Overview

The article emphasizes critical strategies for financial institutions to ensure compliance with the Fair Credit Reporting Act (FCRA). It presents various compliance measures, including:

- The implementation of robust record-keeping systems

- Conducting regular audits

- Leveraging technology for automation

- Fostering a culture of compliance

These strategies are essential for mitigating legal risks and safeguarding consumer rights, ultimately enhancing operational integrity and compliance awareness within the organization.

Introduction

Navigating the complexities of the Fair Credit Reporting Act (FCRA) presents significant challenges for financial institutions, particularly as regulatory landscapes evolve and consumer expectations intensify. This article examines nine essential strategies that empower organizations to comply with FCRA requirements while enhancing operational efficiency and consumer trust. A critical question emerges amidst these strategies: How can institutions effectively balance compliance with innovation while safeguarding consumer rights? Exploring this tension not only highlights the operational challenges but also reveals a roadmap for financial entities aiming to thrive in a regulatory environment.

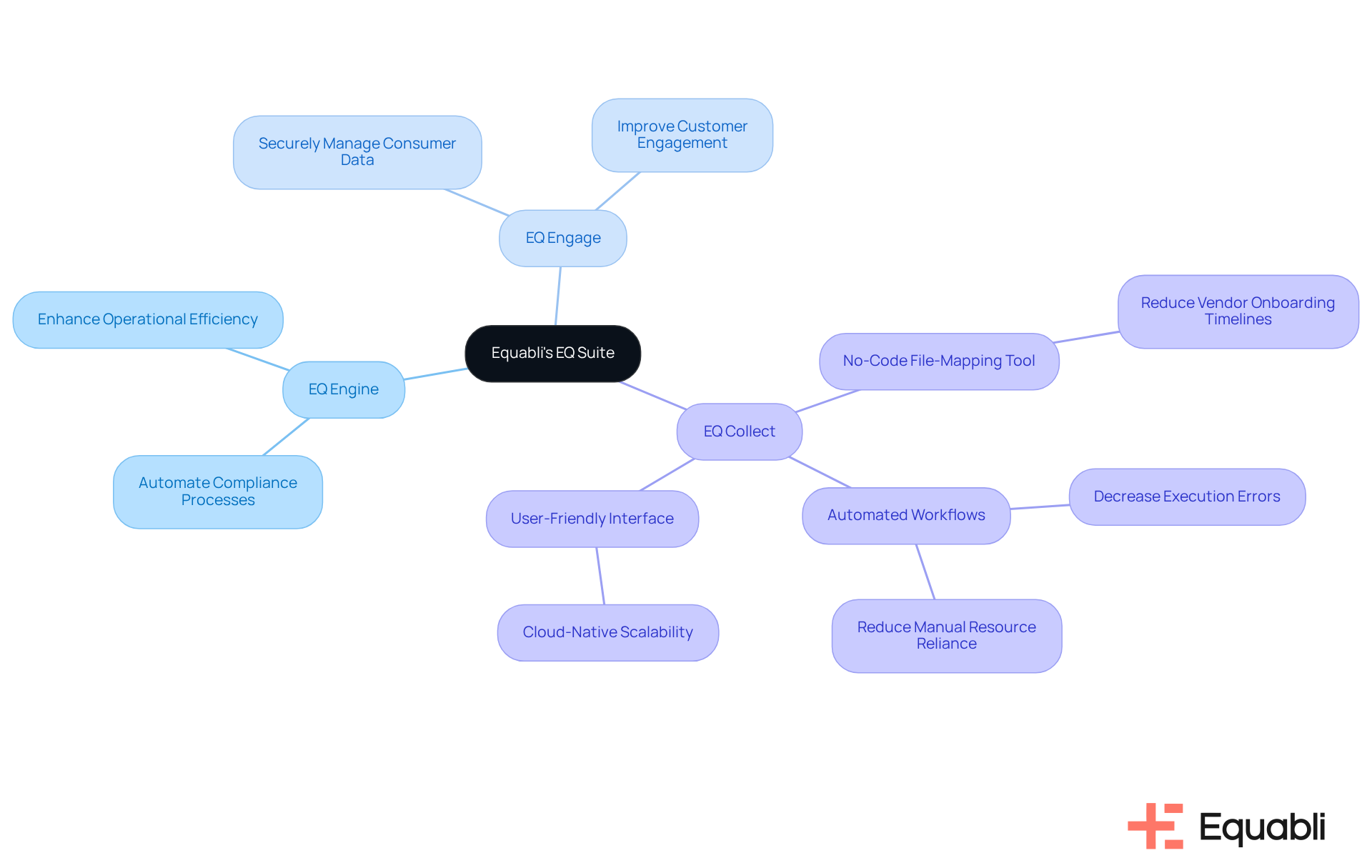

Equabli's EQ Suite: Streamlined Compliance Solutions for FCRA

Equabli's EQ Suite offers a robust array of tools designed to support fair credit reporting act compliance strategies for financial institutions. The suite includes:

- EQ Engine

- EQ Engage

- EQ Collect

These tools empower financial organizations to automate compliance processes, securely manage consumer data, and ensure accurate reporting. For instance, EQ Collect's no-code file-mapping tool significantly reduces vendor onboarding timelines, while its automated workflows decrease execution errors and reliance on manual resources.

By leveraging advanced analytics and machine learning, these tools assist organizations in adopting fair credit reporting act compliance strategies for financial institutions while also enhancing overall operational efficiency. Furthermore, delivers unparalleled transparency and insights, enabling institutions to focus on their core business functions while adeptly navigating regulatory complexities. Additionally, EQ Collect features a user-friendly, scalable, cloud-native interface, further streamlining compliance efforts and improving operational performance.

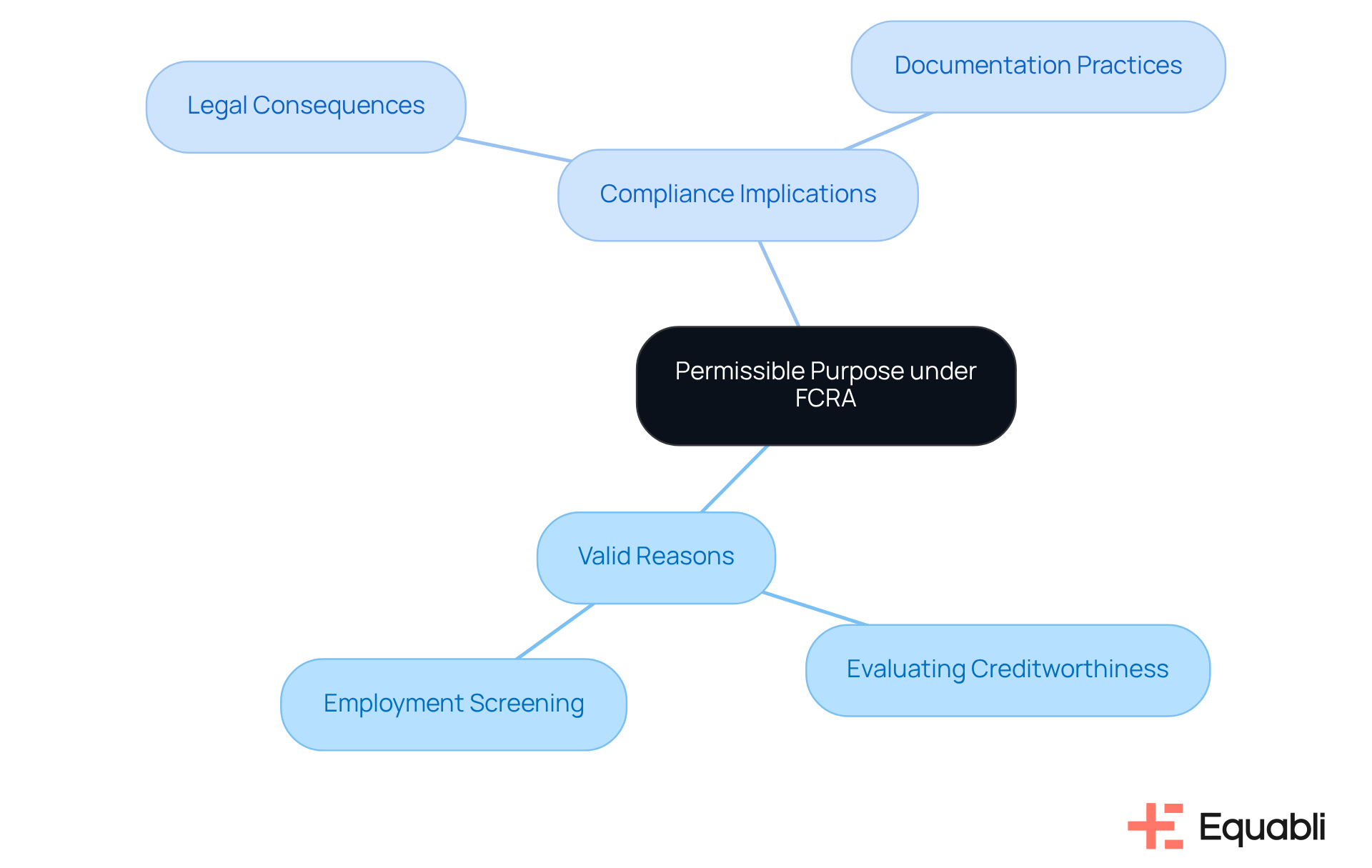

Understand Permissible Purpose: Key to FCRA Compliance

Under the FCRA, a constitutes a legally acceptable rationale for obtaining a client report. Financial organizations must establish a valid reason—such as evaluating creditworthiness or conducting employment screening—prior to accessing client data. Non-compliance with these stipulations can result in significant legal consequences. Institutions are advised to maintain comprehensive documentation of the permissible purposes for which they access client reports, thereby safeguarding against potential violations.

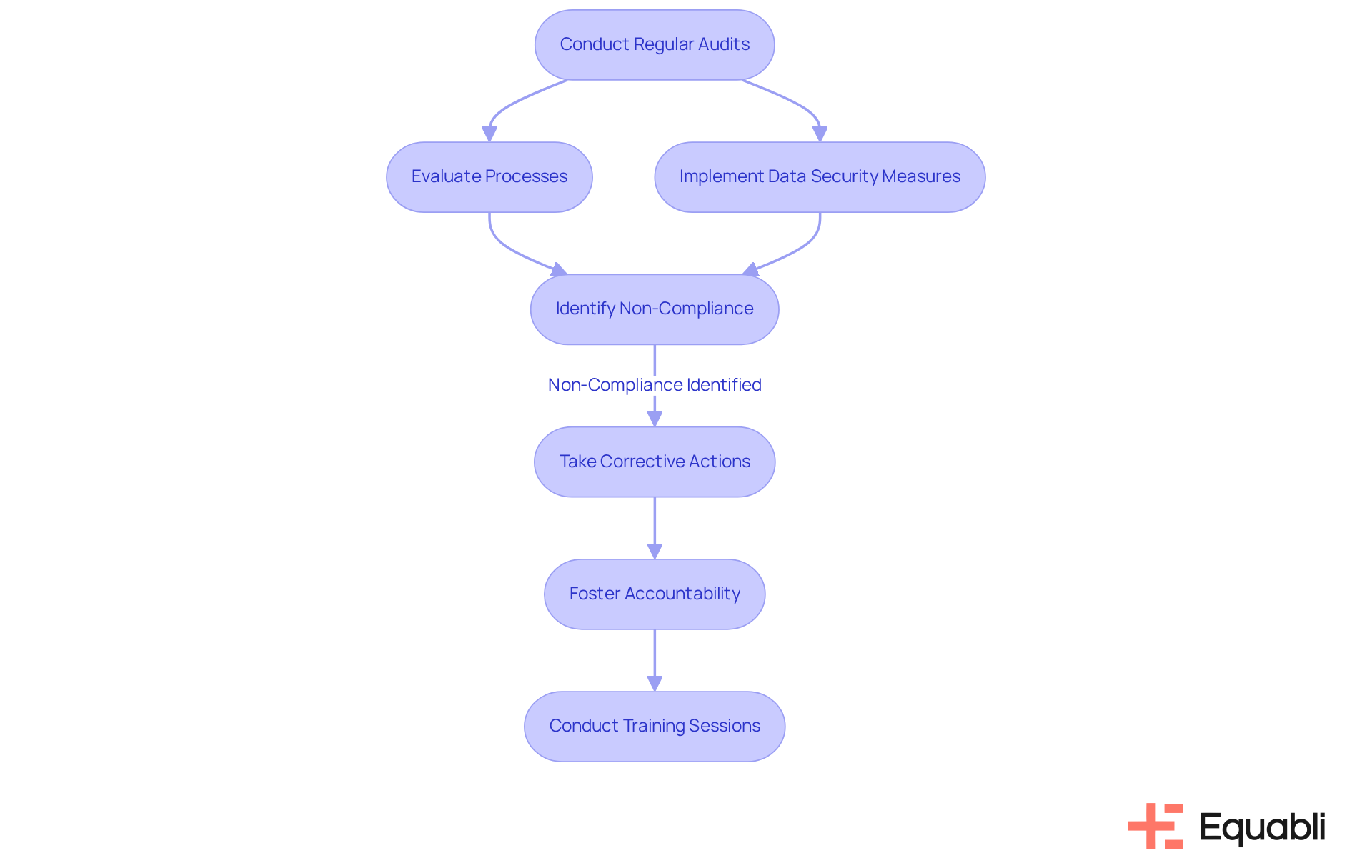

Conduct Regular Audits: Ensure FCRA Adherence

Regular audits of compliance practices are essential for financial institutions to implement fair credit reporting act compliance strategies for financial institutions. These audits must rigorously evaluate processes related to acquiring client reports, managing disputes, and maintaining record accuracy. Organizations are also required to implement robust data security measures to safeguard consumer information against unauthorized access or breaches, demonstrating a commitment to protecting customer data.

By identifying areas of non-compliance, organizations can take corrective actions that strengthen their regulatory frameworks. Furthermore, consistent auditing not only mitigates risks but also fosters a culture of accountability and transparency within the organization. Non-compliance with the Fair Credit Reporting Act can lead to significant legal consequences, highlighting the importance of implementing fair credit reporting act compliance strategies for financial institutions.

As regulatory specialists emphasize, effective auditing methods are critical for maintaining trust and integrity in financial operations, ultimately enhancing compliance with relevant standards and protecting consumer rights. To bolster adherence, organizations should consider conducting for staff on legal requirements and best practices, ensuring that all employees understand the importance of data protection and confidentiality in their roles.

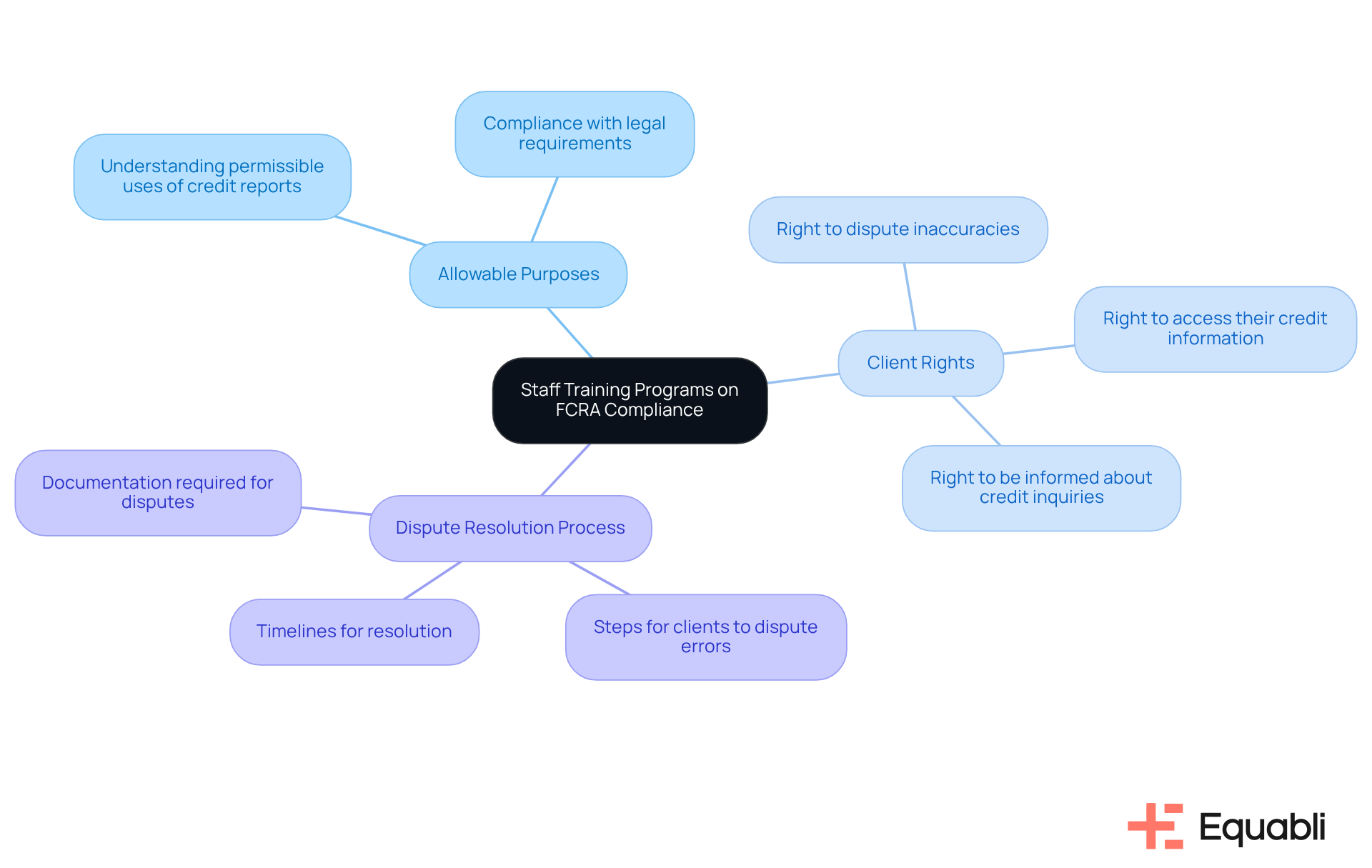

Implement Staff Training Programs: Educate on FCRA Requirements

Implementing comprehensive staff training programs focused on fair credit reporting act compliance strategies for financial institutions is essential. Such training must encompass:

- Allowable purposes

- Client rights

- The dispute resolution process

Evidence suggests that regular workshops and refresher courses reinforce this knowledge, ensuring employees remain informed about regulatory changes. By cultivating a culture of compliance through targeted education, organizations can significantly mitigate the risk of violations, thereby enhancing operational integrity and aligning with fair credit reporting act compliance strategies for financial institutions.

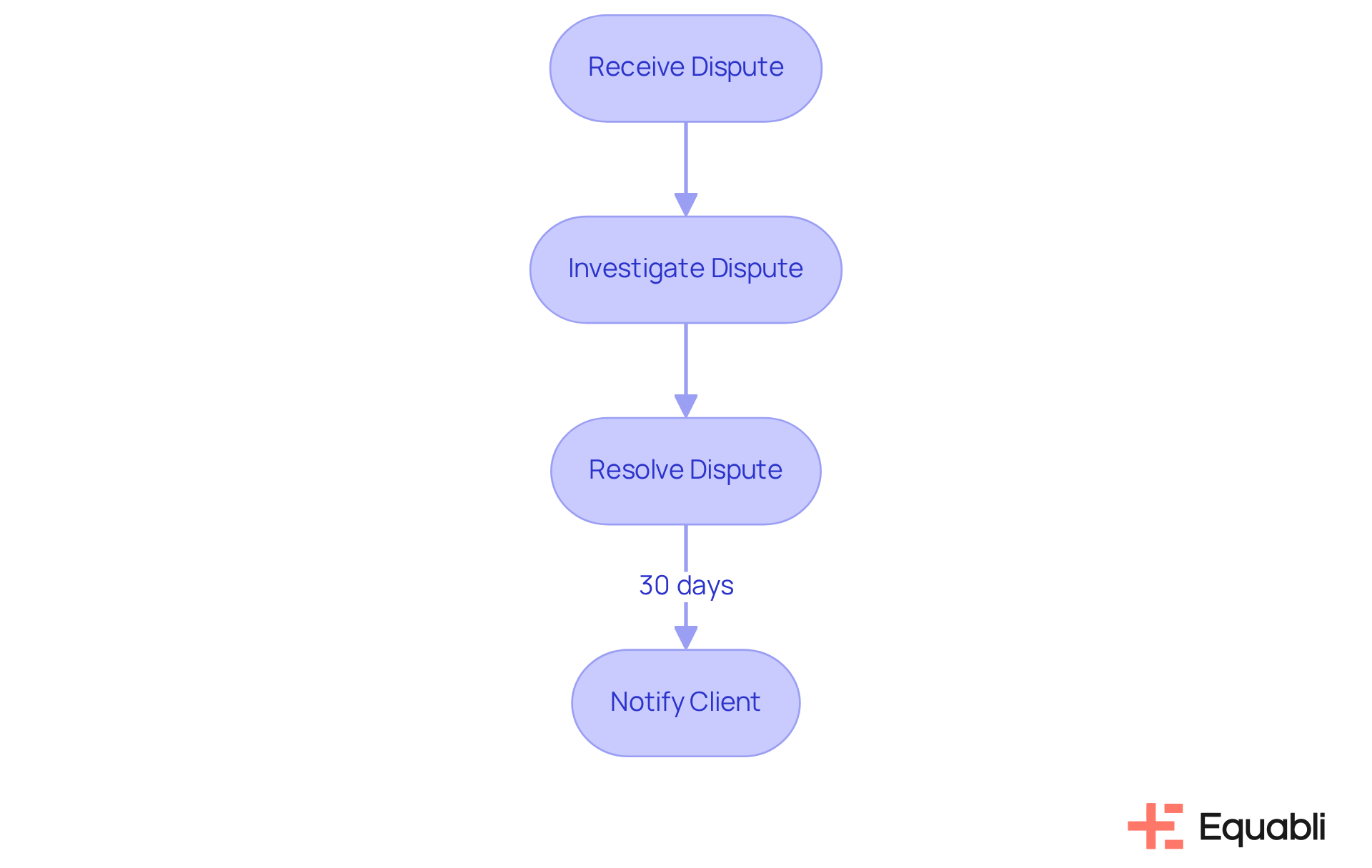

Establish Dispute Resolution Processes: Address Consumer Concerns

Establishing fair credit reporting act compliance strategies for financial institutions is imperative to effectively address client concerns through a robust dispute resolution process. Under the Fair Credit Reporting Act (FCRA), individuals possess the right to contest inaccuracies in their credit reports. Organizations must implement clear protocols for receiving, investigating, and resolving these disputes within mandated timeframes, typically 30 days. This adherence to fair credit reporting act compliance strategies for financial institutions not only ensures compliance but also significantly enhances trust and satisfaction among customers.

As Stephen Covey noted, "Trust is the glue of life. It’s the most essential ingredient in effective communication." When clients witness their issues being addressed thoughtfully and resolved promptly, it fosters a and transparency, which are critical in today’s competitive financial landscape.

Furthermore, a well-structured conflict resolution process can lead to increased customer loyalty and support, as 83% of individuals are unwilling to engage with brands they do not trust. By prioritizing effective dispute resolution, financial organizations can cultivate stronger relationships with their clients while implementing fair credit reporting act compliance strategies for financial institutions to reinforce their commitment to consumer rights.

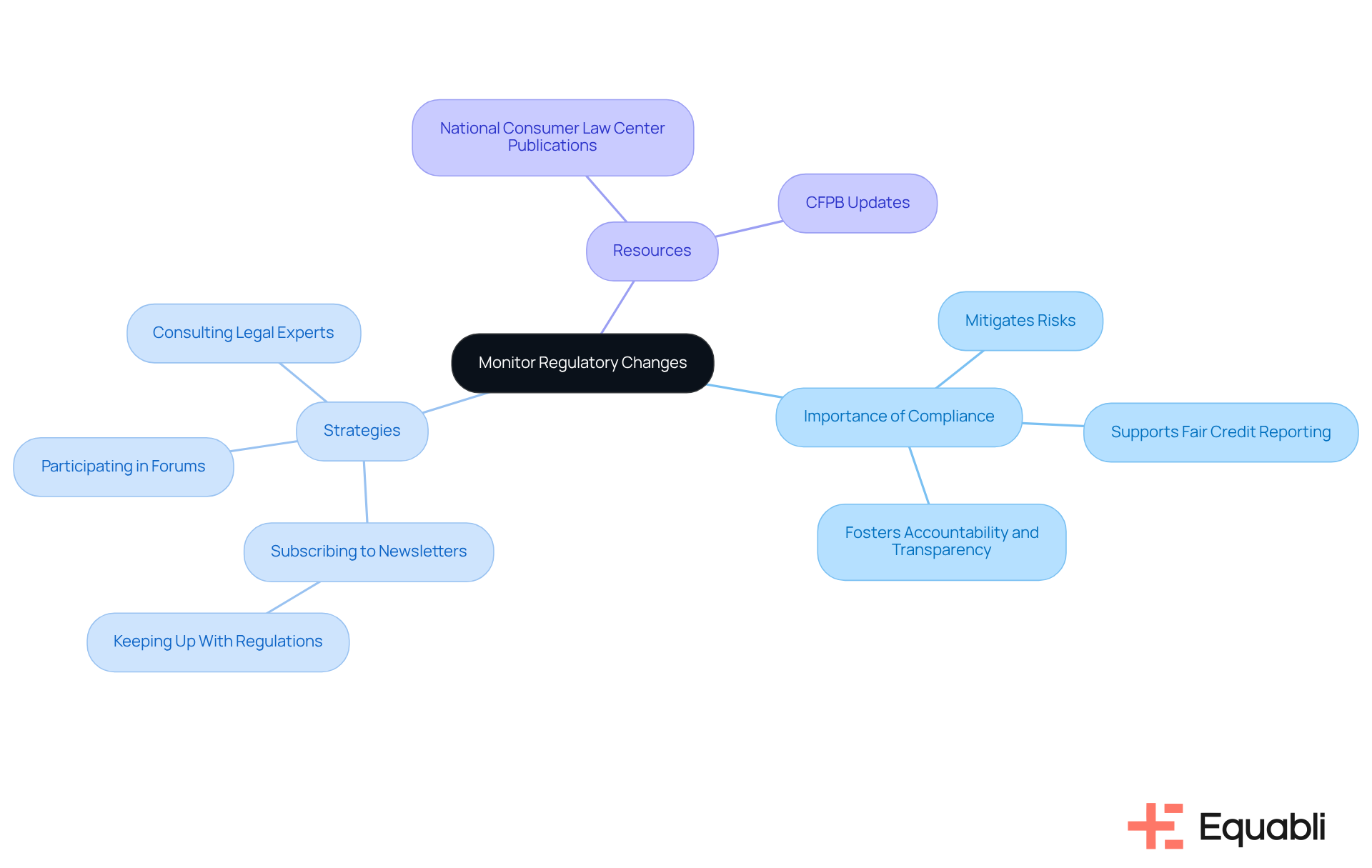

Monitor Regulatory Changes: Stay Updated on FCRA Amendments

Financial organizations must prioritize the active observation of regulatory changes associated with fair credit reporting act compliance strategies for financial institutions to ensure ongoing adherence. Evidence indicates that around 90% of financial organizations experience difficulties in adapting to these changes, underscoring the critical need for effective regulatory strategies. Staying informed about amendments, new interpretations, and enforcement actions from regulatory bodies like the Consumer Financial Protection Bureau (CFPB) is essential.

Organizations can enhance their compliance efforts by:

- Subscribing to industry newsletters, such as the 'Keeping Up With Regulations' newsletter

- Participating in regulatory forums

- Consulting with legal experts

Engaging with resources like the National Consumer Law Center's publications provides valuable insights into recent developments. As Chi Chi Wu indicates, "The act clearly imposes a strict prohibition on using or obtaining a consumer report without a permissible purpose," highlighting the significance of comprehending these regulations.

Proactively adjusting to regulatory changes not only mitigates risks but also supports the implementation of fair credit reporting act compliance strategies for financial institutions in alignment with current standards. This fosters a culture of accountability and transparency within the organization, demonstrating a that is critical in today's regulatory landscape.

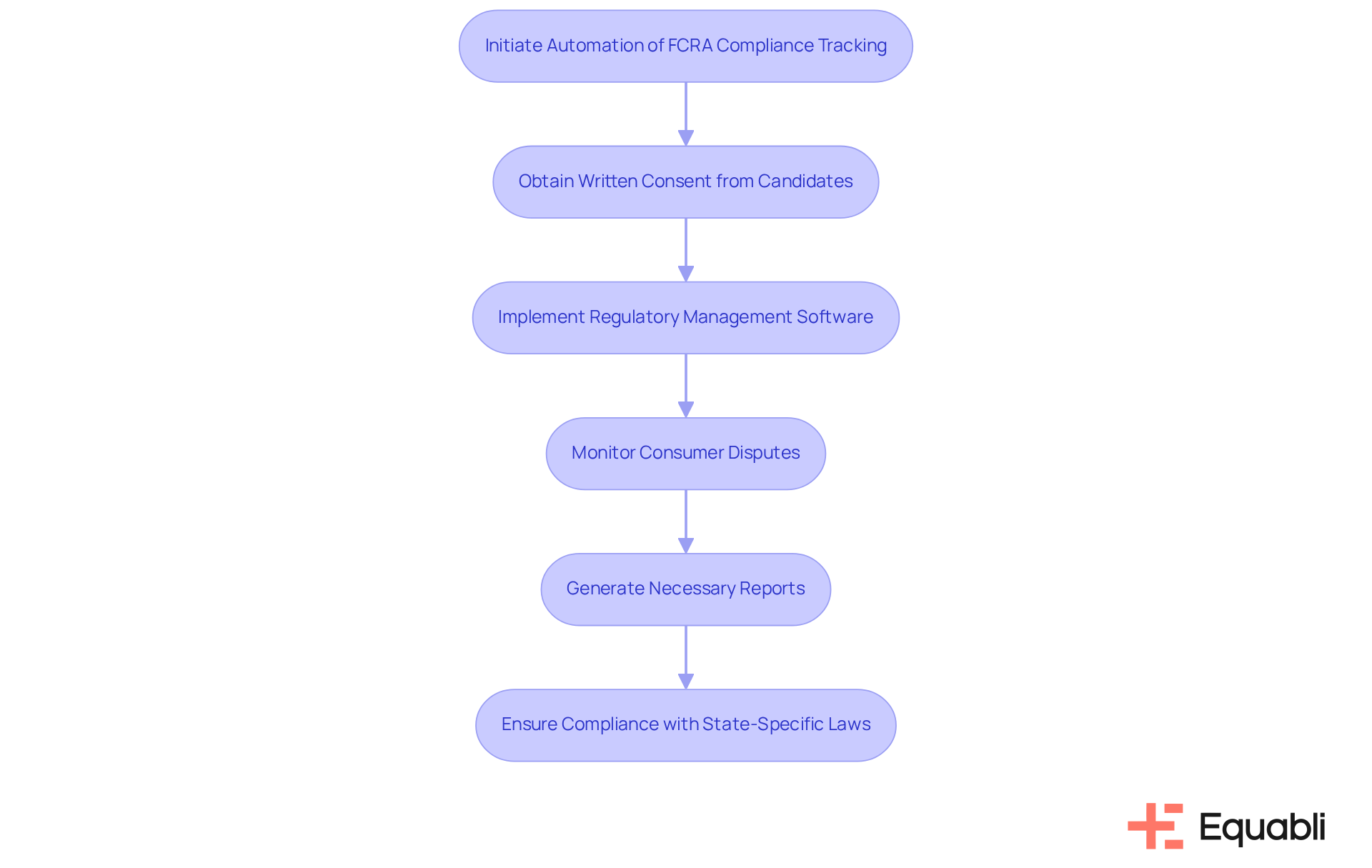

Leverage Technology: Automate FCRA Compliance Tracking

Employing technology to automate regulatory adherence monitoring streamlines processes and enhances accuracy. Financial institutions can utilize regulatory management software as part of their fair credit reporting act compliance strategies for financial institutions to ensure compliance with legal requirements, monitor consumer disputes, and generate necessary reports.

The fair credit reporting act compliance strategies for financial institutions stipulate that employers must before conducting background checks, underscoring the importance of compliance in this area.

Automation not only alleviates the administrative burden on staff but also ensures that regulatory tasks are performed consistently and accurately, thereby minimizing the risk of violations. Additionally, remaining informed about state-specific laws governing background checks is crucial for maintaining compliance.

As noted by TruDiligence, "By prioritizing legal adherence in employee background checks, companies can mitigate risks and create a safer workplace.

Document Compliance Efforts: Maintain Accurate Records

Maintaining precise records is essential for implementing fair credit reporting act compliance strategies for financial institutions. Financial institutions are required to document all activities related to client reporting, including the rationale for accessing client reports, dispute resolutions, and staff training sessions. This meticulous documentation not only serves as but also provides protection against potential legal challenges.

A well-organized record-keeping system promotes transparency and accountability, which are vital for fostering trust with consumers and regulators alike. Notably, while 71% of organizations assess their adherence capabilities as excellent or very good, only 69% of risk and oversight professionals believe their organization is at least 'good' at ongoing monitoring and risk management with third parties. This discrepancy underscores the necessity for continuous improvement.

Implementing centralized systems and standardized naming conventions can significantly enhance record accuracy and security, ensuring that all pertinent information is readily accessible when required. Furthermore, consistent staff training on best practices in record-keeping is crucial; 41% of leaders stress the importance of training employees on regulations for the upcoming year, equipping personnel with the knowledge necessary to uphold standards and avert costly errors.

Failing to maintain precise records can lead to serious business consequences, underscoring the need for financial organizations to prioritize fair credit reporting act compliance strategies for financial institutions. By establishing a centralized record-keeping system, organizations can effectively navigate the complexities of consumer reporting regulations and utilize fair credit reporting act compliance strategies for financial institutions to mitigate risks associated with non-compliance.

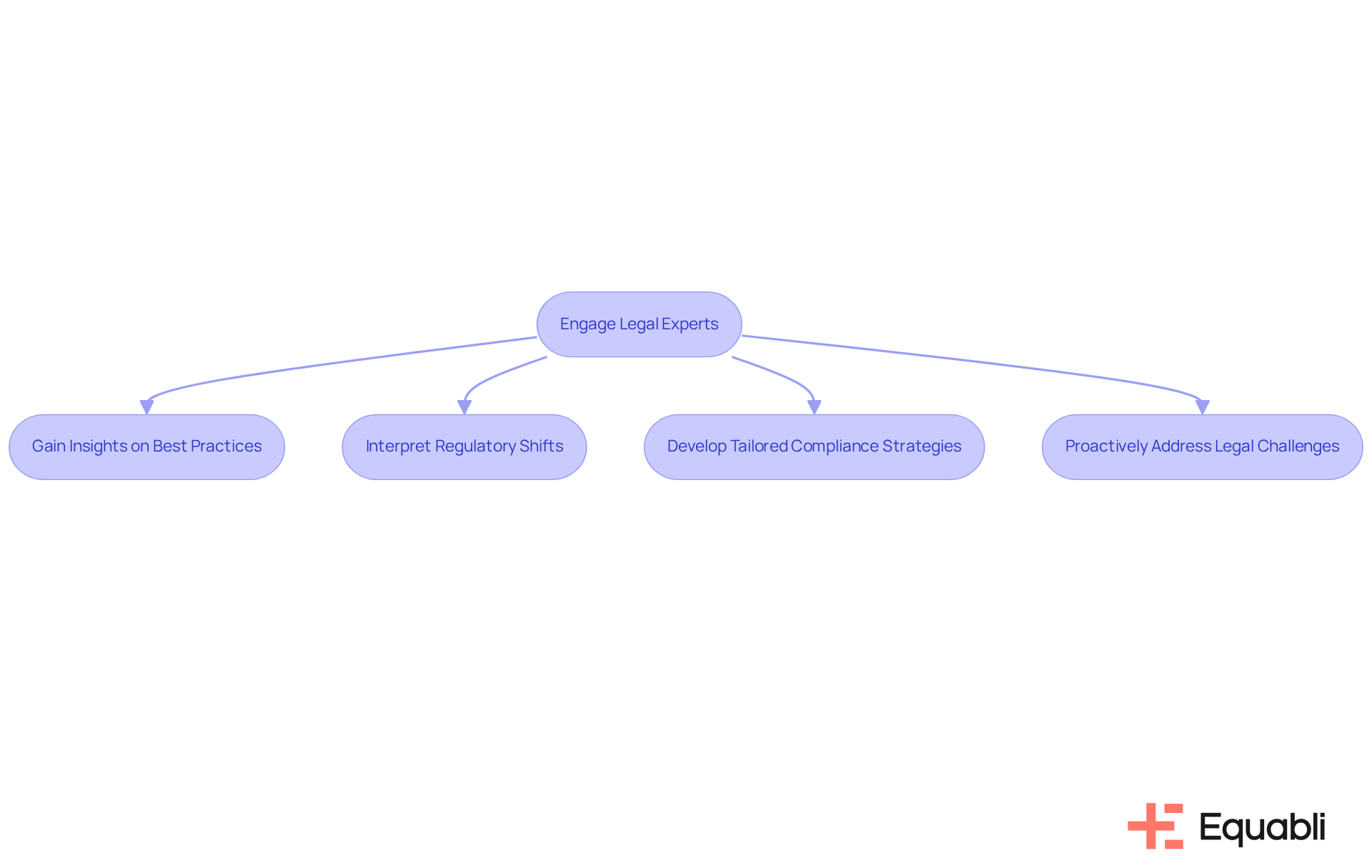

Consult Legal Experts: Ensure Comprehensive FCRA Compliance

Engaging legal professionals specializing in fair credit reporting act compliance strategies for financial institutions is crucial for financial entities aiming to navigate the complexities of the law. These experts provide essential insights into , assist in interpreting regulatory shifts, and help in developing fair credit reporting act compliance strategies for financial institutions tailored to the organization's unique requirements.

Regular consultations with legal professionals not only ensure that financial institutions implement fair credit reporting act compliance strategies but also empower organizations to proactively address potential legal challenges. By fostering a collaborative relationship with legal consultants, financial organizations can enhance their fair credit reporting act compliance strategies for financial institutions and effectively mitigate risks associated with non-compliance.

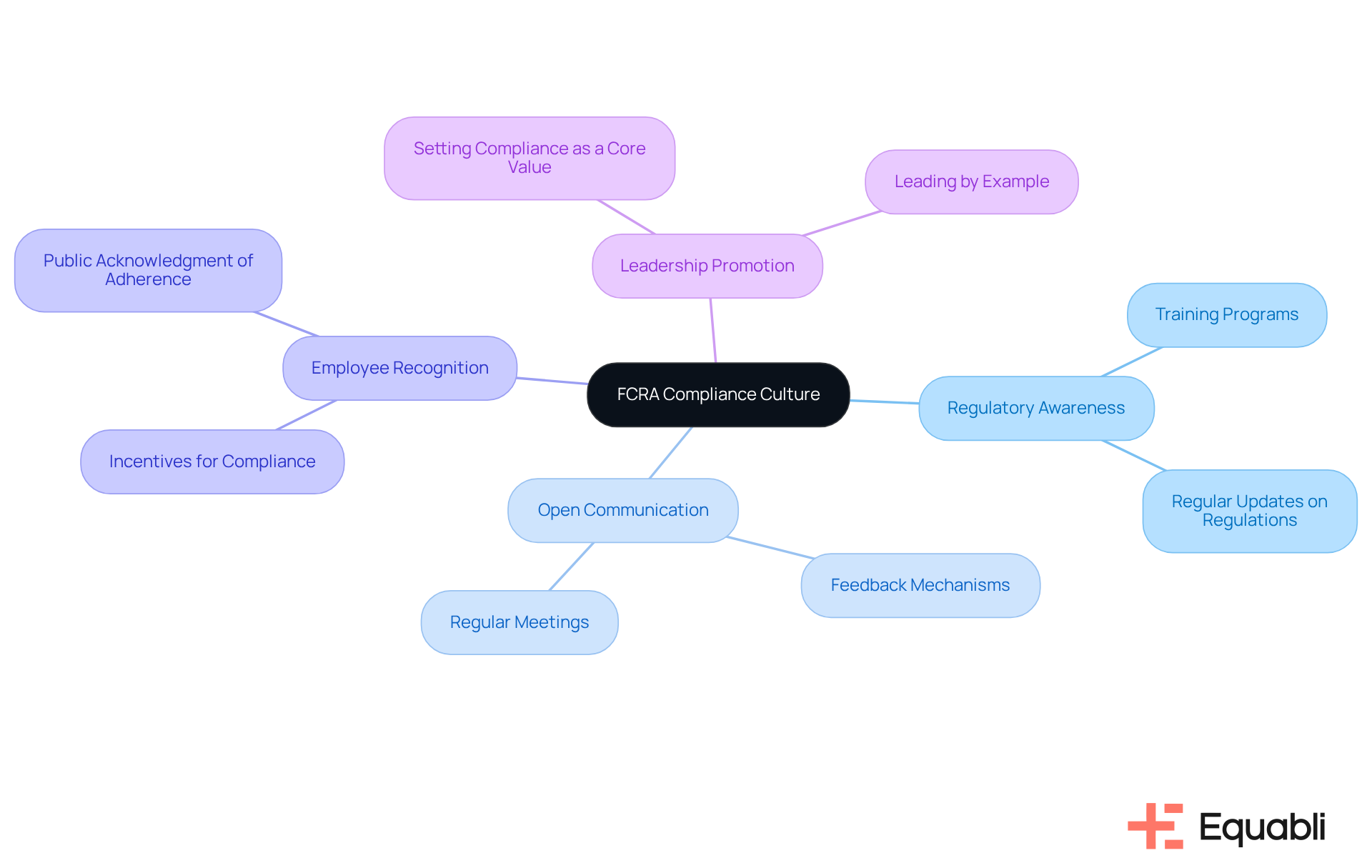

Foster a Compliance Culture: Embed FCRA Awareness in Operations

Nurturing a culture of adherence is vital for financial institutions to apply fair credit reporting act compliance strategies for financial institutions and ensure long-term compliance with FCRA regulations. This approach necessitates embedding into organizational operations and fostering open communication regarding fair credit reporting act compliance strategies for financial institutions.

Recognizing employees who demonstrate a commitment to adherence further reinforces this culture. Leadership must actively promote fair credit reporting act compliance strategies for financial institutions as a core value, ensuring that all employees comprehend their roles in maintaining these compliance strategies and understand the critical importance of protecting consumer rights.

Conclusion

Implementing effective compliance strategies for the Fair Credit Reporting Act (FCRA) is essential for financial institutions seeking to navigate the complexities of consumer reporting regulations. By prioritizing these strategies, organizations can ensure adherence to legal requirements while enhancing operational integrity and fostering trust with consumers.

Key strategies include:

- Leveraging advanced technology, such as Equabli's EQ Suite, to streamline compliance processes

- Understanding and documenting permissible purposes for accessing client reports

- Conducting regular audits to identify areas for improvement

- Establishing comprehensive staff training programs

- Implementing robust dispute resolution processes

- Staying updated on regulatory changes

Each of these elements contributes to a holistic approach that safeguards consumer rights and mitigates legal risks.

Ultimately, fostering a culture of compliance within financial institutions is paramount. By embedding regulatory awareness into daily operations and recognizing employees' commitment to adherence, organizations can create an environment where compliance is prioritized, leading to lasting benefits. Embracing these FCRA compliance strategies not only protects institutions from potential violations but also reinforces their commitment to ethical practices in the financial landscape.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a collection of tools designed to support financial institutions in complying with the Fair Credit Reporting Act (FCRA). It includes the EQ Engine, EQ Engage, and EQ Collect, which help automate compliance processes, manage consumer data securely, and ensure accurate reporting.

How does EQ Collect improve compliance processes?

EQ Collect features a no-code file-mapping tool that significantly reduces vendor onboarding timelines and includes automated workflows that decrease execution errors and reliance on manual resources. Its user-friendly, scalable, cloud-native interface streamlines compliance efforts and enhances operational performance.

Why is understanding permissible purpose important for FCRA compliance?

Understanding permissible purpose is crucial because it refers to the legally acceptable reasons for obtaining a client report, such as evaluating creditworthiness or conducting employment screening. Financial organizations must establish a valid reason before accessing client data to avoid significant legal consequences.

What are the benefits of conducting regular audits for FCRA compliance?

Regular audits help financial institutions evaluate their compliance practices, identify areas of non-compliance, and take corrective actions. They also promote accountability and transparency, protect consumer data, and mitigate risks associated with non-compliance, which can lead to legal issues.

What should organizations do to ensure data security and compliance?

Organizations are required to implement robust data security measures to protect consumer information from unauthorized access or breaches. Additionally, they should maintain comprehensive documentation of permissible purposes for accessing client reports and conduct regular training sessions for staff on legal requirements and best practices.