Overview

The article underscores the necessity for financial institutions to adopt advanced credit risk management best practices to enhance their operations. By leveraging technology, data analytics, and ensuring regulatory compliance, institutions can optimize credit portfolio management. This strategic approach not only improves borrower engagement but also leads to enhanced risk mitigation and operational efficiency.

Introduction

In an increasingly complex financial landscape, effectively managing credit risk has become paramount for financial institutions. The rise of advanced technologies, coupled with evolving regulatory requirements, presents organizations with both unprecedented opportunities and significant challenges in their credit risk management strategies. This article explores ten best practices that not only enhance operational efficiency but also ensure compliance and mitigate risks.

How can financial institutions leverage these practices to navigate the future of credit risk management successfully?

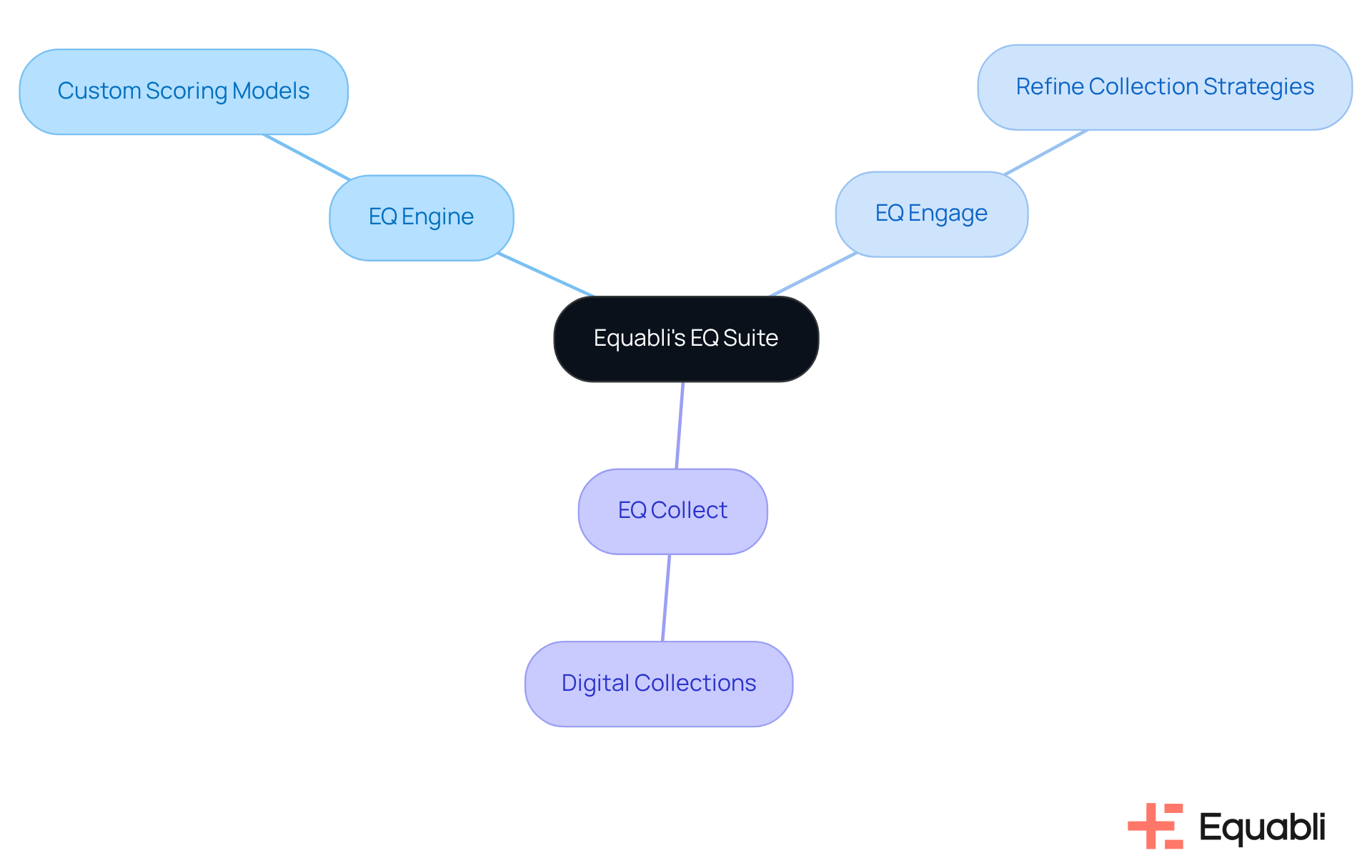

Equabli's EQ Suite: Streamlined Credit Risk Management Solutions

Equabli's EQ Suite provides a robust array of tools tailored for advanced credit risk management best practices for financial institutions. The suite includes the EQ Engine, EQ Engage, and EQ Collect, empowering financial organizations to:

- Develop custom scoring models

- Refine collection strategies

- Facilitate digital collections

Leveraging these solutions enhances operational efficiency in managing delinquency and fosters improved borrower engagement through preferred communication channels. This suite not only reduces operational costs but also ensures , positioning itself as an essential resource for modern financial organizations adopting advanced credit risk management best practices for financial institutions.

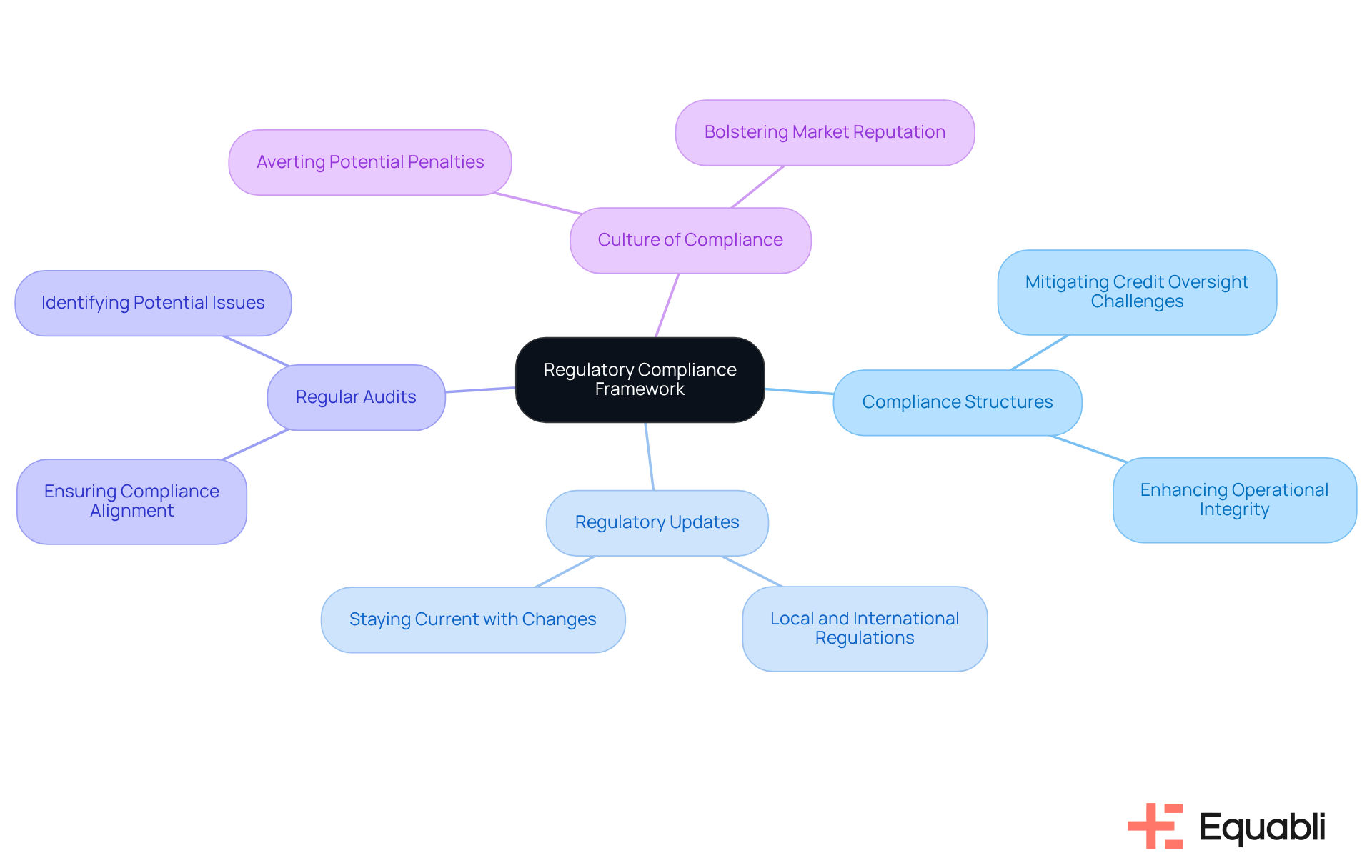

Implement Robust Regulatory Compliance Frameworks

Financial entities must establish robust regulatory compliance structures to mitigate challenges associated with credit oversight. This necessity is underscored by the imperative to remain current with both local and international regulations, coupled with the requirement for regular audits to ensure alignment with . By fostering a culture of compliance, organizations not only avert potential penalties but also bolster their reputation within the market, thereby enhancing operational integrity and stakeholder trust.

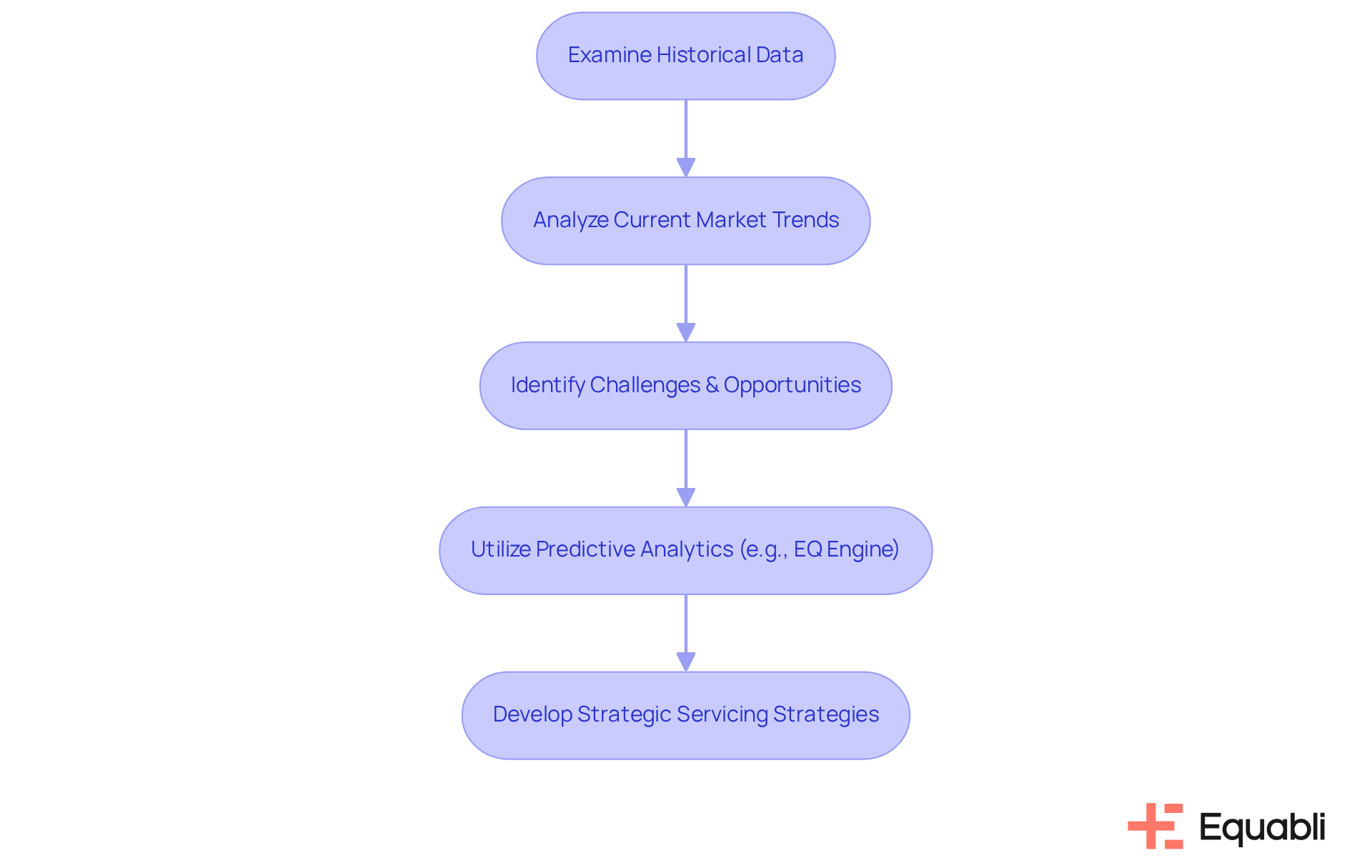

Utilize Advanced Data Analytics for Informed Decision-Making

Sophisticated data analysis is essential for financial entities aiming to adopt advanced credit risk management best practices for financial institutions to make informed decisions regarding credit management. By examining historical data and current market trends, organizations can identify potential challenges and opportunities related to advanced credit risk management best practices for financial institutions.

Predictive analytics, exemplified by Equabli's EQ Engine, allows institutions to anticipate repayment behaviors and assess the likelihood of delinquency for active accounts. This capability empowers organizations to develop tailored to each communication channel, ultimately maximizing net present value (NPV) in debt recovery and enhancing overall operational efficiency.

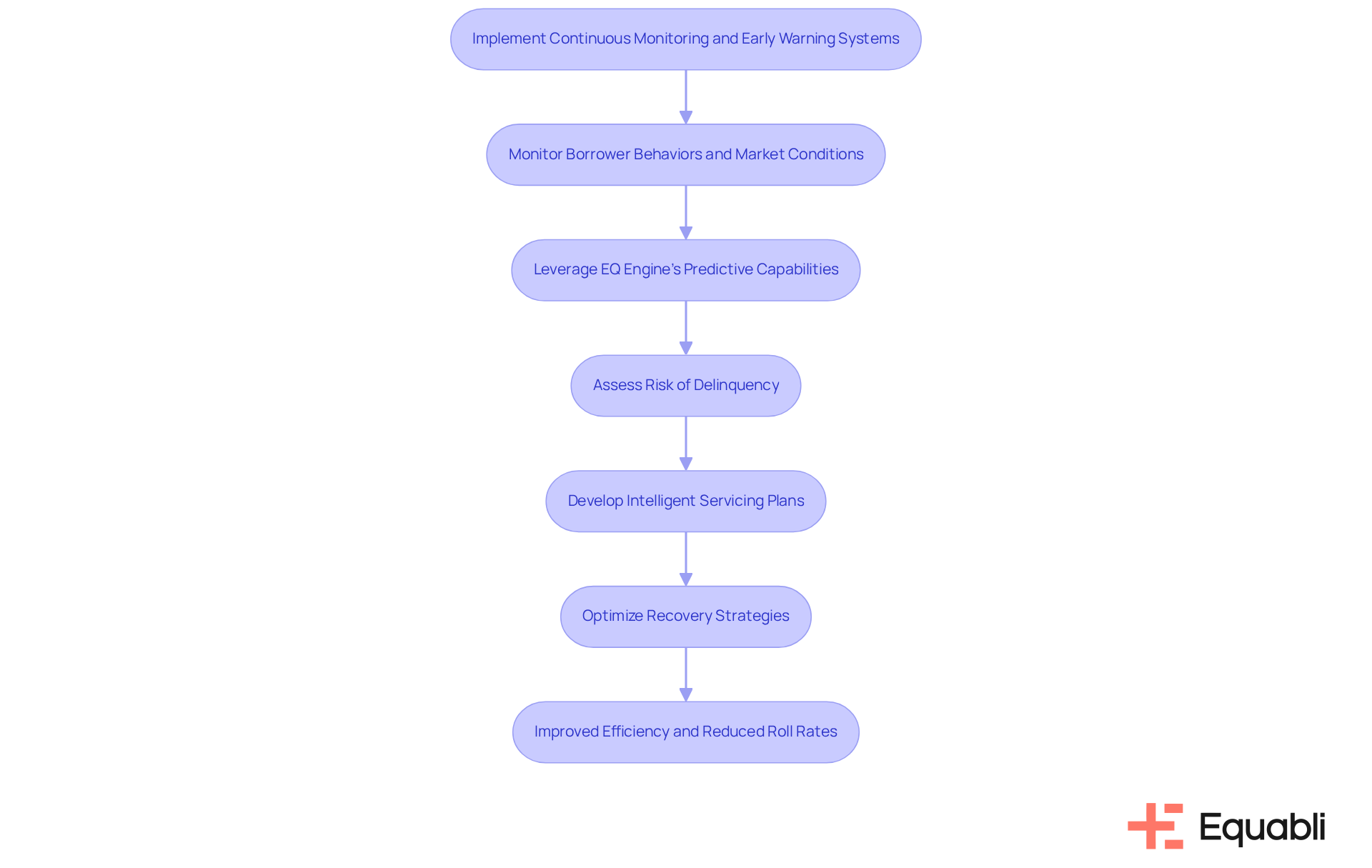

Establish Continuous Monitoring and Early Warning Systems

Implementing ongoing observation and early alert systems is essential for adopting advanced credit risk management best practices for financial institutions. These systems empower organizations to monitor borrower behaviors and market conditions in real-time, which is essential for implementing advanced credit risk management best practices for financial institutions and enabling swift responses to emerging threats.

By leveraging the EQ Engine’s predictive capabilities, financial organizations can assess the risk of delinquency for active accounts. This assessment facilitates the development of intelligent servicing plans tailored to each communication channel. Such integration not only enhances loss mitigation but also optimizes recovery strategies through account-level lifetime value analysis.

Ultimately, this results in and reduced roll rates. Therefore, consider adopting the EQ Engine's predictive capabilities to effectively customize your servicing strategies.

Focus on Comprehensive Risk Identification and Classification

A comprehensive method for identifying and classifying threats is essential for financial institutions. This process involves categorizing uncertainties based on their nature, impact, and probability of occurrence. Understanding the various types of risks—such as credit, operational, and market risks—enables organizations to develop targeted strategies that utilize advanced for financial institutions. By implementing these strategies, financial institutions can enhance their risk mitigation efforts, ensuring compliance with regulatory standards and operational resilience.

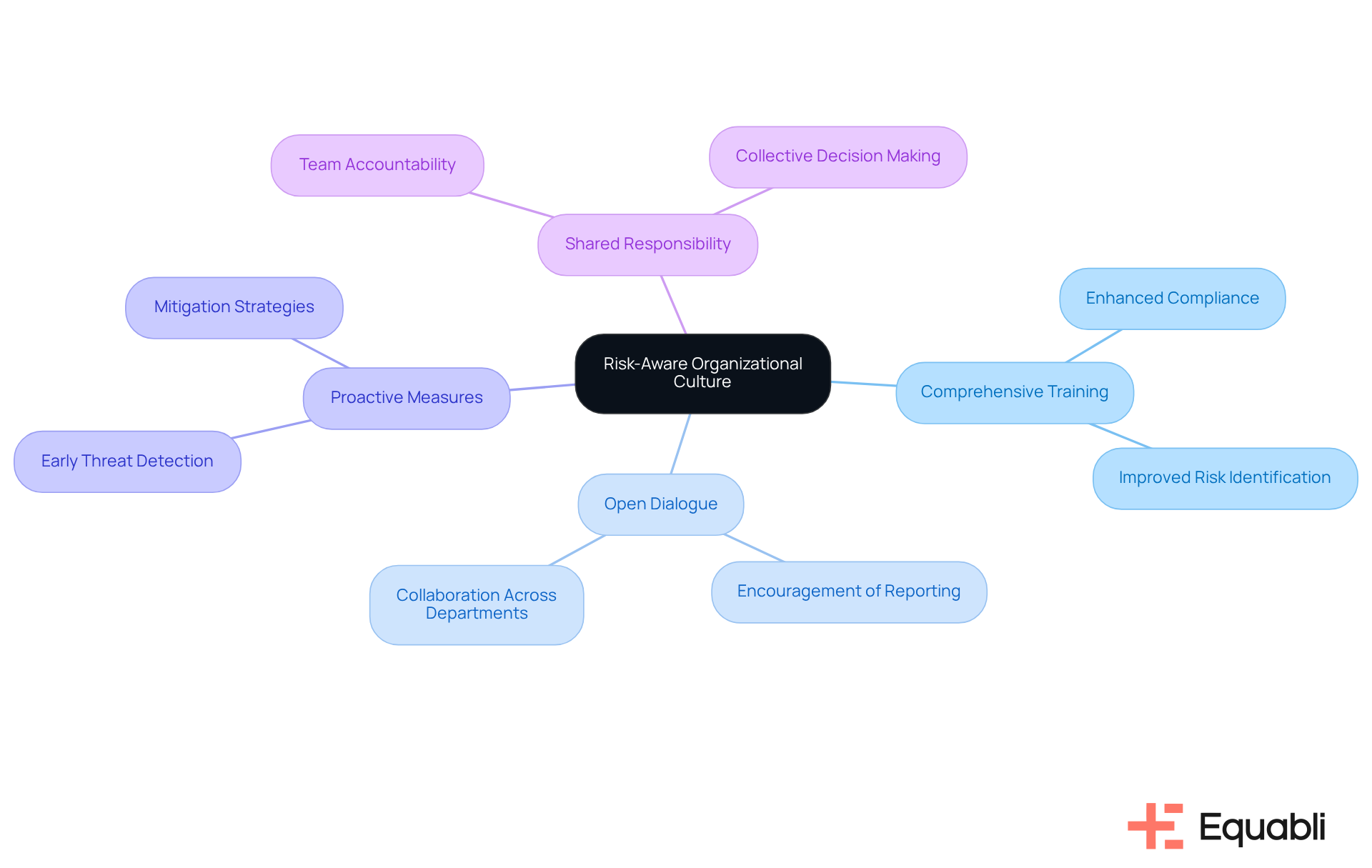

Cultivate a Risk-Aware Organizational Culture

Establishing a culture that recognizes potential challenges is crucial for effective credit oversight. This requires for staff at all levels to identify and respond to possible threats. By promoting open dialogue regarding risks and encouraging proactive measures, organizations can cultivate an environment where the oversight of potential issues becomes a shared responsibility. Such an approach not only enhances compliance but also fortifies the organization's strategic position in debt management.

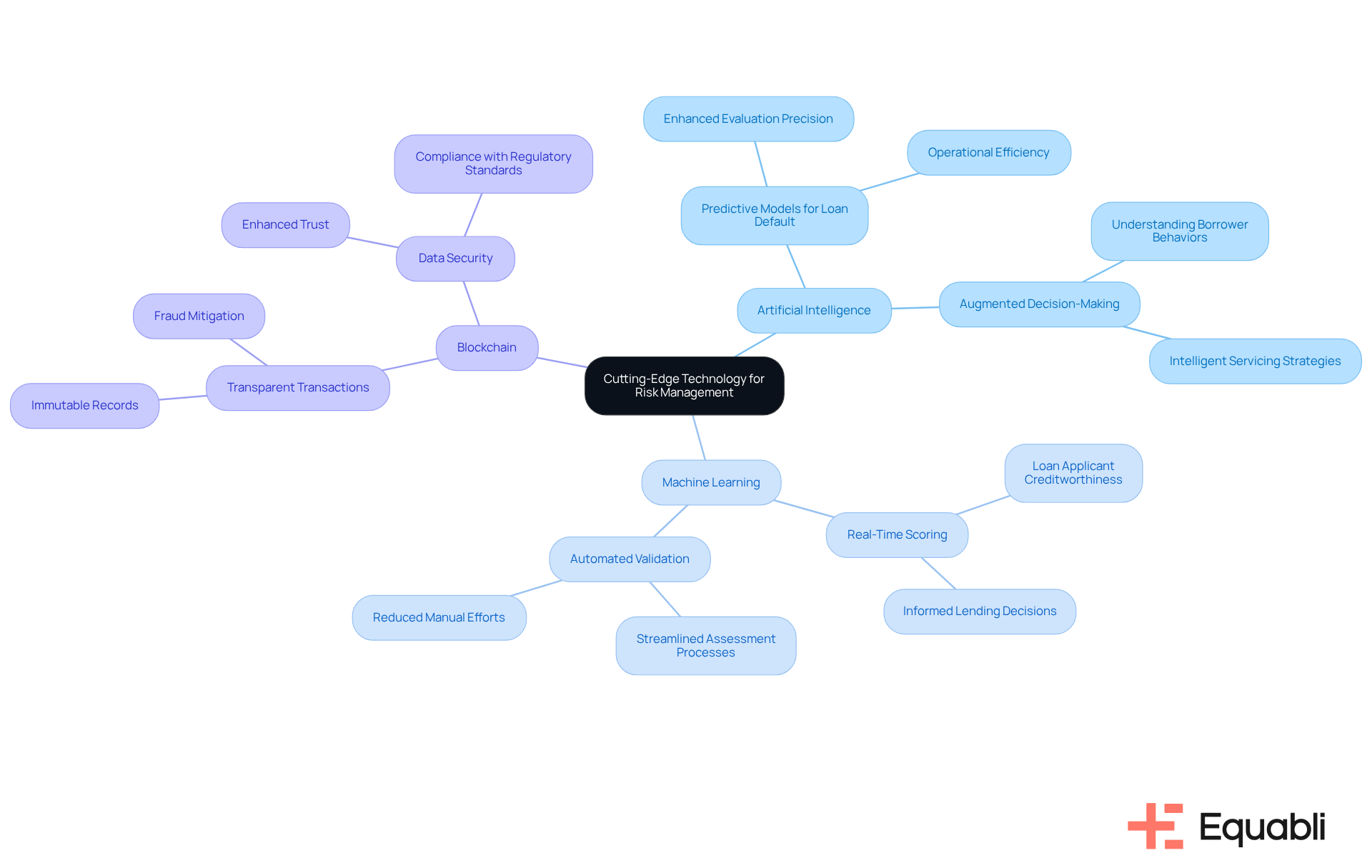

Adopt Cutting-Edge Technology for Enhanced Risk Management

Implementing advanced credit risk management best practices for financial institutions is essential for enhancing credit management. Evidence shows that artificial intelligence and machine learning provide a profound understanding of borrower behaviors, thereby enabling financial organizations to refine their decision-making processes. For instance, Equabli's EQ Engine utilizes machine learning to predict the likelihood of delinquency in active accounts, empowering institutions to devise intelligent servicing strategies that improve recovery rates. This implementation of predictive models for loan default forecasting significantly enhances evaluation precision and operational efficiency.

Moreover, Equabli's intelligent automation solutions streamline assessment processes, bolstering trust and mitigating fraud through blockchain technology, which delivers transparent and immutable transaction records. The integration of these technologies allows financial organizations to alleviate operational challenges and make more informed lending decisions while ensuring compliance with regulatory standards. To capitalize on these advantages, institutions must proactively incorporate for financial institutions into their oversight strategies.

Develop Clear Policies and Governance Structures

Establishing clear policies and governance frameworks is imperative for effective credit oversight. These frameworks delineate roles, responsibilities, and procedures for managing uncertainties, thereby fostering accountability and consistency in hazard oversight practices. Such structured approaches not only enhance operational clarity but also ensure that all employees understand their critical roles in mitigating risks. Ultimately, this strategic alignment contributes to a , reinforcing the organization's commitment to compliance and operational excellence.

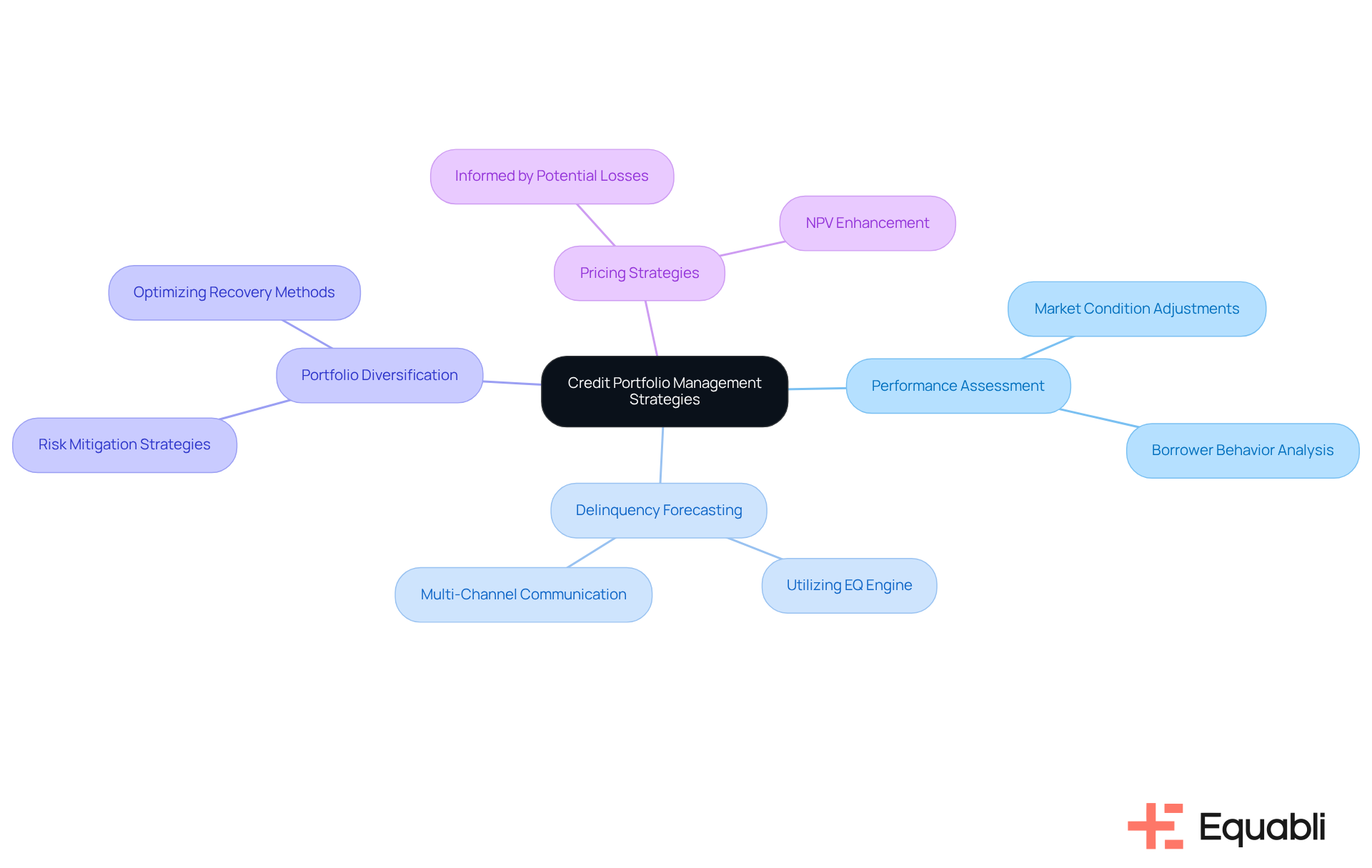

Optimize Credit Portfolio Management Strategies

Enhancing credit portfolio management approaches is critical for financial organizations to adopt advanced credit risk management best practices for financial institutions. Regular assessment of credit portfolio performance is essential, as it supports advanced credit risk management best practices for financial institutions by allowing adjustments based on market conditions and borrower behaviors. Utilizing Equabli's EQ Engine allows organizations to among active accounts across multiple communication channels. This capability enables the development of intelligent servicing plans that enhance efficiency and reduce roll-rates.

Moreover, diversifying portfolios and implementing pricing strategies informed by potential losses can optimize recovery methods by applying advanced credit risk management best practices for financial institutions. By focusing on NPV enhancement and evaluating account-level lifetime value, financial organizations can significantly improve profitability while mitigating uncertainties. These strategies not only address immediate operational challenges but also align with broader compliance frameworks, ensuring sustainable growth in a complex regulatory environment.

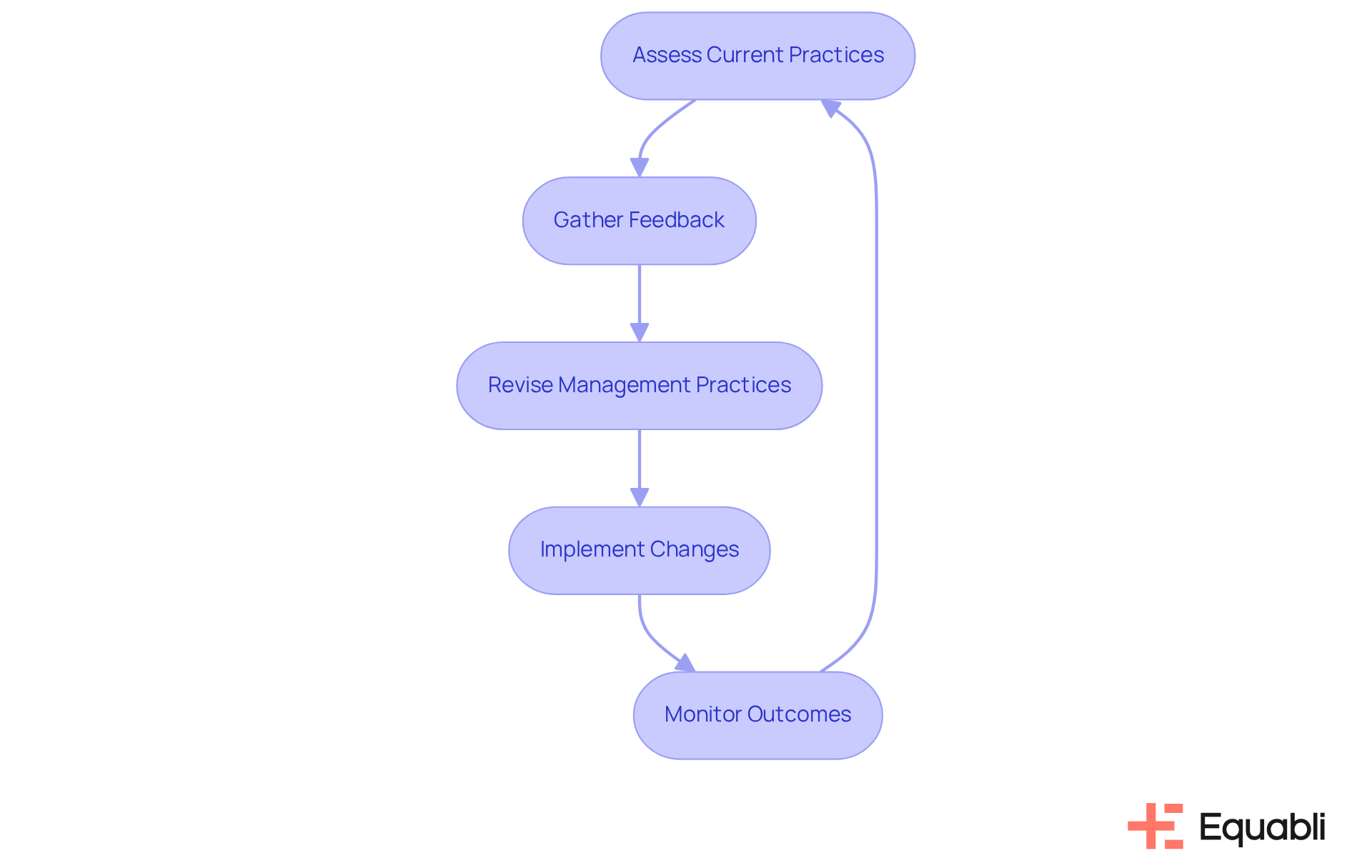

Promote Continuous Improvement in Credit Risk Management

Encouraging ongoing enhancement in credit evaluation is essential for adapting to evolving market conditions. Financial organizations must regularly assess and revise their management practices, integrating feedback from employees and stakeholders. This approach not only fosters a culture of innovation and adaptability but also significantly enhances against emerging risks.

Conclusion

Implementing advanced credit risk management practices is essential for financial institutions aiming to navigate the complexities of today's economic landscape. By adopting innovative tools and strategies, organizations can enhance operational efficiency, ensure compliance with regulatory standards, and ultimately improve their bottom line.

This article highlights critical best practices, including:

- The integration of Equabli's EQ Suite for streamlined credit risk management

- The establishment of robust compliance frameworks

- The utilization of advanced data analytics for informed decision-making

- Continuous monitoring systems

- Comprehensive risk identification

- The promotion of a risk-aware culture

Further contributions to a proactive approach in managing credit risks include:

- Embracing cutting-edge technologies

- Developing clear governance structures

These practices are vital for optimizing credit portfolio management and ensuring sustainable growth.

In conclusion, the importance of adopting advanced credit risk management best practices cannot be overstated. Financial institutions must prioritize these strategies not only to mitigate risks but also to thrive in a competitive market. By committing to continuous improvement and leveraging technological advancements, organizations can position themselves for long-term success while effectively managing the uncertainties of credit risk.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a collection of tools designed for advanced credit risk management, specifically tailored for financial institutions. It includes the EQ Engine, EQ Engage, and EQ Collect to help organizations develop custom scoring models, refine collection strategies, and facilitate digital collections.

How does the EQ Suite enhance operational efficiency?

The EQ Suite enhances operational efficiency by improving the management of delinquency and fostering better borrower engagement through preferred communication channels. This leads to reduced operational costs and ensures compliance with industry regulations.

Why is regulatory compliance important for financial entities?

Regulatory compliance is crucial for financial entities to mitigate challenges related to credit oversight. It helps organizations stay updated with local and international regulations and ensures regular audits align with compliance standards, which can prevent penalties and enhance market reputation.

How can advanced data analytics support credit risk management?

Advanced data analytics enables financial entities to make informed decisions by analyzing historical data and current market trends. This helps identify potential challenges and opportunities in credit management, allowing institutions to anticipate repayment behaviors and assess the likelihood of delinquency.

What role does predictive analytics play in credit risk management?

Predictive analytics, such as that provided by Equabli's EQ Engine, allows institutions to forecast repayment behaviors and identify potential delinquency for active accounts. This capability aids in developing tailored servicing strategies, ultimately maximizing net present value (NPV) in debt recovery and enhancing operational efficiency.