Overview

The article underscores the importance of utilizing third-party debt collection solutions as a critical component of enterprise risk management. These specialized agencies not only enhance recovery rates but also ensure compliance with regulatory standards. Evidence shows that these agencies leverage advanced technologies and data analytics to manage overdue accounts effectively. This capability allows organizations to concentrate on their core operations while mitigating the financial risks associated with debt recovery.

Introduction

Navigating the complexities of enterprise risk management is increasingly critical, particularly as financial institutions confront pressures from overdue accounts. Third-party debt collection solutions have emerged as strategic allies, providing specialized expertise and advanced technologies that enhance recovery rates while ensuring compliance with regulatory standards. As organizations increasingly engage these external partners, a pressing question arises: how can businesses effectively integrate these solutions to mitigate financial risks and bolster overall operational efficiency?

Understand Third-Party Debt Collection Solutions

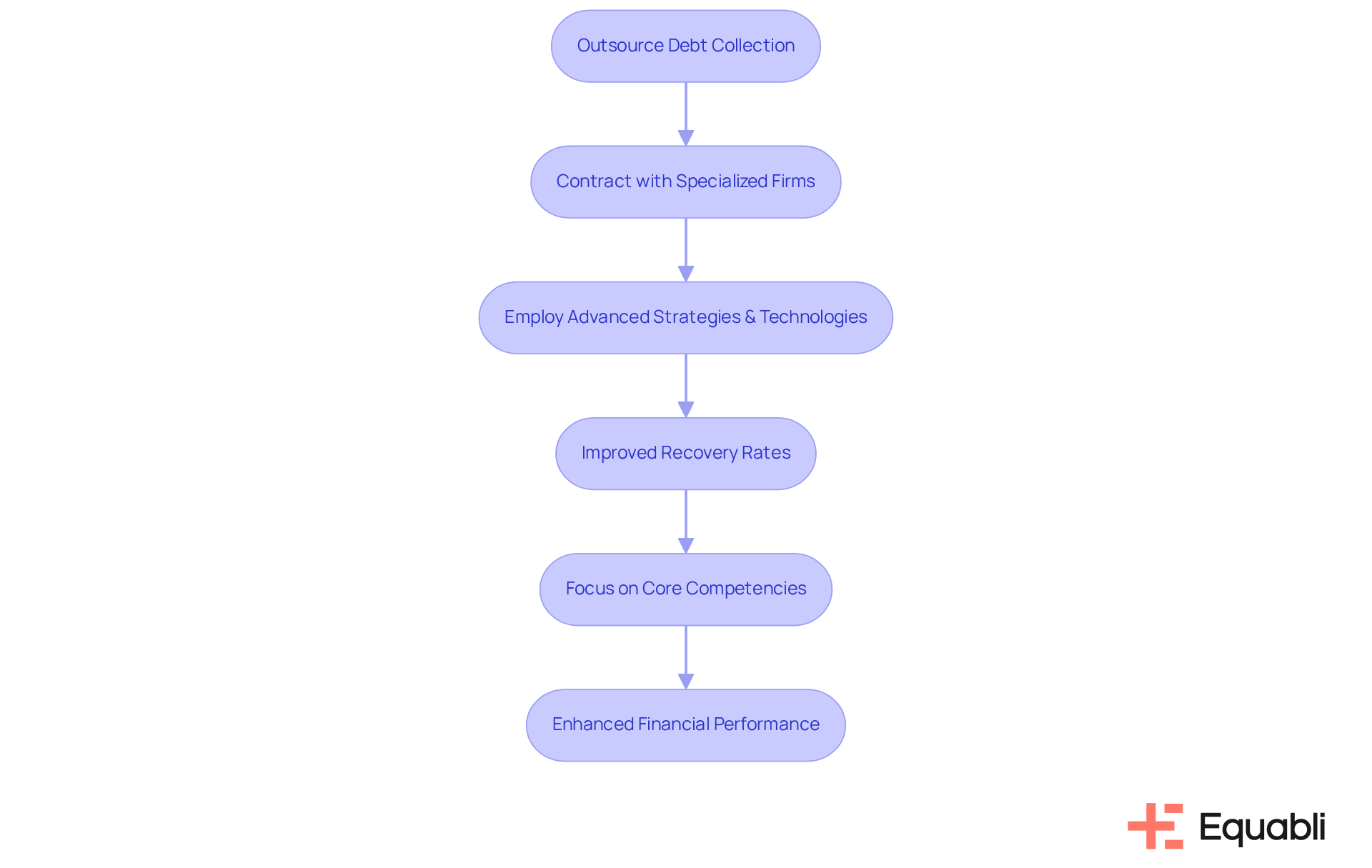

By utilizing third-party debt collection solutions for enterprise risk management, financial institutions can gain a strategic advantage in managing overdue accounts through contracting out receivable management to specialized firms. These agencies operate independently from the original lender, employing advanced strategies and technologies to recover amounts efficiently.

Evidence suggests that by leveraging data analytics and customer engagement techniques, third-party collectors can significantly improve recovery rates while adhering to regulatory standards. In 2025, it is projected that approximately 60% of companies will outsource their collection efforts, reflecting a growing trend toward utilizing external expertise to boost financial performance.

Industry leaders assert that outsourcing not only reduces operational costs but also allows firms to focus on their core competencies. This approach mitigates the financial risks associated with overdue accounts, making third-party debt collection solutions for enterprise risk management essential for organizations looking to .

As the financial recovery landscape evolves, it is critical to understand third-party debt collection solutions for enterprise risk management to maintain a competitive edge in the market.

Leverage Strategic Benefits for Risk Management

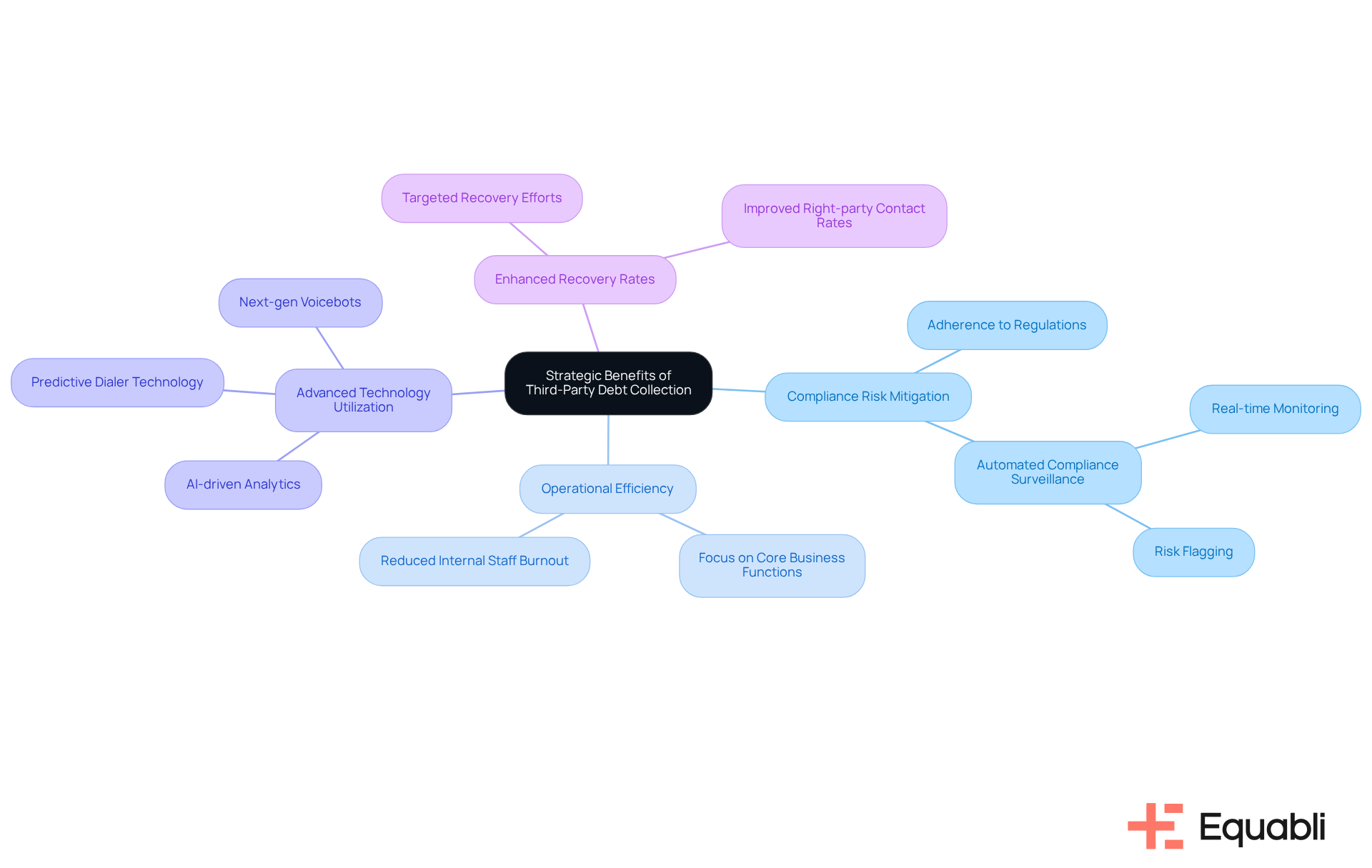

Utilizing for enterprise risk management presents strategic advantages. These agencies possess specialized expertise in navigating complex regulatory landscapes, effectively mitigating compliance risks that could threaten an organization’s reputation and operational integrity. By leveraging advanced technologies, particularly AI-driven analytics, they can swiftly identify high-risk accounts and prioritize recovery efforts, leading to improved recovery rates and optimized resource allocation. This targeted approach accelerates the retrieval process while simultaneously reducing the time and costs associated with traditional methods.

Moreover, delegating receivables enables organizations to concentrate on their core business functions, thereby enhancing overall operational efficiency and minimizing the risk of burnout among internal staff. The integration of AI tools further transforms recovery strategies, equipping collectors with real-time insights and compliance assurance, which are crucial in today’s regulatory environment. Additionally, EQ Collect offers a user-friendly, scalable, cloud-native interface that enhances the overall experience and efficiency of receivable recovery efforts. In conclusion, the use of third-party debt collection solutions for enterprise risk management significantly strengthens an organization’s risk management framework, ensuring compliance while maximizing recovery potential.

Implement Best Practices for Effective Integration

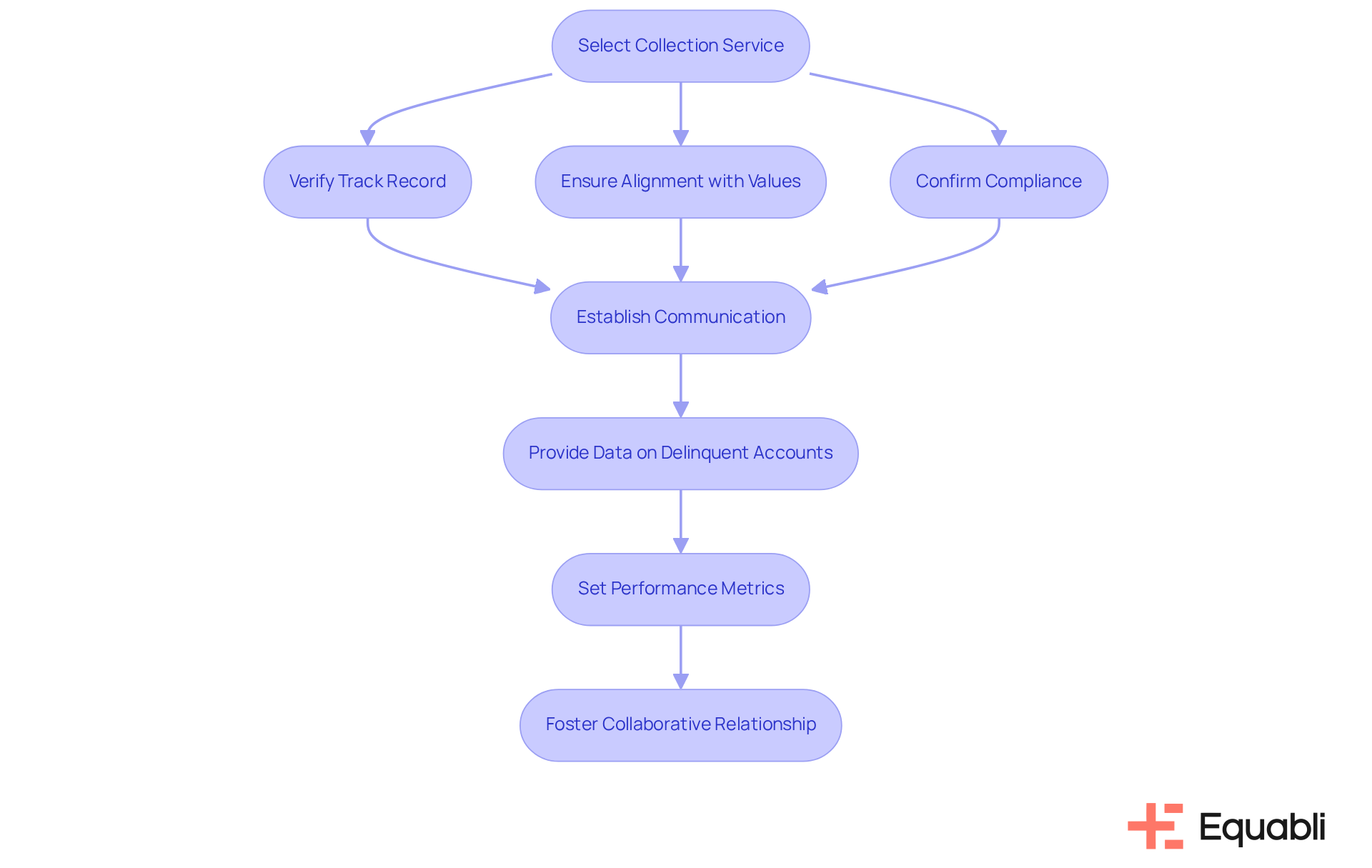

Effectively integrating third-party debt collection solutions for enterprise risk management necessitates adherence to several best practices. Conducting thorough due diligence when selecting a collection service is paramount. This process involves:

- Verifying the service's track record

- Ensuring alignment with your organization’s values

- Confirming compliance with relevant regulations

Establishing clear communication pathways between your business and the agency is also critical; such openness facilitates swift issue resolution and fosters trust.

To address the challenges associated with manual receivables collection, including time loss and inefficiency, organizations should provide the firm with comprehensive data on delinquent accounts—encompassing payment history and prior customer interactions. This information enables the development of informed collection strategies tailored to your requirements. Additionally, establishing specific performance metrics and routinely assessing the organization's outcomes ensures that recovery objectives are consistently met.

Ultimately, fostering a can yield innovative solutions and improved recovery outcomes, which can be achieved through third-party debt collection solutions for enterprise risk management, enhancing your organization’s overall financial management strategy. By leveraging contemporary, cloud-based solutions such as Equabli's EQ Suite, organizations can transform manual processes into intelligent, data-driven operations that bolster recovery outcomes.

Ensure Compliance and Ethical Standards in Collections

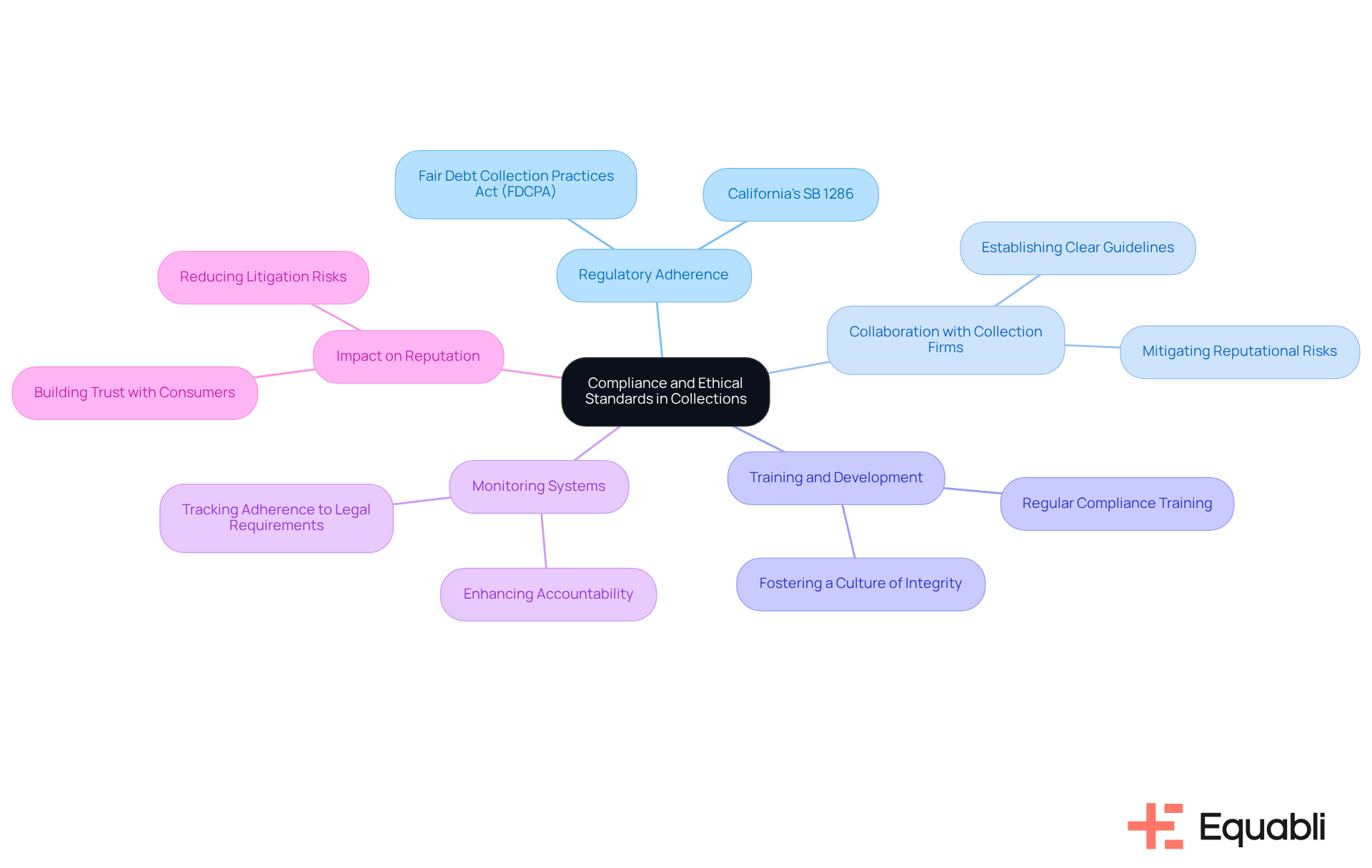

Ensuring compliance and ethical standards in third-party debt collection solutions for enterprise risk management is paramount for organizations. Adhering to regulations such as the Fair Debt Collection Practices Act (FDCPA) and other relevant laws is essential in governing debt recovery methods. Organizations must collaborate closely with their collection firms to establish clear guidelines that prohibit abusive or deceptive practices. This collaboration not only fosters compliance but also mitigates reputational risks associated with unethical behavior.

Regular training on compliance and ethical standards for both internal staff and third-party collectors is crucial in fostering a culture of integrity. By equipping personnel with the necessary knowledge, organizations can better navigate the complexities of debt collection while adhering to legal mandates. Furthermore, implementing monitoring systems to track the agency's adherence to legal requirements and ethical practices enhances accountability and operational transparency.

By prioritizing compliance and ethics, organizations can protect their reputation, reduce the risk of litigation, and build stronger relationships with consumers. This strategic focus not only aligns with regulatory expectations but also positions organizations as by utilizing third-party debt collection solutions for enterprise risk management.

Conclusion

The utilization of third-party debt collection solutions represents a pivotal advancement in enterprise risk management, empowering organizations to effectively address overdue accounts while simultaneously enhancing financial performance. By outsourcing these services, businesses can leverage specialized expertise and cutting-edge technologies, which facilitates more efficient debt recovery and reduces operational costs. This strategic integration not only mitigates financial risks but also allows organizations to focus on their core competencies.

Throughout this discussion, the advantages of third-party debt collection solutions have been elucidated, including:

- Improved recovery rates through data analytics

- Adherence to regulatory standards

- The capability to streamline operations

Best practices for selecting a dependable collection agency, promoting clear communication, and upholding ethical standards have also been examined, underscoring the necessity of a collaborative relationship with external partners.

In an increasingly dynamic financial landscape, the importance of employing third-party debt collection solutions is paramount. Organizations are urged to adopt these innovative strategies to fortify their risk management frameworks, safeguard their reputations, and ultimately achieve superior financial outcomes. By prioritizing compliance and ethical practices, businesses can establish themselves as trusted partners, thereby paving the way for sustainable growth and success in the competitive market.

Frequently Asked Questions

What are third-party debt collection solutions?

Third-party debt collection solutions involve contracting specialized firms to manage overdue accounts independently from the original lender, using advanced strategies and technologies to recover debts efficiently.

How do third-party collectors improve recovery rates?

Third-party collectors utilize data analytics and customer engagement techniques to significantly enhance recovery rates while ensuring compliance with regulatory standards.

What is the projected trend for outsourcing collection efforts by 2025?

It is projected that approximately 60% of companies will outsource their collection efforts by 2025, indicating a growing trend towards utilizing external expertise for financial performance improvement.

What are the benefits of outsourcing debt collection?

Outsourcing debt collection reduces operational costs and allows firms to focus on their core competencies, thereby mitigating financial risks associated with overdue accounts.

Why are third-party debt collection solutions important for enterprise risk management?

These solutions are essential for organizations looking to enhance their recovery processes and maintain a competitive edge in the evolving financial recovery landscape.