Overview

Machine learning applications are significantly enhancing customer experience in finance through:

- Personalized interactions

- Predictive analytics

- Automated services

Evidence of this enhancement is seen in the implementation of:

- Chatbots

- Data analytics for tailored offerings

- Fraud detection systems

These tools not only improve client satisfaction but also drive operational efficiency within the financial sector. Consequently, the strategic integration of machine learning technologies positions financial institutions to better meet compliance demands and elevate service delivery.

Introduction

Machine learning is fundamentally transforming customer experience within the financial sector, delivering innovative solutions that address the evolving demands of clients. Financial institutions are harnessing advanced technologies, such as predictive analytics and automated customer service, to improve interactions and cultivate customer loyalty. As organizations work to personalize their offerings, a critical question emerges: how can they effectively implement these machine learning applications to not only meet but surpass customer expectations? This article explores seven transformative applications of machine learning that are set to revolutionize customer experience in finance, paving the way for a more engaging and responsive banking environment.

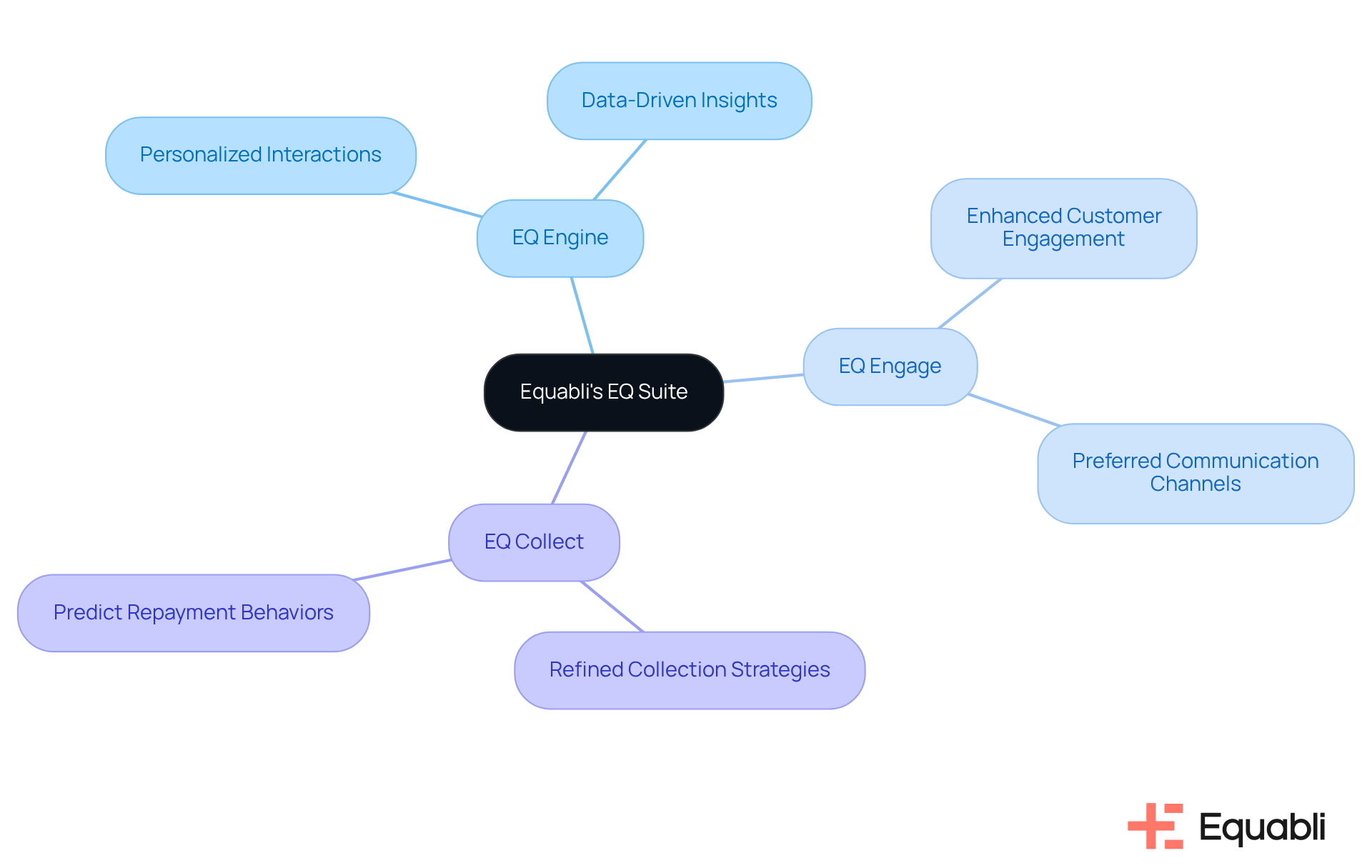

Equabli's EQ Suite: Intelligent Solutions for Customer Experience Enhancement

Equabli's EQ Suite showcases a robust collection of machine learning applications for enhancing customer experience in financial services, specifically designed to elevate user experience within the banking sector. The EQ Suite utilizes machine learning applications for enhancing customer experience in financial services, allowing financial institutions to effectively analyze client data, predict repayment behaviors, and refine collection strategies.

Key components, including EQ Engine, EQ Engage, and EQ Collect, utilize machine learning applications for enhancing customer experience in financial services, facilitating personalized interactions and thereby enhancing overall satisfaction through data-driven insights and automation. These tools and empower organizations to connect with clients via their preferred communication channels, ultimately fostering a more engaging experience.

As industry leaders in financial technology highlight, the integration of machine learning applications for enhancing customer experience in financial services is essential for meeting evolving client expectations and driving satisfaction in 2025 and beyond.

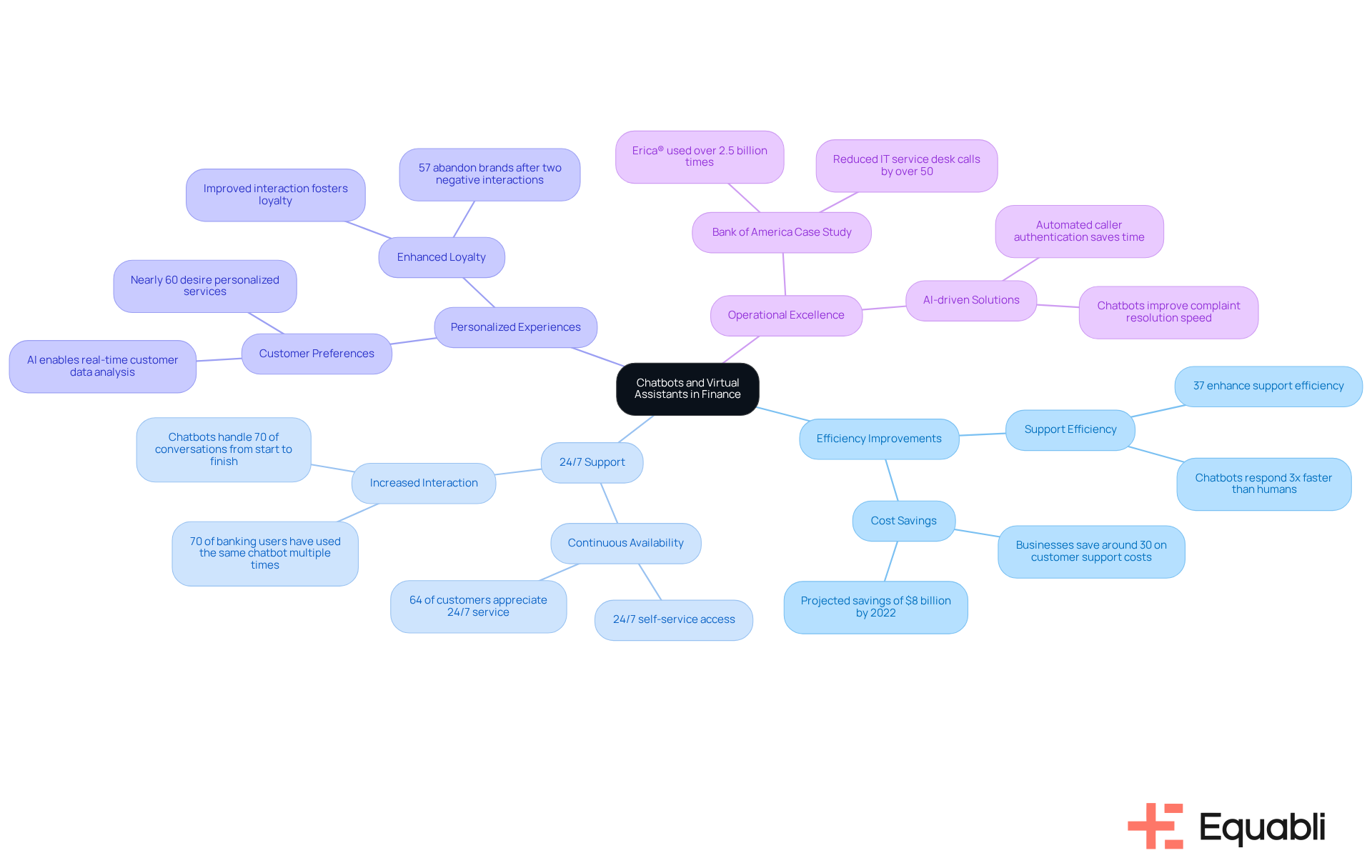

Chatbots and Virtual Assistants: Streamlining Customer Interactions

Machine learning applications for enhancing customer experience in financial services, such as chatbots and virtual assistants, have fundamentally transformed user interactions in finance by delivering instant responses to inquiries and facilitating transactions. These AI-driven tools are examples of machine learning applications for enhancing customer experience in financial services, as they can manage numerous client requests simultaneously, significantly reducing wait times and enhancing user satisfaction.

For instance, banks can deploy chatbots to assist with account inquiries, loan applications, and payment processing, ensuring support is available around the clock. These systems leverage machine learning applications for enhancing customer experience in financial services by utilizing advanced natural language processing to understand and respond to client inquiries in real-time, creating a seamless experience that fosters loyalty.

Notably, 37% of companies indicate that chatbots enhance support efficiency, replying three times quicker than human representatives. Successful implementations, such as those at Bank of America, illustrate how AI can improve operational excellence and client support, ultimately propelling business growth.

As financial organizations increasingly embrace machine learning applications for enhancing customer experience in financial services, the emphasis on personalized client experiences becomes crucial, with nearly 60% of individuals expressing a preference for customized offerings. This shift not only addresses rising client expectations but also enables organizations to through improved interaction.

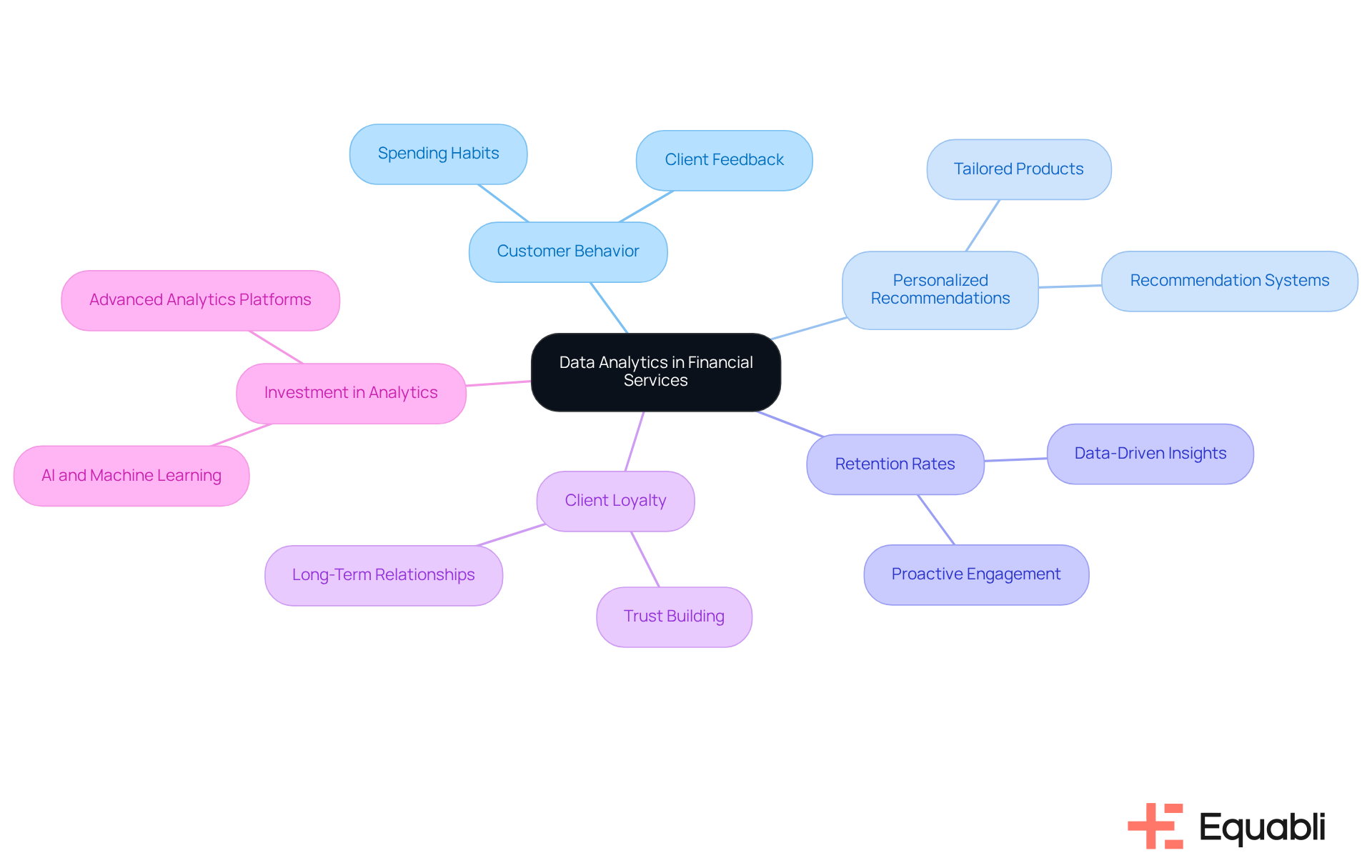

Data Analytics: Driving Insights for Personalized Financial Services

Data analytics is essential for machine learning applications for enhancing customer experience in financial services, as it provides deep insights into client behavior and preferences. Financial institutions utilize transaction data, client feedback, and engagement metrics through machine learning applications for enhancing customer experience in financial services to effectively tailor their offerings.

For instance, by analyzing spending habits, banks can recommend personalized products, such as credit cards with rewards aligned with individual lifestyles. This tailored strategy not only enhances through machine learning applications for enhancing customer experience in financial services—organizations implementing data-driven insights report a 10-15% increase in retention rates—but also improves the likelihood of product adoption, ultimately driving revenue growth.

A study indicates that organizations utilizing machine learning applications for enhancing customer experience in financial services can anticipate client preferences with up to 90% accuracy and reduce churn by 15% by proactively addressing pain points, further underscoring the critical role of data in developing relevant financial solutions.

Market analysts emphasize that understanding client behavior is vital for devising strategies that include machine learning applications for enhancing customer experience in financial services, which foster loyalty and long-term relationships. Additionally, as banking CEOs increasingly express concerns about vulnerabilities associated with AI, the investment in advanced analytics platforms becomes crucial for the implementation of machine learning applications for enhancing customer experience in financial services.

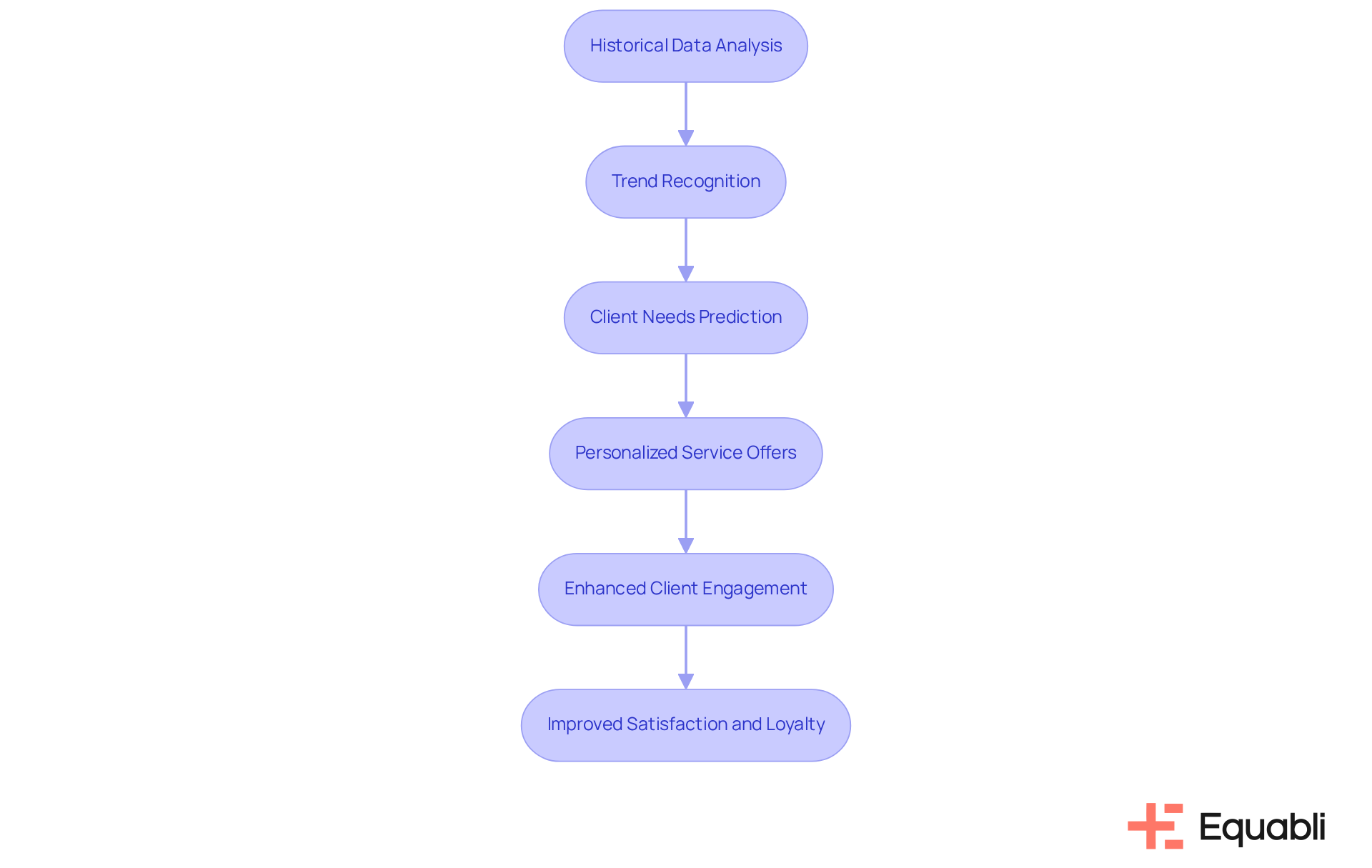

Predictive Analytics: Anticipating Customer Needs in Finance

Predictive analytics serves as a pivotal tool for financial organizations, utilizing machine learning applications for enhancing customer experience in financial services by enabling them to anticipate client needs through the examination of historical data and trend recognition.

By utilizing machine learning applications for enhancing customer experience in financial services, banks can project which clients may require specific services, such as loan refinancing or investment advice. This proactive approach leverages machine learning applications for enhancing customer experience in financial services, not only enhancing client engagement through personalized offers but also fostering satisfaction and loyalty before clients even recognize their needs.

For example, utilizing the EQ Engine, banks can significantly elevate recovery rates while scaling their collections operations by predicting the risk of delinquency among active accounts. This capability allows for the development of intelligent servicing strategies that enhance collection efficiency.

Furthermore, predictive analytics can identify clients approaching the end of their loan term for refinancing opportunities while simultaneously managing accounts at risk of delinquency, thereby improving retention rates and overall recovery outcomes.

To maximize these advantages, financial organizations must continually refine their and client interaction strategies.

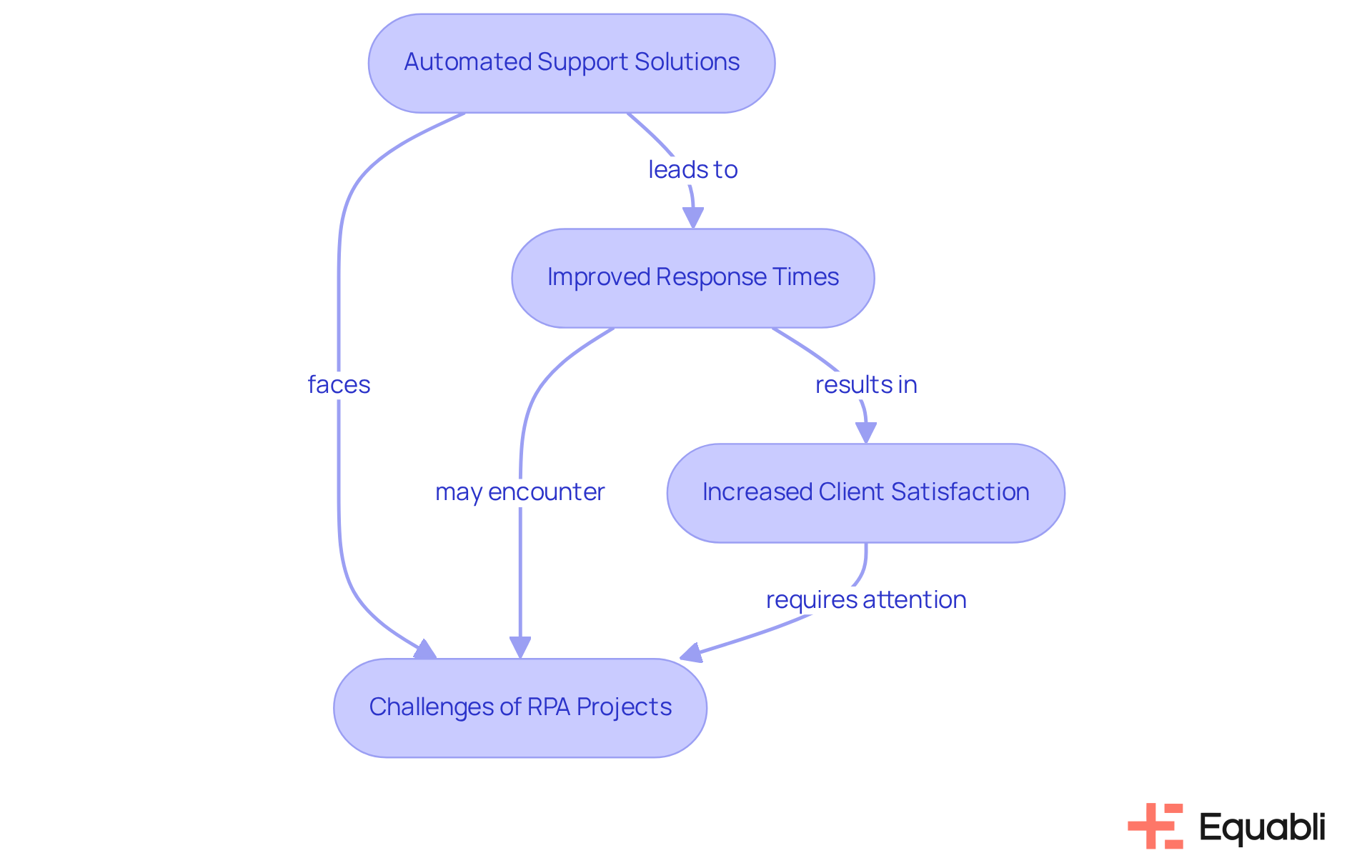

Automated Customer Service: Enhancing Response Times and Satisfaction

Automated support solutions that utilize machine learning applications for enhancing customer experience in financial services significantly improve response times and overall client satisfaction. By implementing machine learning applications for enhancing customer experience in financial services, financial institutions can automate routine inquiries such as balance checks and transaction histories. This allows human agents to focus on more complex issues, thereby not only accelerating response times but also .

For example, a financial institution that utilizes machine learning applications for enhancing customer experience in financial services can automate its client support processes to handle a higher volume of inquiries without increasing personnel, resulting in improved efficiency and client satisfaction.

According to industry insights, RPA was the fastest-growing segment of the global enterprise software market in 2018, highlighting its critical role in the financial sector. Successful implementations of machine learning applications for enhancing customer experience in financial services, as demonstrated by Invex, reveal that automation fosters consistent and reliable service, ultimately strengthening relationships and loyalty.

However, it is crucial to recognize that 30-50% of initial RPA projects may fail, underscoring the necessity for meticulous planning and alignment with corporate objectives to achieve successful outcomes.

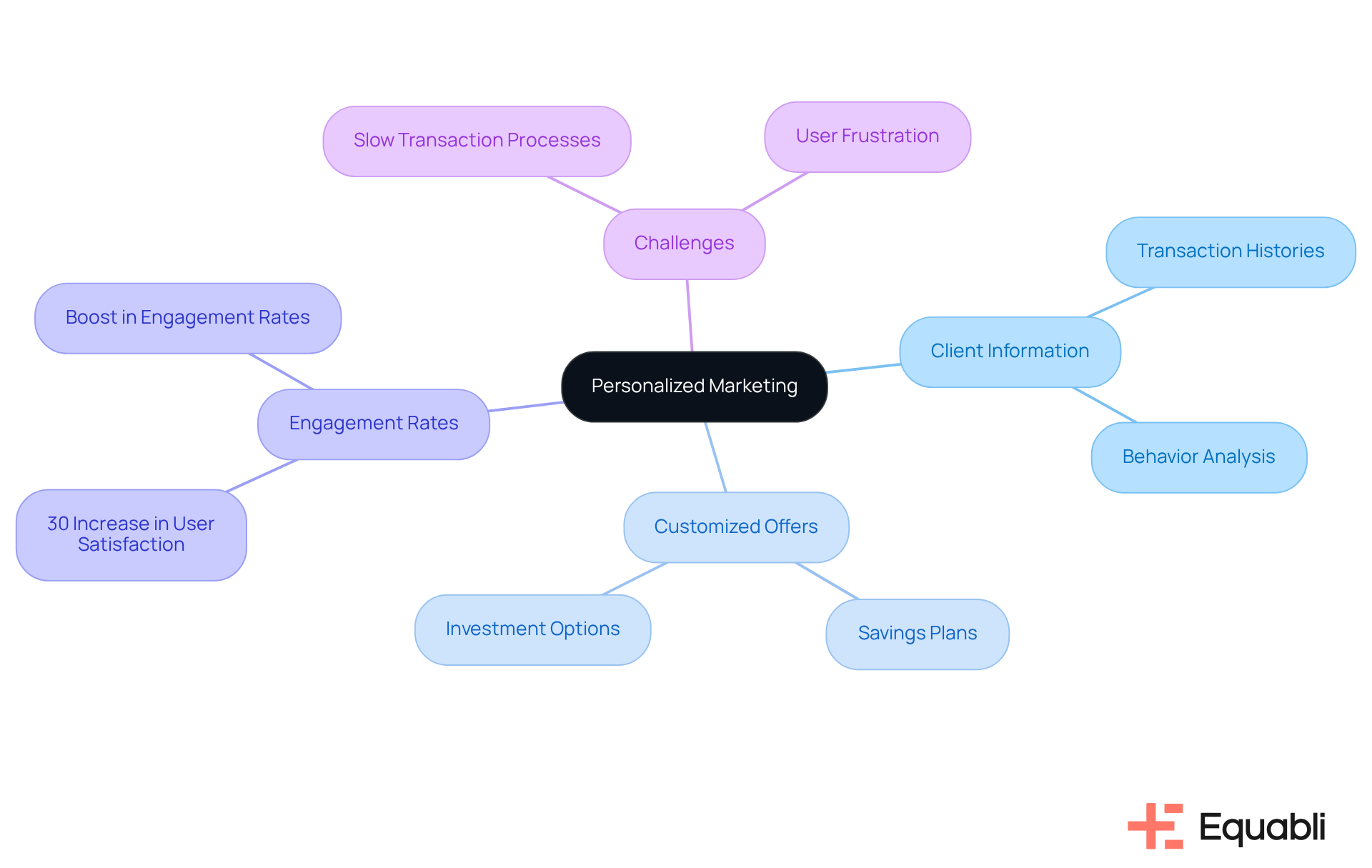

Personalized Marketing: Engaging Customers with Tailored Offers

Customized marketing approaches are essential for effectively engaging clients through tailored offers that align with their unique needs and preferences. By leveraging client information, banking organizations can design focused marketing initiatives that directly address individual client profiles.

For instance, banks may analyze transaction histories to propose customized savings plans or investment options that coincide with individuals' financial objectives. Research shows that can significantly boost engagement rates, with certain campaigns reporting an increase of up to 30% in user satisfaction.

Marketing experts emphasize that understanding client behavior and preferences is critical for developing effective targeted marketing campaigns in banking. Notable examples include campaigns that utilize machine learning applications for enhancing customer experience in financial services to anticipate client needs, resulting in improved service delivery.

Furthermore, addressing challenges faced by current mobile banking applications, such as slow transaction processes, highlights the necessity of tailored marketing strategies to elevate user experience and satisfaction.

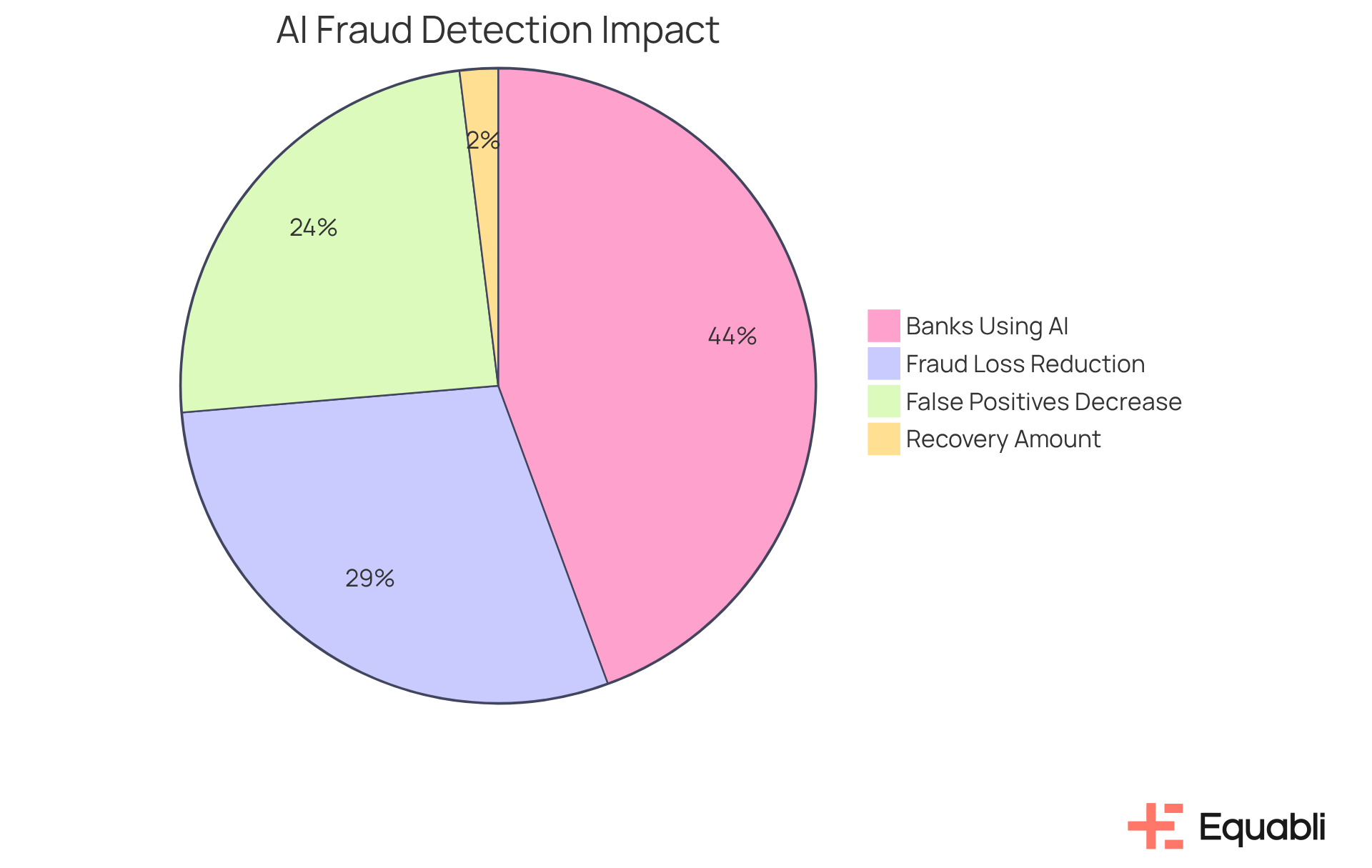

Fraud Detection: Securing Customer Transactions with Machine Learning

Machine learning is transforming fraud detection by systematically analyzing transaction patterns to pinpoint anomalies that suggest fraudulent activity. Financial institutions are increasingly adopting machine learning applications for enhancing customer experience in financial services, as evidenced by 91% of U.S. banks currently utilizing AI for fraud detection and real-time transaction monitoring. This capability enables them to promptly flag suspicious behaviors. For example, a sudden change in a customer's spending habits can trigger alerts, allowing banks to take immediate measures to safeguard their clients. This proactive approach not only enhances but also fosters greater trust in the organization’s commitment to protecting sensitive information.

Recent advancements in AI-driven fraud detection have shown that organizations employing predictive analytics can realize up to a 60% reduction in fraud losses and a 50% decrease in false positives. Furthermore, entities such as the U.S. Treasury have effectively leveraged AI to recover over $4 billion in fraudulent activities, amidst an anticipated potential fraud loss of $40 billion by 2027. This underscores the efficacy of these technologies in the financial sector.

As banks continue to utilize transaction pattern analysis, they are employing machine learning applications for enhancing customer experience in financial services, which not only refines their fraud prevention strategies but also bolsters client confidence in their security measures. Additionally, the movement towards enhancing the explainability and transparency of AI in fraud detection is vital, addressing concerns over the 'black box' nature of certain machine learning models. Collaborative efforts across sectors are also crucial for effective fraud prevention, emphasizing the significance of threat sharing and unified strategies.

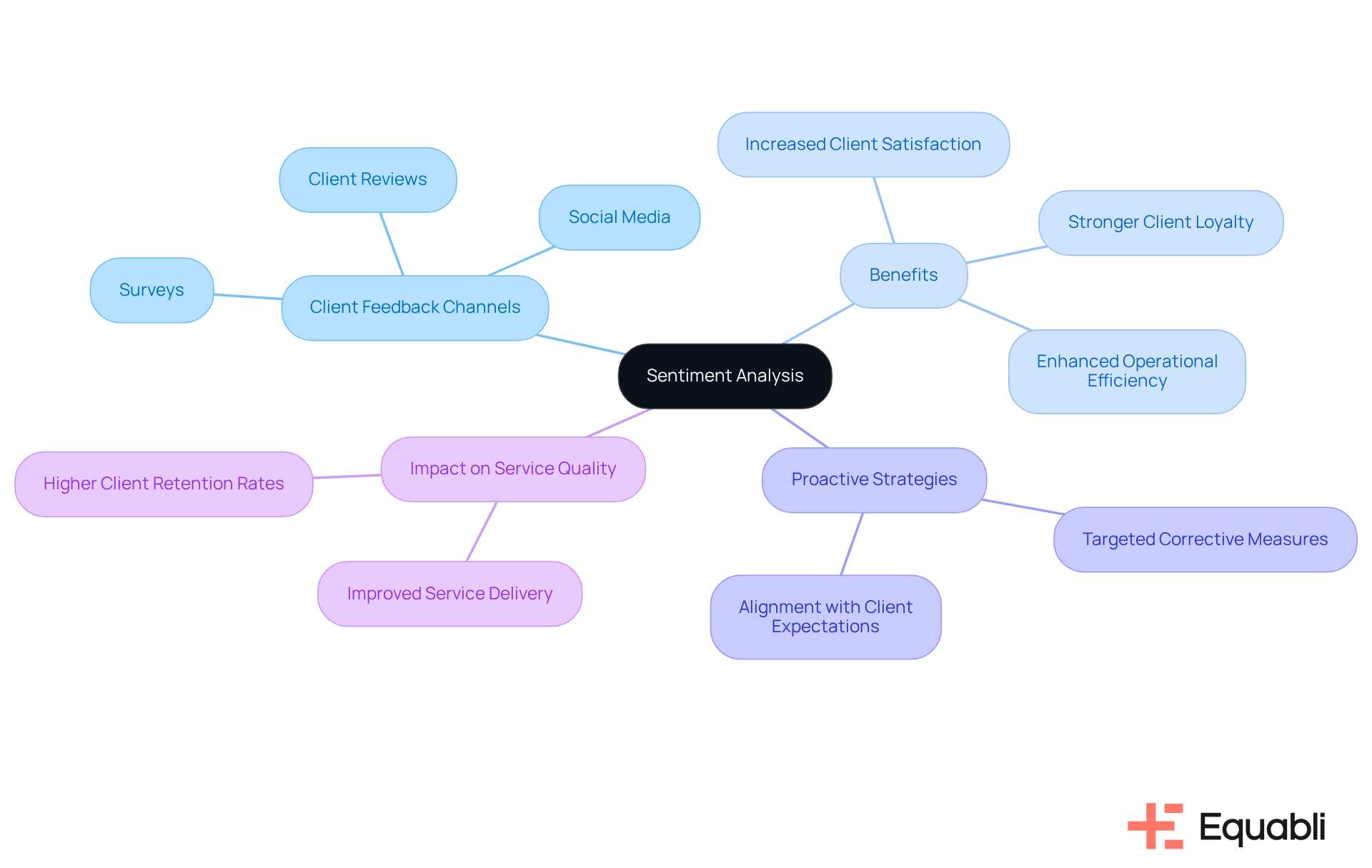

Sentiment Analysis: Understanding Customer Feedback for Service Improvement

Sentiment analysis serves as a crucial tool for financial organizations, enabling them to assess client perceptions and emotions regarding their offerings. By examining feedback from diverse channels, including surveys, social media, and client reviews, banks can uncover significant patterns in client sentiment. This analysis empowers organizations to proactively address issues and enhance their offerings. For example, when sentiment analysis indicates client dissatisfaction with a specific product, organizations can implement targeted corrective measures to improve that offering. Such proactive strategies not only lead to increased client satisfaction but also foster stronger loyalty among patrons.

Recent trends reveal that financial institutions actively engaging in client feedback assessment experience notable improvements in service quality and client retention rates. This underscores the in refining service delivery. By leveraging these insights, organizations can align their strategies with client expectations, ultimately enhancing operational efficiency and compliance adherence. In conclusion, the integration of sentiment analysis into strategic planning represents a vital step for organizations aiming to navigate the complexities of client engagement and service excellence.

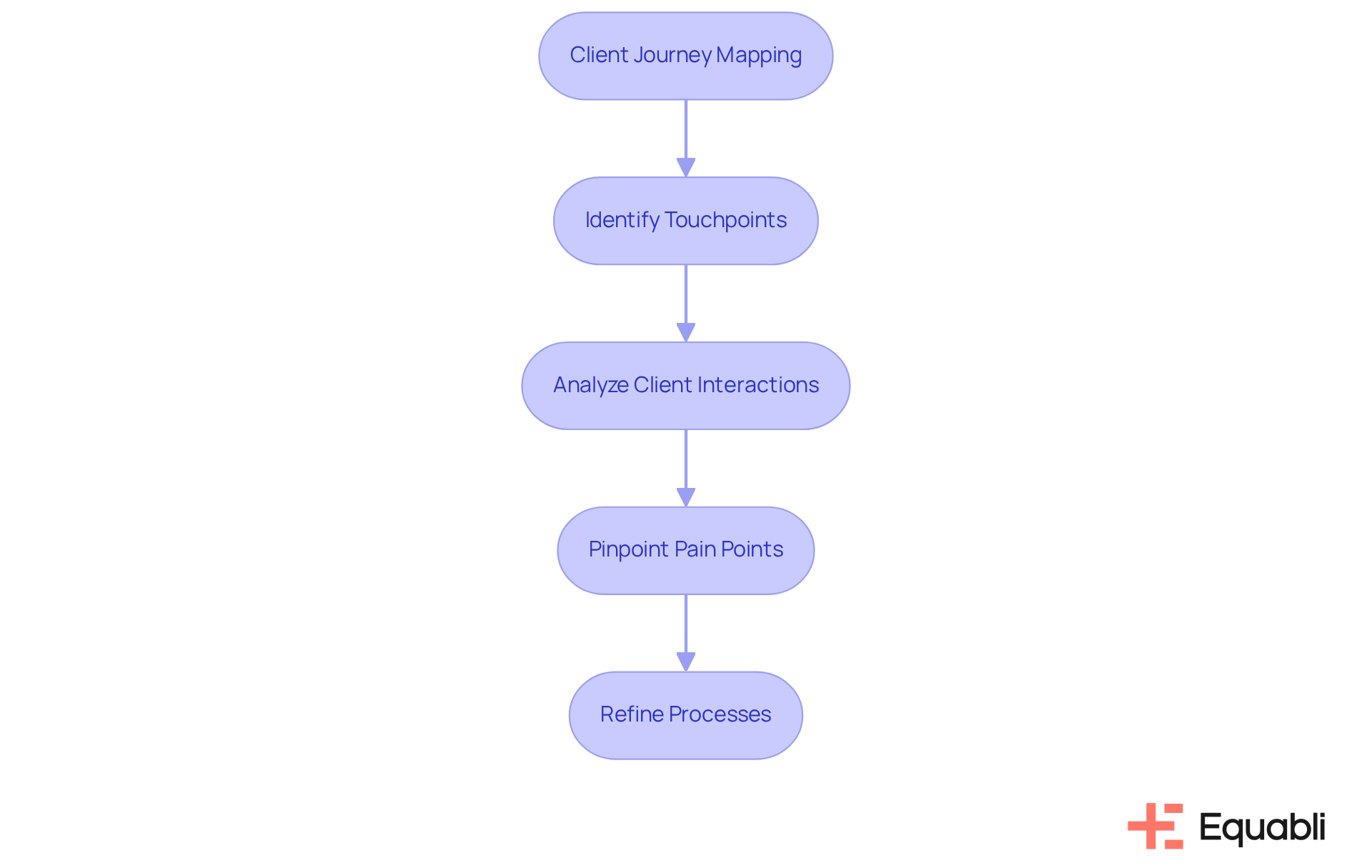

Customer Journey Mapping: Optimizing Interactions with Machine Learning

Client journey mapping serves as a strategic method for financial organizations, enabling them to visualize and comprehend the various touchpoints individuals encounter throughout their relationship with the institution. By utilizing machine learning applications for enhancing customer experience in financial services to analyze client interactions, banks can pinpoint pain points and identify areas for improvement.

For example, if data reveals that clients frequently abandon loan applications at a specific stage, the organization can scrutinize and refine that process to enhance the overall experience. This optimization not only leads to but also significantly improves client satisfaction, emphasizing the role of machine learning applications for enhancing customer experience in financial services within enterprise-level operations.

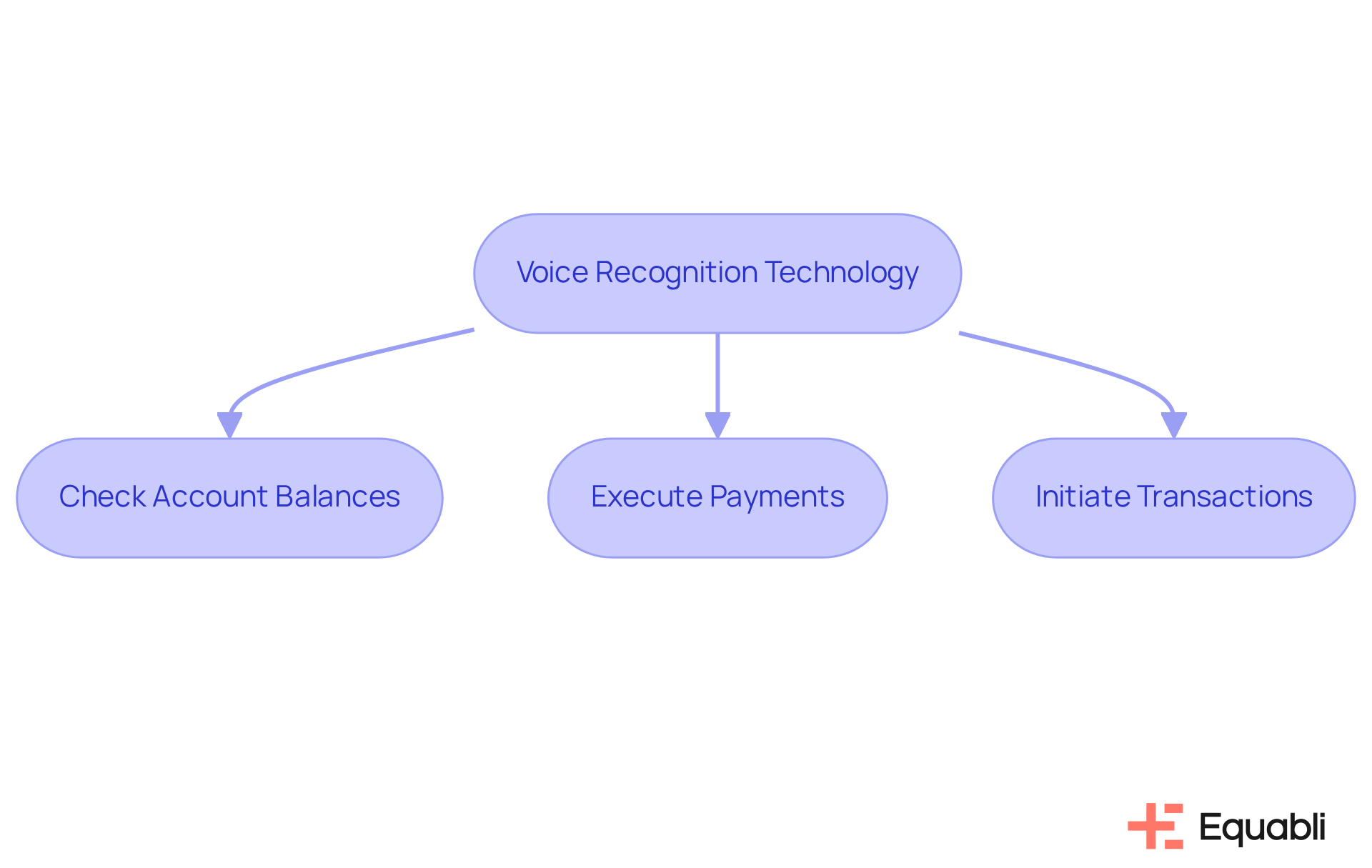

Voice Recognition: Transforming Customer Interaction in Financial Services

is revolutionizing user interactions within the finance sector by facilitating hands-free communication and simplifying access to information. Evidence indicates that customers can utilize voice commands to:

- Check account balances

- Execute payments

- Initiate transactions

Thereby fostering a more convenient and user-centric experience. This implementation of voice recognition exemplifies machine learning applications for enhancing customer experience in financial services, as it not only enhances customer satisfaction but also provides financial institutions with a streamlined and efficient means of service interaction. Furthermore, this technology improves accessibility and aligns with the ongoing trend of digital transformation, which is critical for maintaining competitive advantage in the financial landscape.

Conclusion

The integration of machine learning applications in finance is fundamentally transforming customer experiences. Financial institutions are now empowered to deliver tailored services that effectively address the evolving needs of their clients. By leveraging advanced technologies such as chatbots, predictive analytics, and sentiment analysis, organizations can significantly enhance engagement, streamline operations, and foster customer loyalty. This strategic approach positions them for success in an increasingly competitive landscape.

Key applications of machine learning have been explored throughout this article, notably Equabli's EQ Suite, which provides intelligent solutions aimed at enhancing customer experiences. The implementation of chatbots and virtual assistants has markedly improved response times and service efficiency. Furthermore, data analytics and predictive analytics enable banks to anticipate customer needs and offer personalized solutions. Additionally, the deployment of automated customer service and fraud detection technologies not only enhances operational security but also builds client trust, showcasing the multifaceted advantages of machine learning in the financial sector.

As the financial landscape continues to evolve, the adoption of machine learning applications is essential for organizations aspiring to thrive. By prioritizing customer experience through innovative technologies, financial institutions can forge lasting relationships, drive customer satisfaction, and secure long-term success in an increasingly digital environment. It is imperative for industry leaders to invest in these advancements to maintain competitiveness and remain responsive to customer expectations.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a collection of machine learning applications designed to enhance customer experience in the financial services sector, specifically within banking. It helps financial institutions analyze client data, predict repayment behaviors, and refine collection strategies.

What are the key components of the EQ Suite?

The key components of the EQ Suite include EQ Engine, EQ Engage, and EQ Collect. These tools utilize machine learning to facilitate personalized interactions and enhance overall customer satisfaction through data-driven insights and automation.

How do chatbots and virtual assistants improve customer interactions in finance?

Chatbots and virtual assistants streamline customer interactions by providing instant responses to inquiries and facilitating transactions. They can manage multiple client requests simultaneously, significantly reducing wait times and enhancing user satisfaction.

What benefits do banks gain from deploying chatbots?

Banks that deploy chatbots can assist with account inquiries, loan applications, and payment processing around the clock. These AI-driven tools improve operational efficiency, with reports indicating that chatbots can reply three times quicker than human representatives.

How does data analytics contribute to enhancing customer experience in financial services?

Data analytics provides deep insights into client behavior and preferences, allowing financial institutions to tailor their offerings. By analyzing transaction data and client feedback, banks can recommend personalized products, enhancing client satisfaction and retention rates.

What impact does personalized service have on client satisfaction?

Personalized service significantly improves client satisfaction, with organizations utilizing machine learning applications reporting a 10-15% increase in retention rates. Additionally, nearly 60% of individuals express a preference for customized offerings.

What accuracy can organizations achieve in anticipating client preferences using machine learning?

Organizations utilizing machine learning applications can anticipate client preferences with up to 90% accuracy and reduce churn by 15% by proactively addressing client pain points.

Why is understanding client behavior important for financial institutions?

Understanding client behavior is vital for developing strategies that foster loyalty and long-term relationships. It enables financial institutions to create relevant financial solutions that meet evolving client expectations.

What concerns do banking CEOs have regarding AI in customer experience?

Banking CEOs express concerns about vulnerabilities associated with AI, highlighting the importance of investing in advanced analytics platforms for implementing machine learning applications effectively.