Overview

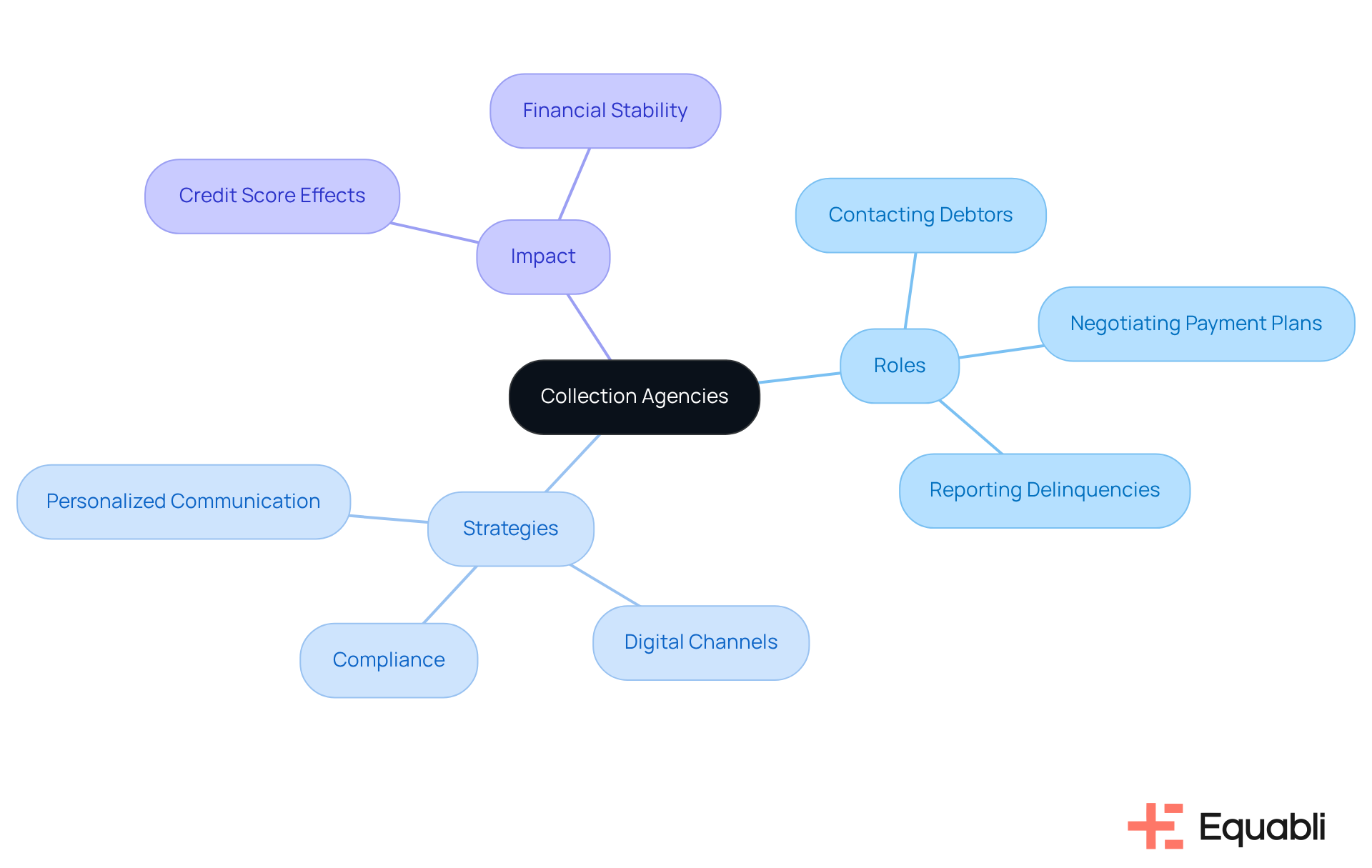

Collection agencies serve as specialized entities engaged by creditors to recover overdue debts, primarily operating on a contingency basis. These agencies employ a variety of strategies designed to enhance recovery rates while strictly adhering to legal standards. Their significant roles include:

- Negotiating payment plans

- Reporting delinquencies

These roles are crucial for maintaining financial health. Furthermore, the impact of technological advancements and legal regulations, such as the Fair Debt Collection Practices Act, cannot be overlooked, as they shape operational frameworks and ensure ethical practices in debt recovery. Understanding these dynamics is essential for stakeholders seeking effective debt management solutions.

Introduction

Collection agencies serve a crucial function in the financial ecosystem, acting as the essential link between creditors and debtors. These specialized entities not only aim to recover overdue payments but also navigate a complex landscape of legal regulations and consumer rights. With the increasing number of Americans facing debt, the effectiveness and ethical practices of collection agencies come under scrutiny.

What challenges do these agencies encounter in balancing recovery efforts with consumer protection? Furthermore, how do their strategies evolve in response to shifting regulations and technological advancements?

Defining Collection Agencies: Roles and Functions

Collection organizations, often referred to as collection agencies, serve as specialized entities engaged by creditors to recover overdue debts from individuals or businesses. Acting as intermediaries, they utilize a range of strategies aimed at effectively collecting outstanding payments. To understand what collection agencies are, it's important to note that they typically operate on a contingency basis, earning a percentage of the amounts they recover, which incentivizes them to enhance their recovery efforts while adhering to legal and ethical standards. In 2025, the anticipated recovery rate for debt recovery firms is approximately 20%, underscoring ongoing challenges in the sector despite advancements in technology and tactics.

These organizations often acquire financial obligations from lenders at a reduced price, assuming the responsibility of collecting the total amount due. Their roles encompass:

- Contacting debtors

- Negotiating payment plans

- Reporting delinquencies to credit bureaus

This illustrates what collection agencies are and how their actions can significantly affect a debtor's credit score. As of 2025, it is estimated that around 28% of Americans have at least one obligation in arrears, which raises the question of what collection agencies are and the critical function these firms fulfill in managing overdue accounts.

Effective debt recovery tactics employed by recovery firms involve personalized communication methods that treat customers as unique individuals rather than mere portfolio profiles. This departure from outdated mass phone call strategies has demonstrated improved recovery rates. For instance, research by McKinsey reveals that 12-35% of delinquent individuals take payment action after being contacted through digital channels. Industry leaders assert that recovery firms must prioritize compliance, transparency, and consumer-focused practices to succeed in a competitive landscape. Tools like EQ Collect can significantly bolster these efforts by minimizing manual tasks and enhancing efficiency through automated workflows and data-driven strategies, directly addressing the challenges of low recovery rates and compliance requirements. Ultimately, the impact of recovery firms transcends simple financial retrieval; they play a vital role in sustaining monetary stability for lenders and .

The Evolution of Collection Agencies: A Historical Perspective

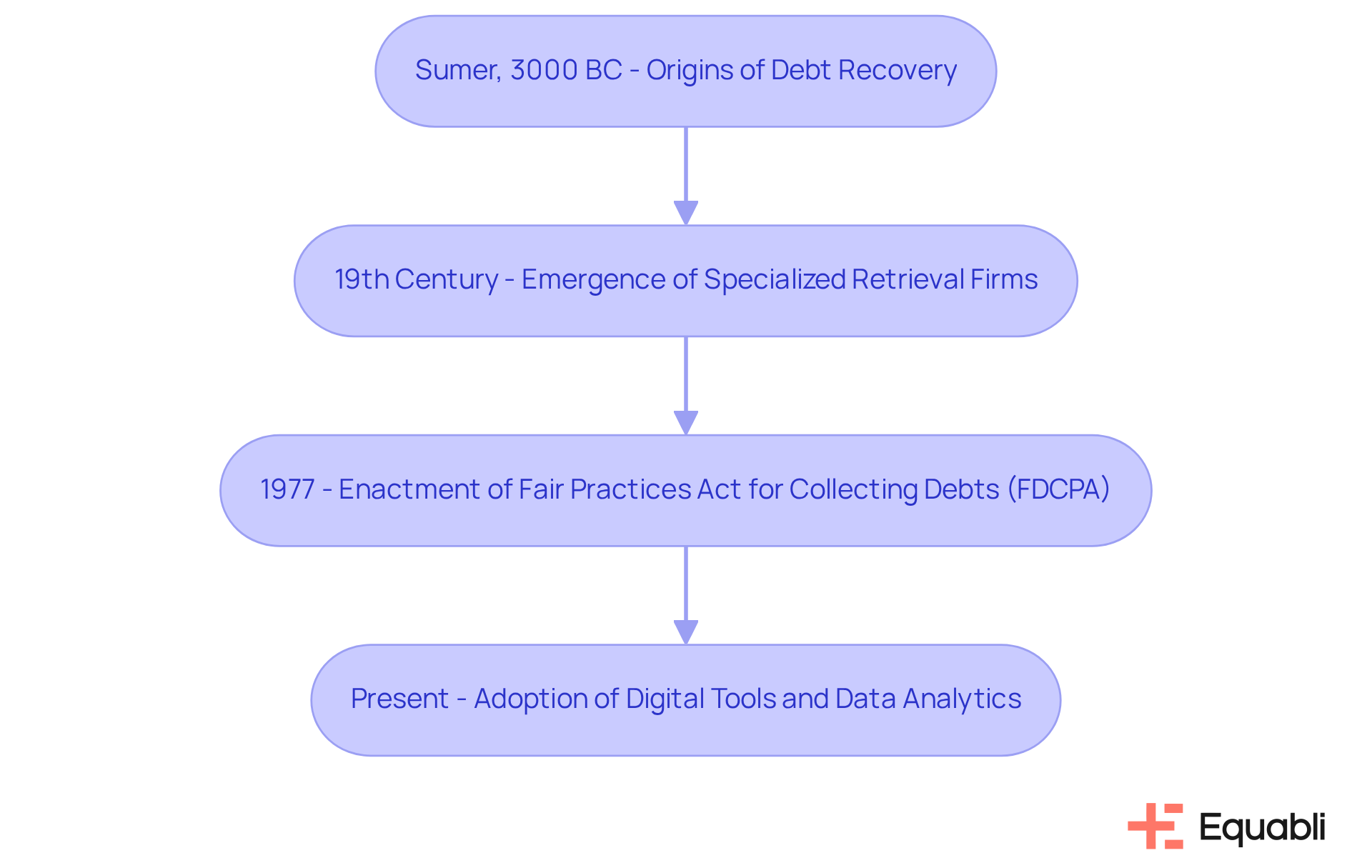

The origins of debt recovery can be traced back to ancient civilizations, with the earliest documentation emerging in Sumer around 3000 BC. Initially, the process was straightforward, relying on direct interactions between creditors and debtors. However, as economies evolved and became increasingly complex, the necessity for specialized retrieval firms, or what are collection agencies, emerged. By the 19th century, these agencies began to formalize their operations, leveraging new technologies like the telephone to enhance communication and efficiency.

A pivotal moment in the history of financial recovery occurred with the enactment of the Fair Practices Act for Collecting Debts (FDCPA) in 1977. This legislation established essential legal standards aimed at ensuring and protecting individuals from abusive tactics. The FDCPA not only transformed the operational environment for debt recovery firms but also underscored the significance of consumer rights within the debt recovery process.

In contemporary times, many are asking what are collection agencies as they experience significant evolution, increasingly adopting digital tools and data analytics to refine their strategies. Modern solutions like EQ Collect exemplify this transformation, offering features such as:

- A no-code file-mapping tool that reduces vendor onboarding timelines

- Automated workflows that enhance operational efficiency

- Real-time reporting that ensures compliance oversight

The incorporation of technology has empowered organizations to boost borrower engagement, optimize operations, and adhere more closely to regulatory standards. As the industry continues to adapt, the focus on ethical practices and consumer-centric approaches remains paramount, reflecting a broader shift towards responsible debt management.

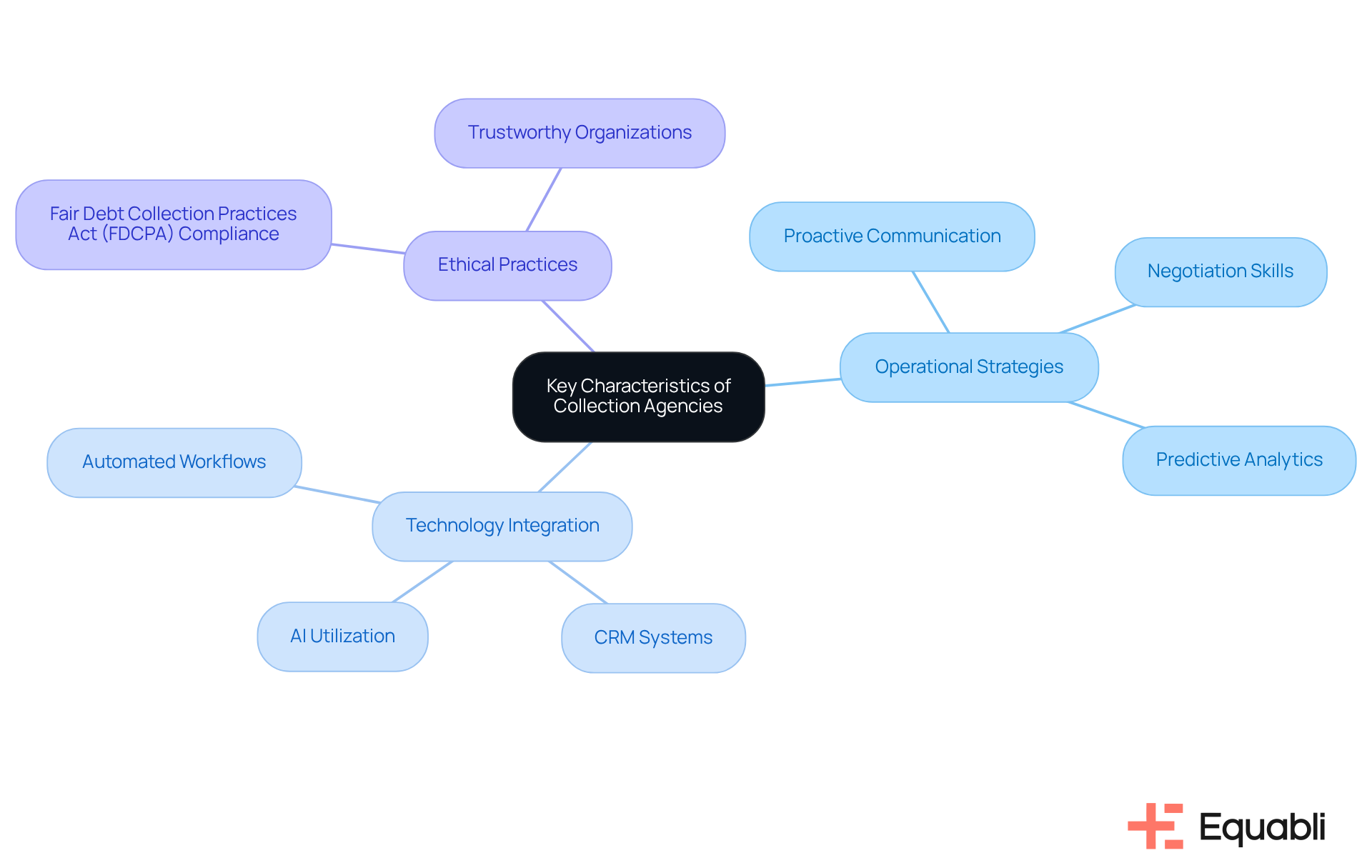

Key Characteristics of Collection Agencies: Operations and Strategies

Collection firms are increasingly distinguished by their innovative operational strategies, which encompass proactive communication, negotiation skills, and the integration of advanced technology. A staggering 57% of debt recovery organizations are now utilizing AI in some capacity, underscoring a significant trend towards technology integration in the sector. By employing predictive analytics and customer relationship management (CRM) systems, these organizations enhance their retrieval efforts, allowing them to tailor strategies based on individual debtor profiles and substantially increasing the likelihood of successful recovery.

Equabli's EQ Collect serves as a prime example of this transformation, streamlining operations by minimizing manual tasks and enhancing efficiency through its key features. The platform boasts a user-friendly, scalable, cloud-native interface, complemented by a no-code file-mapping tool that simplifies vendor onboarding. Automated workflows reduce execution errors and resource expenditure, while real-time reporting delivers unparalleled transparency and insights, ensuring compliance oversight both internally and externally. These innovations not only bolster collection efficiency but also significantly improve the overall debtor experience, aligning with the industry's shift towards more .

Moreover, ethical practices are foundational to trustworthy organizations, which adhere strictly to regulations such as the Fair Debt Collection Practices Act (FDCPA). This commitment to equitable and transparent practices fosters confidence among borrowers and accelerates the technological advancements embraced by these organizations. As technology continues to evolve, the landscape of debt retrieval is transforming, with firms leveraging tools like Equabli's EQ Suite to encompass the entire recovery lifecycle. The future of collections is poised to emphasize the integration of technology with human skill, ensuring that organizations meet contemporary client expectations while maintaining compliance and ethical standards.

Legal Regulations Surrounding Collection Agencies: Rights and Responsibilities

What are collection agencies and how do they operate under stringent legal regulations designed to safeguard individuals from unjust practices? At the forefront of consumer protection is the Fair Collection Practices Act (FDCPA), which clearly delineates the rights of individuals and the obligations of collectors. Under the FDCPA, collectors are explicitly prohibited from employing abusive, deceptive, or unfair methods in their recovery efforts. This includes specific restrictions on communication times, mandates for validating financial obligations, and outright bans on harassment.

In 2025, new legal regulations will further shape the landscape for collection agencies. For instance, California's Senate Bill 1286, effective July 1, 2025, extends protections to 'covered commercial obligations,' necessitating adherence to the Rosenthal Fair Collection Practices Act. This law imposes limits on communication frequency and prohibits false representations regarding legal actions, thereby enhancing protections for clients.

State laws may also introduce additional layers of protection, reinforcing the FDCPA's framework. The Collection Law, pertinent to business obligations, mandates that all collectors, including commercial finance providers, scrutinize their practices to ensure compliance with consumer protection standards. This law underscores the necessity for debt recovery agencies to adapt their operations to avert potential violations, such as excessive communication or misleading disclosures.

Understanding what are collection agencies and the is crucial for both borrowers and lenders as they navigate the complexities of financial recovery. Case studies illustrate the impact of these regulations; a notable example involved the FTC's action against a deceptive payment retrieval scheme that coerced individuals with false threats, culminating in a permanent prohibition on the offenders. Such enforcement actions highlight the importance of adhering to the FDCPA and related laws, ensuring equitable treatment for individuals.

As individuals become increasingly aware of their rights under the FDCPA, they are empowered to assert these rights against unjust financial recovery practices. This growing awareness is vital in cultivating a more equitable debt collection environment, where both consumers and creditors can engage in fair and transparent transactions.

Conclusion

Collection agencies serve a pivotal role in the financial ecosystem, acting as intermediaries that assist creditors in recovering overdue debts. Their functions extend beyond mere collection; they represent a complex interplay of technology, consumer engagement, and legal compliance. By grasping the nature of collection agencies and their operational methods, individuals can more effectively navigate their financial responsibilities and rights.

This article underscores key insights regarding the evolution of collection agencies, their operational strategies, and the legal frameworks governing their practices. From historical roots to modern technological advancements, the industry has undergone significant transformation. The integration of AI and digital tools has not only improved recovery rates but has also shifted the focus toward consumer-centric approaches, highlighting ethical practices and adherence to regulations such as the Fair Debt Collection Practices Act.

As the debt collection landscape continues to evolve, it is imperative for both consumers and creditors to remain informed about their rights and responsibilities. Awareness of the legal protections available fosters a more equitable environment, ensuring that interactions with collection agencies are conducted fairly and transparently. Engaging with this knowledge empowers individuals to assert their rights, ultimately promoting a healthier financial ecosystem for all parties involved.

Frequently Asked Questions

What are collection agencies?

Collection agencies are specialized entities engaged by creditors to recover overdue debts from individuals or businesses, acting as intermediaries to collect outstanding payments.

How do collection agencies operate?

Collection agencies typically operate on a contingency basis, earning a percentage of the amounts they recover, which incentivizes them to enhance their recovery efforts while adhering to legal and ethical standards.

What is the anticipated recovery rate for debt recovery firms in 2025?

The anticipated recovery rate for debt recovery firms in 2025 is approximately 20%.

What roles do collection agencies fulfill?

Collection agencies fulfill several roles, including contacting debtors, negotiating payment plans, and reporting delinquencies to credit bureaus.

How can collection agencies affect a debtor's credit score?

The actions of collection agencies can significantly affect a debtor's credit score, especially when they report delinquencies to credit bureaus.

What percentage of Americans are estimated to have at least one obligation in arrears as of 2025?

As of 2025, it is estimated that around 28% of Americans have at least one obligation in arrears.

What tactics do collection agencies use for effective debt recovery?

Effective debt recovery tactics include personalized communication methods and treating customers as unique individuals rather than using outdated mass phone call strategies.

What impact do digital communication channels have on debt recovery?

Research by McKinsey indicates that 12-35% of delinquent individuals take payment action after being contacted through digital channels.

What are the key priorities for recovery firms in a competitive landscape?

Recovery firms must prioritize compliance, transparency, and consumer-focused practices to succeed in a competitive landscape.

How can tools like EQ Collect assist collection agencies?

Tools like EQ Collect can enhance efficiency through automated workflows and data-driven strategies, minimizing manual tasks and directly addressing challenges related to low recovery rates and compliance requirements.

What broader role do recovery firms play beyond financial retrieval?

Recovery firms play a vital role in sustaining monetary stability for lenders and influencing the creditworthiness of consumers.