Overview

The key differences between international collection agencies and traditional methods are evident in their approach to debt recovery.

International agencies leverage cultural competence and legal expertise, significantly enhancing collection rates on a global scale.

For instance, local representatives improve communication and compliance, leading to recovery rates that can exceed traditional methods by up to 40%.

This statistic underscores the critical importance of adapting strategies to diverse environments, a necessary step for any organization aiming to optimize its debt recovery efforts.

Introduction

International debt recovery presents a complex landscape characterized by high stakes and significant implications for outcomes. As businesses expand across borders, the decision between utilizing international collection agencies and traditional debt collection methods becomes paramount. This article explores the key differences between these two approaches, emphasizing how cultural awareness, legal expertise, and technological advancements can enhance recovery rates. In an increasingly interconnected world, the pressing question arises: can traditional methods keep pace with the demands of global debt collection, or does a shift towards specialized international agencies hold the key to unlocking greater financial success?

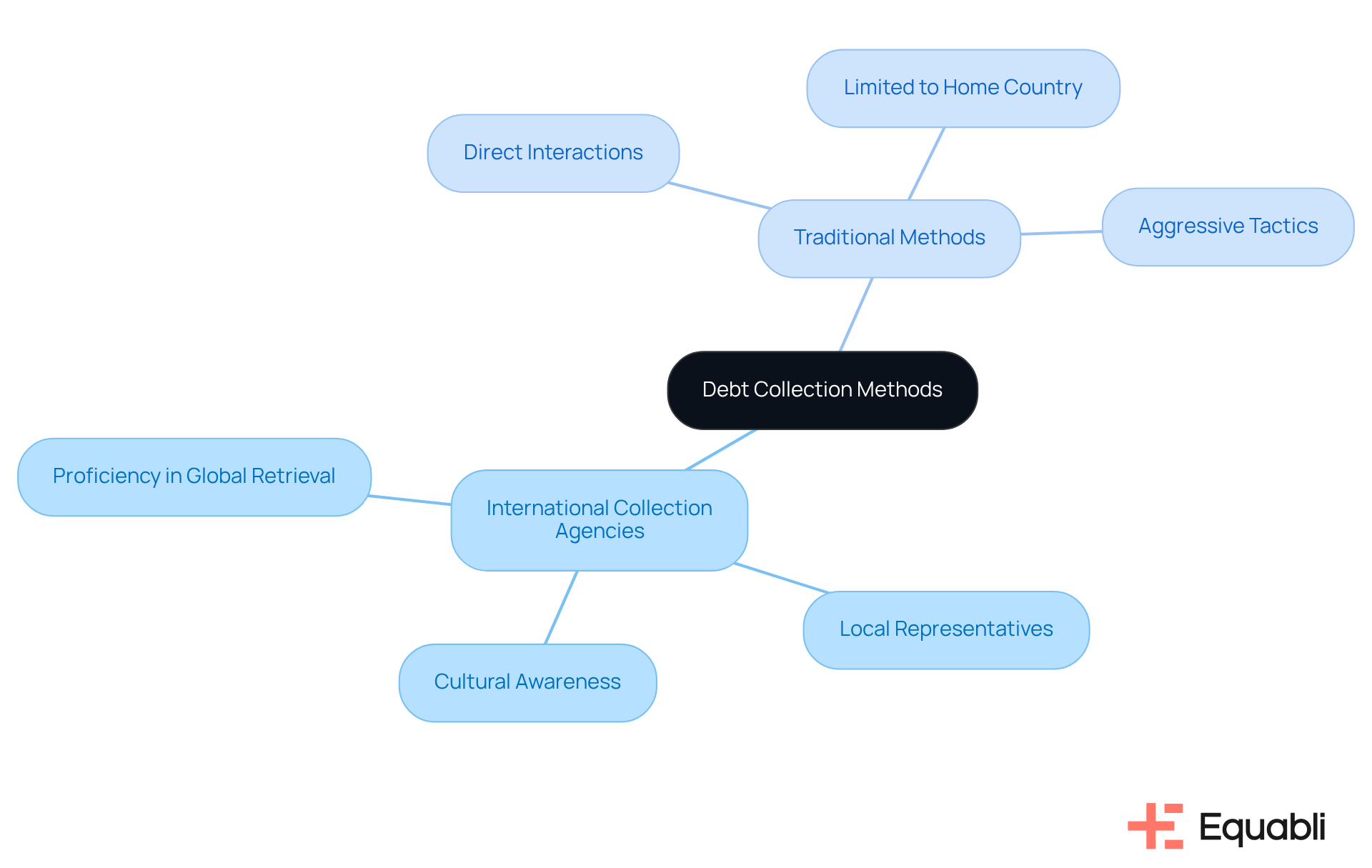

Understanding International Collection Agencies vs. Traditional Methods

International collection agencies demonstrate exceptional proficiency in retrieving funds on a global scale by adeptly navigating complex legal frameworks and cultural nuances. They often engage local representatives who possess an in-depth understanding of the debtor's environment, significantly enhancing collection rates. In contrast, traditional collection methods primarily rely on direct interactions with borrowers through phone calls, letters, and face-to-face meetings, typically confined to the creditor's home country. This approach can be less effective in international contexts due to the that may hinder direct engagement.

Consider this: while aggressive tactics may yield favorable results domestically, such strategies can be counterproductive in other nations where they are perceived negatively. The effectiveness of financial collection methods is profoundly influenced by cultural awareness; understanding local traditions and communication styles is paramount. Companies aiming to refine their financial collection strategies in an increasingly globalized economy must recognize and adapt to these cultural variations, particularly when collaborating with an international collection agency, ensuring that their methods resonate with diverse borrower groups.

Advantages of International Collection Agencies

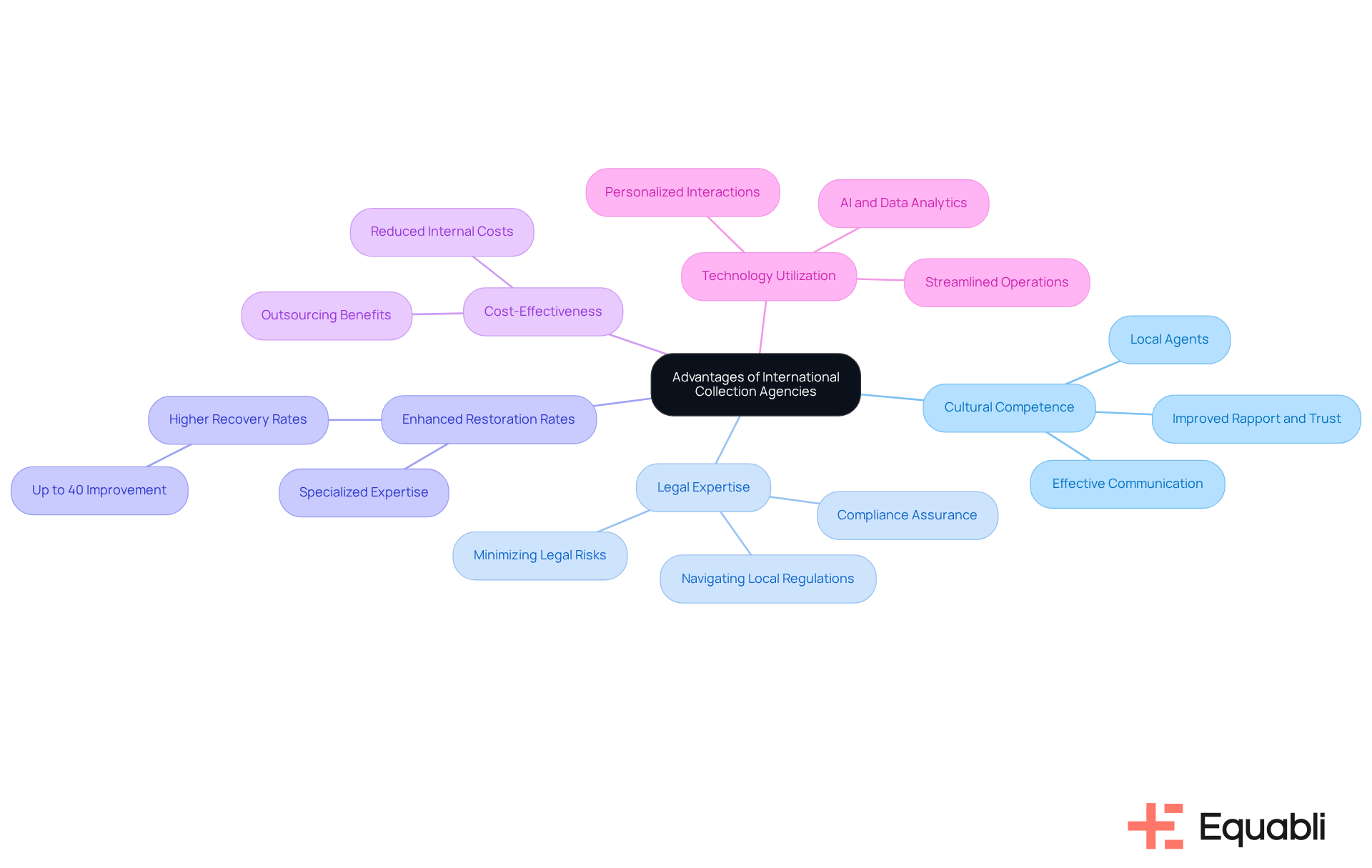

International collection agencies present distinct advantages that significantly enhance debt recovery efforts:

- Cultural Competence: By employing local agents who possess an in-depth understanding of the debtor's cultural context, these agencies facilitate more effective communication and negotiation. This cultural sensitivity fosters improved rapport and trust—elements that are crucial in debt recovery.

- Legal Expertise: These organizations excel in navigating the legal frameworks of their respective countries, ensuring compliance with local regulations. Their expertise minimizes the risk of legal pitfalls and enhances the overall effectiveness of the collection process.

- Enhanced Restoration Rates: With specialized expertise and a regional presence, international organizations often achieve restoration rates that surpass those of conventional methods. Data indicates that organizations leveraging cultural competence can experience recovery rate enhancements of up to 40% compared to traditional practices.

- Cost-Effectiveness: Outsourcing revenue recovery to global firms can lead to substantial cost reductions. Businesses can avoid expenses related to internal recovery efforts—such as staffing, training, and legal fees—while still benefiting from professional services.

- : Many global organizations harness advanced technologies, including AI and data analytics, to refine their collection strategies. This technological integration not only streamlines operations but also personalizes debtor interactions, resulting in improved engagement and outcomes.

In summary, the combination of cultural competence, legal knowledge, and technological innovation positions international agencies as a superior option for businesses seeking effective financial solutions.

Challenges of Traditional Debt Collection Methods

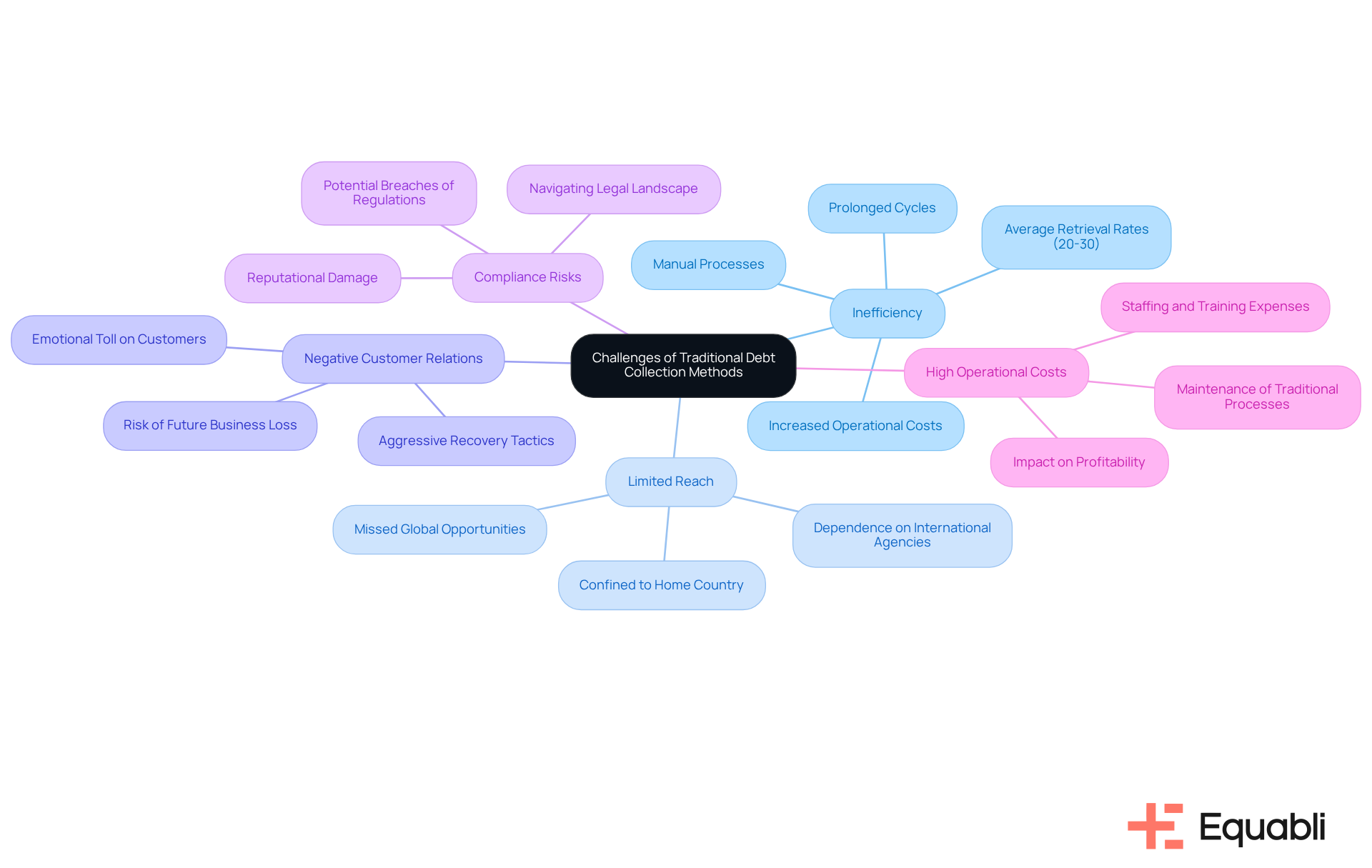

Traditional debt collection methods face significant challenges that undermine their effectiveness:

- Inefficiency: These methods often rely on manual processes, resulting in prolonged cycles and average retrieval rates between 20% and 30%. Such inefficiency not only leads to missed opportunities but also escalates operational costs. Equabli's EQ Suite counters this by providing cloud-based solutions that streamline collections, enhancing the process's intelligence and intuitiveness.

- Limited Reach: Generally confined to the creditor's home country, traditional debt collection methods struggle to engage with international clients, which is why they often rely on an international collection agency to recover debts across borders. This constraint can prevent organizations from fully capitalizing on recovery potential in an increasingly globalized economy. Equabli's solutions empower organizations to expand their reach and effectively manage receivables on a worldwide scale.

- Negative Customer Relations: The use of aggressive recovery tactics can severely damage relationships with customers, fostering resentment and jeopardizing future business opportunities. Debt is often perceived as a form of bondage, and its emotional toll complicates interactions. Equabli emphasizes the importance of compassionate approaches, enabling organizations to engage with borrowers positively through flexible repayment options and enhanced borrower involvement features.

- Compliance Risks: Navigating the intricate legal landscape surrounding debt collection presents significant challenges. Conventional methods may inadvertently breach regulations, exposing organizations to legal repercussions and reputational damage. As regulations evolve, ensuring compliance becomes increasingly complex. Equabli's EQ Suite equips lenders with intelligent tools to manage compliance effectively, mitigating the risk of legal issues.

- High Operational Costs: The financial burden of staffing, training, and maintaining traditional retrieval processes can be substantial, ultimately affecting overall profitability. As the financial landscape shifts, firms must adapt to these challenges to refine their retrieval strategies and maintain a competitive advantage. By transitioning to Equabli's modern solutions, agencies can significantly lower operational costs while enhancing recovery outcomes.

To learn more about how Equabli can , schedule a demonstration today.

Choosing the Right Approach: When to Use Each Method

Selecting the appropriate debt collection strategy is critical and hinges on several key factors:

- Debtor Location: Engaging an international collection agency is often more effective for debtors located overseas. These organizations possess local expertise and a deep understanding of regional regulations and cultural nuances, which can significantly enhance recovery efforts.

- Liability Amount: The magnitude of the liability plays a significant role in determining the recovery method. Larger debts may warrant investment in specialized international collection agencies, which are known for producing higher repayment rates, while smaller debts might be more effectively handled through conventional management techniques.

- Industry Considerations: Various sectors come with distinct regulatory frameworks and cultural contexts that can impact the effectiveness of retrieval strategies. For instance, industries such as healthcare or fintech may require tailored approaches to navigate specific compliance requirements effectively.

- Relationship with Debtor: Maintaining a positive relationship with the debtor is crucial, especially in sectors where repeat business is common. In these cases, traditional methods that emphasize communication and negotiation may be preferable, provided they are handled sensitively.

- Cost vs. Potential Return: Companies must thoroughly assess the expenses linked to each collection technique in relation to the potential return. While global organizations may impose greater charges, an could result in considerably improved restitution outcomes, particularly for larger amounts.

By carefully considering these factors, organizations can make informed decisions that align with their financial goals and operational capabilities, ultimately enhancing their debt recovery efforts.

Conclusion

International collection agencies represent a powerful alternative to traditional debt collection methods, especially in a globalized economy characterized by cultural and legal complexities. By leveraging local expertise, legal knowledge, and advanced technology, these agencies significantly enhance the likelihood of successful debt recovery across borders. This makes them a strategic choice for businesses seeking to optimize their financial solutions.

The article underscores several key advantages of international collection agencies, including:

- Their cultural competence

- Legal expertise

- Superior restoration rates

In contrast, traditional methods often encounter challenges such as:

- Inefficiency

- Limited reach

- High operational costs

These limitations can severely impede effective debt recovery, particularly when engaging with international clients. By recognizing these differences, businesses can navigate their collection strategies more effectively and make informed decisions that align with their specific needs.

Ultimately, selecting the right debt collection approach is critical for maximizing recovery efforts while maintaining positive relationships with debtors. As organizations assess their options, they should weigh the unique advantages of international collection agencies, particularly for larger debts or cross-border scenarios. Embracing these modern solutions not only improves recovery outcomes but also positions businesses for success in an increasingly interconnected marketplace.

Frequently Asked Questions

What is the primary function of international collection agencies?

International collection agencies specialize in retrieving funds on a global scale by navigating complex legal frameworks and cultural nuances.

How do international collection agencies enhance collection rates?

They often engage local representatives who have an in-depth understanding of the debtor's environment, which significantly improves collection rates.

What distinguishes traditional collection methods from international collection agencies?

Traditional collection methods rely on direct interactions with borrowers through phone calls, letters, and face-to-face meetings, typically limited to the creditor's home country, making them less effective in international contexts.

Why can aggressive collection tactics be counterproductive internationally?

Aggressive tactics may yield favorable results domestically but can be perceived negatively in other nations, making them counterproductive.

How does cultural awareness impact financial collection methods?

The effectiveness of financial collection methods is influenced by cultural awareness; understanding local traditions and communication styles is essential for successful collections.

What should companies consider when refining their financial collection strategies globally?

Companies must recognize and adapt to cultural variations, particularly when working with international collection agencies, to ensure their methods resonate with diverse borrower groups.