Overview

The article underscores the obligations and compliance requirements of furnishers in credit reporting, highlighting their essential role in delivering accurate information to credit reporting agencies. Central to this discussion is the legal framework established by the Fair Credit Reporting Act (FCRA), which delineates specific duties that furnishers must fulfill. These responsibilities include:

- Ensuring accuracy

- Investigating disputes

- Maintaining proper records

Such measures are vital for mitigating risks associated with inaccuracies in credit reporting, thereby reinforcing the importance of compliance in enterprise-level operations.

Introduction

Furnishers serve a critical function within the credit reporting ecosystem, acting as the primary source of information that influences individuals' credit profiles. These entities, which include banks and mortgage lenders, are subject to rigorous obligations and compliance requirements that ensure the accuracy and integrity of the data they provide.

The complexity of these regulations presents a significant challenge: how can furnishers effectively navigate their responsibilities while mitigating the risks associated with non-compliance? A thorough understanding of the intricacies surrounding furnishers' obligations is essential for both financial institutions and consumers, as it directly impacts creditworthiness and overall financial stability.

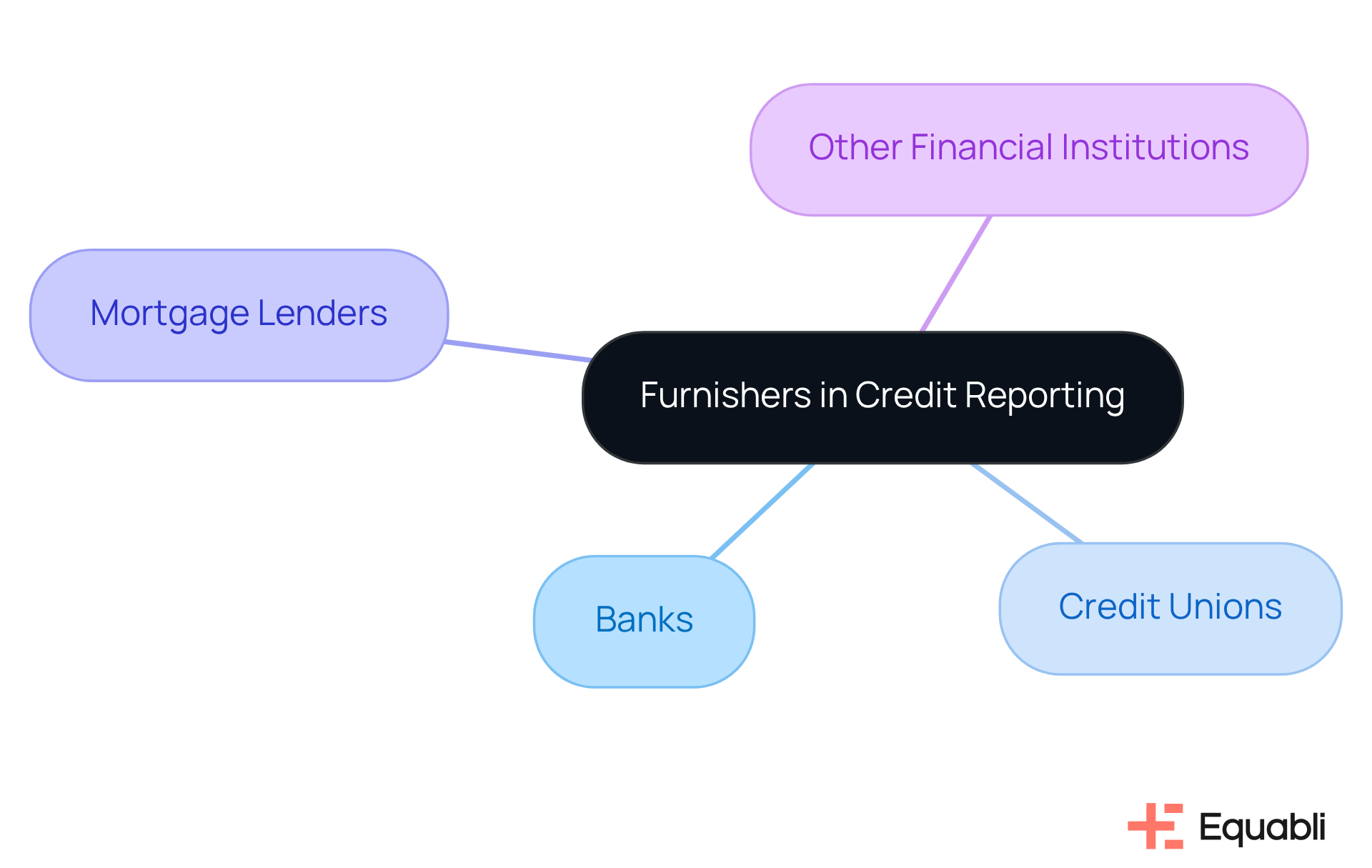

Define Furnishers in Credit Reporting

In the context of financial tracking, furnishers, who have obligations and compliance requirements in credit reporting for financial institutions, are organizations that provide information regarding individuals' accounts to credit assessment agencies (CRAs). This group consists of:

- Banks

- Credit unions

- Mortgage lenders

- Other financial institutions that extend credit and are subject to furnisher obligations and compliance requirements in credit reporting for financial institutions.

Furnishers play a crucial role in the financial assessment process, as their data, which must adhere to furnisher obligations and compliance requirements in credit reporting for financial institutions, directly influences individuals' credit scores and overall trustworthiness. Understanding the role of furnishers is essential for comprehending the for both individuals and lenders.

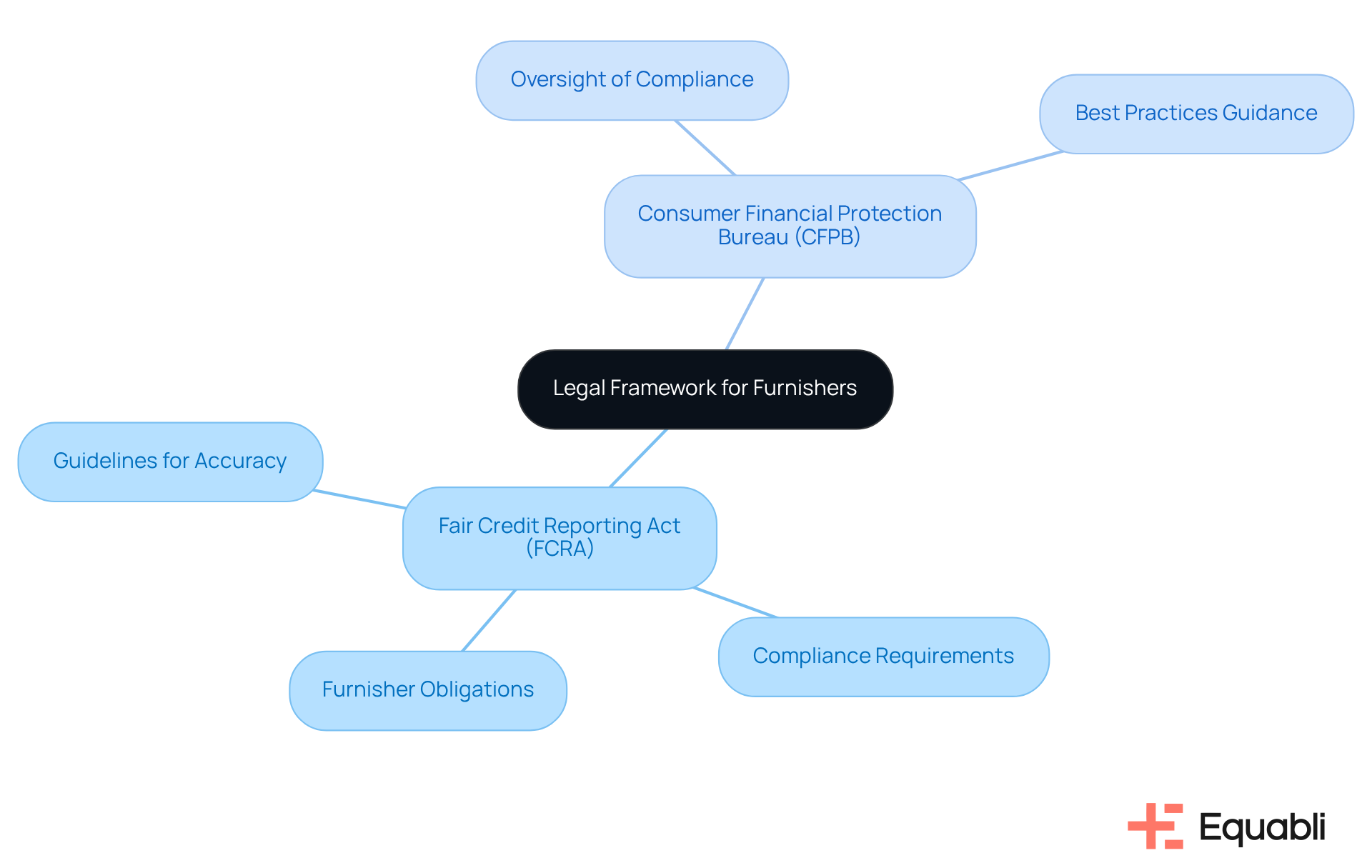

Explore Legal Framework and Regulations for Furnishers

Furnishers must adhere to a complex array of laws and regulations that define their furnisher obligations and compliance requirements in credit reporting for financial institutions. The Fair Credit Reporting Act (FCRA) serves as the cornerstone of federal credit reporting law, establishing critical guidelines for accuracy, fairness, and privacy in consumer credit reporting. Under the FCRA, furnishers must ensure that the information provided to Credit Reporting Agencies (CRAs) is both accurate and current.

Furthermore, the Consumer Financial Protection Bureau (CFPB) plays a pivotal role in overseeing compliance with these regulations, offering additional guidance on best practices for furnishers. Understanding the furnisher obligations and compliance requirements in credit reporting for financial institutions is vital as they and mitigate risk effectively.

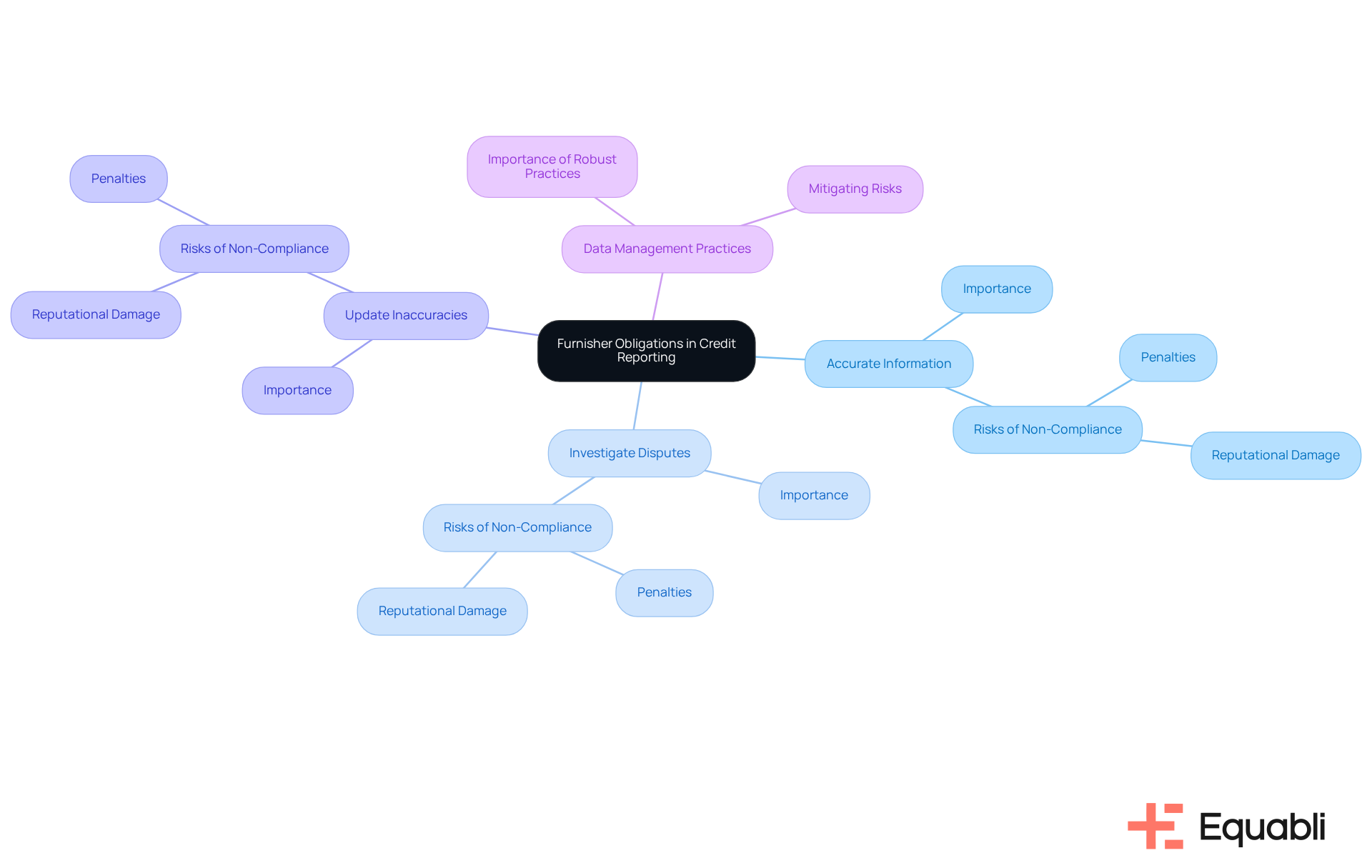

Detail Furnisher Obligations in Credit Reporting

Furnishers have critical obligations and compliance requirements in credit reporting for financial institutions when reporting credit information about individuals. These include:

- The duty to provide accurate and complete information

- The requirement to investigate disputes raised by consumers

- The obligation to promptly update or correct any inaccuracies

All of these are part of the furnisher obligations and compliance requirements in credit reporting for financial institutions. Additionally, providers must maintain records that substantiate the accuracy of the information they report.

Significant penalties, including fines and reputational damage, can result from non-compliance with furnisher obligations and compliance requirements in credit reporting for financial institutions. Therefore, it is imperative for providers to implement robust to ensure compliance with furnisher obligations and compliance requirements in credit reporting for financial institutions and to mitigate risks associated with inaccurate reporting.

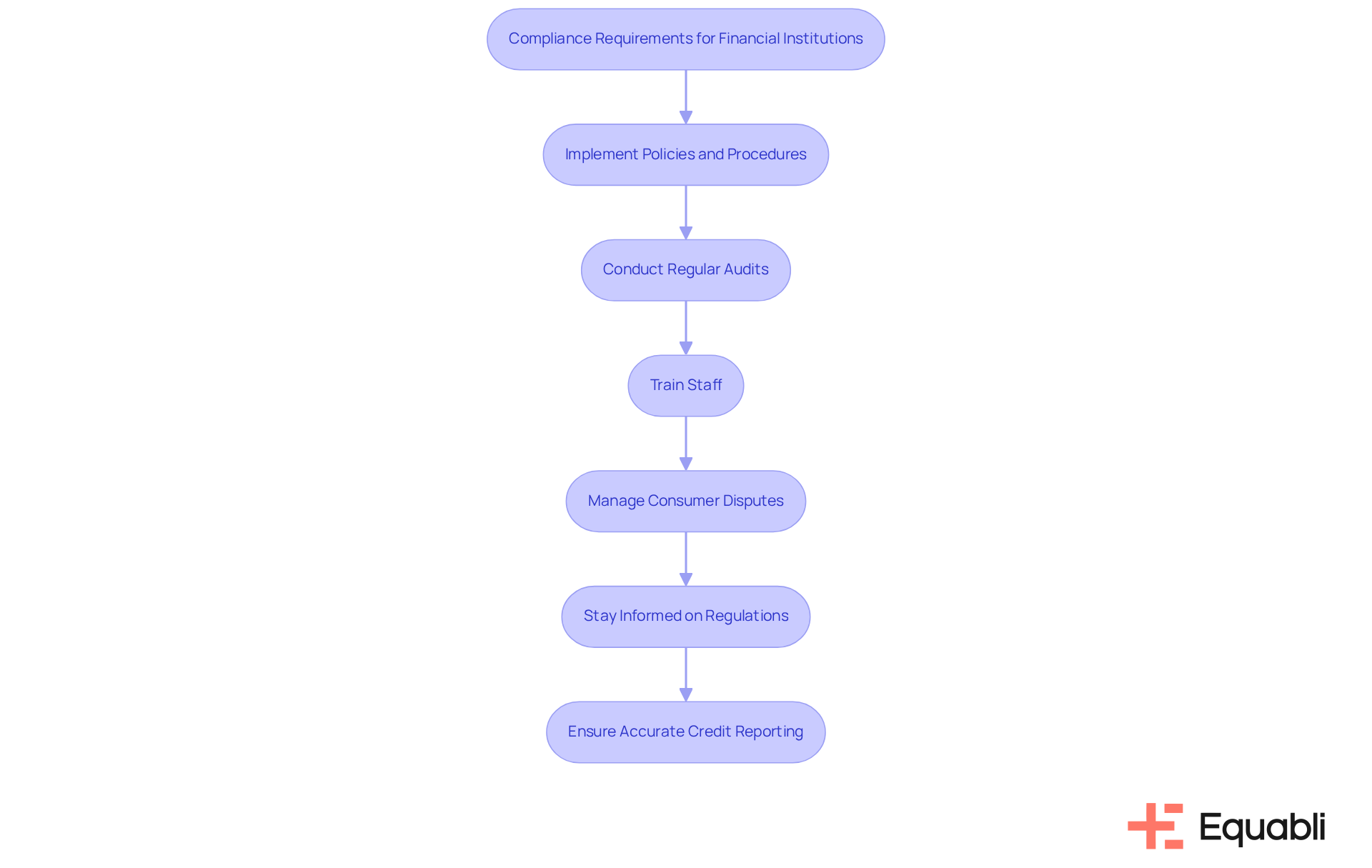

Examine Compliance Requirements for Financial Institutions

Financial institutions must comply with the furnisher obligations and compliance requirements in credit reporting. This necessity includes the implementation of designed to ensure the accuracy of reported information, aligning with furnisher obligations and compliance requirements in credit reporting for financial institutions.

Regular audits of credit reporting practices must be conducted, and staff must receive comprehensive training on furnisher obligations and compliance requirements in credit reporting for financial institutions. Furthermore, institutions should establish a clear process for managing consumer disputes and ensuring timely responses, while adhering to furnisher obligations and compliance requirements in credit reporting for financial institutions.

Staying informed about regulatory changes and best practices is essential to mitigate risks associated with non-compliance. By prioritizing compliance, financial institutions not only protect themselves from potential legal repercussions but also enhance their reputation within the marketplace.

Conclusion

Furnishers play a critical role in the credit reporting landscape, acting as the primary source of information that shapes credit scores and lending decisions. Their obligations and compliance requirements extend beyond mere formalities; they are vital for preserving the integrity of the credit reporting system. By comprehensively understanding the responsibilities associated with the role of furnishers, stakeholders can adeptly navigate the complexities of credit reporting and its implications for both individuals and financial institutions.

This article has explored key points regarding the legal framework governing furnishers, notably the Fair Credit Reporting Act and the oversight provided by the Consumer Financial Protection Bureau. The obligations of furnishers—ensuring accuracy, investigating consumer disputes, and maintaining comprehensive records—are essential for fostering trust in the credit reporting process. Furthermore, the necessity for financial institutions to implement robust policies and conduct regular audits underscores the interconnectedness of compliance and risk management in credit reporting.

The significance of furnishers in credit reporting is paramount. As the financial landscape continues to evolve, it is crucial for both furnishers and financial institutions to remain informed about compliance requirements and best practices. By prioritizing accurate reporting and adhering to legal obligations, all parties involved can enhance the transparency and reliability of the credit system, ultimately benefiting consumers and lenders alike. Emphasizing these responsibilities will ensure the sustained trust and efficacy of credit reporting in the years to come.

Frequently Asked Questions

What are furnishers in credit reporting?

Furnishers are organizations that provide information about individuals' accounts to credit assessment agencies (CRAs) and have obligations and compliance requirements in credit reporting for financial institutions.

Who qualifies as a furnisher?

Furnishers include banks, credit unions, mortgage lenders, and other financial institutions that extend credit and are subject to furnisher obligations in credit reporting.

Why are furnishers important in the financial assessment process?

Furnishers are important because the data they provide directly influences individuals' credit scores and overall trustworthiness, impacting financial assessments for both individuals and lenders.

What obligations do furnishers have in credit reporting?

Furnishers must adhere to specific obligations and compliance requirements in credit reporting to ensure the accuracy and reliability of the information they provide to CRAs.