Overview

The article emphasizes effective strategies for business-to-business debt recovery within corporate finance, highlighting the critical role of advanced technologies and clear payment terms. Evidence is provided through the discussion of Equabli's EQ Suite, which optimizes recovery processes via automation and data-driven insights. This not only enhances recovery efficiency but also underscores best practices like:

- Timely invoicing

- Incentivizing early payments

Such strategies are essential for improving cash flow and fostering robust client relationships, thereby reinforcing the importance of integrating innovative solutions into enterprise-level debt collection efforts.

Introduction

In the intricate realm of corporate finance, effective debt recovery is not merely a necessity; it is a strategic imperative. As businesses grapple with escalating challenges in sustaining cash flow and managing overdue invoices, the stakes have never been higher. This article explores ten innovative strategies poised to transform business-to-business debt recovery, equipping organizations with the tools to enhance efficiency, cultivate stronger client relationships, and ultimately bolster their bottom line. When traditional methods fall short, a critical question arises: can the adoption of technology and proactive practices genuinely revolutionize the approach to debt recovery?

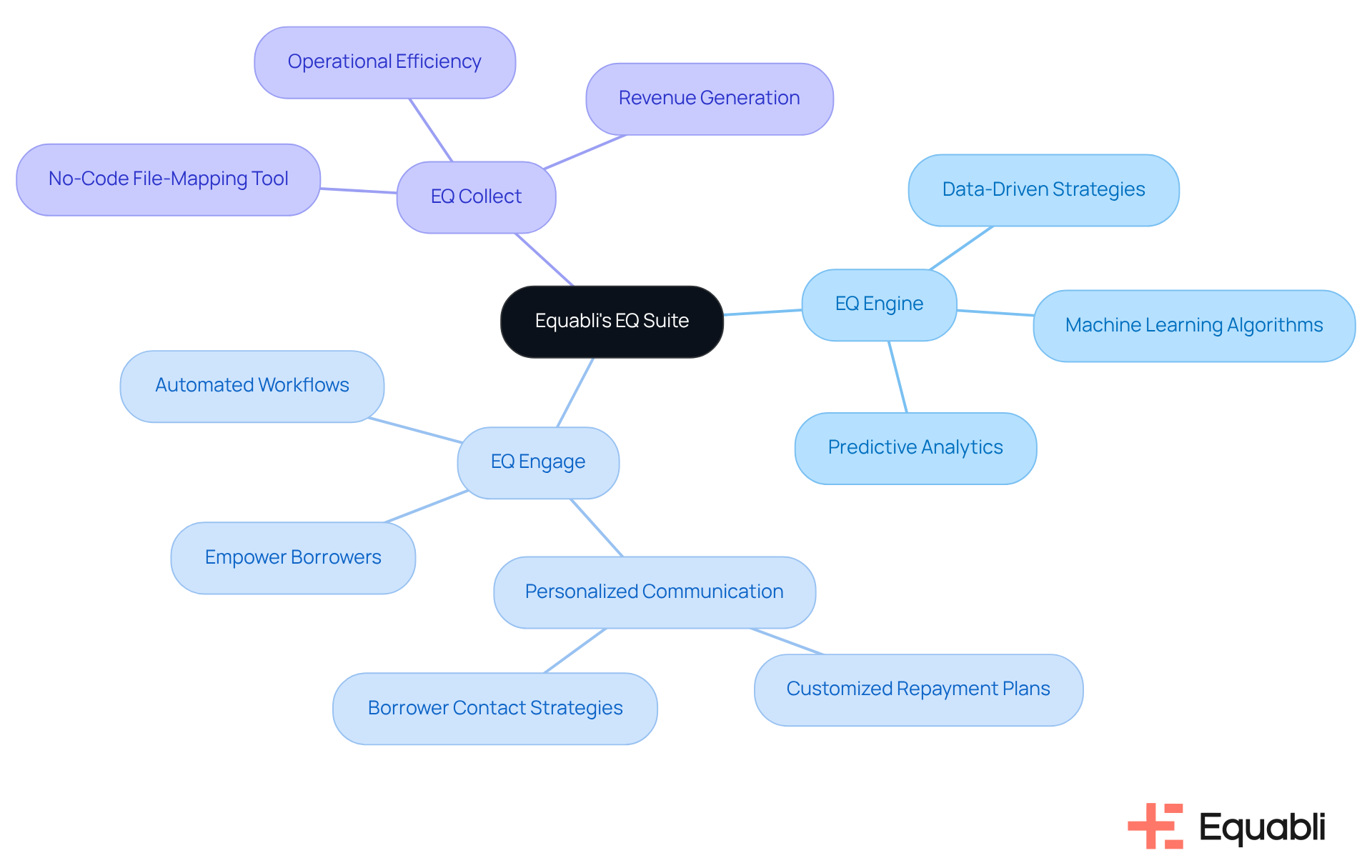

Equabli's EQ Suite: Transforming Debt Recovery with Intelligent Solutions

Equabli's EQ Suite signifies a pivotal advancement in debt recovery, incorporating the EQ Engine, EQ Engage, and EQ Collect. These tools leverage data-driven strategies to accurately forecast repayment behaviors and refine recovery efforts. Specifically, EQ Collect enables organizations to reduce vendor onboarding timelines through an intuitive, no-code file-mapping tool, thereby enhancing operational efficiency and revenue generation.

The implementation of automated workflows minimizes execution errors and reliance on manual resources, while real-time reporting offers unparalleled transparency and insights. Furthermore, EQ Engage facilitates the design and automation of borrower contact strategies, fostering personalized communication journeys that empower borrowers to self-service with customized repayment plans.

By adopting these intelligent solutions, organizations can streamline operations, significantly curtail costs, and enhance borrower engagement via preferred communication channels. This contemporary approach effectively addresses the shortcomings of traditional debt retrieval strategies, incorporating strategies for in corporate finance to allow businesses to achieve measurable improvements in their recovery outcomes.

Notably, the integration of advanced technologies has demonstrated the potential to elevate debt recoveries by up to 65%, highlighting the efficacy of data-driven strategies in optimizing recovery processes. Additionally, the implementation of a comprehensive digital strategy has resulted in a 40% increase in transaction arrangements, fostering a more effective collection environment that equips agencies to adapt swiftly to changing economic conditions and consumer preferences.

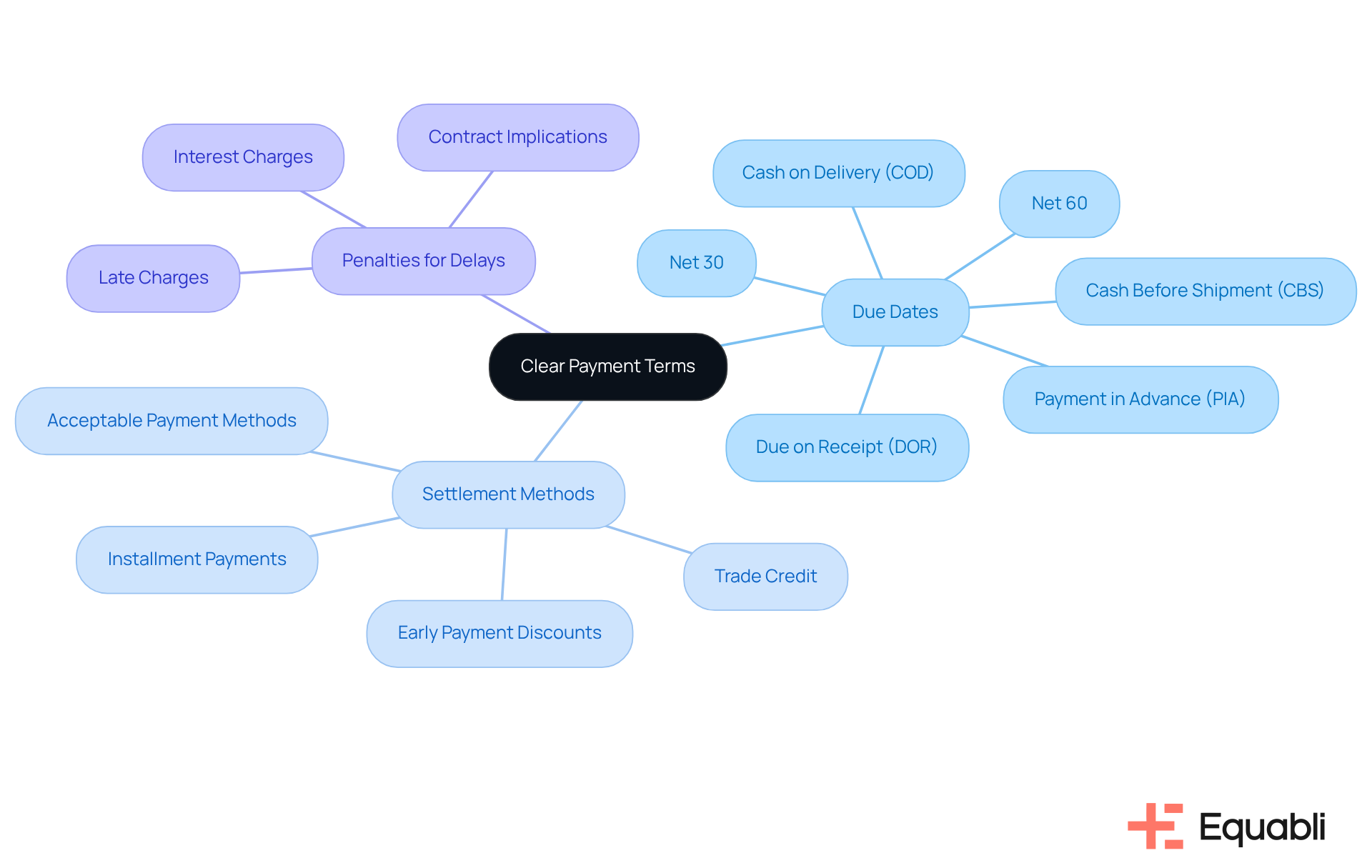

Establish Clear Payment Terms: Set Expectations for Timely Payments

Establishing clear financial terms is critical for successful strategies for business-to-business debt recovery in corporate finance. These terms must explicitly define:

- Due dates for fees

- Acceptable settlement methods

- Penalties for delays, including late charges specified in contracts and invoices

By articulating these expectations in advance, organizations can cultivate a culture of accountability, significantly reducing the likelihood of transaction delays. This proactive strategy incorporates strategies for business-to-business debt recovery in corporate finance, reinforcing client relationships while playing an essential role in .

For instance, firms implementing structured financial terms, such as Net 30, Net 60, or due on receipt (DOR), frequently experience improvements in their Days Sales Outstanding (DSO), which directly correlates with enhanced liquidity and operational efficiency.

Optimal practices, as part of strategies for business-to-business debt recovery in corporate finance, involve offering early settlement discounts to incentivize prompt payments, as these discounts can bolster cash flow and reduce receivables. By aligning transaction terms with client expectations and industry standards while considering cultural differences in financial practices, enterprises can optimize their fiscal operations and nurture long-term partnerships.

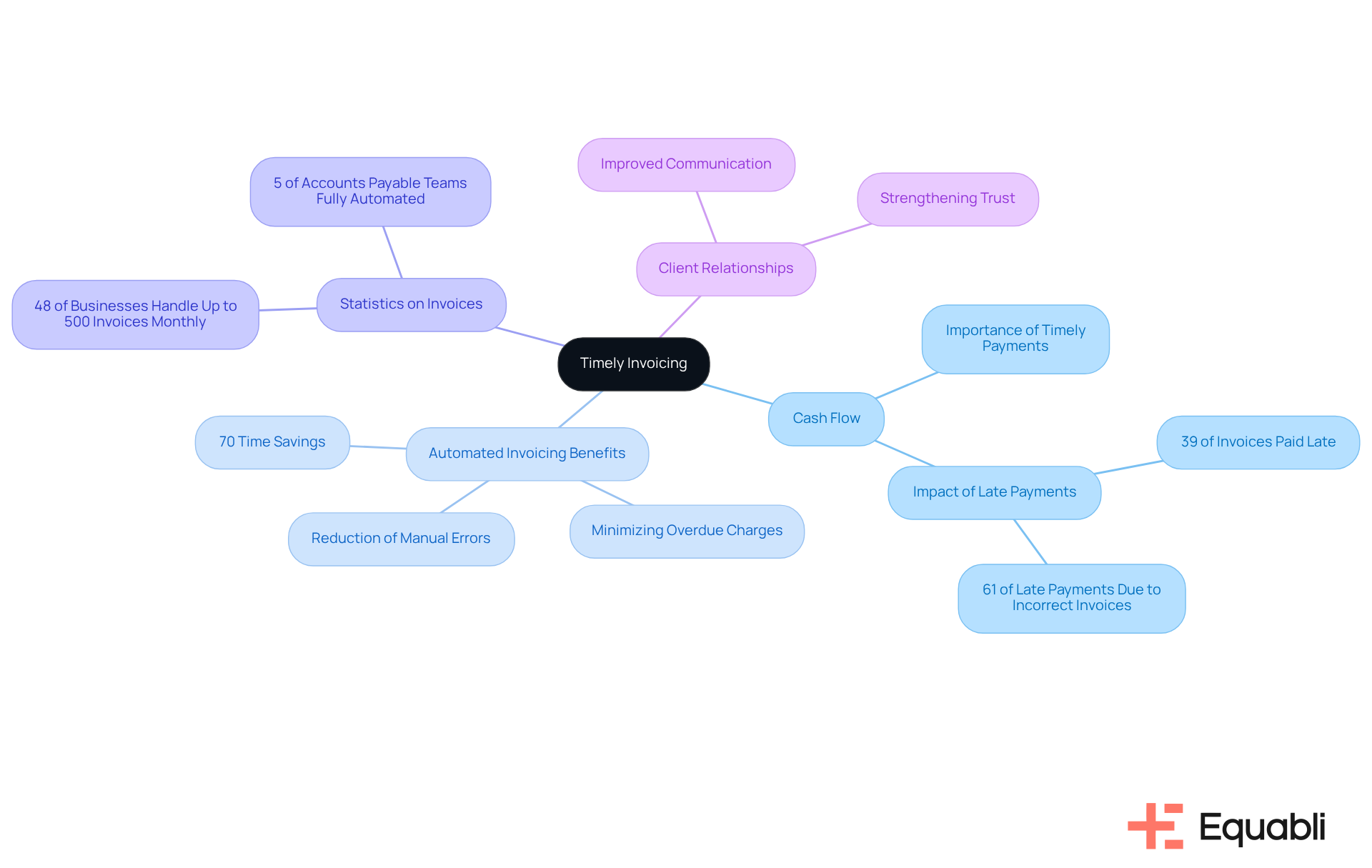

Send Invoices Promptly: Maintain Cash Flow and Reduce Delays

Timely invoicing is critical for sustaining healthy cash flow within any enterprise. A consistent routine for issuing invoices immediately after the delivery of goods or services is essential. Automated invoicing systems significantly enhance this process by ensuring that invoices are generated and dispatched promptly, thereby minimizing the risk of overdue charges.

Evidence indicates that companies adopting automated invoicing systems experience up to 70% time savings on invoice processing. This efficiency allows organizations to focus on core activities rather than chasing receivables. Furthermore, data reveals that 39% of invoices in the United States are settled post-due date, with 61% of these delays attributed to inaccuracies in invoices.

By leveraging automation, businesses can substantially enhance their transaction timelines, thereby ensuring consistent cash flow and reinforcing the importance of prompt remittances with clients. This proactive approach not only mitigates the risk of late transactions but also fosters through improved communication and reliability.

As highlighted, "Invoicing is an essential, time-sensitive process for every company," underscoring the critical nature of timely invoicing.

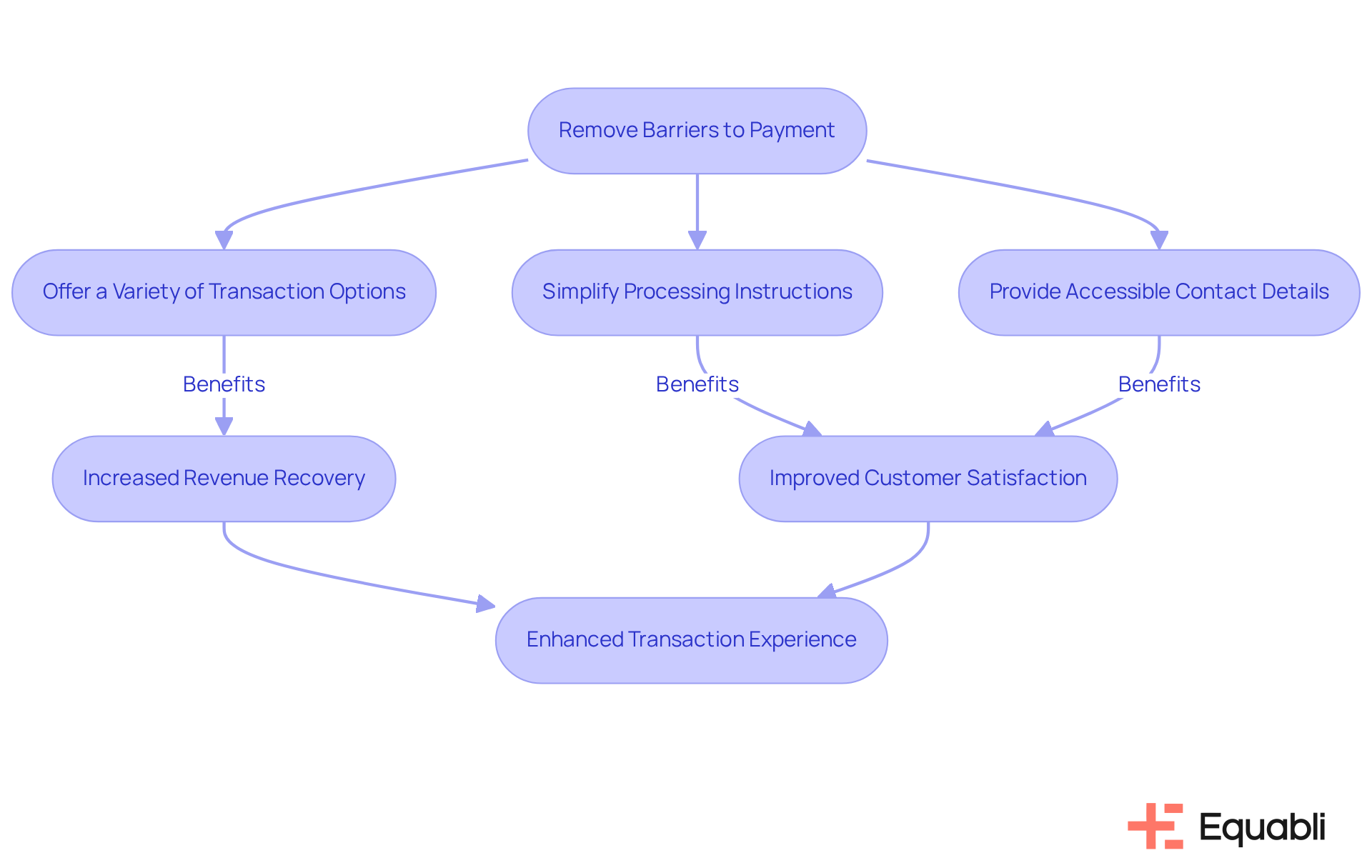

Remove Barriers to Payment: Simplify the Collection Process

To ensure prompt transactions, businesses must proactively identify and eliminate obstacles that hinder . This involves:

- Offering a variety of transaction options

- Simplifying processing instructions

- Providing accessible contact details for inquiries

Evidence indicates that organizations streamlining their transaction processes can see a significant increase in revenue recovery rates. For instance, firms implementing user-friendly transaction systems often report enhanced customer satisfaction and improved on-time settlement rates. By prioritizing payment convenience, companies not only bolster their cash flow but also foster stronger relationships with clients, which ultimately supports the implementation of effective strategies for business-to-business debt recovery in corporate finance.

The features of EQ Collect, including automated workflows and real-time reporting, specifically address these challenges by reducing vendor onboarding timelines and minimizing execution errors. As Jack Nicholaisen asserts, 'Payment processes, automation, and subscriptions are crucial components of any business that deals with financial transactions,' underscoring the necessity of integrating these elements. Moreover, the user-friendly, scalable interface of EQ Collect illustrates how intelligent automation can revolutionize strategies for business-to-business debt recovery in corporate finance, leading to improved collection outcomes.

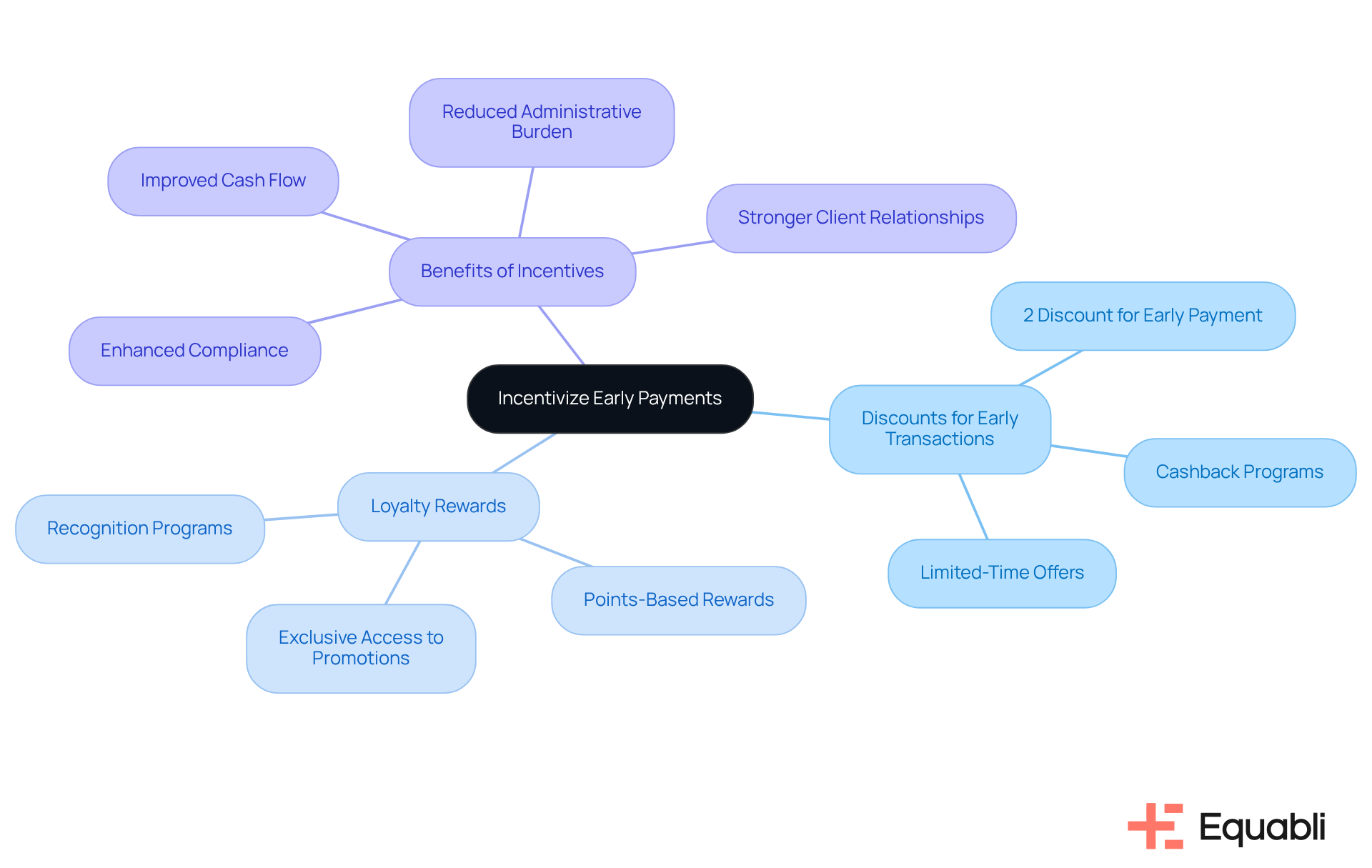

Incentivize Early Payments: Encourage Timely Settlements

Implementing rewards for prompt transactions serves as a strategic method to encourage timely settlements. Evidence suggests that incentives, such as discounts for transactions finalized before the due date or loyalty rewards for consistent early contributors, can significantly enhance compliance and operational efficiency. By delivering tangible benefits for timely transactions, organizations can foster stronger relationships with clients, thereby improving cash flow and reducing the administrative burden associated with collections. This approach not only streamlines operations but also aligns with .

Establish a Follow-Up Process: Address Late Invoices Proactively

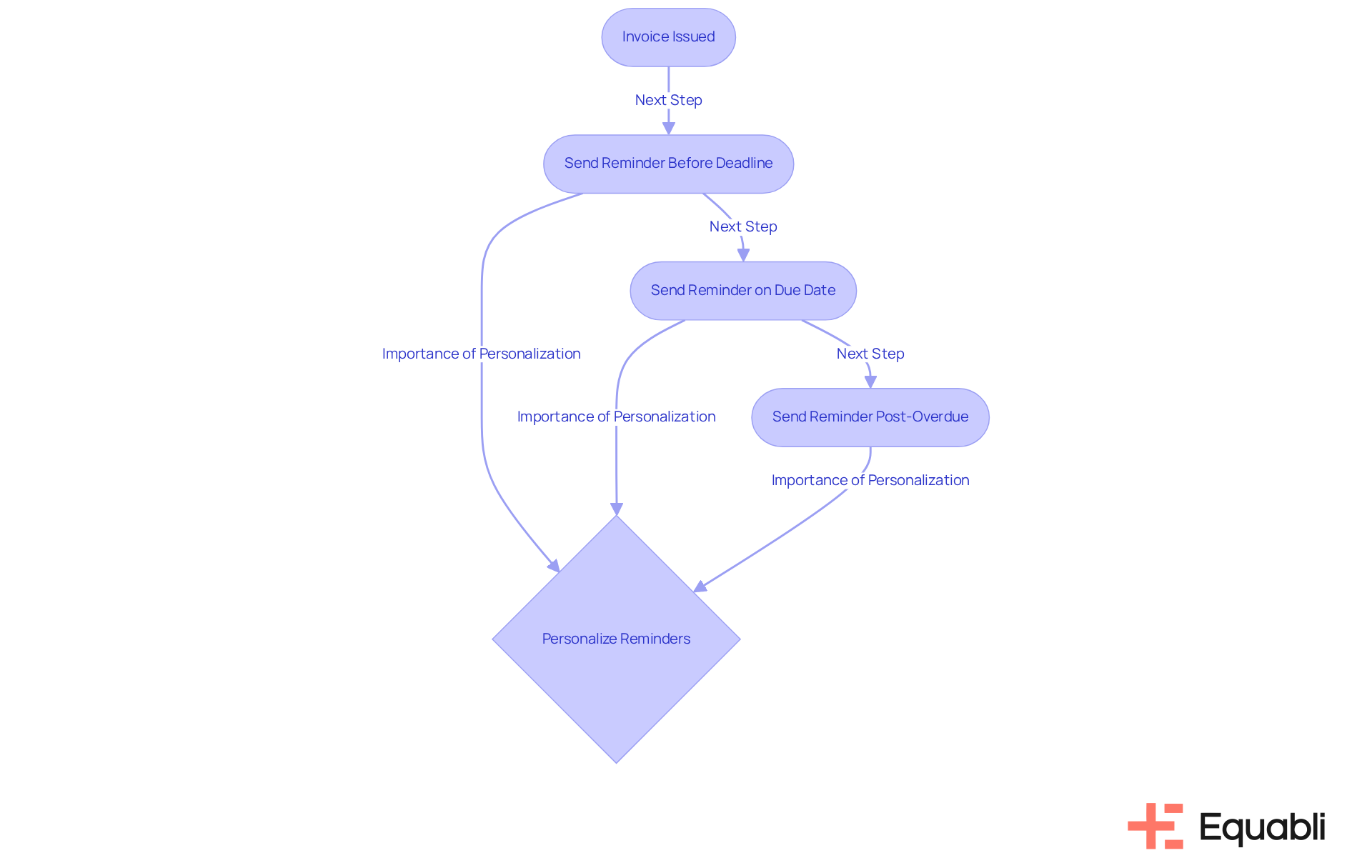

Implementing a systematic follow-up process for late invoices is critical for effective strategies for business-to-business debt recovery in corporate finance. Evidence suggests that organizations that establish an organized timetable for follow-ups—incorporating reminders before deadlines and subsequent communications if dues are overlooked—implement effective strategies for business-to-business debt recovery in corporate finance, leading to significantly improved recovery rates. This proactive strategy demonstrates professionalism and highlights the necessity of , aligning with strategies for business-to-business debt recovery in corporate finance, thereby motivating clients to prioritize their obligations.

Studies indicate that sending reminders at various stages of the billing process—prior to the deadline, on the due date, and post-overdue—can markedly increase the likelihood of receiving payments promptly. Furthermore, personalizing these reminders enhances client relationships, fostering a greater willingness to settle outstanding invoices. By implementing these best practices, organizations can proficiently manage their accounts receivable and cultivate a culture of prompt transactions.

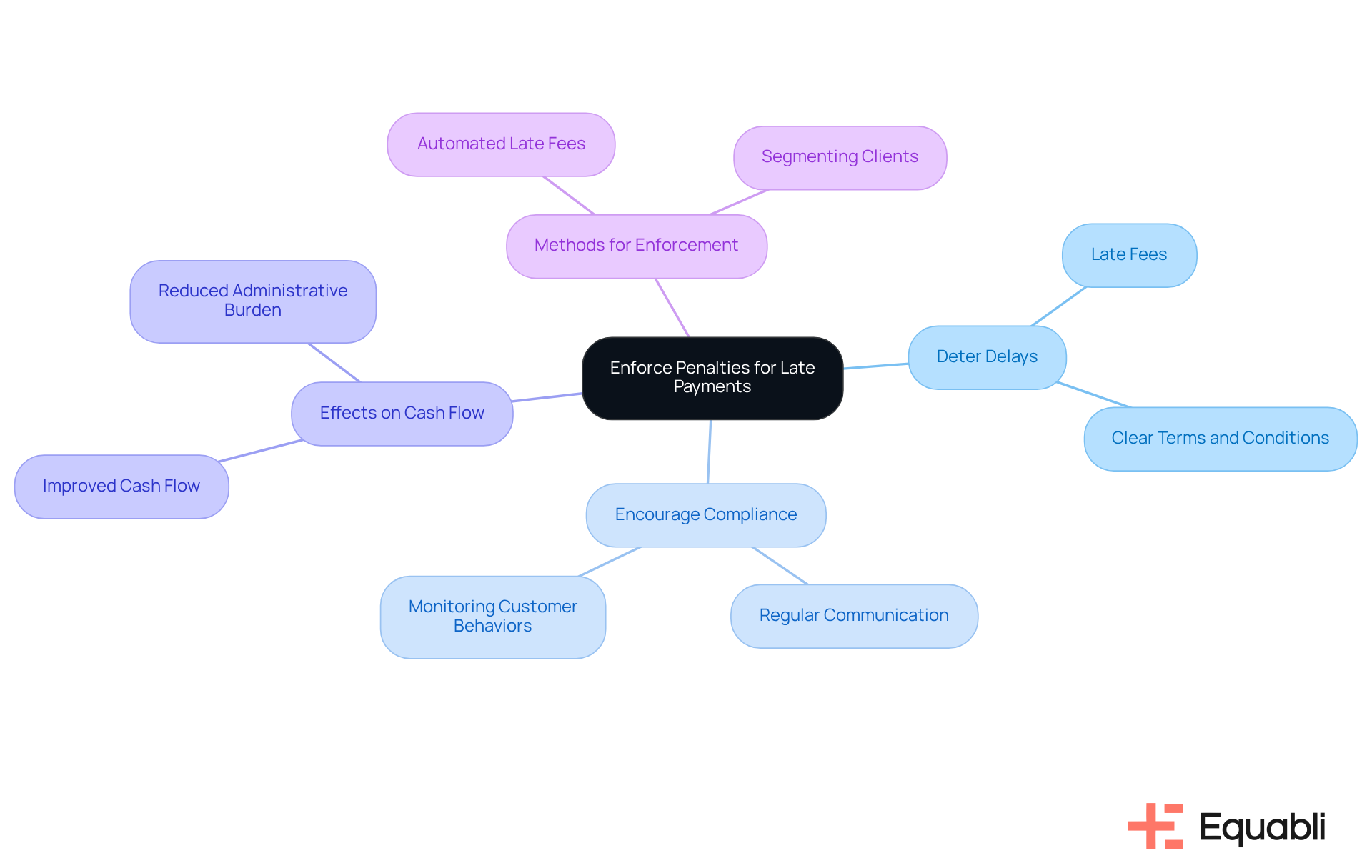

Enforce Penalties for Late Payments: Deter Delays and Encourage Compliance

Enforcing penalties for overdue charges serves as a proven strategy to deter future delays. Businesses must explicitly delineate any penalties, such as late fees or interest charges, within their terms and conditions. This clarity establishes a framework that incentivizes clients to adhere to financial schedules and comply with agreed-upon terms.

Data reveals that 87% of companies face overdue invoices, contributing to an estimated £11 billion loss to the UK economy annually. By instituting late fees, companies can significantly bolster compliance with their invoicing processes. For instance, firms that automate late fees report enhanced cash flow and reduced administrative burdens, as they eliminate the need for manual monitoring of overdue charges.

Moreover, the implementation of transparent late fee structures can catalyze a cultural shift in financial behavior. When clients grasp the , they are more likely to prioritize timely payments. This proactive stance not only alleviates cash flow pressures but also nurtures stronger customer relationships.

Effective methods for enforcing these penalties, which are part of strategies for business-to-business debt recovery in corporate finance, include:

By categorizing clients based on their payment histories, companies can implement strategies for business-to-business debt recovery in corporate finance, ensuring that penalties are both equitable and impactful. Ultimately, the strategic application of late fees not only deters future delays but also cultivates a culture of accountability in financial transactions.

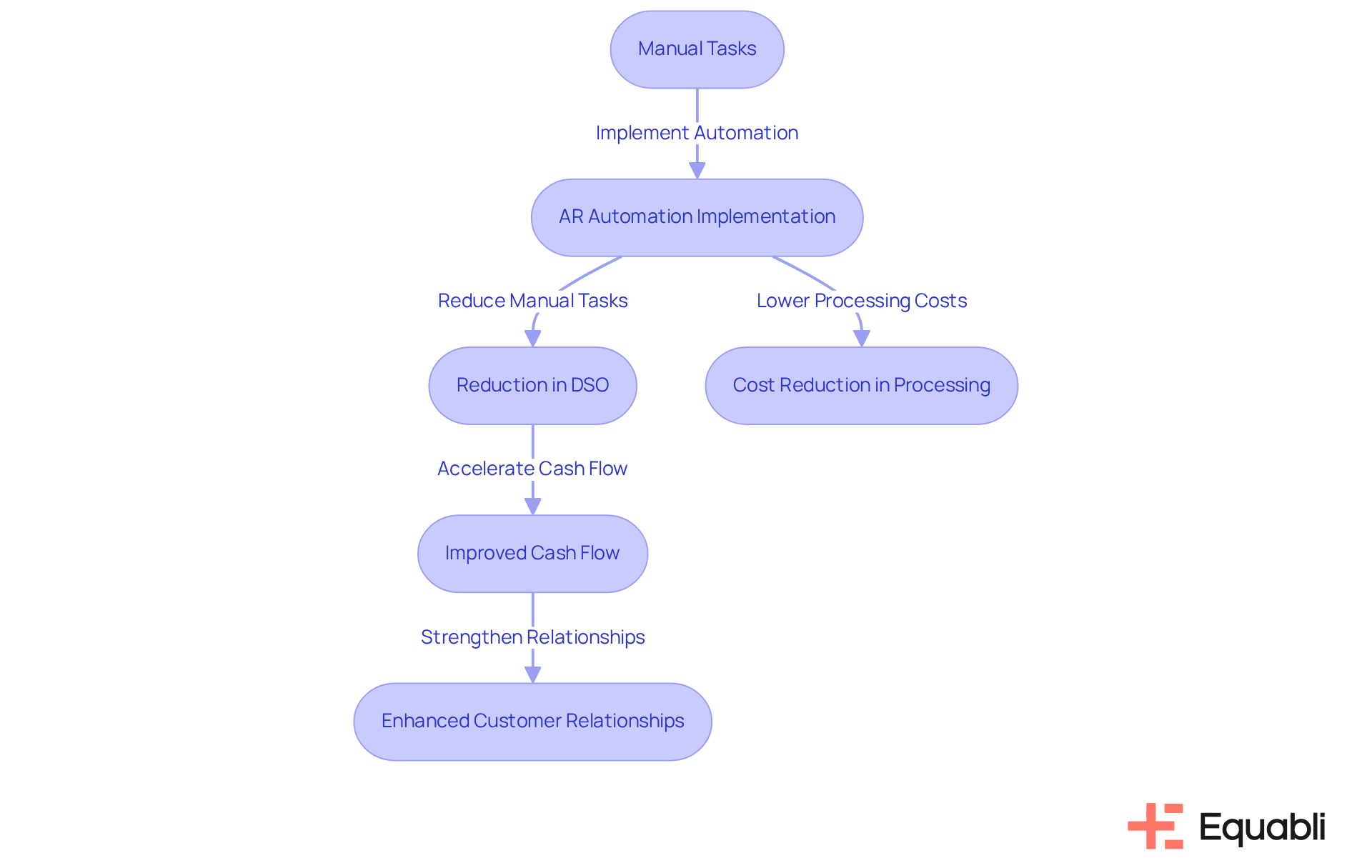

Automate Accounts Receivable: Enhance Efficiency in Collections

Automating accounts receivable procedures is one of the key strategies for business-to-business debt recovery in corporate finance that significantly enhances efficiency in retrieving payments. Evidence shows that leveraging software solutions like Equabli's EQ Collect—featuring a user-friendly, scalable, cloud-native interface, a no-code file-mapping tool, and automated workflows—allows businesses to drastically reduce time spent on manual tasks and minimize the likelihood of errors.

For instance, companies that have implemented AR automation have reported a reduction in Days Sales Outstanding (DSO) from 45 days to just 3 days, unlocking cash flow that was previously tied up for over 45 days. This change not only improves operational efficiency but also enables staff to focus on strategies for in corporate finance, ultimately enhancing performance in collections.

From a compliance perspective, automated systems provide real-time visibility into accounts receivable data, facilitating better-informed decision-making and strengthening customer relationships. As Soumi Sarkar asserts, 'The AR process engages the customer, thus it must be prompt, precise, and professional, from invoicing to payments,' which aligns with the capabilities of EQ Collect.

Furthermore, Equabli's solutions ensure industry-leading compliance oversight and transparency, fostering trust with customers. Additionally, studies indicate that AR automation can significantly reduce the costs associated with processing invoices and collecting payments, making it a vital investment for financial institutions.

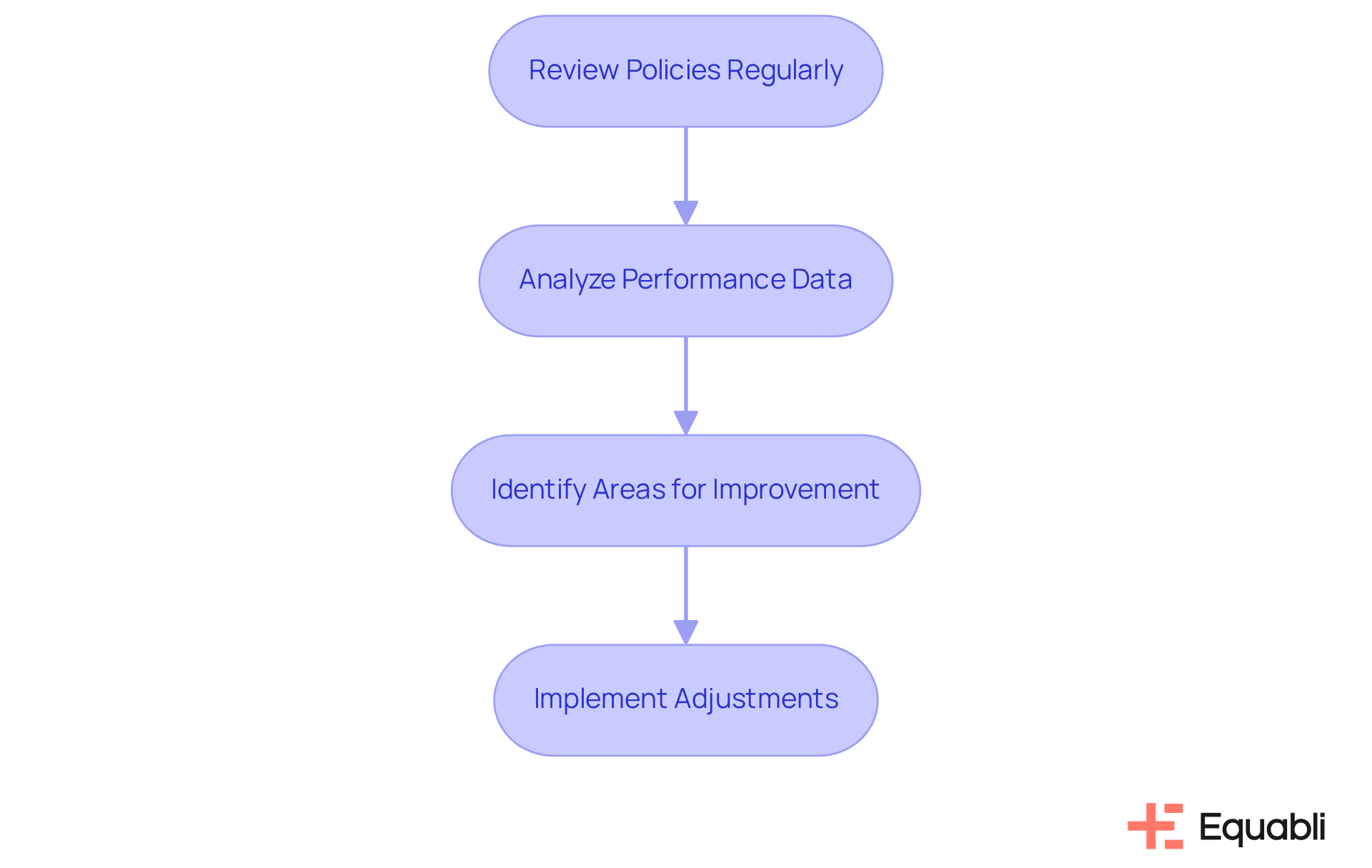

Review Policies Regularly: Adapt and Improve Collection Strategies

Consistently examining policies for gathering is essential for adapting to evolving business environments and enhancing strategies for business-to-business debt recovery in corporate finance. By systematically analyzing performance data, organizations can identify specific areas requiring improvement and implement informed adjustments to their policies.

For instance, banks can improve collection rates by optimizing outreach and repayment options. This proactive methodology not only ensures that remain effective but also aligns them with broader organizational objectives.

As financial institutions face increasing pressure to enhance retrieval rates, leveraging data-driven insights becomes crucial for optimizing strategies for business-to-business debt recovery in corporate finance and maintaining competitiveness in a dynamic market.

As John Sanders, Managing Partner and CEO, emphasizes, "If you’re not acting now, you’re already behind.

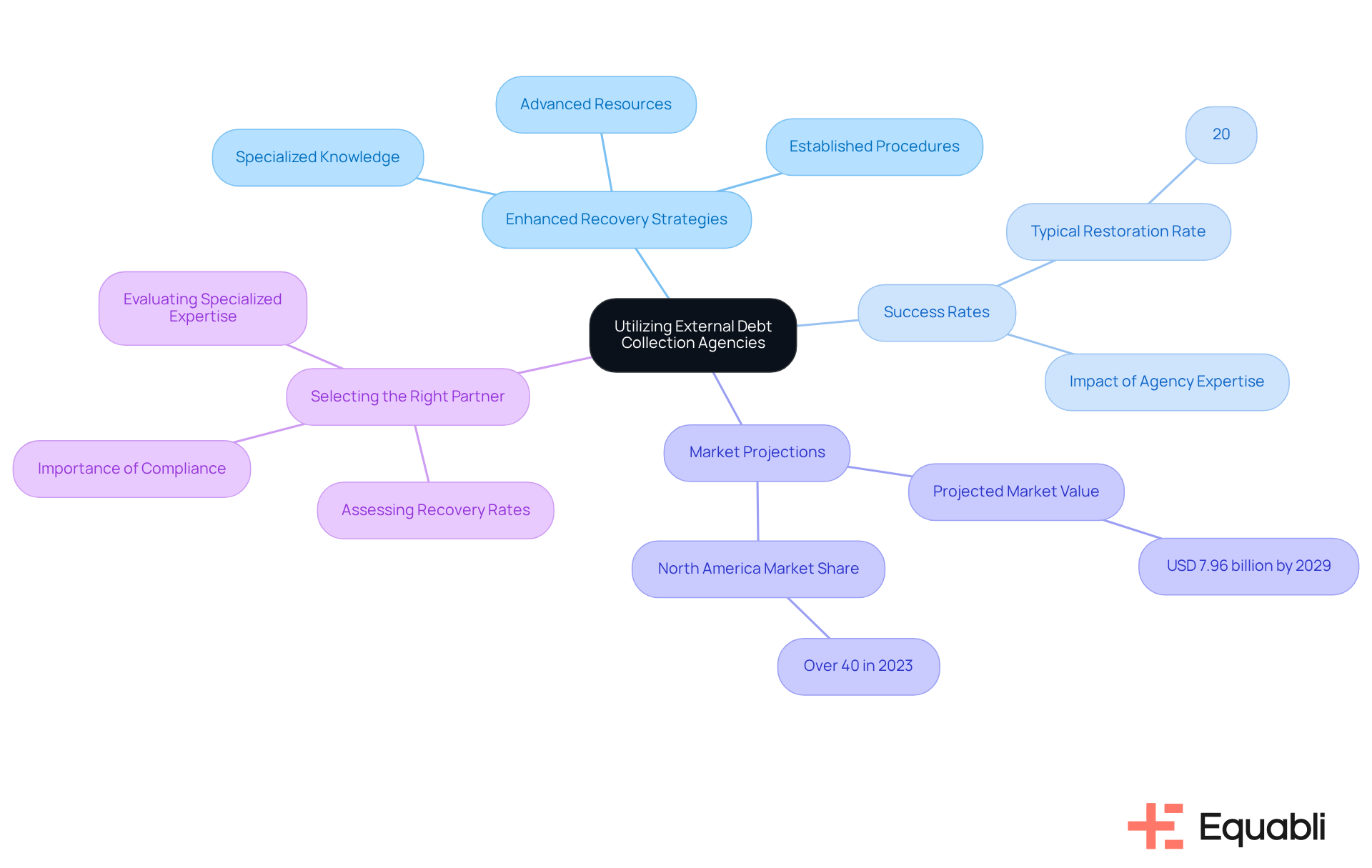

Utilize External Debt Collection Agencies: Leverage Expertise for Difficult Cases

Utilizing external significantly enhances strategies for business-to-business debt recovery in corporate finance for businesses that are confronting challenging debts. These agencies bring specialized knowledge, advanced resources, and established procedures that can markedly improve success rates.

For instance, while the typical restoration rate in the industry hovers around 20%, agencies adept at managing complex cases often achieve higher success rates through tailored strategies and strict adherence to regulatory standards. Recovery rates can fluctuate considerably based on the agency's expertise and the nature of the debt, underscoring the critical importance of selecting the right partner.

By collaborating with reputable agencies, companies can refocus on core operations while trusting experts who employ strategies for business-to-business debt recovery in corporate finance. This partnership not only enhances outcomes but also alleviates the emotional burden associated with debt retrieval, allowing companies to maintain a positive relationship with their clients.

As the market for debt collection services continues to expand—projected to reach USD 7.96 billion by 2029, with North America representing over 40% of the global debt collection agencies market in 2023 and revenues around USD 12.5 billion—leveraging the expertise of these agencies becomes increasingly essential for effective financial management.

Businesses should assess potential agency partners based on their recovery rates and specialized expertise in strategies for business-to-business debt recovery in corporate finance to ensure optimal outcomes.

Conclusion

Incorporating innovative strategies for business-to-business debt recovery is essential for enhancing financial health within corporate finance. This article underscores the necessity of adopting intelligent solutions, such as Equabli's EQ Suite, which revolutionizes traditional debt retrieval methods. By leveraging data-driven insights and automated processes, organizations can significantly improve their recovery outcomes, streamline operations, and foster stronger relationships with clients.

Key strategies discussed include:

- Establishing clear payment terms

- Sending invoices promptly

- Removing barriers to payment

- Incentivizing early settlements

Each of these approaches plays a critical role in ensuring timely payments and maintaining cash flow. Furthermore, implementing a systematic follow-up process and enforcing penalties for late payments can further enhance compliance and accountability. The integration of automation in accounts receivable processes not only increases efficiency but also allows businesses to focus on core operations while effectively managing collections.

Ultimately, organizations must remain proactive in reviewing and adapting their debt recovery policies to align with changing market dynamics. By embracing these strategies, businesses can navigate the complexities of debt recovery more effectively, ensuring sustainable financial practices and improved client relationships. Taking action now to implement these strategies will position companies for greater success in managing their debt recovery processes in the future.

Frequently Asked Questions

What is Equabli's EQ Suite and what does it include?

Equabli's EQ Suite is an advanced solution for debt recovery that includes the EQ Engine, EQ Engage, and EQ Collect. These tools utilize data-driven strategies to forecast repayment behaviors and improve recovery efforts.

How does EQ Collect enhance operational efficiency?

EQ Collect reduces vendor onboarding timelines with an intuitive, no-code file-mapping tool, which enhances operational efficiency and revenue generation.

What benefits do automated workflows provide in debt recovery?

Automated workflows minimize execution errors and reduce reliance on manual resources, leading to increased efficiency in debt recovery processes.

How does EQ Engage improve borrower communication?

EQ Engage allows organizations to design and automate borrower contact strategies, creating personalized communication journeys that enable borrowers to self-service with customized repayment plans.

What impact can the adoption of Equabli's solutions have on debt recovery?

The integration of Equabli's solutions can elevate debt recoveries by up to 65% and increase transaction arrangements by 40%, improving overall recovery outcomes.

Why are clear payment terms important in business-to-business debt recovery?

Clear payment terms set expectations for due dates, acceptable settlement methods, and penalties for delays, which helps cultivate accountability and reduces transaction delays.

What are some examples of structured financial terms?

Examples include Net 30, Net 60, or due on receipt (DOR), which can improve Days Sales Outstanding (DSO) and enhance liquidity and operational efficiency.

How can early settlement discounts benefit organizations?

Offering early settlement discounts can incentivize prompt payments, bolster cash flow, and reduce receivables, optimizing fiscal operations.

Why is timely invoicing crucial for cash flow?

Timely invoicing helps maintain healthy cash flow by ensuring invoices are issued immediately after goods or services are delivered, reducing the risk of overdue charges.

What advantages do automated invoicing systems provide?

Automated invoicing systems can save up to 70% in invoice processing time, allowing organizations to focus on core activities rather than chasing receivables.

What percentage of invoices in the U.S. are settled post-due date?

Evidence shows that 39% of invoices in the United States are settled after the due date, with many delays attributed to inaccuracies in invoices.