Overview

This article provides an authoritative overview of mastering dispute resolution strategies with collection agencies, essential for effectively managing conflicts that arise during the debt collection process. It underscores the significance of understanding various types of disputes, maintaining clear communication, and adhering to regulatory frameworks. These elements collectively enhance the resolution process and lead to improved operational outcomes for financial institutions.

Introduction

Navigating the complexities of debt disputes presents significant challenges for financial institutions, where missteps can lead to considerable financial and legal repercussions. Collection agencies encounter various issues, including inaccuracies in debt amounts and unrecognized obligations, necessitating effective dispute resolution strategies to uphold trust and compliance. This article explores essential practices that empower financial institutions to confront these conflicts directly, highlighting how clear communication, thorough documentation, and an understanding of consumer rights can transform potential disputes into opportunities for resolution.

How can organizations adapt their strategies not only to resolve conflicts but also to enhance their reputations in an increasingly digital landscape?

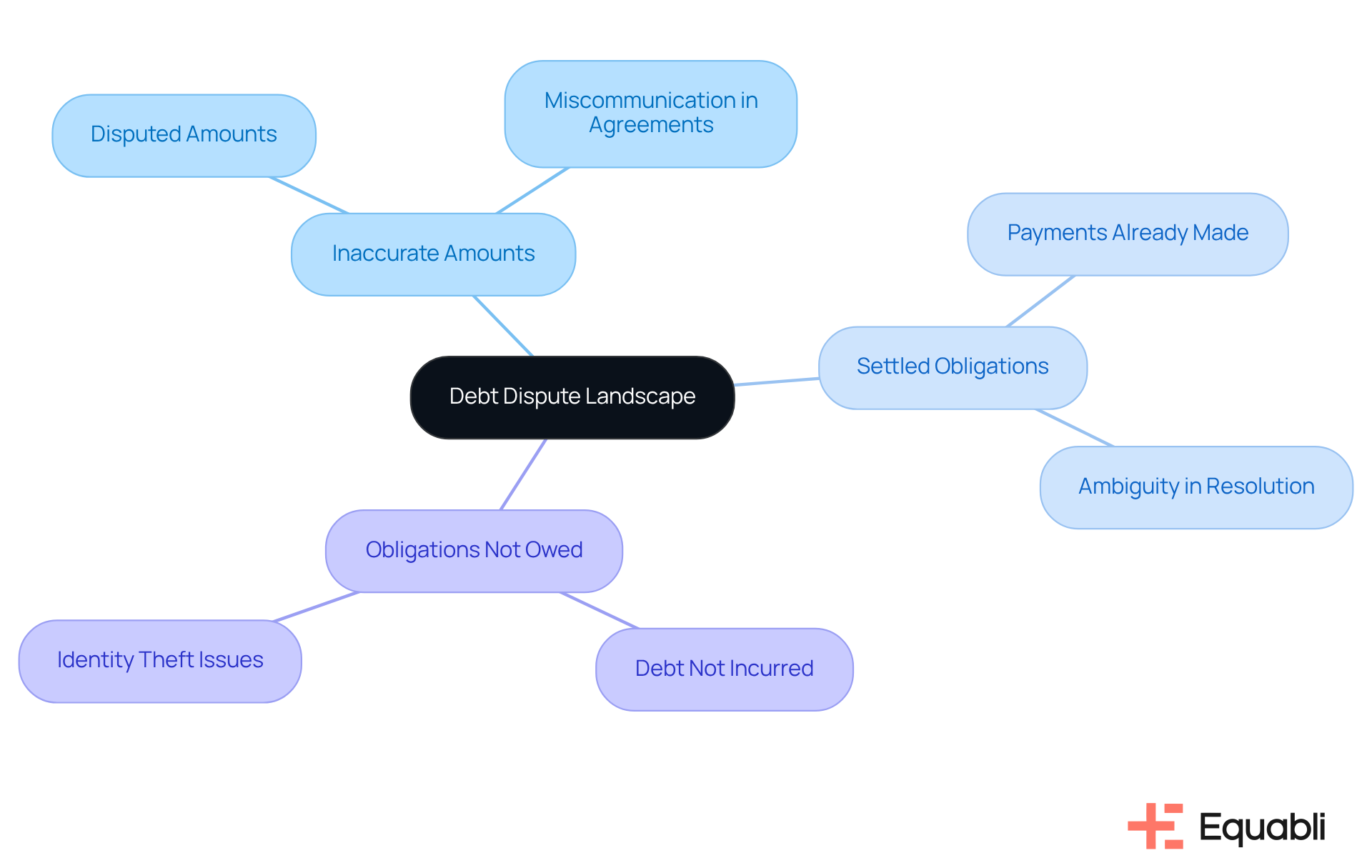

Understand the Debt Dispute Landscape

The landscape of financial conflicts is intricate, encompassing various types of disagreements that may arise during the collection process, often requiring dispute resolution strategies with collection agencies for financial institutions. Common conflicts include:

- Assertions of inaccurate amounts owed

- Obligations that have already been settled

- Obligations that are not owed at all

Understanding these conflicts is essential for collection organizations to effectively navigate the complexities of client interactions and implement with collection agencies for financial institutions.

For instance, a consumer may dispute a debt due to ambiguity in the original agreement or because they believe the debt has been resolved. To maintain trust and ensure compliance with regulations, collection firms must be prepared to address these conflicts promptly and professionally by employing dispute resolution strategies with collection agencies for financial institutions. Implementing EQ Collect can significantly streamline this process by reducing vendor onboarding timelines through a straightforward, no-code file-mapping tool, thereby enhancing efficiency and increasing collections via data-driven strategies.

Moreover, the rise of digital communication has transformed how conflicts are initiated and resolved, requiring organizations to adapt their dispute resolution strategies with collection agencies for financial institutions accordingly. By leveraging the automated workflows and real-time reporting capabilities of EQ Collect, organizations can minimize execution errors and ensure timely responses to conflicts. By identifying the prevalent challenges and underlying drivers of conflicts, along with the insights provided by EQ Collect, organizations can bolster their teams' preparedness to manage these situations with empathy and effectiveness.

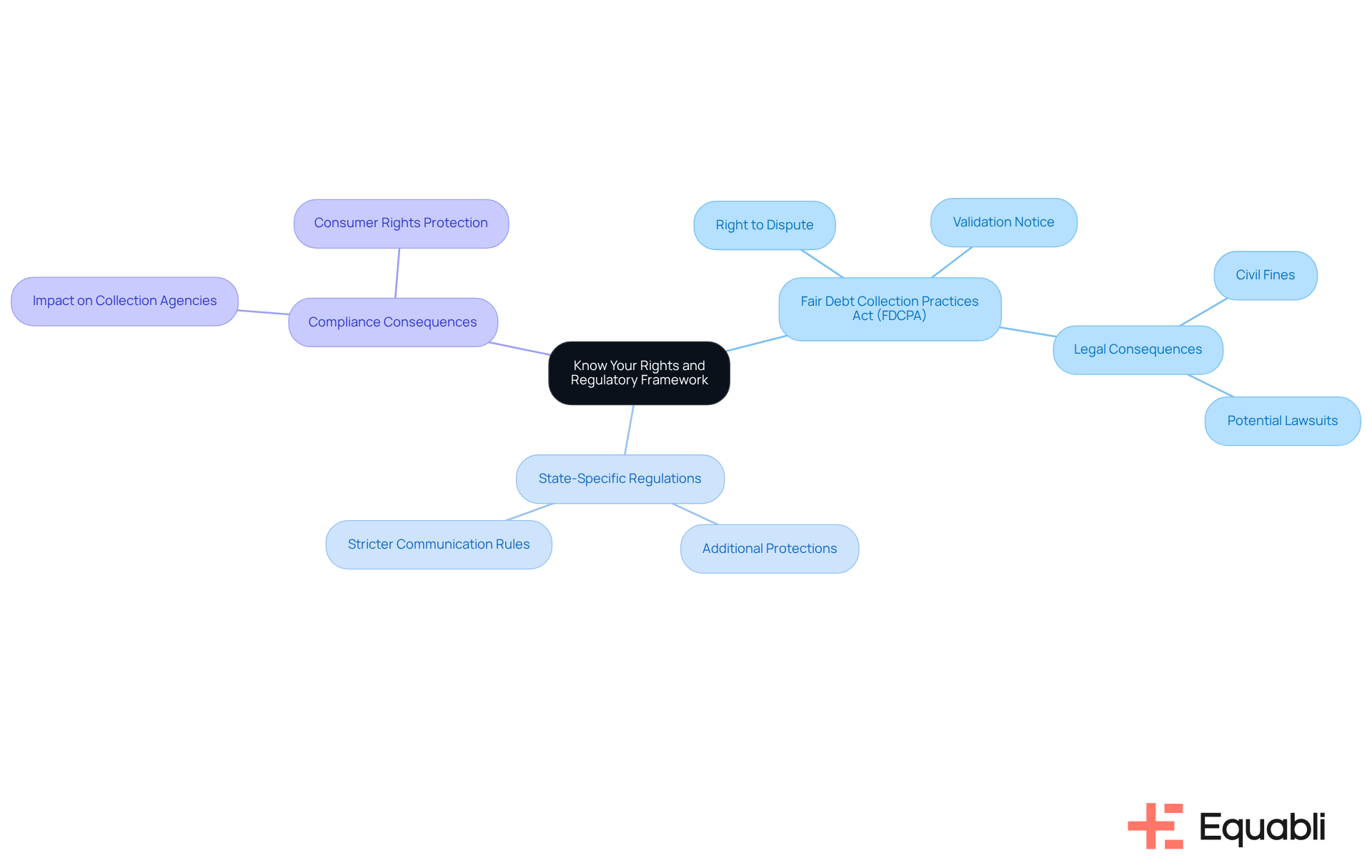

Know Your Rights and Regulatory Framework

Understanding your rights and the is essential for both individuals and collection agencies. The Fair Debt Collection Practices Act (FDCPA) establishes critical protections for individuals, including the right to dispute a financial obligation and the requirement for collectors to provide validation upon request. For example, individuals may request a written validation notice within 30 days of initial contact, which must specify the debt amount and the creditor's name. Non-compliance with these regulations can lead to significant legal consequences for collection agencies, including civil fines exceeding $50,000 per violation under the FTC Act and potential lawsuits.

Moreover, awareness of state-specific regulations is crucial, as these laws may offer additional protections beyond federal requirements. Some states have enacted stricter regulations regarding communication durations and techniques, further safeguarding user rights. Approximately 30 million Americans are affected by debt collection, underscoring the scale of the issue and the importance of understanding individual rights. By being informed of these rights and regulations, both clients and collection firms can foster more productive dialogues, thereby reducing the likelihood of disputes escalating into costly legal confrontations, emphasizing the need for effective dispute resolution strategies with collection agencies for financial institutions.

Insights from legal experts highlight that compliance with these regulations not only protects clients but also enhances the reputation and operational integrity of collection agencies. Dr. Nick Oberheiden notes that engaging in fair practices and respecting consumer rights can yield better outcomes for all parties involved, emphasizing the importance of compliance in the collection process. Additionally, common pitfalls in debt collection practices, such as misrepresenting the amount owed or failing to provide validation notices, should be avoided to ensure adherence and protect against legal repercussions.

Implement Effective Dispute Initiation Strategies

Implementing effective conflict initiation strategies is essential for resolving issues efficiently within the debt collection sector. Collection agencies must establish clear protocols for managing conflicts, which includes training staff to recognize and respond to common issues.

One effective strategy is to encourage individuals to express their concerns early in the process. This can be achieved by providing , such as phone, email, and online portals. For instance, organizations can develop accessible online forms that allow individuals to submit their issues effortlessly, thereby enhancing the initial engagement.

Furthermore, organizations should ensure that their communication is both clear and compassionate. Acknowledging consumer concerns and providing explicit details about the resolution process can help de-escalate tensions and foster a cooperative atmosphere. By prioritizing efficient conflict initiation, organizations can enhance their reputation and increase recovery rates, ultimately contributing to improved operational outcomes.

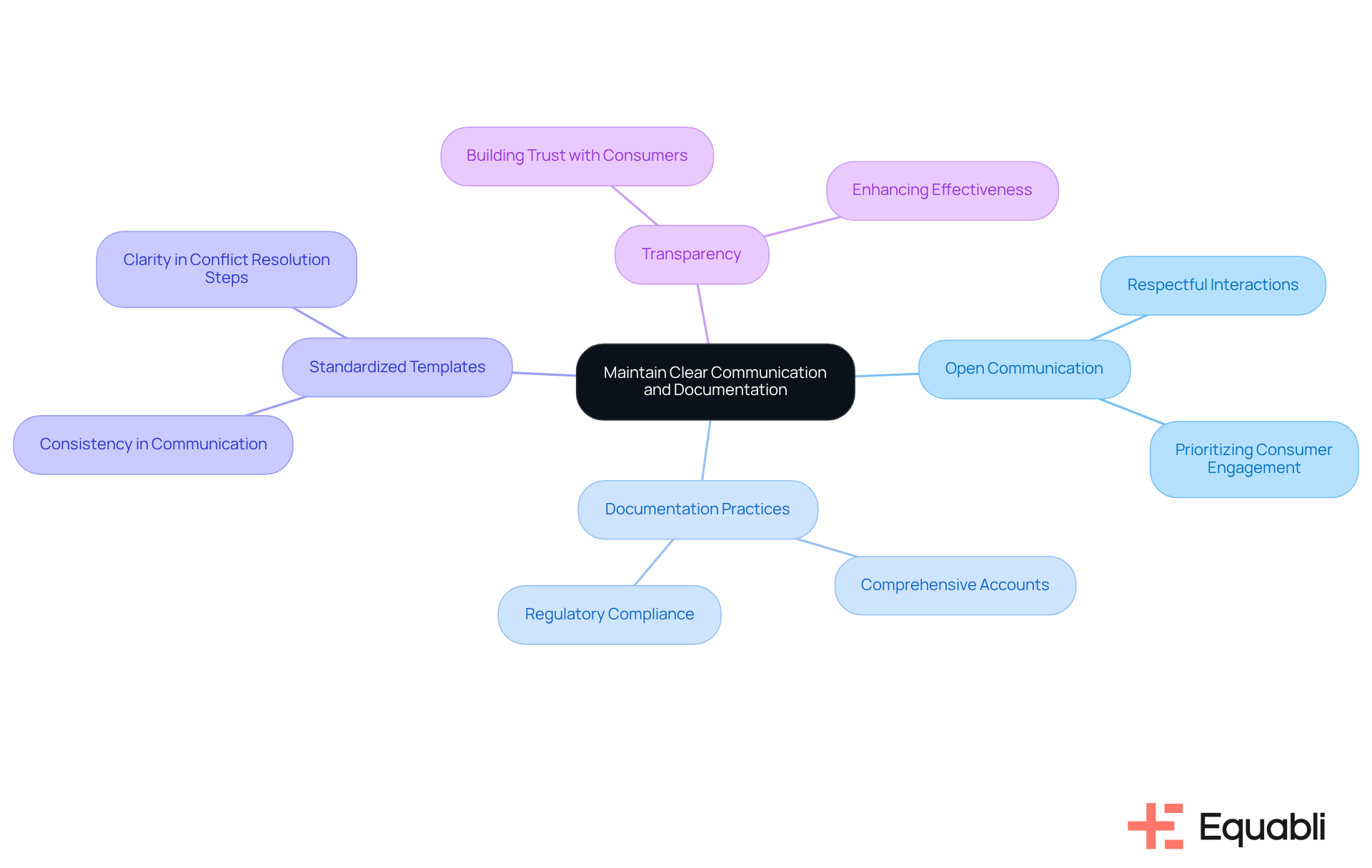

Maintain Clear Communication and Documentation

Effective dispute resolution strategies with collection agencies for financial institutions hinge on maintaining clear communication and thorough documentation. Collection agencies must prioritize open lines of communication with consumers by utilizing dispute resolution strategies with collection agencies for financial institutions, ensuring that all interactions are conducted with respect and professionalism.

Documenting every interaction—whether through phone calls, emails, or letters—provides a comprehensive account of the conflict process. This documentation is crucial not only for but also serves as essential evidence in the event of legal disputes.

Moreover, organizations should implement standardized templates for communication to ensure consistency and clarity. These templates will aid staff in conveying critical information, such as the steps involved in the conflict resolution process and the expected timelines. By fostering a culture of transparency and accountability, agencies can build trust with consumers and enhance their overall effectiveness in managing disputes through effective dispute resolution strategies with collection agencies for financial institutions.

Conclusion

Navigating the complexities of debt disputes is essential for financial institutions aiming to uphold trust and compliance in their operations. Effective dispute resolution strategies with collection agencies are critical, as clear communication, thorough documentation, and a solid understanding of consumer rights can significantly transform potential conflicts into constructive resolutions.

Recognizing various types of disputes, such as inaccuracies in amounts owed and obligations that have already been settled, is imperative. Furthermore, understanding the regulatory framework, including the Fair Debt Collection Practices Act, enables consumers and collection agencies to engage in productive dialogues. Establishing clear protocols for conflict initiation and maintaining open communication channels enhances the resolution process, ultimately improving operational outcomes for collection agencies.

As the landscape of debt disputes evolves, organizations must adapt their strategies not only to resolve conflicts effectively but also to enhance their reputations in an increasingly digital world. Embracing innovative dispute resolution techniques and staying informed about consumer rights and regulatory requirements will empower financial institutions to navigate these challenges successfully, fostering a more respectful and compliant approach to debt collection.

Frequently Asked Questions

What are the common types of conflicts that arise during the debt collection process?

Common conflicts include assertions of inaccurate amounts owed, obligations that have already been settled, and obligations that are not owed at all.

Why is it important for collection organizations to understand debt disputes?

Understanding these conflicts is essential for collection organizations to effectively navigate client interactions and implement dispute resolution strategies with collection agencies for financial institutions.

How can a consumer dispute a debt?

A consumer may dispute a debt due to ambiguity in the original agreement or because they believe the debt has been resolved.

What role does EQ Collect play in dispute resolution?

EQ Collect can streamline the dispute resolution process by reducing vendor onboarding timelines through a straightforward, no-code file-mapping tool, thereby enhancing efficiency and increasing collections via data-driven strategies.

How has digital communication impacted debt dispute resolution?

The rise of digital communication has transformed how conflicts are initiated and resolved, requiring organizations to adapt their dispute resolution strategies accordingly.

What features of EQ Collect help organizations manage conflicts effectively?

EQ Collect offers automated workflows and real-time reporting capabilities, which help minimize execution errors and ensure timely responses to conflicts.

How can organizations improve their preparedness to handle debt disputes?

By identifying prevalent challenges and underlying drivers of conflicts and leveraging insights provided by EQ Collect, organizations can bolster their teams' preparedness to manage these situations with empathy and effectiveness.