Overview

The article examines essential debt collection automation solutions for enterprises, emphasizing various platforms and tools that enhance efficiency and compliance within financial operations. It illustrates how solutions such as the Equabli EQ Suite, AI-driven tools, and Salesforce performance monitoring empower organizations to optimize workflows, elevate repayment rates, and conform to regulatory requirements. This strategic alignment ultimately positions them for sustainable growth in a competitive marketplace.

Introduction

In an era where financial institutions face the increasing challenge of overdue accounts, the necessity for effective debt collection automation solutions has reached a critical juncture. Enterprises are increasingly adopting innovative technologies that not only streamline processes but also enhance recovery rates and ensure compliance with regulatory standards. With a plethora of options available, organizations must discern the most effective tools to optimize their debt collection strategies.

This article delves into seven essential automation solutions poised to transform the debt recovery landscape for enterprises, providing insights into their distinctive features and the tangible benefits they offer.

Equabli EQ Suite: Comprehensive Debt Collection Automation

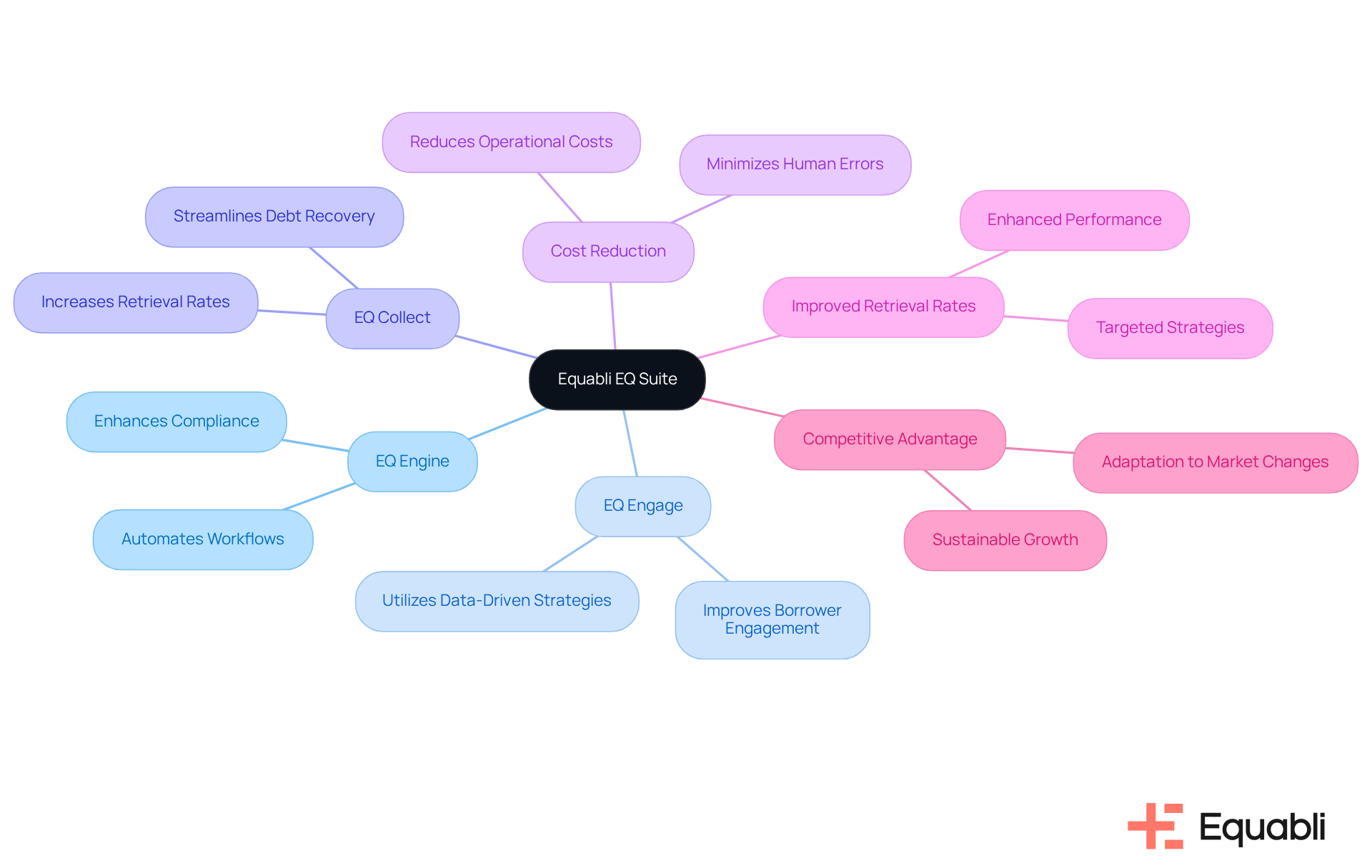

The Equabli EQ Suite serves as a pivotal platform for enterprises focused on optimizing their for enterprise financial operations. Comprising advanced tools such as EQ Engine, EQ Engage, and EQ Collect, this suite leverages innovative technology to automate workflows, enhance borrower engagement, and ensure adherence to regulatory standards.

By implementing data-driven strategies, the EQ Suite significantly reduces operational costs and improves repayment success rates, establishing itself as an indispensable asset for lenders and debt recovery agencies through debt collection automation solutions for enterprise financial operations.

Organizations utilizing the EQ Suite have reported improved retrieval rates through targeted strategies, underscoring the suite's effectiveness in adapting to the evolving landscape of financial management.

As industry leaders highlight, the adoption of comprehensive platforms like the EQ Suite is essential for attaining sustainable growth and utilizing debt collection automation solutions for enterprise financial operations to preserve a competitive advantage in the marketplace.

Convin.ai: AI-Powered Debt Collection Tools for Enhanced Recovery

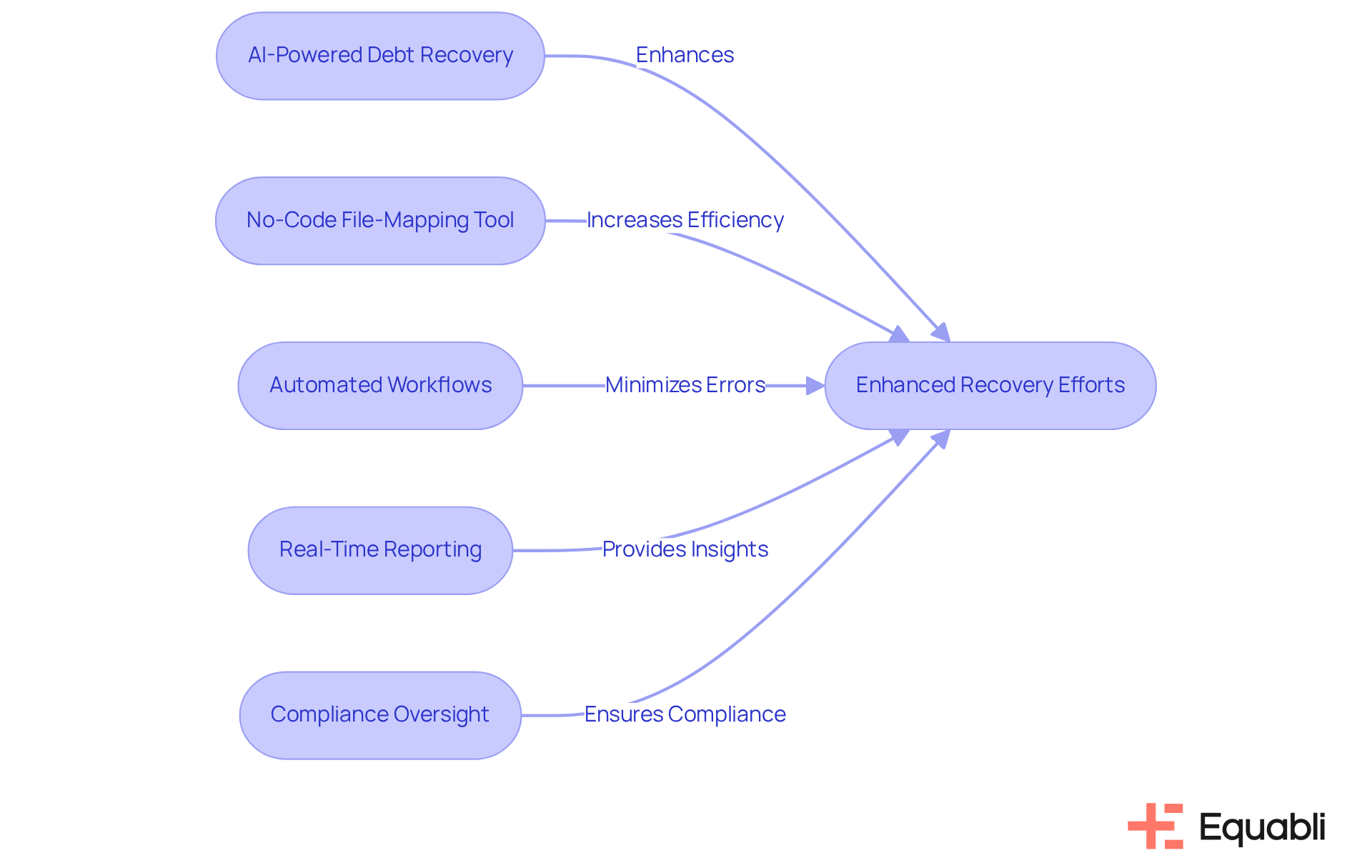

A company provides debt collection automation solutions for enterprise financial operations, which are AI-driven automated debt recovery solutions designed to enhance recovery efforts through intelligent decision-making and streamlined processes. The implementation of a no-code file-mapping tool significantly reduces vendor onboarding timelines, thereby in retrievals.

Automated workflows are instrumental in minimizing execution errors and reducing reliance on manual resources. Furthermore, real-time reporting delivers unparalleled transparency and insights, which are critical for informed decision-making. Industry-leading compliance oversight ensures that financial institutions operate within necessary regulatory frameworks.

By leveraging these advanced features, the company empowers financial organizations to modernize their processes with debt collection automation solutions for enterprise financial operations, facilitating smarter orchestration and improved performance. Collaborating with a partner can significantly enhance financial recovery efficiency and transform retrieval processes.

Salesforce Financial Services Cloud: Integrated Debt Collection Automation

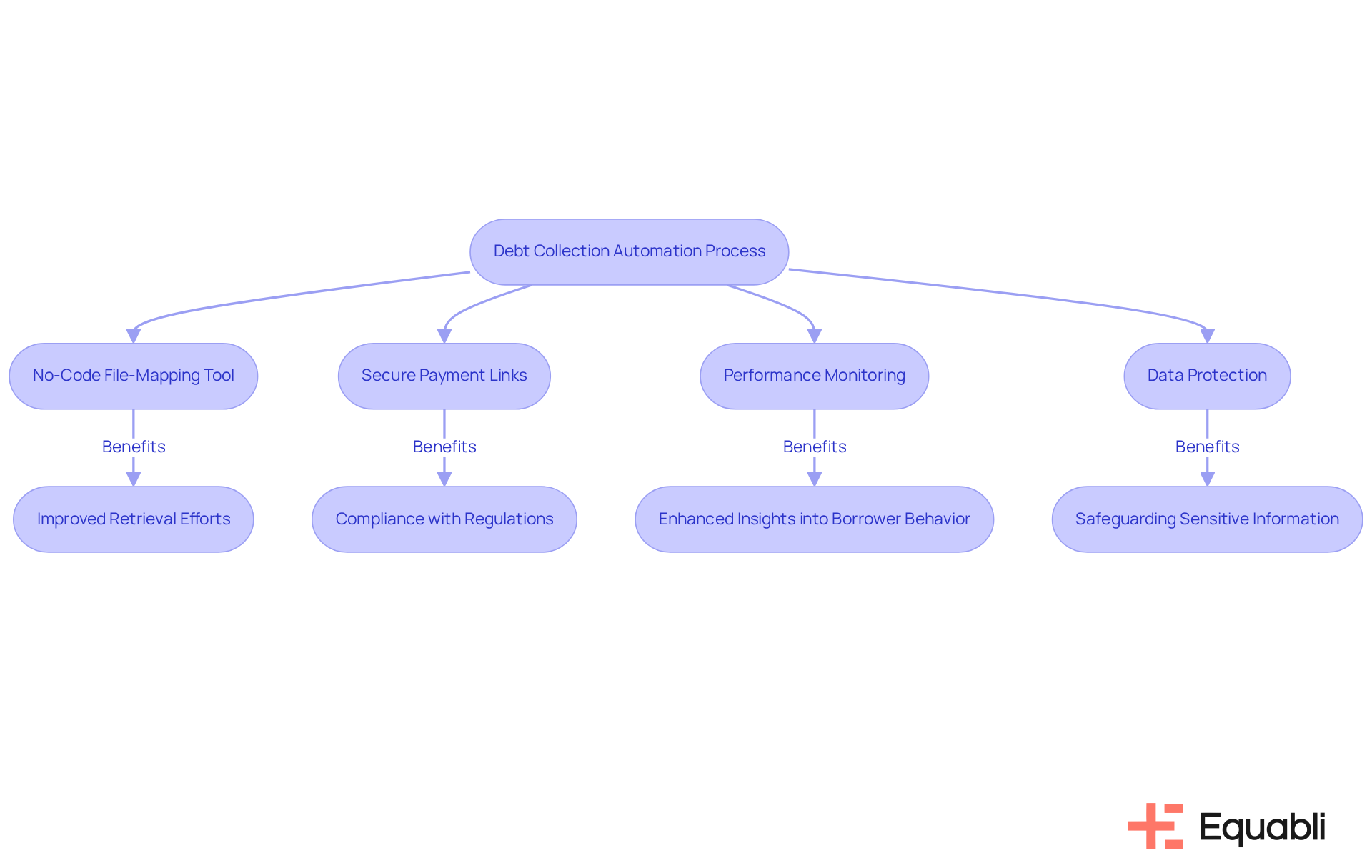

The Equabli platform streamlines debt recovery processes by leveraging debt collection automation solutions for enterprise financial operations. This solution enables organizations to manage assets effectively by providing insights into borrower behavior and automating communication strategies. For instance, features such as a no-code file-mapping tool, secure payment links, and performance monitoring enhance retrieval efforts while ensuring compliance with industry regulations.

Furthermore, the company’s commitment to data protection ensures that all client interactions adhere to a robust privacy policy, safeguarding sensitive information during the collection process. By leveraging data-driven strategies and intelligent automation, Equabli offers debt collection automation solutions for enterprise financial operations, empowering financial institutions to maximize their net present value (NPV) in loan collection. This transformation of traditional practices into positions organizations to navigate the complexities of debt recovery with confidence.

HES FinTech: Cost-Effective Automated Debt Collection Technology

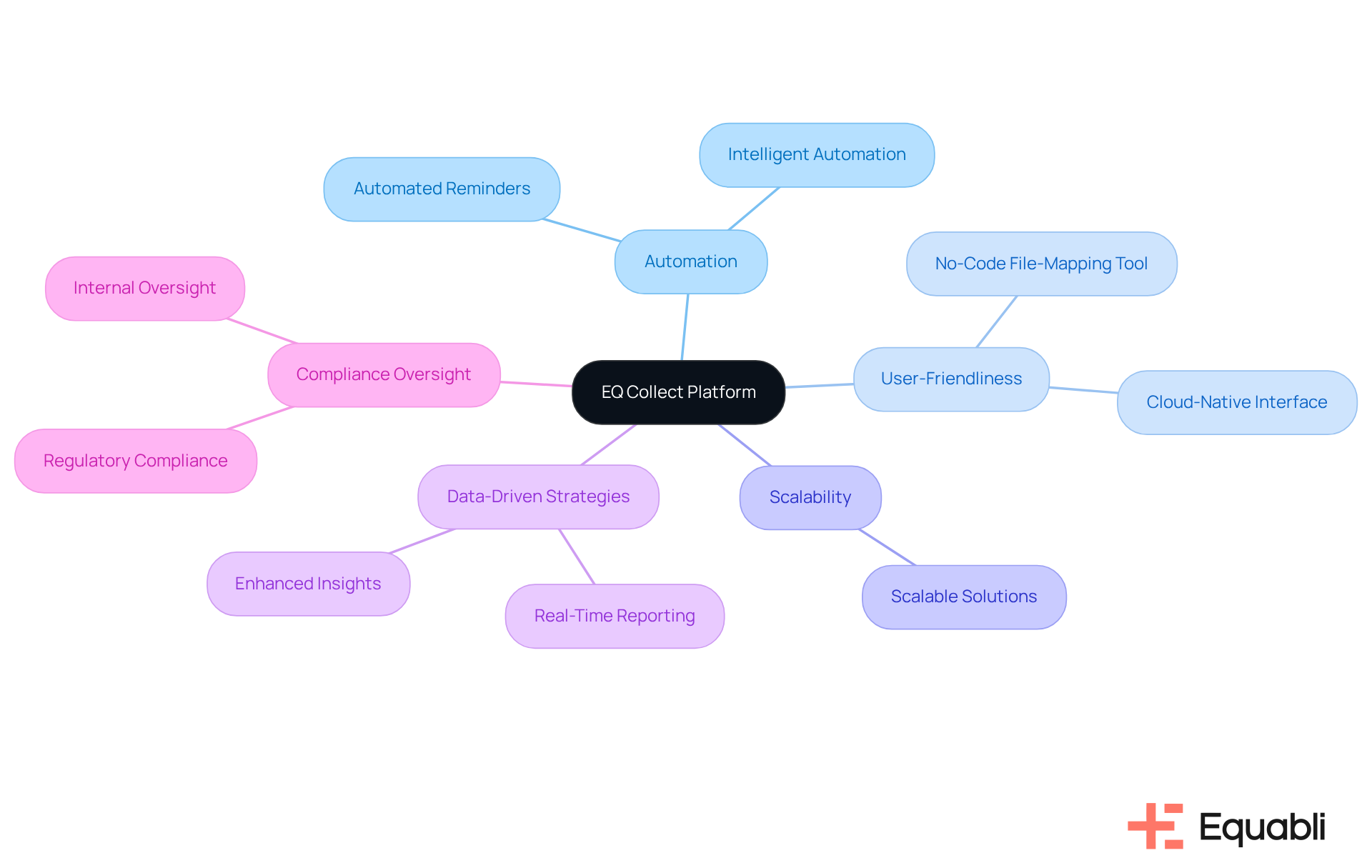

The EQ Collect platform represents a significant advancement in automated collection technology, enhancing recovery strategies through intelligent automation and machine learning. This cloud-native interface is designed to be user-friendly and scalable, featuring a no-code file-mapping tool that effectively reduces vendor onboarding timelines. By automating reminders and improving communication with debtors, Equabli empowers enterprises to increase collection rates while simultaneously lowering operational costs.

With a focus on and automated workflows, financial institutions can achieve exceptional transparency and insights through real-time reporting. This capability ensures robust compliance oversight, addressing both internal and external regulatory requirements. To effectively enhance your financial collection efforts, integrating EQ Collect into your operations is a strategic recommendation that aligns with the evolving demands of debt collection automation solutions for enterprise financial operations.

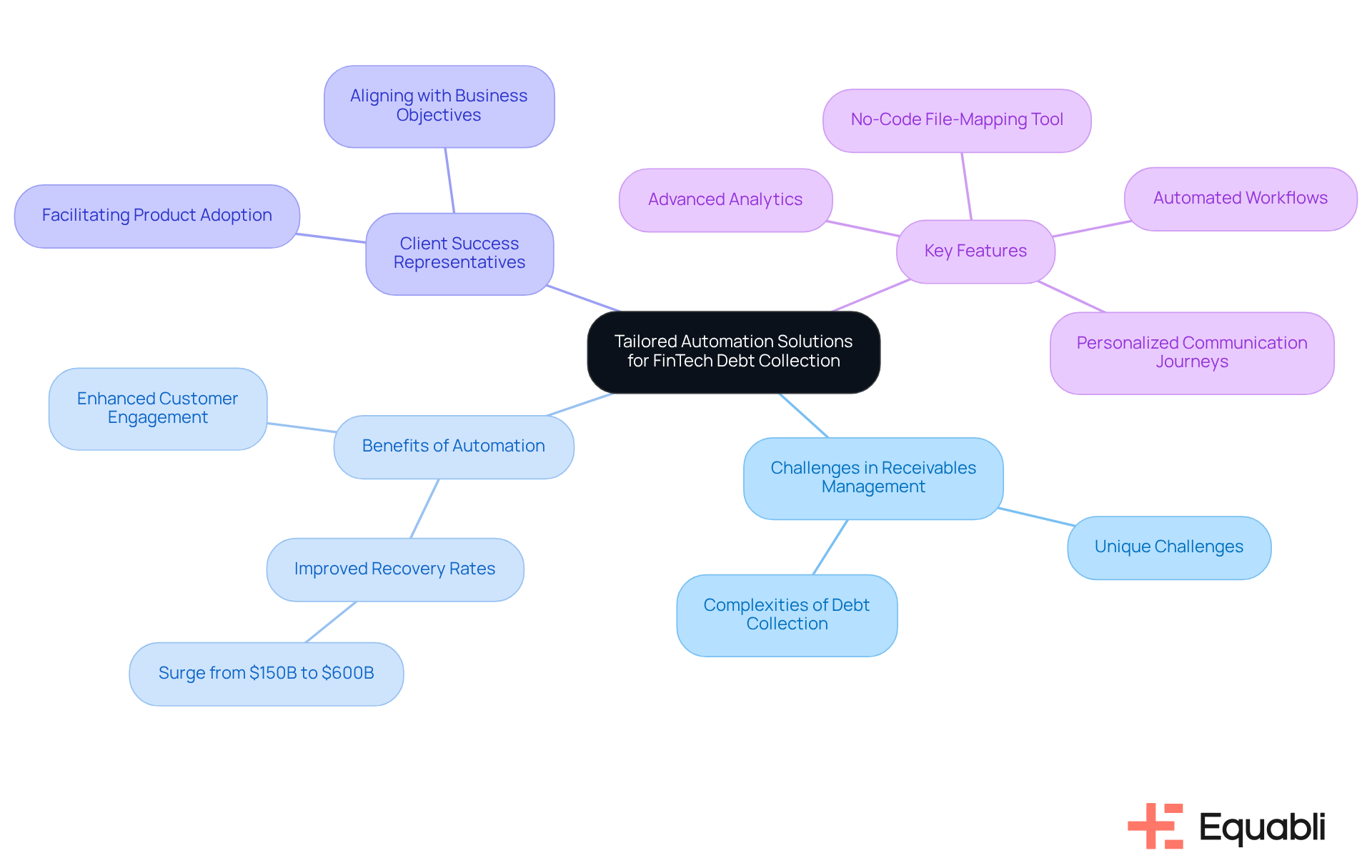

Firstsource: Tailored Automation Solutions for FinTech Debt Collection

In the evolving landscape of receivables management, financial institutions encounter unique challenges that demand innovative solutions. By leveraging advanced analytics and automation, organizations can develop tailored debt collection automation solutions for enterprise financial operations that substantially improve success rates and foster enhanced customer engagement. Evidence suggests that financial institutions utilizing these data-driven insights have experienced remarkable increases in recovery rates, with reports indicating a surge from $150 billion to over $600 billion in overdue accounts in recent years. Industry leaders assert that addressing the complexities of debt collection automation solutions for enterprise financial operations requires an unwavering focus on customer experience and operational efficiency.

The Client Success Representatives within the organization are pivotal to this transformation, facilitating product adoption and client engagement by aligning with business objectives and ensuring that the platform meets these outcomes. Features such as EQ Collect's no-code file-mapping tool and automated workflows are examples of debt collection automation solutions for enterprise financial operations that enable organizations to reduce execution errors and enhance transparency. Furthermore, EQ Engage empowers borrowers through personalized communication journeys, allowing for customized repayment plans and improved engagement.

As competition intensifies in the market, organizations that embrace analytics-driven strategies, supported by dedicated client success teams, will be strategically positioned to thrive and achieve sustainable growth. To fully leverage the advantages of these solutions, financial institutions should proactively to ensure alignment between their strategies and the platform's features.

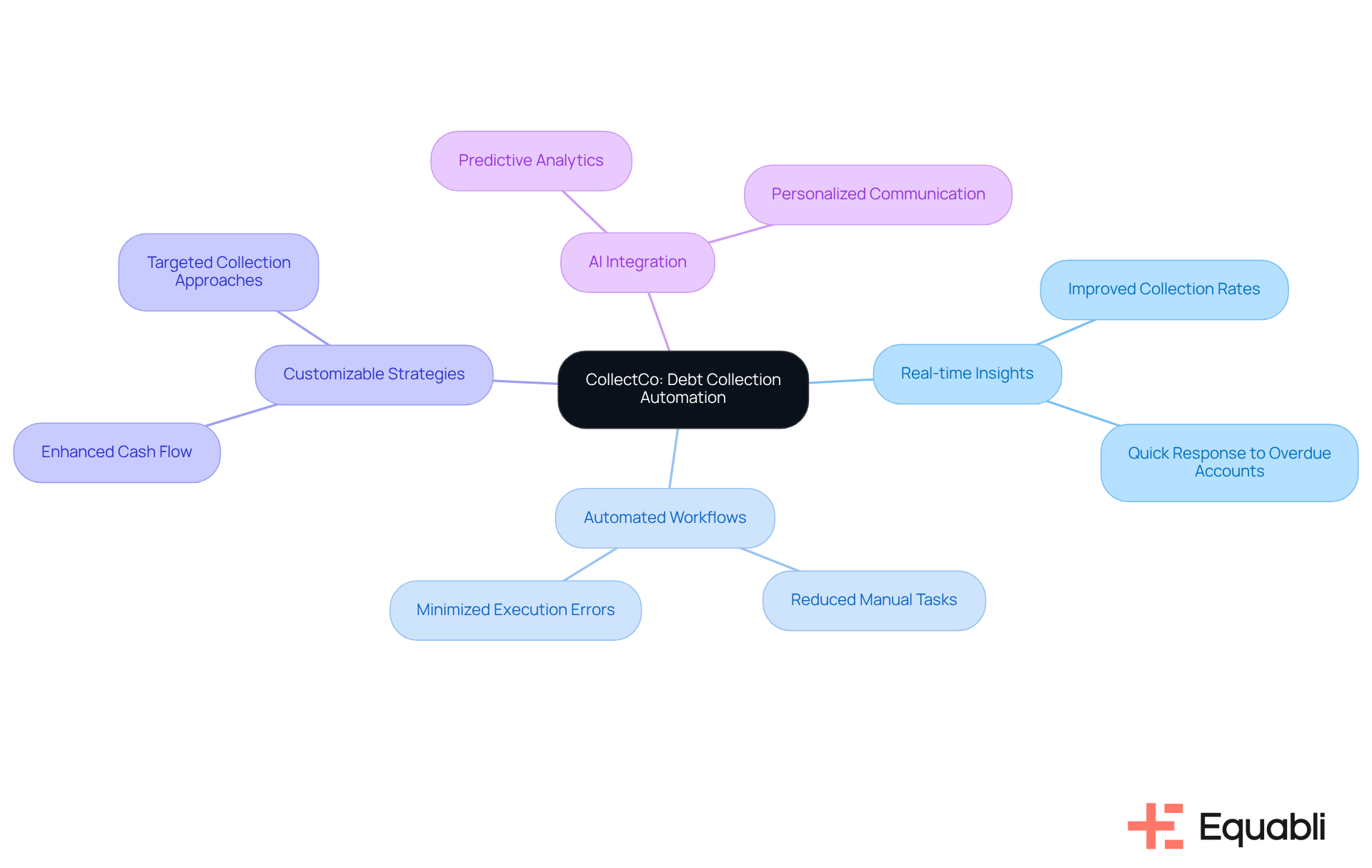

CollectCo: Streamlined Automation for Efficient Debt Collection

The company offers for enterprise financial operations that significantly improve the efficiency of debt recovery processes, especially through its EQ Suite and EQ Collect. Evidence of this includes:

These features empower organizations to optimize their collections and enhance cash flow. By reducing manual tasks and minimizing execution errors, the company enables organizations to concentrate on high-value engagements with debtors through debt collection automation solutions for enterprise financial operations, leading to improved collection rates.

Industry experts assert that leveraging debt collection automation solutions for enterprise financial operations not only streamlines operations but also enhances cash flow management, enabling businesses to respond quickly to overdue accounts and adjust strategies based on real-time data. Furthermore, features such as a no-code file-mapping tool and automated compliance monitoring are integral to debt collection automation solutions for enterprise financial operations, ensuring smarter orchestration and better performance in fund recovery.

As the AI for receivables management market is projected to grow to USD 15.9 billion by 2034, this proactive strategy is vital in today's fast-paced financial environment, where timely decision-making can significantly influence recovery outcomes.

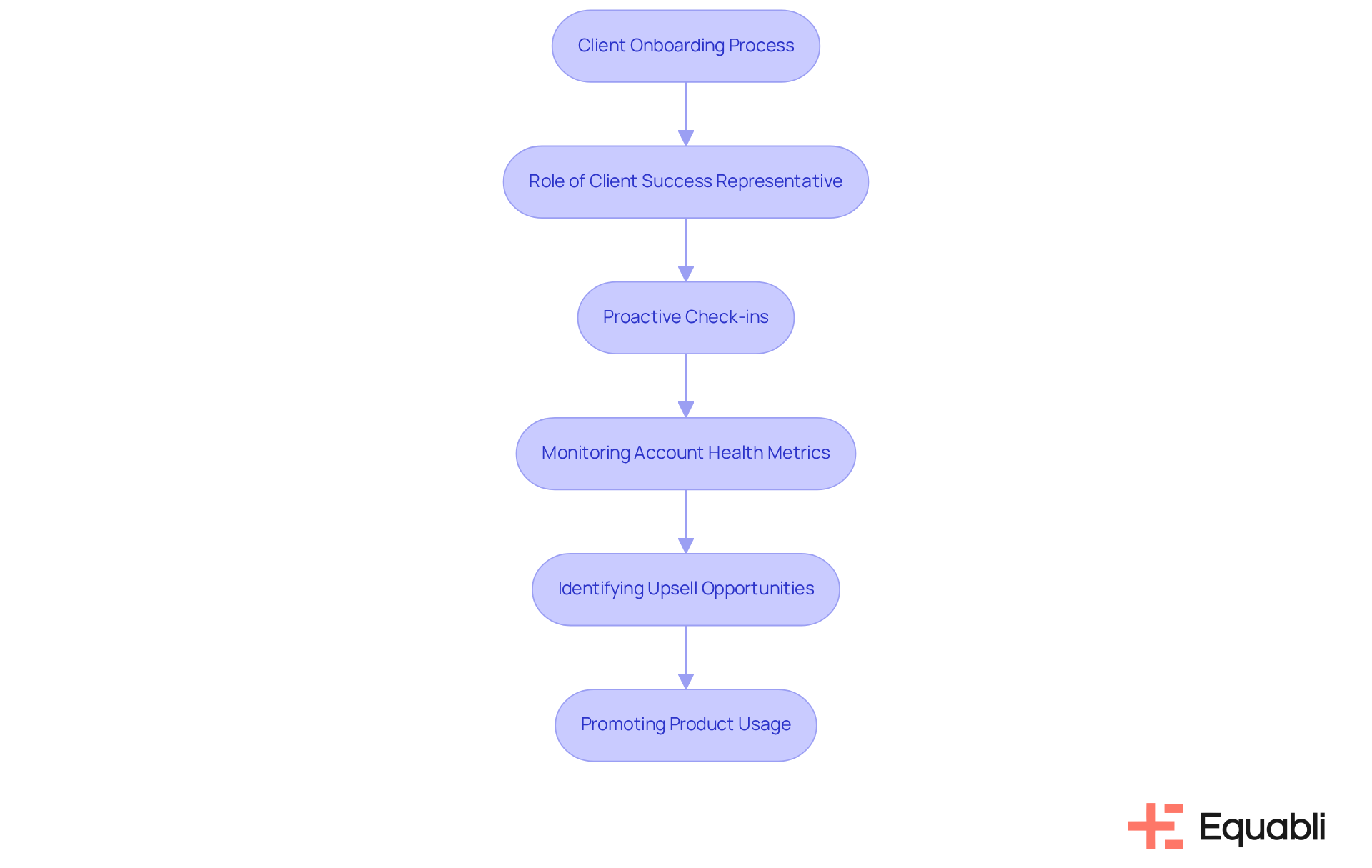

IBS Home: Automated Debt Collection Software for Financial Institutions

The debt collection automation solutions for enterprise financial operations provided by a leading provider are specifically tailored for financial institutions, enhancing the collections process through streamlined communication and robust reporting tools. This solution addresses a critical industry insight: as , effective management of restoration efforts while adhering to compliance standards is paramount. The role of the Client Success Representative is pivotal in this context, leading the setup and implementation process during client onboarding. This ensures a smooth transition from sales to a strong client relationship, reinforcing operational effectiveness.

Client Success Representatives conduct proactive check-ins and strategic business reviews, monitoring account health metrics to identify upsell and cross-sell opportunities in partnership with the sales team. By automating routine tasks, the software serves as one of the leading debt collection automation solutions for enterprise financial operations, boosting operational efficiency and significantly improving compliance with regulatory standards. This dual focus on efficiency and compliance positions organizations to effectively navigate the complexities of debt collection through the use of debt collection automation solutions for enterprise financial operations.

Moreover, Client Success Representatives promote product usage and client involvement by comprehending business objectives, ensuring that the platform meets those results. Successful applications of Equabli's solutions have demonstrated a significant rise in return rates, underscoring the software's capability to adapt to the distinct requirements of financial institutions. This adaptability enhances their debt management strategies by integrating debt collection automation solutions for enterprise financial operations, providing a strategic advantage in an increasingly digital landscape.

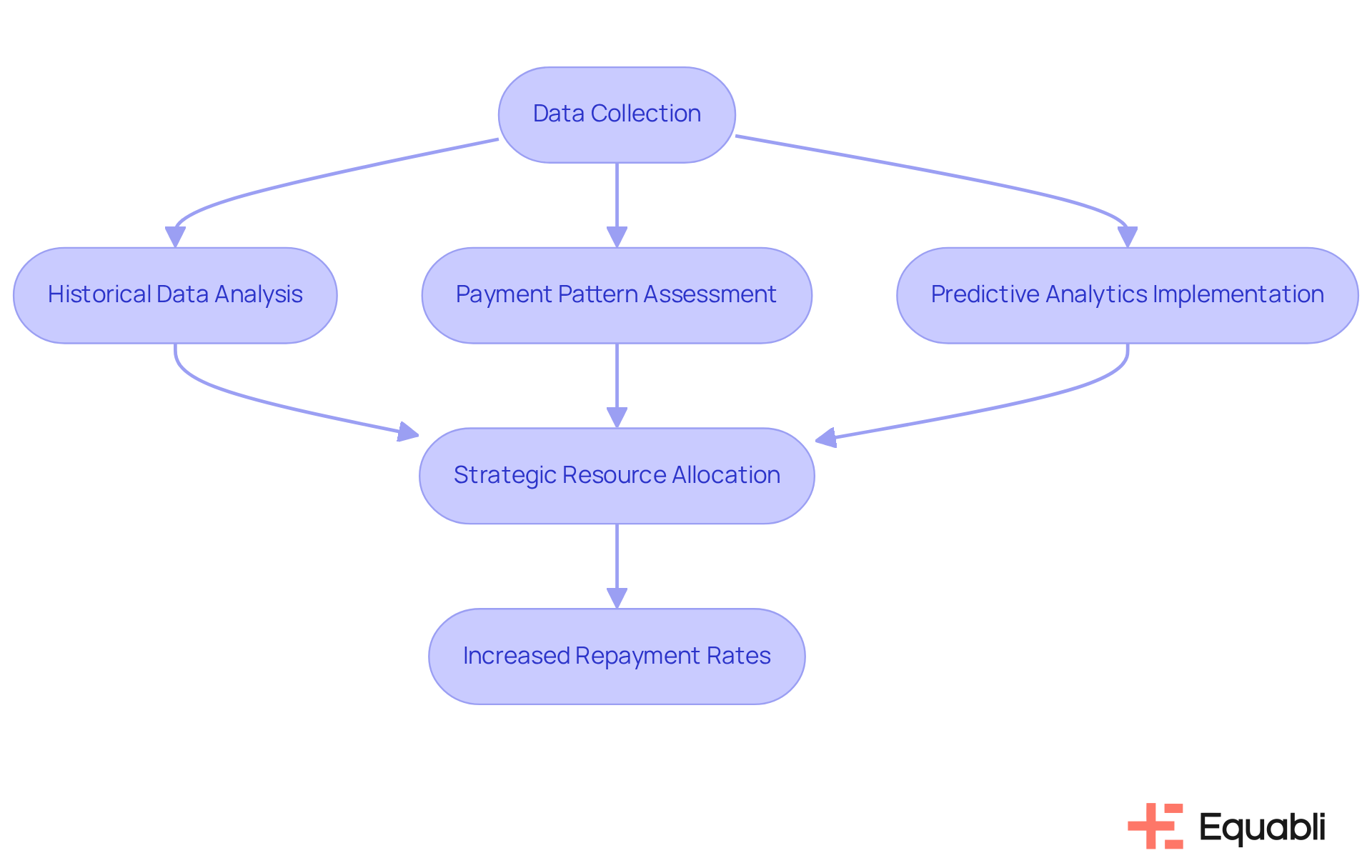

CollectCo Predictive Account Scoring: Data-Driven Decision Making

CollectCo's predictive account scoring effectively utilizes advanced analytics and machine learning to assess the likelihood of repayment for each debtor. By meticulously analyzing historical data and payment patterns, organizations can strategically direct their efforts towards accounts with the highest potential for recovery. This not only enhances decision-making but also significantly boosts overall restoration rates. As experts in financial management emphasize, leveraging historical data is crucial for formulating efficient recovery strategies, thereby ensuring that resources are allocated productively and effectively.

Successful implementations of predictive analytics, particularly those that integrate automation, have demonstrated a notable increase in repayment rates, underscoring the transformative impact of debt collection automation solutions for enterprise financial operations within the debt collection sector. Furthermore, establishing measurable targets, such as improving rehabilitation rates and reducing compliance violations, aligns predictive analytics with broader organizational objectives. Agencies that employ AI for predictive analytics have reported a remarkable 25% increase in retrieval rates, illustrating the efficacy of these tools.

For instance, the 'Predictive Account Scoring' case study illustrates how AI models evaluate account-level data to enhance collection efforts, highlighting the importance of a strategic approach in debt collection. By adopting intelligent servicing strategies, organizations can further refine their restoration processes, ensuring they operate more efficiently and effectively.

Convin.ai AI Voicebots: Automating Communication for Overdue Payments

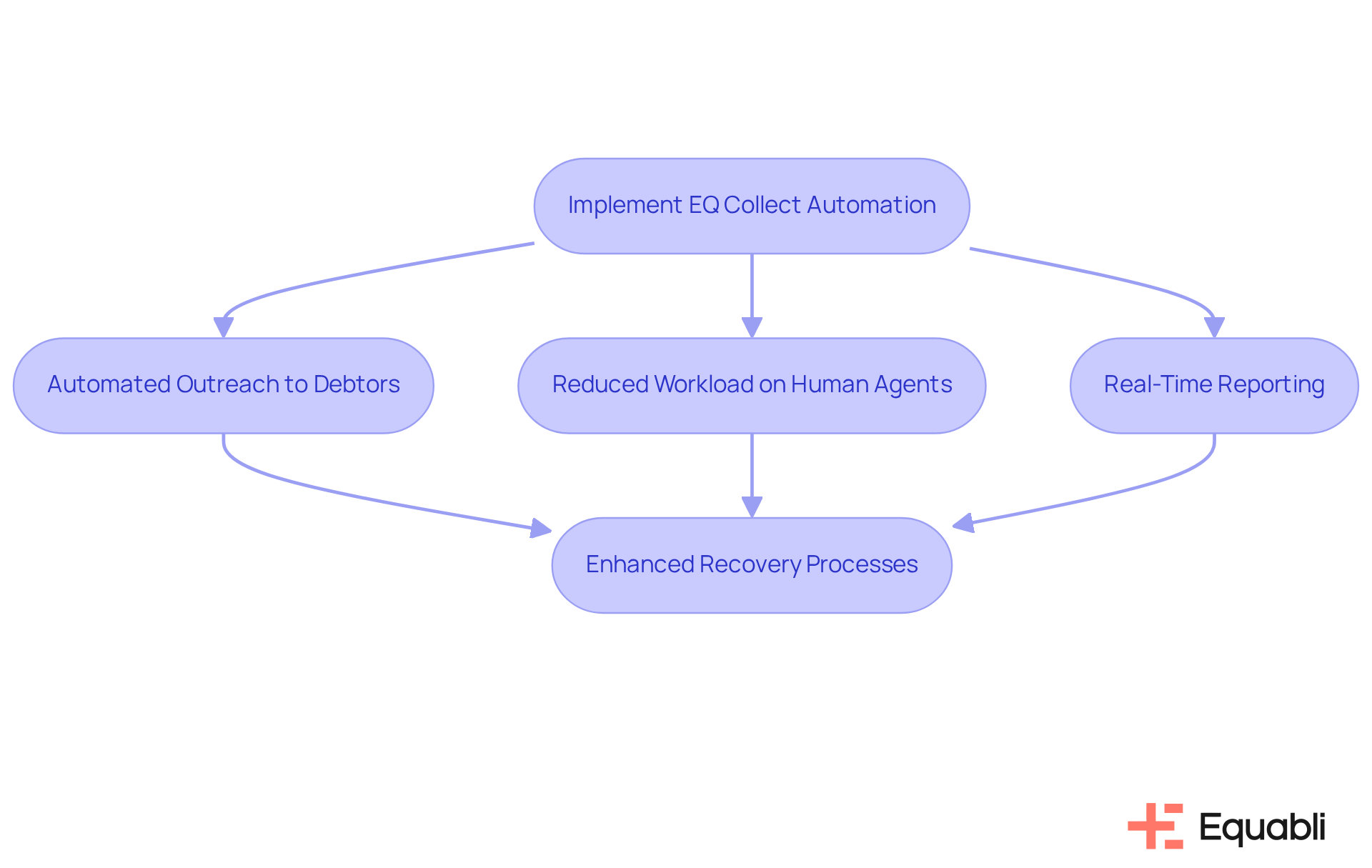

Equabli's EQ Collect represents a significant advancement in the communication landscape for overdue payments, providing debt collection automation solutions for enterprise financial operations by automating outreach to ensure timely and consistent engagement with debtors. Evidence shows that it effectively manages high call volumes, delivering personalized messages and reminders in strict compliance with regulatory standards. This user-friendly, enhances accessibility for diverse customer bases, ensuring all clients receive the necessary support.

The implementation of debt collection automation solutions for enterprise financial operations, along with features such as a no-code file-mapping tool and real-time reporting, significantly minimizes execution errors and alleviates the workload on human agents. This allows them to concentrate on more complex tasks, thereby improving operational efficiency. The impact of automation on success rates is noteworthy; organizations have reported increased engagement and reduced drop-offs in their overdue payment collections.

As the company highlights, "Our solutions are designed for financial institutions—covering support, recovery, compliance, and performance optimization." By streamlining communication and leveraging advanced features, Equabli empowers organizations to enhance their recovery processes effectively. This strategic approach not only addresses operational challenges but also positions firms to navigate the complexities of compliance and risk management in the financial sector.

Salesforce Collections Performance Monitoring: Optimizing Debt Collection Strategies

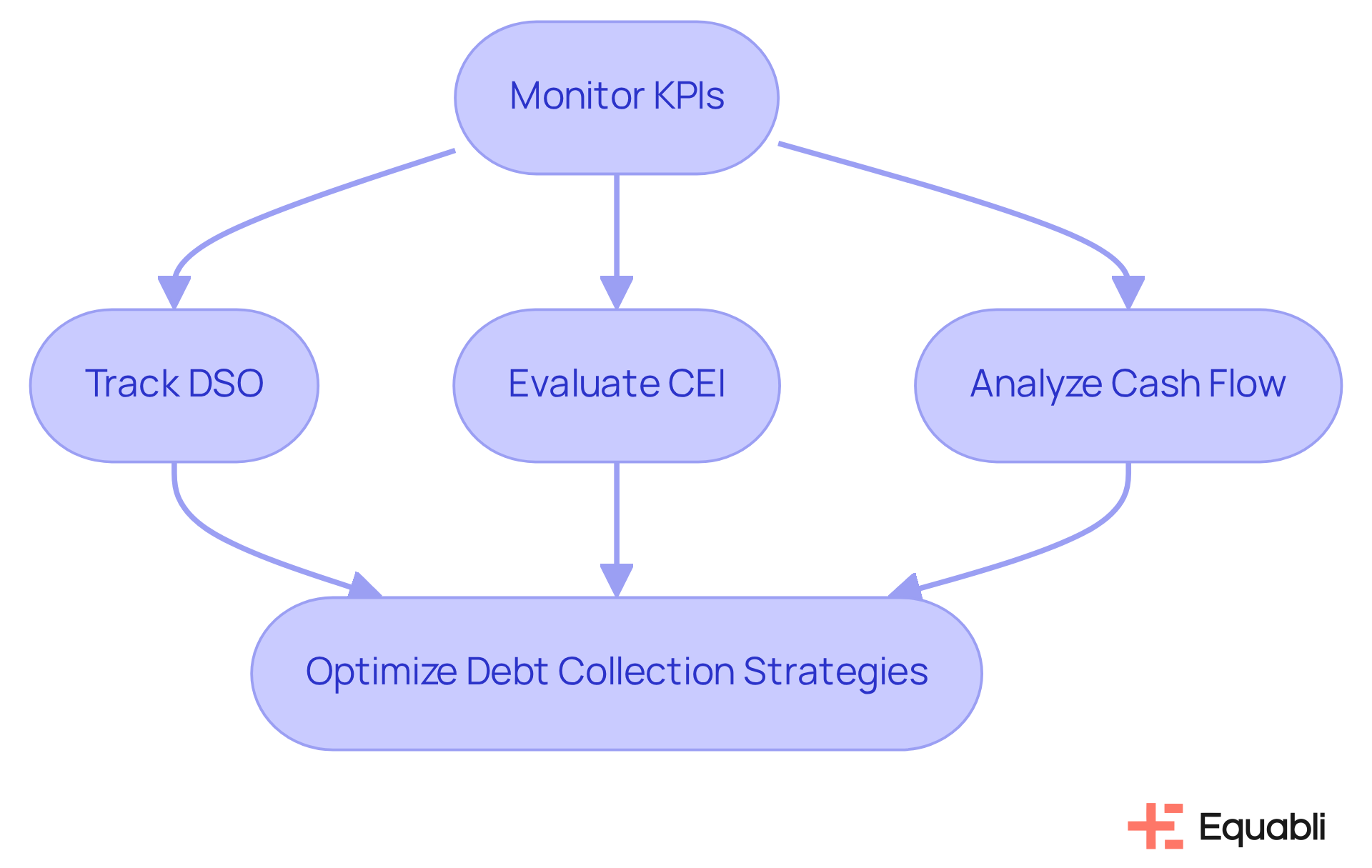

Salesforce's performance monitoring tools for receivables provide organizations with critical insights into their debt recovery strategies. By meticulously tracking key performance indicators (KPIs), companies can pinpoint areas needing improvement and enhance their data-gathering efforts accordingly. This data-driven approach not only elevates recovery rates but also increases .

For instance, organizations that effectively monitor their Days Sales Outstanding (DSO) can maintain an average of 22.5 days, indicating a robust receivables management process. Furthermore, a high Collector Effectiveness Index (CEI) of 75% demonstrates the successful retrieval of outstanding receivables, underscoring the efficacy of targeted strategies.

Financial analysts assert that effective receivable retrieval is fundamentally linked to a company's cash flow, rendering KPI monitoring essential for ensuring liquidity and fostering growth. As noted by Tratta, "Efficient debt recovery is directly linked to a company’s cash flow—collecting receivables punctually ensures that the company has the liquidity necessary to fulfill its obligations and invest in growth."

By leveraging Salesforce's advanced tools in conjunction with Equabli's EQ Collect, which includes a no-code file-mapping tool, automated workflows, and real-time reporting, organizations can utilize debt collection automation solutions for enterprise financial operations to ensure their collection strategies remain effective and adaptable to changing market conditions, ultimately enhancing their financial health.

Conclusion

The exploration of debt collection automation solutions underscores the transformative potential these technologies present for enterprises. By integrating advanced automation tools, organizations can streamline their debt recovery processes, enhance operational efficiency, and significantly improve repayment rates. The central message emphasizes that embracing automation is not merely an option but a necessity for financial institutions aiming to thrive in a competitive landscape.

Key solutions such as the Equabli EQ Suite, Convin.ai, and Salesforce Financial Services Cloud are highlighted for their capacity to reduce operational costs, optimize workflows, and ensure compliance with regulatory standards. Each tool offers unique features that address specific challenges in debt collection, including:

- AI-driven insights

- Predictive analytics

- Automated communication strategies that effectively engage debtors

These innovations not only improve recovery rates but also foster better customer relationships, ultimately leading to sustainable growth.

In a rapidly evolving financial environment, the significance of adopting these debt collection automation solutions cannot be overstated. Organizations leveraging these technologies position themselves to respond adeptly to overdue accounts, enhance cash flow, and maintain a competitive edge. As the market for debt collection automation continues to expand, it is crucial for enterprises to proactively invest in these solutions, ensuring they are equipped to navigate the complexities of debt recovery while optimizing their financial operations for the future.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is a comprehensive platform designed for enterprises to optimize their debt collection automation solutions, featuring tools like EQ Engine, EQ Engage, and EQ Collect to automate workflows and enhance borrower engagement.

How does the EQ Suite improve debt collection processes?

The EQ Suite improves debt collection processes by implementing data-driven strategies that reduce operational costs and improve repayment success rates, helping lenders and debt recovery agencies effectively adapt to the financial management landscape.

What benefits do organizations experience from using the EQ Suite?

Organizations using the EQ Suite report improved retrieval rates through targeted strategies, which highlight the suite's effectiveness in enhancing debt collection automation for enterprise financial operations.

Why is the adoption of platforms like the EQ Suite important for businesses?

Adopting comprehensive platforms like the EQ Suite is essential for sustainable growth and maintaining a competitive advantage in the marketplace through effective debt collection automation solutions.

What are the key features of Convin.ai's debt collection tools?

Convin.ai offers AI-powered automated debt recovery solutions that enhance recovery efforts through intelligent decision-making, a no-code file-mapping tool for faster vendor onboarding, and automated workflows to minimize execution errors.

How does Convin.ai ensure compliance in debt collection?

Convin.ai provides industry-leading compliance oversight to ensure that financial institutions operate within necessary regulatory frameworks while delivering real-time reporting for transparency and informed decision-making.

What role does Salesforce Financial Services Cloud play in debt collection automation?

Salesforce Financial Services Cloud streamlines debt recovery by providing insights into borrower behavior, automating communication strategies, and ensuring compliance through features like secure payment links and performance monitoring.

How does Equabli protect client data during the collection process?

Equabli is committed to data protection, ensuring that all client interactions adhere to a robust privacy policy to safeguard sensitive information throughout the debt collection process.

What transformation does Equabli aim to achieve in debt recovery practices?

Equabli aims to transform traditional debt recovery practices into efficient, compliant operations by leveraging data-driven strategies and intelligent automation, helping organizations navigate the complexities of debt recovery confidently.