Overview

The article presents a compelling analysis of the strategic advantages of conversational AI in debt collection. It highlights significant enhancements in:

- Productivity

- Cost efficiency

- Customer engagement

- Regulatory compliance

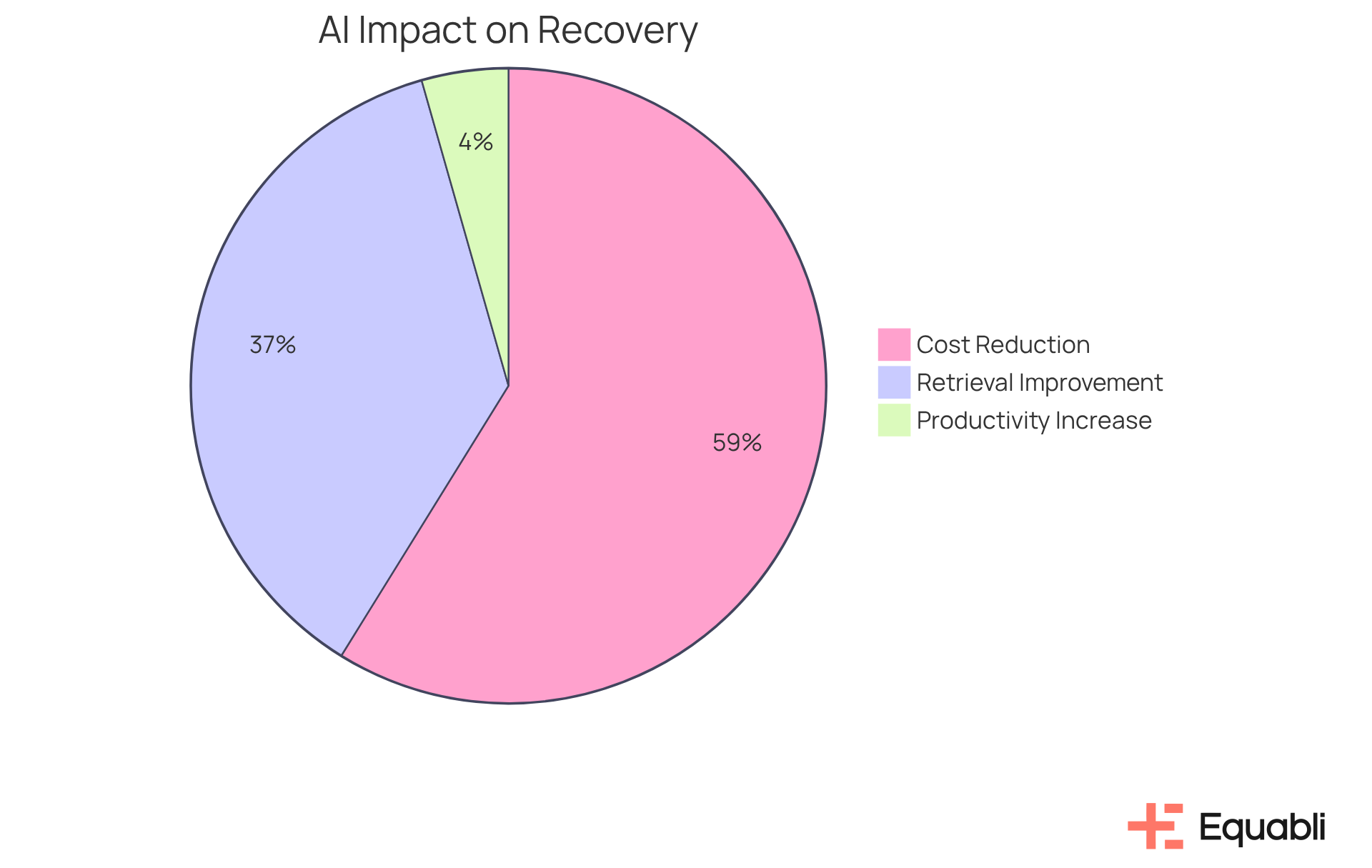

Evidence indicates that the integration of AI technologies can:

- Amplify collector productivity by two to four times

- Reduce operational costs by as much as 50%

- Elevate retrieval rates by up to 25%

These improvements fundamentally transform the efficiency and effectiveness of debt recovery processes, offering actionable insights for enterprises aiming to optimize their collections strategies.

Introduction

Conversational AI is fundamentally transforming debt collection by enhancing operational efficiency and customer engagement. Organizations that adopt these intelligent solutions experience significant advantages, including reduced operational costs and improved retrieval rates. However, a critical question arises: how can businesses effectively harness the strategic benefits of conversational AI to streamline processes and cultivate stronger relationships with borrowers? This article explores the multifaceted advantages of implementing conversational AI in debt collection, demonstrating its role in driving innovation and operational excellence within the financial recovery sector.

Equabli's EQ Suite: Transforming Debt Collection with Intelligent AI Solutions

Equabli's EQ Suite is revolutionizing debt recovery through its intelligent AI solutions. This suite empowers lenders and agencies to develop customized scoring models and optimize retrieval strategies using tools such as EQ Engine, EQ Engage, and EQ Collect. Notably, EQ Collect features a no-code file-mapping tool that streamlines vendor onboarding, automated workflows that reduce execution errors, and real-time reporting that ensures unparalleled transparency. These capabilities significantly enhance operational efficiency, driving productivity while delivering tailored solutions that meet the unique needs of each client. As a result, organizations can expect markedly improved retrieval outcomes.

The strategic benefits of conversational AI implementation in enterprise debt collection processes have been demonstrated through the integration of AI technologies, which can increase collector productivity by 2 to 4 times and decrease operational costs by 30 to 50%. Furthermore, companies leveraging AI in credit and receivables report retrieval rate improvements of up to 25%, which underscores the strategic benefits of conversational AI implementation in enterprise debt collection processes within the financial recovery landscape. With the EQ Suite, Equabli positions itself as an industry leader, fostering a shift towards more .

The AI financial recovery market is projected to grow at a CAGR of 16.9%, reaching $15.9 billion by 2034. This growth highlights the strategic benefits of conversational AI implementation in enterprise debt collection processes, indicating a critical trend for organizations aiming to enhance their debt recovery strategies.

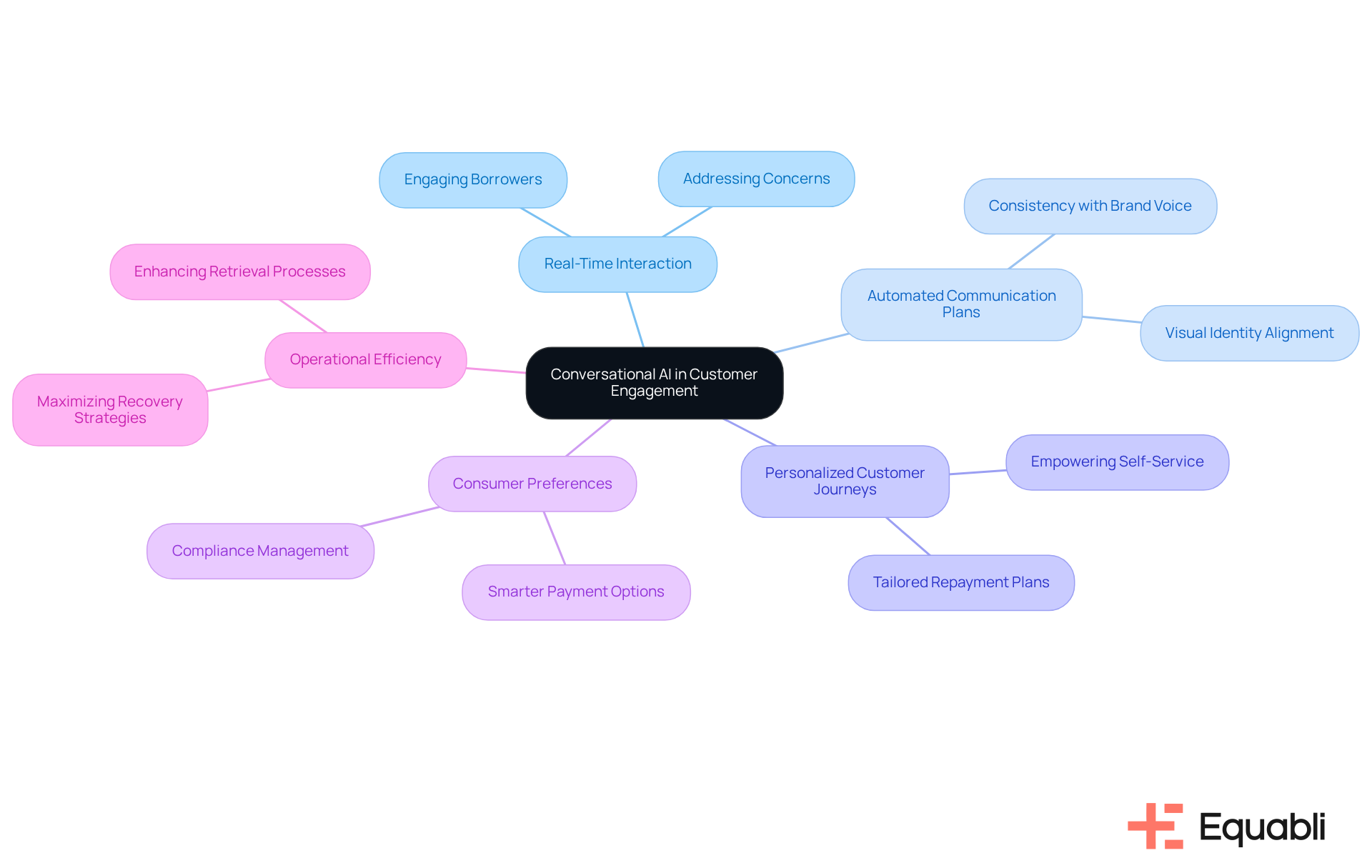

Enhanced Customer Engagement: Leveraging Conversational AI for Improved Communication

Conversational AI serves as a pivotal tool in enhancing customer engagement by establishing a more interactive and responsive communication channel. Evidence suggests that the strategic benefits of conversational AI implementation in enterprise debt collection processes are evident as chatbots and virtual assistants allow collectors to engage borrowers in real-time, effectively addressing their concerns and queries. This approach not only improves the overall customer experience but also fosters a sense of trust and transparency, essential in the retrieval process.

By leveraging EQ Engage, collectors can develop and automate borrower communication plans that ensure interactions are consistent with their brand voice and visual identity. Furthermore, the creation of personalized customer communication journeys empowers borrowers to self-service with tailored repayment plans, thereby enhancing operational efficiency.

Additionally, EQ Engage captures consumer preferences, which facilitates smarter payment options and compliance management. This strategic capability ultimately while highlighting the strategic benefits of conversational AI implementation in enterprise debt collection processes, thereby enhancing overall efficiency in retrieval processes. In conclusion, the strategic benefits of conversational AI implementation in enterprise debt collection processes are imperative for enterprises aiming to optimize their debt collection and compliance frameworks.

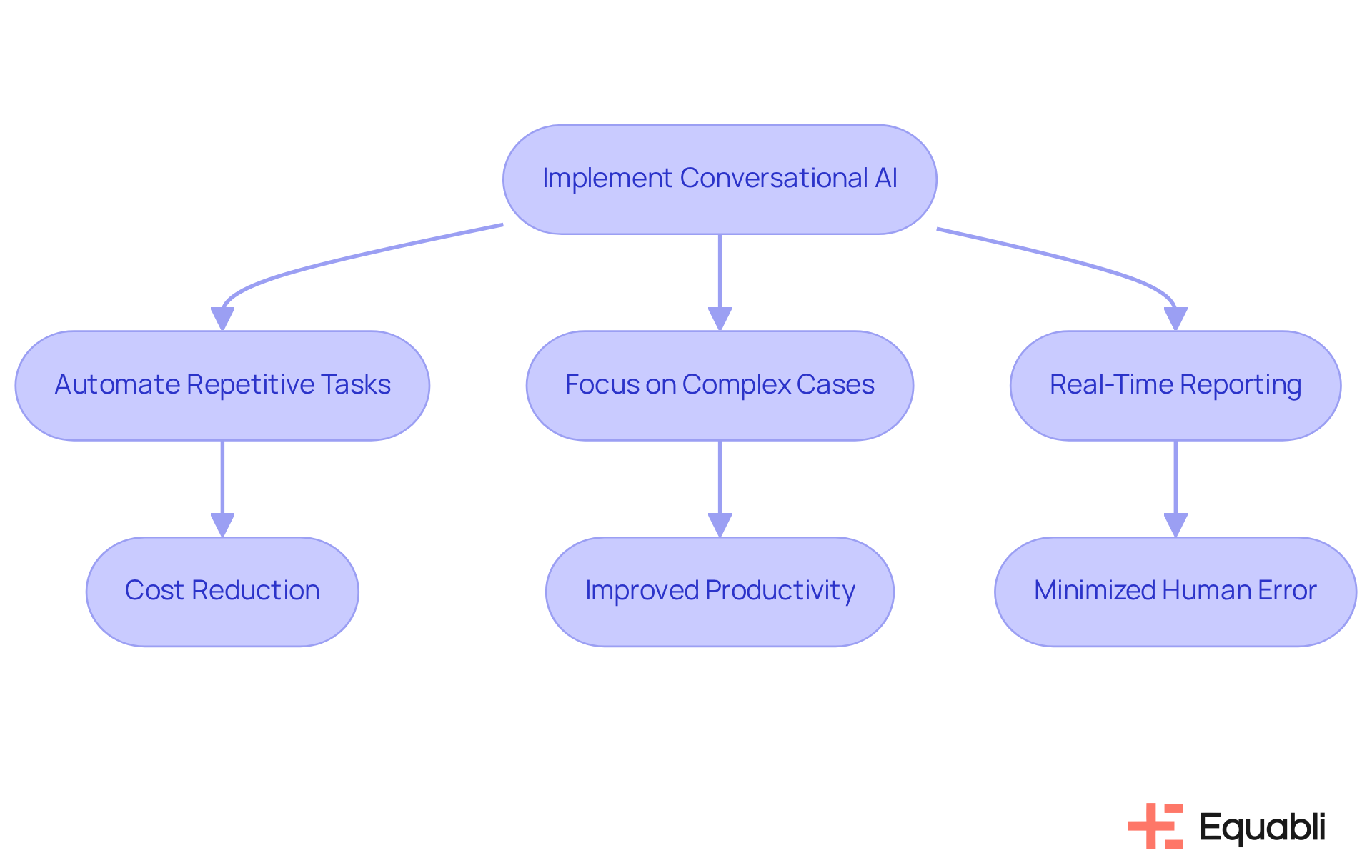

Cost Reduction: Automating Processes with Conversational AI in Debt Collection

The strategic benefits of conversational AI implementation in enterprise debt collection processes include substantial cost reductions through the automation of repetitive tasks, such as follow-ups and payment reminders. By utilizing the strategic benefits of conversational AI implementation in enterprise debt collection processes, this automation allows agents to focus on more complex cases, thereby enhancing productivity and reducing overall recovery expenses.

For instance, EQ Collect's no-code file-mapping tool significantly shortens vendor onboarding timelines, streamlining operations further. Moreover, the strategic benefits of conversational AI implementation in enterprise debt collection processes include minimizing human error and boosting operational efficiency through automated workflows that decrease execution mistakes.

The real-time reporting capabilities of EQ Collect demonstrate the strategic benefits of conversational AI implementation in enterprise debt collection processes by providing unparalleled clarity and insights, ensuring that retrieval strategies are driven by data and effectiveness. This fusion of not only improves performance but also guarantees industry-leading compliance oversight through automated monitoring, ultimately transforming the recovery process.

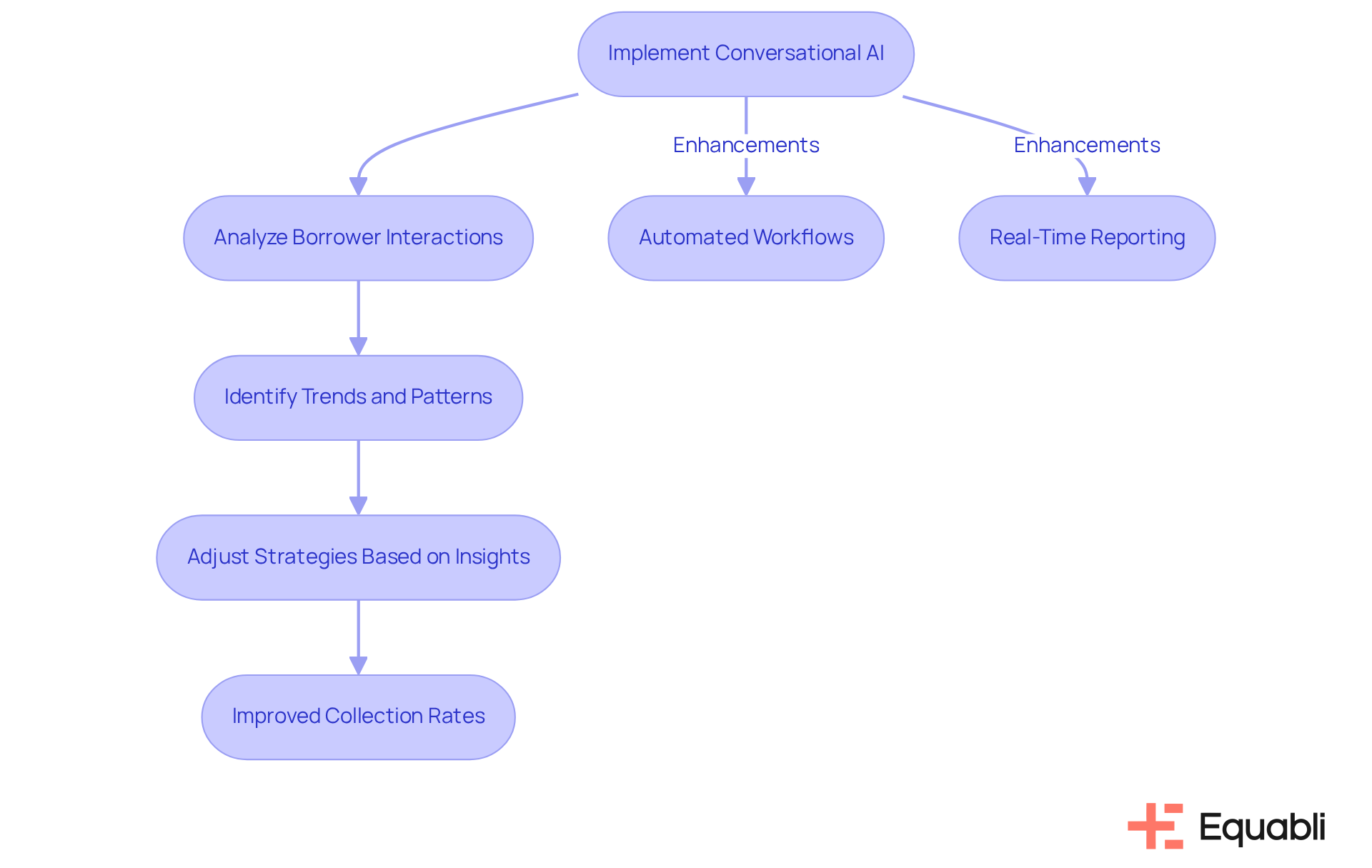

Real-Time Data Insights: Utilizing AI for Informed Decision-Making in Collections

The strategic benefits of conversational AI implementation in enterprise debt collection processes include providing critical real-time data insights that are vital for informed decision-making in debt recovery. By analyzing borrower interactions and payment behaviors, AI tools can identify trends and patterns that showcase the strategic benefits of conversational AI implementation in enterprise debt collection processes, enabling recovery agencies to adjust their strategies effectively.

This , enhanced by EQ Collect's automated workflows and real-time reporting, allows organizations to reduce execution errors and adopt proactive decision-making.

The no-code file-mapping tool significantly accelerates vendor onboarding processes, while robust compliance supervision ensures collection agencies operate within regulatory frameworks, thereby enhancing operational efficiency and ultimately leading to improved collection rates.

Personalized Interactions: Boosting Customer Satisfaction with AI-Driven Engagement

AI-driven engagement through EQ Engage transforms customer interactions by facilitating personalized communication that greatly enhances customer satisfaction. By analyzing borrower preferences and behaviors, EQ Engage customizes communication strategies to meet individual needs, which includes managing inventory, establishing engagement rules, and segmenting borrowers based on performance history. This level of customization not only but also increases the likelihood of successful financial recovery.

Furthermore, companies that utilize AI for customer interactions report a 30-50% increase in satisfaction, as these systems deliver timely and relevant responses. Personalized email campaigns achieve transaction rates six times higher than their non-personalized counterparts, underscoring the effectiveness of targeted communication in fostering engagement.

As organizations increasingly adopt AI technologies, recognizing the strategic benefits of conversational AI implementation in enterprise debt collection processes will be essential for improving recovery rates and cultivating lasting customer relationships.

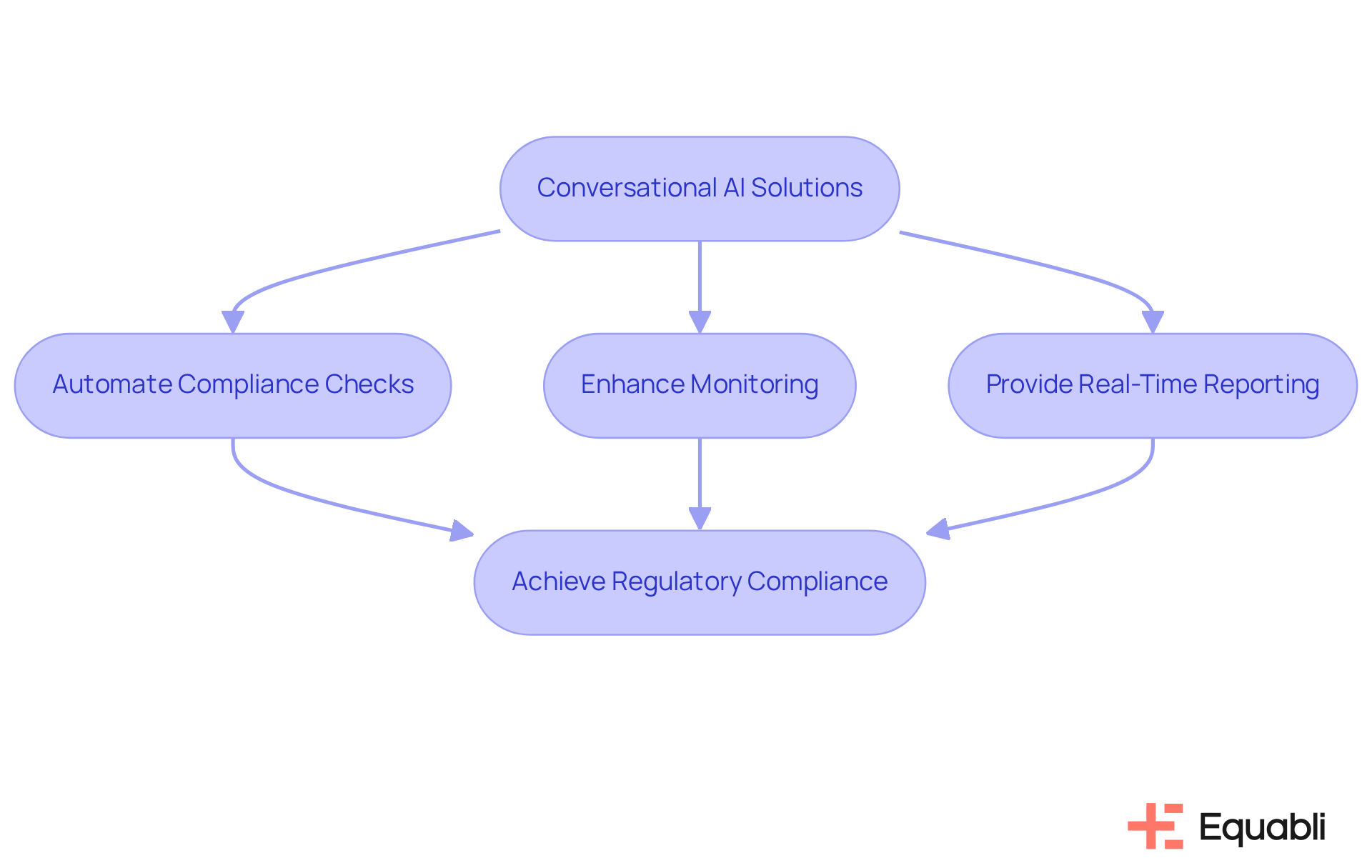

Regulatory Compliance: Ensuring Adherence through Conversational AI Solutions

Conversational AI solutions are instrumental in ensuring regulatory compliance within financial recovery. By automating compliance checks and maintaining precise records of interactions, these AI tools empower organizations to meet legal obligations effectively.

For instance, EQ Collect's automated workflows significantly reduce the risk of non-compliance, while its automated monitoring enhances oversight capabilities. Furthermore, the real-time reporting functions of EQ Collect provide organizations with transparency and insights, thereby reinforcing the integrity of revenue retrieval.

This unwavering and data protection underscores Equabli's dedication to supporting financial institutions in navigating the complexities inherent in financial recovery.

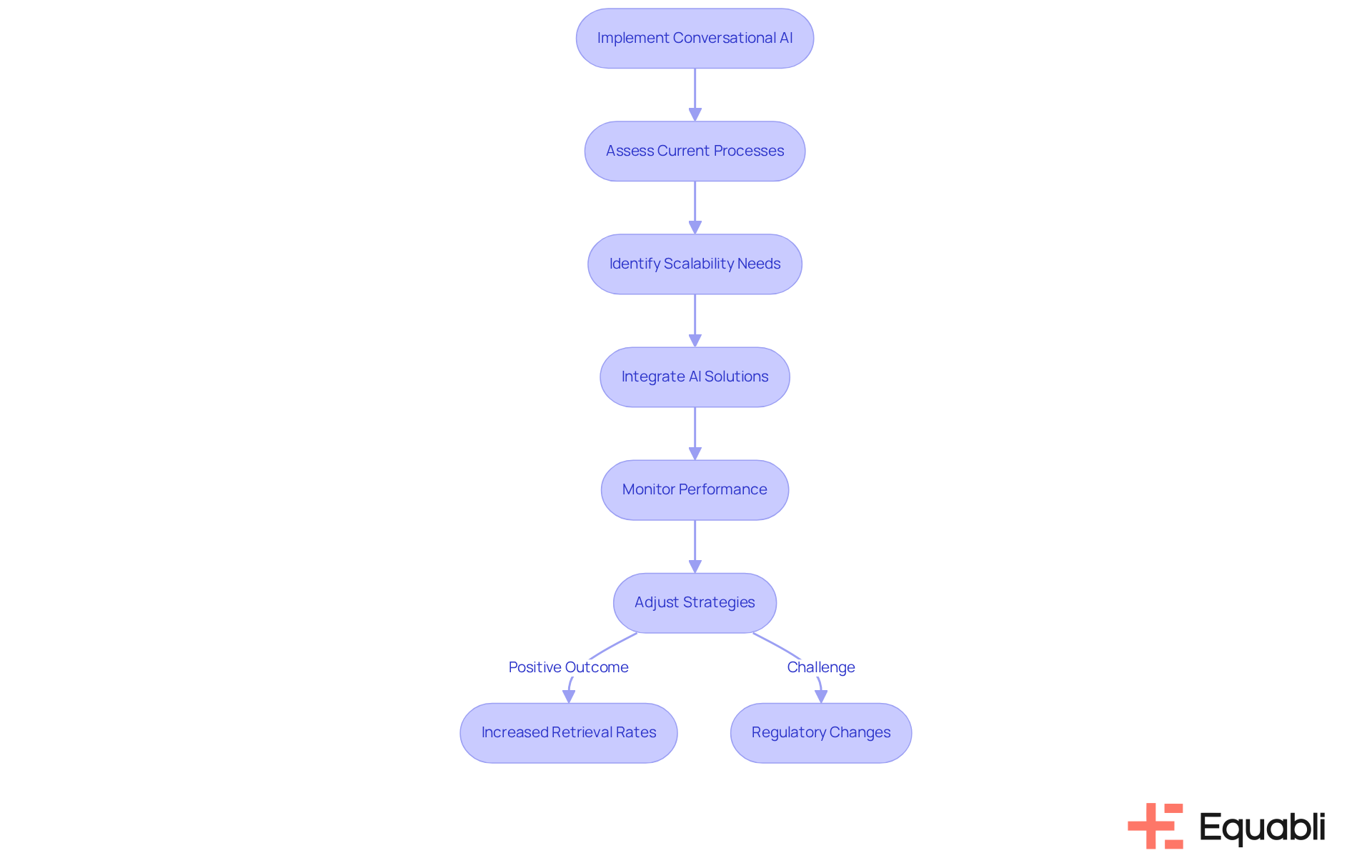

Scalability: Adapting Conversational AI to Meet Changing Collection Demands

The strategic benefits of conversational AI implementation in enterprise debt collection processes include unparalleled scalability, allowing debt recovery agencies to adapt seamlessly to changing demands. Whether managing an influx of new accounts or responding to seasonal variations, can be adjusted in scale without sacrificing service quality. This adaptability ensures that organizations can realize the strategic benefits of conversational AI implementation in enterprise debt collection processes, maintaining efficiency and effectiveness in their recovery efforts, irrespective of external pressures.

Evidence suggests that firms outsourcing accounts receivable typically see a 25-30% increase in retrieval rates compared to internal efforts, highlighting the operational advantages of incorporating AI. As Manny Plasencia, senior director of TransUnion’s third-party recovery business, states, 'Utilizing data to drive the right approach in a rapidly changing environment is becoming more impactful to recovery and performance than ever.'

Despite these advancements, challenges remain in assessing resource efficiency, underscoring the need for clear data standards and consistent process updates. Additionally, the evolving regulatory landscape introduces further considerations regarding the application of AI solutions, making flexibility essential for success in the financial recovery sector.

By leveraging EQ Collect's features, such as automated workflows and real-time reporting, agencies can realize the strategic benefits of conversational AI implementation in enterprise debt collection processes, enhancing their operational efficiency and leading to smarter orchestration and improved performance in their retrieval strategies.

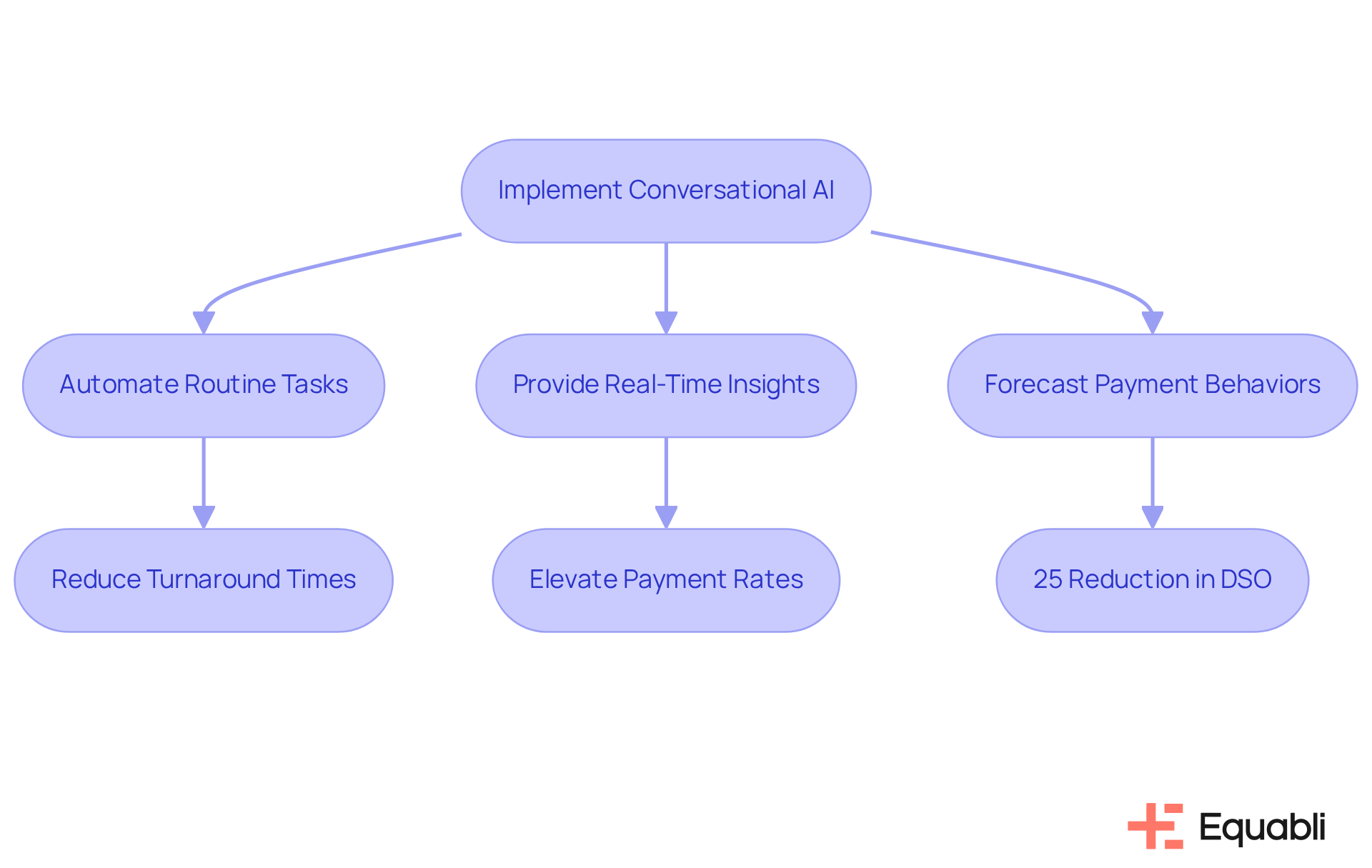

Workflow Optimization: Streamlining Debt Collection Processes with AI Integration

The strategic benefits of conversational AI implementation in enterprise debt collection processes are evident as it significantly enhances operational efficiency in debt retrieval workflows. Evidence suggests that automation of routine tasks and the provision of real-time insights empower agents, streamlining operations and reducing turnaround times. Organizations that have adopted AI technologies report an average 25% reduction in days sales outstanding (DSO), demonstrating the substantial efficiency gains achievable through AI integration.

Furthermore, AI systems analyze over 200 data points to forecast payment behaviors, facilitating customized communication approaches that can elevate payment rates by as much as 30% compared to conventional methods. This capability allows organizations to and effectively, enhancing the overall efficiency of retrieval methods.

The shift towards automation in debt recovery is not merely a trend; it is becoming essential to leverage the strategic benefits of conversational AI implementation in enterprise debt collection processes to maintain a competitive advantage in a rapidly evolving financial landscape. Executives must recognize that embracing these technologies is critical to navigating the complexities of enterprise-level debt collection and risk management.

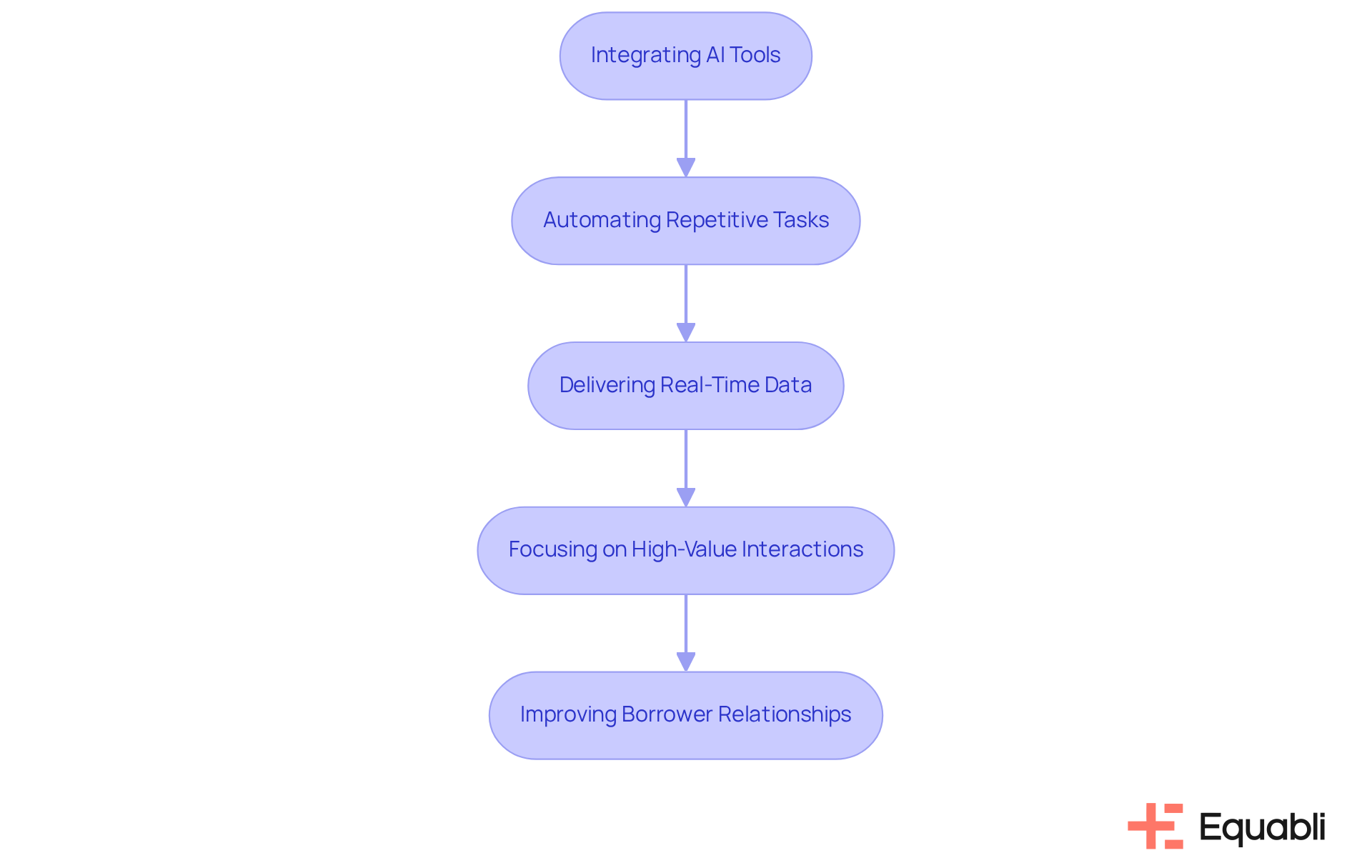

Agent Performance Enhancement: Supporting Collection Agents with AI Tools

Conversational AI tools significantly enhance agent performance by providing essential resources and insights. Evidence shows that the strategic benefits of conversational AI implementation in enterprise debt collection processes, by automating repetitive tasks and delivering real-time data, enable agents to focus on high-value interactions, leading to increased productivity. This shift not only improves but also demonstrates the strategic benefits of conversational AI implementation in enterprise debt collection processes, leading to enhanced job satisfaction among agents as they can engage more meaningfully with borrowers.

For instance, organizations integrating AI into their workflows report a 61% increase in efficiency, allowing agents to manage more inquiries and concentrate on complex cases that necessitate human empathy and judgment. Furthermore, the strategic benefits of conversational AI implementation in enterprise debt collection processes are evident in AI's capability to recognize emotional cues through sentiment analysis, which empowers agents to customize their communication strategies, resulting in improved borrower relationships and higher recovery rates. Consequently, the combination of AI assistance and human knowledge cultivates a more productive and fulfilling work environment for agents.

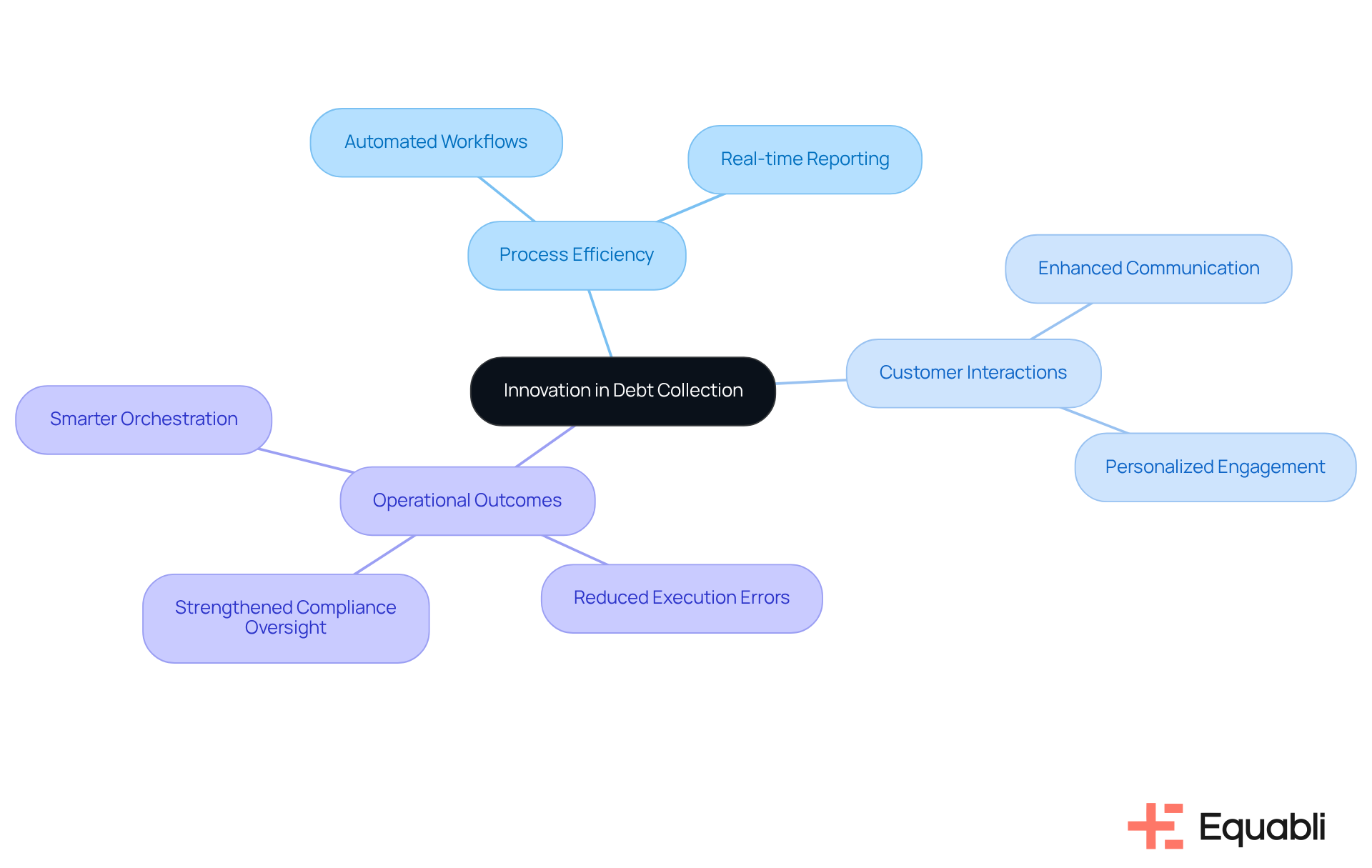

Innovation in Debt Collection: Driving Change with Conversational AI Technologies

Conversational AI technologies are catalyzing significant innovation in the debt recovery sector. These technologies are fundamentally transforming debt management by enhancing process efficiency, improving customer interactions, and delivering actionable insights, highlighting the strategic benefits of conversational AI implementation in enterprise debt collection processes.

For instance, solutions like EQ Collect provide automated workflows and real-time reporting, enabling organizations to minimize manual tasks and bolster their financial performance. This advancement not only reduces execution errors but also strengthens , facilitating smarter orchestration and improved operational outcomes.

Organizations that adopt these innovations position themselves to better navigate market fluctuations and address the evolving needs of borrowers, thereby leveraging the strategic benefits of conversational AI implementation in enterprise debt collection processes for long-term success in the collections landscape.

Conclusion

The integration of conversational AI in debt collection signifies a pivotal transformation in organizational approaches to financial recovery. By leveraging intelligent AI solutions, companies can significantly enhance operational efficiency, improve customer engagement, and achieve substantial cost reductions. This technological advancement streamlines processes and empowers agents, enabling them to concentrate on high-value interactions and cultivate stronger relationships with borrowers.

Key benefits of conversational AI include:

- Increased productivity

- Enhanced customer satisfaction

- Improved compliance oversight

The EQ Suite from Equabli exemplifies these advantages, showcasing features that facilitate real-time data insights, personalized communication, and scalable solutions. As organizations adapt to the evolving landscape of debt collection, the strategic benefits of implementing conversational AI become increasingly evident, positioning them for sustained success.

Embracing conversational AI is essential for organizations aiming to thrive in a competitive market. As the financial recovery sector evolves, the emphasis on innovative technologies will be critical in addressing borrower demands and optimizing debt collection strategies. By prioritizing the integration of AI, companies can ensure they remain at the forefront of industry advancements, ultimately driving more effective and efficient recovery outcomes.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a collection of intelligent AI solutions designed to revolutionize debt recovery. It includes tools such as EQ Engine, EQ Engage, and EQ Collect, which empower lenders and agencies to develop customized scoring models and optimize retrieval strategies.

What features does EQ Collect offer?

EQ Collect features a no-code file-mapping tool for streamlined vendor onboarding, automated workflows that reduce execution errors, and real-time reporting for enhanced transparency.

How does conversational AI improve debt collection processes?

Conversational AI increases collector productivity by 2 to 4 times and reduces operational costs by 30 to 50%. It also improves retrieval rates by up to 25% for companies leveraging AI in credit and receivables.

What are the projected growth trends for the AI financial recovery market?

The AI financial recovery market is projected to grow at a compound annual growth rate (CAGR) of 16.9%, reaching $15.9 billion by 2034.

How does EQ Engage enhance customer communication?

EQ Engage allows collectors to develop and automate borrower communication plans, ensuring consistent interactions that align with brand voice and visual identity. It also facilitates personalized customer communication journeys for tailored repayment plans.

What cost reductions can be achieved through conversational AI in debt collection?

Conversational AI automates repetitive tasks such as follow-ups and payment reminders, allowing agents to focus on complex cases. This automation minimizes human error and enhances productivity, leading to substantial cost reductions.

How does EQ Collect ensure operational efficiency?

EQ Collect's no-code file-mapping tool shortens vendor onboarding timelines, while its automated workflows reduce execution mistakes. Real-time reporting provides insights that drive data-driven retrieval strategies.

What is the significance of compliance in the EQ Suite?

The EQ Suite guarantees industry-leading compliance oversight through automated monitoring, ensuring that debt recovery processes are not only effective but also compliant with regulations.