Overview

The article titled "9 Key Factors for Choosing a Credit Management Collections Agency" outlines critical criteria essential for selecting a collections agency. It underscores the necessity of:

- Verifying licensing and compliance

- Assessing industry experience

- Evaluating technology and tools

- Understanding fee structures

Each of these factors is vital for ensuring effective and ethical debt recovery processes. In an increasingly complex financial landscape, making informed decisions about collections agencies is paramount for success.

Introduction

Selecting the right credit management collections agency presents a formidable challenge, particularly given the multitude of options in today's market. Businesses operate within a complex landscape where the stakes are substantial, and the consequences of a poor decision can be severe. This article explores nine crucial factors that will guide organizations in identifying an agency that not only aligns with their objectives but also optimizes their recovery efforts.

What critical elements should you consider to ensure a successful partnership rather than a costly misstep?

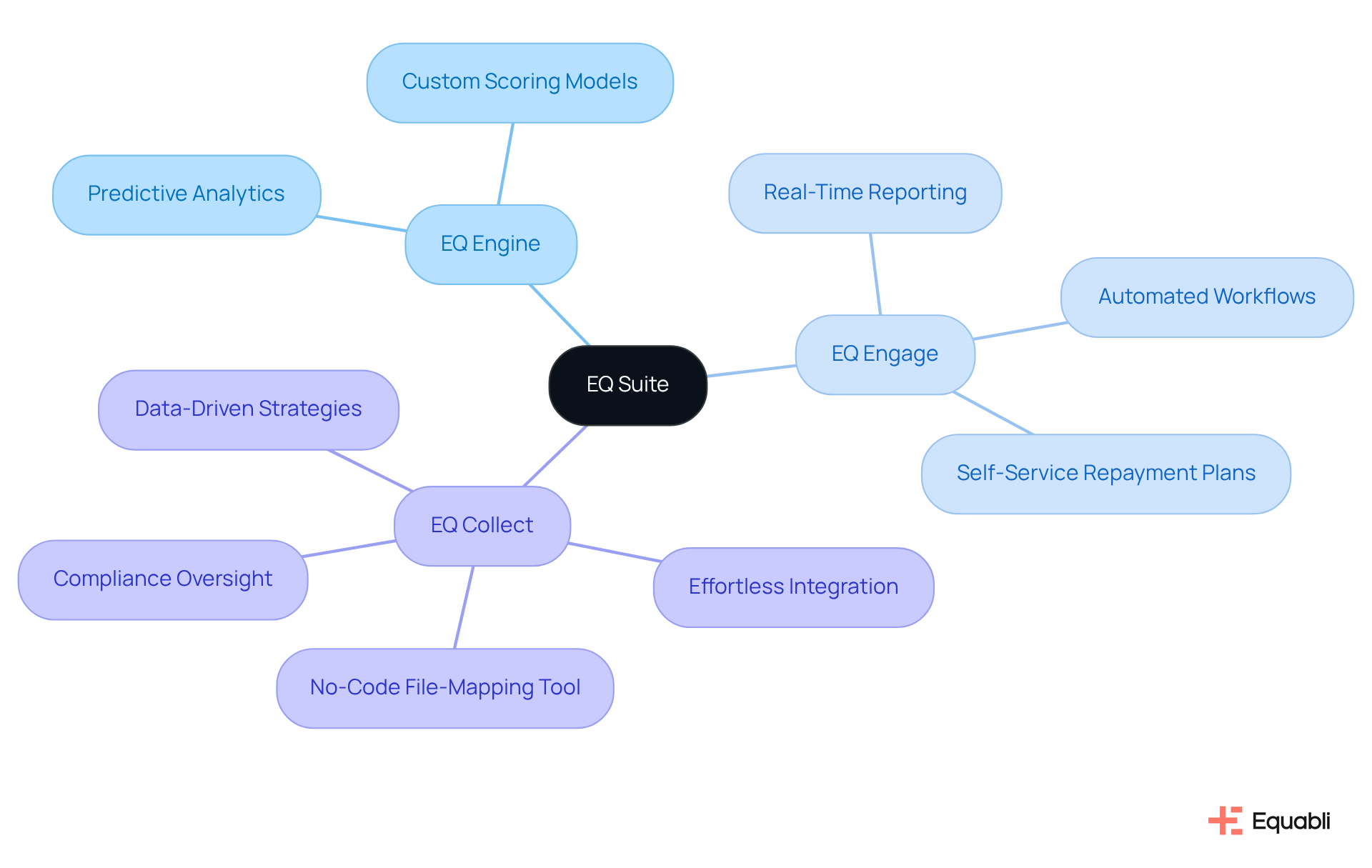

Equabli: Transform Your Collections with the EQ Suite

Equabli's offers a comprehensive suite of tools designed to , incorporating the expertise of a credit management collections agency. With features like the EQ Engine, EQ Engage, and , clients can leverage predictive analytics, optimize retrieval strategies, and . The is pivotal in this transformation, guiding the setup and implementation process during client onboarding to ensure a seamless transition to modern financial recovery practices. Acting as the primary point of contact, this representative drives product adoption and client engagement by aligning the platform's capabilities with the clients' business objectives.

Specifically, the EQ Collect tool facilitates effortless integration with existing systems, ensuring a smooth transition to . It shortens vendor onboarding timelines through a no-code file-mapping tool, enhances efficiency with data-driven strategies, and reduces execution errors via . Moreover, EQ Engage empowers clients to design, automate, and execute borrower contact strategies, improving communication and compliance. With features such as real-time reporting and an intuitive interface, these tools optimize operations, , and lower costs, making them essential for any lender or organization seeking to enhance recovery efficiency and maximize NPV in financial recuperation.

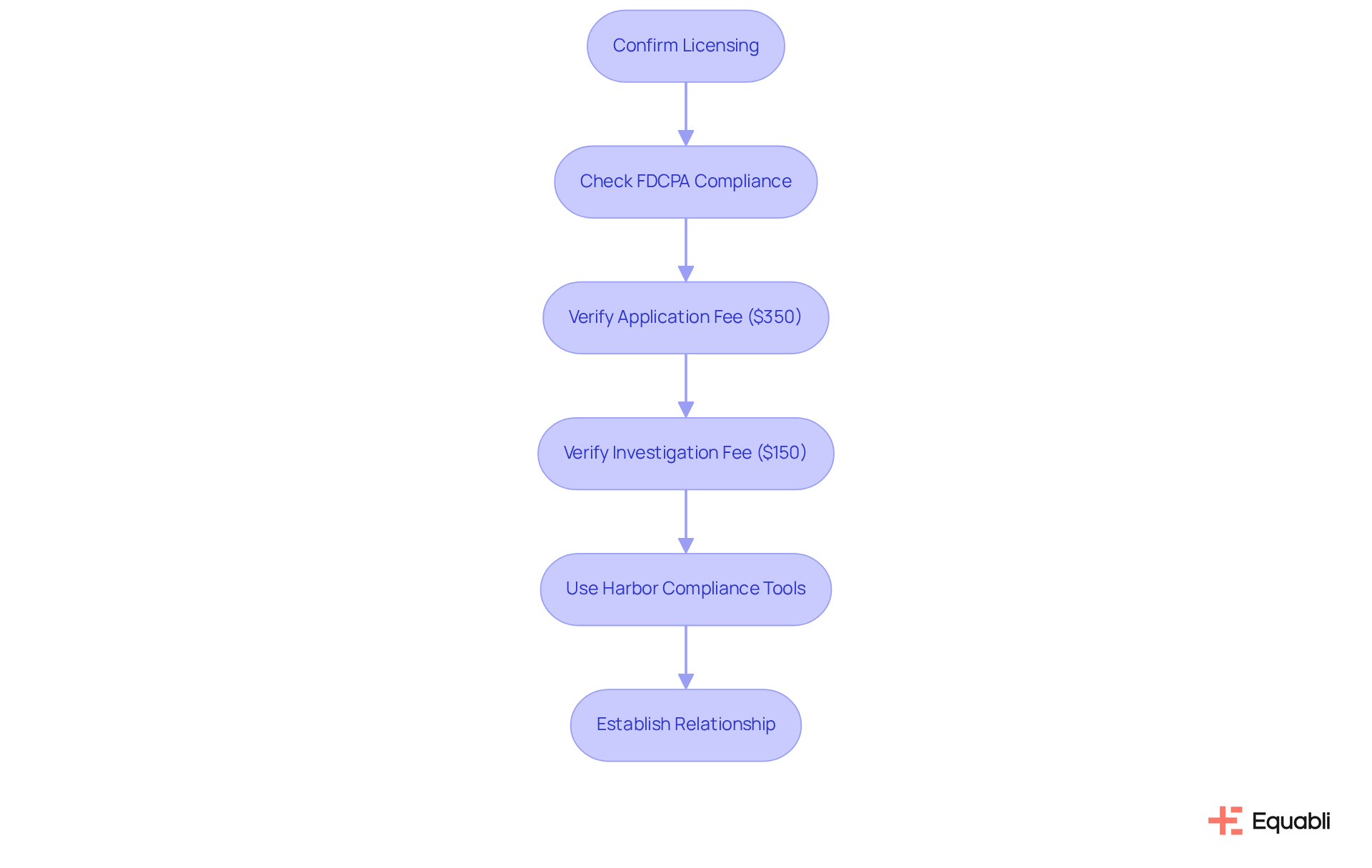

Verify Licensing and Compliance of the Agency

Before collaborating with a , it is crucial to and adherence to local and federal regulations. Agencies are required to comply with the and other relevant laws, which protect your business from potential legal complications.

The stands at $350, accompanied by an additional investigation fee of $150 per applicant. Verifying their through state regulatory bodies ensures that they are authorized to operate, safeguarding your business from potential legal issues.

Moreover, tools provided by Harbor Compliance can assist in , thereby promoting ethical practices in and fostering a reliable relationship with clients and consumers.

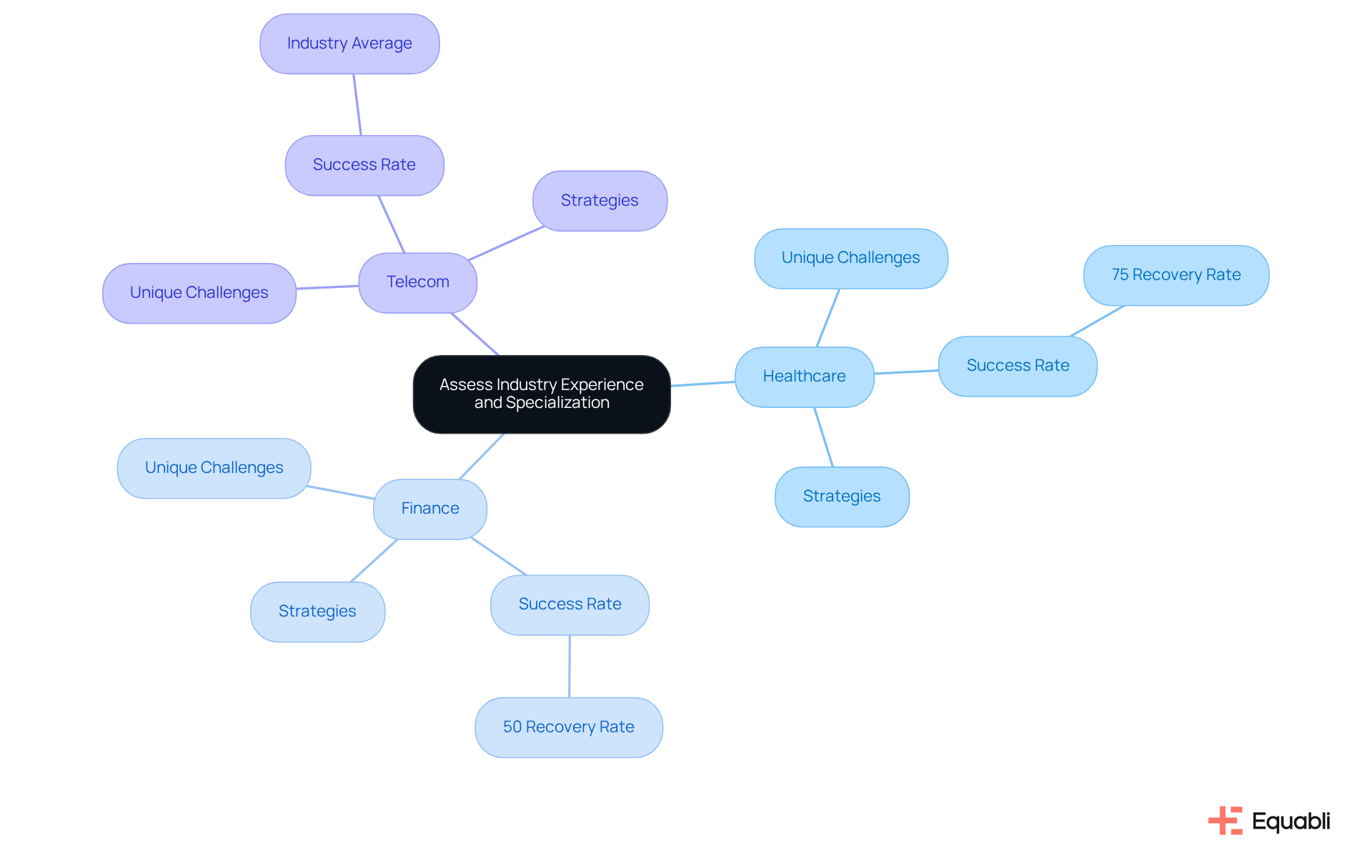

Assess Industry Experience and Specialization

When selecting a , it is crucial to assess their experience and expertise within your specific sector. Each sector—be it healthcare, finance, or telecom—presents that necessitate tailored strategies.

For instance, organizations concentrating on have demonstrated success rates significantly higher than those without such focus, often achieving return rates that exceed industry norms. Recent data reveals that recovery firms in healthcare have reported recovery rates of up to 75%, compared to the overall industry average of 50%.

As we look ahead to 2025, the trend of specialization in is expected to grow, with firms increasingly adopting to enhance efficiency. A proven track record in your field not only ensures familiarity with regulatory requirements but also equips the organization to implement effective retrieval strategies that align with your unique operational needs.

As Adam Parks aptly noted, "Agencies that lead with professionalism and respect in every digital interaction see better payment performance and fewer disputes."

By partnering with a specialized firm, businesses can navigate the complexities of more effectively, ultimately resulting in and reduced operational expenses.

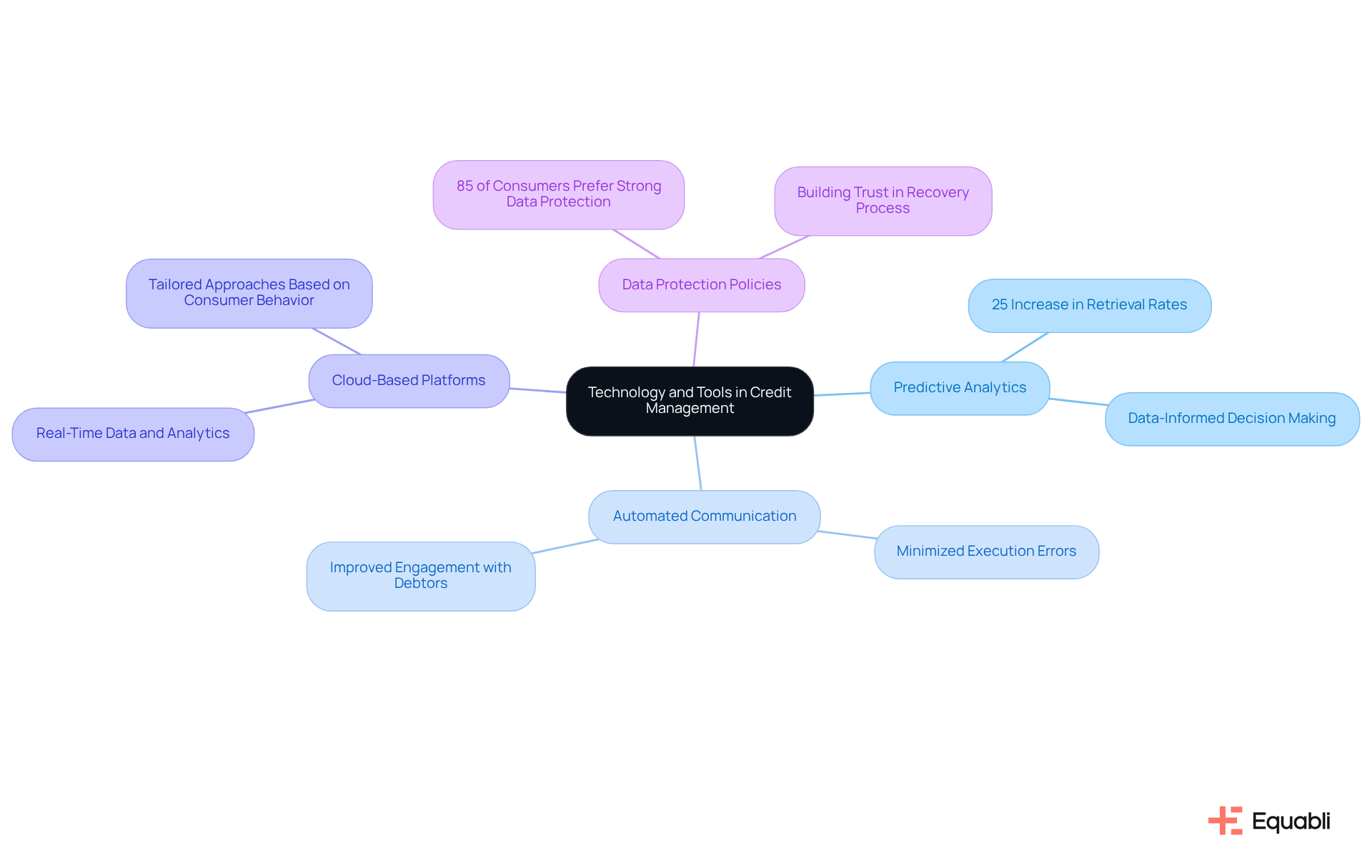

Examine Technology and Tools Used by the Agency

Evaluating the technology and instruments employed by a credit management collections agency is essential for efficient credit management. Organizations that utilize advanced software tools, particularly and , can significantly enhance their operational efficiency and success rates.

For instance, organizations leveraging predictive analytics have reported a 25% increase in retrieval rates, underscoring the effectiveness of data-informed decision-making in debt management. Furthermore, , such as , offer real-time data and analytics that refine gathering strategies, allowing organizations to tailor their approaches based on consumer behavior.

Features like minimize execution errors and reduce vendor onboarding timelines, thus improving overall efficiency. This technological advantage not only streamlines processes but also fosters better engagement with debtors, ultimately leading to improved outcomes in for a credit management collections agency.

Additionally, 85% of consumers are more likely to collaborate with organizations that demonstrate robust , emphasizing the critical role of trust in the recovery process.

Check Client Testimonials and Success Stories

Assessing client testimonials and success narratives is crucial when selecting a . Positive feedback from past clients serves as a strong indicator of the firm's ability to recover debts efficiently while maintaining good relationships with debtors. For instance, a manufacturing firm successfully retrieved 75% of overdue invoices within three months by implementing a strategic pre-legal recovery process that involved direct interaction and organized repayment plans, showcasing the firm's effectiveness in similar sectors.

Furthermore, in a business after reading positive reviews and testimonials, underscoring the significance of social proof in the decision-making process. It is advisable to seek in addressing challenges specific to your sector, as these examples provide valuable insights into their operational strategies and outcomes.

In 2025, further underscore the efficacy of collection firms. For example, a law firm reclaimed 90% of its overdue fees within six months by utilizing customized , which included diplomatic communication techniques and mediation services. By prioritizing firms with proven success and , you can ensure that your selection aligns with your organization's needs and enhances your overall recovery efforts.

Clarify Fee Structure and Payment Terms

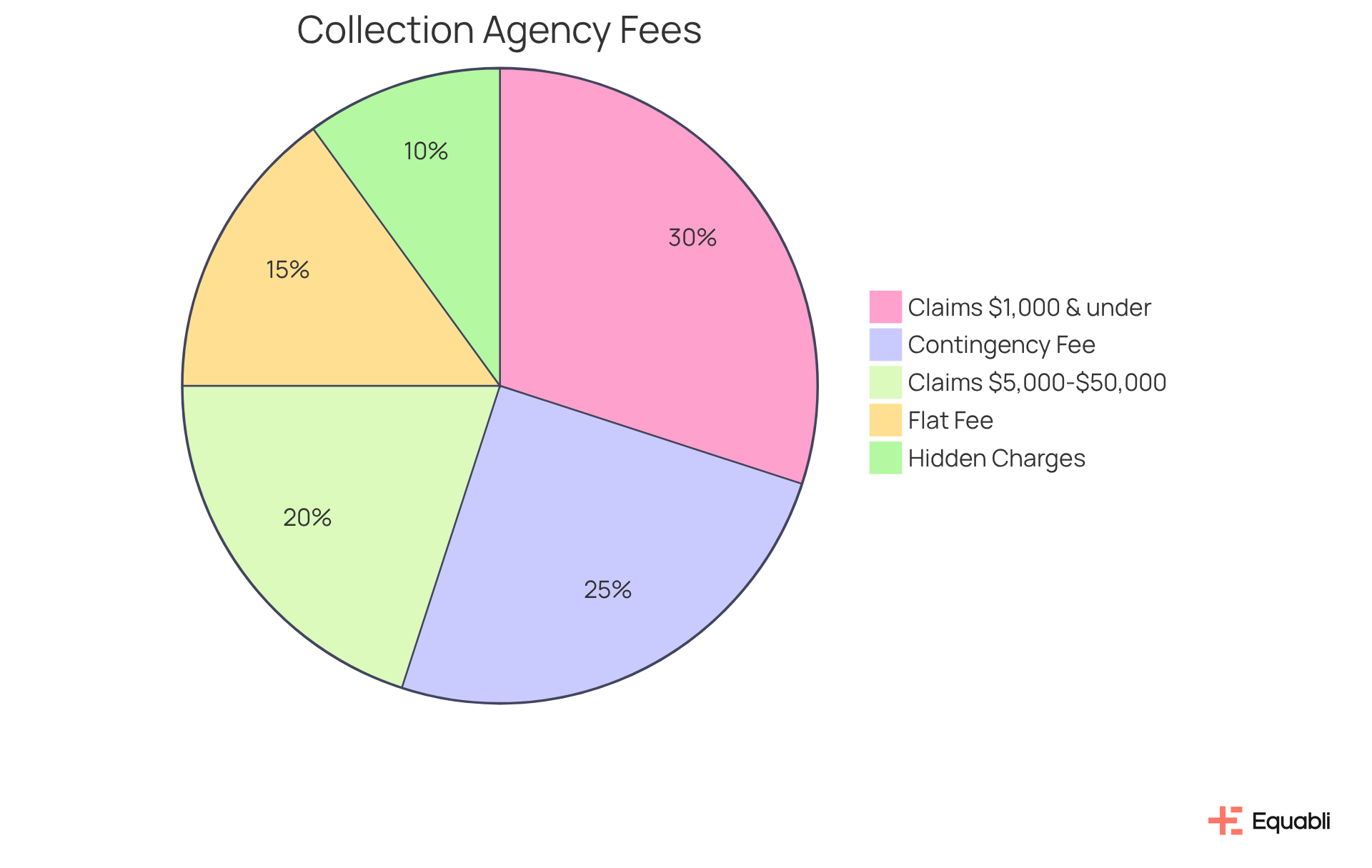

Before engaging a , it is imperative to clarify their fee structure and . Credit management collections agencies typically charge either a flat fee, a percentage of the collected amount, or a combination of both. For instance, , depending on the size and age of the obligation. Specifically, claims between $5,000 and $50,000 incur a 20% contingency rate, while claims of $1,000 and under face a 50% rate.

Understanding these costs in advance is crucial for a credit management collections agency to and ensure that its offerings align with your budget. Additionally, be vigilant about ; for example, some agencies may impose their own fees when a creditor sells or transfers an obligation.

In 2025, is more vital than ever, as additional recovery expenses can significantly increase the total sum due, complicating debt management. By the time a debt is two years past due, the likelihood of collection drops to approximately 10%, emphasizing the urgency of grasping payment terms. Engaging in transparent discussions regarding payment conditions can help resolve ambiguities and foster a more productive collaboration with a credit management collections agency.

To ensure clarity, request a detailed breakdown of fees before signing any contract.

Evaluate Communication Strategies and Client Interaction

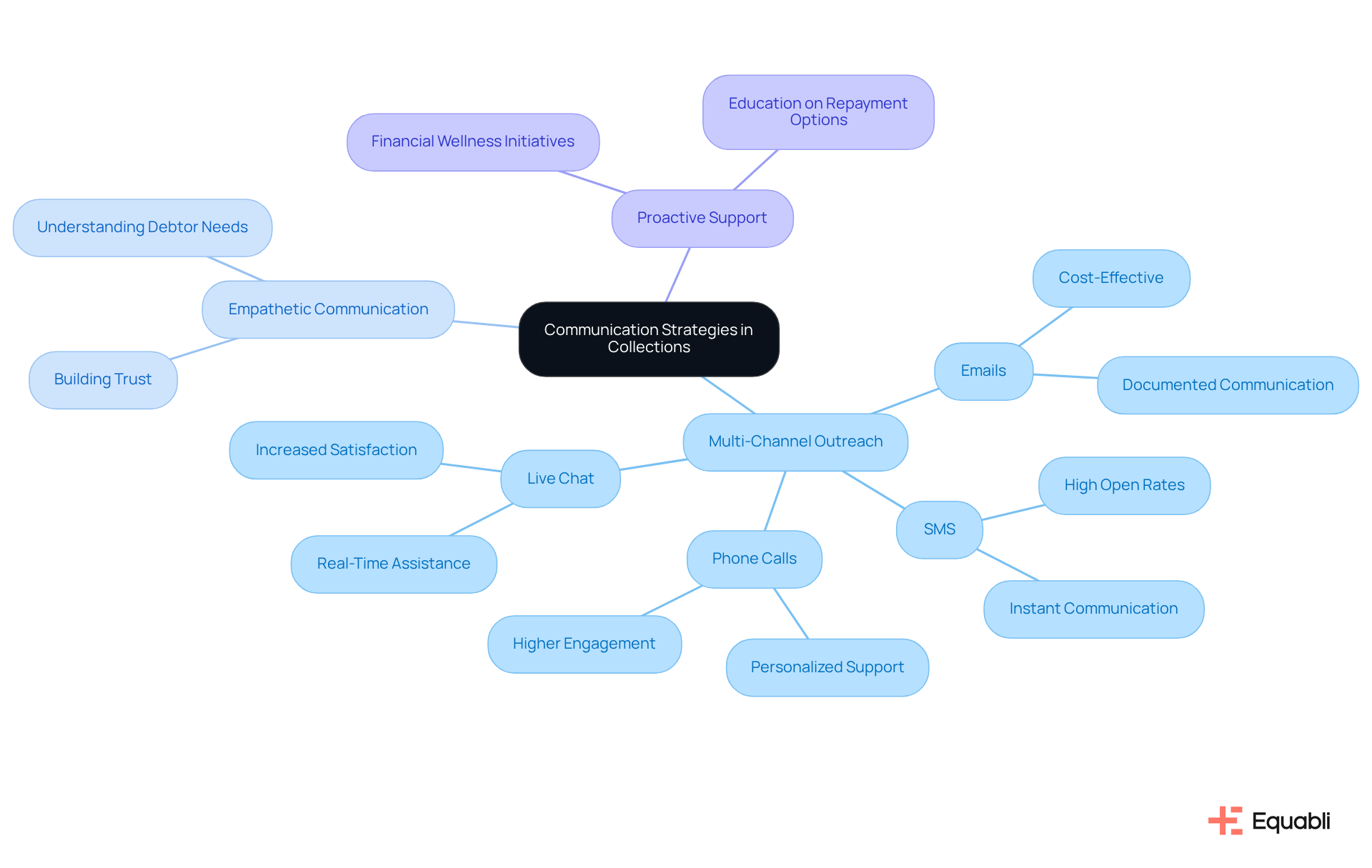

Evaluate the . An efficient organization, such as a , must leverage multiple channels—such as phone calls, emails, SMS, and live chat—to effectively engage debtors. This is not just beneficial; companies that implement such strategies, often in collaboration with a credit management collections agency, experience a compared to those relying on a single method.

The organization's approach as a credit management collections agency should be rooted in respect and empathy, fostering positive interactions that encourage repayment. Assess how they manage client interactions in the context of a credit management collections agency, placing a premium on transparency and responsiveness.

enhances debtor relationships and significantly influences collection rates, which a credit management collections agency can achieve by building trust and understanding. For example, organizations that take a , focusing on financial wellness and education, are better positioned to support debtors in managing their obligations with the help of a credit management collections agency.

By integrating these principles, organizations can cultivate a more efficient and empathetic process within a credit management collections agency.

Understand Dispute Resolution Processes

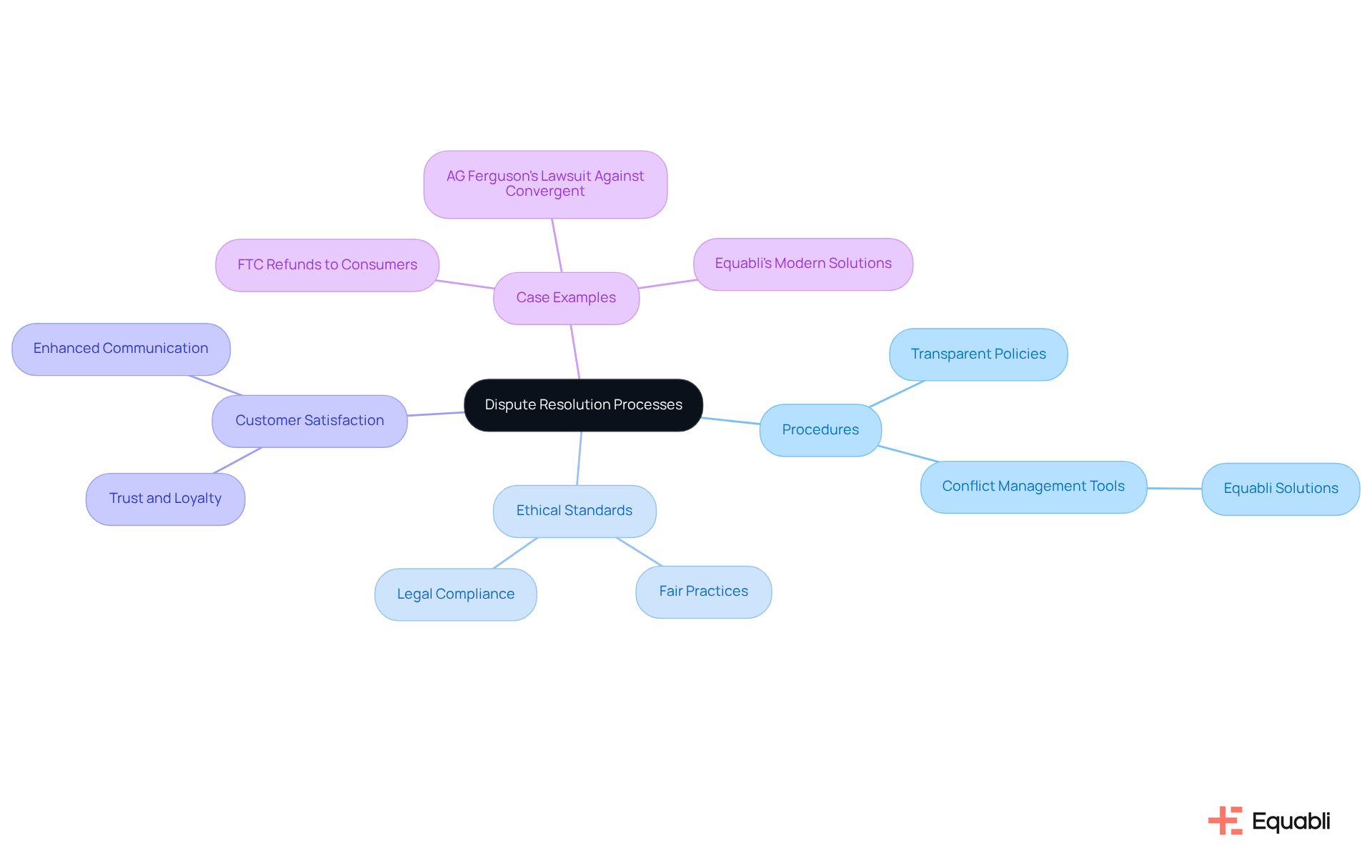

Inquire about the dispute resolution procedures established by the . A reputable agency should uphold and complaints from debtors. This commitment to conflict resolution not only reflects their dedication to fair practices but also plays a crucial role in .

As Bob Ferguson, Attorney General, asserted, " as a means to circumvent the law." This statement underscores the importance of maintaining ethical standards in debt collections. , fostering trust and loyalty—key components in today’s competitive landscape.

For instance, Convergent dispatched 75,466 demand letters to Washington consumers, illustrating the potential conflicts organizations may face. Utilizing can streamline these processes, ensuring your organization is well-equipped to manage conflicts effectively and maintain a strong reputation.

Assess Reporting and Analytics Capabilities

Evaluating the reporting and analytics functions of a debt management firm is paramount for enhancing retrieval strategies. Agencies, specifically credit management collections agencies, that provide , repayment rates, and debtor behavior empower clients to make informed decisions. By leveraging , these organizations can identify trends and refine their strategies, leading to continuous improvement in recovery efforts.

For instance, firms employing , enabling proactive measures that enhance engagement and repayment rates. Given that 92% of consumers prefer self-service payment tools, organizations integrating these features into their strategies witness improved completion rates and overall satisfaction.

Furthermore, the underscores the importance of transparency and data security—elements essential for building trust with borrowers. In a landscape where 85% of consumers are more inclined to collaborate with organizations showcasing robust , the ability to assess and report on compliance and security measures emerges as a competitive advantage.

Ultimately, a strong emphasis on not only streamlines operations but also amplifies the effectiveness of , ensuring agencies align with evolving consumer expectations and regulatory mandates.

Conclusion

Choosing the right credit management collections agency is a pivotal decision that can profoundly influence a business's financial recovery efforts. Understanding essential factors such as technology integration, industry specialization, compliance verification, and effective communication strategies empowers organizations to make informed choices that align with their operational needs and goals. The insights provided in this article underscore the significance of selecting an agency that not only possesses the requisite tools and expertise but also demonstrates a commitment to ethical practices and customer satisfaction.

Key considerations include:

- Evaluating an agency's licensing and compliance status

- Recognizing the importance of their industry experience

- Leveraging advanced technology and analytics

Furthermore, the value of client testimonials and transparent fee structures cannot be overstated, as these elements foster a trustworthy partnership. By prioritizing these factors, businesses can enhance their debt recovery processes and ultimately improve cash flow.

In a landscape where effective debt recovery is paramount, it is essential to thoroughly assess potential collections agencies. Organizations are encouraged to engage with agencies that not only meet compliance standards but also embrace innovative strategies and technologies. By doing so, they can cultivate a more efficient and empathetic recovery process, ensuring the recovery of debts while maintaining positive relationships with clients and consumers.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a comprehensive set of tools designed to modernize receivables management processes. It includes features like the EQ Engine, EQ Engage, and EQ Collect, which leverage predictive analytics, optimize retrieval strategies, and enhance borrower engagement.

How does the Client Success Representative contribute to the EQ Suite?

The Client Success Representative plays a crucial role in guiding the setup and implementation process during client onboarding. They ensure a seamless transition to modern financial recovery practices and act as the primary point of contact to drive product adoption and client engagement.

What functionalities does the EQ Collect tool offer?

The EQ Collect tool facilitates effortless integration with existing systems, shortens vendor onboarding timelines through a no-code file-mapping tool, enhances efficiency with data-driven strategies, and reduces execution errors via automated workflows.

What advantages does EQ Engage provide to clients?

EQ Engage allows clients to design, automate, and execute borrower contact strategies, improving communication and compliance. It features real-time reporting and an intuitive interface that optimizes operations and enhances compliance.

Why is it important to verify the licensing and compliance of a recovery agency?

Verifying a recovery agency's licensing and compliance is crucial to ensure they adhere to local and federal regulations, such as the Fair Debt Collection Practices Act (FDCPA). This protects businesses from potential legal complications.

What are the fees associated with obtaining a collection agency license?

The application fee for a collection agency license is $350, along with an additional investigation fee of $150 per applicant.

How can Harbor Compliance assist in managing agency licenses?

Harbor Compliance provides tools that help manage licenses and monitor renewals, promoting ethical practices in financial recovery and fostering reliable relationships with clients and consumers.

Why is assessing industry experience important when selecting a credit management collections agency?

Assessing industry experience is important because different sectors have unique debt recovery challenges that require tailored strategies. Agencies with sector-specific expertise can implement effective retrieval strategies and navigate regulatory requirements more efficiently.

What recovery rates have been reported by healthcare-focused recovery firms?

Healthcare-focused recovery firms have reported recovery rates of up to 75%, significantly higher than the overall industry average of 50%.

What is the trend regarding specialization in financial recovery expected to grow by 2025?

By 2025, the trend of specialization in financial recovery is expected to grow, with firms increasingly adopting industry-specific strategies to enhance efficiency in debt collection.