Overview

The article examines nine predictive analytics models designed to optimize debt collection strategies, emphasizing their critical roles in enhancing repayment behaviors and recovery rates. Each model, including linear regression, logistic regression, and neural networks, provides distinct insights and methodologies. These tools empower organizations to customize their collection strategies, improve operational efficiency, and ultimately secure superior financial outcomes.

Introduction

The landscape of debt collection is undergoing a significant transformation, driven by the integration of advanced predictive analytics models that enhance recovery strategies. Organizations increasingly recognize the potential of these models to forecast repayment behaviors and tailor their approaches to meet the unique needs of various debtor segments. However, as the industry evolves, a pressing question arises: how can firms effectively navigate the complexities of compliance and operational challenges while optimizing their debt collection processes? This article explores nine predictive analytics models poised to revolutionize debt collection strategies, offering insights into their applications and the tangible benefits they deliver to financial recovery efforts.

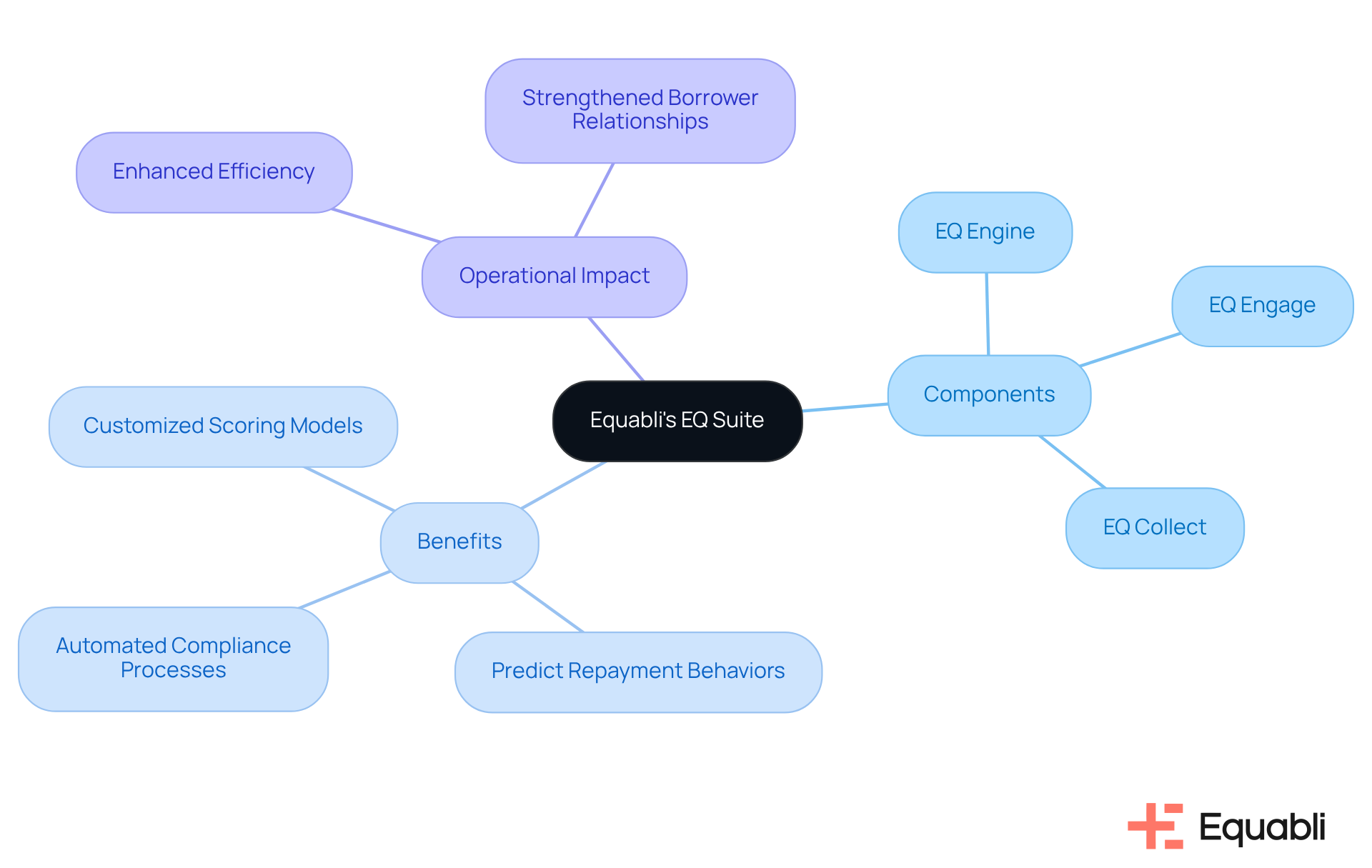

Equabli's EQ Suite: Intelligent Solutions for Debt Collection Optimization

Equabli's EQ Suite represents a transformative approach to optimizing debt management processes by employing predictive analytics models for optimizing enterprise debt collection strategies through a suite of cloud-based tools, including the EQ Engine, EQ Engage, and EQ Collect. These solutions empower lenders and agencies to implement customized scoring models that incorporate predictive analytics models for optimizing enterprise debt collection strategies, predict repayment behaviors, improve recovery strategies, and facilitate seamless digital transactions. For instance, EQ Collect allows organizations to expedite vendor onboarding timelines with an intuitive, no-code file-mapping tool, thereby enhancing operational efficiency and driving revenue through data-informed strategies.

Moreover, the automation of workflows significantly reduces execution errors and reliance on manual resources, while real-time reporting delivers exceptional transparency and insights. The EQ Suite's user-friendly, scalable, cloud-based interface enhances operational efficiency, effectively addressing the limitations associated with traditional recovery methods. This not only boosts borrower engagement but also , ensuring strict adherence to regulatory standards.

As the financial recovery landscape evolves, organizations leveraging the EQ Suite can expect improved operational efficiency and strengthened relationships with borrowers through predictive analytics models for optimizing enterprise debt collection strategies. This aligns with the industry's shift towards ethical and consumer-centric financial management, positioning firms to navigate the complexities of compliance and operational challenges effectively.

Linear Regression: Forecasting Repayment Behaviors in Debt Collection

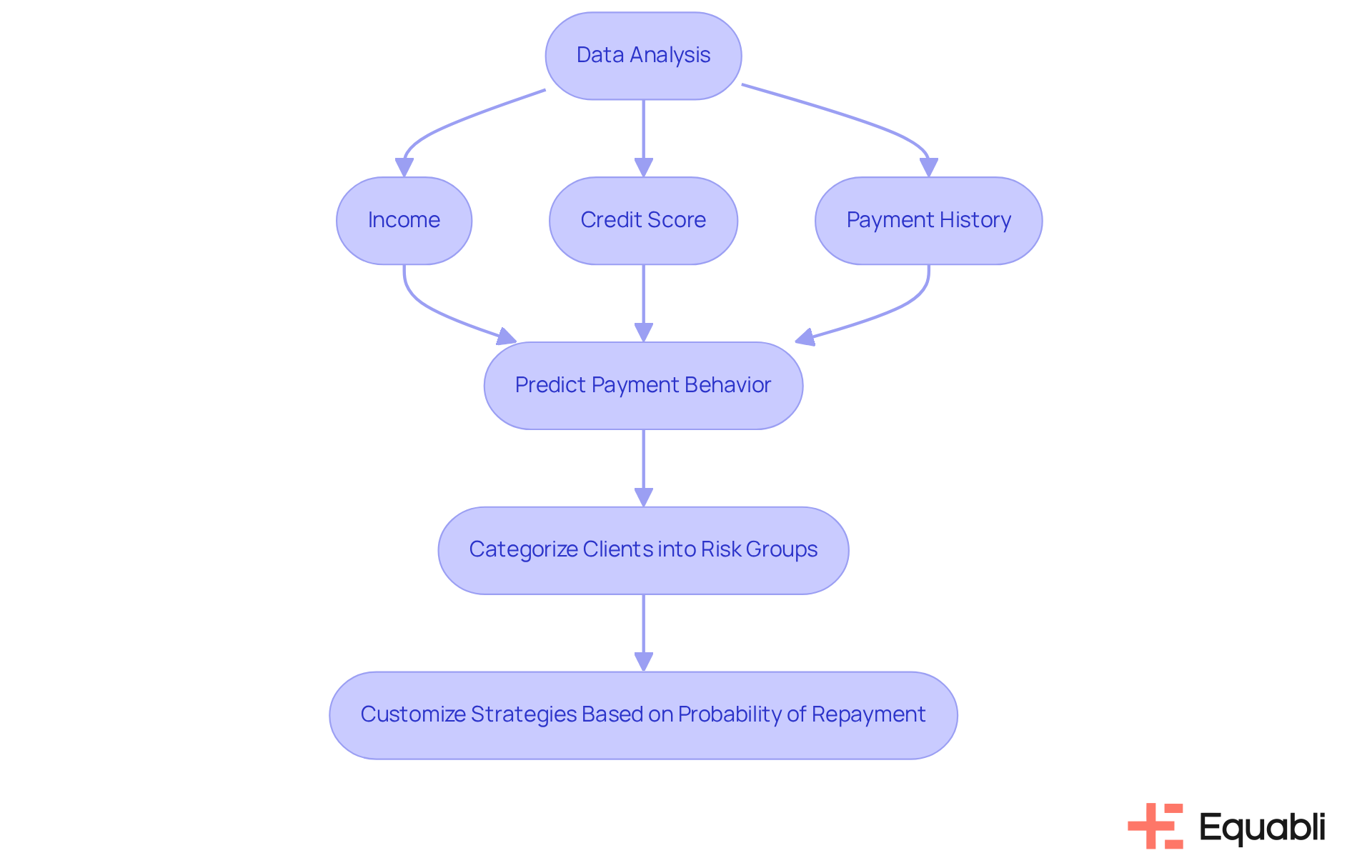

Linear regression serves as a pivotal tool in managing outstanding balances by analyzing the correlation between independent variables—such as income, credit score, and payment history—and the dependent variable, which is the amount to be repaid. This model empowers debt collectors to , thereby facilitating more strategic decision-making in collection efforts. By leveraging linear regression, agencies can prioritize accounts based on anticipated payment behaviors, which allows for tailored communication strategies that effectively engage individual debtors.

Current best practices in forecasting payment behaviors underscore the necessity of integrating linear regression with predictive analytics models for optimizing enterprise debt collection strategies to enhance accuracy. Organizations employing linear regression techniques report financial recovery success rates that are up to 30% higher than those achieved through conventional methods. This improvement is attributed to the model's capacity to yield insights into borrower characteristics and payment patterns, enabling collectors to concentrate their resources on high-potential accounts.

The effective application of linear regression in loan recovery involves categorizing clients into risk groups, which enables agencies to customize their strategies based on the anticipated probability of repayment. By adopting predictive analytics models for optimizing enterprise debt collection strategies, collection agencies can enhance their operational effectiveness and improve overall recovery rates, ultimately leading to a more sustainable financial outcome for both the organization and the borrower.

Logistic Regression: Predicting Default Risks in Debt Recovery

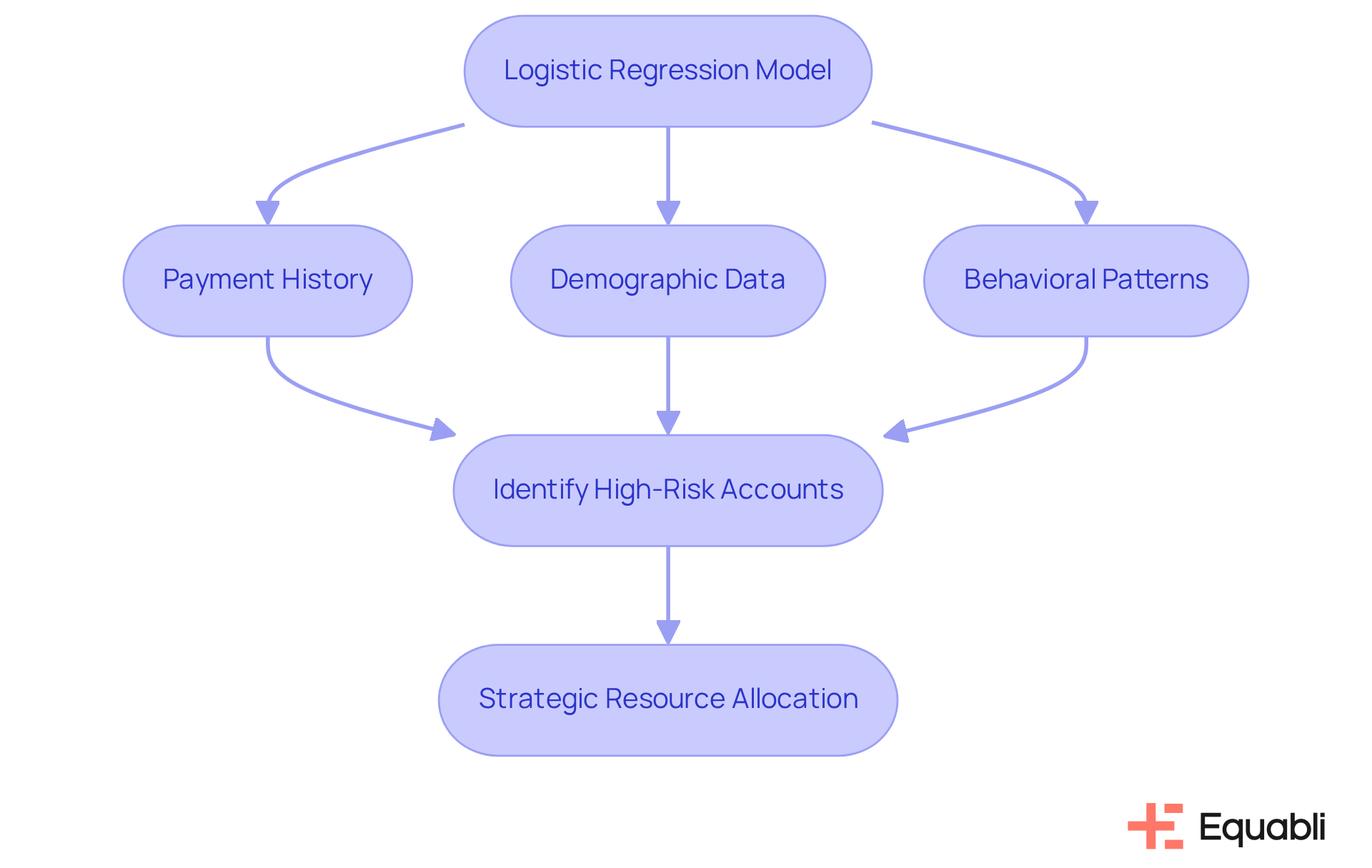

Logistic regression is a critical tool in predicting the likelihood of binary outcomes, such as a debtor's potential to default on a payment. By analyzing various factors—including payment history, demographic data, and behavioral patterns—organizations can effectively pinpoint high-risk accounts. This capability allows creditors to concentrate their resources on accounts with the highest probability of default, thereby enhancing recovery rates and minimizing costs associated with ineffective retrieval efforts.

As we approach 2025, incorporating logistic regression into credit recovery strategies is increasingly essential. Default rates among borrowers are fluctuating, necessitating a data-driven approach to prioritize recoveries. Experts in the field assert that leveraging predictive analytics models for optimizing enterprise debt collection strategies not only streamlines the identification of high-risk accounts but also promotes a more strategic allocation of collection resources. This ultimately results in , positioning organizations to navigate the complexities of debt collection more effectively.

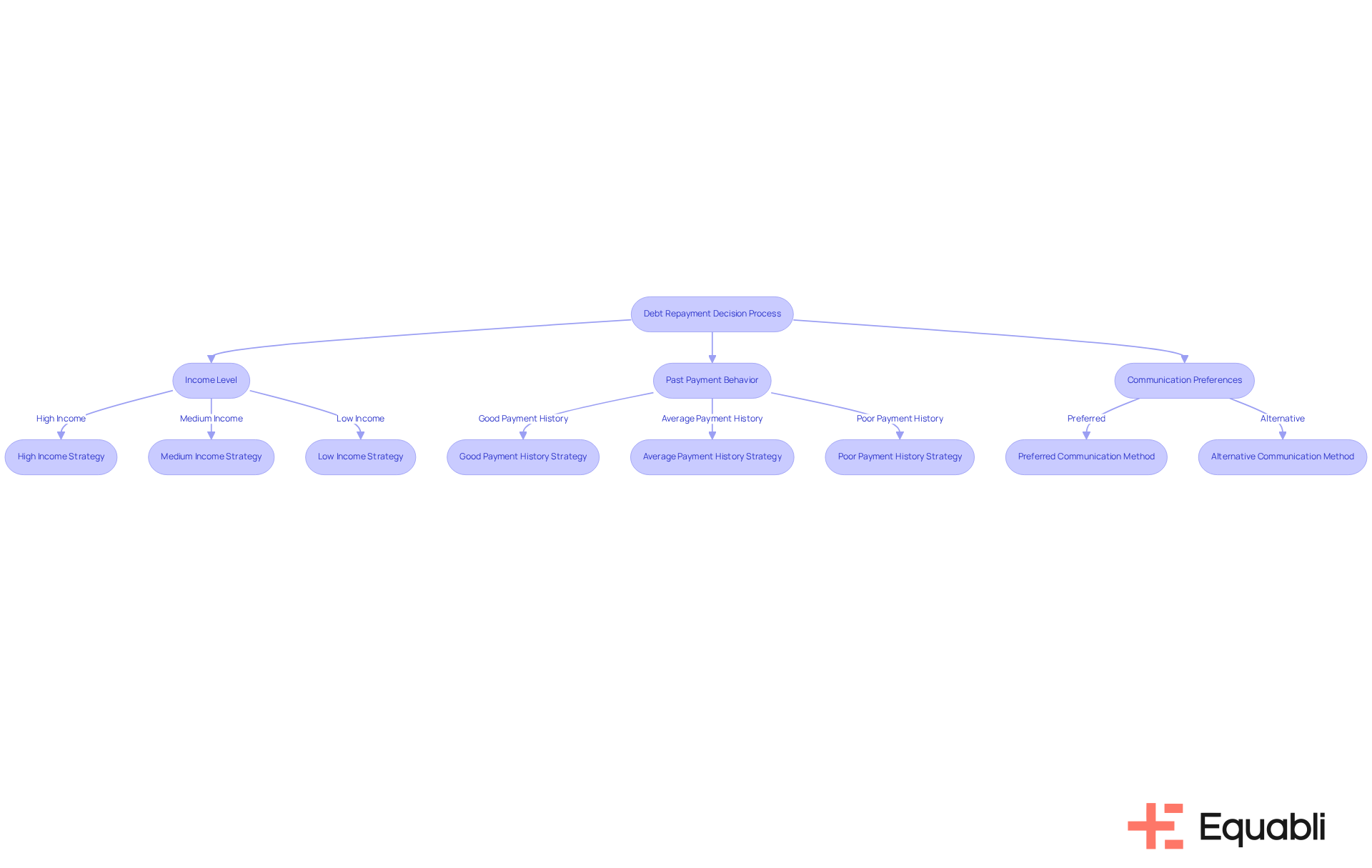

Decision Trees: Visualizing Factors Influencing Debt Repayment

Decision trees serve as a robust tool for visualizing decision-making processes in debt management. By graphically illustrating the interplay of various factors—such as income level, past payment behavior, and communication preferences—organizations can identify the most significant influences on repayment outcomes. This visualization clarifies the relationships between these variables and facilitates the development of targeted strategies tailored to specific debtor segments. Consequently, retrieval efforts become more effective, enabling agencies to engage with debtors in a manner that aligns with their individual circumstances.

The current effectiveness of decision trees in identifying repayment factors is underscored by their capacity to enhance predictive analytics models for optimizing enterprise debt collection strategies, especially when applied to balanced datasets. This capability allows organizations to prioritize accounts based on dynamic risk assessments rather than static criteria. The practical applications of decision trees have shown their value in creating predictive analytics models for optimizing enterprise debt collection strategies, leading to improved financial recovery rates and greater adherence to regulatory standards. Furthermore, by employing advanced visualization methods, financial organizations can refine their decision-making processes, ultimately fostering a more efficient and compassionate approach to recovery. This aligns with the growing movement towards ethical financial recovery practices, where understanding consumer emotions is paramount.

With Equabli's EQ Suite, organizations can modernize their manual processes by leveraging intelligent tools that through personalized communication and self-service payment options. As the AI for Debt Collection Market is projected to reach USD 15.9 billion by 2034, the integration of decision trees with Equabli's innovative solutions becomes increasingly pertinent for organizations striving to remain competitive and compliant in a rapidly evolving landscape.

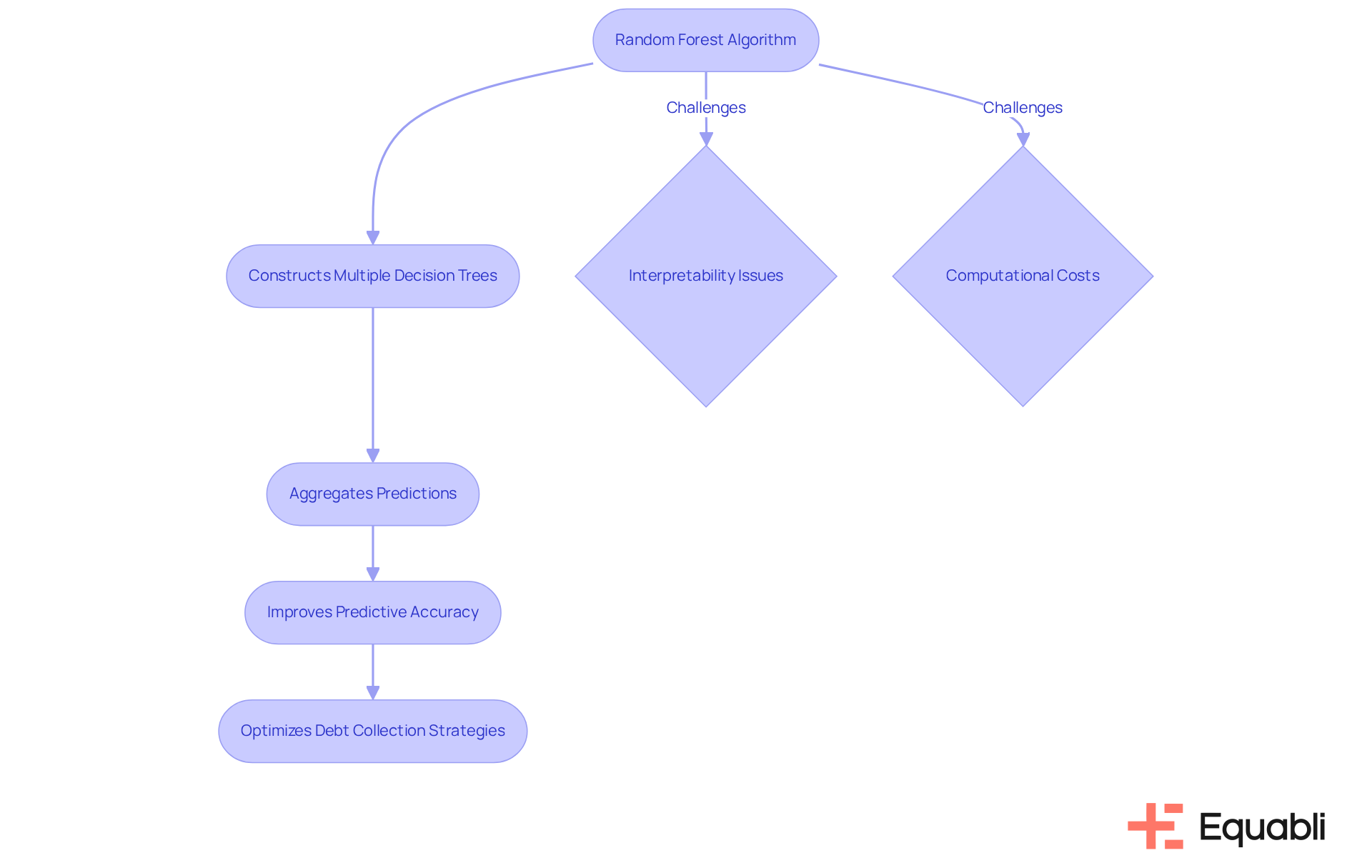

Random Forest: Enhancing Predictive Accuracy in Debt Collection

Random Forest serves as a robust ensemble learning technique that constructs multiple decision trees, aggregating their predictions to improve accuracy. This method is particularly advantageous in debt recovery when employing predictive analytics models for optimizing enterprise debt collection strategies, as a multitude of factors can affect repayment behavior. By integrating Random Forest models with Equabli's EQ Engine, organizations can effectively use predictive analytics models for optimizing enterprise debt collection strategies to predict the risk of delinquency among active accounts, thereby facilitating the development of intelligent servicing strategies. This synergy not only results in more reliable forecasts regarding debtor behaviors but also enhances in recovery efforts.

Significantly, Random Forest demonstrates resilience against overfitting and excels in identifying feature significance, making it especially suitable for the complex datasets typically encountered in debt recovery scenarios. However, it is crucial to recognize the challenges associated with this algorithm, including interpretability issues and elevated computational costs. Current trends indicate a growing reliance on ensemble learning methods like Random Forest, as they serve as predictive analytics models for optimizing enterprise debt collection strategies, ultimately leading to more efficient recovery.

For instance, a case study highlighted how a financial organization utilized Random Forest to accurately predict payment likelihood, resulting in a marked reduction in recovery costs. As Geoffrey Moore aptly stated, 'Without big data, you are blind and deaf and in the middle of a freeway,' emphasizing the necessity of leveraging advanced analytics, such as those provided by Equabli, in today’s data-driven environment.

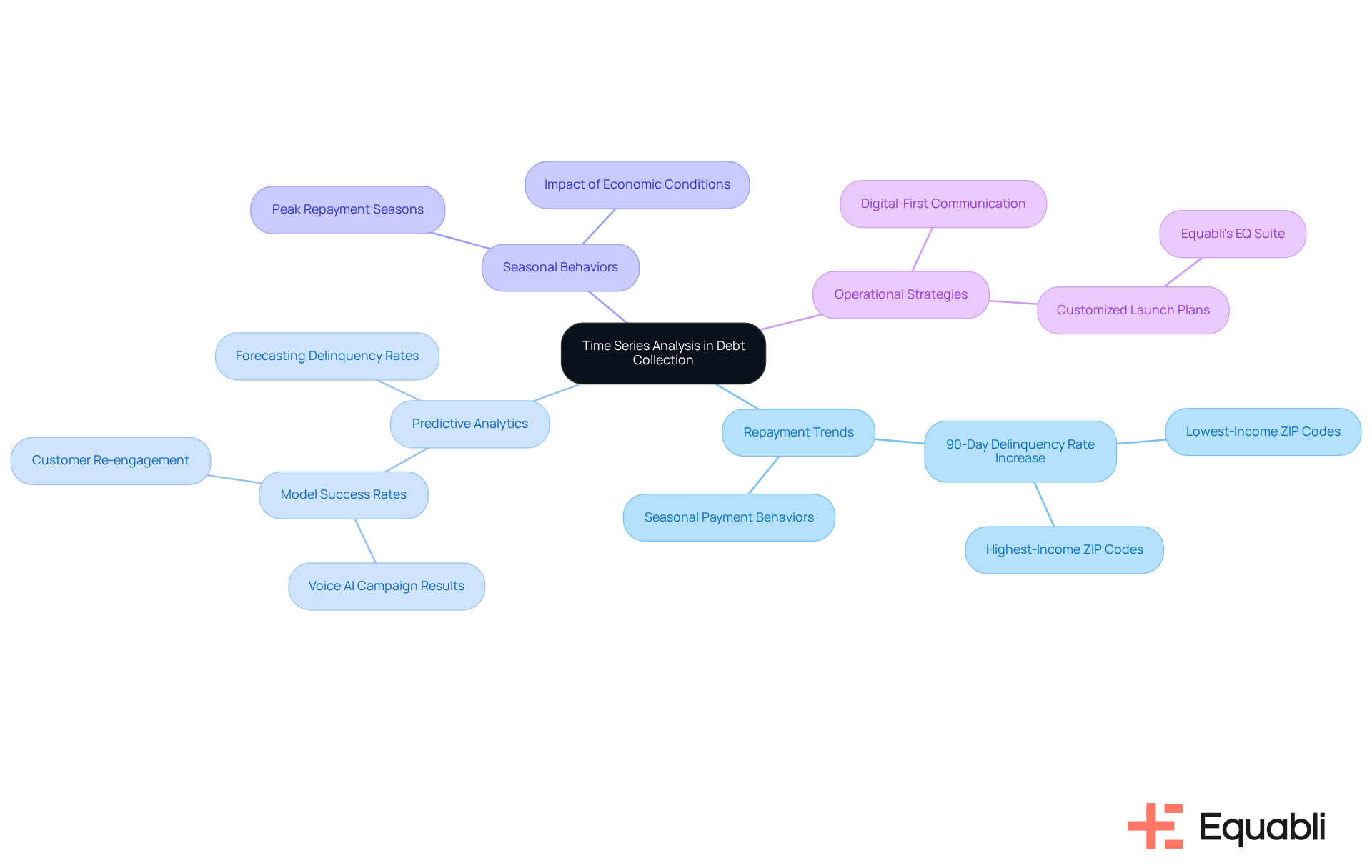

Time Series Analysis: Anticipating Repayment Trends in Debt Collection

Time series analysis is essential for examining data points collected at specific intervals, revealing trends and patterns. In debt collection, this analytical method proves invaluable for creating predictive analytics models for optimizing enterprise debt collection strategies by identifying seasonal trends in payment behaviors. Recent data indicates that the 90-day delinquency rate in the lowest-income 10% of ZIP codes rose from 12.6% in late 2022 to 20.1% by early 2025, highlighting a significant shift in payment behaviors that can be effectively analyzed through time series techniques.

Leveraging these insights allows organizations to utilize predictive analytics models for optimizing enterprise debt collection strategies, tailoring communication efforts to align with periods when debtors are more likely to repay. Financial analysts emphasize that recognizing these seasonal trends can enhance recovery rates, which can be achieved through predictive analytics models for optimizing enterprise debt collection strategies, enabling agencies to time their interventions more strategically. For instance, during peak repayment seasons, agencies that implement predictive analytics models for optimizing enterprise debt collection strategies have achieved a 91.9% success rate in re-engaging contacted customers to resume their payment plans.

As consumer preferences increasingly favor digital-first interactions, integrating time series analysis with advanced communication strategies can significantly boost debtor engagement. Organizations that adapt their retrieval methods by employing predictive analytics models for optimizing enterprise debt collection strategies based on these insights are better positioned to navigate the evolving landscape of financial recovery, ultimately leading to more effective and efficient retrieval processes. To further strengthen these initiatives, organizations should contemplate deploying a customized launch plan with Equabli's EQ Suite, which offers intelligent, aimed at modernizing manual processes and optimizing operational efficiency.

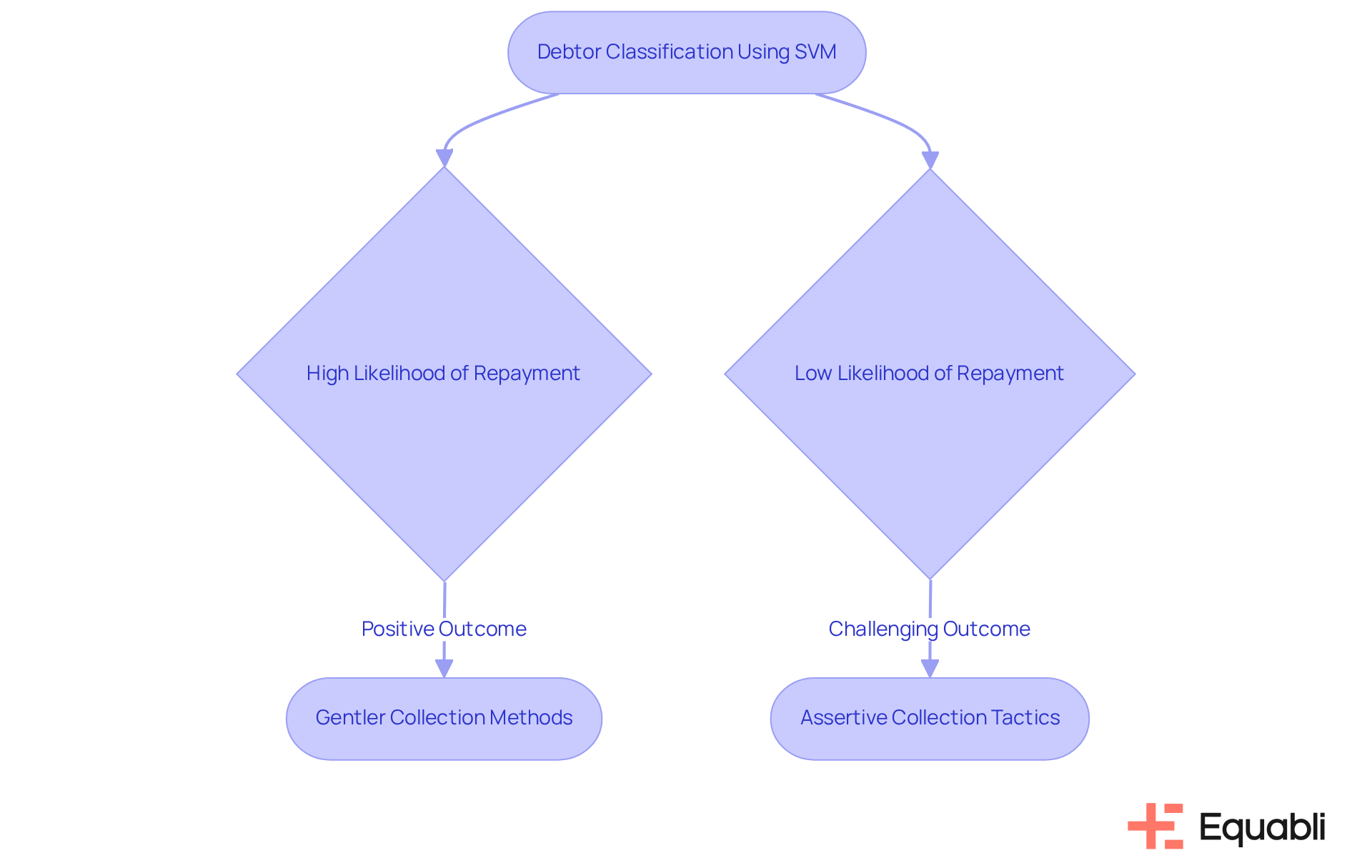

Support Vector Machines: Classifying Debtors for Targeted Collection Strategies

Support vector machines (SVM) represent advanced supervised learning models that excel in both classification and regression tasks. In the context of debt recovery, SVM is instrumental in categorizing debtors based on their likelihood of repayment through predictive analytics models for optimizing enterprise debt collection strategies. By meticulously analyzing various attributes—such as credit history and payment behaviors—organizations can effectively employ predictive analytics models for optimizing enterprise debt collection strategies to distinguish between debtors requiring more assertive retrieval tactics and those likely to respond favorably to gentler methods. This targeted strategy not only but also significantly enhances overall efficiency, enabling financial institutions to allocate resources more effectively and improve recovery rates.

As Richard Pohlmann noted, "AI can assist collection agents in operating more effectively, and aid borrowers in staying up to date on their accounts with prompt messaging and convenient self-service payments." Given the recent increase in the number of individuals missing payments—5.3% for one payment and 6.3% for two payments—the implementation of predictive analytics models for optimizing enterprise debt collection strategies becomes increasingly vital in refining debt recovery strategies. Furthermore, case studies indicate that AI-powered tools can evaluate customer preferences for communication, leading to customized outreach that enhances retrieval outcomes.

By integrating predictive analytics models for optimizing enterprise debt collection strategies into their methodologies, financial institutions can more adeptly confront the challenges associated with managing non-performing assets (NPAs) and enhance their overall recovery processes. This strategic application not only addresses immediate operational hurdles but also positions organizations to utilize predictive analytics models for optimizing enterprise debt collection strategies, leading to sustainable improvements in debt recovery efficiency.

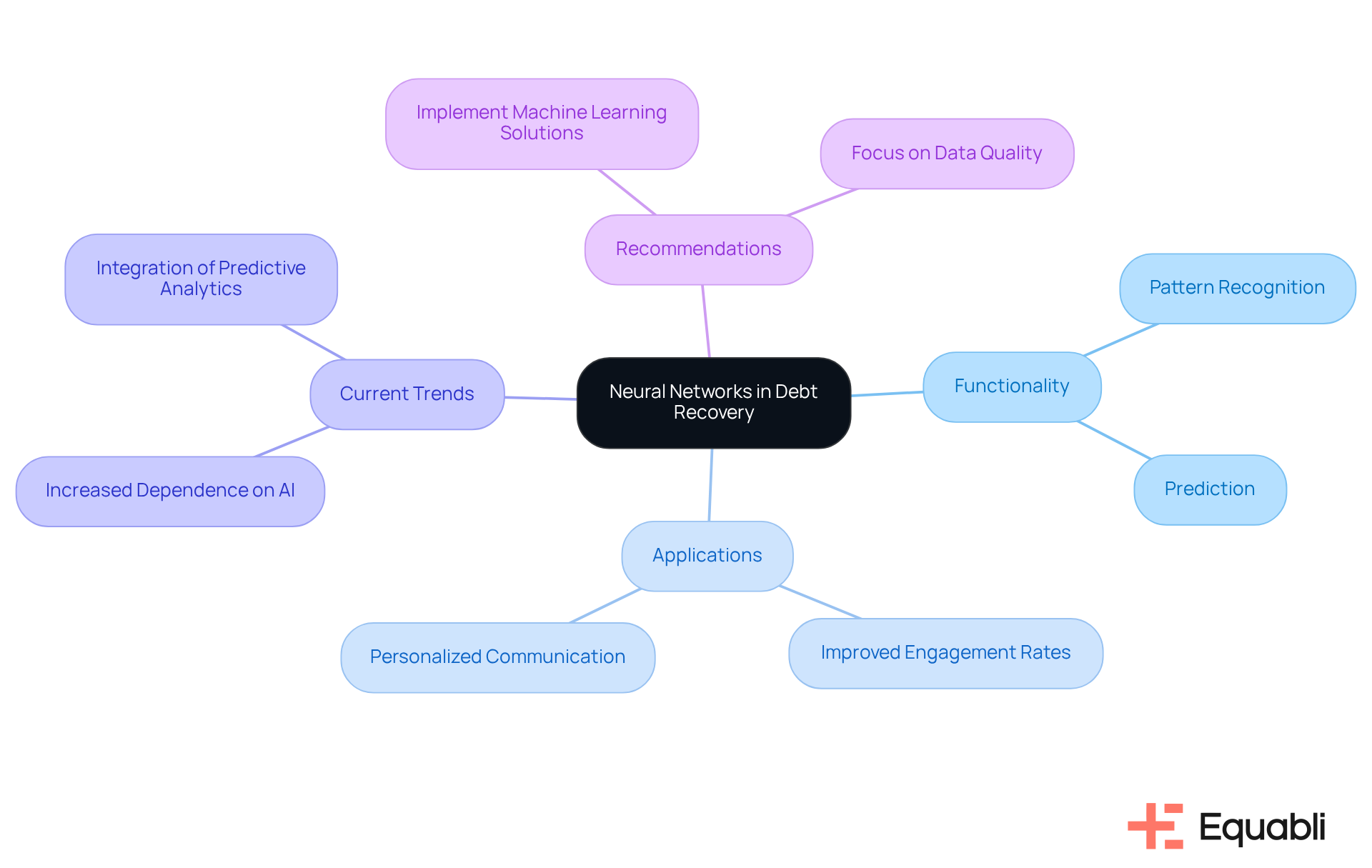

Neural Networks: Modeling Complex Debtor Behaviors for Improved Recovery

Neural networks, inspired by the architecture of the human brain, function as powerful computational models capable of recognizing patterns and making predictions from complex datasets. In the financial collection sector, these networks leverage predictive analytics models for optimizing enterprise debt collection strategies by processing extensive data to uncover intricate relationships among various factors influencing repayment behaviors. This advanced modeling capability empowers organizations to develop sophisticated strategies using predictive analytics models for optimizing enterprise debt collection strategies, ultimately leading to significantly improved recovery outcomes.

Current trends reveal an increasing dependence on neural networks to enhance debt recovery processes. By leveraging predictive analytics models for optimizing enterprise debt collection strategies, agencies can identify patterns in debtor interactions and predict repayment likelihood with greater accuracy. Insights from data scientists indicate that neural networks excel in detecting subtle behavioral cues, facilitating personalized communication approaches that resonate with individual debtors. The integration of Equabli's EQ Engine further enhances these strategies by utilizing predictive analytics models for optimizing enterprise debt collection strategies, enabling organizations to proactively address potential delinquencies.

Real-world applications of neural networks in debt recovery underscore their effectiveness. Organizations that utilize predictive analytics models for optimizing enterprise debt collection strategies report improved engagement rates and refined approaches, resulting in a marked decrease in delinquency rates. As the industry continues to evolve, the integration of neural networks, alongside tools like Equabli's EQ Engine, becomes essential for organizations striving to remain competitive and optimize recovery efficiency. To fully harness these advancements, organizations should consider that align with their specific collection objectives.

Clustering Models: Tailoring Collection Approaches for Different Debtor Segments

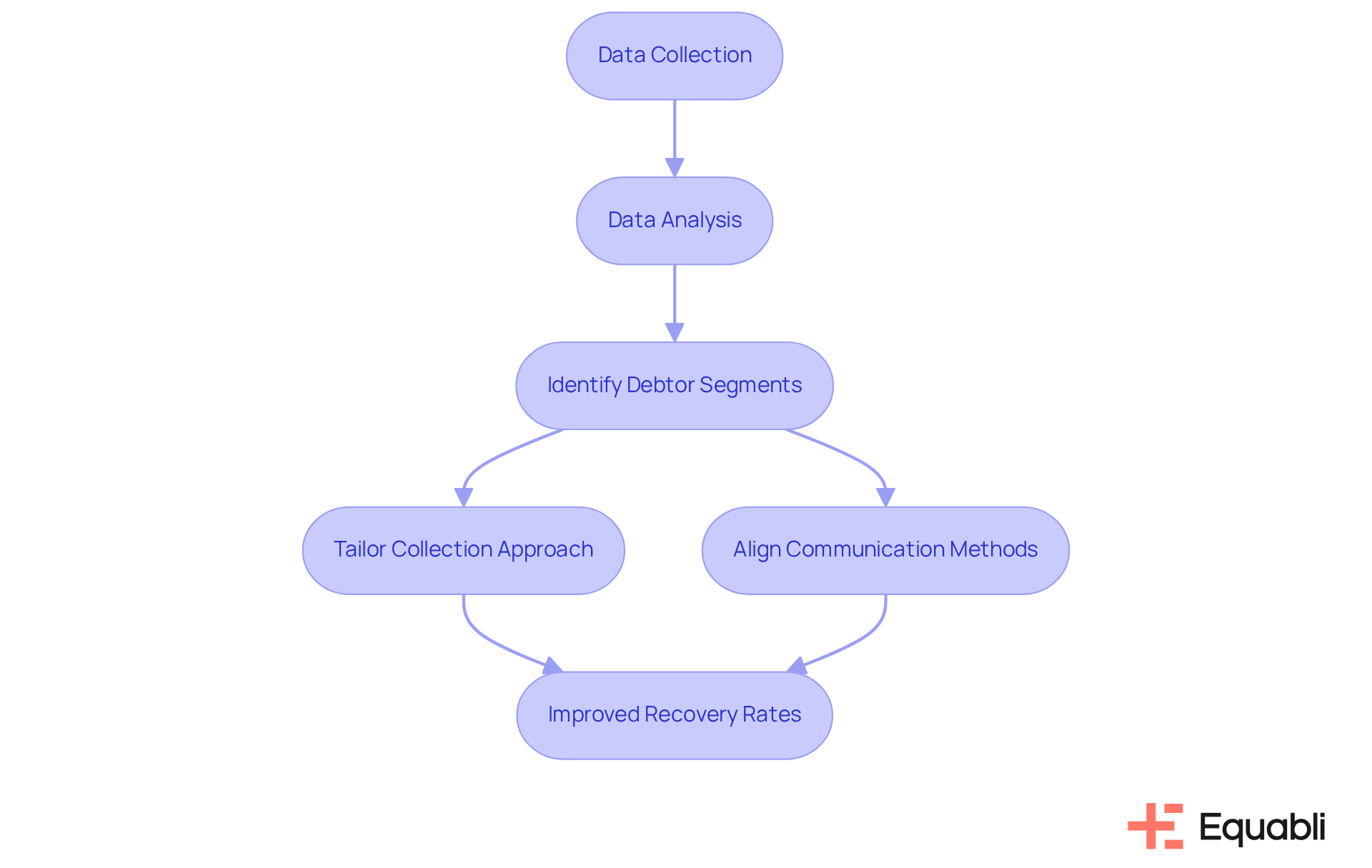

Clustering models play a crucial role in categorizing data points into distinct groups based on shared characteristics, thereby supporting predictive analytics models for optimizing enterprise debt collection strategies and enabling organizations to identify unique debtor segments.

By analyzing critical elements such as payment history, demographics, and communication preferences through predictive analytics models for optimizing enterprise debt collection strategies, collectors can effectively tailor their approaches to meet the specific requirements of each segment.

This tailored methodology not only enhances engagement but also significantly increases the likelihood of by utilizing predictive analytics models for optimizing enterprise debt collection strategies.

Industry leaders underscore the necessity of personalized strategies; for instance, agencies that utilize predictive analytics models for optimizing enterprise debt collection strategies report a 25% increase in recovery rates.

Furthermore, aligning communication methods with each debtor's preferences fosters trust and collaboration, ultimately leading to improved payment outcomes.

As the financial landscape continues to evolve, the implementation of predictive analytics models for optimizing enterprise debt collection strategies will be crucial for agencies aiming to refine their financial recovery processes and maintain a competitive edge.

ARIMA: Forecasting Repayment Timelines in Debt Collection

ARIMA, or AutoRegressive Integrated Moving Average, serves as a pivotal statistical method for forecasting future values in a time series through the analysis of historical data. In receivable management, predictive analytics models for optimizing enterprise debt collection strategies, including ARIMA models, play a crucial role in predicting when borrowers are likely to fulfill their payment obligations based on past behaviors. By leveraging ARIMA, organizations can strategically plan their retrieval efforts, facilitating efficient resource allocation to maximize recovery rates.

Current trends indicate a growing reliance on predictive analytics models for optimizing enterprise debt collection strategies within the debt recovery sector, as they provide valuable insights into repayment timelines. Financial analysts assert that utilizing predictive analytics models for optimizing enterprise debt collection strategies enhances planning by offering a clearer perspective on anticipated payment schedules, enabling organizations to tailor their retrieval strategies accordingly. For instance, a recent case study highlighted that a financial institution employing ARIMA models experienced a 20% increase in recovery rates within the first quarter of implementation, underscoring its efficacy as a predictive tool.

Moreover, the integration of predictive analytics models for optimizing enterprise debt collection strategies into collection processes not only streamlines operations but also bolsters data-driven decision-making. This approach empowers organizations to employ predictive analytics models for optimizing enterprise debt collection strategies, enabling them to anticipate challenges and seize opportunities. As financial analysts suggest, the adoption of predictive analytics models for optimizing enterprise debt collection strategies can significantly improve forecasting accuracy, allowing institutions to manage their assets more effectively and enhance overall performance.

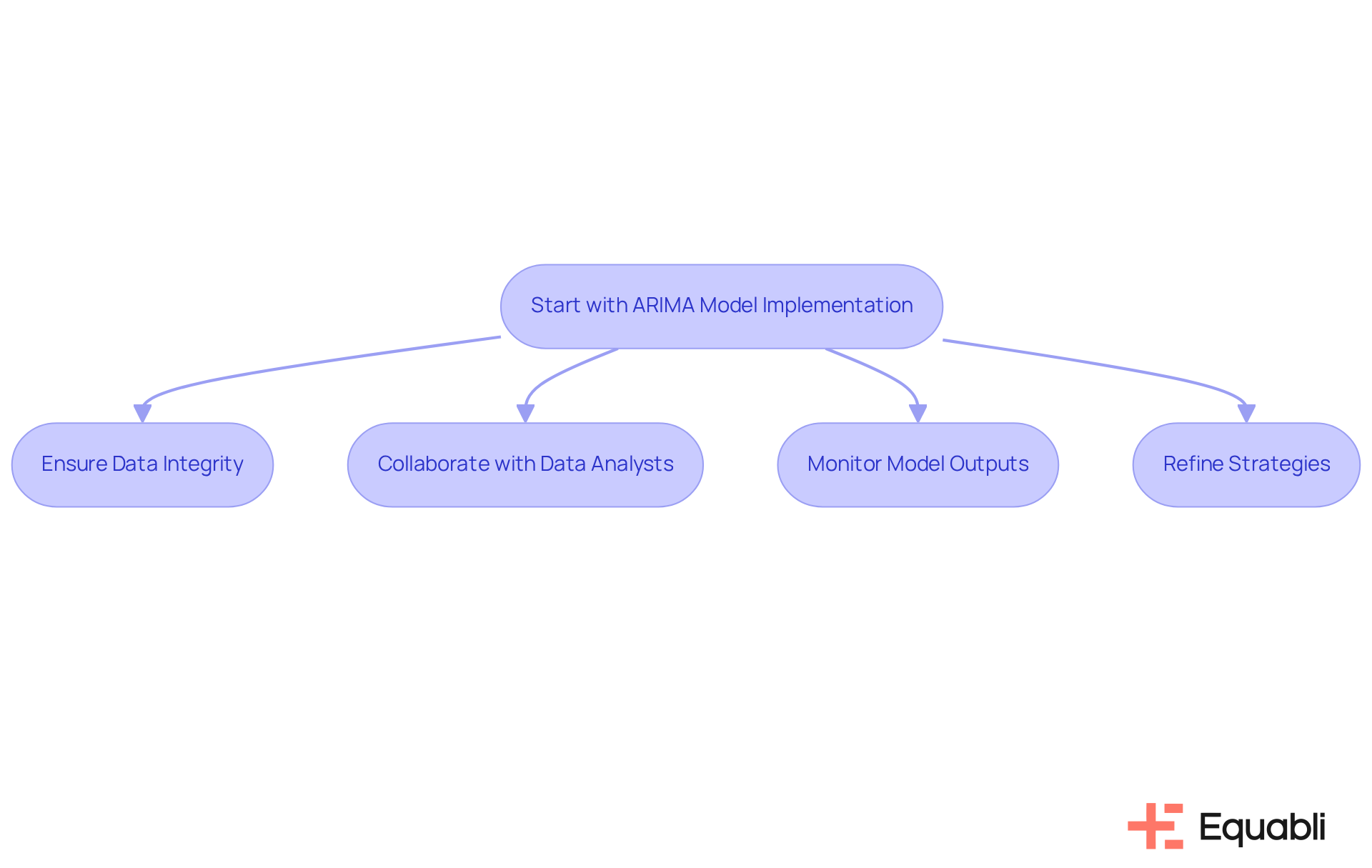

To implement ARIMA models effectively, organizations should consider the following actionable strategies:

- Ensure data integrity by consistently updating historical repayment data

- Collaborate with data analysts to customize ARIMA parameters tailored to specific collection scenarios

- Continuously monitor and refine strategies based on model outputs to optimize recovery efforts

Conclusion

Integrating predictive analytics models into debt collection strategies represents a pivotal evolution in organizational financial recovery management. Leveraging advanced tools such as Equabli's EQ Suite enables agencies to enhance operational efficiency, tailor approaches to specific debtor segments, and ultimately improve recovery outcomes. This transition not only promotes better engagement with borrowers but also aligns with the industry's shift towards ethical and consumer-centric practices.

Various predictive analytics models, including:

- Linear regression for forecasting repayment behaviors

- Logistic regression for predicting default risks

- Decision trees for visualizing repayment influences

Each model provides unique insights, empowering organizations to make data-informed decisions, prioritize high-risk accounts, and customize communication strategies. Furthermore, methodologies like:

- Random Forest

- Time series analysis

- Neural networks

refine these approaches, allowing firms to anticipate trends and behaviors that affect recovery rates.

As the debt collection landscape continues to evolve, adopting these predictive analytics models is crucial for organizations striving to maintain competitiveness and efficiency. By implementing intelligent solutions and tailoring strategies based on data insights, agencies can enhance recovery processes and foster stronger relationships with borrowers. The imperative is clear: organizations must invest in these innovative approaches to optimize debt collection strategies and effectively navigate the complexities of financial recovery.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a cloud-based solution designed to optimize debt management processes through predictive analytics models. It includes tools such as the EQ Engine, EQ Engage, and EQ Collect, which help lenders and agencies implement customized scoring models, predict repayment behaviors, and improve recovery strategies.

How does EQ Collect enhance operational efficiency?

EQ Collect enhances operational efficiency by providing a no-code file-mapping tool that expedites vendor onboarding timelines. This allows organizations to drive revenue through data-informed strategies while reducing execution errors and reliance on manual resources.

What benefits does automation provide in the EQ Suite?

Automation in the EQ Suite significantly reduces execution errors, enhances operational efficiency, and automates compliance processes, ensuring adherence to regulatory standards while delivering real-time reporting for better transparency and insights.

How does linear regression aid in debt collection?

Linear regression helps debt collectors analyze the correlation between independent variables (like income and credit score) and the repayment amount. This allows agencies to predict payment likelihood, prioritize accounts, and tailor communication strategies for effective debtor engagement.

What are the advantages of using linear regression in forecasting payment behaviors?

Organizations using linear regression report financial recovery success rates up to 30% higher than conventional methods. This improvement comes from the model's ability to provide insights into borrower characteristics and payment patterns, enabling focused resource allocation on high-potential accounts.

What is the role of logistic regression in debt recovery?

Logistic regression predicts the likelihood of a debtor defaulting on a payment by analyzing factors such as payment history and demographic data. This helps organizations identify high-risk accounts and allocate collection resources more strategically.

Why is incorporating logistic regression into credit recovery strategies important?

Incorporating logistic regression is essential as it helps organizations navigate fluctuating default rates among borrowers. It streamlines the identification of high-risk accounts, leading to improved recovery outcomes and more effective resource allocation in debt collection.