Overview

The collection department is pivotal in managing overdue accounts and recovering outstanding debts, thereby minimizing financial losses for monetary organizations. This department has evolved significantly; it now not only focuses on debt recovery but also aims to strengthen customer relationships and leverage technology. Such advancements are crucial for sustaining the financial health of institutions. By embracing these changes, organizations can enhance their operational efficiency and foster a more resilient financial environment.

Introduction

The collection department stands as a vital cog in the machinery of financial institutions, tasked with the crucial role of managing overdue accounts and recovering outstanding debts. By implementing strategic debt recovery methods and fostering customer relationships, this department not only mitigates financial losses but also enhances overall profitability. However, as the landscape of financial services evolves with technology, how can collection departments adapt to maintain efficiency and compliance while also prioritizing customer engagement?

Define Collection Department: Purpose and Functionality

The recovery division represents a critical component within monetary organizations, tasked with the oversight of overdue accounts and the retrieval of outstanding debts. Its primary objective is to mitigate financial losses through the implementation of effective debt recovery strategies. This involves proactive outreach to borrowers, negotiation of repayment plans, and the application of diverse recovery methods to encourage timely payments.

In the contemporary landscape, the function of a retrieval unit transcends mere recovery; it encompasses the cultivation of customer relationships, adherence to regulatory standards, and the deployment of data-driven strategies to bolster recovery initiatives.

The Client Success Representative is pivotal in this framework, driving product adoption and client engagement while ensuring that the retrieval team effectively utilizes advanced solutions such as EQ Collect. This platform not only accelerates vendor onboarding with its no-code file-mapping tool but also enhances revenue through and provides real-time reporting for unparalleled transparency.

By harnessing these technologies, retrieval teams can significantly improve their recovery operations while simultaneously strengthening client relationships and engagement, ultimately transforming debt recovery into a more streamlined and effective process.

Contextualize the Collection Department in Financial Institutions

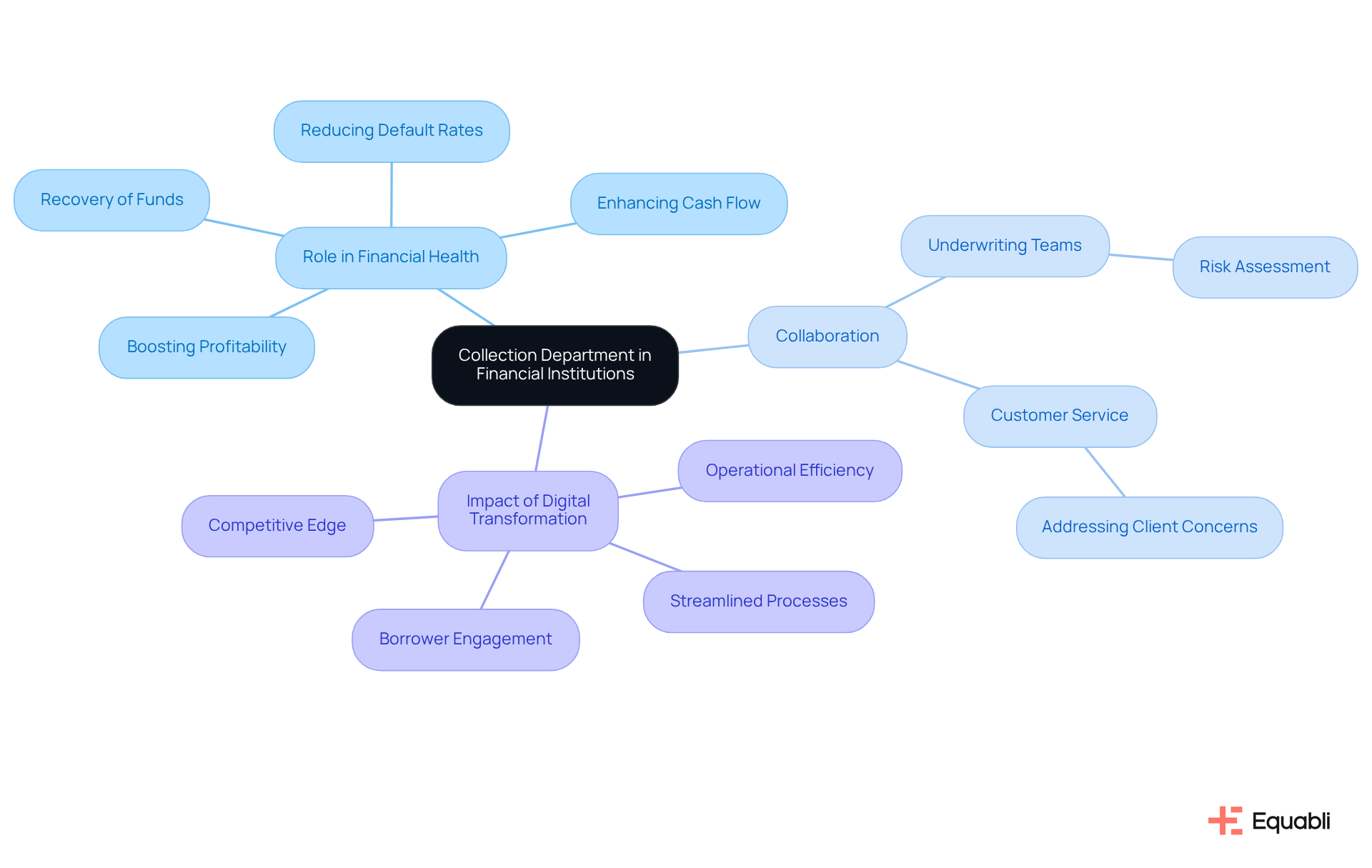

In financial institutions, understanding what the collection department is crucial as it plays a pivotal role in sustaining the organization's financial health. Positioned at the intersection of lending and risk management, the collection department ensures the recovery of funds extended to clients. To understand what the collection department is, it is important to note that this department collaborates closely with underwriting teams to and engages with customer service to effectively address client concerns. By managing assets efficiently, institutions can significantly reduce default rates, enhance cash flow, and boost overall profitability.

The impact of digital transformation on retrieval strategies is profound; as institutions embrace advanced technologies, they streamline processes and elevate borrower engagement. This evolution not only improves operational efficiency but also establishes the team responsible for collections as a crucial driver of financial stability and growth. In this rapidly changing landscape, harnessing these advancements is essential for maintaining a competitive edge.

Trace the Evolution of Collection Departments: Historical Perspective

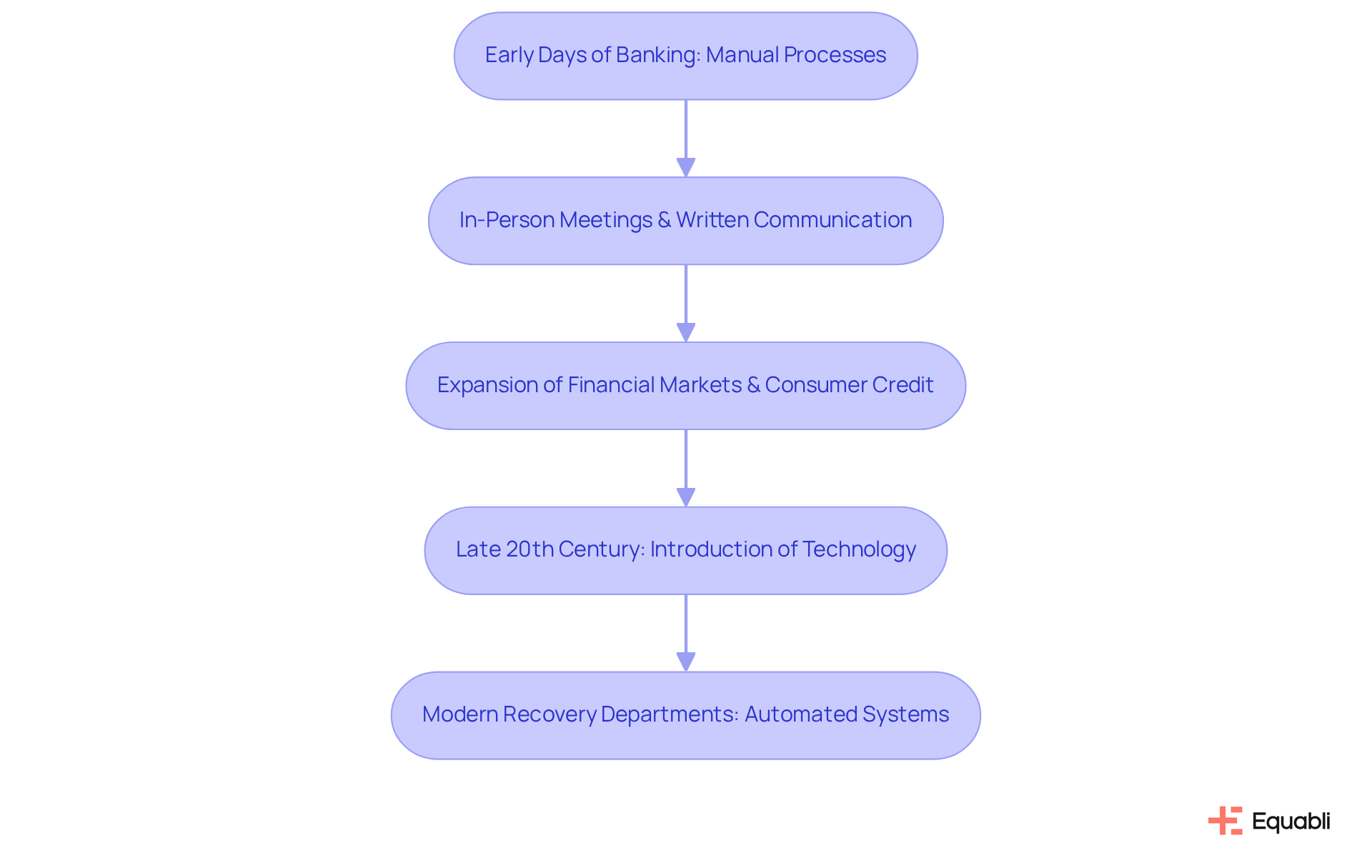

The evolution of recovery departments can be traced back to the early days of banking, when institutions relied on manual processes to manage overdue accounts. Initially, these interactions were managed through in-person meetings and written communication. However, as financial markets expanded and consumer credit surged, the need for more organized retrieval processes became increasingly evident. The late 20th century heralded a significant turning point with the introduction of technology; automated systems and data analytics transformed asset management. Today, recovery departments leverage , such as Equabli's EQ Suite, to modernize manual processes and enhance efficiency through intelligent, data-driven strategies. This evolution not only improves compliance but also customizes approaches to individual borrower behaviors, underscoring Equabli's commitment to data protection and effective client engagement. This historical perspective emphasizes the ongoing necessity for innovation within the inventory landscape.

Identify Key Characteristics and Components of Collection Departments

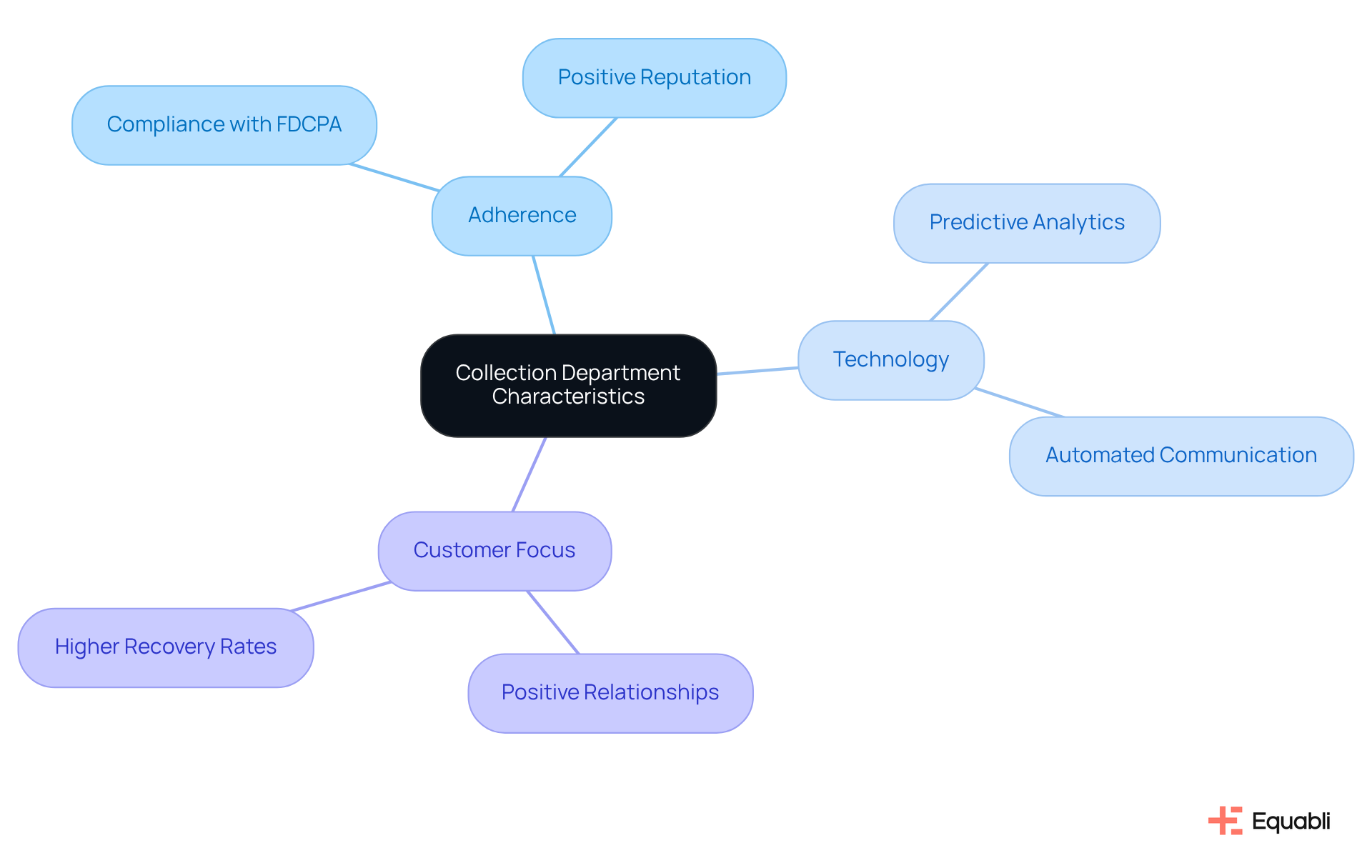

Efficient retrieval teams are characterized by a strong emphasis on adherence, the strategic application of technology, and a customer-focused approach. Compliance with regulations, such as the Fair Debt Collection Practices Act (FDCPA), is essential to avoid legal repercussions and uphold a positive reputation. Technology plays a critical role; tools like predictive analytics and automated communication systems empower teams to refine their gathering strategies effectively. Furthermore, a customer-centric approach underscores the significance of fostering positive relationships with borrowers, ultimately leading to higher recovery rates and enhanced customer loyalty.

To ensure the collection department operates efficiently and effectively, integral components include:

- Robust training programs for staff

- Performance metrics

- Feedback mechanisms

Conclusion

The collection department stands as a crucial mechanism within financial institutions, concentrating on the recovery of overdue accounts and the minimization of financial losses. By integrating advanced technologies and cultivating robust relationships with borrowers, this department not only amplifies its operational efficiency but also plays a significant role in the overall financial health of the organization.

Key insights throughout this article have underscored the multifaceted role of collection departments. This includes:

- Their collaboration with underwriting and customer service teams

- The historical transition from manual processes to sophisticated automated systems

- The critical importance of compliance and customer-centric approaches

These elements highlight the necessity for innovation and adaptability in the ever-evolving financial landscape.

Recognizing the significance of collection departments is essential for any financial institution striving for stability and profitability. As the industry continues to advance, embracing technological innovations and prioritizing customer relationships will be vital in transforming debt recovery from a mere necessity into a strategic advantage. Engaging with these insights empowers institutions to refine their collection strategies, ensuring long-term success and resilience in the competitive financial sector.

Frequently Asked Questions

What is the primary purpose of a collection department?

The primary purpose of a collection department is to oversee overdue accounts and retrieve outstanding debts, aiming to mitigate financial losses through effective debt recovery strategies.

What are some key functions of a collection department?

Key functions include proactive outreach to borrowers, negotiation of repayment plans, and the application of diverse recovery methods to encourage timely payments.

How has the role of the collection department evolved in contemporary settings?

The role has evolved to include cultivating customer relationships, adhering to regulatory standards, and employing data-driven strategies to enhance recovery initiatives.

What is the role of a Client Success Representative in the collection department?

The Client Success Representative drives product adoption and client engagement while ensuring the retrieval team effectively utilizes advanced solutions for improved recovery operations.

What is EQ Collect, and how does it benefit the collection department?

EQ Collect is a platform that accelerates vendor onboarding with a no-code file-mapping tool, enhances revenue through automated workflows, and provides real-time reporting for greater transparency in recovery operations.

How do advanced technologies impact the collection department's operations?

Advanced technologies significantly improve recovery operations, strengthen client relationships, and streamline the debt recovery process, making it more effective and efficient.