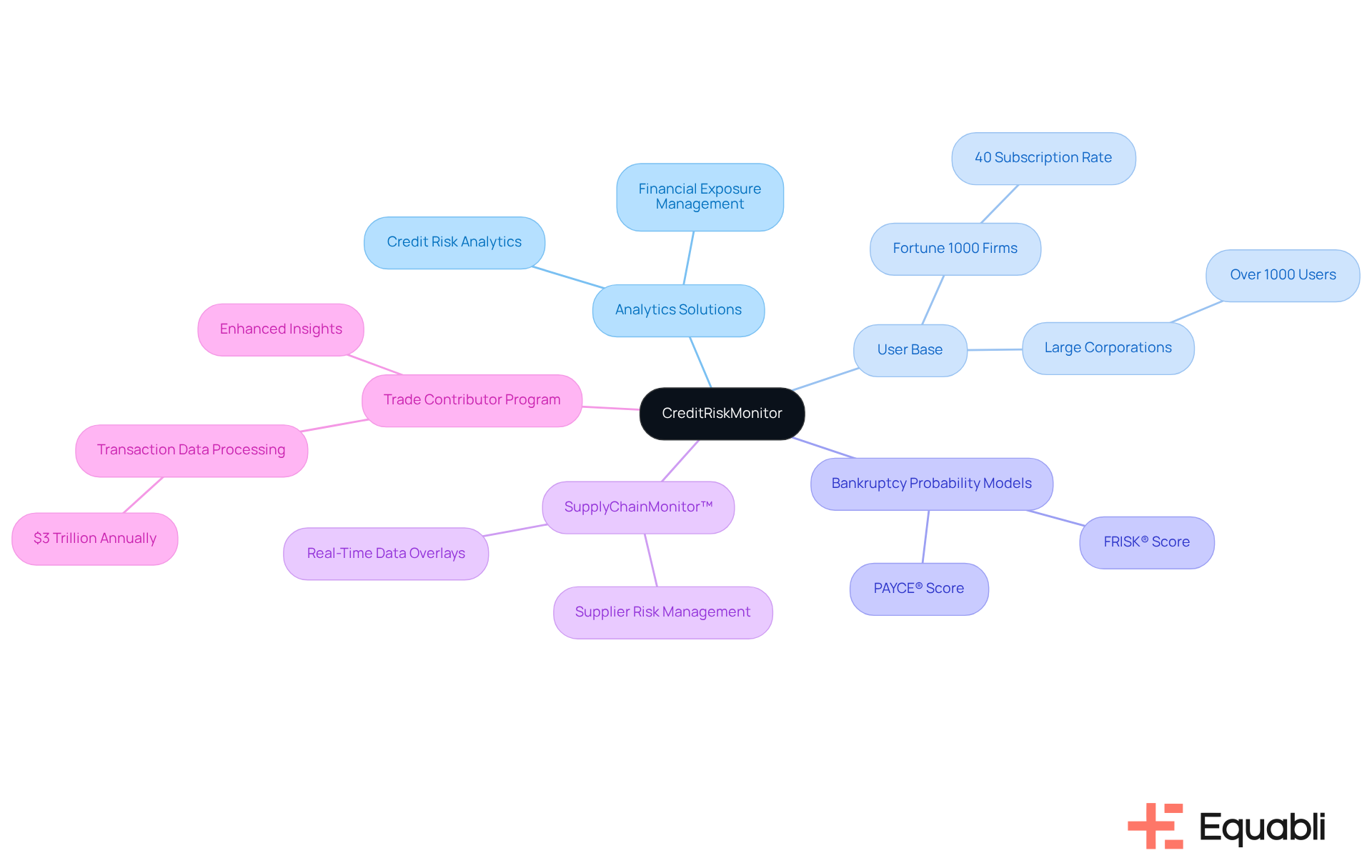

CreditRiskMonitor: Data and Analytics for Credit Risk Management

CreditRiskMonitor delivers specialized information and analytics that are essential for effective financial exposure management. Their comprehensive solutions provide financial institutions with advanced credit risk analytics solutions for institutional financial risk management, offering critical insights that enhance credit evaluations and inform lending decisions. By leveraging CreditRiskMonitor's data-driven insights, organizations can refine their management strategies, thereby significantly reducing potential losses.

Notably, nearly 40% of Fortune 1000 firms, along with over a thousand additional large corporations, utilize these services, underscoring their importance in timely evaluations. The platform provides advanced credit risk analytics solutions for institutional financial risk management, including proprietary bankruptcy probability models such as FRISK® and PAYCE®, which enable users to more accurately identify high-risk entities, facilitating better-informed lending practices.

Furthermore, the introduction of SupplyChainMonitor™ allows procurement and finance professionals to efficiently address supplier challenges through detailed assessments and real-time data overlays. Additionally, CreditRiskMonitor's Trade Contributor Program processes approximately $3 trillion of transaction data annually, enhancing the depth of insights available to users. This illustrates the of CreditRiskMonitor's offerings in bolstering overall economic decision-making.

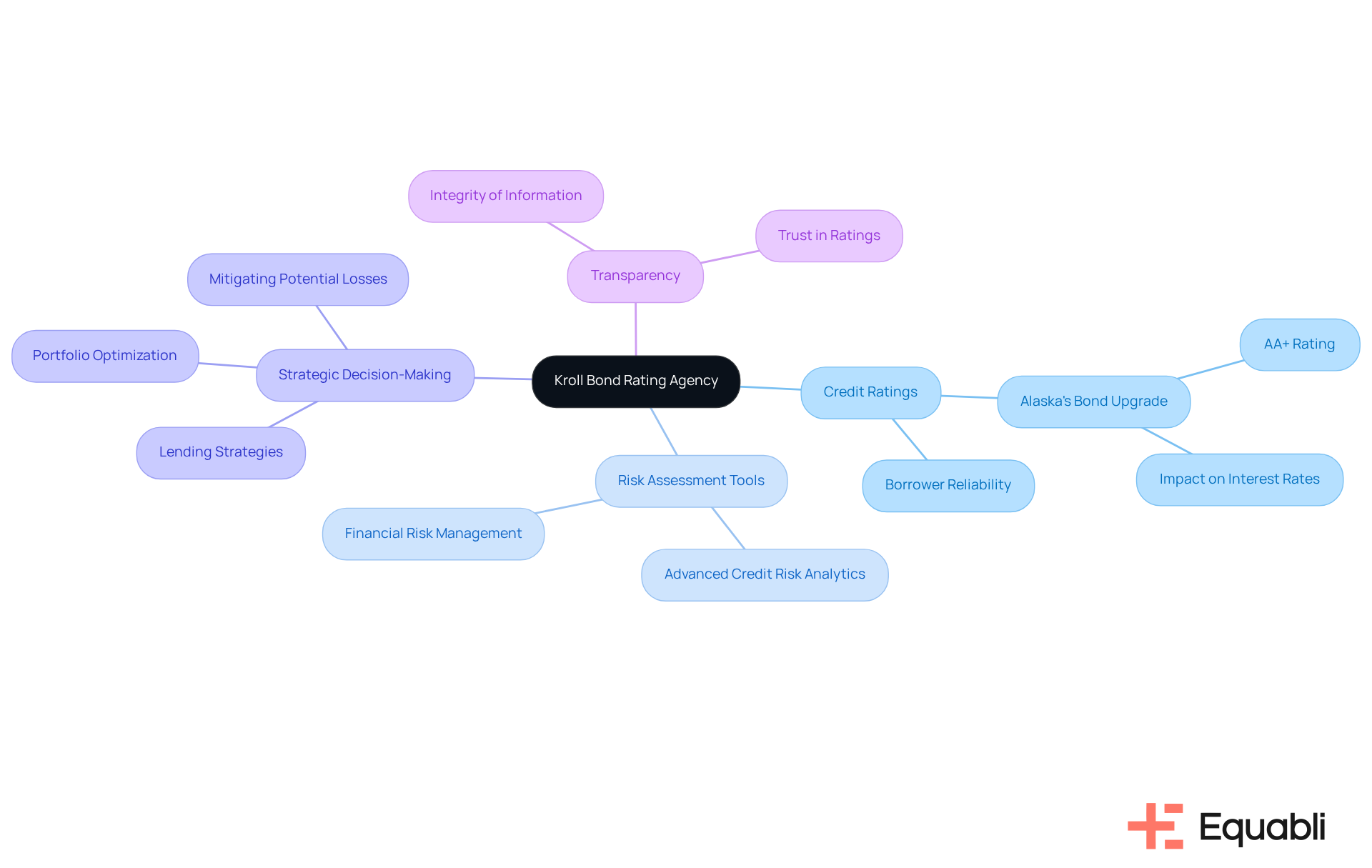

Kroll Bond Rating Agency: Credit Ratings and Risk Assessment Tools

Kroll Bond Rating Agency (KBRA) provides essential ratings and evaluation tools that empower financial institutions to assess borrower reliability with precision. Their ratings serve as a critical resource, offering insights that enable lenders to make informed decisions regarding financial exposure. By utilizing advanced credit risk analytics solutions for institutional financial risk management, organizations can significantly enhance their credit evaluation processes, thereby improving their lending strategies.

In 2025, the importance of robust creditworthiness assessment tools is paramount, particularly as institutions navigate a complex economic landscape. KBRA's ratings not only enhance risk management but also support strategic decision-making, allowing lenders to optimize their portfolios and mitigate potential losses. For instance, the recent upgrade of Alaska's General Obligation Bonds to an AA+ rating—just one step below a AAA rating—illustrates how improved ratings can positively influence lending strategies, enabling states to secure favorable interest rates and bolster economic stability.

Moreover, KBRA's commitment to ensures that organizations can trust the integrity of the information provided. This trust is crucial for lenders aiming to refine their lending evaluation methods by incorporating advanced credit risk analytics solutions for institutional financial risk management and adopting innovative strategies that align with evolving market conditions. By integrating KBRA's tools into their operations, organizations can enhance their assessment of creditworthiness and position themselves for sustainable growth in an increasingly competitive environment. Additionally, KBRA's designation as a Qualified Rating Agency in Taiwan underscores its global relevance in the rating landscape.

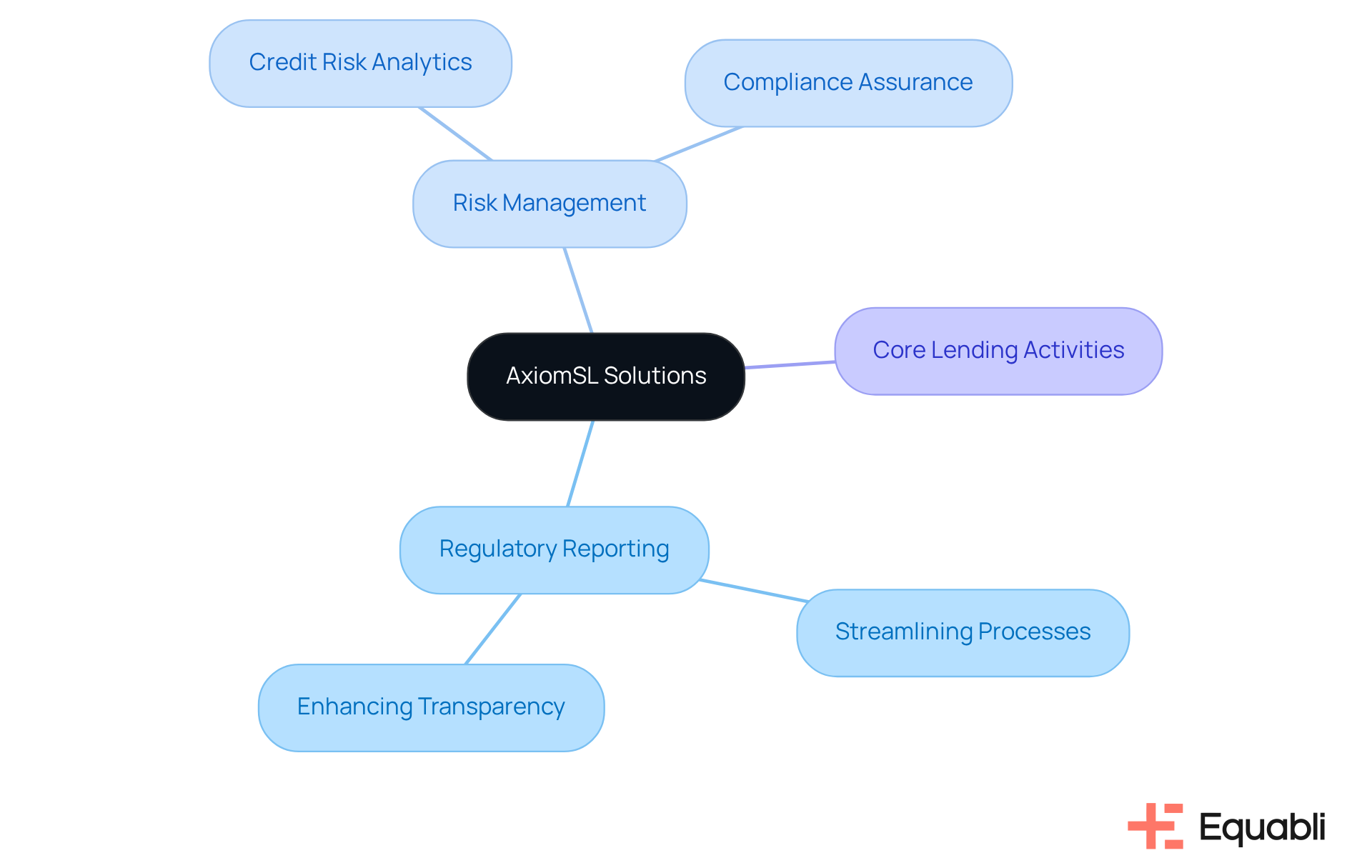

AxiomSL: Regulatory Reporting and Risk Management Solutions

AxiomSL provides regulatory reporting and management solutions that enable financial organizations to comply with industry regulations while effectively addressing credit challenges. Their tools and enhance transparency, which allows organizations to concentrate on their core lending activities. By leveraging advanced credit risk analytics solutions for institutional financial risk management, AxiomSL enables institutions to not only ensure compliance but also bolster their overall risk management framework, thereby positioning themselves strategically within the competitive landscape.

Conclusion

The landscape of credit risk management is rapidly evolving, driven by the imperative for financial institutions to adopt advanced analytics solutions that enhance decision-making processes. Innovative tools and platforms, such as the Equabli EQ Suite, FICO, and SAS, empower organizations to assess creditworthiness more effectively, streamline operations, and improve recovery rates. By leveraging these advanced credit risk analytics solutions, institutions can significantly reduce default rates and enhance overall operational efficiency.

Key insights emphasize the importance of integrating machine learning, real-time data, and predictive analytics into credit risk management strategies. Solutions from providers like Experian and RiskMetrics demonstrate how data-driven insights can refine lending practices, while Zoot Enterprises illustrates the benefits of automation in expediting loan decision-making. Additionally, the significance of regulatory compliance and effective risk assessment is underscored through offerings from AxiomSL and Kroll Bond Rating Agency, which assist institutions in navigating the complexities of financial exposure in an increasingly competitive market.

As financial organizations embrace these advanced credit risk analytics solutions, they position themselves to adapt to evolving consumer expectations and mitigate potential losses. The necessity of investing in sophisticated analytics tools is clear; it is essential for institutions aiming to thrive in the dynamic landscape of credit risk management. By leveraging these technologies, financial institutions can secure their future, enhance decision-making capabilities, and ultimately contribute to a more stable economic environment.

Frequently Asked Questions

What is the purpose of the Equabli EQ Suite?

The Equabli EQ Suite provides tools for advanced credit risk analytics solutions aimed at enhancing institutional financial risk management within monetary organizations.

What are the main components of the Equabli EQ Suite?

The main components of the Equabli EQ Suite are the EQ Engine, EQ Engage, and EQ Collect, which help users develop custom scoring models to predict repayment behaviors.

How does EQ Collect improve debt collection efficiency?

EQ Collect streamlines vendor onboarding with a no-code file-mapping tool, enhances collections through data-driven strategies, minimizes execution errors, and reduces manual resources through automated workflows.

What benefits does EQ Engage offer to financial organizations?

EQ Engage allows organizations to create and automate tailored contact strategies, communicate in their brand voice, develop customized repayment plans, and empower borrowers to self-service, improving debt management outcomes.

How do these tools affect operational expenses and collection efficiency?

By leveraging intelligent solutions, organizations can reduce operational expenses through automated monitoring and reporting while boosting collection efficiency.

Why is the integration of advanced credit risk analytics solutions important?

The integration is essential for maintaining a competitive edge, adapting to changing consumer expectations, and improving overall recovery rates in the evolving debt collection landscape.

What does FICO provide for credit risk assessment?

FICO offers advanced credit risk analytics solutions that enhance the ability of financial organizations to accurately assess lending potential using sophisticated machine learning algorithms.

How does FICO's analytics improve lending outcomes?

FICO's analytics streamline assessment processes, leading to improved lending outcomes and a notable reduction in default rates.

Can you provide an example of FICO's impact on a financial institution?

Santander, with a $60 billion asset portfolio, transformed its evaluation of financial exposure using FICO's advanced credit risk analytics, allowing for efficient processing of applications and gaining real-time insights into borrower behavior.

What does SAS offer for risk management?

SAS provides a comprehensive suite of advanced credit risk analytics tools that facilitate efficient management of uncertainties and thorough evaluations of credit exposure through predictive modeling and scenario analysis.

How does high-quality data affect predictive analytics outcomes?

High-quality, well-structured data is crucial for achieving accurate outcomes in predictive analytics, enabling institutions to effectively gauge the likelihood of borrower defaults.

What notable results have institutions achieved with SAS's predictive models?

Institutions that implemented predictive models reported a 25% improvement in the accuracy of credit evaluations, significantly reducing default rates.

What recent development has SAS made to enhance its analytics capabilities?

SAS's acquisition of Kamakura Corporation demonstrates its commitment to advancing management solutions in credit risk analytics.