Overview

Digital debt collection solutions are critical for enterprise risk management, enhancing operational efficiency and aligning with consumer preferences for technology-driven engagement.

Evidence shows that leveraging analytics, automated workflows, and tailored communication strategies not only improves compliance with regulations but also leads to significant cost reductions and better recovery outcomes.

This underscores the necessity for enterprises to adopt such solutions in today's evolving financial landscape, positioning them to navigate compliance challenges effectively while optimizing operational performance.

Introduction

The landscape of digital debt collection is undergoing a significant transformation, propelled by technological advancements and evolving consumer preferences. This shift presents organizations with a unique opportunity to enhance their financial risk management through innovative debt collection solutions that streamline processes and cater to a tech-savvy clientele.

As the industry progresses, enterprises must navigate the complexities of compliance and operational efficiency while ensuring a personalized approach to debt recovery. This dual focus not only mitigates risk but also aligns with the strategic goals of modern financial institutions.

Understand the Digital Debt Collection Landscape

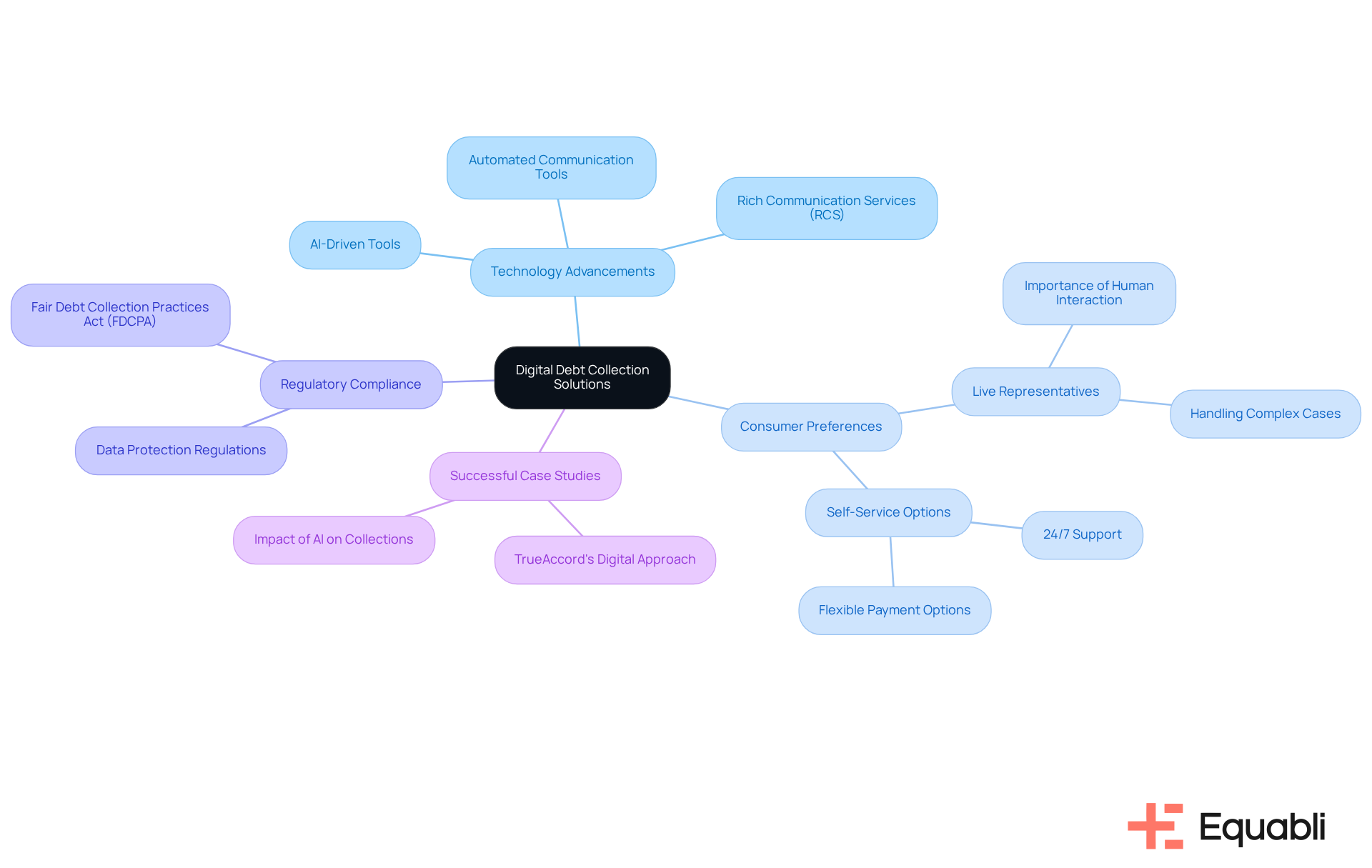

The digital debt collection solutions for enterprise financial risk management landscape have evolved significantly, driven by advancements in technology and changing consumer expectations. Organizations must acknowledge the importance of adopting digital debt collection solutions for enterprise financial risk management, which includes the utilization of online platforms, mobile applications, and automated communication tools. This shift not only enhances operational efficiency but also aligns with the preferences of a tech-savvy consumer base that favors . Notably, while 50% of consumers prefer interacting with live representatives for service, it is essential to balance this with self-service alternatives to enhance user experience, as highlighted in recent industry insights.

Furthermore, understanding the regulatory environment is crucial, as compliance with laws such as the Fair Debt Collection Practices Act (FDCPA) is paramount in maintaining ethical standards and avoiding legal pitfalls. Organizations must remain informed about industry trends and consumer behavior, particularly the transition from SMS to Rich Communication Services (RCS), which has been shown to enhance engagement rates and reduce friction in repayment processes.

Successful case studies illustrate how digital debt collection solutions for enterprise financial risk management impact receivable management practices. For instance, TrueAccord's digital-first approach demonstrates how leveraging AI-driven tools can lead to a 40% reduction in operational expenses and a 10% improvement in recoveries. By incorporating behavioral insights and predictive analytics, companies can customize their strategies to address diverse consumer needs, ultimately resulting in more efficient retrievals and enhanced customer satisfaction. As the debt collection industry continues to evolve, adopting digital debt collection solutions for enterprise financial risk management will be key to achieving sustainable growth and compliance.

Adopt Data-Driven Strategies for Compliance and Efficiency

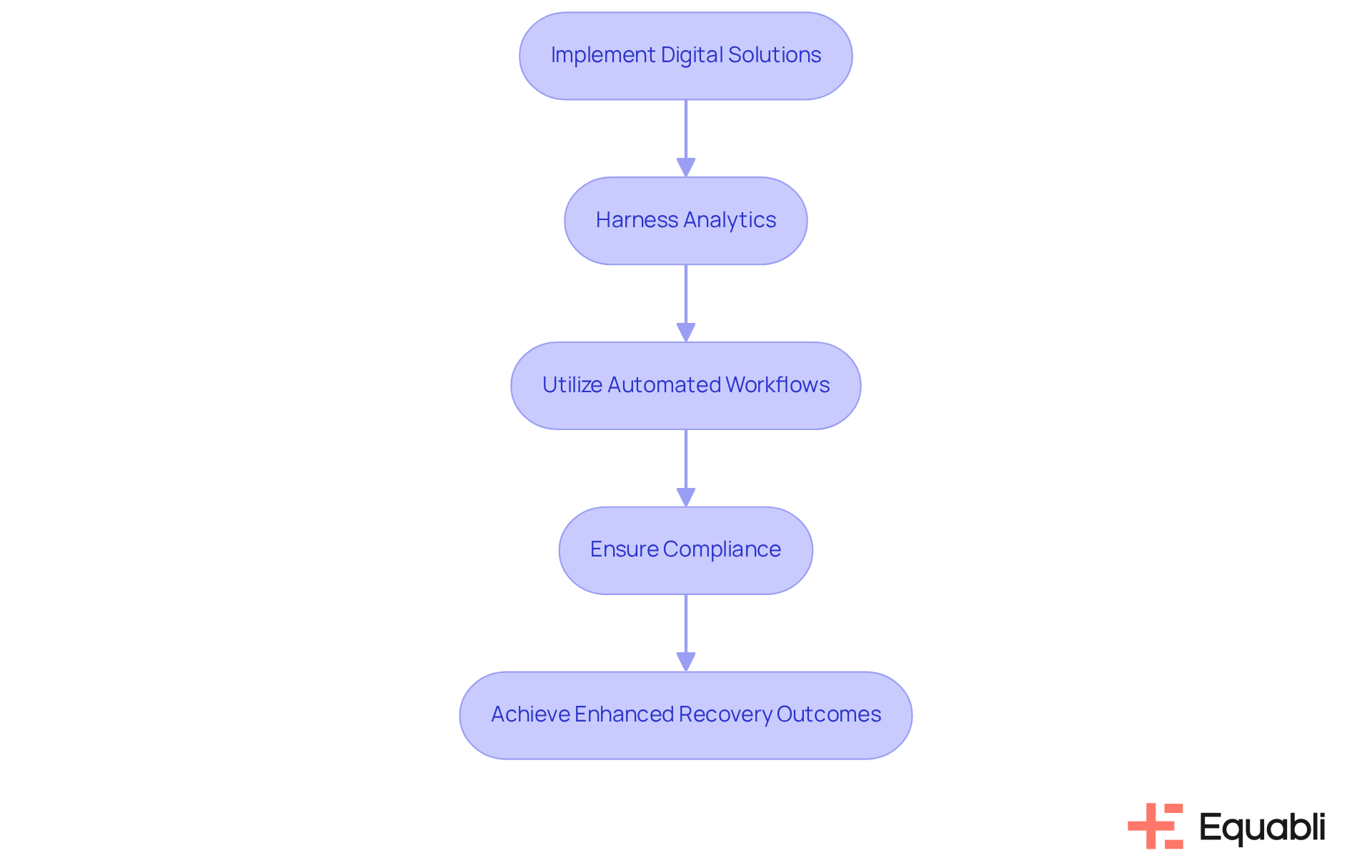

Implementing digital debt collection solutions for enterprise financial risk management is essential for organizations aiming to enhance their debt recovery efforts. By harnessing analytics, companies can gain valuable insights into debtor behavior and preferences. Advanced analytics tools, such as Equabli's EQ Collect, offer a user-friendly, scalable, cloud-native interface along with a no-code file-mapping tool that streamlines vendor onboarding and enhances operational efficiency.

Utilizing minimizes execution errors and reduces manual tasks, allowing financial institutions to concentrate on high-risk accounts identified through predictive analytics. This approach not only forecasts repayment likelihood but also enables collectors to prioritize efforts on accounts with the greatest potential for recovery.

Moreover, it is imperative for entities to ensure compliance with regulatory requirements. Real-time reporting and automated monitoring facilitate the tracking of communication history and documentation of interactions with debtors. By adopting a data-centric approach through digital debt collection solutions for enterprise financial risk management, organizations can enhance operational efficiency, reduce costs, and improve compliance, ultimately leading to superior recovery outcomes.

Customize Solutions to Fit Organizational Needs

Every organization possesses unique characteristics that significantly influence its debt recovery processes. Tailoring solutions to fit specific operational requirements and client profiles is essential for success. Organizations should conduct a comprehensive assessment of their current gathering strategies to identify areas for enhancement, including:

For example, a fintech company may find value in integrating mobile payment solutions to streamline transactions, while a healthcare provider might prioritize empathetic communication strategies to effectively navigate sensitive financial situations. By utilizing adaptable tools and technologies, companies can enhance their gathering efforts, increase customer satisfaction, and ultimately achieve higher recovery rates.

Case studies indicate that companies implementing customized communication strategies have experienced substantial improvements in their recovery results, underscoring the importance of a personalized approach in today's evolving financial recovery landscape.

Provide Comprehensive Training and Support for Staff

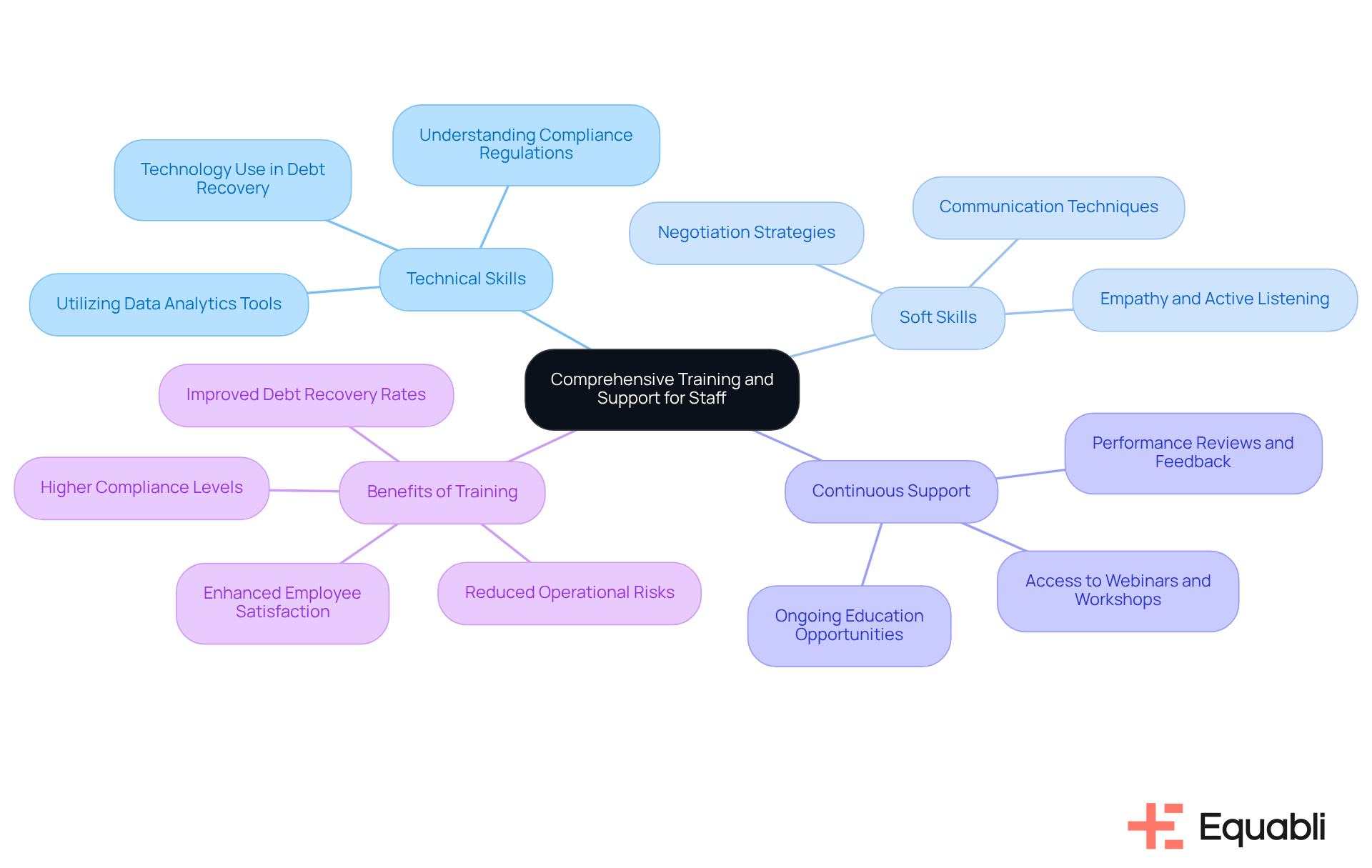

To maximize the effectiveness of digital financial recovery strategies, organizations must invest in comprehensive training programs for their staff. This investment is crucial as it equips employees with knowledge on the latest technologies, compliance regulations, and best practices in customer engagement. Training should encompass both technical skills and , such as empathy and negotiation techniques, which are vital for building rapport with debtors. Communication stands out as the most invaluable skill for successful debt recovery; therefore, training programs must emphasize this aspect.

Furthermore, organizations should provide continuous assistance and resources, including access to sector webinars, workshops, and certification programs, to ensure that staff remain updated on emerging trends and practices. Leveraging data analytics tools enhances training initiatives by tracking team performance and tailoring programs to meet specific needs. By fostering a culture of ongoing education, organizations can elevate their team's capabilities, leading to improved retrieval outcomes and greater employee satisfaction.

Statistics indicate that well-trained collections teams can recover amounts more effectively. For instance, firms implementing structured training programs report higher compliance levels and reduced operational risks. Establishing clear metrics and key performance indicators (KPIs) is essential for tracking improvements in debt recovery performance. Case studies reveal that agencies participating in industry events and engaging in continuous education not only enhance their performance but also promote innovation within their teams.

Expert recommendations underscore the necessity of assessing current skill levels and identifying gaps through performance reviews and feedback sessions. This strategic approach ensures that training programs are tailored to meet the specific needs of the team, ultimately resulting in better financial management and enhanced liquidity for the organization through digital debt collection solutions for enterprise financial risk management. By investing in robust training for collections teams, financial institutions can safeguard their reputation, promote fairness in financial services, and achieve sustainable growth.

Conclusion

The evolution of digital debt collection solutions represents a pivotal moment in enterprise risk management, underscoring the imperative for organizations to embrace technological advancements and shifting consumer preferences. By adopting these digital strategies, businesses can enhance operational efficiency and align their practices with the expectations of a modern, tech-savvy clientele. The integration of online platforms, mobile applications, and automated communication tools is vital for creating a more effective and user-friendly debt recovery process.

Key insights from the article emphasize the necessity of:

- Data-driven strategies

- Adherence to regulatory standards

- Customization of debt collection practices to meet the unique needs of each organization

Successful case studies, such as TrueAccord's AI-driven approach, illustrate the tangible benefits of these solutions, including:

- Reduced operational costs

- Improved recovery rates

Furthermore, investing in comprehensive training for staff equips teams with the essential skills and knowledge to navigate the complexities of the digital debt collection landscape effectively.

Ultimately, mastering digital debt collection solutions is of paramount importance. As organizations pursue sustainable growth and compliance in an increasingly competitive environment, leveraging technology and data insights will be critical. By prioritizing tailored strategies and ongoing staff development, enterprises can enhance their debt recovery efforts, protect their reputations, and contribute to a fairer financial ecosystem. Embracing these practices today will establish a strong foundation for success in the evolving landscape of debt collection.

Frequently Asked Questions

What is the current landscape of digital debt collection solutions?

The digital debt collection landscape has evolved significantly due to advancements in technology and changing consumer expectations. Organizations are increasingly adopting online platforms, mobile applications, and automated communication tools to enhance operational efficiency and meet the preferences of tech-savvy consumers.

Why is it important to adopt digital debt collection solutions?

Adopting digital debt collection solutions is important for improving operational efficiency and aligning with consumer preferences for self-service options. It also helps organizations manage financial risk more effectively.

What do consumers prefer in terms of debt collection interactions?

While 50% of consumers prefer interacting with live representatives for service, it is essential to balance this with self-service alternatives to enhance the overall user experience.

What regulatory considerations should organizations be aware of in debt collection?

Organizations must comply with laws such as the Fair Debt Collection Practices Act (FDCPA) to maintain ethical standards and avoid legal issues.

What are some recent trends in consumer communication preferences?

There is a notable transition from SMS to Rich Communication Services (RCS), which has been shown to enhance engagement rates and reduce friction in repayment processes.

Can you provide an example of a successful digital debt collection strategy?

TrueAccord's digital-first approach is a successful case study that demonstrates how leveraging AI-driven tools can lead to a 40% reduction in operational expenses and a 10% improvement in recoveries.

How can companies customize their debt collection strategies?

Companies can customize their strategies by incorporating behavioral insights and predictive analytics to address diverse consumer needs, resulting in more efficient retrievals and enhanced customer satisfaction.

What is the future outlook for digital debt collection solutions?

As the debt collection industry continues to evolve, adopting digital solutions will be key to achieving sustainable growth and compliance in enterprise financial risk management.