Overview

Integrated credit risk management solutions serve a critical role in enhancing financial decision-making and operational efficiency. By maximizing impact through improved data analytics, borrower assessment, compliance oversight, and reporting functionalities, these solutions empower financial institutions to predict risks more effectively. This capability is essential for tailoring strategies that lead to improved customer satisfaction and reduced default rates. Ultimately, a comprehensive and aligned approach to risk management positions organizations to navigate the complexities of the financial landscape with greater confidence.

Introduction

In an increasingly complex financial landscape, the effectiveness of credit risk management is pivotal to an institution's success. Integrated credit risk management solutions empower financial organizations to enhance their operational efficiency and decision-making capabilities through advanced data analytics, compliance oversight, and tailored assessment tools.

However, the challenge lies in effectively aligning these systems with organizational strategies and engaging key stakeholders throughout the implementation process. Institutions must ensure not only the adoption of these solutions but also their optimization to navigate the evolving risks of 2025 and beyond.

Understand Core Components of Integrated Credit Risk Management Platforms

The essential components of integrated credit risk management platform solutions for financial institutions include:

- Data analytics

- Assessment tools

- Compliance oversight

- Reporting functionalities

Data analytics is fundamental, empowering organizations to process and analyze extensive datasets, which leads to more precise predictions of potential issues. Risk assessment tools serve to evaluate borrower creditworthiness, while compliance management ensures adherence to regulatory standards. Furthermore, reporting features deliver insights into exposure and performance metrics, facilitating informed decision-making.

For example, financial organizations can leverage advanced analytics to discern patterns in borrower behavior, significantly influencing lending strategies and efforts to mitigate potential issues. This comprehensive approach utilizes for financial institutions, enhancing evaluation processes, boosting operational efficiency, and reducing roll-rates, ultimately yielding improved financial outcomes.

Equabli's EQ Engine further refines this landscape by forecasting the likelihood of delinquency for active accounts, enabling institutions to develop intelligent servicing strategies tailored for each communication channel. As industry leaders emphasize, integrating data analysis into lending evaluations is vital for successfully navigating the complexities of today's financial environment.

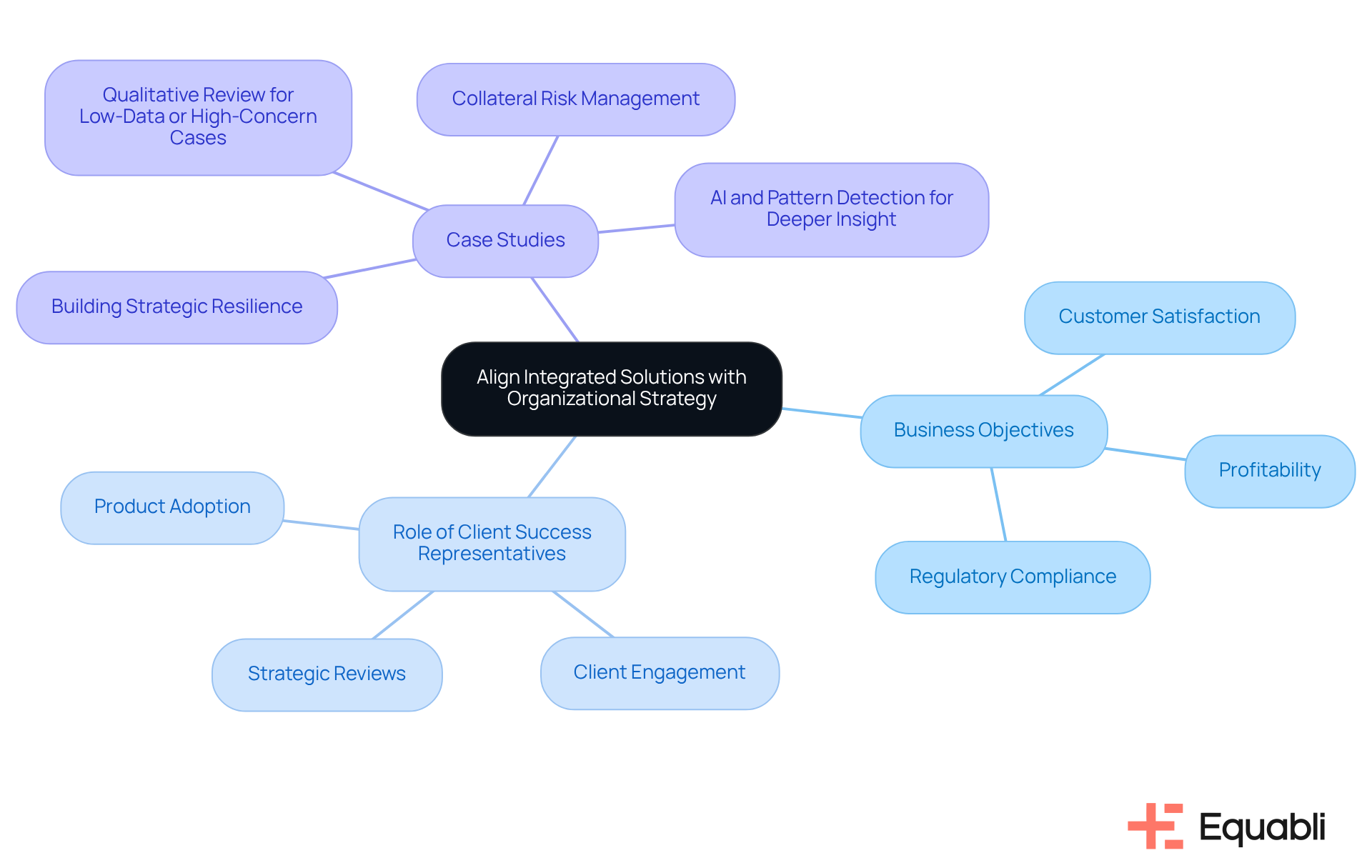

Align Integrated Solutions with Organizational Strategy and Operations

To enhance the effectiveness of integrated credit risk management platform solutions for financial institutions, organizations must ensure these systems are closely aligned with their overall strategy and operational processes. This alignment is crucial for supporting business objectives such as improving customer satisfaction, enhancing profitability, and ensuring regulatory compliance.

For instance, lenders can utilize credit assessment tools that not only gauge borrower vulnerability but also enhance customer interaction through personalized communication strategies. By integrating these tools with strategic goals, lenders can improve both threat oversight and customer experience, ultimately leading to heightened loyalty and reduced default rates. The role of a Client Success Representative at Equabli is pivotal in this process, as they drive product adoption and client engagement by understanding business goals and ensuring that the platform delivers on those outcomes. They manage customer accounts, conduct proactive check-ins, and identify upsell opportunities, which are essential for fostering strong client relationships.

Frequent evaluations of the consistency between hazard control practices and organizational objectives are critical. This enables institutions to identify areas for improvement and maintain agility in a rapidly evolving market landscape. Client Success Representatives contribute to this by conducting strategic business reviews and sharing insights on product usage trends, which can lead to better decision-making and enhanced client relationships.

Case studies demonstrate that organizations implementing integrated credit risk management platform solutions for financial institutions have successfully enhanced customer satisfaction by streamlining processes and improving responsiveness to borrower needs, ultimately resulting in better business outcomes.

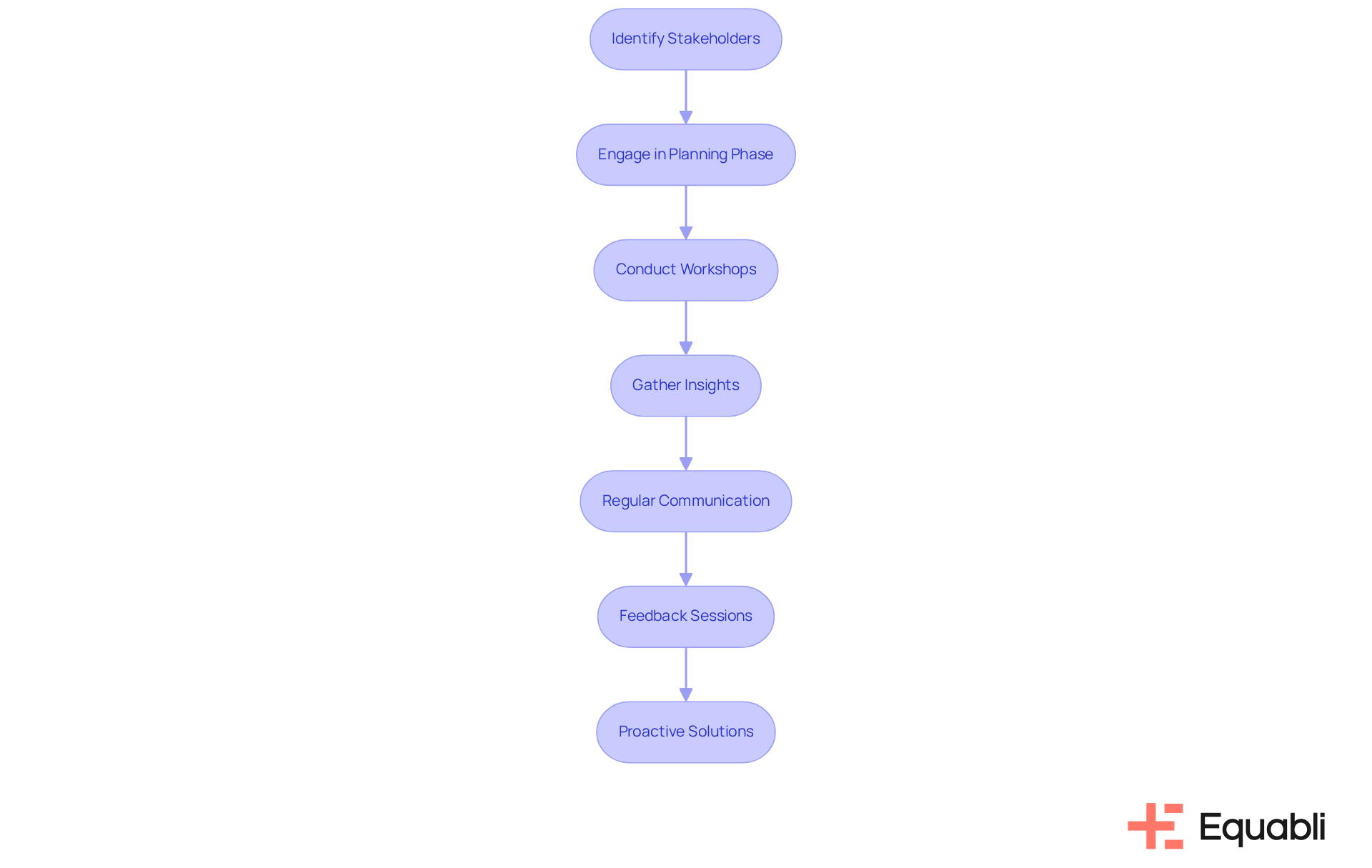

Engage Stakeholders and Foster Communication During Implementation

Effective stakeholder involvement is essential during the implementation of integrated credit risk management platform solutions for financial institutions. Organizations must identify key stakeholders—including leadership, IT teams, compliance officers, and front-line staff—and actively engage them in both the planning and execution phases. Regular communication through meetings, updates, and feedback sessions fosters trust and ensures alignment among all parties involved.

For instance, a financial institution may conduct workshops to gather insights from various departments regarding their specific needs and concerns about the new system. This collaborative approach among stakeholders and aids in identifying potential challenges early in the process, enabling proactive solutions. Industry insights indicate that entities with robust communication strategies during system implementation experience a 30% increase in project success rates. Dan Byrne emphasizes that "consistent, reliable communication is crucial for [building trust over time](https://riskonnect.com/esg/how-can-companies-improve-investor-relations-and-stakeholder-engagement)." By maintaining open channels of communication, companies can facilitate smoother transitions and significantly enhance the overall efficiency of their financial vulnerability management efforts.

Furthermore, recognizing that stakeholders encompass any group or individual who can influence or is influenced by the entity's objectives, as highlighted by R. Edward Freeman, underscores the importance of involving all relevant parties. It is also critical to be aware of common pitfalls in stakeholder engagement, such as neglecting to address concerns or failing to involve key stakeholders early enough, which can impede the success of the implementation process.

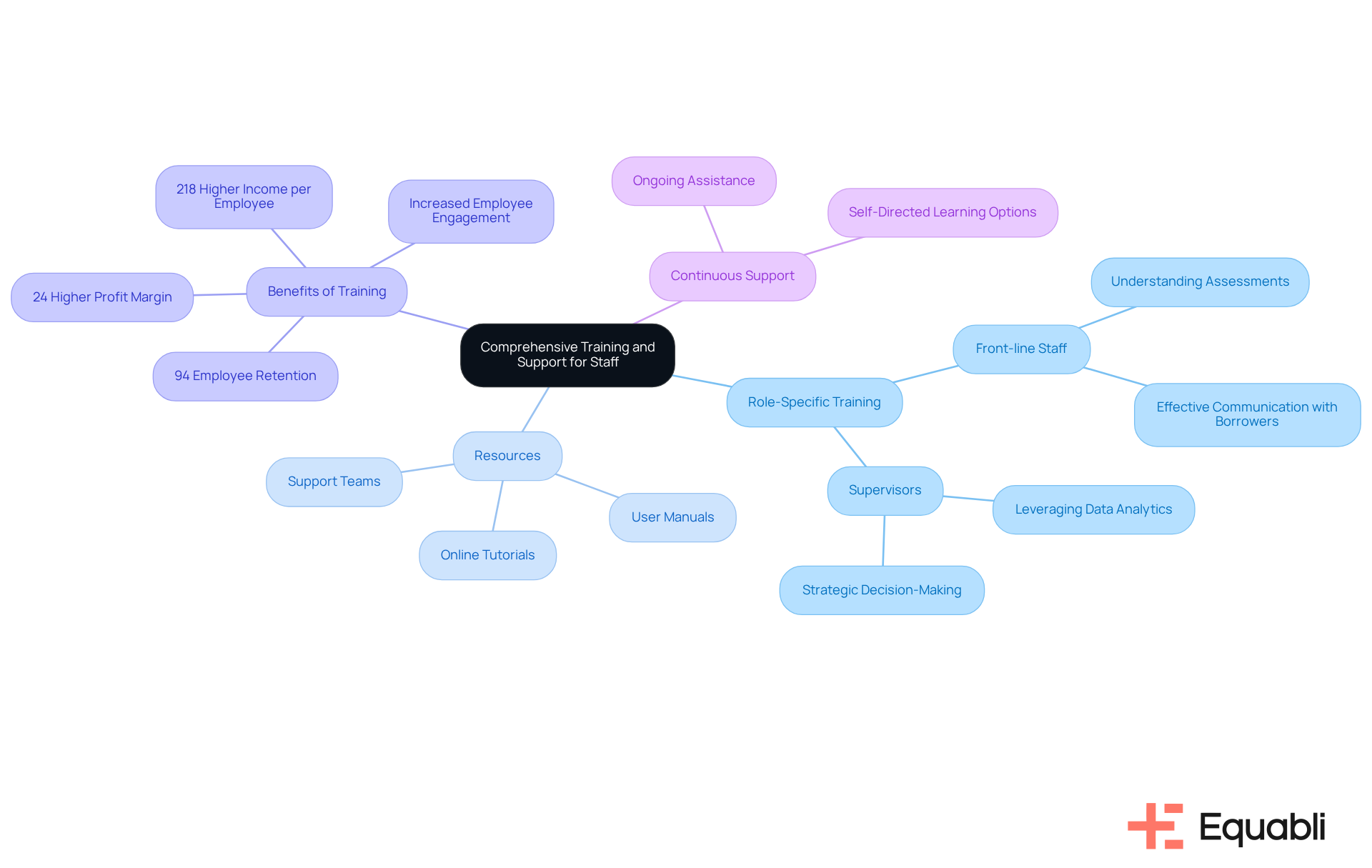

Provide Comprehensive Training and Support for Staff

To fully leverage the advantages of integrated financial threat oversight solutions, organizations must prioritize and continuous support for their personnel. This approach transcends initial training on system usage; it encompasses ongoing assistance to resolve challenges as they arise, reflecting Equabli's commitment to client success.

Training programs should be customized for various roles within the organization, ensuring that each employee comprehends how their responsibilities contribute to the overall credit assessment strategy. For instance, front-line staff may require training on understanding assessments and effectively communicating with borrowers, while supervisors may need insights into leveraging data analytics for strategic decision-making. Grasping business objectives is essential for fostering product adoption and enhancing client engagement, ensuring that the platform meets desired outcomes.

Furthermore, providing access to resources such as user manuals, online tutorials, and dedicated support teams can significantly enhance staff confidence in utilizing new tools. Research indicates that organizations investing in employee training experience a 24% higher profit margin, and companies that offer extensive training have 218% higher income per employee compared to those without it. Additionally, 94% of employees are likely to remain longer at a company that invests in their career development, highlighting the importance of prioritizing training and support. By cultivating a culture of continuous education and growth, including options for self-directed learning—preferred by 58% of employees—organizations can enhance employee engagement and ensure the effective implementation of their credit management initiatives. This encompasses identifying and supporting upsell, cross-sell, and renewal opportunities in collaboration with the sales team, as well as working closely with internal teams to monitor account health metrics and proactively address risk factors.

Conclusion

Maximizing impact through integrated credit risk management solutions is essential for financial institutions navigating the complexities of the modern financial landscape. A comprehensive approach that incorporates data analytics, risk assessment tools, compliance oversight, and robust reporting functionalities enhances decision-making processes and improves overall performance.

The integration of these core components streamlines operations and aligns with organizational strategies to achieve business objectives such as customer satisfaction and profitability. Engaging stakeholders throughout the implementation process, along with providing tailored training and support for staff, strengthens the effectiveness of these solutions. Fostering collaboration and ensuring involvement from all relevant parties significantly increases the likelihood of successful outcomes.

Ultimately, embracing integrated credit risk management solutions is not merely a tactical decision; it is a strategic imperative that can enhance operational efficiency, reduce default rates, and improve financial results. Organizations are encouraged to invest in these systems and prioritize ongoing training and stakeholder engagement to fully realize the benefits and maintain a competitive edge in an ever-evolving market.

Frequently Asked Questions

What are the core components of integrated credit risk management platforms?

The core components include data analytics, assessment tools, compliance oversight, and reporting functionalities.

How does data analytics contribute to credit risk management?

Data analytics empowers organizations to process and analyze extensive datasets, leading to more precise predictions of potential issues.

What is the purpose of risk assessment tools in credit risk management?

Risk assessment tools are used to evaluate borrower creditworthiness.

Why is compliance oversight important in integrated credit risk management?

Compliance oversight ensures adherence to regulatory standards.

What role do reporting functionalities play in credit risk management?

Reporting functionalities deliver insights into exposure and performance metrics, facilitating informed decision-making.

How can financial organizations use advanced analytics in their lending strategies?

Financial organizations can leverage advanced analytics to discern patterns in borrower behavior, significantly influencing lending strategies and efforts to mitigate potential issues.

What benefits do integrated credit risk management platforms provide to financial institutions?

They enhance evaluation processes, boost operational efficiency, and reduce roll-rates, ultimately yielding improved financial outcomes.

What is Equabli's EQ Engine, and how does it contribute to credit risk management?

Equabli's EQ Engine forecasts the likelihood of delinquency for active accounts, enabling institutions to develop intelligent servicing strategies tailored for each communication channel.

Why is integrating data analysis into lending evaluations emphasized by industry leaders?

It is vital for successfully navigating the complexities of today's financial environment.