Overview

The article highlights critical criteria that financial institutions must consider when selecting debt collection agencies. Evaluating vendor reputation, technology adoption, customization capabilities, and cost-effectiveness is paramount, as these factors significantly influence recovery rates and operational efficiency. By prioritizing these elements, institutions can establish successful partnerships that enhance their overall debt collection strategies.

Introduction

Selecting the appropriate debt collection agency represents a significant challenge for financial institutions, particularly in light of the complexities inherent in the financial recovery landscape. With a multitude of options available, organizations must navigate a complex array of criteria to identify a provider that not only aligns with their operational requirements but also optimizes recovery outcomes.

This article examines seven critical vendor selection criteria that are essential for financial institutions aiming to implement effective debt collection strategies.

What elements fundamentally influence the success of a debt recovery agency, and how can organizations utilize these criteria to make informed, strategic decisions?

Equabli's EQ Suite: Comprehensive Tools for Modern Debt Collection

Equabli's EQ Suite offers a suite of powerful tools—EQ Engine, EQ Engage, and EQ Collect—each meticulously designed to enhance the collection process. The EQ Engine employs predictive analytics to forecast repayment behaviors with high accuracy, allowing agencies to prioritize accounts with the greatest potential and tailor their strategies accordingly. This predictive capability is essential; studies show that such analytics can improve recovery rates by as much as 25%.

Furthermore, EQ Engage streamlines borrower communication through preferred channels, ensuring outreach is both timely and relevant. It empowers borrowers with self-service options for tailored repayment plans, thereby fostering personalized communication journeys that significantly increase the likelihood of effective debt management.

Meanwhile, EQ Collect automates retrieval strategies through a no-code file-mapping tool, which reduces vendor onboarding timelines and enhances operational efficiency. This tool minimizes execution errors and reliance on manual resources through , promoting compliance through continuous monitoring and ensuring adherence to regulations while delivering real-time insights.

Collectively, these tools enable organizations to modernize their assets, resulting in substantial improvements in recovery outcomes and a reduction in operational expenses by 30-50%. As the financial recovery landscape continues to evolve, the integration of advanced analytics and automation is vital for achieving sustainable growth and maintaining a competitive edge.

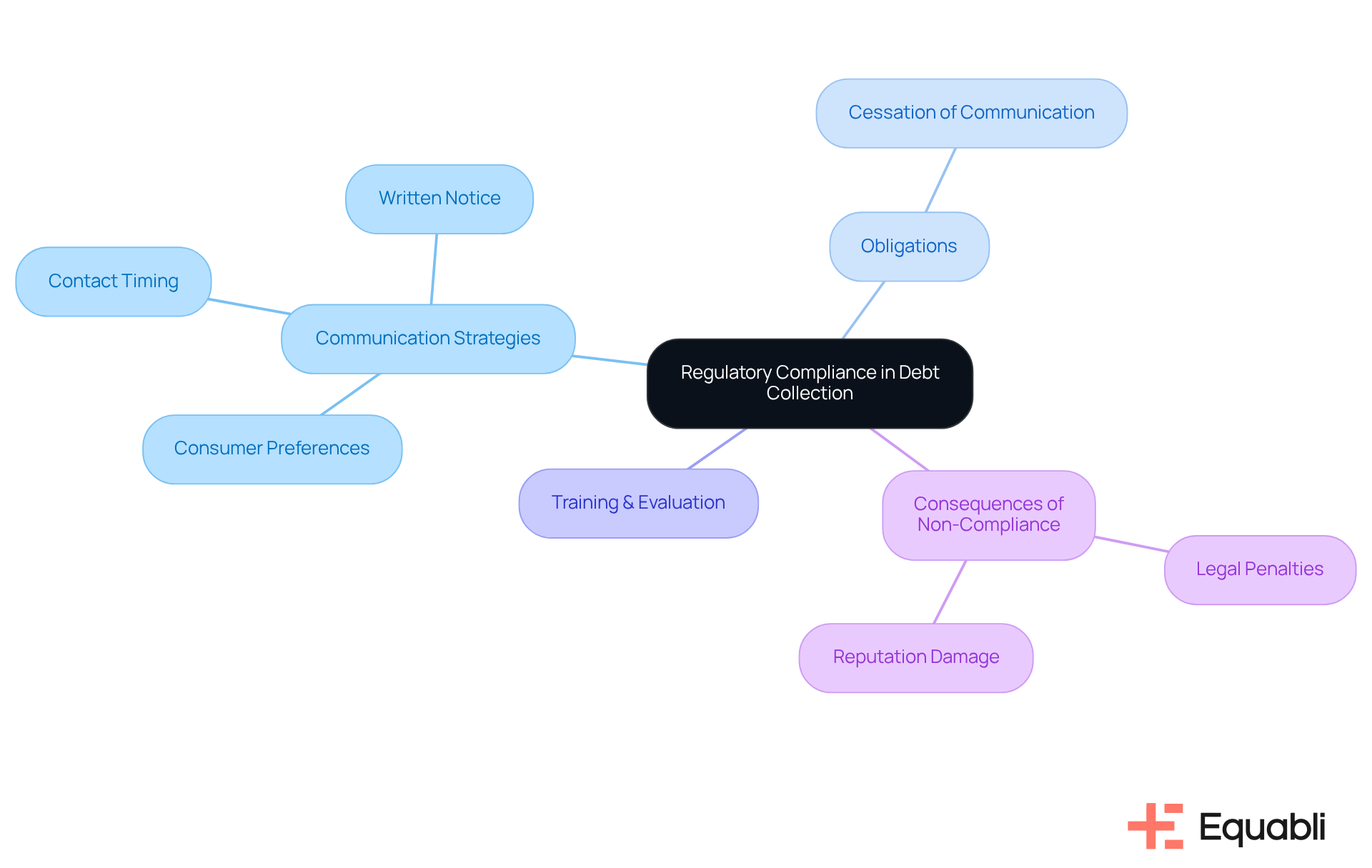

Regulatory Compliance: Ensuring Adherence to Debt Collection Laws

Debt recovery agencies must prioritize adherence to the Fair Debt Practices Act (FDCPA) and other relevant regulations to ensure ethical operations. This commitment requires a comprehensive understanding of permissible communication strategies, including:

- Honoring consumer preferences for communication channels under Regulation F

- Refraining from contact before 8 AM or after 9 PM local time

- The obligation to provide a written notice outlining the obligation within five days of initial communication

Maintaining accurate records is crucial, as it supports transparency and accountability in collection practices. Furthermore, agencies must cease communication if a consumer questions the legitimacy of an obligation, thereby reinforcing consumer rights.

Regular training sessions and evaluations are essential for organizations to stay abreast of regulatory changes, thereby mitigating the risk of costly penalties. A pertinent example is the recent agreement involving Encore Capital Group, which highlighted the consequences of non-compliance; the firm was found to have collected payments without sufficient evidence of legitimacy and employed deceptive practices, resulting in a $12 million compensation to affected consumers. Legal specialists emphasize that ethical financial recovery not only protects consumers but also enhances the reputation of organizations, fostering trust and long-lasting relationships with clients.

By adhering to these guidelines, organizations can navigate the complexities of financial recovery while ensuring equitable treatment of consumers.

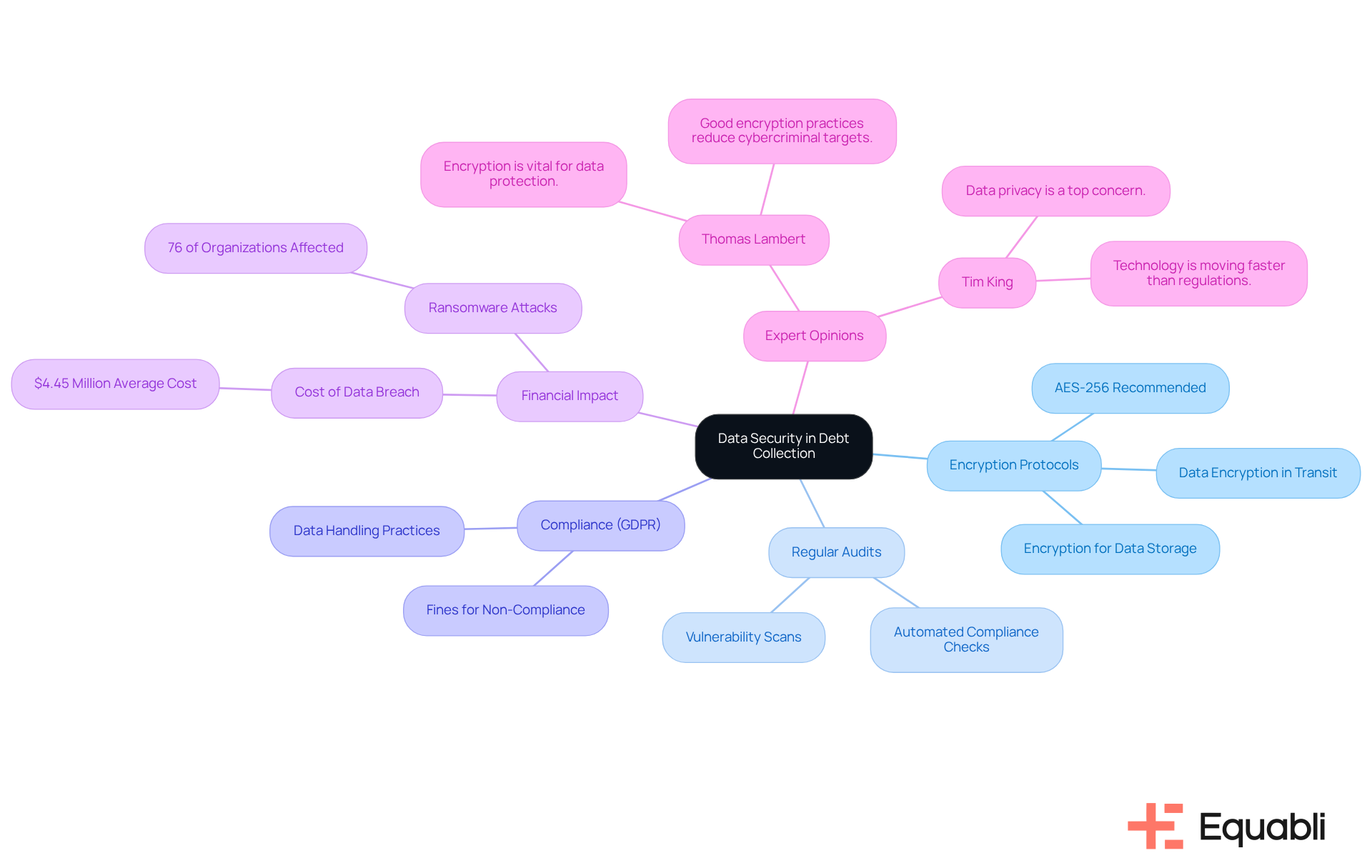

Data Security: Protecting Sensitive Information in Debt Collection

To safeguard sensitive information from breaches, debt collection firms must adopt rigorous , a commitment exemplified by Equabli. This includes the implementation of encryption protocols for both data storage and transmission, which are critical for protecting personal and financial information. Equabli effectively secures personal information against unauthorized access, use, or disclosure, ensuring that all personal data transmitted is encrypted in transit and stored securely.

Regular security audits play a vital role in identifying vulnerabilities and ensuring adherence to data protection regulations like GDPR, which enforces strict data handling practices. Notably, some organizations have successfully integrated automated compliance checks to bolster their GDPR compliance. By prioritizing these security measures, agencies enhance their operational integrity and foster trust with clients, significantly mitigating the risk of data breaches.

Recent statistics indicate that the average cost of a data breach in 2023 was $4.45 million, highlighting the financial repercussions of insufficient security. Furthermore, 76% of organizations reported experiencing ransomware attacks in the past year, underscoring the pressing need for robust data protection strategies.

As Thomas Lambert, a Senior Data Protection Consultant, asserts, 'By implementing encryption protection measures, companies can significantly reduce the risk of privacy breaches, security breaches, and unauthorized data access.' Tim King, Executive Editor, emphasizes, 'With a new wave of AI set to revolutionize how we live and work, data privacy has never been more important than it is today.'

This proactive approach is essential in an industry that is under increasing scrutiny for its management of sensitive data. Equabli's stringent policies guarantee that all information collected is treated with the highest level of confidentiality.

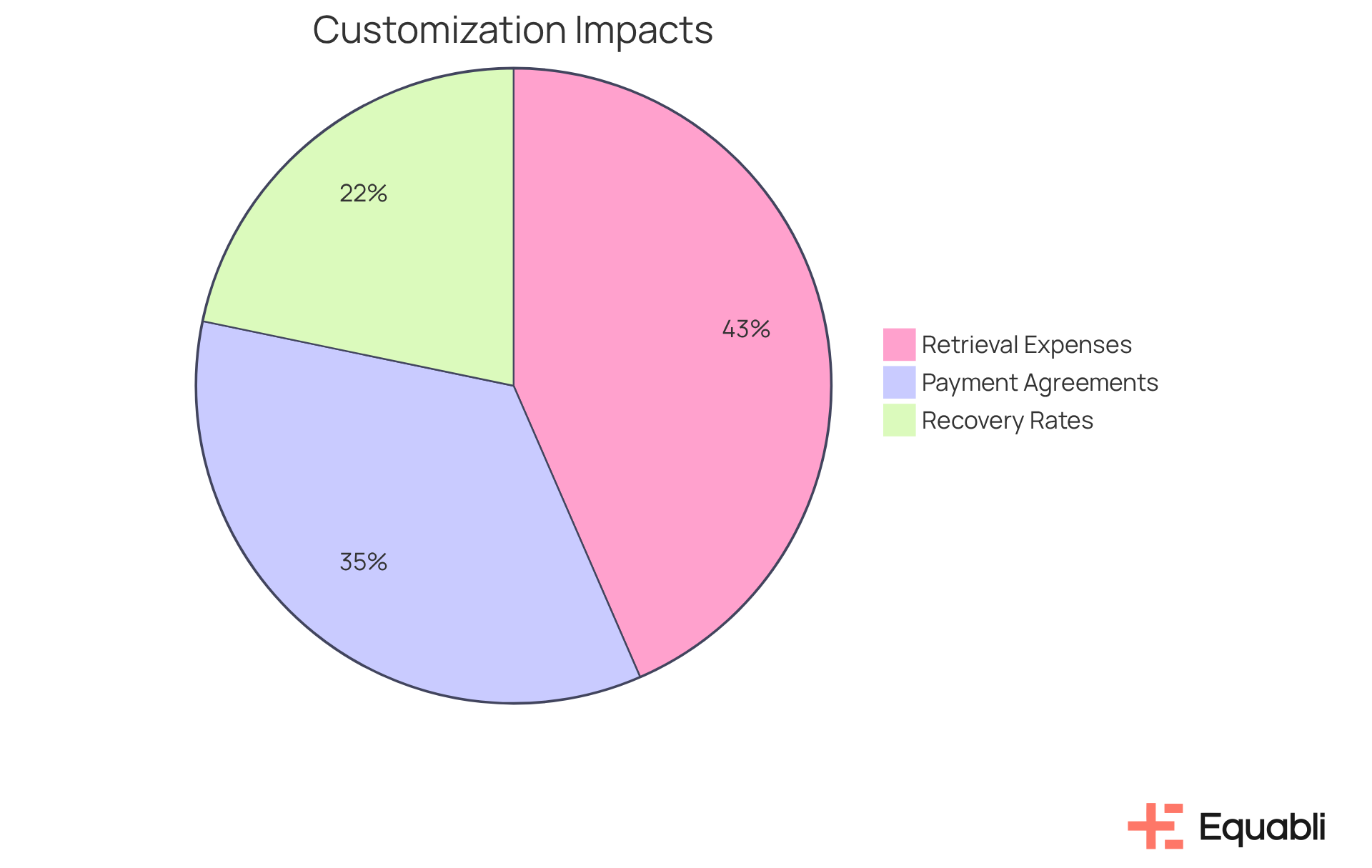

Customization Capabilities: Tailoring Strategies to Client Needs

Agencies must prioritize suppliers that align with the vendor selection criteria for debt collection agencies in financial institutions, providing customizable solutions that enable them to tailor retrieval strategies to meet the specific requirements of their clients. Evidence suggests that developing personalized communication plans, flexible payment options, and engagement strategies that reflect debtor behavior significantly enhances recovery rates.

For instance, industry studies indicate that personalized retrieval strategies can lead to a 25% increase in recovery rates. Furthermore, a can enhance customer interaction, resulting in a 40% rise in payment agreements and a 50% reduction in retrieval expenses through the utilization of virtual agents.

By focusing on tailored communication, agencies can foster stronger relationships with debtors, thereby improving the overall customer experience and achieving superior recovery outcomes. As highlighted by industry leaders, centering strategies around individuals not only boosts recovery rates but also cultivates trust and loyalty among clients.

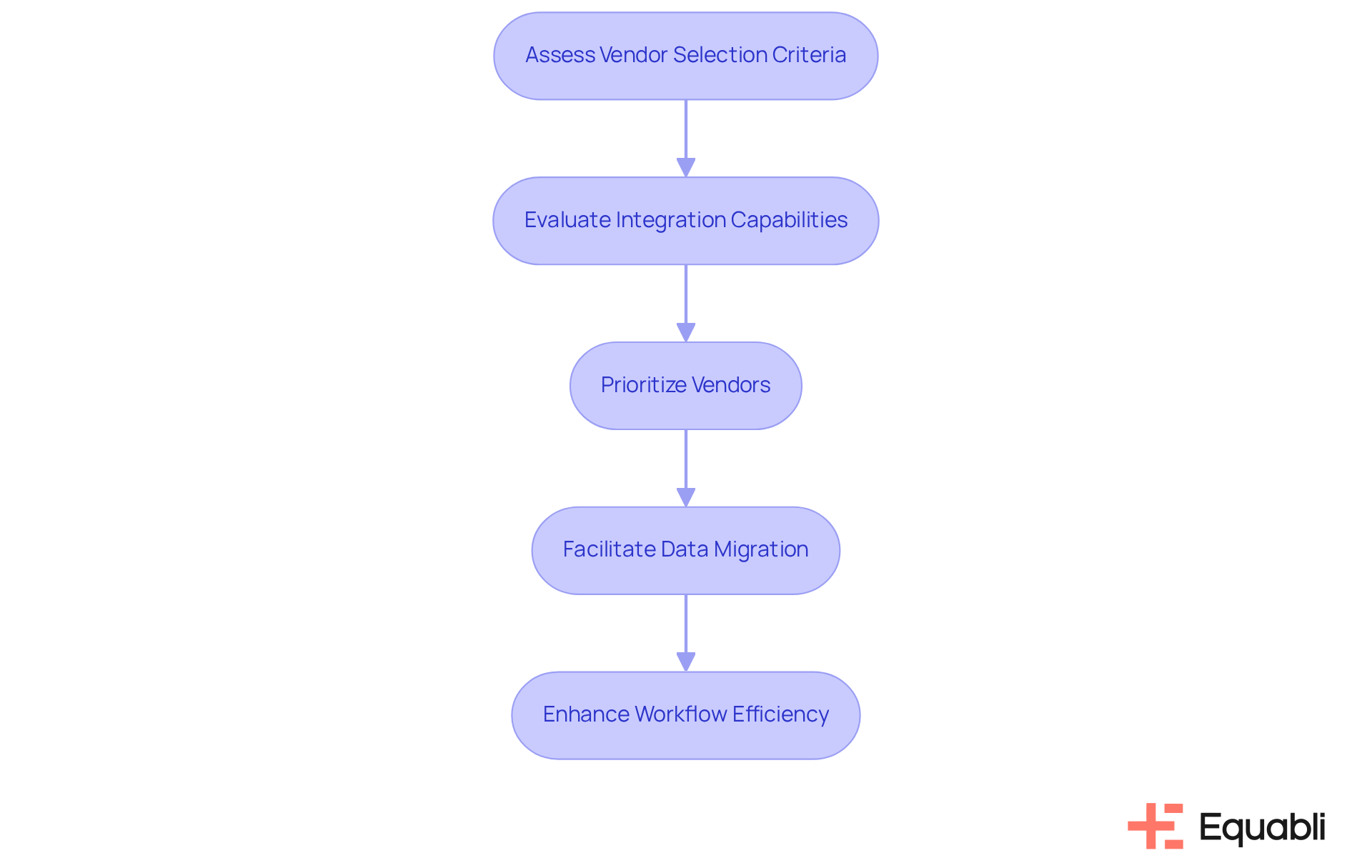

System Integration: Ensuring Compatibility with Existing Infrastructure

Choosing a recovery service provider necessitates a thorough assessment based on the vendor selection criteria for debt collection agencies in financial institutions, particularly regarding the effectiveness of their systems in integrating with existing infrastructure, such as CRM and accounting applications. This compatibility is vital for minimizing operational disruptions and enhancing workflow efficiency.

Agencies should prioritize suppliers according to the vendor selection criteria for debt collection agencies in financial institutions, focusing on those that exhibit strong integration capabilities to facilitate seamless data migration and interoperability. Current trends demonstrate that successful data migration not only streamlines processes but also significantly mitigates the risk of errors during transitions.

As technology experts emphasize, aligning new solutions with existing systems is essential for maintaining operational continuity. For example, the Starter Team Plan from PDCflow, priced at $9 per month, serves as a cost-effective solution that promotes easy integration.

By concentrating on the vendor selection criteria for debt collection agencies in financial institutions, agencies can enhance their overall effectiveness in debt collection. This is further underscored in the case study "The Role of Debt Collection in the American Economy," which highlights the in supporting economic stability.

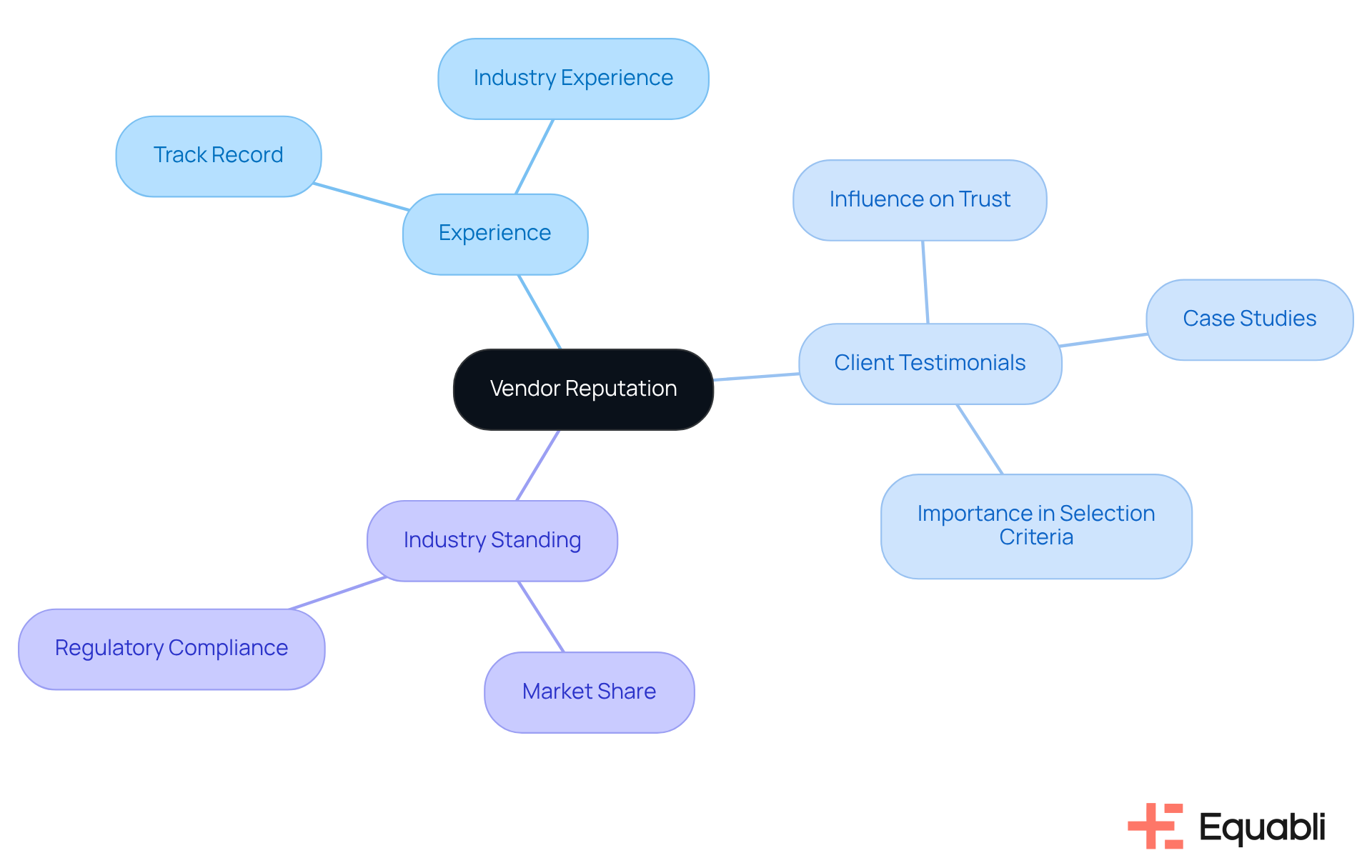

Vendor Reputation: Assessing Experience and Industry Standing

Agencies must conduct comprehensive research when evaluating potential suppliers, using the vendor selection criteria for debt collection agencies in financial institutions, which include their experience, client testimonials, and overall industry reputation. This process necessitates a thorough examination of any regulatory violations or complaints associated with the supplier. A reputable supplier typically demonstrates a strong history of success, supported by favorable client feedback that serves as a testament to their capabilities.

Recent trends indicate that testimonials are increasingly utilized not only as endorsements but also as and effectiveness within the debt collection landscape. For instance, case studies reveal that organizations leveraging client testimonials have experienced heightened trust and engagement from potential clients, ultimately fostering improved partnerships.

Industry analysts underscore that the trust derived from client testimonials significantly influences decision-making processes, making it imperative for firms to prioritize this aspect in their supplier selection criteria. Furthermore, with North America accounting for over 40% of the global market for financial recovery firms, generating revenues of approximately USD 12.5 billion, the significance of selecting trustworthy partners cannot be overstated. In a landscape where maintaining consumer trust and satisfaction poses increasing challenges, the role of client testimonials becomes even more critical.

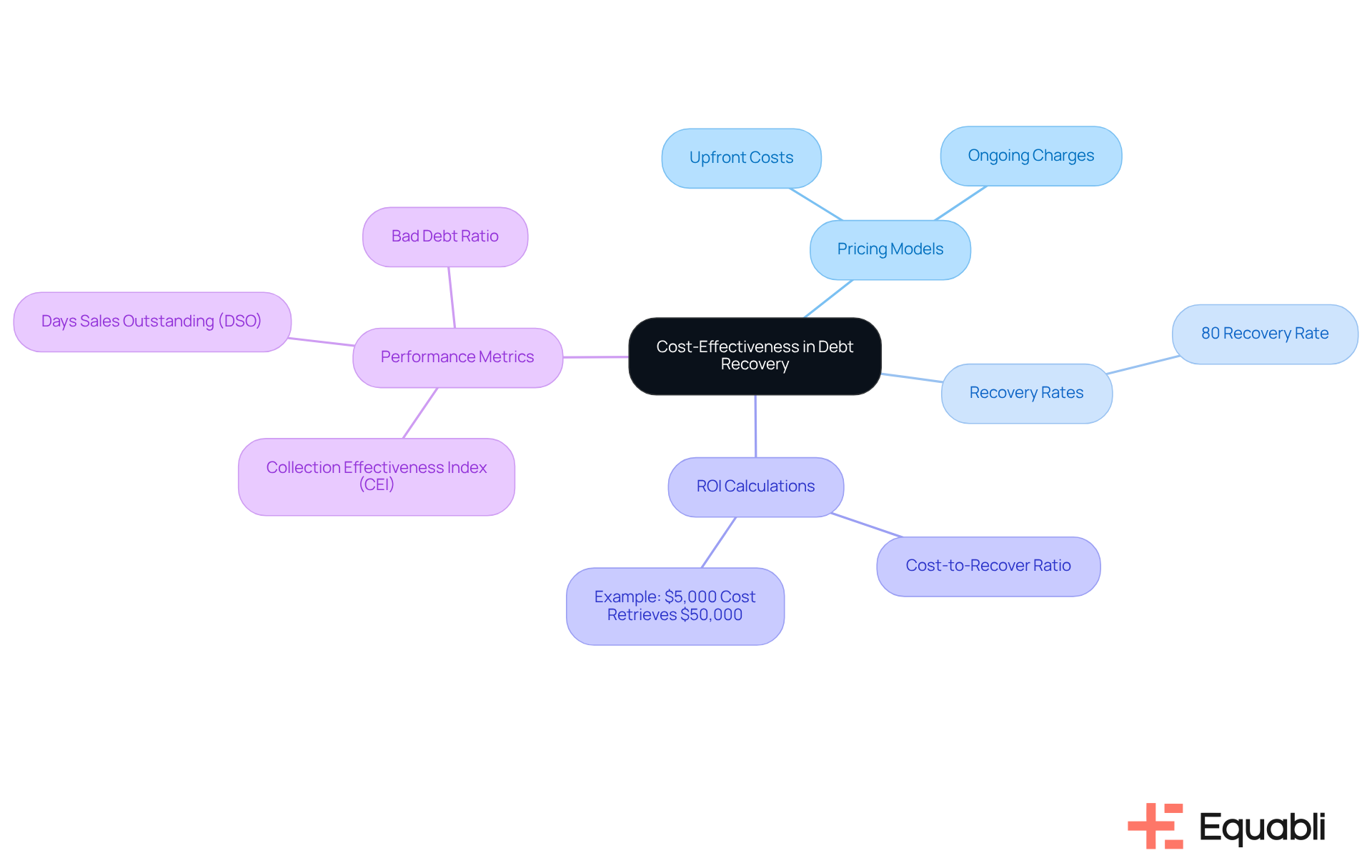

Cost-Effectiveness: Evaluating Pricing Structures and ROI

When selecting a , financial institutions must meticulously evaluate the pricing models of potential providers, taking into account both upfront costs and ongoing charges. A thorough analysis of recovery rates and the effectiveness of the supplier's retrieval strategies is crucial for assessing potential return on investment (ROI). For instance, a supplier demonstrating a recovery rate of 80% can significantly enhance the overall efficiency of recovery efforts, leading to a more favorable ROI.

Cost-effective solutions not only reduce expenses but also optimize recovery results. For example, if an organization allocates $5,000 to recovery efforts and successfully retrieves $50,000, this results in a cost-to-recover ratio of 10%, indicating a positive ROI. Furthermore, monitoring metrics such as the Collection Effectiveness Index (CEI) and Days Sales Outstanding (DSO) can yield valuable insights into the efficacy of collection strategies.

Financial analysts underscore the necessity of ongoing evaluation of these metrics to pinpoint areas for enhancement. By leveraging data-driven insights, agencies can refine their strategies, ensuring that their investments generate positive outcomes. Ultimately, a well-structured ROI analysis not only facilitates informed decision-making based on vendor selection criteria for debt collection agencies in financial institutions but also fosters sustainable growth in debt recovery initiatives.

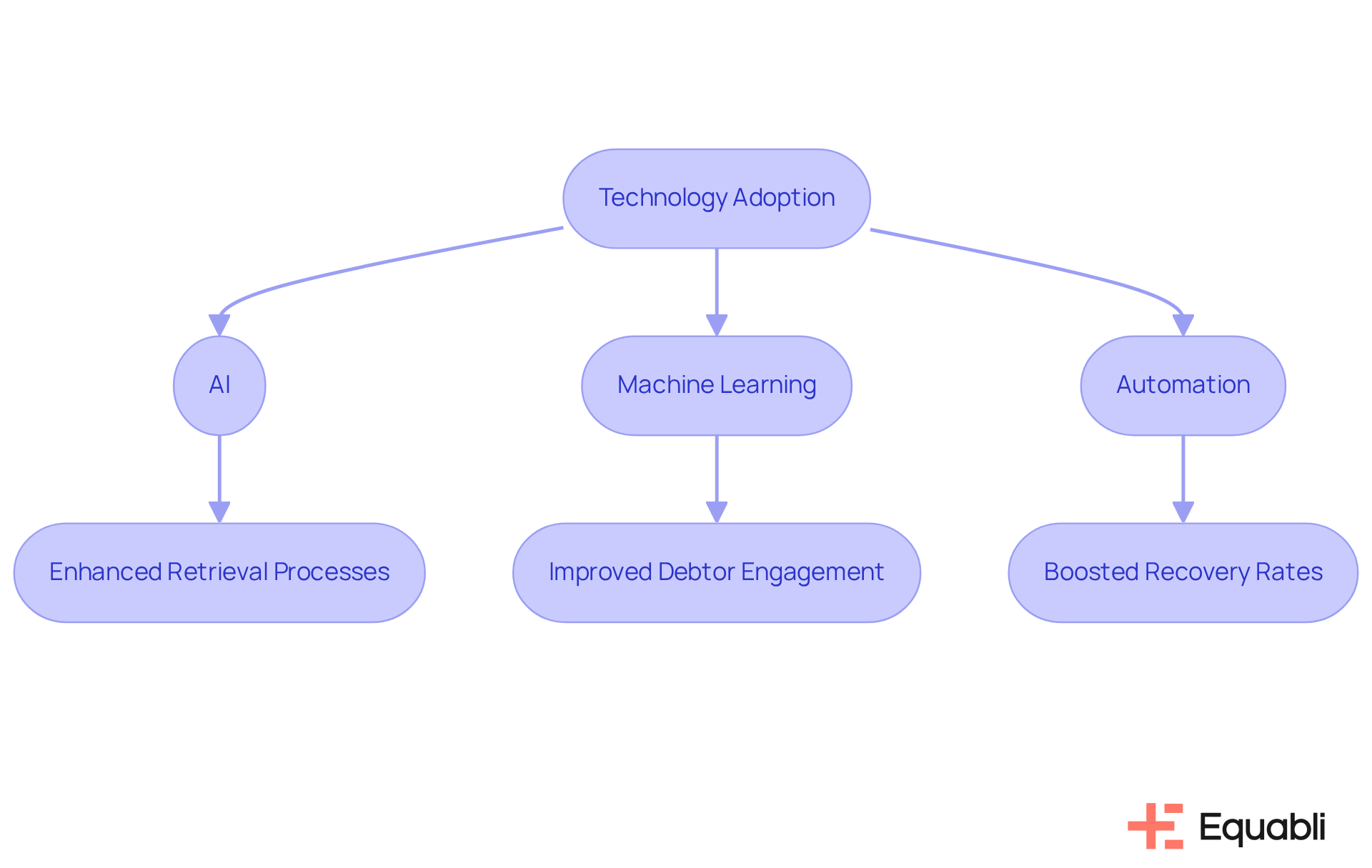

Technology Adoption: Leveraging Advanced Tools for Efficiency

Agencies must prioritize partnerships with vendors that leverage advanced technologies such as AI, machine learning, and automation to enhance their retrieval processes. Equabli's EQ Suite exemplifies this transformation by offering cloud-based solutions that make collections intelligent and intuitive. These innovations streamline operations while enhancing debtor engagement and significantly boosting recovery rates. Organizations implementing AI-driven solutions like the EQ Engine have reported an average 30% reduction in days sales outstanding (DSO), showcasing the tangible benefits of these technologies.

Furthermore, the EQ Suite's custom scoring models can examine customer payment behaviors, allowing organizations to foresee potential late payments and proactively tackle them with customized strategies. As Chris Warburton from ROstrategy notes, the integration of technology with human expertise is essential for meeting modern consumer expectations. By embracing innovative tools, such as EQ Collect's automation and compliance features, organizations can improve proactive compliance, fostering borrower trust and bolstering institutional reputation. This strategy positions them to uphold a in the swiftly changing financial recovery environment, ensuring they are well-prepared to manage the intricacies of compliance and customer interaction.

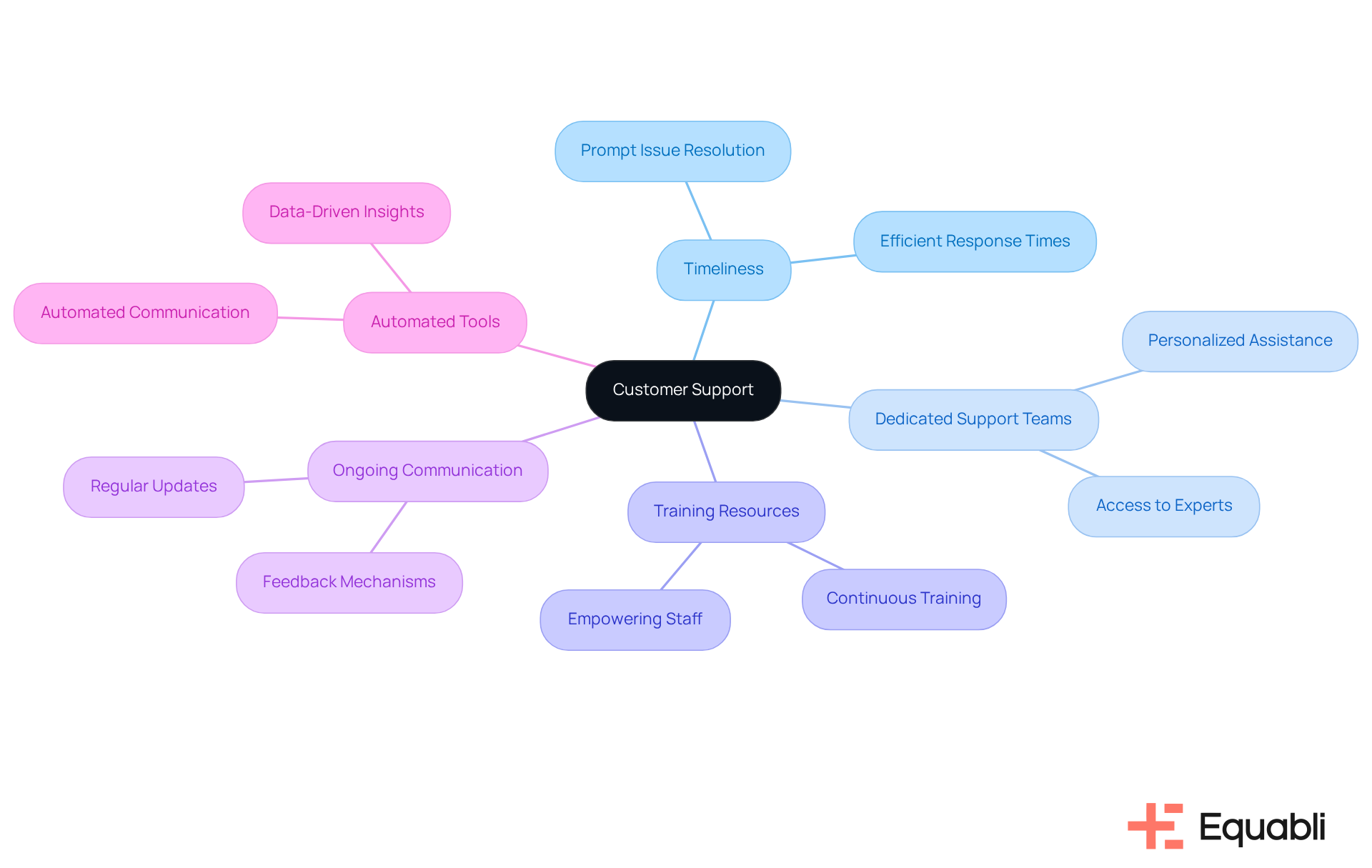

Customer Support: Ensuring Responsive and Effective Service

Assessing the quality of customer assistance provided by prospective suppliers is essential for accounts receivable agencies. Agencies should prioritize vendors that deliver timely and effective support, which includes access to dedicated support teams and comprehensive training resources. Ongoing communication is vital for swiftly resolving issues, thereby maintaining operational efficiency. Robust customer support enhances the overall efficiency of the recovery process and fosters positive relationships with clients.

As highlighted by industry leaders, exceptional service serves as a key differentiator for achieving success. Research indicates that organizations with strong customer support systems can significantly enhance their recovery rates. Current trends underscore the importance of continuous training resources that empower staff to manage customer interactions effectively.

By investing in these areas, including Equabli's customized onboarding procedures and proactive engagement strategies, organizations can ensure preparedness in navigating the complexities of financial recovery while delivering an exceptional customer experience.

To further improve recovery rates, organizations should consider implementing that facilitate prompt outreach to delinquent consumers.

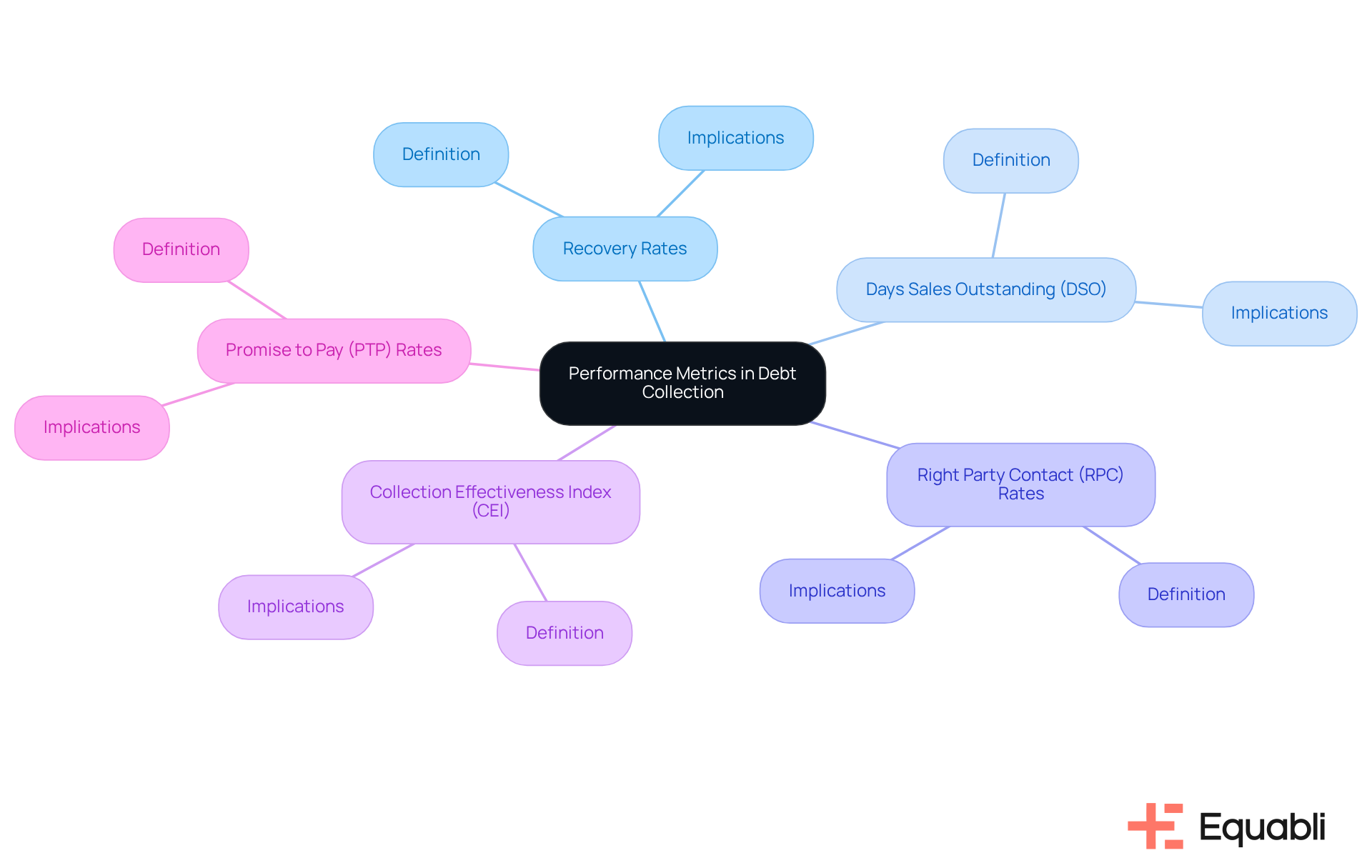

Performance Metrics: Tracking Effectiveness and Outcomes in Debt Collection

To effectively assess the success of financial recovery efforts, agencies must establish clear performance metrics. Key performance indicators (KPIs) such as:

- Recovery rates

- Days Sales Outstanding (DSO)

- Right Party Contact (RPC) rates

- Collection Effectiveness Index (CEI)

- Promise to Pay (PTP) rates

are essential for gaining insights into operational efficiency. A higher recovery rate signifies effective retrieval policies and strong follow-up actions, while a low DSO reflects swift receivables practices. By utilizing Equabli's EQ Suite, financial institutions can modernize their debt retrieval processes, making them more intelligent and intuitive. Consistently evaluating these metrics allows organizations to identify areas requiring enhancement and adjust their strategies accordingly. This proactive strategy not only but also promotes better financial results, ensuring that agencies remain competitive in a challenging market. Industry analysts emphasize that focusing on metrics tied to real financial results is crucial for optimizing collections and achieving sustainable growth.

Conclusion

The selection of a debt collection agency represents a pivotal decision that can profoundly influence financial recovery efforts. By concentrating on essential criteria—such as:

- Technology adoption

- Regulatory compliance

- Data security

- Customization capabilities

- Vendor reputation

- Cost-effectiveness

- Customer support

- Performance metrics

organizations can pinpoint partners that will enhance their recovery strategies. These factors not only promote operational efficiency but also cultivate trust and transparency with clients and consumers alike.

The significance of each criterion has been underscored throughout this article. Advanced tools like Equabli's EQ Suite illustrate how technology can streamline processes and elevate recovery rates. Compliance with regulations safeguards consumer rights and bolsters agency reputations, while stringent data security measures protect sensitive information. Customization in strategies enables agencies to effectively tailor their approaches to client needs, and a solid vendor reputation guarantees reliability in service delivery. Furthermore, assessing cost-effectiveness and performance metrics provides organizations with the insights necessary for informed decision-making.

In a continuously evolving financial landscape, prioritizing these selection criteria is vital for achieving sustainable growth and operational excellence in debt collection. Agencies are encouraged to conduct comprehensive evaluations and pursue partnerships that not only address their immediate requirements but also align with long-term objectives. By adopting these principles, organizations can navigate the complexities of debt recovery with confidence, ultimately resulting in improved outcomes and strengthened client relationships.

Frequently Asked Questions

What tools are included in Equabli's EQ Suite for debt collection?

Equabli's EQ Suite includes three main tools: EQ Engine, EQ Engage, and EQ Collect, each designed to enhance the debt collection process.

How does the EQ Engine improve debt collection?

The EQ Engine uses predictive analytics to forecast repayment behaviors, allowing agencies to prioritize accounts with the highest potential for recovery and tailor their strategies, which can improve recovery rates by up to 25%.

What features does EQ Engage offer for borrower communication?

EQ Engage streamlines communication with borrowers through their preferred channels, providing self-service options for personalized repayment plans, which enhances effective debt management.

How does EQ Collect automate the debt collection process?

EQ Collect features a no-code file-mapping tool that automates retrieval strategies, reduces vendor onboarding timelines, minimizes execution errors, and promotes compliance through continuous monitoring.

What overall impact do these tools have on debt collection agencies?

The tools collectively modernize debt collection practices, leading to significant improvements in recovery outcomes and a reduction in operational expenses by 30-50%.

What regulations must debt recovery agencies comply with?

Agencies must comply with the Fair Debt Practices Act (FDCPA) and other relevant regulations, which include honoring consumer communication preferences, not contacting consumers during prohibited hours, and providing written notices of obligations.

Why is maintaining accurate records important for debt recovery agencies?

Accurate records support transparency and accountability in collection practices and help ensure compliance with regulations.

What are the consequences of non-compliance with debt collection laws?

Non-compliance can lead to costly penalties, as demonstrated by the case of Encore Capital Group, which faced a $12 million compensation due to unethical collection practices.

What data security measures should debt collection firms adopt?

Firms should implement encryption protocols for data storage and transmission, conduct regular security audits, and ensure compliance with data protection regulations like GDPR.

What are the financial implications of insufficient data security?

The average cost of a data breach in 2023 was $4.45 million, and 76% of organizations reported experiencing ransomware attacks, highlighting the need for robust data protection strategies.

How does Equabli ensure the confidentiality of sensitive information?

Equabli employs stringent data protection policies, including encryption and regular audits, to safeguard personal information and maintain the highest level of confidentiality.